Global PVB Interlayers Market Size, Share Analysis Report By Form (Sheets And Rolls, Films, and Others), By Type (Standard and Structural), By End-Use (Automotive And Transportation, Building And Construction, Consumer Electronics, Industrials, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160978

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

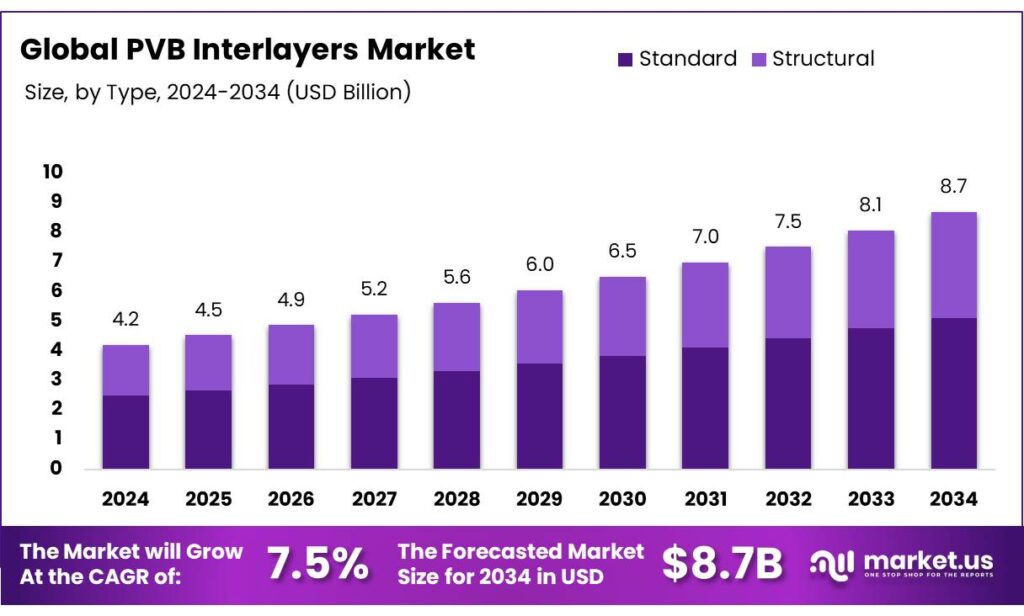

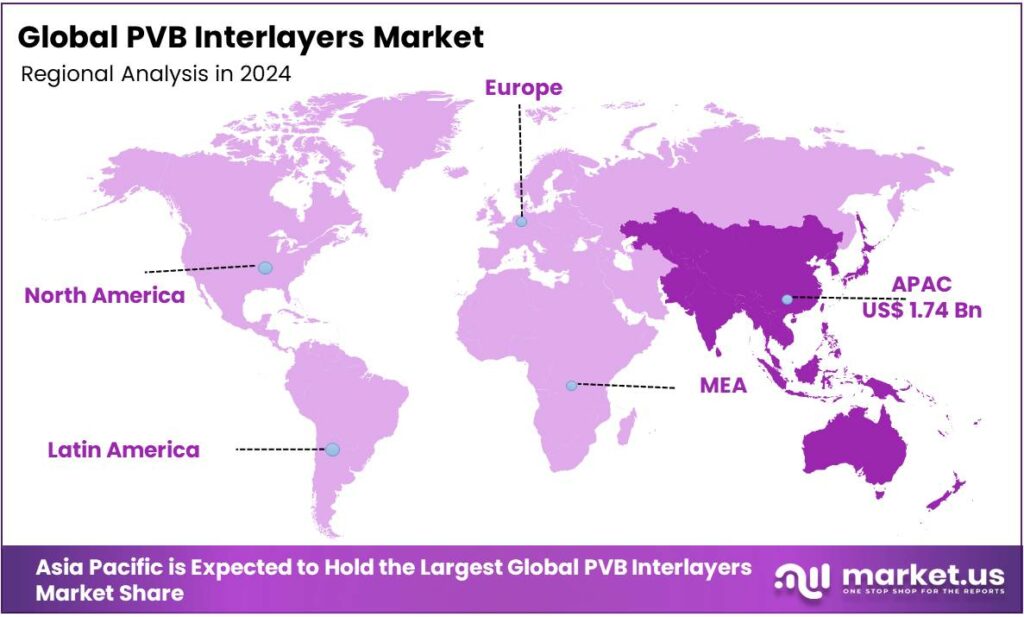

The Global PVB Interlayers Market size is expected to be worth around USD 8.7 Billion by 2034, from USD 4.2 Billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 41.3% share, holding USD 1.7 Billion in revenue.

PVB Interlayers, polyvinyl butyral, interlayers are thin, transparent plastic films used to laminate glass, providing safety and security by holding shattered fragments together and offering sound insulation, UV protection, and impact resistance. Manufactured by combining PVB resin with plasticizer and additives, these films are a primary choice for automotive windshields and architectural glass due to their excellent adhesion, flexibility, and cost-effectiveness.

The automotive sector is the major driver of these interlayers. However, the past decade has shown a rising demand for interlayers in the construction sector as focus is on energy efficiency and