Global Quantum Machine Learning Market Size, Share, Industry Analysis Report By Component (Software & Solutions, Services), By Deployment (On-Premise, Cloud-based), By Application (Optimization Problems, Pattern Recognition & Classification, Drug Discovery & Material Science, Quantum Chemistry Simulation, Generative Models, Others), By End-Use Industry (Banking, Financial Services, and Insurance (BFSI), Healthcare & Pharmaceuticals, Automotive & Aerospace, Energy & Power, Government & Defense, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165115

- Number of Pages: 201

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Adoption Rate Statistics

- Role of Generative AI

- Investment and Business Benefits

- U.S. Quantum ML Market Size

- Component Analysis

- Deployment Analysis

- Application Analysis

- End-Use Industry Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

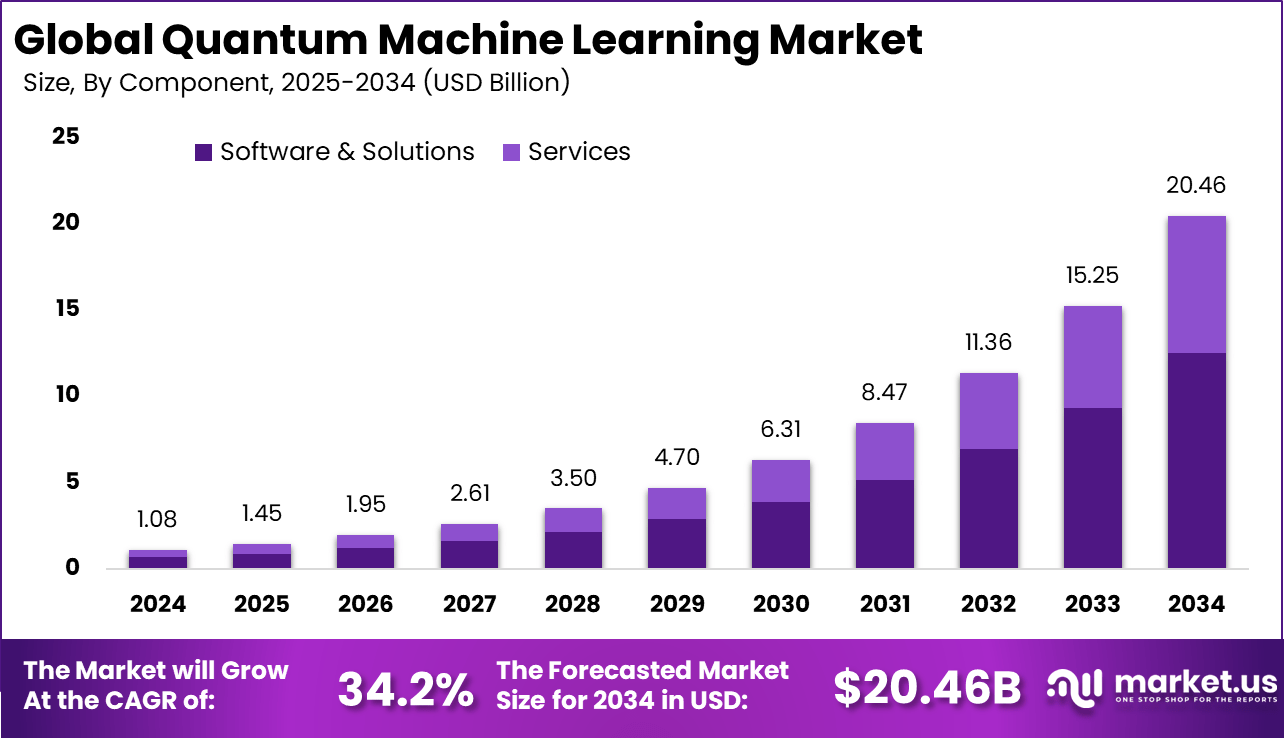

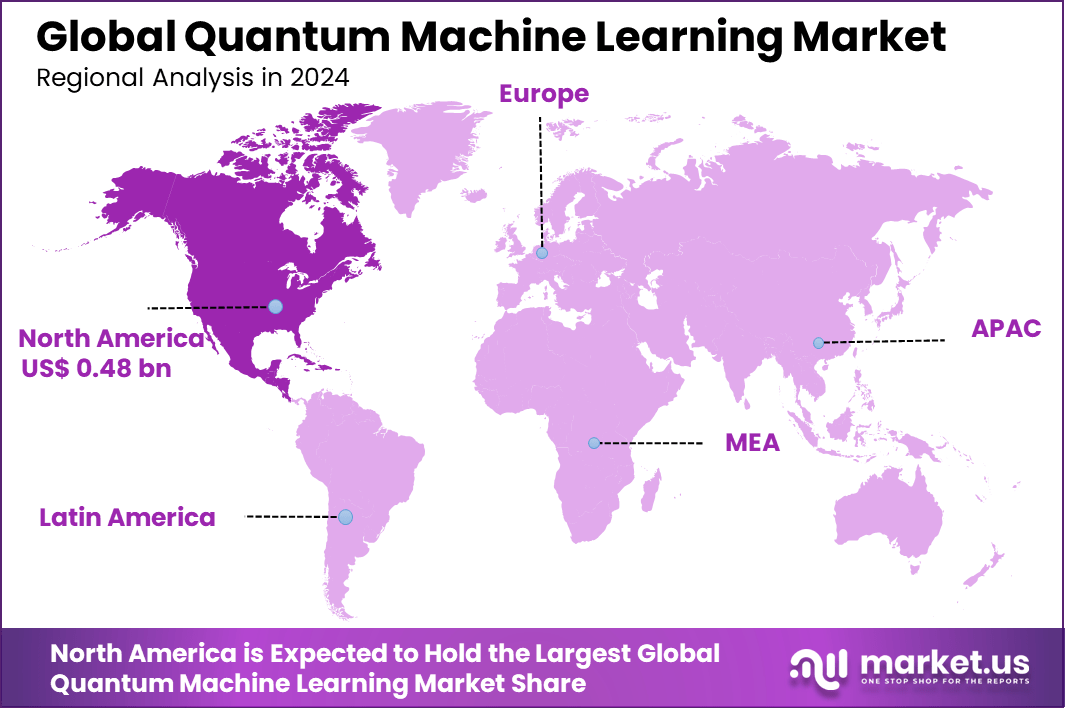

The Global Quantum Machine Learning Market size is expected to be worth around USD 20.46 billion by 2034, from USD 1.08 billion in 2024, growing at a CAGR of 34.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.2% share, holding USD 0.48 billion in revenue.

The quantum machine learning (QML) market is an emerging segment that combines the power of quantum computing with machine learning techniques. This market is gaining momentum as quantum computers enable faster processing and greater accuracy by leveraging quantum mechanics principles. QML is poised to revolutionize data processing across industries by providing solutions to complex problems beyond the capabilities of classical machine learning.

Top driving factors for QML include the need for faster, more efficient processing of ever-growing datasets and the demand for sophisticated models in artificial intelligence. One strong force is the data explosion seen in many sectors where classical methods struggle with computational limits. Also, the rising energy consumption of traditional AI models pushes interest in quantum methods that could offer more energy-efficient solutions.

Demand for QML solutions is expanding as more organizations recognize the potential speed and accuracy gains. Over 300 companies worldwide actively engage in QML development, collectively raising billions in investment. Cloud quantum computing platforms have improved accessibility, leading to increasing adoption in medium and large enterprises. The ability to handle high-dimensional data in areas like risk management and drug discovery positions QML as a transformative technology for data-intensive industries.

For instance, In September 2025, Rigetti Computing received USD 5.7 million in orders for two 9-qubit Novera quantum systems, scheduled for delivery in early 2026. The company also signed a USD 5.8 million three-year contract with the U.S. Air Force Research Laboratory to advance superconducting quantum networking, highlighting growing interest in quantum machine learning and hybrid quantum-classical technologies.

