Global Public Charging Service Market Report By Type (AC Charging, DC Charging), By Application (Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 129361

- Number of Pages: 379

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

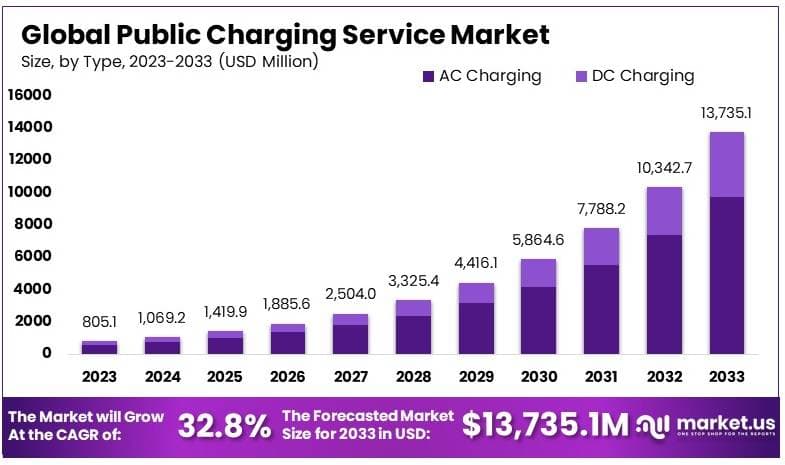

The Global Public Charging Service Market size is expected to be worth around USD 13,735.1 Million by 2033, from USD 805.1 Million in 2023, growing at a CAGR of 32.8% during the forecast period from 2024 to 2033.

Public Charging Service refers to the infrastructure that allows electric vehicle (EV) owners to charge their cars at public stations. These charging stations are usually located in convenient places like parking lots, highways, malls, and other public areas. They provide a way for drivers to recharge their EV batteries while they are away from home.

The Public Charging Service market involves companies that provide the services for electric vehicle charging infrastructure in public spaces. This market includes hardware suppliers, network operators, and software platforms that manage payments and monitor station usage. The growth of this market is closely tied to the adoption of electric vehicles and the need for widespread charging networks.

The growth of the Public Charging Service market is mainly driven by the increasing number of electric vehicles on the road. As more consumers switch to electric cars, the need for accessible and reliable charging stations grows.

The demand for public charging services is increasing as more people choose electric vehicles due to environmental concerns and rising fuel prices. EV owners need convenient and reliable charging options, especially for long-distance travel. This demand is also fueled by fleet operators, like delivery companies, that are adopting electric vehicles and require efficient charging networks to support their operations.

There are significant opportunities in the Public Charging Service market. One key opportunity is the development of fast-charging stations, which can reduce the time it takes to charge an EV. Another opportunity lies in expanding charging networks in underserved areas, particularly in rural and suburban locations.

As of early 2024, the U.S. has over 61,000 publicly accessible EV charging stations, a significant increase from 29,000 in 2020, underscoring the rapid expansion of charging infrastructure to meet growing demand.

The public charging service market is experiencing accelerated growth due to the rising number of electric vehicles on the road and increasing government support. With an estimated 33 million EVs expected in the U.S. by 2030, there will be a need for 28 million charging ports, including 182,000 fast chargers to support long-distance travel and fleet operations.

This surge in demand presents a significant opportunity for companies involved in charging infrastructure, hardware manufacturing, and software solutions that optimize charging services.

Additionally, urban areas are currently leading the deployment of public charging stations, covering 95% of the U.S. population. However, rural regions still face challenges in infrastructure development, though recent policies, such as the Inflation Reduction Act, have led to a 34% increase in charging station growth in non-urban areas.

The public charging service market is being driven by several factors, including rising EV adoption, advancements in EV charging cables, and supportive government policies. Fast-charging technology, particularly DC fast charging, is seeing notable growth, with a 9.2% increase in the last quarter of 2023.

Public-private partnerships are also creating opportunities for the development of advanced charging networks. Initiatives like the Joint Office of Energy and Transportation are playing a key role in expanding EV infrastructure, particularly by focusing on integrating renewable energy sources and optimizing charging speeds.

Government support is a major factor in the growth of public charging services. Legislation such as the Inflation Reduction Act provides tax incentives and funding to accelerate the development of EV infrastructure, particularly in underserved areas.

Additionally, initiatives like the 2030 National Charging Network study highlight the need for comprehensive planning to meet the projected demand for EV charging ports. This government involvement is critical for ensuring that charging infrastructure keeps pace with EV adoption, especially in rural and less densely populated regions.

State and local governments are also developing EV infrastructure plans in collaboration with private companies. These plans include considerations for renewable energy integration and advanced charging solutions, which are essential for building a sustainable and future-ready charging network.