aesthetics. Additionally, as there is a global shift towards a circular economy, the business for recycled PVB films is gaining traction. Despite the advantages of the interlayer, it is hygroscopic, which can restrain the demand for the PVB interlayers.

- In 2024, China, Mexico, and India were the largest exporters of the PVB resin, and Vietnam, India, and Argentina were the largest importers of the PVB resin, making the Asia Pacific region the biggest market for the polyvinyl butyral.

Key Takeaways

- The global PVB interlayers market was valued at USD 4.2 billion in 2024.

- The global PVB interlayers market is projected to grow at a CAGR of 7.5% and is estimated to reach USD 8.7 billion by 2034.

- Based on the forms of PVB interlayers, sheets & rolls dominated the market in 2024, comprising about 74.6% share of the total global market.

- Based on the types of PVB interlayers, standard interlayers were at the forefront of the market in 2024, accounting for 58.9% share of the total global market.

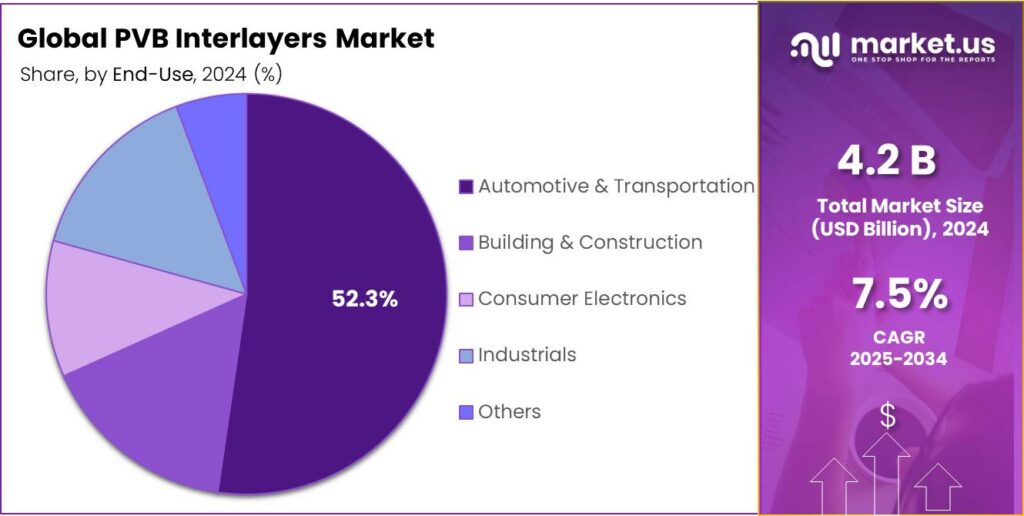

- Among the end uses of PVB interlayers, the automotive & transportation dominated the market in 2024, accounting for around 52.3% of the market share.

- Asia Pacific was the largest market for PVB interlayers in 2024, accounting for around 41.3% of the total global consumption.

