Rapid Antigen Testing Market By Kit Type (Quantitative and Digital), By Application (Infectious diseases testing, Oncology testing, Human genetic testing, Blood screening, Forensic applications and Others), By End-User (Hospitals and diagnostic centres, Stand-alone diagnostic laboratories, Research laboratories, and Pharmaceutical & biotechnology companies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167266

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

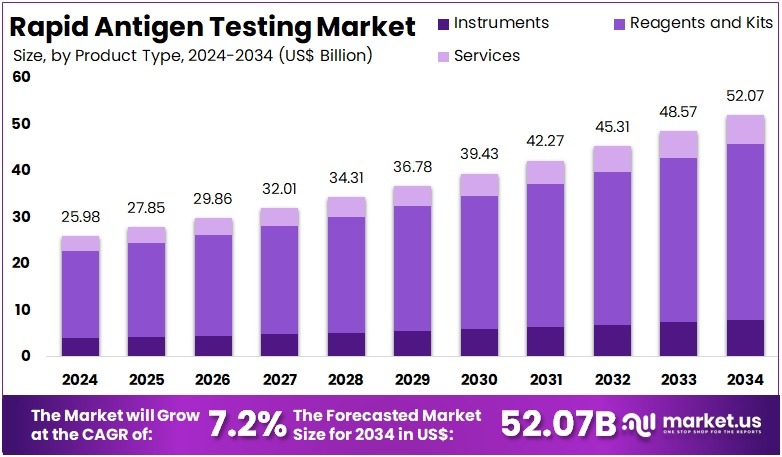

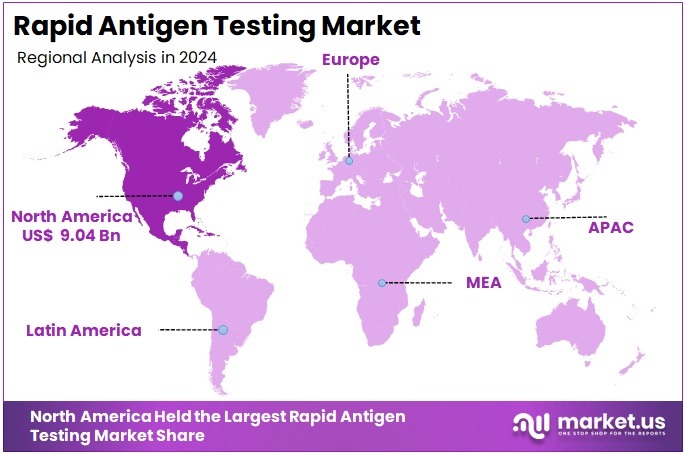

The Rapid Antigen Testing Market Size is expected to be worth around US$ 52.07 billion by 2034 from US$ 25.98 billion in 2024, growing at a CAGR of 7.2% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 34.8% share and holds US$ 9.04 Billion market value for the year.

The Rapid Antigen Testing Market has emerged as a critical pillar of infectious disease diagnostics, driven by growing global demand for rapid, point-of-care (POC) results that support early detection, outbreak monitoring, and decentralized screening.

Rapid antigen tests enable healthcare providers and consumers to identify pathogens within minutes, bypassing the time-intensive laboratory workflows required for nucleic-acid amplification tests (NAATs). These tests are now extensively used in communicable disease surveillance programs, emergency response pathways, and routine screening across healthcare and public health settings.

Rapid antigen platforms commonly utilize lateral flow immunoassays (LFA) and fluorescence-enhanced readout systems, offering fast and cost-effective detection of viral and bacterial proteins. They are increasingly integrated into emergency departments, outpatient settings, community testing drives, occupational health programs, and self-testing environments. The market’s growth is reinforced by rising prevalence of infectious diseases, expanding screening requirements, and global initiatives encouraging early detection to reduce transmission risks.

