Global Quantum-Safe Messaging Apps Market Size, Share, Growth Analysis By Component (Software, Services), By Security Type (End-to-End Encryption, Post-Quantum Cryptography, Hybrid Encryption), By Deployment Mode (On-Premises, Cloud), By Application (Individual, Enterprise [Government, Defense, Healthcare, BFSI, Others, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164157

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Role Of Security

- Emerging Trends

- Industry Adoption

- Analysts’ Viewpoint

- US Market Size

- By Component

- By Security Type

- By Deployment Mode

- By Application

- Key Market Segments

- Regional Analysis

- Driving Factors

- Restraint Factors

- Growth Opportunities

- Challenging factors

- Competitive Analysis

- Major Developments

- Report Scope

Report Overview

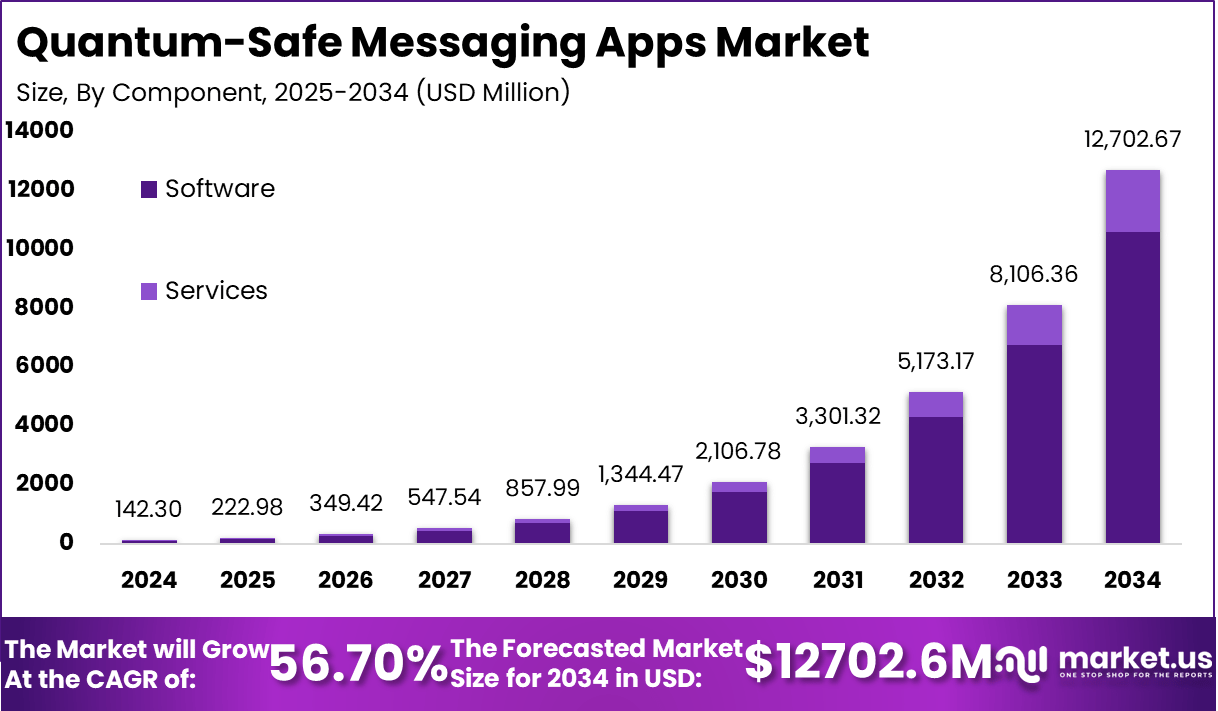

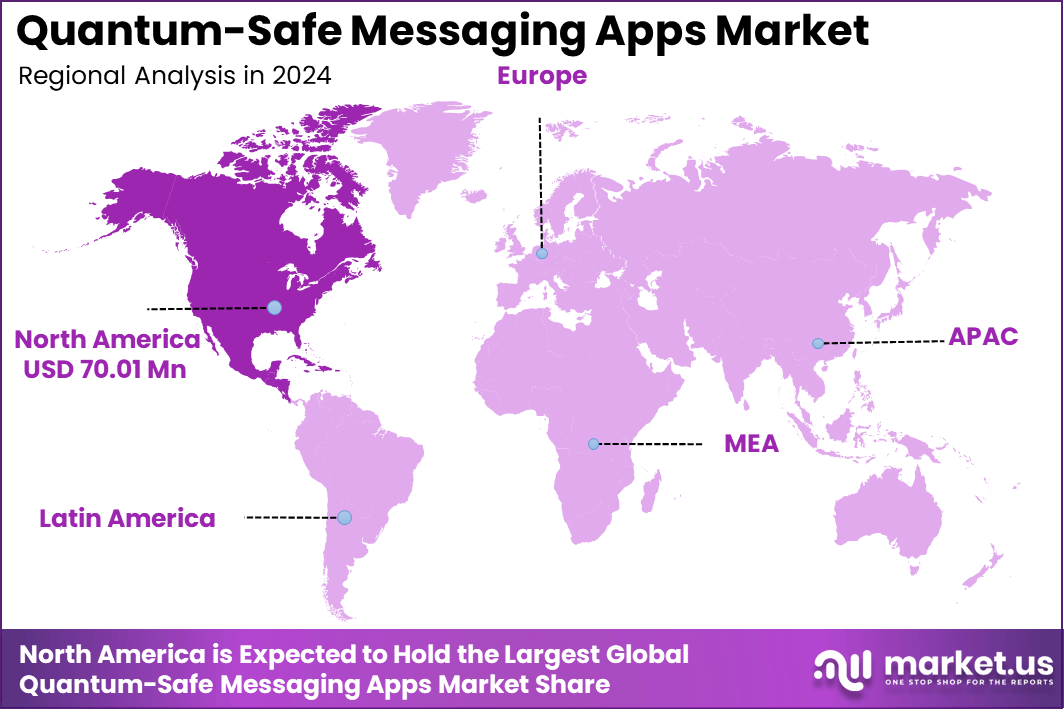

The global quantum-safe messaging apps market is poised for exceptional growth, increasing from a value of USD 142.3 million in 2024 to USD 12,702.6 million by 2034, reflecting a phenomenal CAGR of 56.7 %. In North America alone, the market represented USD 70.01 million in 2024, accounting for 49.2 % of the global share.

