Global Real-Time Wage Access Market Size, Share, Industry Analysis Report By Type of Real-Time Wage Access Service (Employer-Sponsored RTWA Solutions, Independent (Third-Party) RTWA Providers, Integrated Payroll Solutions), By User Type (Hourly Workers, Salaried Workers, Gig & Freelance Workers, Others), By Enterprises Size (Small to Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry (Retail & Hospitality, Healthcare, Construction & Manufacturing, IT & Telecom, Government & Education, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165702

- Number of Pages: 359

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- User and employee statistics

- Employer and Adoption Statistics

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Type of Real-Time Wage Access Service Analysis

- User Type Analysis

- Enterprise Size Analysis

- Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

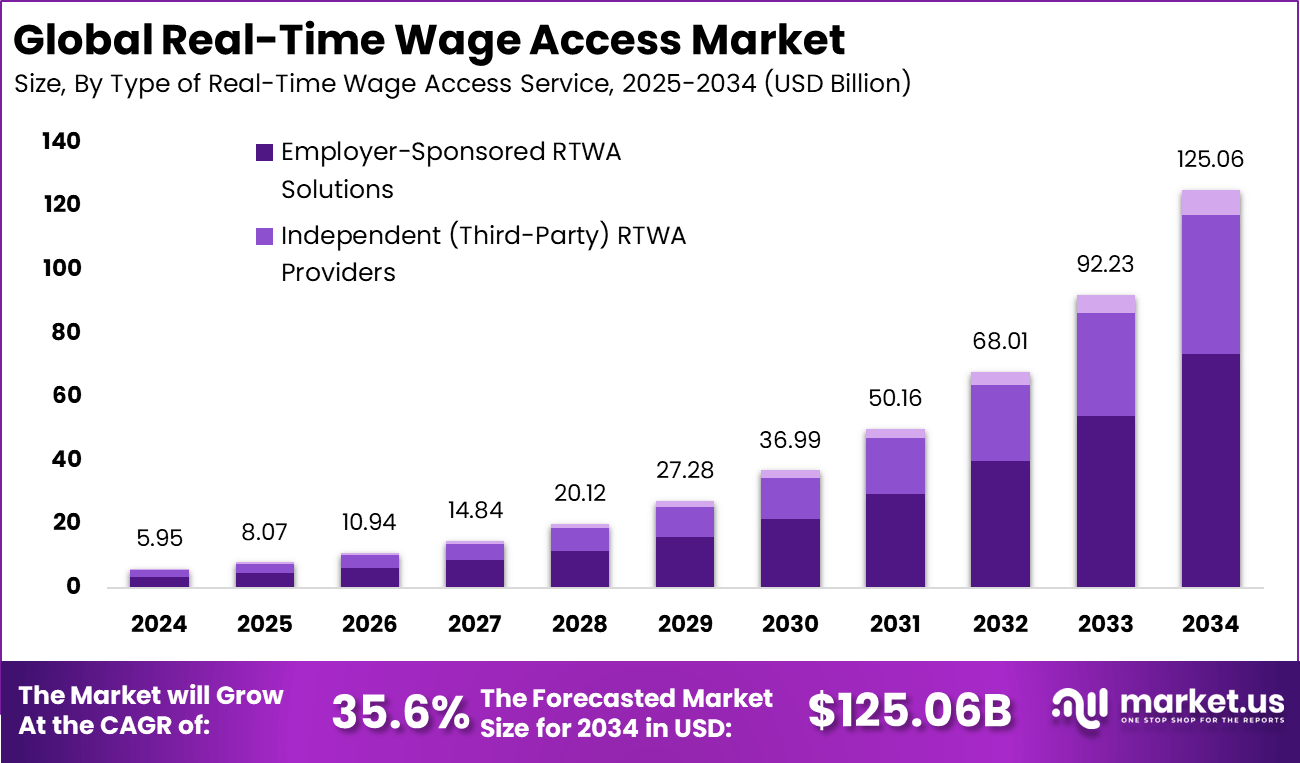

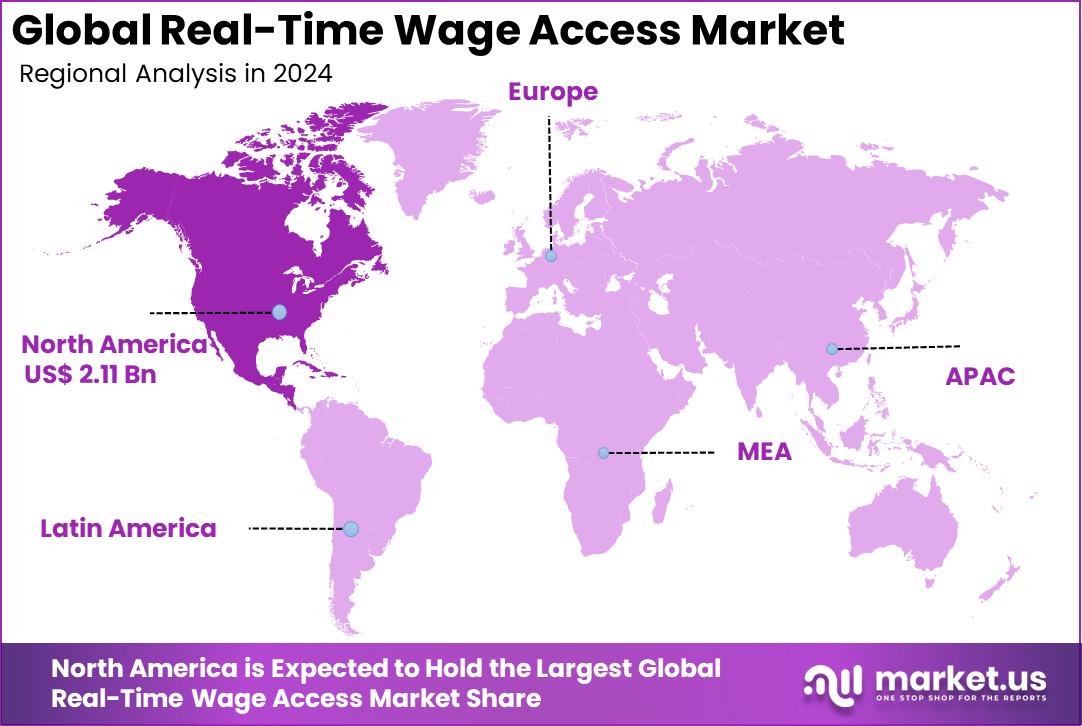

The Global Real-Time Wage Access Market size is expected to be worth around USD 125.06 billion by 2034, from USD 5.95 billion in 2024, growing at a CAGR of 35.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 35.6% share, holding USD 2.11 billion in revenue.

The RWA market is growing rapidly as employers and workers increasingly adopt systems that enable wages to be accessed as soon as they are earned rather than waiting for the standard pay cycle. The market sits at the intersection of payroll, fintech and workforce-benefit services. Growth is supported by rising demand for wage flexibility, decreasing costs of payment rail technologies and expanded mobile banking penetration.

Several factors are driving expansion in the RWA market. Financial stress among employees has become more pronounced, prompting demand for faster access to earned wages. The growth of hourly, shift-based and gig-economy employment has made traditional pay cycles appear less compatible with worker needs. Digital payroll and payment systems have matured to enable real-time or near-real-time wage tracking and transfer.

Demand for real-time wage access is growing rapidly, particularly in hourly and shift-based industries where employees face erratic incomes. Surveys indicate more than half of employees express a strong interest in using RWA services to better manage their finances. This demand is supported by businesses looking to differentiate benefits offerings for talent attraction and retention. Integration with payroll data in real time allows seamless wage calculation and disbursement, which heightens employee acceptance and use.

For instance, in November 2025, Emerald Finance partnered with Gaurav Enterprises to launch an early wage access program aimed at providing employees quicker access to their earned wages before the standard payday. This initiative supports financial wellness by offering flexible salary disbursement options, reducing the need for high-interest loans or credit usage. The program is designed to improve employee satisfaction, productivity, and retention by alleviating financial stress.

