Global Pyrene Market Size, Share, And Enhanced Productivity By Concentration (Above 98%, 95% to 98%), By Application (Dye Production, Synthetic Resin Manufacturing, Insecticides, Plasticizers, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176569

- Number of Pages: 314

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

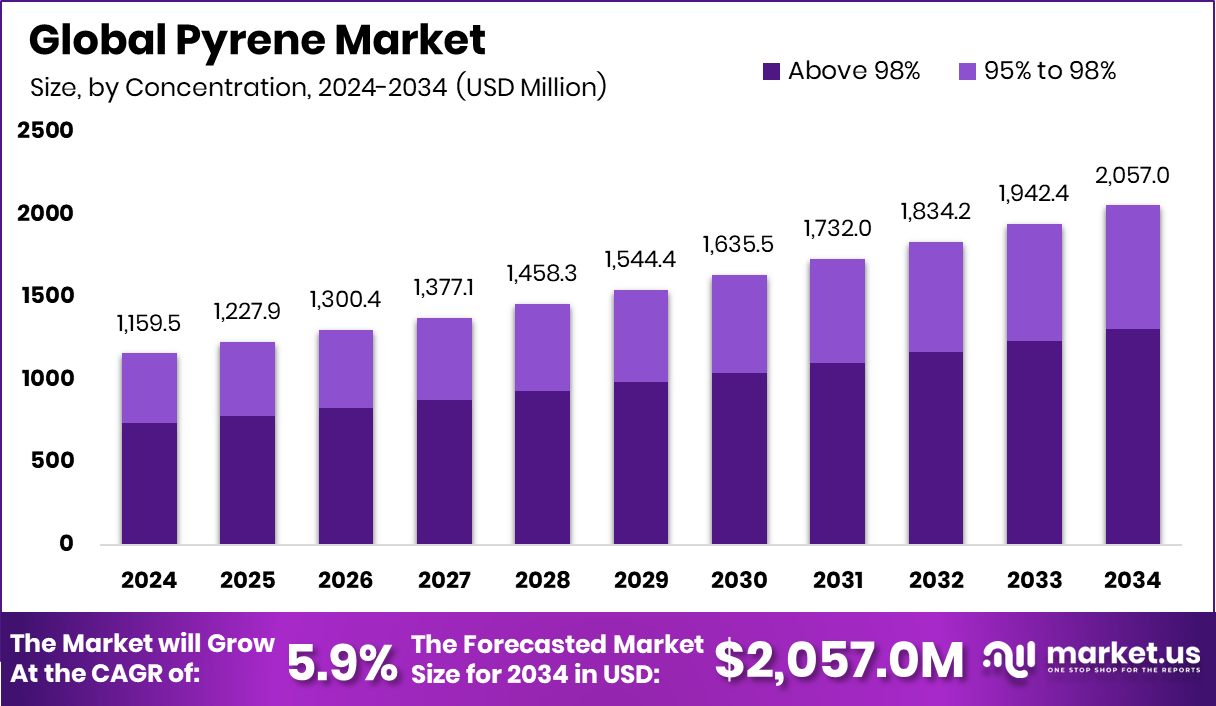

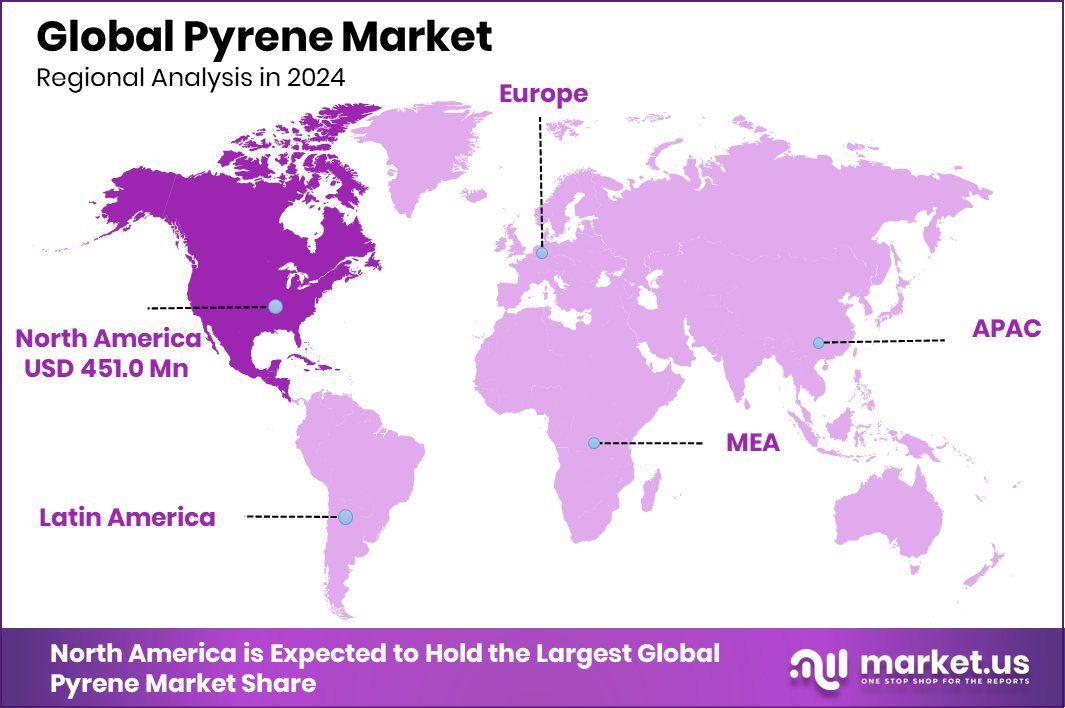

The Global Pyrene Market is expected to be worth around USD 2,057.0 Million by 2034, up from USD 1159.5 Million in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034. The region of North America captured a 38.9% share, valued at USD 451.0 Mn.

Pyrene is a polycyclic aromatic hydrocarbon known for its strong fluorescence, stability, and usefulness as a building block in dyes, resins, and specialty chemical formulations. It is widely used in research laboratories, material science, and industrial applications where high-purity aromatic compounds are required.

The Pyrene Market covers its production, distribution, and use across industries such as dye manufacturing, synthetic resins, insecticides, and plasticizers. Segments like Above 98% purity and 95% to 98% purity help classify products based on quality needs. Applications such as Dye Production, synthetic resin manufacturing, and insecticides reflect where most consumption occurs.

Growth in the pyrene market is supported by rising interest in advanced dye technologies. Global funding toward sustainable color solutions—such as Chromologics raising $8M, Colorifix securing $18M, and a Danish startup raising $5.8M for fossil-free pigments—indirectly boosts demand for aromatic intermediates like pyrene used in specialty dye formulations.

Demand is also supported by expansion in ink and pigment manufacturing. Investments such as Jaysynth Orgochem approving ₹7.75 crore capex highlight continued industrial activity, while new technologies that remove 80% of dye pollutants in wastewater encourage the development of more efficient intermediates, including pyrene-based blends.

Opportunities emerge as global textile and chemical sectors adopt cleaner processes. Even though some companies report pressures—such as an 82.6% profit drop in one dye manufacturer—ongoing capital raises like Colorifix’s $18M scale-up show strong momentum toward next-generation dye materials, creating room for pyrene-linked innovation in sustainable production pathways.

Key Takeaways

- The Global Pyrene Market is expected to be worth around USD 2,057.0 Million by 2034, up from USD 1159.5 Million in 2024, and is projected to grow at a CAGR of 5.9% from 2025 to 2034.

- The Pyrene market sees strong demand for above 98% purity, capturing 63.7% global share.

