Global Rear Spoiler Market Size, Share, Growth Analysis By Technology Type (Injection Molding, Blow Molding, Reaction Injection Molding), By Material Type (ABS, Carbon Fiber, Fiberglass, Sheet Metal), By Fuel Type (ICE, BEV, Others), By Vehicle Type (SUV, Hatchback, MPV), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175944

- Number of Pages: 337

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

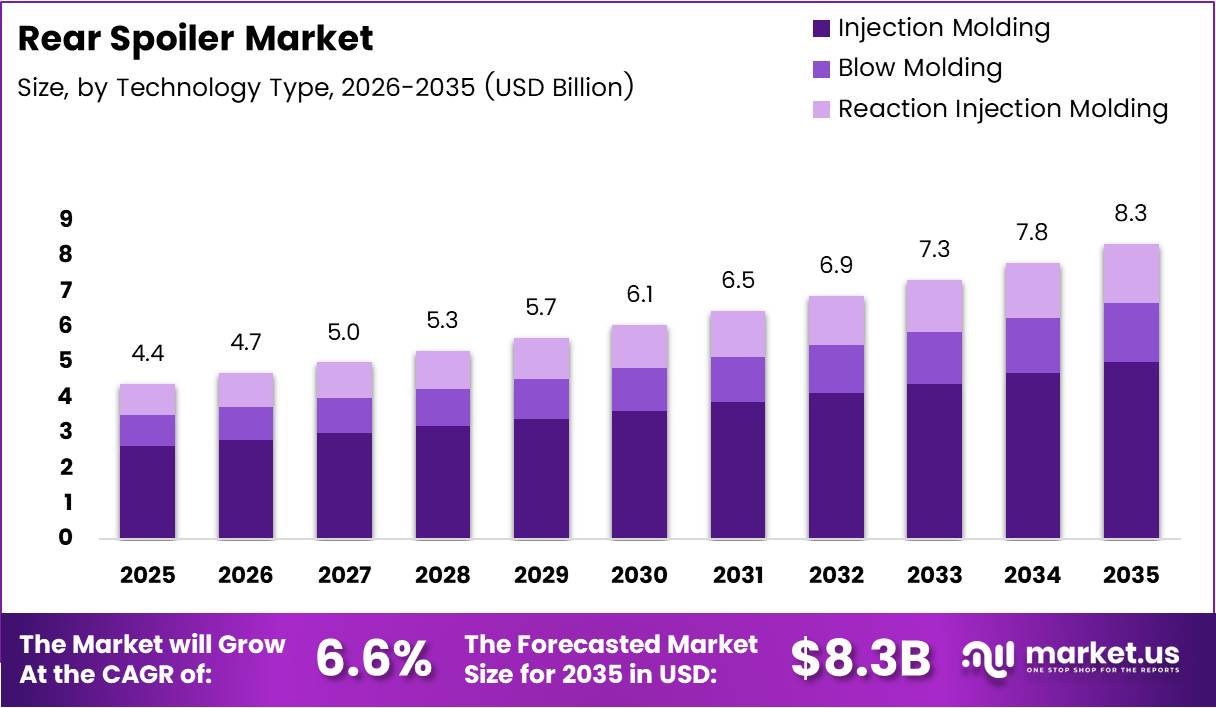

Global Rear Spoiler Market size is expected to be worth around USD 8.3 Billion by 2035 from USD 4.4 Billion in 2025, growing at a CAGR of 6.6% during the forecast period 2026 to 2035.

Rear spoilers serve as aerodynamic devices mounted on vehicle trunks or tailgates. These components redirect airflow to reduce drag and increase downforce. Consequently, they enhance vehicle stability at higher speeds while improving fuel economy through optimized air resistance management.

The automotive accessory sector experiences substantial transformation driven by consumer demand for performance upgrades. Vehicle owners increasingly seek exterior modifications that combine functional aerodynamics with aggressive styling. Moreover, manufacturers develop spoilers using advanced materials like carbon fiber and lightweight composites to meet efficiency standards.

Market expansion stems from growing production volumes of sports utility vehicles and performance-oriented cars. Original equipment manufacturers integrate rear spoilers into vehicle designs to comply with fuel economy regulations. Additionally, aftermarket retailers expand distribution networks through physical stores and digital platforms, making customization accessible to broader consumer segments.