Technologies supporting RWA adoption include payroll-integration platforms that allow earned-wage calculation in real time, digital payment rails (push-to-bank or card), mobile apps for wage-access requests, and analytics systems to manage risk, monitor usage and deliver financial-wellness insights. Cloud-based services and API integrations with HR/time-clock systems reduce deployment friction. Secure data-linking between time-worked and wage-earned modules is also crucial for smooth RWA functioning.

Key Takeaway

- The Employer-Sponsored model led the real-time wage access landscape in 2024, accounting for 58.8%, supported by strong adoption of payroll-integrated payout systems.

- Salaried workers represented the largest user group with 45.4%, reflecting consistent demand for flexible income access among full-time employees.

- Large enterprises dominated with 70.7%, as organizations with sizable workforces increasingly adopt real-time pay to improve retention and reduce financial stress.

- The Retail and Hospitality sector held 35.7%, driven by high turnover and the need for liquidity among hourly and frontline workers.

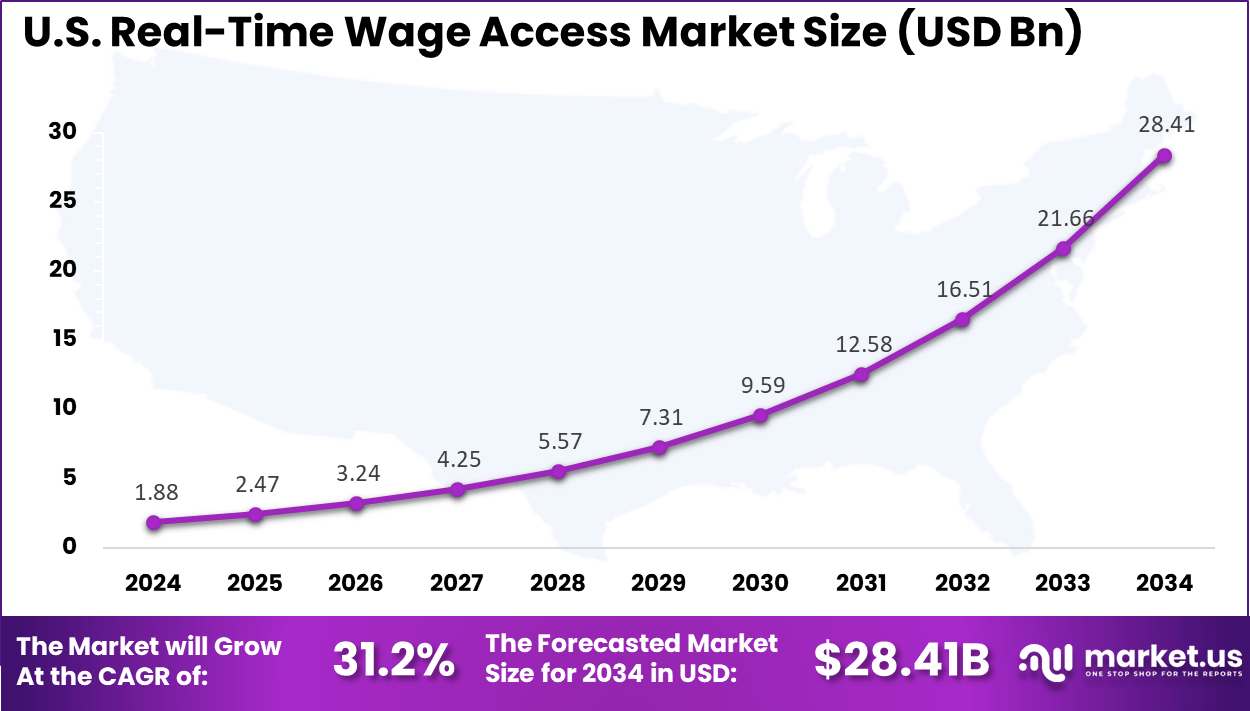

- The U.S. market reached USD 1.88 billion in 2024, expanding at a strong 31.2% CAGR, highlighting rapid employer and employee adoption.