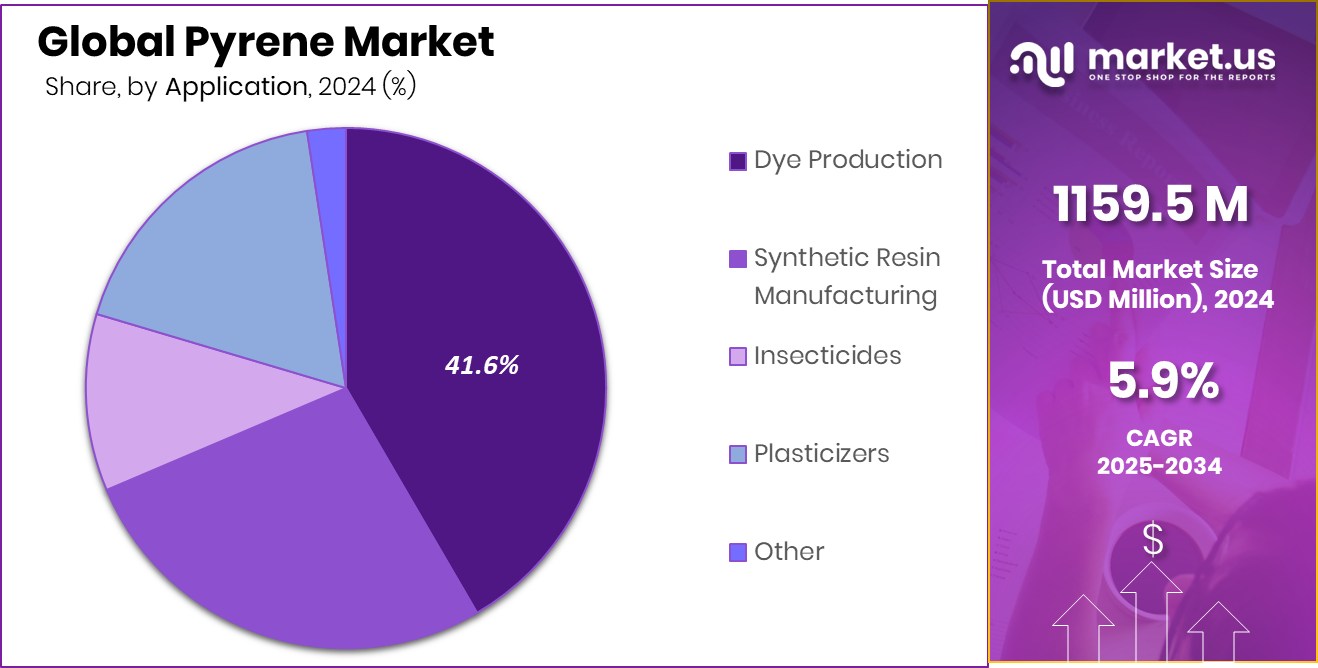

- Dye production leads the Pyrene market with 41.6% share, supported by expanding textile coloration needs.

- In North America, the Pyrene Market achieved USD 451.0 Mn and 38.9%.

By Concentration Analysis

Pyrene Market dominated the Above 98% concentration segment with a 63.7% share.

In 2024, the Above 98% concentration grade dominated the Pyrene Market, securing a strong 63.7% share on the back of its high purity and suitability for advanced industrial uses. This grade is widely preferred in pharmaceuticals, specialty chemicals, and research applications where precision and consistency are essential.

Its dominance also reflects growing demand from laboratories and high-performance material manufacturers who rely on ultra-pure pyrene for fluorescence studies, organic semiconductor development, and environmental tracing.

As industries move toward cleaner inputs and controlled-quality raw materials, the need for 98%+ pure pyrene has increased steadily. This shift keeps the segment firmly positioned as the primary revenue contributor within the global market landscape.

By Application Analysis

Pyrene Market dominated the dye production application segment with a 41.6% share.

In 2024, Dye Production emerged as the leading application segment in the Pyrene Market, accounting for a 41.6% share, driven by the rising use of pyrene-based intermediates in vibrant and durable color formulations. The segment’s dominance is closely linked to demand from textile, leather, and specialty paper manufacturers who prefer pyrene derivatives for their stability, strong coloration, and compatibility with multiple dyeing processes.

Additionally, the growth of eco-friendly and high-performance dyes has strengthened the use of pyrene compounds in developing efficient chromophores. Industries focused on premium-quality pigments also rely on pyrene’s structural characteristics, supporting consistent market traction. This strong adoption ensures dye production remains a key factor shaping overall pyrene consumption patterns.

Key Market Segments

By Concentration

- Above 98%

- 95% to 98%

By Application

- Dye Production

- Synthetic Resin Manufacturing

- Insecticides

- Plasticizers

- Other

Driving Factors

Rising demand for advanced dye intermediates

The Pyrene Market continues to grow as industries seek more advanced dye intermediates that deliver stronger performance and better stability during processing. This rising demand aligns with broader developments in the chemical and agro-inputs landscape, where companies are investing heavily in next-generation solutions.

A recent example is BioPrime securing $6 million to develop a new range of bio-fungicides and bio-insecticides, reflecting a rising global push toward efficient and specialty chemical ingredients. Such investments indirectly support demand for pyrene-based components used in dyes, resins, and analytical applications. As manufacturers expand their portfolios and focus on higher-value intermediates, the role of pyrene becomes more significant within these evolving industrial ecosystems.

Restraining Factors

Limited availability of high-purity feedstock

The Pyrene Market faces limitations primarily due to restricted access to high-purity feedstock, which is essential for producing materials required in dyes, resins, and fluorescence applications. Supply constraints elevate production costs and slow down capacity expansions for several users that depend on consistent quality inputs.

Even though the textile and materials sector has seen improvements—such as BRFL Textiles reporting a 50% increase in fabric production after securing funding—these gains do not fully resolve the underlying challenge of sourcing ultra-pure aromatic compounds. Producers remain cautious about scaling operations when feedstock volatility threatens reliability, creating a natural restraint on the market’s overall growth pace.

Growth Opportunity

Expanding applications in specialty chemical industries

Opportunities in the Pyrene Market are expanding as specialty chemical industries widen their applications across dyes, fluorescence markers, resins, and advanced material research. Pyrene is increasingly viewed as a valuable intermediate for high-performance formulations. Growth momentum is also supported by significant financial activity in adjacent specialty segments.

