Global Quantum Computing in Automotive Market Size, Share, Growth Analysis By Component Type (Software, Hardware, Services), By Deployment Type (Cloud, On-premises), By Stakeholder Type (OEM, Automotive Tier 1 and 2, Warehousing and Distribution), By Application (Route Planning and Traffic Management, Battery Optimization, Material Research, Autonomous and Connected Vehicle, Production Planning and Scheduling, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174486

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

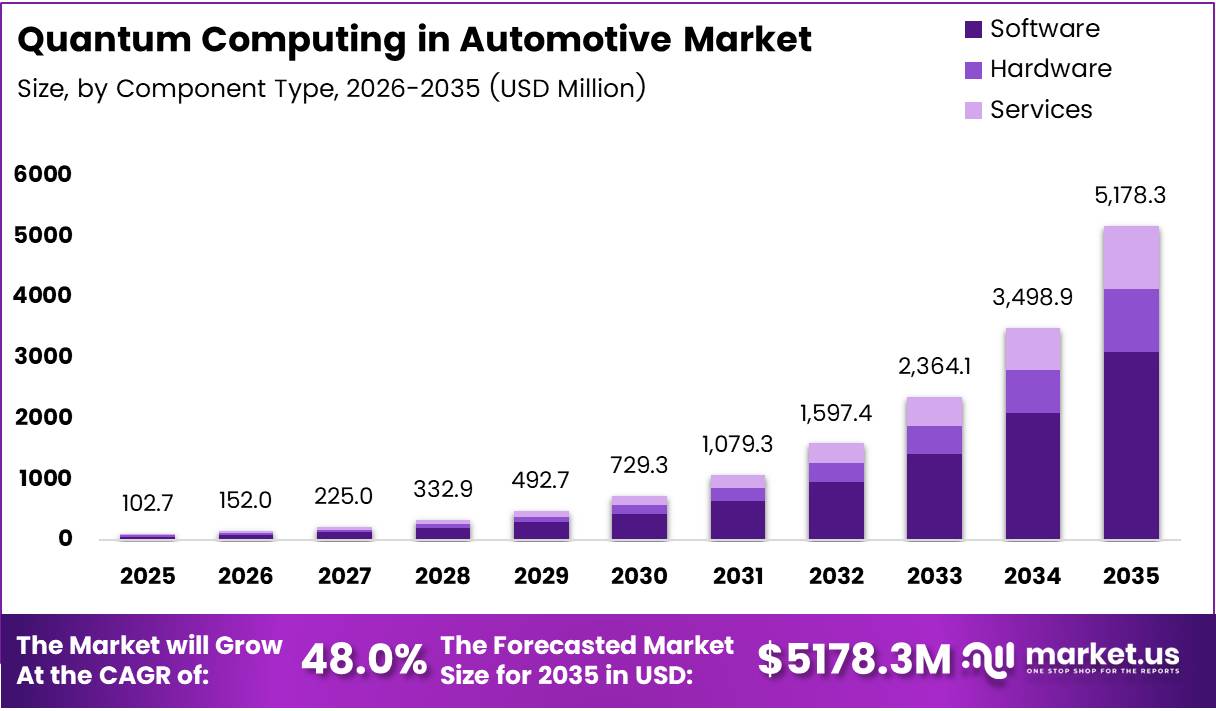

Global Quantum Computing in Automotive Market size is projected to reach approximately USD 5,178.3 Million by 2035 from USD 102.7 Million in 2025, expanding at a CAGR of 48.0% during the forecast period 2026 to 2035.

Quantum computing represents a revolutionary computational approach leveraging quantum mechanics principles to solve complex automotive challenges. Moreover, this technology enables unprecedented processing capabilities for vehicle design, battery optimization, and autonomous system development. Therefore, automotive manufacturers increasingly adopt quantum solutions for competitive advantage.

The automotive sector faces escalating computational demands across electric vehicle development and autonomous driving systems. Consequently, traditional computing architectures struggle to address optimization problems involving millions of variables simultaneously. However, quantum computing offers exponential processing power for route optimization, material discovery, and production planning.

Market growth stems from rising electric vehicle adoption requiring advanced battery chemistry optimization. Additionally, autonomous vehicle development demands sophisticated simulation capabilities beyond classical computing limits. Furthermore, OEMs seek quantum-enabled solutions for supply chain risk management and real-time fleet optimization.

