Global Puddling Robot Market Size, Share, Industry Analysis Report By Type (Fully Autonomous, Semi-Autonomous/Operator-Assisted, Manual Remote-Controlled), By Power Source (Electric/Battery-Powered, Diesel-Powered, Hybrid), By Application (Large-Scale Commercial Farming, Small & Medium Enterprises (SMEs), Research & Educational Institutions), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 163094

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- China Market Size

- Type Analysis

- Power Source Analysis

- Application Analysis

- Emerging trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Future Outlook

- Report Scope

Report Overview

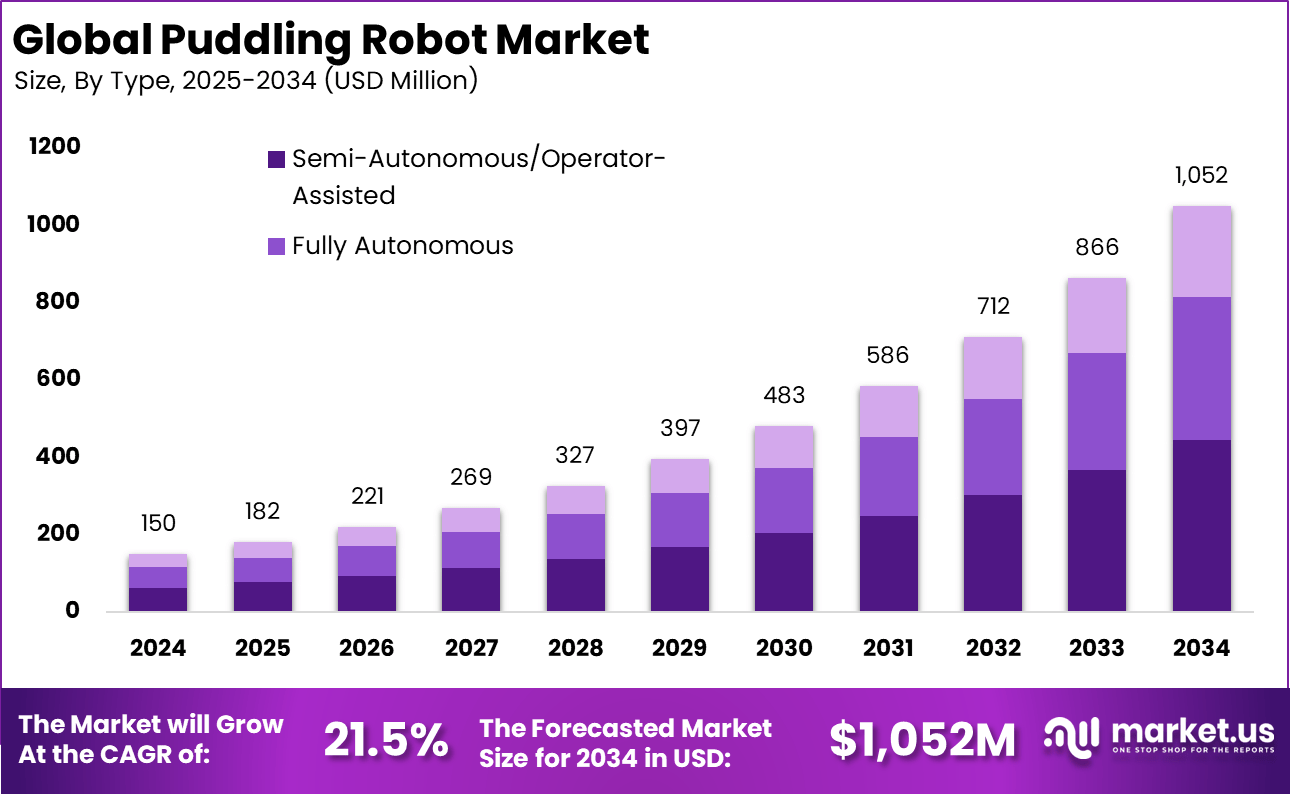

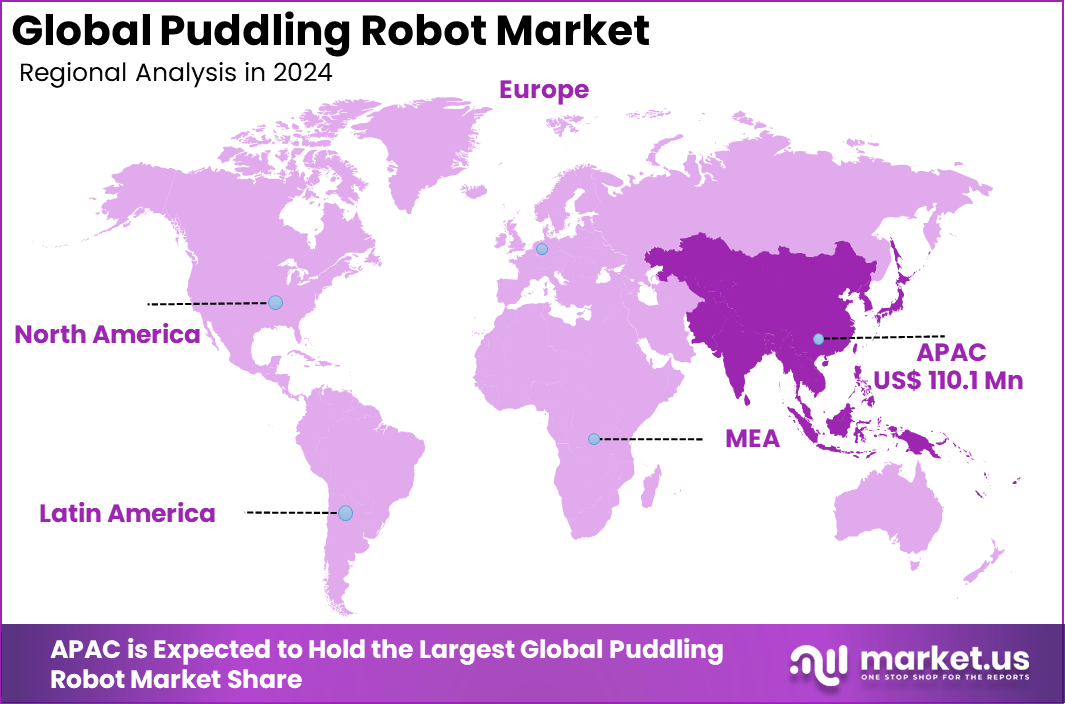

The Global Puddling Robot Market size is expected to be worth around USD 1,052 million by 2034, from USD 150 million in 2024, growing at a CAGR of 21.5% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 73.4% share, holding USD 110.1 million in revenue.

The market for puddling robots is rapidly gaining attention as a vital part of the automation landscape in various industries. These robots are designed to perform tasks like mixing, stirring, and handling hot or hazardous materials, which traditionally relied heavily on manual labor. Their adoption is due to the increasing need for safer, more efficient processes in industries such as manufacturing, metalworking, and construction.

Among the top driving factors for the puddling robot market are workplace safety concerns and the rising need for operational efficiency. Companies face increasing pressure to minimize accidents related to manual handling of hazardous materials, and puddling robots offer a reliable solution by taking over these risky tasks. Labor shortages and the cost of skilled workers add to the motivation for investing in robotic automation.

The market for puddling robots is driven by the increasing demand for automation in agriculture. These robots improve efficiency by automating labor-intensive tasks such as soil preparation and water management, reducing the need for manual work. They help farmers save time and costs while boosting crop yields. The global shift toward smart farming drives the adoption of puddling robots for efficient and sustainable agriculture.

For instance, in February 2025, Waybot’s outdoor robot vacuum cleaners showcased advanced puddle detection and cleaning systems, designed for all-weather conditions with IP67 moisture protection. This technological edge helps their robots navigate puddles safely or clean them when feasible, positioning Waybot as a specialized player in outdoor cleaning robotics.

Key Takeaway

- The Semi-Autonomous/Operator-Assisted segment led the market with 42.5%, reflecting strong demand for systems that balance automation efficiency with manual control flexibility.

- The Electric/Battery-Powered segment dominated with 74.3%, driven by increasing adoption of sustainable and energy-efficient agricultural machinery.