Companies continue innovating with improved sensitivity assays, digital readers, connected devices, and multiplex panels capable of identifying multiple pathogens simultaneously—expanding use cases beyond COVID-19 toward influenza, RSV, dengue, Group A strep, and sexually transmitted infections. As governments strengthen epidemic preparedness programs, rapid antigen testing remains indispensable for accessible, fast, and scalable diagnostics.

In November 2023, the U.S. Food and Drug Administration authorized the first over-the-counter (OTC) COVID-19 antigen test for commercial distribution. ACON Laboratories’ Flowflex COVID-19 Antigen Home Test, which initially received Emergency Use Authorization (EUA) in 2021, has now completed the FDA’s full premarket review process—becoming the second home COVID-19 test to do so and the first approved for use in individuals under 18 years. This clearance follows the earlier approval of a home-based molecular test earlier in the year.

Key Takeaways

- In 2024, the market generated a revenue of US$ 98 billion, with a CAGR of 7.2%, and is expected to reach US$ 52.07 billion by the year 2034.

- The Product Type segment is divided into Instruments, Reagents and Kits, and Services, with Reagents and Kits taking the lead in 2024 with a market share of 72.8%.

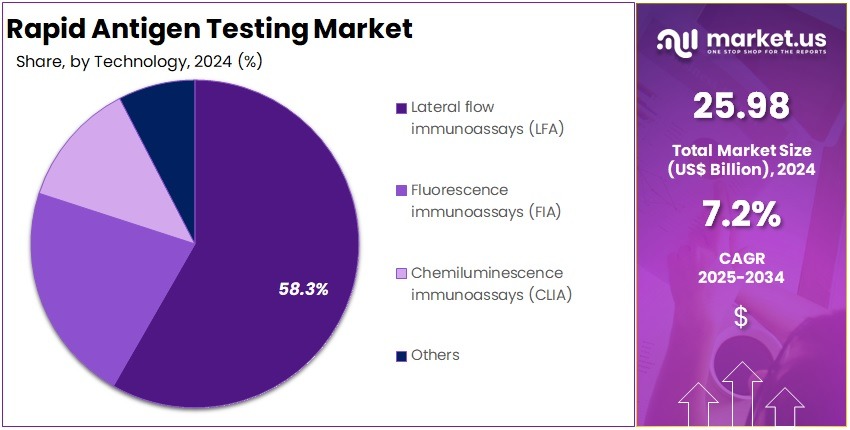

- The Technology segment is divided into Lateral flow immunoassays (LFA), Fluorescence immunoassays (FIA), Chemiluminescence immunoassays (CLIA), and Others, with Lateral flow immunoassays (LFA) taking the lead in 2024 with a market share of 58.3%

- The Application segment is divided into Infectious diseases, Sexually transmitted infections, and Others, with Infectious diseases taking the lead in 2024 with a market share of 79.5%.

- The End-User segment is bifurcated into Hospitals & clinics, Diagnostic laboratories & reference centres, Home care, and Others, with Hospitals & clinics taking the lead in 2024 with a market share of 34.7%.

- North America led the market by securing a market share of 34.8% in 2024.

Product Type Analysis

Reagents and kits dominated the product landscape with 72.8% arkey share as they represent the primary consumable component used across point-of-care, clinical, and home-based testing. These include test cassettes, swabs, assay buffers, extraction solutions, and single-use panels—widely used for influenza, COVID-19, RSV, dengue, malaria, and strep testing. Their fast turnaround time (5–20 minutes), affordability, and simple operational workflow drive widespread adoption across both developed and emerging markets. Their large-scale deployment during pandemics established durable global distribution channels.

In January 2021, Abbott announced that it successfully fulfilled the U.S. government’s massive order of 150 million BinaxNOW™ COVID-19 Rapid Antigen Tests, designed for mass-scale community screening across schools, workplaces, and public-health programs. Following the completion of this contract, Abbott confirmed readiness for broad commercial distribution of the test across pharmacies and healthcare networks. The BinaxNOW platform, offering results in 15 minutes, became a major tool during the pandemic, enabling decentralized, large-volume testing at national scale. This milestone solidified Abbott’s position as a global leader in rapid antigen diagnostics.