Government initiatives supporting quantum technology infrastructure accelerate automotive industry adoption. Moreover, increasing collaboration between automotive manufacturers and quantum computing providers drives innovation. Subsequently, cloud-based quantum services democratize access for tier-1 suppliers and smaller automotive stakeholders.

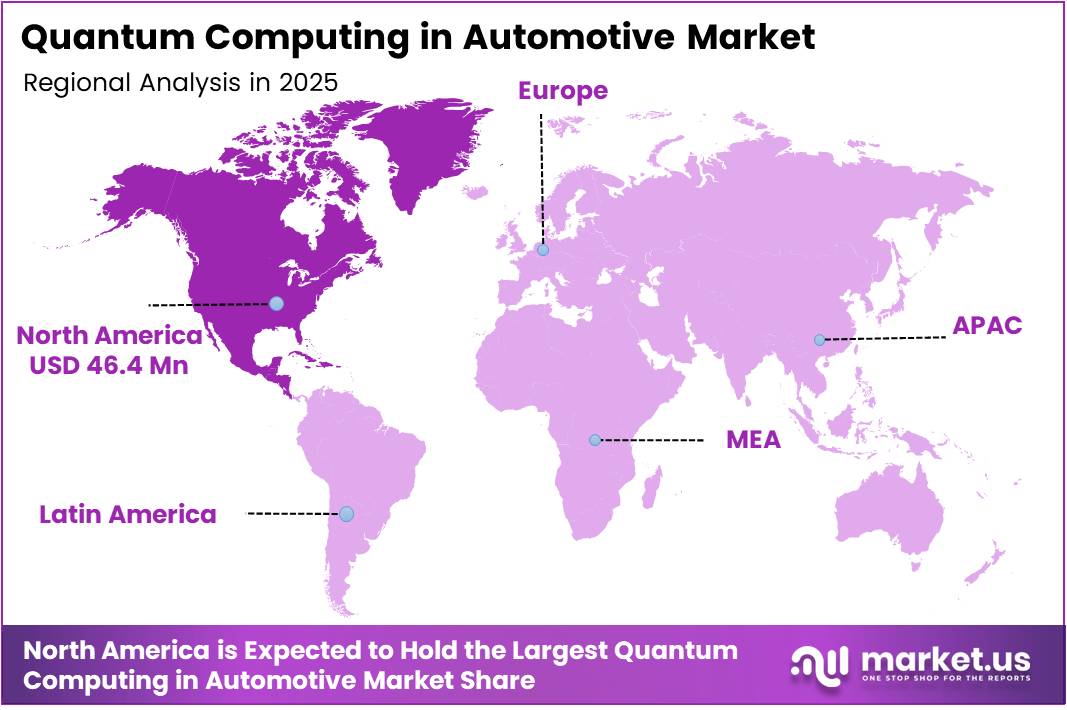

North America dominates the market with 45.2% share, valued at USD 46.4 Million, driven by strong quantum computing infrastructure and automotive technology investments. Additionally, software solutions capture 49.6% of component type segment, reflecting growing demand for quantum algorithms. Furthermore, cloud deployment accounts for 79.3% share, enabling scalable quantum computing access.

Key Takeaways

- Global Quantum Computing in Automotive Market valued at USD 102.7 Million in 2025, projected to reach USD 5,178.3 Million by 2035

- Market expanding at 48.0% CAGR during forecast period 2026-2035

- Software segment dominates Component Type with 49.6% market share

- Cloud deployment holds 79.3% share in Deployment Type segment

- OEM stakeholders lead with 43.7% market share

- Route Planning and Traffic Management applications capture 28.1% share

- North America leads regional market with 45.2% share, valued at USD 46.4 Million

Component Type Analysis

Software dominates with 49.6% share due to increasing demand for quantum algorithms and simulation platforms.

In 2025, Software held a dominant market position in the Component Type segment of Quantum Computing in Automotive Market, with a 49.6% share. Moreover, software solutions enable automotive manufacturers to develop quantum algorithms for battery optimization and autonomous driving simulations. Additionally, cloud-based quantum software platforms provide accessible entry points for OEMs exploring quantum capabilities.

Hardware components represent critical infrastructure enabling quantum computing operations within automotive applications. Furthermore, quantum hardware includes processors, cryogenic systems, and quantum chips designed for automotive-specific computational challenges. Consequently, hardware investments support long-term quantum infrastructure development across major automotive manufacturers and research institutions.