Form Analysis

Sheets & Rolls PVB Interlayers were the Leading Segment in the Market.

On the basis of the forms of PVB interlayers, the market is segmented into sheets & rolls, films, and others. Sheets & rolls PVB interlayers dominated the market in 2024 with a market share of 74.6%. They are more widely utilized than films primarily due to their ease of handling, uniform thickness, and suitability for large-scale lamination processes in automotive and architectural applications. Sheets and rolls provide better control during the lamination of large glass panels, ensuring consistent adhesion and optical clarity.

In contrast, PVB films can be more difficult to process due to their size and may require additional handling care to avoid wrinkles or uneven application. Moreover, sheets and rolls offer greater flexibility in cutting and sizing, allowing manufacturers to meet diverse design and dimensional requirements.

Type Analysis

Standard PVB Interlayers Dominated the Market in 2024.

Based on the types of PVB interlayers, the market is segmented into standard and structural. Standard PVB interlayers dominated the market in 2024 with a market share of 58.9%. They are more widely used than specialized structural variants as they offer a cost-effective and reliable solution for general safety and impact resistance, which are the primary requirements in most automotive and architectural applications. While acoustic, solar-control, colored, or UV-resistant interlayers provide added functionalities, they are used in niche or high-performance settings where specific properties are required.

Standard PVB interlayers meet the baseline regulatory and safety standards, making them suitable for mass-market use. Additionally, their simpler production process and broader availability make them more accessible and affordable for manufacturers. This balance of performance, availability, and cost makes standard PVB interlayers the preferred choice for widespread applications.

End-Use Analysis

Automotive & Transportation Emerged as a Leading Segment in the PVB Interlayers Market.

Based on the end-use of PVB interlayers, the market is divided into automotive & transportation, building & construction, consumer electronics, industrials, and others. The automotive & transportation dominated the market in 2024 with a market share of 52.3%. Most PVB interlayers are used in the automotive and transportation sector, as safety regulations and performance demands in these industries heavily rely on laminated glass for impact resistance and passenger protection.

Windshields and vehicle windows require high-strength, clear, and durable interlayers that can absorb energy during collisions and prevent glass shattering. While building and construction use PVB interlayers, the volume and safety standards in vehicles create a much larger and more consistent demand. In contrast, sectors such as consumer electronics and industrial applications often require specialized or different types of interlayers tailored for specific uses, such as flexibility or heat resistance, which limits PVB’s prevalence. The automotive sector’s stringent safety requirements make it the dominant market for PVB interlayers.

Key Market Segments

By Form

- Sheets & Rolls

- Films

- Others

By Type

- Standard

- Structural

- Acoustic

- Solar-Control

- Colored & Tinted

- UV-Resistant

- Others

By End-Use

- Automotive & Transportation

- Passenger Cars

- Hatchback

- Sedan

- SUV

- Others

- Commercial Vehicles

- Light Duty

- Heavy Duty

- Others

- Passenger Cars

- Building & Construction

- Consumer Electronics

- Industrials

- Others

Drivers

Stringent Safety Regulations in the Automotive Sector Drive the PVB Interlayers Market.

Stringent safety regulations in the automotive sector play a pivotal role in driving the demand for PVB (polyvinyl butyral) interlayers. Governments and regulatory bodies around the world are mandating higher safety standards to reduce fatalities and injuries resulting from road accidents. For instance, the United Nations Economic Commission for Europe (UNECE) regulations and Euro NCAP testing protocols emphasize the importance of laminated safety glass in vehicles, especially in windshields, to prevent shattering upon impact.

PVB interlayers, known for their excellent adhesion, impact resistance, and optical clarity, are widely used in laminated glass to enhance passenger safety. In countries like the United States, the Federal Motor Vehicle Safety Standards (FMVSS) require laminated glazing for front windshields in all vehicles. Moreover, with the growing adoption of electric vehicles and autonomous cars, the need for advanced glazing solutions that can integrate HUD (head-up display) technology while meeting safety standards further boosts the use of PVB interlayers in the automotive industry.