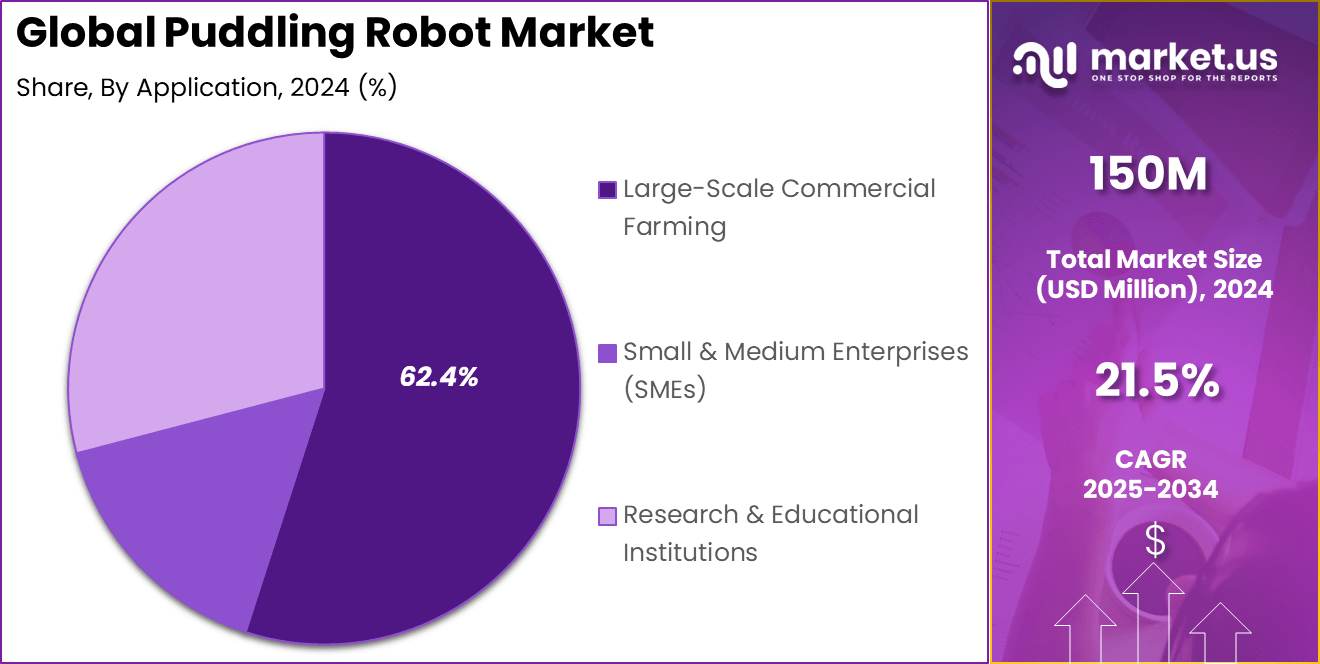

- Large-Scale Commercial Farming accounted for 62.4%, highlighting the rising use of robotic technologies to enhance productivity and reduce labor dependency.