Key Takeaway

- The Software & Solutions segment dominated the market, capturing 61.2%, driven by growing enterprise investment in quantum algorithms and hybrid AI models for advanced analytics.

- The Cloud-based segment led with 90.3%, as organizations increasingly relied on cloud infrastructure for scalable access to quantum computing capabilities.

- The Optimization Problems segment accounted for 30.7%, highlighting the widespread use of quantum systems in improving decision-making, logistics, and financial modeling.

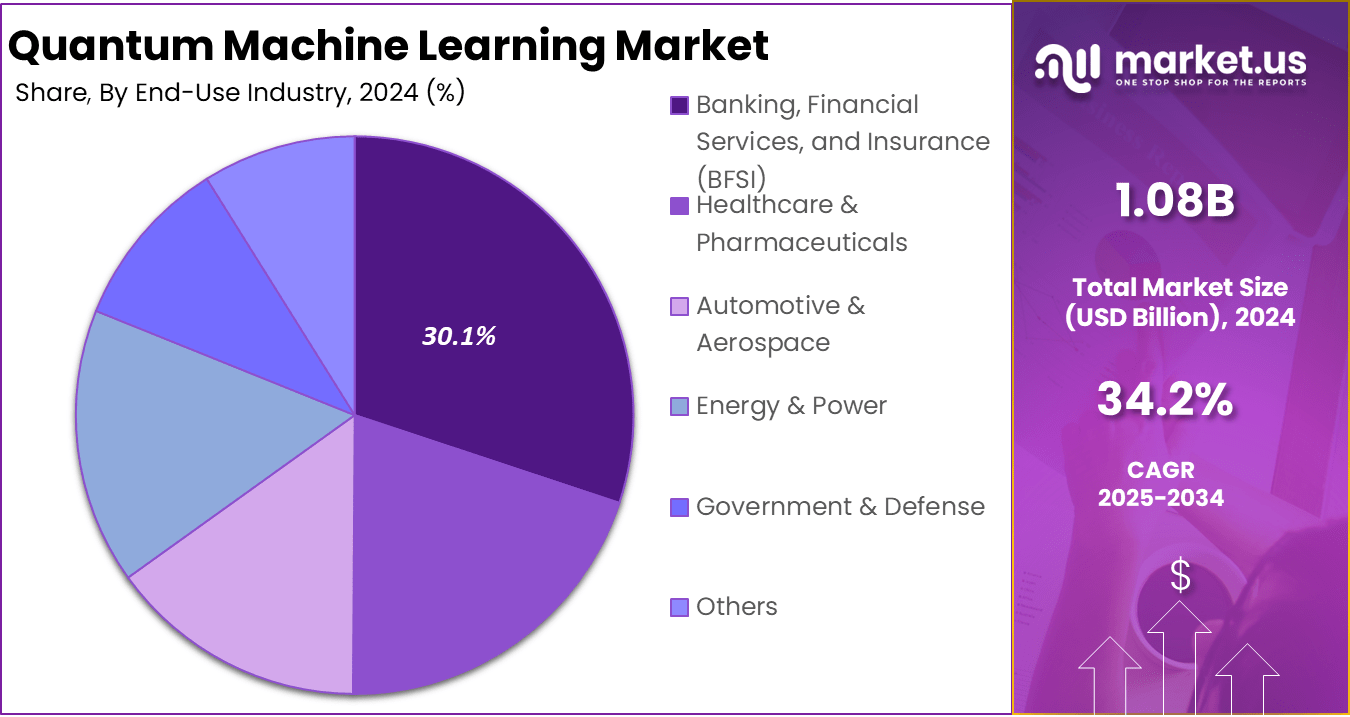

- The BFSI sector held a strong position with 30.1%, adopting quantum machine learning for fraud detection, portfolio optimization, and real-time risk assessment.