Instruments form the structured backbone of advanced rapid antigen testing systems, particularly for fluorescence immunoassays (FIA) and digital lateral-flow readers that enhance interpretation accuracy. Hospitals and laboratories adopt these analyzers to reduce result variability and enable semi-quantitative readouts for respiratory pathogens and STIs. Automated readers support traceability, digital reporting, and integration with EMR/LIS systems, making them suitable for high-volume screening programs and regulated clinical environments.

Technology Analysis

LFA technology dominated the market with 58.3% market share in 2024 because of its low cost, ease of use, and suitability for mass screening. These tests require minimal equipment, produce results in minutes, and have widespread adoption in community health campaigns, travel screening, emergency care, and home testing.

In July 2021, Abbott expanded its global testing portfolio by launching the Panbio™ COVID-19 Antigen Self-Test in India, enabling consumers to quickly detect infections at home without clinical supervision. Designed for adults and children (with adult assistance), the self-test delivers results in 15 minutes and complies with Indian ICMR guidelines.

Their portability and simplicity make them critical tools for resource-limited and remote settings. FIA-based antigen tests offer superior analytical sensitivity compared to visually interpreted LFAs. Hospitals and diagnostic centers prefer FIA for respiratory panels (flu, RSV, SARS-CoV-2) and STIs where improved accuracy is necessary for clinical decision-making. FIA readers support digital interpretation, reducing subjective variability and supporting semi-quantitative measurement.

Application Analysis

Infectious diseases represent the largest application area, supported by extensive adoption for respiratory viruses (influenza, RSV, COVID-19), vector-borne diseases (dengue, malaria), gastrointestinal pathogens, and Group A streptococcus. Rapid antigen testing enables clinicians and public-health systems to detect cases early, initiate isolation, and guide immediate therapeutic decisions. Seasonal outbreaks and global preparedness programs continue to strengthen demand.

Rapid antigen tests for STIs—including chlamydia, gonorrhea, and trichomonas—are gaining traction due to rising global incidence and the need for same-visit diagnosis in clinics and community health centers. Rapid workflows reduce loss-to-follow-up and enable immediate treatment initiation.

End-User Analysis

Hospitals and clinics serve as major adopters due to the requirement for fast triage, emergency response, and point-of-care decision-making. Rapid antigen testing is integral in emergency departments, outpatient respiratory clinics, maternity units, and routine infectious disease screening units. Reference laboratories deploy antigen assays for high-throughput screening and large-scale outbreak management. FIA and CLIA antigen tests are commonly used for confirmatory screening, epidemiological surveillance, and multi-pathogen panels.

The home-care segment expanded significantly due to self-testing cultures established during the COVID-19 pandemic. Rapid antigen self-tests are increasingly used for respiratory symptoms, exposure screening, and testing for conditions like influenza or RSV—especially for pediatric and geriatric groups. For instance, in December 2021, Roche introduced a dual-target SARS-CoV-2 and Influenza A/B Rapid Antigen Test for professional use in CE-mark countries. The test addresses the need for differential diagnosis of respiratory symptoms, especially during overlapping flu and COVID-19 seasons. By detecting multiple pathogens simultaneously, the test reduces diagnostic uncertainty and enables clinicians to make quicker clinical decisions.

Key Market Segments

By Product Type

- Instruments

- Reagents and Kits

- Services

By Technology

- Lateral flow immunoassays (LFA)

- Fluorescence immunoassays (FIA)

- Chemiluminescence immunoassays (CLIA)

- Others

By Application

- Infectious diseases

- Sexually transmitted infections

- Others

By End-User

- Hospitals & clinics

- Diagnostic laboratories & reference centres

- Home care

- Others

Drivers

Growing demand for rapid and accurate diagnostics

The demand for rapid, on-site diagnostics is driving the rapid antigen testing market, as healthcare systems seek fast turnaround to identify and isolate infections. For instance, during the COVID-19 pandemic, over 1 billion tests including rapid antigen and PCR had been conducted globally by March 2021 according to World Health Organization.

