Global Proteinase K Market Analysis By Form (Powder, Liquid), By Therapeutic Area (Infectious Diseases, Diabetes, Oncology, Cardiology, Nephrology, Autoimmune Diseases, Neurology, Others), By End-use (Isolation and Purification of Genomic DNA & RNA, In Situ Hybridization, Mitochondria Isolation), By Application (Contract Research Organization, Academic Institutes, Biotechnology Companies, Diagnostic Laboratories), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2023

- Report ID: 31853

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

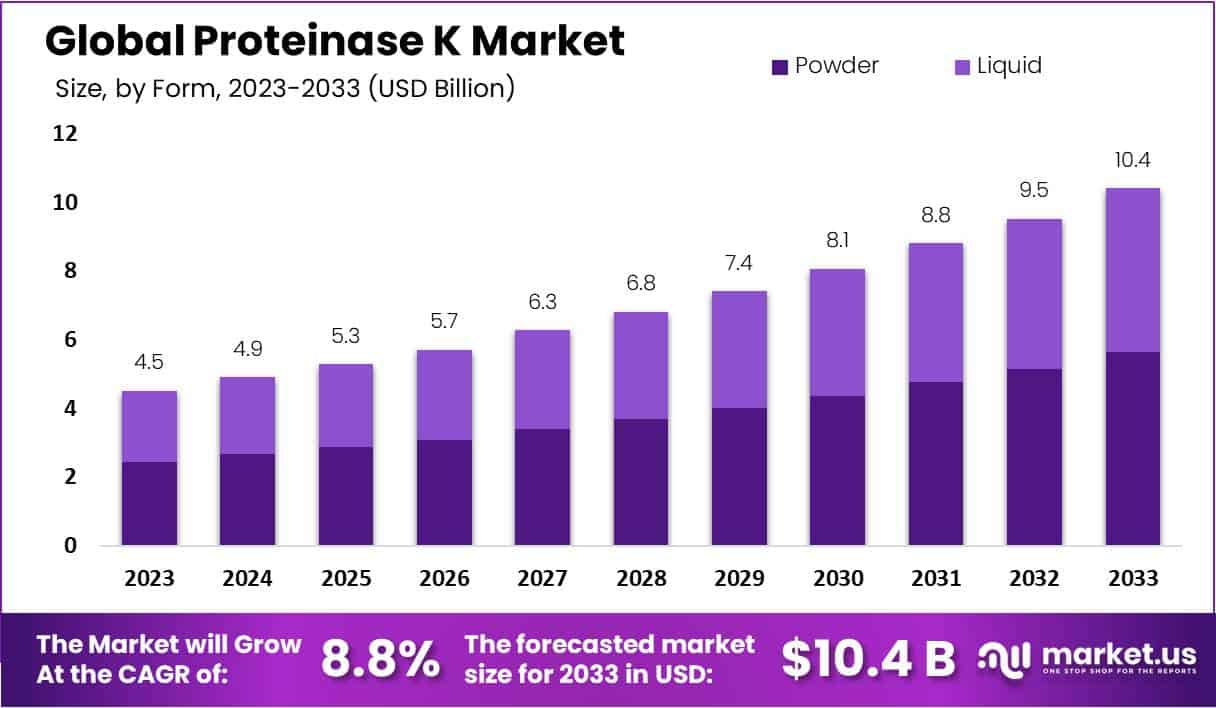

The Proteinase K Market Size is anticipated to reach approximately USD 10.4 billion by the year 2033, exhibiting a substantial increase from USD 4.5 billion in 2023. This growth is projected to transpire at a Compound Annual Growth Rate (CAGR) of 8.8% throughout the forecast period spanning from 2024 to 2033.

*Note: Actual Numbers Might Vary In the Final Report

Proteinase K, derived from the fungus Tritirachium album, is a versatile serine protease widely applied in molecular biology research. Renowned for its efficacy in cleaving peptide bonds adjacent to aliphatic and aromatic amino acids, this enzyme plays a pivotal role in DNA and RNA extraction protocols. Its stability across diverse temperatures and pH levels makes it invaluable for various enzymatic reactions.

Particularly useful in removing interfering proteins during nucleic acid isolation, Proteinase K excels in applications like inactivating nucleases and facilitating protein footprinting experiments. Laboratories worldwide consider it an indispensable tool due to its robust proteolytic activity, ensuring efficiency in diverse molecular biology applications.