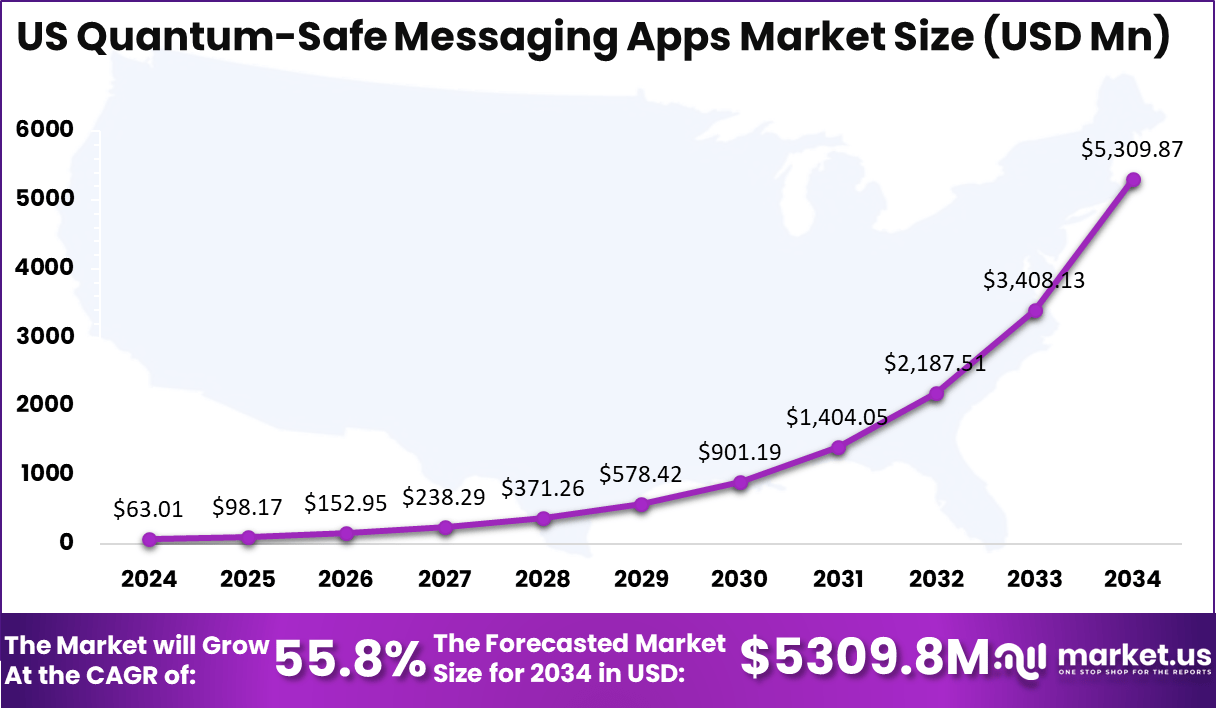

The US market, with USD 63.01 million in 2024, is projected to expand to USD 5,309.8 million by 2034 at a CAGR of 55.8 %. This surge is driven by rising concerns over quantum-computing-based threats to classical encryption methods and growing demand for messaging platforms that ensure long-term confidentiality and resistance to emerging cyber risk.

As quantum-resistant cryptography moves toward mainstream use, messaging applications are undergoing a transition—from standard end-to-end encryption toward hybrid implementations that incorporate post-quantum algorithms and quantum-key distribution (QKD) frameworks.

Organizations and consumers alike are seeking platforms that offer future-proof secure communications, particularly in sectors such as finance, government, healthcare, and legal services. The North American region, backed by strong cybersecurity infrastructure, regulatory emphasis, and high awareness of data-security needs, remains a strategic growth zone for vendors deploying quantum-safe solutions.

Quantum-safe messaging apps are emerging as the next frontier in secure digital communication, designed to protect data against the looming threats posed by quantum computing. Unlike traditional encryption methods, which rely on algorithms vulnerable to quantum decryption, these platforms integrate post-quantum cryptography (PQC) and quantum key distribution (QKD) to ensure long-term confidentiality.

As quantum processors advance in speed and computational power, conventional encryption techniques such as RSA and ECC are expected to become obsolete, driving organizations and consumers toward quantum-resistant messaging solutions. The technology is gaining particular traction across sectors like defense, finance, government, and healthcare, where data sensitivity and compliance requirements are critical.

The development of quantum-safe messaging applications is supported by increasing global cybersecurity concerns, stricter data privacy regulations, and the widespread adoption of cloud communication systems. Vendors are now focusing on hybrid cryptographic frameworks that combine classical and quantum-resistant algorithms to provide transition-ready security models.