- North America maintained leadership with 35.6% share, supported by advanced fintech ecosystems and widespread interest in flexible pay models.

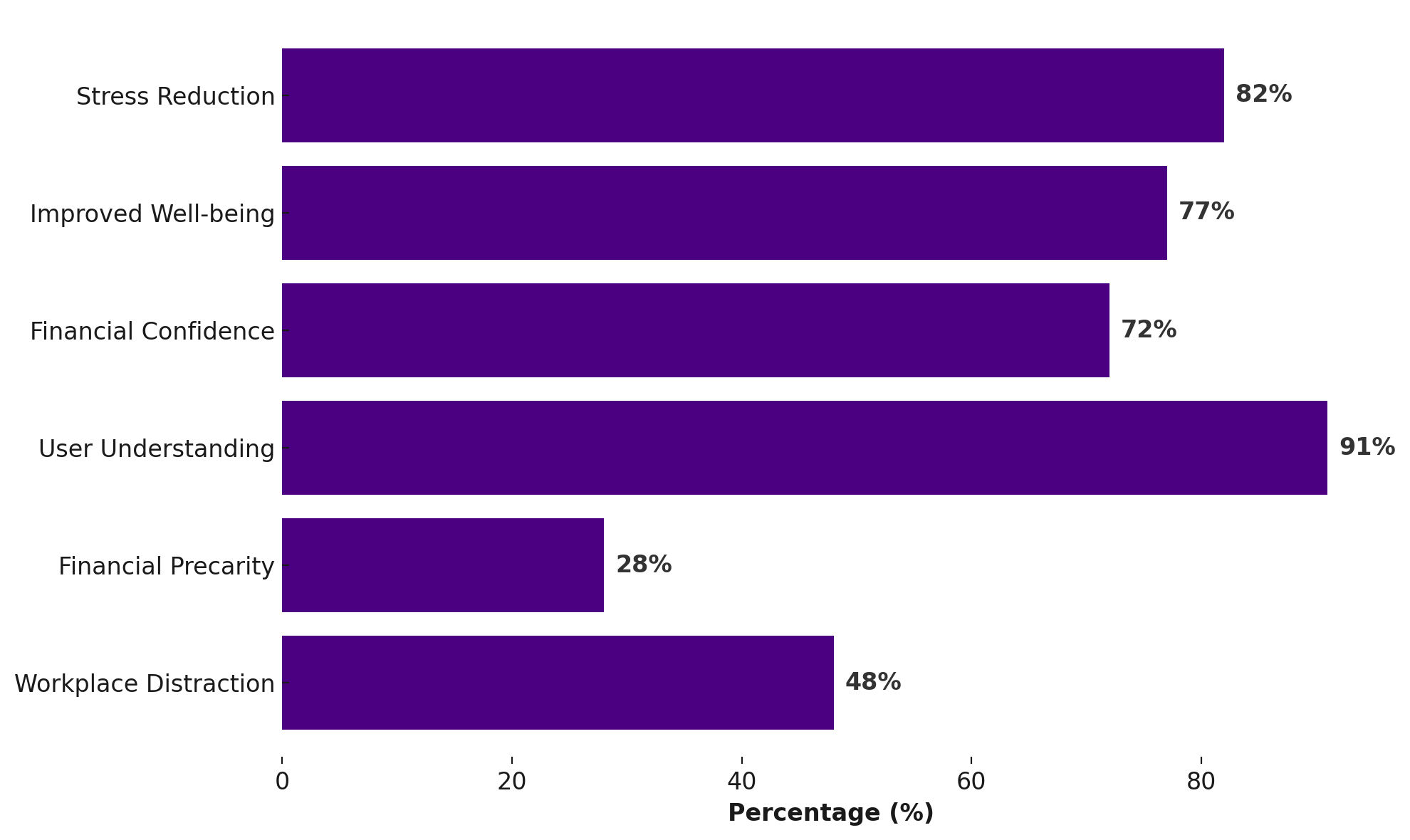

User and employee statistics

Employer and Adoption Statistics

- Employer adoption: Only 10% of employers currently provide early wage access as an employee benefit. This indicates significant room for growth as more organizations explore financial wellness programs.