Rapid antigen tests are valued for delivering results in minutes, requiring minimal equipment, and enabling decentralized testing in settings such as schools, workplaces, travel checkpoints and home-care. The accessibility and affordability of lateral flow immunoassays (LFA) reinforce their use especially in mass screening. Producers and governments alike are expanding distribution of antigen kits to meet this urgent need; for example, one source notes that more than 65% of healthcare providers rely on such tools for quick diagnosis.

In May 2021, Ortho Clinical Diagnostics announced the launch of the VITROS® SARS-CoV-2 Antigen Test, the first high-throughput COVID-19 antigen test authorized by Health Canada. Designed for the VITROS platform installed in many hospitals, the test provides rapid antigen detection with laboratory-level capacity, enabling facilities to screen large patient volumes daily.

As the need for early detection of emerging infectious diseases and routine screening increases, the rapid antigen testing market is expected to benefit substantially from this driver.

Restraints

Concern over reduced sensitivity / false negatives

A major restraint is the lower sensitivity of some rapid antigen tests compared with gold-standard methods such as NAAT or RT-PCR, especially in asymptomatic patients or low viral load cases. For example, a study reported antigen testing accurately detected infection among symptomatic individuals ~73% but only ~55% among asymptomatic individuals.

Such performance limitations raise concerns for clinical settings and regulatory bodies, and may limit uptake in contexts where high diagnostic certainty is required. Furthermore, false negatives can lead to missed infections and undermine public-health efforts to control outbreaks, reducing stakeholder confidence in rapid antigen platforms. As a result, laboratories and hospitals may continue to rely on confirmatory molecular tests, limiting the share of antigen testing in specific use-cases.

Regulatory approval processes may also become stricter because of these sensitivity challenges, increasing time-to-market and cost for developers. Overall, the comparison with more sensitive technologies represents a persistent hurdle for widespread adoption of rapid antigen testing in all application settings.

Opportunities

Expansion into non-COVID applications and multiplex panels

As the immediate urgency of COVID-19 testing moderates, an opportunity lies in extending rapid antigen testing into other infectious diseases and multiplex panels. Many manufacturers are now developing antigen assays for influenza, RSV, dengue, strep-A, and other pathogens beyond the original COVID-19 focus. For instance, one market report highlights that the market growth is driven by the growing adoption of rapid antigen tests for diagnosis of other viral infection and the growing shift towards digitalisation in the healthcare industry.

By launching multiplex antigen formats that can detect several pathogens in one test, companies can capture widened end-user segments (such as hospitals, clinics, home-care) and regions where molecular infrastructure is limited. Further, deploying antigen tests in emerging markets with constrained lab access offers additional upside. Governments and health agencies are also increasingly investing in preparedness for future pandemics, which creates demand for broad-spectrum antigen-based screening tools. This shift broadens the market beyond its earlier pandemic-driven demand and supports sustained growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical dynamics continue to influence the Rapid Antigen Testing Market by affecting production stability, supply chains, public-health priorities, and accessibility of diagnostic materials. Periods of economic slowdown lead governments and healthcare institutions to prioritize cost-effective diagnostic tools, which supports the adoption of antigen tests due to their lower operational requirements compared with PCR testing. However, global inflationary pressures increase the cost of raw materials such as nitrocellulose membranes, monoclonal antibodies, microfluidic plastics, and electronic components for FIA readers. Rising freight, chemical procurement, and cold-chain logistics costs create pricing fluctuations that impact affordability in low-resource regions.

Geopolitical tensions—especially cross-border restrictions on sensitive biological materials and trade disruptions—affect manufacturing hubs in Asia, Europe, and North America. For example, disruptions in shipping lanes or export controls on lab chemicals can delay the availability of test components, slowing distribution to healthcare providers and public programs. Countries with centralized procurement systems may experience delays in bulk testing campaigns, affecting surveillance effectiveness during seasonal outbreaks of influenza, RSV, or dengue.