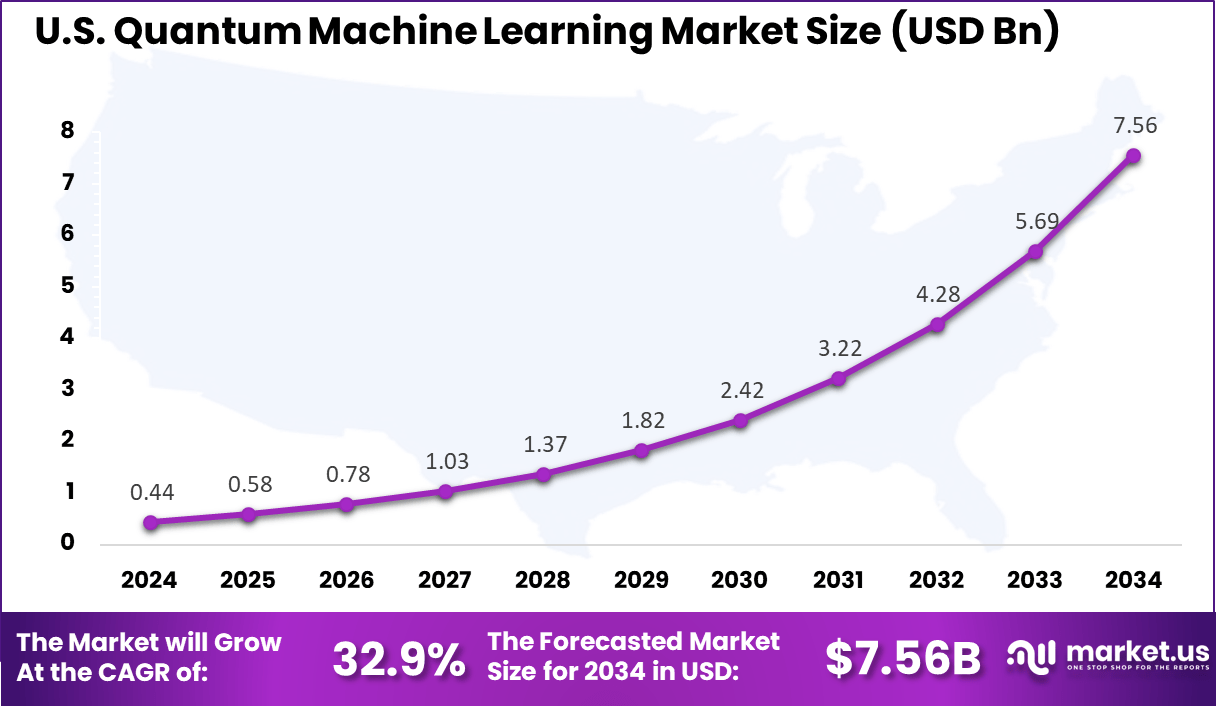

- The U.S. market reached USD 0.44 Billion in 2024, advancing at a robust 32.9% CAGR, supported by expanding research initiatives and public-private partnerships in quantum computing.

- North America led globally with over 45.2% market share, reflecting strong technological infrastructure, government funding, and early integration of quantum technologies in enterprise AI systems.

Adoption Rate Statistics

- Overall enterprise adoption: As of mid-2024, only 25% of organizations had integrated quantum computing solutions. The slow adoption rate is mainly due to high costs and complex implementation requirements.

- Investment and exploration: A 2024 Deloitte study found that 25% of U.S. business and technology leaders had invested in quantum computing during the previous 12 months, marking a threefold increase compared with 2023. Among these investors, 76% believed that quantum technology was already delivering measurable value to their operations.

- Early-stage experimentation: In 2021, about 25% of large enterprises were actively researching or testing quantum technologies. This figure has likely increased in 2024-2025, reflecting steady progress as the market matures and proof-of-concept initiatives expand.

- Cloud-based growth: The growth of Quantum-as-a-Service (QaaS) has made quantum technology more accessible. Amazon Braket, one of the leading QaaS platforms, reported 30% growth in subscriptions in July 2024, with increasing demand from industries such as automotive, retail, and medicine.