Services encompass consulting, integration, and maintenance solutions supporting quantum computing adoption in automotive operations. Moreover, specialized services help automotive companies navigate complex quantum implementation processes and talent acquisition challenges. Therefore, service providers bridge knowledge gaps between quantum technology capabilities and automotive engineering requirements.

Deployment Type Analysis

Cloud deployment dominates with 79.3% share due to cost-effectiveness and scalability advantages for automotive companies.

In 2025, Cloud held a dominant market position in the Deployment Type segment of Quantum Computing in Automotive Market, with a 79.3% share. Additionally, cloud-based quantum computing eliminates substantial upfront hardware investments required for quantum infrastructure. Moreover, automotive tier suppliers leverage cloud platforms for flexible quantum computing access without maintaining complex physical systems.

On-premises deployment serves automotive manufacturers requiring dedicated quantum computing infrastructure for proprietary research and development. Furthermore, on-premises solutions provide enhanced data security and control for sensitive autonomous driving algorithms and battery chemistry development. Consequently, large OEMs invest in private quantum computing facilities for strategic competitive advantages.

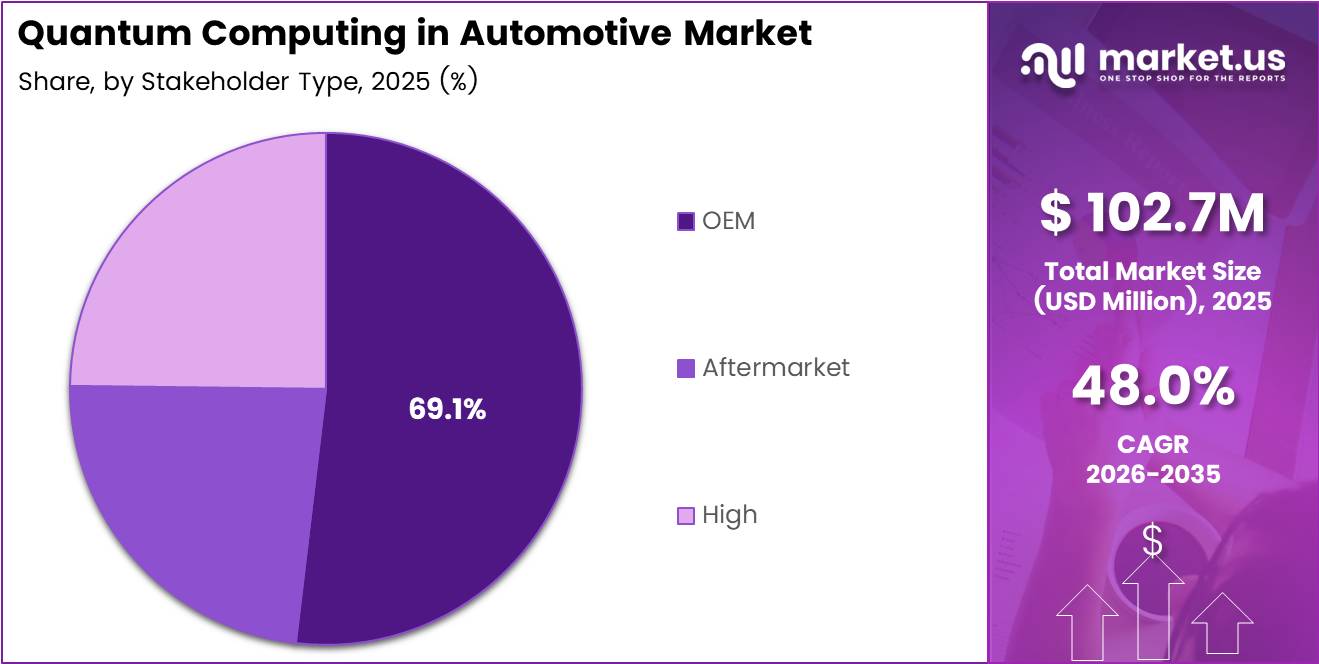

Stakeholder Type Analysis

OEM dominates with 43.7% share due to direct investment in quantum computing for vehicle development and manufacturing optimization.