- Employer benefits: Companies that offer EWA report better workplace outcomes. Employers observe higher morale, improved attendance, and stronger engagement, as employees with greater financial confidence remain more focused and productive.

- Job seeker preference: Around 74% of job seekers prefer employers that provide financial wellness tools, showing that EWA can be an important differentiator in competitive labor markets.

- Large enterprise adoption: Large enterprises accounted for 59.7% of the EWA market in 2024. These organizations have adopted EWA primarily to strengthen employee retention, reduce financial stress, and improve overall workforce performance.

Role of Generative AI

Generative AI is playing a growing role in real-time wage access by making payroll systems more efficient and accurate. AI algorithms can quickly calculate earned wages, deduct taxes, and handle complex payroll data in real time without delays.

This saves time for employers and reduces errors in paycheck calculations. Over 80% of companies using AI-enhanced payroll solutions report increased processing speed, while employees benefit from faster payment access and fewer disputes over earnings. This integration boosts worker trust and satisfaction by ensuring pay is delivered correctly and promptly.

AI also supports fraud detection and security in real-time wage access systems. With financial transactions happening instantly, AI monitors unusual activities to prevent fraud and protect employees’ funds. Research shows that AI-driven fraud detection can reduce suspicious transaction rates by up to 30%.

Investment and Business Benefits

Investment in RWA platforms is attracting significant capital as the sector moves from a fringe benefit to mainstream adoption. Funding rounds worth hundreds of millions indicate confidence in the model’s longevity and scalability. Areas ripe for investment include API platforms, AI risk analytics, real-time payment integrations, and user experience innovations.

Expanding RWA capabilities into new geographies and industries represents further business growth potential. Businesses offering RWA gain a competitive advantage by improving employee financial well-being, which correlates with higher productivity and loyalty.

Providing this on-demand pay option reduces absenteeism caused by financial emergencies and helps stabilize workforce morale. Additionally, companies benefit from streamlined payroll processes, lower loan defaults when employees borrow less externally, and positive employer branding linked to progressive financial benefits.

U.S. Market Size

The market for Real-Time Wage Access within the U.S. is growing tremendously and is currently valued at USD 1.88 billion, the market has a projected CAGR of 31.2%. This growth is driven by increasing financial stress among workers who need faster access to earned wages to manage bills and emergencies. Employers are adopting these solutions to improve employee satisfaction, reduce turnover, and enhance workforce productivity.

Technological advancements, such as real-time payment systems and easy payroll integration, also fuel market expansion by enabling seamless and instant wage transfers. Additionally, regulatory clarity and rising fintech adoption support wider acceptance of real-time wage access. This combination of demand, technology, and employer incentives is propelling the market forward.

For instance, in October 2025, DailyPay announced a strategic partnership with a leading U.S. payroll services provider to expand its real-time wage access solution to millions of new employees across North America. This collaboration underscores DailyPay’s position as a dominant player providing flexible earning access, helping workers manage their finances more effectively.

In 2024, North America held a dominant market position in the Global Real-Time Wage Access Market, capturing more than a 35.6% share, holding USD 2.11 billion in revenue. This leadership comes from widespread early adoption of digital payroll systems and a mature fintech ecosystem.

The region’s advanced payment infrastructures, such as real-time payment networks, enable seamless instant wage transfers. Additionally, increasing demand for financial flexibility among hourly, gig, and paycheck-to-paycheck workers fuels adoption, supported by regulatory clarity and strong employer integration of EWA platforms. Together, these factors sustain North America’s market dominance.

For instance, in October 2025, EarnIn introduced a real-time pay service allowing employees to access earnings as they are accrued, distinct from traditional earned wage access, aiming to transform payroll with greater immediacy and flexibility.