Role of Generative AI

Quantum machine learning (QML) is steadily becoming a key intersection where quantum computing powers new advances in artificial intelligence. Generative AI plays a growing role here by leveraging quantum systems to create outputs like text or patterns that traditional machines struggle to produce efficiently.

Recent research shows quantum models can generate data patterns beyond classical reach, thanks to quantum neural networks that balance classical training and quantum inference. This breakthrough means quantum generative AI could one day handle tasks like language generation or complex data modeling more efficiently than current methods, with studies reporting these models outperform classical approaches as systems scale.

Within this space, around 44% of advances in quantum machine learning are tied directly to generative AI applications, highlighting its significance. As quantum models improve compressions of quantum circuits and generate new quantum states efficiently, the boundary between machine learning and quantum hardware becomes more practical and impactful.

Investment and Business Benefits

Investment opportunities in QML span multiple high-value areas, including AI and machine learning, cybersecurity with post-quantum encryption, drug discovery, finance, and materials science. Venture funding is flowing towards companies advancing quantum hardware, software, and hybrid AI solutions.

Financial institutions, healthcare companies, and industrial players all seek to capitalize on QML’s potential for competitive advantage. Quantum computing’s ability to tackle previously unsolvable problems attracts broad investor attention.

Business benefits from QML include more accurate predictive analytics, better resource allocation, and faster decision-making. Quantum tools can optimize supply chains, improve financial forecasts, and speed up research in pharmaceuticals and materials development. Enhanced cybersecurity through quantum-safe encryption protects sensitive data. Ultimately, QML promises improved operational efficiency and new capabilities that conventional methods cannot match.

U.S. Quantum ML Market Size

The market for Quantum Machine Learning within the U.S. is growing tremendously and is currently valued at USD 0.44 billion, the market has a projected CAGR of 32.9%. This growth is driven by the explosive increase in data volume requiring faster and smarter processing solutions. Traditional machine learning struggles with scalability for complex applications, while quantum machine learning offers superior speed and accuracy in analyzing vast datasets, enabling timely and precise decision-making.

Additionally, key industries like finance, healthcare, and manufacturing are adopting quantum machine learning to boost operational efficiency and unlock new opportunities. Advances in quantum hardware and software, growing cloud-based quantum solutions, and significant investments from government and private sectors further accelerate market expansion.

For instance, in October 2025, Microsoft announced the operational deployment of a “Level 2” quantum computer, in partnership with Atom Computing. This system supports quantum error correction and prepares Microsoft’s Azure cloud platform for commercial quantum workloads, enabling more reliable quantum machine learning applications in the cloud.

In 2024, North America held a dominant market position in the Global Quantum Machine Learning Market, capturing more than a 45.2% share, holding USD 0.48 billion in revenue. This dominance is due to the region’s robust ecosystem of leading tech firms, advanced research institutions, and heavy government funding.

The U.S. especially drives growth with strategic initiatives like the National Quantum Initiative Act, accelerating R&D and commercial quantum technology adoption. Strong collaborations between academia, startups, and industry players foster continuous innovation. Additionally, North America’s focus on critical applications such as cryptography, optimization, and scientific research across industries like BFSI, healthcare, and defense solidifies its leadership position.

For instance, in October 2025, Google revealed the capabilities of its Quantum Echoes algorithm on a 65-qubit processor, achieving a physics simulation 13,000 times faster than the fastest classical supercomputer. This advancement highlights Google’s strong position in achieving practical quantum speedups for quantum machine learning tasks.

Component Analysis

In 2024, The Software & Solutions segment held a dominant market position, capturing a 61.2% share of the Global Quantum Machine Learning Market. This segment includes platforms and tools that enable organizations to harness quantum computing’s power for machine learning purposes. These software solutions help to accelerate data processing and improve algorithm performance, making complex computations more manageable.

Organizations are increasingly investing in these software offerings because they provide practical ways to integrate quantum capabilities into existing machine learning workflows. Such solutions cover a broad range of functionalities, from algorithm development to deployment, helping businesses solve sophisticated problems and derive value from quantum advancements.