North America, led by the US, remains at the forefront of this transformation due to robust R&D investments, strong encryption policies, and the presence of leading cybersecurity firms. As quantum computing approaches commercial viability, the adoption of quantum-safe messaging apps is expected to accelerate, shaping the future of secure communication worldwide.

Quantum-safe messaging apps are driving major market activity in 2025, with key statistics showing rapid growth, innovation, and funding. Recently, Spectral Capital acquired 42 Telecom Ltd., a global messaging provider, issuing 8 million shares (with another 8 million held in escrow) and targeting at least $16 million in profitable revenue by the end of 2025.

This move merges AI and quantum technologies to modernize secure enterprise communications, especially for markets like finance and healthcare. The Signal app has launched quantum-resistant encryption protocols to safeguard conversations against future quantum computers, reflecting the industry’s push toward post-quantum security.

Funding is surging: expansion capital for quantum messaging security, like C$2.8 million for product development at Scope Security, and globally, financial blockchain quantum applications are expected to attract $300 million in funding in 2025.

The quantum-resistant secure chat software development kit market will reach $1.08 billion in 2025 and is forecasted to swell to $3.28 billion by 2029, with a CAGR of 31.9%. Drivers include rising cyberattacks (Australia had 94,000 reported cybercrimes in 2023, up 23%), increased privacy regulations, and quantum computing threats.

Enterprise deployments are scaling fast – 53% of top financial institutions are exploring quantum cryptography, and 25% of banks globally are implementing quantum-safe messaging within their cybersecurity systems by 2024.

North American institutions are expected to account for 45% of global spending on quantum cryptography in 2025, and quantum cryptography can reduce data breach costs by 80% for financial organizations. Overall, quantum-safe messaging apps are seeing accelerated growth in M&A, product launches, and funding, driven by security needs and new regulations.