Type of Real-Time Wage Access Service Analysis

In 2024, the Employer-Sponsored RTWA Solutions segment held a dominant market position, capturing a 58.8% share of the Global Real-Time Wage Access Market. This dominance reflects how many employers are actively integrating RTWA into their payroll systems to offer workers faster access to earned wages.

Employer sponsorship often enhances employee financial wellness by providing streamlined, direct access to earned wages without intermediaries. This approach also boosts employee satisfaction and retention by reducing financial stress and creating a more supportive compensation environment.

Many businesses see this model as a critical tool to improve workforce engagement and reduce turnover. It is particularly favored by large enterprises with the capacity to integrate these solutions into existing HR infrastructure. The employer-sponsored option aligns with corporate initiatives geared toward financial inclusion and modern payroll practices, making it a key driver for market growth in real-time wage access technology.

For Instance, in June 2025, Refyne expanded its Series A funding by issuing INR 35 Crores in debt instruments, enhancing its capacity to widen employer partnerships and advance financial wellness features, including earned wage access solutions in India. This development underlines Refyne’s commitment to reinforcing its leadership in employer-sponsored RTWA services and broadening its reach beyond metropolitan areas.

User Type Analysis

In 2024, the Salaried Workers segment held a dominant market position, capturing a 45.4% share of the Global Real-Time Wage Access Market. Although wage access is commonly associated with hourly workers, an increasing number of salaried employees now seek flexibility in accessing earned wages before the traditional payday. This reflects a broader trend of employees looking for greater control over their finances and seeking solutions to manage unexpected expenses more efficiently.

Salaried workers’ growing adoption of RTWA services indicates the market’s evolution toward inclusivity beyond hourly wage earners. Technologies enabling real-time wage access are expanding, catering to diverse employment types, which enhances financial wellness programs and offers comprehensive benefits that appeal across different workforce categories.

For instance, in March 2025, EarnIn launched its Early Pay product nationwide, allowing users to access up to two days of their paycheck in advance. This feature empowers salaried and hourly workers to better manage finances on their own schedule while maintaining their existing banking relationships, supporting the growing presence of salaried workers using RTWA.

Enterprise Size Analysis

In 2024, The Large Enterprises segment held a dominant market position, capturing a 70.7% share of the Global Real-Time Wage Access Market. Their extensive workforce and resources enable them to implement these solutions widely and integrate them with existing payroll and HR systems efficiently.

Larger companies recognize RTWA as a strategic approach to improve employee satisfaction and reduce turnover, particularly in highly competitive industries. The scale of operations in large enterprises allows for leveraging RTWA technology to optimize payroll processes and improve liquidity access for workers at a mass level.

For Instance, in 2025, Zellis Group’s acquisition of Hastee Technologies enhanced its HR and payroll offerings by incorporating earned wage access, financial education, and money management tools. This strategic move targets large enterprises aiming to provide comprehensive financial wellness benefits to their workforce.

Industry Analysis

In 2024, The Retail & Hospitality segment held a dominant market position, capturing a 35.7% share of the Global Real-Time Wage Access Market. These sectors traditionally have high employee turnover and many hourly or part-time workers who benefit substantially from faster access to their earned wages. RTWA in retail and hospitality helps address cash flow challenges faced by employees and acts as an incentive to attract and retain talent in these competitive labor markets.

The fast-paced nature of retail and hospitality, combined with often fluctuating work hours, creates a strong demand for flexible wage payment options. Real-time wage access services provide vital financial relief and contribute to improving worker retention and job satisfaction, supporting overall operational stability in these industries.

For Instance, in September 2025, DailyPay introduced a new Frontline Communications feature to its platform. This tool aims to strengthen employer-employee engagement, promoting real-time pay access for hourly workers and enhancing workplace connection. This recent addition supports DTWA solutions heavily adopted in industries like retail and hospitality, where wage flexibility is critical.