At the policy level, geopolitical events shape national health-security agendas. Increased government focus on epidemic preparedness—especially after COVID-19—has led to large public-sector stockpiling of rapid antigen kits, expansion of diagnostic infrastructure, and stronger emphasis on decentralized testing strategies. Conversely, budget reallocations during economic tightening can reduce investment in screening programs, limiting uptake.

Additionally, shifts in global mobility—tourism recovery, migration flows, and international travel requirements—directly influence demand for rapid screening at airports, borders, and workplaces. As geopolitical uncertainties continue to evolve, rapid antigen testing remains a critical component of resilient, quick-response public-health systems.

Latest Trends

Shift towards self-testing and home-care settings

An emerging trend in the rapid antigen testing market is the movement from regulated clinical settings to self-testing and home-care environments. During the COVID-19 pandemic, many governments distributed free antigen kits for home use (for example, the U.S. government’s one-billion-kit initiative) which increased consumer awareness and acceptance of self-testing.

The permanent shift in patient behaviour towards convenient, at-home diagnostics is prompting manufacturers to develop user-friendly antigen kits, including smartphone-read apps, digital connectivity, and simplified workflows. At-home testing adoption is supporting decentralised care models and reducing pressure on hospital infrastructure.

As regulatory frameworks evolve to include self-testing approval pathways, the market for home antigen kits is expected to grow faster than traditional institutional segments. This trend has particular relevance in regions with limited laboratory capacity or in remote settings, thus broadening the geographical reach and user base of rapid antigen testing technologies.

Regional Analysis

North America is leading the Rapid Antigen Testing Market

North America remains the largest region in the Rapid Antigen Testing Market covering for over 34.8% market share due to its extensive diagnostic infrastructure, high infectious-disease surveillance capacity, and strong adoption of point-of-care technologies.

The United States alone conducts more than 900 million clinical laboratory tests annually, according to the CDC, creating a strong foundation for rapid antigen test integration into routine care pathways. The region also reports high seasonal circulation rates of respiratory viruses; for example, the CDC recorded 52 million flu illnesses in the 2022–23 season, increasing demand for fast triage diagnostics.

Additionally, over 85% of US hospitals operate emergency departments equipped for rapid screening, supporting widespread clinical use. Canada further reinforces the region’s leadership through national public-health programs, which distributed over 400 million rapid test kits to households and workplaces during pandemic-related preparedness initiatives. The region’s strong manufacturing base and robust regulatory pathways strengthen its position as the dominant market contributor.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is the fastest-growing region due to rising infectious-disease burdens, expanding healthcare access, and increasing adoption of decentralized diagnostics. Countries such as India, China, and Indonesia collectively represent over 45% of the global population, creating high-volume testing requirements for respiratory and tropical diseases. Dengue outbreaks in Southeast Asia continue to surge, with the WHO reporting more than 3.9 million cases annually, driving rapid adoption of point-of-care antigen tests for early detection.

Urbanization is accelerating demand as well—over 2.3 billion people now live in Asia-Pacific cities, many relying on outpatient clinics that favor rapid testing over complex lab methods. Additionally, Japan and South Korea have some of the world’s highest diagnostic testing capacities, with Japan performing over 17 million infectious-disease tests annually, reinforcing regional adoption of rapid antigen technologies. Strong e-commerce penetration and home-care acceptance further accelerate the region’s rapid growth trajectory.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the market include Abbott Laboratories, F. Hoffmann-La Roche AG, Danaher Corporation, Becton, Dickinson and Company, bioMérieux SA, QuidelOrtho, SD Biosensor Inc., PerkinElmer Inc., Thermo Fisher Scientific, Meridian Bioscience Inc., Bio-Rad Laboratories Inc., Mylab Discovery Solutions Pvt. Ltd, and Others.