Government initiatives promoting fuel-efficient transportation accelerate adoption of aerodynamic enhancements. Regulatory frameworks in developed regions mandate stricter emission standards for passenger vehicles. Therefore, automakers invest in aerodynamic testing and design refinements that reduce carbon footprints while maintaining vehicle aesthetics.

Investment in research facilities enables development of active spoiler systems with adjustable angles. These smart components automatically optimize downforce based on driving conditions and speed parameters. Furthermore, partnerships between technology firms and automotive suppliers drive innovation in lightweight manufacturing processes and sustainable material sourcing.

According to Mechanical Journals research, reducing a vehicle’s drag coefficient by approximately 10% can lead to a 5-7% improvement in fuel efficiency at highway speeds. This finding demonstrates how aerodynamic optimization directly impacts operational costs for consumers and fleet operators seeking economic advantages.

Consumer preferences shift toward personalized vehicle styling influenced by social media trends and motorsport culture. Young buyers prioritize exterior modifications that enhance visual appeal and performance characteristics. Additionally, urbanization in emerging economies creates new customer bases for aftermarket accessories, expanding market reach across diverse geographic segments.

Key Takeaways

- Global Rear Spoiler Market projected to reach USD 8.3 Billion by 2035 from USD 4.4 Billion in 2025 at 6.6% CAGR

- Injection Molding technology dominates with 49.8% market share due to cost-effectiveness and production scalability

- ABS material holds 46.2% share driven by durability and affordability for mass-market applications

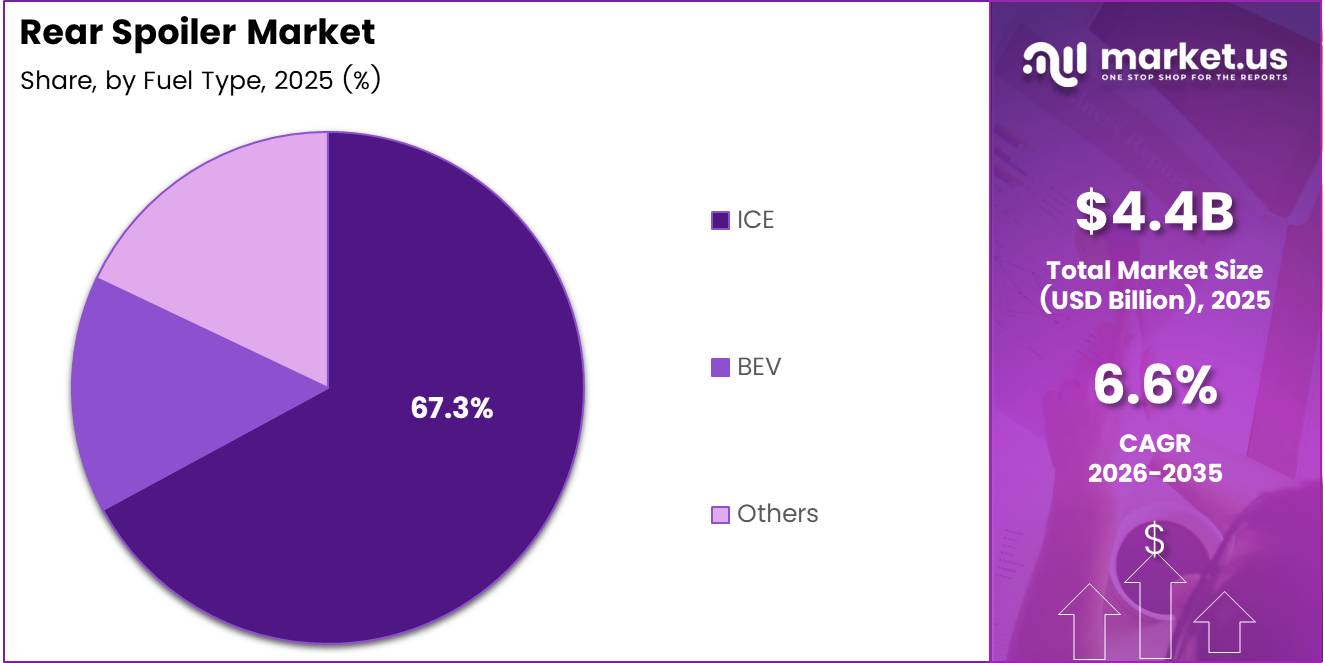

- ICE vehicles account for 67.3% of demand reflecting current automotive powertrain distribution