In 2025, OEM held a dominant market position in the Stakeholder Type segment of Quantum Computing in Automotive Market, with a 43.7% share. Moreover, original equipment manufacturers deploy quantum solutions for battery research, autonomous vehicle simulation, and production planning optimization. Additionally, OEMs possess financial resources and technical expertise necessary for quantum computing integration across operations.

Automotive Tier 1 and 2 suppliers increasingly adopt quantum computing for component optimization and supply chain management. Furthermore, tier suppliers utilize quantum algorithms for material discovery, quality control optimization, and logistics planning. Consequently, supplier-level quantum adoption strengthens entire automotive value chain computational capabilities and efficiency.

Warehousing and Distribution stakeholders leverage quantum computing for route optimization, inventory management, and logistics network planning. Moreover, quantum-enabled solutions address complex distribution challenges involving multiple variables and real-time optimization requirements. Therefore, logistics operations achieve significant efficiency improvements through quantum computing applications.

Application Analysis

Route Planning and Traffic Management dominates with 28.1% share due to immediate practical applications and measurable efficiency gains.

In 2025, Route Planning and Traffic Management held a dominant market position in the Application segment of Quantum Computing in Automotive Market, with a 28.1% share. Additionally, quantum algorithms solve complex routing problems involving thousands of vehicles and dynamic traffic conditions simultaneously. Moreover, real-time traffic optimization delivers immediate cost savings and improved fleet efficiency.

Battery Optimization applications utilize quantum computing for exploring vast chemical composition spaces and predicting battery degradation patterns. Furthermore, quantum simulations accelerate electric vehicle battery development by testing thousands of material combinations virtually. Consequently, automotive manufacturers reduce battery research timelines while improving performance and longevity.

Material Research applications leverage quantum computing for discovering advanced automotive materials with enhanced properties. Moreover, quantum simulations model molecular interactions impossible to calculate using classical computing methods. Therefore, material innovation accelerates across lightweighting, thermal management, and structural component development.

Autonomous and Connected Vehicle applications require quantum computing for processing massive sensor data and complex decision-making algorithms. Additionally, quantum-enabled simulations test autonomous driving scenarios across millions of potential road conditions and edge cases. Furthermore, connected vehicle networks utilize quantum optimization for vehicle-to-vehicle communication and coordination.

Production Planning and Scheduling applications employ quantum algorithms for optimizing manufacturing workflows involving numerous interdependent variables. Moreover, quantum computing addresses complex factory scheduling challenges while minimizing downtime and maximizing resource utilization. Consequently, automotive manufacturers achieve significant production efficiency improvements and cost reductions.

Others category encompasses emerging quantum computing applications including supply chain risk assessment and predictive maintenance. Additionally, automotive companies explore quantum solutions for cybersecurity, warranty cost optimization, and customer experience personalization. Therefore, application diversity expands as quantum computing technology matures.

Key Market Segments

By Component Type

- Software

- Hardware

- Services

By Deployment Type

- Cloud

- On-premises

By Stakeholder Type

- OEM

- Automotive Tier 1 and 2

- Warehousing and Distribution

By Application

- Route Planning and Traffic Management

- Battery Optimization

- Material Research

- Autonomous and Connected Vehicle

- Production Planning and Scheduling

- Others

Drivers

Growing Need for Ultra-Fast Optimization Drives Quantum Computing Adoption in Automotive Sector

Electric vehicle manufacturers face unprecedented challenges optimizing battery chemistry and materials discovery processes. Moreover, quantum computing enables simultaneous evaluation of millions of molecular combinations impossible through traditional computational methods. Consequently, automotive companies accelerate battery development cycles while improving energy density and charging performance.

Autonomous driving systems require exponential computing power for processing complex algorithms involving real-time decision-making. Additionally, quantum computing addresses computational bottlenecks limiting autonomous vehicle development and safety validation. Therefore, OEMs invest heavily in quantum infrastructure supporting next-generation mobility solutions.

Vehicle fleet simulation and traffic modeling demand advanced computational capabilities exceeding classical computing limits. Furthermore, real-time optimization across thousands of vehicles requires quantum algorithms processing massive datasets simultaneously. Subsequently, automotive manufacturers achieve significant operational efficiency improvements through quantum-enabled fleet management systems.

Restraints

Limited Hardware Availability and High Talent Costs Restrain Quantum Computing Market Growth

Automotive-ready quantum hardware remains scarce with limited commercially available stable qubit systems meeting industry requirements. Moreover, quantum computers require extreme operating conditions including cryogenic temperatures challenging automotive integration. Consequently, hardware availability constrains widespread quantum computing adoption across automotive operations.