Restraints

Moisture Sensitivity Might Hamper the Growth of the PVB Interlayers Market.

The moisture sensitivity of PVB interlayers presents notable challenges to the growth of the PVB interlayers market. PVB is hygroscopic, meaning it readily absorbs moisture from the environment, which can compromise adhesion to glass, reduce optical clarity, and lead to delamination over time, particularly in humid or poorly sealed applications. This issue is particularly dominant in regions with high humidity or in structures where long-term weather resistance is critical. To combat this, additional edge-sealing and lamination processes are often required, increasing production complexity and cost.

Moreover, alternative interlayer materials like ionoplasts, such as SentryGlas and EVA (ethylene-vinyl acetate), are gaining popularity for their superior moisture resistance, thermal stability, and mechanical strength. For instance, ionoplast interlayers offer better performance in structural glazing and hurricane-resistant applications, making them a preferred choice in demanding environments. This growing competition from technically advanced materials could potentially limit PVB’s dominance in certain market segments.

Opportunity

Shift Towards Circular Economy Creates Opportunities in the PVB Interlayers Market.

The global shift towards a circular economy is creating new opportunities in the PVB interlayers market, particularly through the development of biodegradable and recyclable PVB films. As industries seek to reduce waste and lower their environmental footprint, manufacturers are investing in sustainable alternatives to traditional materials. For instance, recycled PVB (rPVB) recovered from end-of-life windshields and architectural glass is now being reused in new interlayers, reducing the reliance on virgin raw materials and cutting down landfill waste.

According to the Ellen MacArthur Foundation, adopting circular principles in materials production can significantly reduce carbon emissions and resource consumption. Companies such as Eastman and Sekisui are exploring closed-loop recycling processes to produce high-performance PVB interlayers with similar durability and clarity as conventional versions. Additionally, innovations in biodegradable PVB formulations are being researched to meet growing regulatory and consumer demands for eco-friendly automotive and construction materials, opening up a path for greener, circular-focused applications in the market.

Trends

Use of PVB Interlayers in the Construction Sector.

The use of PVB interlayers in the construction sector is an ongoing trend, driven by the rising demand for safety, durability, and acoustic insulation in modern architectural designs. Laminated safety glass incorporating PVB interlayers is increasingly used in building facades, skylights, balustrades, and interior partitions due to its ability to hold shattered glass together, thereby reducing injury risk during impact or natural disasters such as earthquakes or storms.

For instance, in hurricane-prone regions of the U.S., building codes require the use of impact-resistant glazing, where PVB-laminated glass is a preferred solution. Additionally, PVB interlayers provide UV protection and sound insulation, making them ideal for high-rise buildings and commercial spaces in noisy urban environments.

The laminated glass with PVB can reduce sound transmission by up to 10 decibels compared to standard glass. Iconic structures such as the Apple Store’s glass cube in New York City showcase how architects leverage laminated glass for both safety and aesthetic appeal.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the PVB Interlayers Market.

Geopolitical tensions have a considerable impact on the PVB interlayers market, primarily through disruptions in global supply chains, increased raw material costs, and heightened trade uncertainties. PVB interlayers depend on key raw materials such as polyvinyl alcohol, plasticizers, and butyraldehyde, which are part of a globally interconnected chemical supply network. When geopolitical conflicts arise, supply routes can be blocked or restricted, leading to shortages and price volatility.

For instance, sanctions on Russian chemical exports have led to rising costs of petrochemicals. Similarly, tariffs on Chinese goods have forced manufacturers to seek alternative sources, which may be more expensive or less reliable.

Furthermore, transportation challenges caused by military conflicts or restricted maritime routes, such as disruptions in the Red Sea or the Strait of Hormuz, delay shipments and increase freight costs. These disruptions strain production schedules, especially for industries such as automotive and construction that rely on just-in-time manufacturing systems.