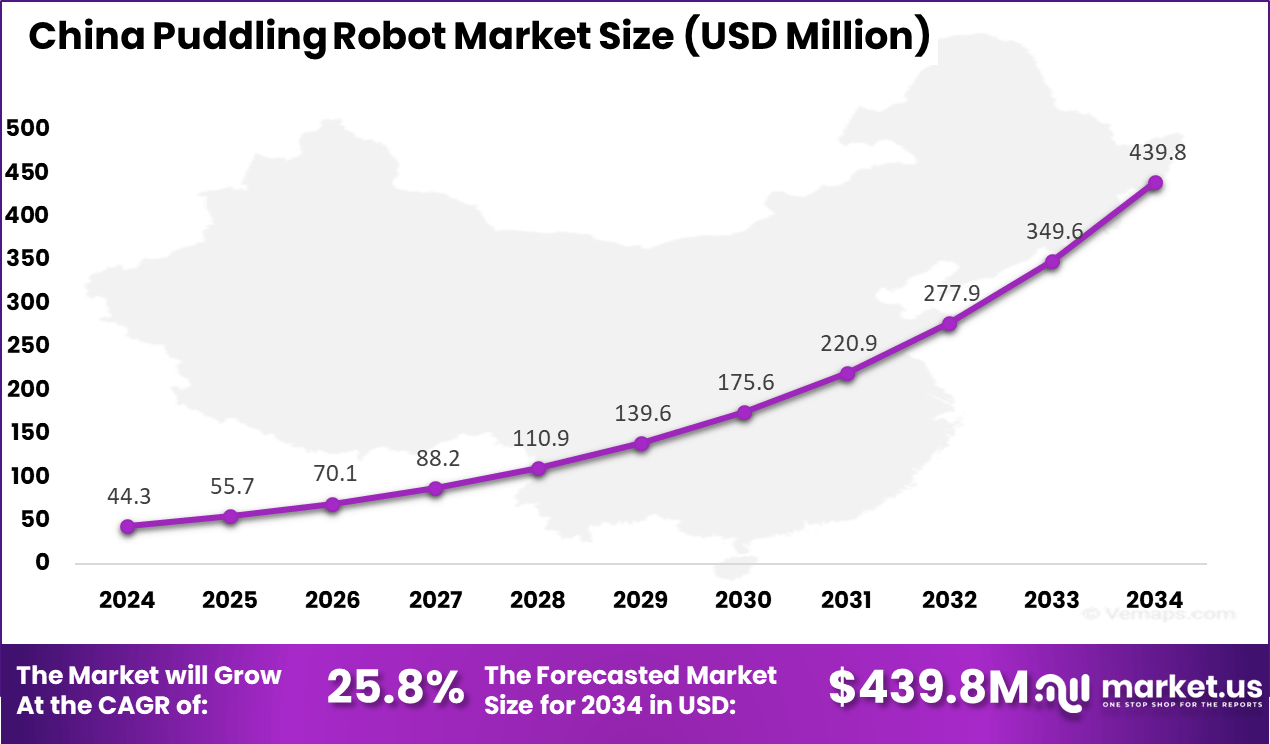

- The China market was valued at USD 44.3 Million in 2024, expanding at a robust 25.8% CAGR, supported by government initiatives promoting smart agriculture and mechanization.

- Asia-Pacific held a leading 73.4% share of the global market, driven by extensive paddy cultivation, growing labor shortages, and accelerated adoption of agri-robotics technologies.

Role of Generative AI

Generative AI plays a crucial role in puddling robots by giving them the ability to learn from experience and improve their tasks autonomously. Instead of relying on fixed programming, these robots use generative AI to simulate many possible scenarios, allowing them to practice and perfect their movements in virtual environments.

About 30% of automated robotic tasks today benefit from this technology, as it lets the robots adapt quickly to different soil conditions and puddling requirements. This adaptability reduces mistakes and boosts efficiency, making puddling work faster and more reliably. In addition to learning from simulations, generative AI helps puddling robots make decisions on the fly.

The robots do not need constant human control because the AI enables them to adjust their actions based on what works best in real time. This capability means that puddling robots can handle unpredictable situations, such as uneven fields or changing weather, without pausing for software updates. This autonomous adjustment improves productivity and allows farmers to focus on other important tasks while the robots work independently.

Investment and Business Benefits

Investment opportunities are expanding quickly as the market opens to new industrial sectors and more efficient robotic solutions. Capital is flowing into developing robots with better energy efficiency, smarter interfaces, and lower total cost of ownership. Both private equity and public funding support projects aimed at scaling production and improving adaptability.

Investors recognize that puddling robotics aligns with broader industrial trends toward digital transformation and smart manufacturing. The business benefits include faster production cycles, fewer safety incidents, and compliance with increasingly demanding environmental and occupational health regulations. The business benefits of puddling robots are extensive, primarily from improving workforce safety and enhancing process control.

These robots reduce incidents of injuries caused by exposure to extreme temperatures and hazardous materials. Beyond safety, they enable businesses to maintain consistent production quality and increase throughput without fatigue-related slowdowns. The integration of automation leads to better resource management and less material waste, directly impacting cost reductions.

China Market Size

The market for Puddling Robot within China is growing tremendously and is currently valued at USD 44.3 million, the market has a projected CAGR of 25.8%. The market is growing due to rising labor costs, and a shortage of agricultural workers is pushing farmers toward automation to improve efficiency and reduce reliance on manual labor.

Additionally, government support through initiatives that promote smart farming and technological innovation is accelerating the adoption of advanced robotic systems in agriculture. Technological advancements, especially in AI-powered robotics, have enabled more precise and autonomous puddling solutions that meet the demands of large-scale commercial farming.