For example, biotech start-up Pili raised US$15.8 million in Series A funding to scale its innovative bio-based dye technologies. Such funding flows encourage further exploration of chemical building blocks that enhance color strength, stability, and sustainability. As industries move toward environmentally conscious and high-efficiency materials, pyrene’s versatility positions it well for future opportunities.

Latest Trends

Shift toward sustainable dye technologies

Sustainability remains one of the strongest trends shaping the Pyrene Market, particularly as manufacturers search for cleaner dye technologies and more efficient chemical intermediates. Across the textile and materials sector, companies are investing in greater production capacity to meet evolving global needs.

A major example is Nitin Spinners investing Rs. 1,100 crore to expand its production capabilities, signaling strong momentum in downstream industries that rely on pigments, dyes, and specialty chemicals. As these industries upgrade infrastructure, demand naturally shifts toward higher-purity intermediates, including pyrene. This trend supports a broader move toward modernized, efficient, and environmentally aligned dye and chemical production practices.

Regional Analysis

North America leads the pyrene market with a 38.9% share, reaching USD 451.0 Mn.

In 2024, North America stood as the leading regional market for pyrene, holding a dominant 38.9% share valued at USD 451.0 million, supported by strong chemical manufacturing activity and steady industrial consumption.

Europe followed with consistent demand from specialty chemical producers and research institutions, maintaining stable growth across Western and Central countries. The Asia Pacific region continued to expand due to rising production needs in emerging economies and increasing use of pyrene derivatives in material and dye applications.

Meanwhile, the Middle East & Africa showed moderate development, driven by gradual industrial diversification and a growing focus on chemical intermediates. Latin America registered steady uptake, supported by the region’s evolving manufacturing landscape and rising interest in pyrene-based applications within local industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE remained a central participant due to its longstanding expertise in producing high-quality aromatic compounds. Its broad chemical portfolio and strong industrial presence supported consistent supply capabilities, making it one of the most dependable contributors within the pyrene value chain. BASF’s disciplined approach to material engineering helped reinforce the segment’s stability through reliable product performance.

Haihang Industry Co., Ltd demonstrated meaningful traction by offering a wide range of specialty ingredients, including pyrene for industrial and research applications. The company’s focus on maintaining product purity and meeting diverse client requirements positioned it as a competitive supplier. Its operational flexibility and ability to cater to bulk as well as customized orders added to its relevance in 2024.

Henan Tianfu Chemical Co., Ltd strengthened its presence through targeted production of fine chemicals, supporting sectors that rely on pyrene derivatives. With a focus on consistent quality and dependable delivery, the company maintained stable engagement with buyers seeking specialized aromatic compounds. Together, these companies contributed to a balanced and functional competitive environment across the global pyrene landscape.

Top Key Players in the Market

- BASF SE

- Haihang Industry Co., Ltd

- Henan Tianfu Chemical Co., Ltd

- BOC Sciences

- China Qingdao Hongjin Chemical Co., Ltd.

- Biosynth

- Carbone Scientific Co., Ltd.

- Glentham Life Sciences

- Kishida Chemical Co., Ltd.

Recent Developments

- In July 2025, Biosynth, a company that makes and supplies complex chemicals, peptides, and biologics, expanded its Berlin facility by adding a new commercial bioconjugation suite to better support production of specialized materials like conjugates. This helps the company increase manufacturing options and serve biotechnology customers more widely.

- In May 2024, Glentham Life Sciences, a supplier and manufacturer of fine chemicals and reagents, announced that its products are now supplied with Delivered Duty Paid (DDP) terms to European Union countries from its German subsidiary. This update improved delivery speed and customs clearance for customers in Europe.

Report Scope

Report Features Description Market Value (2024) USD 1159.5 Million Forecast Revenue (2034) USD 2,057.0 Million CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Concentration (Above 98%, 95% to 98%), By Application (Dye Production, Synthetic Resin Manufacturing, Insecticides, Plasticizers, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Haihang Industry Co., Ltd, Henan Tianfu Chemical Co., Ltd, BOC Sciences, China Qingdao Hongjin Chemical Co., Ltd., Biosynth, Carbone Scientific Co., Ltd., Glentham Life Sciences, Kishida Chemical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Haihang Industry Co., Ltd

- Henan Tianfu Chemical Co., Ltd

- BOC Sciences

- China Qingdao Hongjin Chemical Co., Ltd.

- Biosynth

- Carbone Scientific Co., Ltd.

- Glentham Life Sciences

- Kishida Chemical Co., Ltd.