Key Takeaways

- The Public Charging Service Market was valued at USD 805.1 Million in 2023, and is expected to reach USD 13,735.1 Million by 2033, with a CAGR of 32.8%.

- In 2023, AC Charging leads the type segment with 71%, due to its compatibility with most electric vehicles.

- In 2023, the Battery Electric Vehicles (BEVs) application segment dominates with 68%, reflecting the shift towards fully electric vehicles.

- In 2023, North America leads with 34%, driven by expanding EV infrastructure and government incentives.

Type Analysis

AC Charging dominates with 71% due to cost-effectiveness and widespread availability.

In the public charging service market, AC (Alternating Current) charging stations represent the dominant sub-segment, accounting for 71% of the market. This dominance is primarily due to the cost-effectiveness and widespread availability of AC charging infrastructure.

AC charging stations are relatively inexpensive to install and maintain, making them a preferred choice for municipalities and businesses looking to offer charging solutions without significant investment. Additionally, AC chargers are suitable for slower charging needs, typically during hours when vehicles are parked for extended periods—at home or at work—which aligns with daily consumer behavior.

Despite its smaller market share, DC (Direct Current) charging is an essential part of the charging infrastructure. DC chargers are capable of delivering much faster charging speeds, making them ideal for locations along highways and in areas where drivers need to quickly recharge and continue their journey.

Though more expensive to install and operate, the role of DC charging is crucial as it addresses the range anxiety associated with electric vehicles (EVs) and is a key enabler of long-distance EV travel.

The future growth in the public charging market is likely to see an increase in both types, with AC charging maintaining dominance due to its convenience for daily use. However, as electric vehicle adoption grows, the demand for faster charging solutions will likely increase the installation of DC charging stations, particularly in commercial and high-traffic areas.

Application Analysis

Battery Electric Vehicles (BEVs) dominate with 68% due to the growing shift towards fully electric mobility solutions.

In the application segment of the public charging service market, Battery Electric Vehicles (BEVs) hold a significant majority with 68% market share. This dominance is driven by the increasing consumer and governmental push towards fully electric vehicles as a means to reduce carbon emissions and decrease reliance on fossil fuels.

BEVs, which rely entirely on electric power, require frequent access to charging services, making them the primary users of public charging stations. The growth of the BEV market is supported by improvements in battery technology, which have led to longer ranges and shorter charging times, thereby increasing the practicality of BEVs for a wider range of consumers.

Plug-in Hybrid Electric Vehicles (PHEVs), while also benefiting from public charging infrastructure, are less dependent on it because they can also operate on gasoline. This dual-functionality means that PHEVs often use public chargers less frequently, as they are not solely reliant on electric power for operation.

However, as emission regulations become stricter and battery technology improves, the role of PHEVs in the public charging market could see significant changes. The segment is expected to grow, albeit at a slower pace compared to BEVs, as some consumers prefer the flexibility of having both an electric motor and a gasoline engine.

As the market continues to evolve, the segment of Battery Electric Vehicles is expected to expand further, driven by technological advancements and increasing consumer awareness of environmental issues. This expansion will necessitate a broader and more robust public charging infrastructure, capable of supporting the needs of an increasingly electric-powered vehicle fleet.

Key Market Segments

By Type

- AC Charging

- DC Charging

By Application

- Battery Electric Vehicles (BEVs)

- Plug-in Hybrid Electric Vehicles (PHEVs)

Driver

Increasing Adoption of Electric Vehicles Drives Market Growth

The increasing adoption of electric vehicles (EVs) is one of the key drivers of the Public Charging Service market. As more consumers shift towards electric mobility due to environmental concerns and government regulations, the demand for public charging stations is growing rapidly. This trend is also supported by manufacturers ramping up EV production, further driving the need for accessible charging infrastructure.

Government initiatives for clean energy adoption further drive market growth. Many governments are introducing policies and subsidies to promote the use of electric vehicles, as part of broader efforts to reduce carbon emissions. These initiatives often include funding for the development of public charging networks, which is boosting the market.

The expansion of fast-charging infrastructure is another critical factor. Consumers are looking for quick and convenient charging solutions, and the development of fast-charging stations is meeting this demand. These stations significantly reduce the time required to charge EVs, making public charging services more attractive.

Rising consumer awareness about sustainability also contributes to the growth of the market. As more individuals become conscious of their environmental impact, they are more likely to opt for electric vehicles and seek out public charging services, further accelerating the growth of this market.

Restraint

High Installation Costs of Charging Stations Restraints Market Growth

High installation costs are a major restraining factor in the Public Charging Service market. Setting up charging stations, especially fast chargers, requires significant investment in infrastructure, land, and electrical upgrades, which can limit the pace at which new stations are deployed, especially in less developed regions.