For instance, in July 2025, Pudu Technology launched its new PUDU T600 Series, a line of heavy-payload industrial delivery robots designed for complex logistics and intralogistics automation. This series enhances operational efficiency in warehouses and manufacturing with advanced autonomous navigation and adaptable features.

In 2024, Asia-Pacific held a dominant market position in the Global Puddling Robot Market, capturing more than a 73.4% share, holding USD 110.1 million in revenue. This dominance is due to the widespread adoption of automated farming solutions in countries like China, Japan, and South Korea.

The region’s large-scale rice farming, labor shortages, and government initiatives promoting agricultural modernization fuel this growth. Technological advancements and investments supporting smart farming enhance efficiency and productivity in the agriculture sector. Additionally, strong infrastructure and a favorable regulatory environment encourage rapid deployment of puddling robots, reinforcing Asia-Pacific’s leading market position.

For instance, in March 2025, Kubota exhibited two versatile platform robots, including the Type V model, at the Expo 2025 Osaka. These autonomous robots are developed for precision agriculture, supporting sustainable farming through advanced data-driven technology and environmental friendliness.

Type Analysis

In 2024, The Semi-Autonomous/Operator-Assisted segment held a dominant market position, capturing a 42.5% share of the Global Puddling Robot Market. These robots combine automated functions with human control, providing a balance between technology and manual oversight. This approach makes the technology accessible and practical for farmers who want increased efficiency but still prefer to manage critical tasks themselves.

The benefit of these robots lies in their ability to reduce workload while maintaining flexibility and precision. They help farmers complete complex tasks with less effort and greater accuracy, allowing for better crop management. This type also suits varying field conditions, where fully autonomous solutions might struggle.

For Instance, in March 2025, Kubota Corporation showcased its development of versatile platform robots, including semi-autonomous models, at Expo 2025 Osaka. These robots blend data-driven autonomous functions with operator assistance to improve farming efficiency while maintaining human oversight in complex agricultural tasks. Kubota’s approach highlights their commitment to precision agriculture and sustainable farming solutions with semi-autonomous capabilities.

Power Source Analysis

In 2024, the Electric/Battery-Powered segment held a dominant market position, capturing a 74.3% share of the Global Puddling Robot Market. The popularity of electric power is due to its environmental friendliness and lower operating costs compared to fuel-based machines. Improved battery technology supports longer operation times, making these robots reliable for demanding agricultural work.

These robots contribute to quieter, cleaner farming practices and support sustainability goals. The high adoption reflects a shift toward energy-efficient agricultural machinery, which helps farmers reduce emissions and minimize fuel dependency while maintaining performance.

For instance, in January 2025, Kubota unveiled its electric tractor concept Agri Concept 2.0 and other electric-powered autonomous machines at CES 2025. These battery-powered robots aim to reduce emissions and offer high performance with extended runtime suited for farming applications. Kubota’s focus on electric and battery power aligns with the market’s preference for cleaner, energy-efficient technologies.

Application Analysis

In 2024, the Large-Scale Commercial Farming segment held a dominant market position, capturing a 62.4% share of the Global Puddling Robot Market. These robots are designed to meet the demands of vast agricultural operations by improving productivity and lowering labor costs. Their precision in soil preparation is especially valuable in large fields where efficiency is crucial.

The use in large-scale farming highlights how robotics can modernize operations by ensuring consistent work quality and addressing labor shortages. This segment shows the direct benefit of automation in boosting crop yields and operational effectiveness for big farms.

For Instance, in May 2025, Pudu Robotics launched the CC1 Pro, an AI-powered autonomous cleaning robot designed for large-scale commercial spaces, including industrial facilities. While primarily a cleaning robot, Pudu’s expansion into large-scale, high-capacity autonomous systems exemplifies key applications in vast commercial operations needing efficiency and precision automation.

Emerging trends

Emerging trends in puddling robots show a move toward greater autonomy and smarter sensory systems. More than 40% of new puddling robots now include AI-powered sensors and machine vision, which help them measure soil moisture and control the depth of puddling very precisely. This precision contributes to better soil conditions and healthier crops by ensuring puddles are made evenly across fields.