Moreover, uncertainty surrounding international trade policies can deter investment in long-term supply contracts and create hesitancy among manufacturers. Many major companies are increasingly regionalizing their supply chains or stockpiling critical materials, which adds operational complexity. The ongoing geopolitical instability poses a persistent risk to the stability and growth of the PVB interlayers market.

Regional Analysis

Asia Pacific is the Largest Market for PVB Interlayers

Asia Pacific held the major share of the global PVB Interlayers market, valued at around USD 1.7 billion, commanding an estimated 41.3% of the total revenue share. The region stands as the largest market for PVB interlayers, driven by rapid urbanization, expanding automotive production, and increasing infrastructure investments across the region. Countries such as China, India, Japan, and South Korea have witnessed a significant rise in demand for laminated safety glass in both construction and automotive sectors.

For instance, China is the world’s largest automobile producer, manufacturing over 30 million units in 2023 alone, many of which use PVB-laminated windshields to meet safety standards. Additionally, in construction, major cities across Asia are seeing a boom in high-rise buildings and smart infrastructure projects that require advanced glazing solutions for energy efficiency, noise reduction, and impact resistance, key features provided by PVB interlayers.

Additionally, government regulations mandating enhanced safety and environmental performance in both vehicles and buildings are accelerating the adoption of laminated glass. The region’s strong manufacturing base, cost-effective labor, and availability of raw materials further support Asia Pacific’s leadership in the global PVB interlayers market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global participants in the PVB Interlayers market are Eastman Chemical Company, Everlam, Genau Manufacturing Company LLP, Guangzhou Aojisi New Material, Huakai Plastic (Chongqing), Jinjing (Group), KB PVB, Kuraray, Saint-Gobain, Sekisui Chemical, and Chang Chun Group. These companies primarily focus on their R&D to improve the properties of the interlayers and make them more compatible for various applications.

Several leading players are focused on the expansion of manufacturing facilities to cater to the growing need for the product. And many major companies maintain a competitive edge in the market through strategic partnerships with automobile manufacturers and real estate giants.

The major players in the industry

- Eastman Chemical Company

- Everlam

- Genau Manufacturing Company LLP (GMC LLP)

- Guangzhou Aojisi New Material Co., Ltd.

- Huakai Plastic (Chongqing) Co., Ltd.

- Jinjing (Group) Co., Ltd.

- KB PVB

- Kuraray Co., Ltd.

- Saint-Gobain

- Sekisui Chemical Co., Ltd.

- Chang Chun Group

- Other Players

Key Developments

- In November 2024, Eastman Chemical Company announced it to invest in upgrading and expanding its extrusion capability for the production of interlayer product lines at its manufacturing facility in Ghent, Belgium. The investment for Saflex PVB products in the automotive premiums market, while also positioning the site for future growth in both automotive and architecture segments.

- In October 2025, Kuraray, a global leader in laminated safety glass solutions, launched CertiPly blockchain-based authentication platform, a system that assigns a unique blockchain token to every batch of interlayer, tracking materials in real time from production to installation to verify laminate origin and authenticity throughout the lifecycle.

Report Scope

Report Features Description Market Value (2024) USD 4.2 Bn Forecast Revenue (2034) USD 8.7 Bn CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Sheets & Rolls, Films, Others), By Type (Standard, Structural), By End-Use (Automotive & Transportation, Building & Construction, Consumer Electronics, Industrials, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Eastman Chemical Company, Everlam, Genau Manufacturing Company LLP (GMC LLP), Guangzhou Aojisi New Material, Huakai Plastic (Chongqing), Jinjing (Group), KB PVB, Kuraray, Saint-Gobain, Sekisui Chemical, Chang Chun Group, Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Eastman Chemical Company

- Everlam

- Genau Manufacturing Company LLP (GMC LLP)

- Guangzhou Aojisi New Material Co., Ltd.

- Huakai Plastic (Chongqing) Co., Ltd.

- Jinjing (Group) Co., Ltd.

- KB PVB

- Kuraray Co., Ltd.

- Saint-Gobain

- Sekisui Chemical Co., Ltd.

- Chang Chun Group

- Other Players