Key Takeaways

- The global quantum-safe messaging apps market is valued at USD 142.3 million in 2024 and is projected to reach USD 12,702.6 million by 2034, expanding at a CAGR of 56.7%.

- North America dominates the market with a 49.2% share, representing USD 70.01 million in 2024, driven by the rapid adoption of advanced cybersecurity solutions.

- The US leads the regional market with USD 63.01 million in 2024 and is expected to reach USD 5,309.8 million by 2034, growing at a CAGR of 55.8%.

- By Component, software accounts for 83.4% of the market, reflecting the strong demand for encryption-enabled messaging applications and integrated security platforms.

- By Security Type, post-quantum cryptography holds 48.6% share, emphasizing its critical role in countering future quantum computing threats to data encryption.

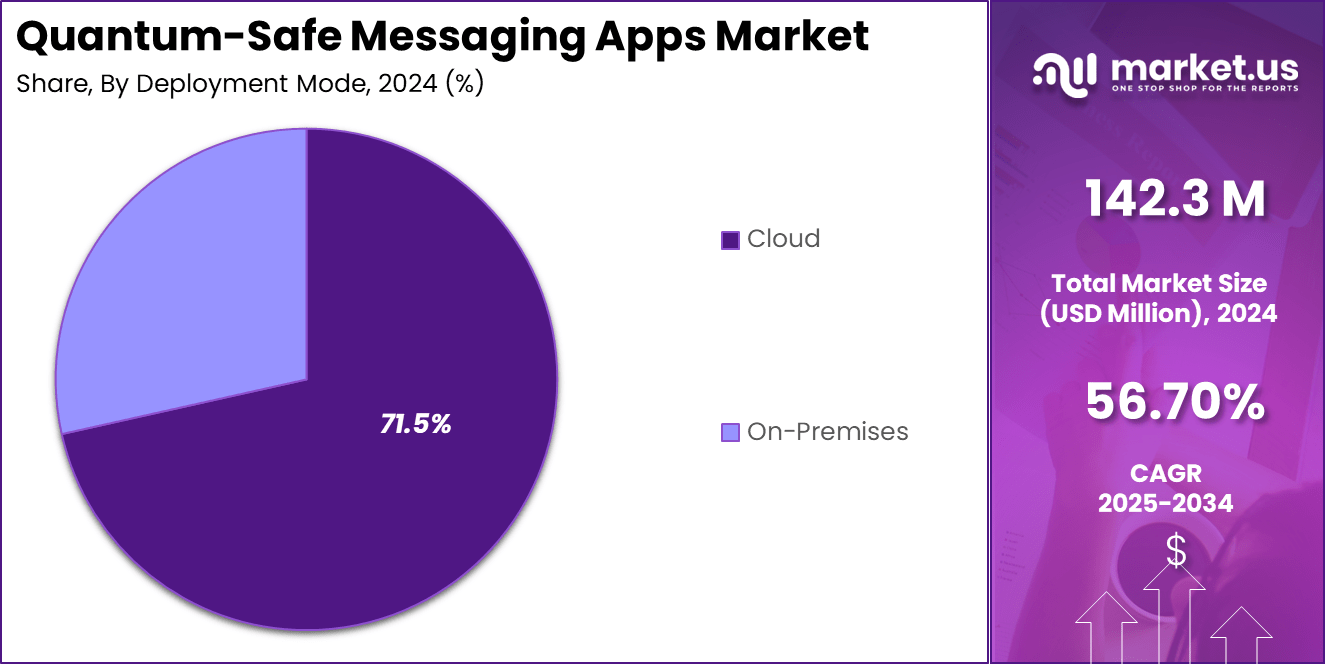

- By Deployment Mode, cloud deployment dominates with 71.5%, supported by scalability, real-time encryption updates, and ease of integration with enterprise communication systems.

- By Application, the enterprise segment leads with a commanding 92.7% share, driven by increasing use in corporate, government, and defense sectors requiring quantum-resistant data protection.

- The market’s growth is fueled by rising concerns over quantum cyber risks, regulatory emphasis on secure communication, and accelerated innovation in quantum cryptographic technologies.

Role Of Security

Security plays a central role in the quantum-safe messaging apps market, serving as the foundation upon which the entire ecosystem operates. With the rapid advancement of quantum computing, traditional encryption standards such as RSA and ECC are becoming increasingly vulnerable to decryption by powerful quantum algorithms.