Emerging Trends

Emerging trends show that real-time wage access is becoming a standard benefit for many workers, especially hourly and gig workers. Today, about 8 out of 10 employees express a strong interest in accessing their wages immediately after work rather than waiting weeks for traditional pay cycles.

This demand is driving broader adoption by employers seeking to reduce financial stress among their staff. The trend also includes mobile app-enabled instant payments and integration with digital wallets, making wage access seamless and convenient for users. Another rising trend is the combination of real-time wage access with financial wellness programs.

Many platforms now offer tools to help employees budget, save, and manage money more effectively. Studies indicate that over half of users report improved financial habits after gaining access to real-time earnings. Employers are noticing that this combination not only improves employee well-being but also reduces turnover and absenteeism, as workers feel more financially secure and supported.

Growth Factors

Growth in real-time wage access is largely driven by workers’ need for financial flexibility. Financial stress impacts nearly 70% of workers, and early access to wages directly addresses urgent cash flow needs such as unexpected expenses. Companies using real-time wage access report as much as a 50% drop in staff turnover and a 60% reduction in unfilled shifts, highlighting the strong link between pay timing and employee retention.

Technological advances also fuel growth. Automated payroll systems integrated with real-time wage platforms lower operational costs and simplify implementation. The accessibility of smartphone apps and digital payment methods further expands reach, especially among younger and gig economy workers who prioritize immediate access to earnings. This evolution reshapes workforce management by aligning pay more closely with hours worked.

Key Market Segments

By Type of Real-Time Wage Access Service

- Employer-Sponsored RTWA Solutions

- Independent (Third-Party) RTWA Providers

- Integrated Payroll Solutions

By User Type

- Hourly Workers

- Salaried Workers

- Gig & Freelance Workers

- Others

By Enterprise Size

- Small to Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Industry

- Retail & Hospitality

- Healthcare

- Construction & Manufacturing

- IT & Telecom

- Government & Education

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Demand for Financial Flexibility

The rising financial pressure faced by many workers is a major factor driving the adoption of real-time wage access. Many employees live paycheck to paycheck and face urgent cash needs before their regular pay date. Real-time wage access allows them to tap into the money they have already earned without waiting. This reduces reliance on payday loans or credit cards, helping employees maintain stability.

In addition, advances in technology, such as integration with payroll systems and real-time payment infrastructure, make it easier to provide immediate access to wages. This seamless wage distribution improves the employee experience and fosters trust. The convenience of receiving earned pay in bank accounts or digital wallets instantly motivates more workers to adopt these services.

For instance, in August 2025, DailyPay announced a strategic partnership with Workday to offer frontline and hourly workers real-time access to their earned pay. This collaboration enables more businesses to provide financial well-being benefits, supporting employees’ desire for immediate access to earned income.

Restraint

Regulatory Uncertainty and Compliance Complexity

One major challenge for the real-time wage access market is navigating the unclear and evolving regulatory landscape. Different regions have varied laws and standards covering wage access services, causing confusion about compliance. Some worry whether these programs are considered loans and subject to strict regulations, adding legal risk for providers.

Furthermore, regulatory bodies are increasingly focused on consumer protection and ensuring fair practices. Providers must comply with disclosure requirements, fee transparency, and data privacy laws, complicating implementation. These regulatory pressures can delay product launches and increase operational costs.

For instance, in May 2023, FlexWage released a comprehensive guide addressing critical vendor solutions and regulatory questions in earned wage access. This effort was made to help employers and providers navigate an evolving and complex regulatory environment that poses compliance challenges.

Opportunities

Integration with Fintech Ecosystems and Financial Inclusion

Real-time wage access presents a compelling opportunity by integrating with broader fintech solutions to enhance financial inclusion. It offers immediate liquidity to workers who often lack access to traditional credit, such as part-time, gig, or low-income employees. By embedding real-time wage access into payroll systems and digital wallets, providers can deliver quick funds without debt, helping users manage emergencies more effectively.

Additionally, partnerships with fintech players like digital banks, budgeting apps, and credit services allow wage access to be part of a wider financial wellness ecosystem. This opens new avenues to bundle earning advances with savings, insurance, and credit-building tools, creating a personalized financial management experience. This expansion into comprehensive financial care is an important growth avenue for the market and benefits end users.