For Instance, in June 2025, IBM introduced a detailed roadmap toward building large-scale fault-tolerant quantum computers, including new quantum processors and tools designed to enable advanced quantum software applications and solutions. IBM’s Quantum Loon chip and planned modules are key for scalable quantum machine learning software development.

Deployment Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 90.3% share of the Global Quantum Machine Learning Market. It allows businesses to access quantum computing resources remotely without needing to invest heavily in physical quantum hardware. This ease of access has accelerated adoption by lowering barriers that traditionally held back quantum technology use.

Using cloud platforms, companies of all sizes can experiment with and implement quantum machine learning solutions flexibly and cost-effectively. The cloud model also ensures users can leverage state-of-the-art quantum systems maintained by service providers, enhancing scalability and reducing maintenance concerns.

For instance, in May 2025, AWS and Rigetti Computing collaborated on building quantum machine learning applications on AWS’s cloud-based Amazon Braket platform, easing access to quantum hardware and software via the cloud. This supports enterprises adopting quantum ML remotely without hardware investments.

Application Analysis

In 2024, the Optimization Problems segment held a dominant market position, capturing a 30.7% share of the Global Quantum Machine Learning Market. Quantum machine learning is especially effective at solving these problems faster and more efficiently than classical methods. This capability is vital for industries where resource allocation, scheduling, and decision-making demand high precision and speed.

The quantum advantage in optimization helps organizations reduce costs and improve outcomes in areas like logistics, finance, and AI. This application is expected to continue driving market growth as companies seek innovative ways to solve complex operational challenges.

For Instance, in August 2025, D-Wave showcased several quantum AI projects addressing optimization problems, including pharmaceutical drug discovery and high-energy physics simulations employing quantum-enhanced ML tools for speed and accuracy improvements.

End-Use Industry Analysis

In 2024, The BFSI segment held a dominant market position, capturing a 30.1% share of the Global Quantum Machine Learning Market. Banks, financial services, and insurance companies use quantum-enhanced machine learning to improve portfolio management, detect fraud, assess risks, and optimize trading strategies. These capabilities enhance decision-making speed and accuracy in a very data-intensive industry.

The BFSI industry’s interest is fueled by the need to manage vast, complex datasets while maintaining security and regulatory compliance. Early investment in quantum technologies positions these firms to gain a competitive advantage through improved analytics and operational efficiency.

For Instance, in September 2025, Honeywell Quantum raised $600 million to expand its quantum computing systems aimed at commercial applications like finance, accelerating efforts to build universal fault-tolerant computers for BFSI use cases such as fraud detection and risk management.

Emerging Trends

Emerging trends in quantum machine learning show rapid adoption of hybrid quantum-classical frameworks that combine the strengths of both technologies. Around 38% of current research focuses on developing these integrated models, which apply quantum algorithms for demanding tasks while relying on classical methods for data processing steps.

This hybrid approach makes quantum machine learning more accessible and applicable in the near term, even as errors and qubit fidelity remain challenges. It also opens new avenues for fields like drug discovery, finance, and autonomous systems, where specialized optimization and simulations are crucial. Another solid trend involves the cloud-based delivery of quantum machine learning as a service.

About 27% of firms involved in quantum computing now provide accessible platforms that let users tap into quantum models without needing on-site hardware. This cloud model simplifies entry points for businesses aiming to leverage quantum enhancements in machine learning, setting a foundation for wider adoption as quantum hardware matures.

Growth Factors

Key growth factors for quantum machine learning include rapid advancements in quantum hardware, especially error correction and qubit quality improvements. Technologies with higher qubit counts and lower error rates have demonstrated the ability to perform complex computations faster than classical supercomputers. This progress fuels confidence in the commercial viability of quantum ML.

Additionally, the increasing availability of cloud-based quantum computing platforms is enabling more organizations to access resources and experiment without owning quantum systems. Another growth driver is the expanding application scope of quantum ML in various industries such as healthcare, finance, and autonomous systems.