- SUV segment leads with 48.5% share supported by popularity of crossover and performance utility vehicles

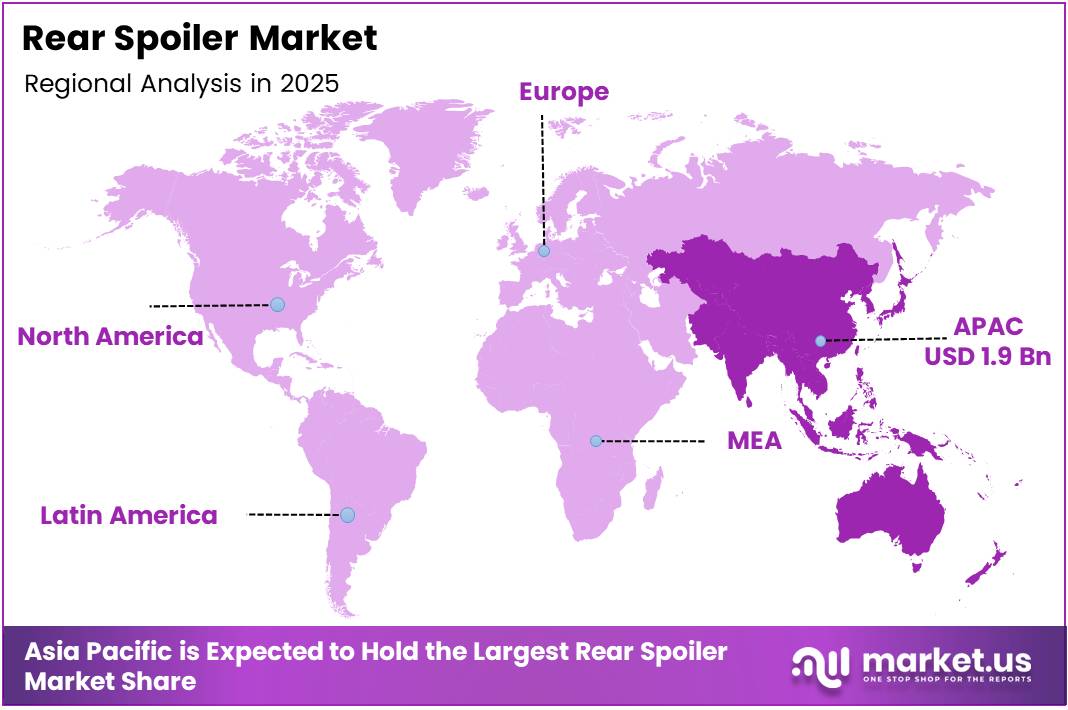

- Asia Pacific region dominates with 44.8% market share valued at USD 1.9 Billion in 2025

Technology Type Analysis

Injection Molding dominates with 49.8% due to superior manufacturing efficiency and design flexibility.

In 2025, Injection Molding held a dominant market position in the By Technology Type segment of Rear Spoiler Market, with a 49.8% share. This technology enables mass production of complex spoiler geometries with consistent quality standards. Manufacturers utilize high-pressure injection systems to mold thermoplastic materials into precise aerodynamic shapes. Additionally, shorter cycle times and reduced material waste make this method economically attractive for both OEM and aftermarket suppliers.

Blow Molding technology serves niche applications requiring hollow spoiler structures with reduced weight characteristics. This process inflates heated plastic material inside mold cavities to create lightweight components. However, limited design complexity restricts its adoption compared to injection methods. Consequently, blow molding finds specific use in budget-oriented aftermarket products where cost considerations outweigh precision requirements.

Reaction Injection Molding addresses demand for high-strength composite spoilers in premium vehicle segments. This technique combines reactive liquid components that cure inside molds to form rigid structures. Moreover, manufacturers achieve superior surface finishes and intricate detailing suitable for luxury applications. Nevertheless, higher production costs and longer cycle times limit widespread adoption across mass-market product lines.

Material Type Analysis

ABS dominates with 46.2% due to balanced durability, affordability, and ease of manufacturing.