This has accelerated the shift toward quantum-resistant communication frameworks that ensure long-term data confidentiality. Quantum-safe messaging apps employ post-quantum cryptography (PQC) and, in some cases, quantum key distribution (QKD) to safeguard sensitive information, even against future computational threats. These mechanisms rely on complex mathematical algorithms and quantum physics principles to secure messages from interception or tampering.

Security in this domain extends beyond encryption; it encompasses authentication, data integrity, and secure key management. Enterprises and government agencies are prioritizing multi-layered security models that integrate PQC with classical encryption to create hybrid systems capable of seamless transition during the quantum era.

Cloud-based deployments further enhance security by allowing continuous cryptographic updates and real-time threat monitoring. Additionally, compliance with data privacy regulations such as GDPR and NIST PQC standards ensures that organizations maintain legal and ethical accountability. Ultimately, robust quantum-safe security protocols are becoming indispensable to maintaining trust, resilience, and continuity in global digital communications.

Emerging Trends

Emerging trends in the quantum-safe messaging apps market are signalling a major shift in secure communications as the industry adapts to quantum-era threats. One prominent trend is the accelerated standardisation and interoperability efforts around post-quantum cryptography (PQC), driven by organisations such as the National Institute of Standards and Technology (NIST) and open-source initiatives. Analysts note that as PQC standards mature, messaging platforms are expected to adopt shared frameworks, enabling seamless communication across distinct quantum-safe systems.

Another trend is the growing prevalence of hybrid cryptographic schemes, where classical encryption methods are supplemented by quantum-resistant algorithms. This approach helps ease migration risk while ensuring readiness for quantum attacks.

A third key trend is the dominance of cloud-based deployment models for quantum-safe messaging solutions, offering scalability, rapid updates, and simplified integration with enterprise ecosystems. The market research highlights cloud-mode as the preferred architecture given its flexibility and cost-effectiveness for quantum-secure platforms.

Finally, the push for industry-specific adoption – especially within finance, government, and defence sectors – reflects heightened concern about long-term data confidentiality in a quantum-computing scenario. These sectors are driving demand for messaging solutions that remain secure well beyond the current cryptographic horizon. Together, these trends underscore the industry’s transition from conventional secure messaging to quantum-resilient communication frameworks geared for the next decade.

Industry Adoption

Industry adoption of quantum-safe messaging apps is gaining traction as enterprises and governments increasingly recognise the long-term threat posed by quantum computing to current encryption standards. Major players in sectors such as finance, defence, healthcare, and telecommunications are beginning to deploy and plan for a transition to post-quantum cryptography (PQC) solutions.

For example, the enterprise-grade platform QVerse offers PQC-based end-to-end messaging for regulated sectors like BFSI and defence, signalling real-world uptake of quantum-safe communications. qnulabs.com

Adoption is also supported by standardisation efforts and industry readiness initiatives.The National Institute of Standards and Technology (NIST) has released its first PQC algorithm standards in 2024, prompting organisations to begin migration strategies that include quantum-safe messaging among priorities. Despite momentum, adoption remains uneven: only a small fraction of websites or organisations have implemented PQC mechanisms at scale, with many still in pilot or evaluation phases.

F5, Inc. However, as awareness of the “harvest now, decrypt later” risk grows and quantum-computing capabilities advance, adoption across core industries is expected to accelerate significantly, positioning quantum-safe messaging apps as a strategic imperative for secure communication infrastructure.

Analysts’ Viewpoint

Analysts view the quantum-safe messaging apps market as one that is entering a phase of strategic urgency rather than gradual evolution. They note that with quantum computing technology advancing, traditional encryption methods such as RSA and ECC are increasingly seen as vulnerable to future attacks.

Accordingly, many enterprises and governments are beginning to prioritise post-quantum cryptography (PQC) and hybrid encryption frameworks to shore up communication infrastructure well ahead of widespread quantum threats.

Experts emphasise that key success factors will include not only the robustness of cryptographic algorithms but also integration with existing enterprise workflows, cloud scalability, and minimal impact on user experience. For instance, platforms like Signal are cited as early movers that have implemented quantum-resistant methods while maintaining usability.