Abbott Laboratories, F. Hoffmann-La Roche AG, and Danaher Corporation play pivotal roles in advancing rapid antigen diagnostics through large-scale product innovation and infrastructure support. Abbott accelerated global adoption with its BinaxNOW 15-minute antigen card in the US and Panbio rapid antigen tests internationally, both widely deployed across hospitals, travel hubs, workplaces, and home-care settings.

Roche strengthened the category with its SARS-CoV-2 Rapid Antigen Test, followed by the upgraded “2.0” generation offering enhanced antibodies and improved sensitivity, along with a combined SARS-CoV-2 & Influenza A/B rapid antigen test for multi-pathogen detection. Roche also integrated digital verification through the navify Pass platform to support connected screening workflows.

Danaher, through its diagnostics businesses such as Beckman Coulter, contributes with immunoassay automation, workflow integration, and clinical-grade pathogen identification systems that complement rapid antigen deployment in high-volume settings. Together, these companies significantly expand global accessibility, accuracy, and scalability of rapid antigen testing.

Top Key Players in the Rapid Antigen Testing Market

- Abbott Laboratories

- Hoffmann-La Roche AG

- Danaher Corporation

- Becton, Dickinson and Company

- bioMérieux SA

- QuidelOrtho

- SD Biosensor Inc.

- PerkinElmer Inc.

- Thermo Fisher Scientific

- Meridian Bioscience Inc.

- Bio-Rad Laboratories Inc.

- Mylab Discovery Solutions Pvt. Ltd

- Others

Recent Developments

- In September 2025: Lumiquick Diagnostics announced the donation of over 1.2 million rapid antigen tests to local communities in California to strengthen public-health readiness. The donation supported underserved counties, schools, and community clinics with limited access to rapid diagnostics. This initiative enhanced Lumiquick’s reputation as a contributor to community health and strengthened relationships with state agencies and healthcare providers.

- In January 2023: OraSure expanded its InteliSwab® portfolio by receiving FDA authorization to use the InteliSwab® COVID-19 Rapid Test for children aged 2 and older. Additionally, the company launched InteliSwab® Connect, a mobile application enabling users to capture digital results and share them with healthcare providers or workplaces.

- In October 2020: Siemens Healthineers introduced its CLINITEST Rapid Antigen Cassette Test, a point-of-care solution designed for rapid identification of SARS-CoV-2 infections. Suitable for use in outpatient clinics, airports, and community screening, the test provides results in just 15 minutes. Its ease of use and availability across CE-mark markets supported government-led large-scale screening initiatives across Europe.

Report Scope

Report Features Description Market Value (2024) US$ 25.98 billion Forecast Revenue (2034) US$ 52.07 billion CAGR (2025-2034) 7.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instruments, Reagents and Kits and Services), By Technology (Lateral flow immunoassays (LFA), Fluorescence immunoassays (FIA), Chemiluminescence immunoassays (CLIA) and Others), By Application (Infectious diseases, Sexually transmitted infections and Others), By End-User (Hospitals & clinics, Diagnostic laboratories & reference centres, Home care, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, F. Hoffmann-La Roche AG, Danaher Corporation, Becton, Dickinson and Company, bioMérieux SA, QuidelOrtho, SD Biosensor Inc., PerkinElmer Inc., Thermo Fisher Scientific, Meridian Bioscience Inc., Bio-Rad Laboratories Inc., Mylab Discovery Solutions Pvt. Ltd, and Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Rapid Antigen Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Rapid Antigen Testing MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Hoffmann-La Roche AG

- Danaher Corporation

- Becton, Dickinson and Company

- bioMérieux SA

- QuidelOrtho

- SD Biosensor Inc.

- PerkinElmer Inc.

- Thermo Fisher Scientific

- Meridian Bioscience Inc.

- Bio-Rad Laboratories Inc.

- Mylab Discovery Solutions Pvt. Ltd

- Others