For instance, in June 2025, Zellis Group acquired Hastee Technologies, aiming to enhance its employee well-being offerings by integrating earned wage access with financial education and money management tools. This move expands wage access beyond simple pay advances into holistic financial wellness solutions.

Challenges

Data Security and Trust Concerns

Handling sensitive payroll and bank information brings significant data security challenges in real-time wage access platforms. Users must trust that their financial data is protected against breaches and misuse. Any security lapse can harm consumer confidence, damage reputation, and attract regulatory penalties. This makes strong cybersecurity measures a top priority for providers.

Besides technological safeguards, transparency about how data is handled helps build trust. Users can be skeptical about service reliability and ongoing stability, especially since these platforms often hold and move large sums in real time. Overcoming these concerns requires constant investment in security infrastructure, clear communication, and compliance with privacy laws to gain and maintain user loyalty.

For instance, in April 2025, Payactiv introduced Visa+, a service to deliver real-time earned wage transfers to popular digital wallets such as Venmo and PayPal. This innovation focused on secure transactions without requiring users to disclose sensitive bank details, addressing trust and security concerns.

Key Players Analysis

Refyne, DailyPay, and EarnIn lead the real-time wage access market with platforms that allow employees to access earned income instantly. Their systems integrate directly with employer payroll, improving cash flow for workers and reducing reliance on short-term credit products. Payactiv and Stream Platforms Ltd. strengthen adoption with enterprise-focused tools that combine wage access, budgeting support, and responsible usage features suited for large and distributed workforces.

FlexWage Solutions, Hastee Technologies, ZayZoon, and Instant Financial expand the market with mobile-first platforms designed for hourly and gig workers. Their focus on rapid transfers, strong employer controls, and secure payment gateways supports reliable and flexible disbursement. Branch enhances competitiveness by linking wage access with digital wallets and everyday financial tools, improving financial convenience for frontline employees.

Other providers add value through enhanced payroll integrations, real-time APIs, and transparent transaction models. Growing interest in financial wellness and employee retention is strengthening market demand. Collaboration across fintech firms, payroll processors, and employers is improving service reliability and enabling wider adoption of real-time wage access solutions.

Top Key Players in the Market

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others

Recent Developments

- In April 2025, Payactiv, Inc. launched Visa+, a new service enabling real-time disbursement of earned wages directly to Venmo and PayPal accounts. This employee-centric feature offers convenience and flexibility without requiring users to share debit card or bank details, enhancing financial control and helping improve employee satisfaction and retention.

- In September 2025, EarnIn launched a new payroll platform aimed at providing employees with flexible, real-time access to their wages. Its “Live Pay” feature streams pay in real time based on hours worked, shifting payroll control from employer to employee and promoting financial flexibility and wellbeing.

Report Scope

Report Features Description Market Value (2024) USD 5.95 Bn Forecast Revenue (2034) USD 125.6 Bn CAGR(2025-2034) 35.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type of Real-Time Wage Access Service (Employer-Sponsored RTWA Solutions, Independent (Third-Party) RTWA Providers, Integrated Payroll Solutions), By User Type (Hourly Workers, Salaried Workers, Gig & Freelance Workers, Others), By Enterprises Size (Small to Medium-Sized Enterprises (SMEs), Large Enterprises), By Industry (Retail & Hospitality, Healthcare, Construction & Manufacturing, IT & Telecom, Government & Education, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Refyne, DailyPay, EarnIn, Payactiv, Inc., Stream Platforms Ltd., Flexwage Solutions, Hastee Technologies Ltd., ZayZoon, Instant Financial, Branch, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Real-Time Wage Access MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Real-Time Wage Access MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Refyne

- DailyPay

- EarnIn

- Payactiv, Inc.

- Stream Platforms Ltd.

- Flexwage Solutions

- Hastee Technologies Ltd.

- ZayZoon

- Instant Financial

- Branch

- Others