In 2025, ABS held a dominant market position in the By Material Type segment of Rear Spoiler Market, with a 46.2% share. Acrylonitrile Butadiene Styrene offers excellent impact resistance and dimensional stability for automotive exterior applications. Manufacturers favor this thermoplastic for its compatibility with various molding technologies and cost-effective processing. Furthermore, ABS components withstand environmental stresses including UV exposure and temperature fluctuations typical in automotive use.

Carbon Fiber materials attract performance enthusiasts seeking maximum weight reduction and premium aesthetics. These composite structures deliver exceptional strength-to-weight ratios beneficial for high-speed stability and fuel economy. However, elevated manufacturing costs and specialized production techniques limit adoption to luxury and sports vehicle markets. Additionally, carbon fiber spoilers command premium pricing that restricts accessibility for price-sensitive consumer segments.

Fiberglass provides mid-range solution balancing performance characteristics with reasonable pricing for aftermarket customization. This material allows complex molding for aerodynamic profiles while maintaining acceptable structural integrity. Meanwhile, Sheet Metal serves traditional manufacturing approaches offering robustness and paint compatibility for OEM applications. Nevertheless, heavier weight profiles reduce efficiency benefits compared to modern polymer alternatives.

Fuel Type Analysis

ICE dominates with 67.3% reflecting current powertrain distribution in global vehicle production.

In 2025, ICE held a dominant market position in the By Fuel Type segment of Rear Spoiler Market, with a 67.3% share. Internal combustion engine vehicles represent majority of existing automotive fleet requiring aerodynamic enhancement accessories. Consumers retrofit spoilers on gasoline and diesel vehicles to improve fuel efficiency and visual appeal. Moreover, established aftermarket infrastructure supports widespread availability of ICE-compatible spoiler designs across multiple vehicle platforms and price points.

BEV segment demonstrates accelerating growth as electric vehicle adoption increases across global markets. Battery electric vehicles benefit significantly from aerodynamic refinements that extend driving range by reducing energy consumption. Manufacturers design specialized spoilers optimized for EV weight distribution and lower center of gravity characteristics. Therefore, automakers integrate rear spoilers as standard features in many electric vehicle models to maximize efficiency and performance metrics.

Others category encompasses hybrid powertrains and alternative fuel vehicles requiring specialized aerodynamic solutions. These vehicles blend conventional and electric propulsion systems demanding balanced spoiler designs. Additionally, plug-in hybrid models adopt rear spoilers to optimize fuel economy during extended highway driving conditions while maintaining electric-only range capabilities in urban environments.

Vehicle Type Analysis

SUV dominates with 48.5% driven by popularity of crossover and performance utility vehicle segments.

In 2025, SUV held a dominant market position in the By Vehicle Type segment of Rear Spoiler Market, with a 48.5% share. Sport utility vehicles exhibit higher aerodynamic drag due to boxy body shapes and elevated ride heights. Consequently, rear spoilers provide measurable benefits in reducing turbulence and improving stability during highway driving. Furthermore, manufacturers offer factory-installed spoiler options on performance-oriented SUV variants appealing to enthusiast buyers seeking aggressive styling combined with functional advantages.

Hatchback vehicles benefit from compact spoiler designs that enhance aerodynamics without compromising cargo accessibility. These shorter rear overhangs allow integrated spoiler mounting directly on tailgate structures. Aftermarket suppliers develop vehicle-specific kits catering to popular hatchback models in European and Asian markets. Additionally, young buyers customize hatchbacks with spoilers to achieve sporty appearance reflecting motorsport heritage and rally racing aesthetics.

MPV segment adopts rear spoilers primarily for styling differentiation rather than substantial aerodynamic improvements. Multi-purpose vehicles prioritize interior space and practicality over performance characteristics. However, certain manufacturers include subtle spoiler elements on MPV designs to modernize exterior appearance and appeal to family buyers. Consequently, this segment represents smaller market share with limited aftermarket customization activity compared to performance-focused vehicle categories.

Drivers

Rising Demand for Enhanced Vehicle Aerodynamics Drives Market Expansion

Consumers increasingly recognize aerodynamic modifications as practical investments that reduce fuel consumption and operational costs. Rear spoilers optimize airflow over vehicle surfaces minimizing drag coefficient and turbulence at highway speeds. Consequently, fleet operators adopt these accessories to achieve measurable fuel savings across commercial vehicle operations.