Another restraint is the limited charging network coverage in rural areas. While urban centers are seeing increased deployment of charging stations, rural areas still face a shortage, limiting the overall accessibility of public charging services and potentially deterring rural consumers from purchasing EVs.

Compatibility issues across different EV models also hinder the market. With various manufacturers using different charging connectors and technologies, public charging stations need to support multiple standards, which can complicate the installation process and increase costs for operators.

Additionally, slow charging speeds at standard public stations act as a barrier to wider adoption. Many consumers are discouraged by the long time it takes to charge an EV at slower public charging points, especially when faster options are not available, which impacts user satisfaction.

Opportunity

Expansion of Charging Services in Emerging Markets Provides Opportunities

The expansion of public charging services in emerging markets presents significant growth opportunities. As electric vehicle adoption rises in these regions, there is a growing need for robust charging infrastructure. Companies that invest in developing networks in these high-potential markets can tap into a rapidly expanding user base.

Partnerships between automakers and charging service providers offer further opportunities for growth. By collaborating, automakers can ensure their vehicles have dedicated, reliable charging networks, while charging service providers benefit from access to a loyal customer base. These partnerships also help enhance the user experience.

The increasing demand for subscription-based charging models provides another growth avenue. Many consumers and businesses are looking for flexible, cost-effective charging solutions. Subscription models allow users to pay a flat rate for access to charging services, offering convenience and predictability in pricing.

Integration of renewable energy sources with charging stations is another opportunity that aligns with global sustainability goals. By using solar or wind power to charge electric vehicles, service providers can offer green energy solutions, attracting environmentally conscious consumers and supporting broader clean energy initiatives.

Challenge

Balancing Energy Demand During Peak Usage Challenges Market Growth

Balancing energy demand during peak usage is a significant challenge in the Public Charging Service market. With the increasing number of EVs on the road, public charging stations may face high demand during peak hours, putting strain on local grids and causing delays for users if supply cannot meet demand.

Ensuring network security and preventing cyberattacks also presents a challenge. As public charging networks become more interconnected and data-driven, they are vulnerable to potential cyber threats. Protecting these networks from security breaches is essential to maintaining user trust and operational reliability.

Managing grid capacity for large-scale charging infrastructure is another issue. The widespread deployment of public charging stations requires significant power capacity, and ensuring that local grids can handle the additional load is critical for avoiding power shortages or grid instability.

Adapting charging stations for future EV battery technologies is also a key challenge. As battery technology evolves, charging stations need to be updated to accommodate new requirements, such as higher voltage capacities or faster charging times, to remain compatible with the latest electric vehicles.

Growth Factors

Rising Investments in Charging Infrastructure Development Is Growth Factor

Rising investments in charging infrastructure development are a major growth factor for the Public Charging Service market. Governments, private companies, and automakers are all investing heavily in expanding the network of public charging stations to meet the growing demand for EVs.

Government incentives for EV adoption and charging network expansion further support market growth. Many governments are offering subsidies, grants, and tax incentives to encourage the installation of charging stations, making it more financially viable for businesses to enter the market.

Increasing urbanization and demand for public EV charging stations is another growth factor. As more people move to urban areas and adopt electric vehicles, the need for accessible, reliable public charging services continues to rise, driving market demand.

The growing integration of smart grid technologies with charging networks is fueling market growth. Smart grids enable more efficient energy distribution, ensuring that charging stations can operate smoothly even during peak demand, and help manage energy usage more effectively across the grid.

Emerging Trends

Growing Focus on Ultra-Fast Charging Stations Is Latest Trending Factor

The growing focus on ultra-fast charging stations is one of the latest trends driving the Public Charging Service market. Consumers and businesses are increasingly seeking out stations that can charge electric vehicles in a matter of minutes rather than hours, making ultra-fast charging solutions a key trend for future market development.

The rising adoption of wireless charging for electric vehicles is another trend shaping the market. Wireless charging eliminates the need for physical connections, offering greater convenience for users and presenting a more seamless experience at public charging stations.

The use of AI for optimizing charging patterns is also gaining traction. AI-driven systems can help manage demand, optimize energy distribution, and ensure that charging stations operate efficiently, improving the overall user experience and reducing operational costs.

The increased implementation of the Charging-as-a-Service (CaaS) model is a growing trend. This model allows users to access charging services on a pay-per-use or subscription basis, making public charging more accessible and affordable, while providing operators with recurring revenue streams.

Regional Analysis

North America Dominates with 34% Market Share

North America leads the Public Charging Service Market with a 34% share, valued at USD 273.75 million. This dominance is driven by the rapid adoption of electric vehicles (EVs), significant government support for clean energy initiatives, and strong investment in charging infrastructure. The presence of leading EV manufacturers further boosts the demand for public charging services in the region.