While growth prospects are exceptionally high—with forecast CAGRs exceeding 50% in some cases—analysts warn that the market remains at a relatively early stage, with many organisations still in pilot or evaluation phases and lacking full readiness for quantum-era threats.

Key concerns remain around standardisation, transition costs, regulatory compliance, and convincing end-users of the necessity of quantum-safe adoption today. In their view, vendors that deliver enterprise-grade, transition-ready solutions with strong vendor-partner ecosystems are best positioned to lead the race.

US Market Size

The US quantum-safe messaging apps market is poised for exponential growth, expanding from USD 63.01 million in 2024 to USD 5,309.8 million by 2034, registering a remarkable CAGR of 55.8%. This rapid advancement is driven by growing awareness of the vulnerabilities in traditional encryption systems as quantum computing becomes more capable of breaking classical cryptographic protocols.

With the US being a global leader in cybersecurity innovation and digital infrastructure, enterprises, defense agencies, and government bodies are accelerating the adoption of quantum-resistant communication solutions to safeguard sensitive data. The increasing emphasis on post-quantum cryptography (PQC) and quantum key distribution (QKD) frameworks highlights the nation’s proactive stance toward securing its digital future.

The strong presence of major cybersecurity companies, research institutions, and federal initiatives such as the National Institute of Standards and Technology’s (NIST) PQC standardization program further supports the country’s leadership in quantum-safe technology.

Cloud-based deployments are gaining traction across enterprises, offering scalability and seamless integration with existing IT ecosystems. The financial, healthcare, and government sectors are expected to be the largest adopters due to high data sensitivity. Overall, the US market is establishing itself as a key hub for innovation, regulation, and deployment of next-generation, quantum-safe messaging platforms.

By Component

In the quantum-safe messaging apps market, the software component commands an estimated 83.4% share, underscoring its critical importance in delivering secure, future-proof communication solutions. This dominance reflects the fact that software comprising encryption algorithms, post-quantum cryptographic modules, secure messaging apps, and integration layers is the immediate means by which organisations and users confront the threat posed by quantum computers.

As quantum-capable adversaries loom, messaging platforms incorporating advanced cryptographic stacks, key-management functionalities, and quantum-resistant protocols become central to enterprise-grade security strategy. Real-world examples include apps that embed true random number generation, hybrid classical/quantum-resistant encryption, and cloud-based key-distribution systems.

The services component, though smaller in share, plays an essential supporting role. It covers professional consulting (cryptographic transition planning, risk assessment), managed services (ongoing monitoring, update delivery), and deployment assistance (integration of quantum-safe messaging into existing IT ecosystems).

As organisations embark on migration from classical to post-quantum secure communications, demand for these services is rising to ensure smooth transitions and regulatory alignment. Cloud-native and hybrid deployments further highlight how software and services combine to deliver scalable, resilient messaging systems capable of withstanding emerging threats.

By Security Type

The security-type segmentation of the quantum-safe messaging apps market shows that post-quantum cryptography (PQC) holds 48.6% of the total share. This dominance is driven by the looming threat that quantum computers pose to conventional encryption methods such as RSA and ECC, prompting providers to adopt quantum-resistant algorithms like CRYSTALS-Kyber for secure key exchange and future-proofing.

End-to-end encryption remains a critical foundational layer, ensuring that messages are decrypted only by the intended recipients. Yet many current systems integrate classic E2E encryption with post-quantum components, forming hybrid schemes that offer both immediate protection and long-term quantum resistance. For example, Signal has begun incorporating PQC into its protocol stack.

Hybrid encryption models—in which classical cryptographic methods and PQC algorithms run in parallel—are emerging as the transition path for many applications. These models balance performance, interoperability, and security, thus facilitating gradual migration toward fully quantum-secure messaging solutions.

In sum, while end-to-end encryption continues to underpin secure messaging, post-quantum cryptography is rapidly becoming the defining element of this market segment, with hybrid systems playing a pivotal role in bridging legacy methods and quantum-safe future standards.

By Deployment Mode

The deployment-mode segment of the quantum-safe messaging apps market is dominated by cloud-based solutions, which account for approximately 71.5% of total deployment share. This strong preference for cloud architectures is driven by the need for rapid scalability, ease of updates, centralized cryptographic key management, and streamlined global rollout of post-quantum encryption stacks.