Quantum computing expertise represents a critical bottleneck with severe talent shortages affecting automotive industry adoption. Additionally, integration specialists combining quantum computing knowledge with automotive engineering experience command premium compensation. Furthermore, educational institutions struggle producing sufficient quantum-trained professionals meeting growing automotive sector demand.

High implementation costs associated with quantum computing infrastructure deter smaller automotive suppliers and manufacturers. Therefore, market growth concentrates among well-funded OEMs and tier-1 suppliers possessing necessary financial resources for quantum technology investments.

Growth Factors

Quantum-Driven EV Platforms and Autonomous Simulations Create Significant Market Opportunities

Development of quantum-driven electric vehicle powertrain optimization platforms addresses critical range anxiety and charging efficiency challenges. Moreover, quantum algorithms optimize battery management systems and thermal control strategies improving overall vehicle performance. Consequently, automotive manufacturers gain competitive advantages through superior electric vehicle capabilities.

Integration of quantum computing for large-scale autonomous mobility simulations enables comprehensive safety validation across billions of scenarios. Additionally, quantum-powered simulations reduce physical testing requirements while accelerating autonomous vehicle deployment timelines. Therefore, regulatory approval processes benefit from enhanced simulation capabilities.

Quantum-enabled supply chain risk forecasting helps automotive OEMs navigate complex global supply networks and geopolitical uncertainties. Furthermore, predictive analytics powered by quantum computing identify potential disruptions before impacting production schedules. Subsequently, automotive manufacturers improve supply chain resilience and operational continuity.

Emerging Trends

Strategic Partnerships and Quantum-as-a-Service Models Transform Automotive Technology Landscape

Partnerships between automotive OEMs and quantum technology startups accelerate practical application development and commercial deployment. Moreover, collaborative initiatives combine automotive domain expertise with cutting-edge quantum computing capabilities. Consequently, joint ventures deliver industry-specific quantum solutions addressing real-world automotive challenges.

Adoption of quantum algorithms for battery degradation prediction enables predictive maintenance strategies and warranty cost optimization. Additionally, machine learning models enhanced by quantum computing improve battery lifecycle management and residual value forecasting. Therefore, electric vehicle total cost of ownership decreases through intelligent battery management.

Emergence of Quantum-as-a-Service models democratizes access enabling smaller automotive suppliers to leverage quantum capabilities affordably. Furthermore, cloud-based quantum platforms eliminate infrastructure barriers accelerating industry-wide technology adoption. Subsequently, innovation distributes across entire automotive ecosystem beyond large manufacturers.

Regional Analysis

North America Dominates Quantum Computing in Automotive Market with 45.2% Share, Valued at USD 46.4 Million

North America leads the global market with 45.2% share, valued at USD 46.4 Million, driven by robust quantum computing infrastructure and substantial automotive technology investments. Moreover, United States hosts leading quantum computing companies and research institutions collaborating extensively with automotive manufacturers. Additionally, government funding supports quantum technology development accelerating automotive applications. Furthermore, presence of major electric vehicle manufacturers and autonomous driving companies drives quantum computing adoption.

Europe Quantum Computing in Automotive Market Trends

Europe demonstrates strong quantum computing adoption supported by government initiatives and automotive industry leadership. Moreover, German automotive manufacturers invest heavily in quantum research for electric vehicle development and manufacturing optimization. Additionally, European Union funding programs accelerate quantum technology commercialization across automotive applications. Furthermore, stringent emission regulations drive demand for quantum-optimized electric vehicle technologies.

Asia Pacific Quantum Computing in Automotive Market Trends

Asia Pacific exhibits rapid growth driven by expanding electric vehicle production and smart manufacturing initiatives. Moreover, China invests substantially in quantum computing infrastructure supporting domestic automotive industry transformation. Additionally, Japanese automotive manufacturers pioneer quantum applications for autonomous driving and production planning. Furthermore, government policies promoting electric vehicles accelerate quantum computing adoption across region.

Latin America Quantum Computing in Automotive Market Trends

Latin America shows emerging interest in quantum computing applications for automotive logistics and fleet management optimization. Moreover, Brazilian automotive sector explores quantum solutions for supply chain efficiency and route optimization. Additionally, regional manufacturers collaborate with international quantum computing providers accessing cloud-based platforms. Furthermore, growing electric vehicle adoption creates opportunities for quantum-enabled battery optimization.