The region benefits from a well-established network of public charging stations, particularly in urban areas, supporting the growing number of EV owners. Additionally, favorable regulations and subsidies for EV infrastructure encourage both public and private investment in charging stations. North America’s advanced technological landscape allows for the integration of fast and ultra-fast charging solutions, enhancing the user experience.

North America is expected to maintain its leadership as EV adoption continues to rise. The expansion of fast-charging networks and ongoing government incentives will drive further growth, making public charging services more accessible and efficient across the region.

Regional Mentions:

- Europe: Europe is rapidly expanding its public charging network, driven by strict environmental regulations and the growing adoption of electric vehicles. Key countries like Germany and Norway are at the forefront of the region’s charging infrastructure growth.

- Asia Pacific: Asia Pacific is emerging as a significant player in the Public Charging Service Market, fueled by high EV adoption in countries like China and Japan. Government support and industrial expansion are accelerating infrastructure development in the region.

- Middle East & Africa: The Middle East & Africa are gradually adopting public charging services, with a focus on building infrastructure in urban areas. Investments in clean energy and electric vehicle initiatives are expected to drive market growth.

- Latin America: Latin America is showing growing interest in public charging services, particularly in countries like Brazil and Mexico. Government efforts to modernize transportation systems and promote sustainable energy are helping expand the market.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Public Charging Service Market is dominated by ChargePoint, Tesla, and EVgo, three companies that lead in building extensive charging networks and offering innovative solutions to meet the rising demand for electric vehicle (EV) charging infrastructure.

ChargePoint is one of the largest EV charging networks globally, with a strong presence in North America and Europe. Its cloud-based services and subscription models give businesses and drivers flexible solutions. ChargePoint’s focus on expanding charging stations in key locations, including retail centers and workplaces, positions it as a market leader. The company’s open network approach also encourages interoperability, enhancing its market influence.

Tesla holds a significant position due to its extensive Supercharger network, which is designed specifically for its electric vehicles. Tesla’s proprietary network offers fast charging speeds, and its strategic locations along major highways make it highly convenient for long-distance travelers. The brand’s strong EV sales naturally drive the usage of its charging stations, solidifying Tesla’s dominance in this space.

EVgo is another major player, with a focus on high-power, fast charging solutions. EVgo’s partnerships with automakers and retail chains have helped it grow a robust network of public charging stations. Its commitment to 100% renewable energy for powering its stations gives it a competitive edge as sustainability becomes a key factor for both consumers and businesses.

Together, ChargePoint, Tesla, and EVgo drive the Public Charging Service Market. Their leadership in expanding infrastructure, providing fast charging options, and forming key partnerships ensures continued growth in the rapidly evolving EV market, making public charging more accessible and efficient.

Top Key Players in the Market

- ChargePoint

- EVgo

- ABB

- Tesla

- BP Chargemaster

- Shell Recharge

- IONITY

- Electrify America

- Enel X

- State Grid

- EnBW

- Other Key Players

Recent Developments

- Power-Up Tech: In September 2024, Power-Up Tech launched its mobile EV charging van service in Penang, Malaysia, offering 50kW DC charging. Users are charged RM1.70 per kWh, with additional service and parking fees. The service plans to expand to other regions like Klang Valley and Johor Bahru.

- BluSmart: In May 2024, BluSmart launched the “BluSmart Charge” app, allowing the public access to its EV charging infrastructure in India. The app provides real-time availability and booking of charging stations to support the growing EV ecosystem.

- BluSmart: In June 2024, BluSmart opened its 50th EV charging hub in India, further expanding its charging network. The company aims to provide seamless charging solutions across major urban areas, complemented by the launch of its “BluSmart Charge” app.

- Statiq and Glida: In February 2024, Statiq and Glida partnered to expand EV charging infrastructure across India. This collaboration will roll out new charging stations in both urban and rural areas, aiming to boost the adoption of electric vehicles nationwide.

Report Scope

Report Features Description Market Value (2023) USD 805.1 Million Forecast Revenue (2033) USD 13,735.1 Million CAGR (2024-2033) 32.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (AC Charging, DC Charging), By Application (Battery Electric Vehicles (BEVs), Plug-in Hybrid Electric Vehicles (PHEVs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ChargePoint, EVgo, ABB, Tesla, BP Chargemaster, Shell Recharge, IONITY, Electrify America, Enel X, State Grid, EnBW, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Public Charging Service MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Public Charging Service MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ChargePoint

- EVgo

- ABB

- Tesla

- BP Chargemaster

- Shell Recharge

- IONITY

- Electrify America

- Enel X

- State Grid

- EnBW

- Other Key Players