Automotive manufacturers integrate spoilers into vehicle designs to meet stringent corporate average fuel economy standards. Regulatory pressures compel automakers to reduce emissions through comprehensive efficiency improvements including aerodynamic refinements. Moreover, performance testing validates spoiler effectiveness in reducing lift forces and enhancing high-speed stability for passenger safety.

Growing consumer preference for sporty vehicle aesthetics accelerates aftermarket accessory sales across demographic segments. Young buyers prioritize exterior modifications that differentiate their vehicles and reflect personal style preferences. Additionally, social media platforms amplify customization trends encouraging broader adoption of rear spoilers as essential styling components.

Restraints

High Component Costs and Regulatory Compliance Limit Market Penetration

Premium rear spoiler materials like carbon fiber command elevated pricing that restricts adoption among price-sensitive buyers. Consumers in emerging markets prioritize essential vehicle maintenance over aesthetic upgrades due to budget constraints. Consequently, manufacturers struggle to balance quality expectations with affordable pricing for mass-market penetration across diverse economic segments.

Strict vehicle modification regulations in developed regions impose compliance requirements on aftermarket accessory installations. Authorities mandate safety certifications ensuring spoilers meet structural integrity standards and do not obstruct visibility. Moreover, enforcement of modification limits restricts customization options available to consumers reducing overall market demand.

Installation complexity and compatibility issues deter casual buyers from purchasing aftermarket rear spoilers. Consumers require professional mounting services ensuring proper alignment and secure attachment to vehicle structures. Additionally, warranty concerns regarding aftermarket modifications discourage some vehicle owners from pursuing exterior enhancements that might void manufacturer coverage agreements.

Growth Factors

Technological Innovation and Manufacturing Partnerships Accelerate Market Development

Introduction of 3D-printed rear spoilers enables rapid prototyping and customized designs tailored to specific vehicle models. Additive manufacturing reduces production costs while allowing complex geometries impossible with traditional molding techniques. Consequently, small-batch manufacturers serve niche markets with bespoke aerodynamic solutions attracting enthusiast buyers seeking unique styling options.

According to Automotive Testing Technology International, improved aerodynamics can contribute to 5-8% increased electric vehicle range in some cases because aerodynamic drag becomes more significant at higher speeds. Tesla’s refreshed Model S in June 2025 reportedly uses aerodynamic refinements including rear spoiler and diffuser as part of styling improvements that lift range performance and downforce balance.

Strategic partnerships between original equipment manufacturers and aftermarket accessory suppliers expand distribution channels and product availability. Collaborative development initiatives integrate spoiler designs into new vehicle platforms ensuring compatibility and performance optimization. Moreover, co-branding opportunities leverage manufacturer credibility to build consumer trust in aftermarket products.

Emerging Trends

Sustainable Materials and Digital Commerce Transform Market Dynamics

Rising popularity of eco-friendly materials in automotive accessory manufacturing reflects broader sustainability commitments across the industry. Manufacturers explore bio-based composites and recycled plastics for spoiler production reducing environmental impact. Consequently, environmentally conscious consumers favor products demonstrating responsible sourcing and manufacturing practices aligned with personal values.

Surge in e-commerce platforms offering custom rear spoiler options expands market reach beyond traditional retail limitations. Online marketplaces provide virtual fitting tools allowing buyers to preview spoiler designs on their vehicles. Moreover, direct-to-consumer sales models eliminate intermediary costs making premium accessories more affordable and accessible to broader customer segments.

Increasing social media influence shapes vehicle styling preferences and customization choices among younger demographics. Automotive influencers showcase modification projects generating viral content that drives product awareness and purchase intent. Additionally, manufacturers leverage digital marketing campaigns targeting specific enthusiast communities to build brand loyalty and capture emerging market opportunities.

Regional Analysis

Asia Pacific Dominates the Rear Spoiler Market with a Market Share of 44.8%, Valued at USD 1.9 Billion

Asia Pacific commands dominant market position with 44.8% share valued at USD 1.9 Billion in 2025 driven by massive automotive production volumes in China, Japan, and South Korea. Rapid urbanization and rising disposable incomes accelerate vehicle ownership rates creating substantial aftermarket accessory demand. Moreover, regional manufacturers offer cost-competitive products leveraging local supply chains and manufacturing expertise serving diverse consumer preferences across multiple price segments.