Middle East & Africa Quantum Computing in Automotive Market Trends

Middle East & Africa demonstrates nascent quantum computing adoption focused on automotive logistics and smart mobility initiatives. Moreover, GCC countries invest in quantum technology infrastructure supporting future mobility visions and autonomous vehicle programs. Additionally, South African automotive sector explores quantum applications for manufacturing optimization. Furthermore, government smart city initiatives drive quantum computing interest for traffic management.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Quantum Computing in Automotive Company Insights

IBM Corporation maintains leadership position in quantum computing for automotive applications through comprehensive hardware and software offerings. Moreover, IBM’s quantum computing platforms enable automotive manufacturers to develop custom algorithms for battery optimization and autonomous vehicle simulations. Additionally, the company provides extensive consulting services helping automotive clients navigate quantum implementation challenges. Furthermore, IBM’s partnerships with major OEMs accelerate practical quantum application development across vehicle design and manufacturing processes.

Microsoft Corporation delivers quantum computing solutions through Azure Quantum cloud platform serving automotive industry clients globally. Moreover, Microsoft integrates quantum capabilities with classical computing infrastructure enabling hybrid approaches for automotive applications. Additionally, the company invests substantially in quantum algorithm development specifically targeting autonomous driving and materials research. Furthermore, Microsoft’s automotive partnerships focus on production planning optimization and supply chain risk management using quantum-enhanced analytics.

D-Wave Systems, Inc. specializes in quantum annealing technology particularly suited for automotive optimization problems including route planning and scheduling. Moreover, D-Wave provides accessible quantum computing systems enabling automotive companies to solve complex combinatorial problems efficiently. Additionally, the company supports automotive clients developing quantum applications for fleet management and logistics optimization. Furthermore, D-Wave’s cloud-based quantum services lower entry barriers for automotive tier suppliers exploring quantum technology benefits.

Amazon offers Amazon Braket quantum computing service providing automotive companies access to multiple quantum hardware platforms simultaneously. Moreover, Amazon’s cloud infrastructure enables scalable quantum computing deployment supporting automotive research and development activities. Additionally, the company facilitates automotive industry quantum education through comprehensive training programs and technical resources. Furthermore, Amazon’s quantum consulting services help automotive manufacturers identify high-value quantum use cases and implementation strategies.

Key Players

- IBM Corporation

- Microsoft Corporation

- D-wave systems, inc.

- Amazon

- Rigetti & Co, LLC

- PASQAL

- Accenture plc

- Terra Quantum

- IONQ

Recent Developments

- In December 2025, Luminar announced the sale of its Photonics Business to Quantum Computing Inc. for $110 Million, marking strategic realignment toward core automotive sensing technologies. Moreover, this transaction enables Quantum Computing Inc. to expand semiconductor capabilities supporting quantum processor development.

- In October 2025, Aeluma acquired significant capital equipment assets to accelerate manufacturing readiness for advanced semiconductor production. Additionally, this acquisition strengthens Aeluma’s capacity for producing quantum computing components serving automotive applications.

- In December 2025, Quantum Computing Inc. announced agreement to acquire Luminar Semiconductor, Inc., accelerating technology roadmap for automotive quantum applications. Furthermore, this acquisition enhances Quantum Computing Inc.’s photonics capabilities critical for quantum processor manufacturing and automotive sensor integration.

Report Scope

Report Features Description Market Value (2025) USD 102.7 Million Forecast Revenue (2035) USD 5178.3 Million CAGR (2026-2035) 48.0% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component Type (Software, Hardware, Services), By Deployment Type (Cloud, On-premises), By Stakeholder Type (OEM, Automotive Tier 1 and 2, Warehousing and Distribution), By Application (Route Planning and Traffic Management, Battery Optimization, Material Research, Autonomous and Connected Vehicle, Production Planning and Scheduling, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape IBM Corporation, Microsoft Corporation, D-wave systems, inc., Amazon, Rigetti & Co, LLC, PASQAL, Accenture plc, Terra Quantum, IONQ Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Quantum Computing in Automotive MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Quantum Computing in Automotive MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- Microsoft Corporation

- D-wave systems, inc.

- Amazon

- Rigetti & Co, LLC

- PASQAL

- Accenture plc

- Terra Quantum

- IONQ