Analysts highlight that cloud-based models enable messaging platforms to deliver quantum-resistant security as a service, reducing the infrastructural burden on end-users and allowing seamless software upgrades as quantum-safe standards evolve.

On-premises deployments remain an important alternative for organisations with stringent data sovereignty, compliance or latency requirements such as defence, government agencies or highly regulated enterprises. However, they represent a smaller share due to higher upfront infrastructure costs, slower update cycles, and limited geographic flexibility.

Cloud solutions allow vendors to integrate real-time monitoring, threat intelligence, and automatic cryptographic transitions capabilities critical in a quantum-threat environment. Consequently, cloud deployment is emerging as the de facto standard for enterprise messaging platforms seeking both quantum-resilience and operational agility.

By Application

The application segment of the quantum-safe messaging apps market is overwhelmingly dominated by enterprise use, accounting for 92.7% of the total. This dominance reflects the urgent need within corporate, government, defence, healthcare, and banking sectors to secure communications against future quantum threats. Enterprises are deploying these solutions to protect sensitive data, ensure compliance, and future-proof their messaging infrastructure.

Individual user-level adoption remains comparatively small, as private consumers typically face lower risk from quantum-based attacks and less regulatory pressure to migrate to quantum-safe platforms at this stage. Within the enterprise category, sectors such as government and defence are leading, followed by healthcare and BFSI (banking, financial services, and insurance), all of which handle high-stakes data and therefore prioritise quantum-resilient communication systems.

The enterprise-first orientation underscores that quantum-safe messaging apps are not yet mainstream consumer utilities but rather strategic tools for organisations aiming to safeguard long-term confidentiality and integrity of communications. Over time, as quantum computing advances and consumer awareness grows, individual adoption may accelerate, but for now, the enterprise application remains the primary driver of market scale.

Key Market Segments

By Component

- Software

- Services

By Security Type

- End-to-End Encryption

- Post-Quantum Cryptography

- Hybrid Encryption

By Deployment Mode

- On-Premises

- Cloud

By Application

- Individual

- Enterprise

- Government

- Defense

- Healthcare

- BFSI

- Others

Regional Analysis

The North American region holds a leading position in the quantum-safe messaging apps market, accounting for 49.2% of global share and a market size of USD 70.01 million in 2024. This dominance is driven by the region’s advanced cybersecurity infrastructure, strong regulatory frameworks, and high awareness among enterprises of emerging quantum-computing threats. The United States, which forms the bulk of the region’s activity, is rapidly investing in post-quantum frameworks and secure communications platforms that embed quantum-safe cryptography.

Supportive factors in North America include significant R&D investment from both public (e.g., national standards bodies) and private players, mature cloud-based deployment ecosystems, and widespread adoption of enterprise-grade secure messaging solutions.

Organisations across sectors such as defense, healthcare, and BFSI are proactively migrating or piloting quantum-resistant messaging systems to mitigate “store-now, decrypt-later” risks. However, market penetration remains relatively qualitative, with many deployments in pilot or early-stage integration. The region’s scale and maturity make it not only a major revenue centre but also a trend-setter for global quantum-safe messaging adoption.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

A key driver for the quantum-safe messaging apps market is the increasing awareness of quantum computing’s potential to break current encryption standards, prompting enterprises and governments to invest in quantum-resistant communication solutions.

The rapid digital transformation across industries, including cloud adoption and remote working models, has elevated demand for secure messaging platforms capable of preserving data integrity and confidentiality in a post-quantum future.

Advancements in post-quantum cryptography (PQC) and standardisation efforts (e.g., by the National Institute of Standards and Technology) are making integration of quantum-safe features more feasible and trustworthy. Additionally, regulatory pressures around data protection and the “harvest now, decrypt later” threat model are compelling organisations to adopt messaging apps that offer long-term security.

Restraint Factors

Despite strong motivations, the market is restrained by the high complexity and cost of migrating existing messaging systems to quantum-safe architectures. Many organisations still lack clarity on timelines and standards for quantum-safe cryptography, which delays investment decisions.

The shortage of skilled cryptographic professionals, combined with unfamiliarity with PQC, creates implementation risk and slows adoption.

On top of that, until quantum threats become immediate and visible, many enterprises may deprioritise migration, thereby reducing near-term uptake of quantum-safe messaging solutions.