North America Rear Spoiler Market Trends

North America demonstrates strong demand for premium rear spoilers driven by established performance vehicle culture and customization traditions. Consumers prioritize quality materials and certified installations ensuring compliance with safety standards. Additionally, extensive aftermarket retail infrastructure supports widespread product availability through specialty shops and online platforms catering to enthusiast communities.

Europe Rear Spoiler Market Trends

Europe exhibits sophisticated market dynamics influenced by stringent emission regulations and environmental consciousness among consumers. Automakers integrate aerodynamic enhancements including rear spoilers to achieve fuel efficiency targets mandated by regulatory frameworks. Furthermore, motorsport heritage particularly in Germany and Italy drives consumer interest in performance-oriented accessories that enhance vehicle dynamics and visual appeal.

Latin America Rear Spoiler Market Trends

Latin America presents emerging opportunities as economic development increases vehicle ownership and discretionary spending on customization accessories. Consumers in Brazil and Mexico show growing interest in exterior modifications reflecting personal style preferences. However, price sensitivity remains significant factor limiting premium product adoption across broader population segments.

Middle East & Africa Rear Spoiler Market Trends

Middle East and Africa region demonstrates selective demand concentrated in affluent markets where luxury and performance vehicles dominate automotive landscapes. High-income consumers invest in premium rear spoilers crafted from advanced materials like carbon fiber. Nevertheless, limited aftermarket infrastructure and regulatory variations across countries constrain overall market development compared to established regions.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Magna International operates as leading automotive supplier delivering integrated rear spoiler solutions for global automakers and aftermarket channels. The company leverages advanced engineering capabilities and extensive manufacturing footprint to develop aerodynamic components meeting stringent quality standards. Moreover, strategic investments in lightweight materials and automated production technologies position Magna as preferred partner for original equipment manufacturers seeking competitive advantage through performance-oriented exterior accessories.

Plastic Omnium specializes in innovative polymer-based automotive components including rear spoilers designed for optimal aerodynamic efficiency. The company employs sophisticated simulation tools and wind tunnel testing to validate spoiler designs before mass production. Additionally, Plastic Omnium maintains strong relationships with major automakers supporting early integration of aerodynamic accessories into new vehicle development programs across multiple regional markets.

SMP Automotive focuses on aftermarket rear spoiler manufacturing serving customization enthusiasts and performance vehicle owners. The company offers extensive product portfolios covering diverse vehicle models with competitive pricing strategies. Furthermore, SMP Automotive invests in digital commerce platforms expanding market reach and simplifying purchase processes for consumers seeking convenient access to quality aftermarket accessories.

Polytec Group delivers specialized rear spoiler solutions emphasizing sustainable manufacturing practices and recyclable material applications. The company addresses growing environmental consciousness among automotive suppliers and end consumers. Consequently, Polytec Group differentiates its offerings through eco-friendly product certifications attracting automakers committed to reducing carbon footprints across entire supply chains while maintaining performance standards.

Key Players

- Magna International

- P.U. Tech Spoiler

- Plastic Omnium

- AP Plasman Inc.

- SMP Automotive

- Polytec Group

- Rehau Ltd.

- Albar Industries Inc.

- Inoac Corporation

Recent Developments

- April 2024 – Community testing and vehicle forums reported that Tesla Model 3 Highland version’s trunk spoiler was engineered to help reduce drag, reflecting real-world adoption of aerodynamic upgrades in new EV variants that enhance range performance and operational efficiency.

Report Scope

Report Features Description Market Value (2025) USD 4.4 Billion Forecast Revenue (2035) USD 8.3 Billion CAGR (2026-2035) 6.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology Type (Injection Molding, Blow Molding, Reaction Injection Molding), By Material Type (ABS, Carbon Fiber, Fiberglass, Sheet Metal), By Fuel Type (ICE, BEV, Others), By Vehicle Type (SUV, Hatchback, MPV) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Magna International, P.U. Tech Spoiler, Plastic Omnium, AP Plasman Inc., SMP Automotive, Polytec Group, Rehau Ltd., Albar Industries Inc., Inoac Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Magna International

- P.U. Tech Spoiler

- Plastic Omnium

- AP Plasman Inc.

- SMP Automotive

- Polytec Group

- Rehau Ltd.

- Albar Industries Inc.

- Inoac Corporation