Quantum ML’s capability to accelerate drug discovery, optimize portfolios, and improve sensor data analysis for autonomous vehicles is increasingly recognized. Growing interest in these sectors propels research investments and fosters collaborations, supporting further maturation and integration of quantum machine learning technologies into business workflows.

Key Market Segments

By Component

- Software & Solutions

- Services

- Consulting & Advisory

- Deployment & Integration

- Support & Maintenance

By Deployment

- On-Premise

- Cloud-based

By Application

- Optimization Problems

- Pattern Recognition & Classification

- Drug Discovery & Material Science

- Quantum Chemistry Simulation

- Generative Models

- Others

By End-Use Industry

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare & Pharmaceuticals

- Automotive & Aerospace

- Energy & Power

- Government & Defense

- Others

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Data Generation Boosts Quantum Machine Learning

The growing volume of data created through digital technologies and connected devices is a key driver for the Quantum Machine Learning market. Handling such massive amounts of information requires advanced computing power that goes beyond traditional methods.

Quantum machine learning offers faster and more efficient data analysis capabilities, helping businesses extract valuable insights and make smarter decisions. This demand for better data processing pushes industries like healthcare, finance, and manufacturing to adopt quantum solutions. As the need for quick and accurate data interpretation increases, quantum machine learning becomes an essential tool for maintaining competitive advantage and driving innovation.

For instance, In June 2025, IBM partnered with four U.S. government research centers to develop quantum-centric supercomputing systems. The initiative focuses on integrating quantum and classical processing to meet rising demands for advanced data analysis in science and industry, reinforcing IBM’s strategy to strengthen computational efficiency through quantum technology.

Restraint

High Development Costs Limit Market Reach

One major restraint slowing down the growth of Quantum Machine Learning is the high cost of developing and operating quantum computing hardware. Quantum machines require complex infrastructure, including specialized cooling systems, which only large organizations or research institutes can afford. This expensive setup makes it difficult for smaller companies and startups to access and benefit from quantum technology.

The limited availability of quantum hardware means many businesses remain reliant on classical computing methods or cloud-based quantum services, which can still be expensive and have constraints. This slow adoption, caused by financial and infrastructure barriers, restricts the market’s expansion into broader segments.

For instance, in November 2025, Rigetti Computing acknowledged the challenges posed by costly quantum system developments when reports appeared about stock downgrades linked to concerns over financial sustainability despite growing demand for their quantum cloud services. The high expenses of manufacturing and maintaining quantum hardware continue to limit the market reach mainly to large enterprises and research institutions.

Opportunities

Cloud-Based Quantum Platforms Democratize Access

Cloud-based quantum computing platforms represent an important opportunity for the market. These platforms provide access to quantum computing resources and algorithms without the need for heavy investment in physical infrastructure. This model allows businesses of varying sizes to begin experimenting with quantum machine learning and integrate it into their processes conveniently.

By lowering the barriers to entry, cloud platforms foster broader adoption and innovation across industries. They enable solutions for complex problems in logistics, drug discovery, and financial analysis, accelerating the pace at which quantum technologies become mainstream tools.

For instance, in December 2024, Amazon Web Services (AWS) collaborated with NVIDIA to integrate NVIDIA’s CUDA-Q platform with the AWS Braket service, enabling users to develop and run quantum algorithms on hybrid quantum-classical environments through the cloud. This partnership demonstrates how cloud platforms lower the barrier for businesses and researchers to access advanced quantum computing resources without heavy upfront investments.

Challenges

Quantum Hardware Limitations and Stability Issues

Quantum machine learning faces significant challenges due to the fragile nature of current quantum hardware. Qubits are highly sensitive and prone to errors caused by environmental factors. This instability impacts the reliability and accuracy of quantum computations, hindering the effectiveness of machine learning applications.

At present, quantum systems are still early-stage technologies with limited scalability and error correction capabilities. Advances in hardware design and error mitigation techniques are crucial to improving stability and unlocking the full potential of quantum machine learning for practical use.