Another trend is connecting these robots to cloud platforms, enabling farmers to monitor and control their machines remotely. This connectivity integrates puddling robots into broader smart farming setups, enhancing overall farm management.

Another growing trend is making puddling robots more energy-efficient and environmentally friendly. Innovations in battery technology combined with AI help optimize energy use, which allows robots to work longer with less charging. With these advancements, puddling robots are not only more efficient but also support sustainable farming practices by reducing water and energy waste.

Growth Factors

The main growth factors driving demand for puddling robots include water conservation and labor shortages. These robots help reduce water use by up to 20% compared to traditional methods, a significant benefit in regions facing water scarcity.

They also improve soil quality by puddling more consistently and accurately, which helps crops grow better. At the same time, the farming industry’s struggle to find enough laborers makes puddling robots an attractive alternative since they can perform repetitive, physically demanding tasks with ease.

Advances in AI and robotics technology make puddling robots more affordable and accessible. The improvements reduce maintenance costs and increase uptime, which convinces more farmers to invest in automation. Lower costs plus stronger performance combine to fuel adoption in both small family farms and large commercial operations. These factors together create a favorable environment for the ongoing growth of puddling robots.

Key Market Segments

By Type

- Fully Autonomous

- Semi-Autonomous/Operator-Assisted

- Manual Remote-Controlled

By Power Source

- Electric/Battery-Powered

- Diesel-Powered

- Hybrid

By Application

- Large-Scale Commercial Farming

- Small & Medium Enterprises (SMEs)

- Research & Educational Institutions

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Automation Boosts Productivity in Agriculture

The rapid advancement in automation technologies is driving the adoption of puddling robots, especially in rice cultivation, where precise water management and soil preparation are critical. These robots enhance efficiency by automating labor-intensive puddling tasks, reducing manual effort and increasing operational speed. This leads to higher productivity and lower costs for farmers, making puddling robots increasingly attractive in regions with labor shortages.

The global push towards smart farming and precision agriculture also supports its market growth. Governments and the private sector investing in modern farming technologies encourage wider acceptance of robotic solutions.

For instance, in March 2025, Kubota showcased its KATR robot at CES, a four-wheeled all-terrain multifunction robot designed to automate labor-intensive farming tasks. This robot enhances productivity by autonomously maintaining a level cargo deck on uneven terrain, supporting diverse agricultural operations. Kubota’s focus on autonomous machines demonstrates its commitment to boosting efficiency for farmers through innovative robotic solutions.

Restraint

High Initial Investment Limits Adoption

One significant barrier to broad puddling robot adoption is the high upfront cost of these advanced machines. Small and medium-sized farms, particularly in developing regions, find it challenging to justify the capital expenditure due to limited financial resources. The maintenance and training costs associated with these robots further add to the financial burden.

Additionally, the lack of widespread awareness and demonstration of cost benefits over traditional methods slows market penetration. Farmers tend to be cautious about switching to new technologies unless clear economic advantages are evident.

For instance, in July 2025, Pudu Robotics launched the PUDU T600 Series aimed at industrial delivery but highlighting challenges in scaling complex robotics technologies. While the company expanded into heavy-payload robots, the high cost and technical sophistication limit widespread adoption in smaller-scale or budget-restricted markets. These financial and complexity factors restrain the puddling robot, especially among smaller farms.

Opportunities

Growth in Emerging Agricultural Markets

Emerging markets in Asia-Pacific, Africa, and Latin America represent a substantial growth opportunity for puddling robots. These regions have large agricultural sectors that are increasingly facing labor shortages and growing demand for higher crop yields. Governments supporting mechanization and subsidies for smart agriculture create favorable conditions for puddling robot adoption.

Furthermore, integration of AI and sensor technologies can enhance puddling robots’ precision and adaptability to different soil types and conditions. This technological evolution is expected to open new applications and customer segments, expanding the market base.

For instance, in October 2025, Yanmar’s concept agricultural machine won a prestigious Red Dot Design Award for innovative robotic solutions in farming. This showcases Yanmar’s potential to lead in advanced, design-forward agricultural robots that address emerging market needs for smarter and more sustainable farming technologies.

Challenges

Technical Complexity and Skill Gaps

The complexity of operating and maintaining puddling robots poses a challenge, particularly in rural farming communities with limited technical skills. The need for trained personnel to manage, troubleshoot, and repair these machines can hinder their effective deployment and reliability in the field.