Growth Opportunities

Significant growth opportunities exist as larger numbers of enterprises across sectors such as finance, healthcare, government, and defence seek future-proof messaging platforms. The transition trend provides vendors with a chance to offer end-to-end solutions, including post-quantum algorithm integration, secure key management, and cloud-native deployment.

The ongoing standardisation of PQC and increasing partnerships between cybersecurity firms, messaging app providers, and cloud platforms further expand addressable markets. Emerging markets with rising digital infrastructure also present opportunities for earlier-stage adoption.

Challenging factors

One major challenge is ensuring interoperability and compatibility between legacy messaging systems and new quantum-safe protocols, which can hinder seamless migration and user experience. Keeping pace with evolving quantum-computing capabilities and cryptographic research adds complexity and demands continuous investment.

The uncertainty around regulatory frameworks and standard delivery timelines may create trust issues and slow adoption. Moreover, convincing organisations of the urgency of quantum-safe messaging when actual quantum threats remain abstract is still difficult, particularly when resources must be balanced across immediate cybersecurity needs and long-term preparedness.

Competitive Analysis

In the quantum-safe messaging space, a growing number of specialised platforms are emerging to meet enterprise and government demand for communication security in the quantum era.

Key players such as QVerse, PQChat, NetSfere, and Cellcrypt are differentiating themselves on quantum-resistant cryptography, enterprise controls, and regulatory compliance. For example, QVerse is built around NIST-aligned post-quantum algorithms such as CRYSTALS-Kyber and offers granular administrative controls and containerised security.

PQChat emphasises “quantum-safe, end-to-end encrypted messaging” for enterprises and combines with multi-factor authentication.

NetSfere markets itself as the “industry’s first quantum-proof encrypted communication platform” aimed at corporate users.

Cellcrypt offers dual-layer post-quantum encryption and is targeted at highly regulated or government-grade markets.

The competitive field is characterised by a few distinct trends: first, deep investment in cryptographic R&D and alignment with emerging standards is becoming table-stakes. Second, enterprise adoption requires more than encryption—it demands interoperability, cloud deployment, admin tooling and regulatory audit readiness.

Third, differentiation is increasingly about vertical market fit (e.g., defence, BFSI, healthcare) and hybrid deployment models (cloud/on-premises). However, with multiple entrants racing to establish first-mover advantage, pricing pressure and integration complexity are rising.

In this environment, vendors with strong partner ecosystems, clear migration pathways from legacy systems, and trusted certifications are best positioned to capture leadership in this nascent but rapidly growing market.

Top Key Players in the Market

- PQShield

- ISARA Corporation

- QuintessenceLabs

- ID Quantique

- Arqit

- Quantum Xchange

- CryptoNext Security

- EvolutionQ

- Securosys

- Thales Group

- IBM

- Microsoft

- Others

Major Developments

- August 20, 2025: Microsoft announced its Quantum-Safe Program, detailing how it is upgrading its services, supply chain, and ecosystem to support post-quantum cryptography and crypto-agility across cloud platforms.

- July 15, 2025 (approx.): A whitepaper published by Capgemini highlighted that organisations are increasingly viewing quantum-safe security not as optional but as a strategic imperative due to “harvest now, decrypt later” threats—prompting early adoption of quantum-resistant messaging solutions.

Report Scope

Report Features Description Market Value (2024) USD 142.3 Million Forecast Revenue (2034) USD 12702.6 Million CAGR(2025-2034) 56.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Software, Services), By Security Type (End-to-End Encryption, Post-Quantum Cryptography, Hybrid Encryption), By Deployment Mode (On-Premises, Cloud), By Application (Individual, Enterprise [Government, Defense, Healthcare, BFSI, Others Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PQShield, ISARA Corporation, QuintessenceLabs, ID Quantique, Arqit, Quantum Xchange, CryptoNext Security, EvolutionQ, Securosys, Thales Group, IBM, Microsoft, Google, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Quantum-Safe Messaging Apps MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Quantum-Safe Messaging Apps MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- PQShield

- ISARA Corporation

- QuintessenceLabs

- ID Quantique

- Arqit

- Quantum Xchange

- CryptoNext Security

- EvolutionQ

- Securosys

- Thales Group

- IBM

- Microsoft

- Others