For instance, in February 2025, Microsoft unveiled its Majorana 1 quantum chip, highlighting advancements in error correction through logical qubits but also acknowledging ongoing challenges related to hardware reliability and stability. Despite progress, current quantum systems still face difficulties with noise and qubit coherence, important hurdles to overcome.

Key Players Analysis

Leadership in quantum machine learning is led by firms such as IBM, Google, Microsoft and Amazon Web Services. These providers emphasize cloud-based SDKs and hybrid workflows to enable variational algorithms and kernel-method models. They focus on developer ecosystems, integration with existing AI stacks and enterprise governance, which positions them as primary enablers of early quantum-ML adoption.

Meanwhile, hardware-centric companies drive the physical feasibility of quantum machine learning. Firms like Rigetti Computing, D‑Wave Systems, Xanadu Quantum Technologies, IonQ and Quantinuum (formerly Honeywell Quantum Solutions) span superconducting, annealing, photonic and trapped-ion architectures. They deliver cloud endpoints, pulse-level control and error mitigation tools critical for QML experimentation.

Complementing both layers are software and services specialists such as Zapata Computing, QC Ware, Classiq Technologies, Terra Quantum, 1QBit alongside integrators like Accenture and Atos. Regional players like Alibaba Cloud and Fujitsu support compliance and localisation. These firms focus on algorithm design, workflow automation and domain-specific templates, enabling applications across finance, logistics and materials.

Top Key Players in the Market

- IBM

- Microsoft

- Amazon Web Services (AWS)

- Rigetti Computing

- D-Wave Systems

- Xanadu Quantum Technologies

- Honeywell Quantum Solutions (Quantinuum)

- IonQ

- Zapata Computing

- QC Ware

- Atos

- Alibaba Cloud

- Fujitsu

- Accenture

- 1QBit

- Terra Quantum

- Classiq Technologies

- Others

Recent Developments

- In October 2025, Google reported a major quantum breakthrough with its Quantum Echoes algorithm running on a 65-qubit processor. The algorithm achieved a physics simulation 13,000 times faster than the fastest classical supercomputer, marking a key step towards practical quantum advantage in quantum machine learning applications. This underscores Google’s leadership in both hardware and software innovation in this field.

- In October 2025, D-Wave Quantum was recognized by Fast Company for its Advantage2 annealing quantum computer with over 4400 qubits. Launched in May 2025, this system is noted for high connectivity and energy-efficient quantum computation ideal for production in optimization and AI applications, furthering D-Wave’s reputation in the quantum machine learning market.

Report Scope

Report Features Description Market Value (2024) USD 1.08 Bn Forecast Revenue (2034) USD 20.46 Bn CAGR(2025-2034) 34.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software & Solutions, Services), By Deployment (On-Premise, Cloud-based), By Application (Optimization Problems, Pattern Recognition & Classification, Drug Discovery & Material Science, Quantum Chemistry Simulation, Generative Models, Others), By End-Use Industry (Banking, Financial Services, and Insurance (BFSI), Healthcare & Pharmaceuticals, Automotive & Aerospace, Energy & Power, Government & Defense, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM, Google, Microsoft, Amazon Web Services (AWS), Rigetti Computing, D-Wave Systems, Xanadu Quantum Technologies, Honeywell Quantum Solutions (Quantinuum), IonQ, Zapata Computing, QC Ware, Atos, Alibaba Cloud, Fujitsu, Accenture, 1Qbit, Terra Quantum, Classiq Technologies, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Quantum Machine Learning MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Quantum Machine Learning MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM

- Microsoft

- Amazon Web Services (AWS)

- Rigetti Computing

- D-Wave Systems

- Xanadu Quantum Technologies

- Honeywell Quantum Solutions (Quantinuum)

- IonQ

- Zapata Computing

- QC Ware

- Atos

- Alibaba Cloud

- Fujitsu

- Accenture

- 1QBit

- Terra Quantum

- Classiq Technologies

- Others