Bridging this skill gap requires substantial investment in farmer education, support infrastructure, and user-friendly design improvements. Without addressing these issues, the pace of adoption may slow down, limiting the overall market growth.

For instance, in May 2025, Kubota acknowledged the challenge of training operators to effectively use their multifunctional agricultural robots at global tech shows. They emphasized their focus on creating intuitive systems to ease the skill gap but recognized that rural areas still require substantial education and infrastructure support.

Key Players Analysis

The Puddling Robot Market is led by agricultural machinery manufacturers such as Kubota Corporation, Yanmar Holdings Co., Ltd., and ISEKI & Co. Ltd. These companies are pioneering automated rice field preparation technologies that improve soil consistency and water management for paddy cultivation. Their advanced robotic systems integrate GPS navigation, AI-based field mapping, and precision control, significantly reducing manual labor and fuel consumption in traditional farming practices.

Emerging technology innovators such as Pudu Technology Inc., Yamabiko Corporation, and ArvaTec focus on developing compact, intelligent puddling robots designed for small to mid-scale farms. Their models emphasize user-friendly interfaces, real-time performance monitoring, and remote control capabilities, making automation accessible to a broader segment of the agricultural sector.

Additional contributors including Waybot Robotics and other market participants are enhancing the market landscape through the integration of autonomous driving, IoT connectivity, and electric-powered drive systems. Their innovations aim to support sustainable rice farming, reduce soil erosion, and optimize field uniformity, marking a significant step toward precision agriculture and environmentally efficient paddy cultivation.

Top Key Players in the Market

- Kubota Corporation

- Pudu Technology Inc.

- Yanmar Holdings Co., Ltd.

- Yamabiko Corporation

- ISEKI & Co. Ltd

- ArvaTec

- Waybot Robotics

- Others

Recent Developments

- In July 2025, Pudu Robotics launched the T600 Series, a new heavy-payload autonomous delivery robot line targeting complex industrial logistics. The T600 models feature a 600 kg payload, advanced navigation, and IoT integration for optimized goods handling. This series extends Pudu’s market scope from service robots to industrial automation.

- In February 2025, Waybot’s outdoor robot vacuum cleaners showcased advanced puddle detection and cleaning systems, designed for all-weather conditions with IP67 moisture protection. This technological edge helps their robots navigate puddles safely or clean them when feasible, positioning Waybot as a specialized player in outdoor cleaning robotics.

Future Outlook

The puddling robot market is expected to experience notable expansion as automation continues transforming agricultural practices. Future developments indicate a transition toward greater autonomy, with robots increasingly using artificial intelligence (AI) and machine learning to adjust operations dynamically to field conditions.

A significant trend will be the rise of swarm robotics, where multiple small and lightweight robots collaborate to perform large-scale puddling tasks more efficiently, minimizing soil compaction compared to traditional heavy machinery. Moreover, integrated smart farming systems are anticipated to link puddling robots with IoT sensors and data analytics to enhance water management, nutrient distribution, and energy efficiency.

Additionally, alternative business models, such as Robots-as-a-Service (RaaS) and cooperative ownership schemes, are likely to emerge, lowering the financial barriers for small and medium-scale farms and promoting widespread adoption of robotic technologies in sustainable rice cultivation.

Report Scope

Report Features Description Market Value (2024) USD 150 Million Forecast Revenue (2034) USD 1,052 Million CAGR(2025-2034) 21.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Type (Fully Autonomous, Semi-Autonomous/Operator-Assisted, Manual Remote-Controlled), By Power Source (Electric/Battery-Powered, Diesel-Powered, Hybrid), By Application (Large-Scale Commercial Farming, Small & Medium Enterprises (SMEs), Research & Educational Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Kubota Corporation, Pudu Technology Inc., Yanmar Holdings Co., Ltd., Yamabiko Corporation, ISEKI & Co. Ltd, ArvaTec, Waybot Robotics, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)

-

-

- Kubota Corporation

- Pudu Technology Inc.

- Yanmar Holdings Co., Ltd.

- Yamabiko Corporation

- ISEKI & Co. Ltd

- ArvaTec

- Waybot Robotics

- Others