The Proteinase K market is experiencing dynamic growth, driven by the increasing adoption of molecular biology techniques across diverse industries such as pharmaceuticals, biotechnology, and research. Widely used for DNA and RNA isolation, Proteinase K’s demand is pivotal in advancing molecular research applications. Industry reports from reputable market research firms offer valuable insights into current market trends, competitive landscapes, and growth prospects.

Additionally, scientific journals, company websites, and news sources contribute to a comprehensive understanding of the Proteinase K market. Regular monitoring of conferences and events within the molecular biology and life sciences sectors ensures staying updated on the latest advancements and industry dynamics.

Key Takeaways

- Market Growth: Anticipated market size: USD 10.4 billion by 2033, growing from USD 4.5 billion in 2023 at a CAGR of 8.8%.

- Proteinase K Characteristics: Derived from Tritirachium album, a versatile serine protease vital in molecular biology, renowned for cleaving peptide bonds.

- Application Diversity: Widely used in pharmaceuticals, biotechnology, and research, excelling in DNA and RNA extraction, enzymatic reactions, and protein footprinting experiments.

- Form Preferences: Powder segment dominates with 54.7% market share due to practicality, stability, and controlled measurements.

- Therapeutic Area Significance: Infectious Diseases segment leads with 32% market share, followed by pivotal roles in Diabetes, Oncology, and other therapeutic areas.

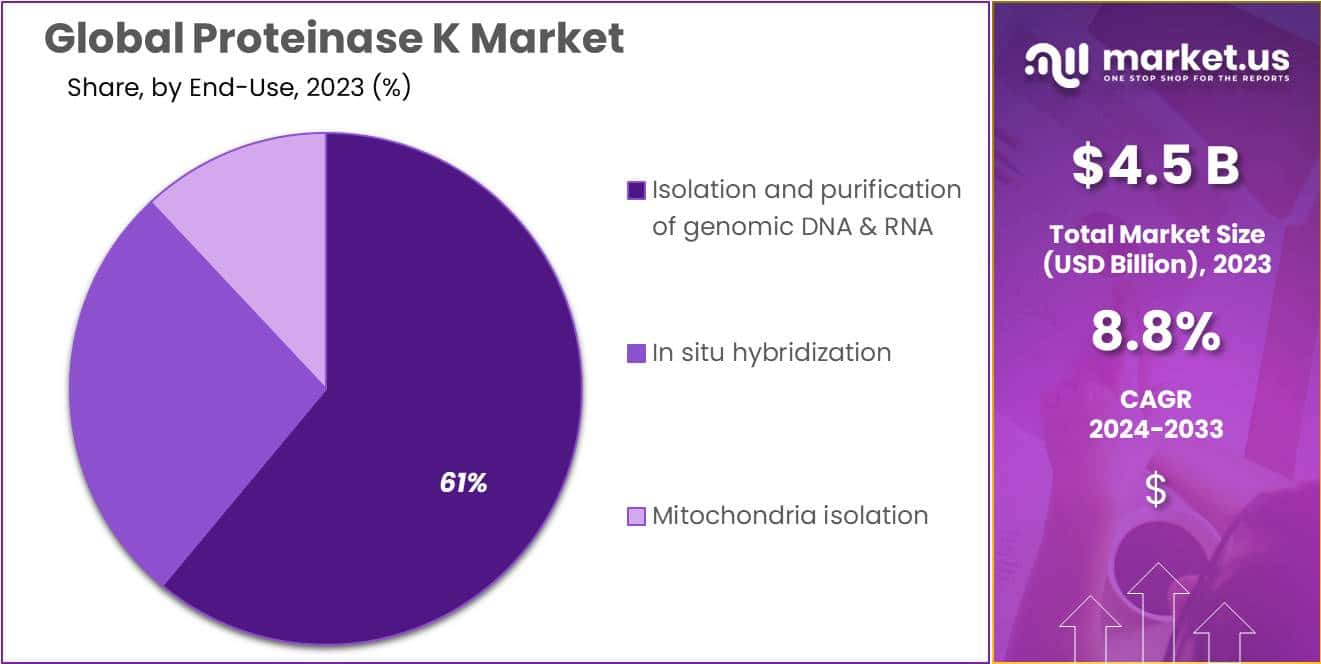

- End-Use Dominance: Isolation and Purification of Genomic DNA & RNA segment commands over 61% market share, highlighting Proteinase K’s versatility.

- Application Leaders: Biotechnology Companies lead with 37.2% market share, followed by significant contributions from Contract Research Organizations (CROs) and Academic Institutes.

- Market Drivers: Biotechnological advancements propel demand, particularly in pharmaceutical research and drug development, and the expanding molecular diagnostics sector.

- Market Challenges: High enzyme costs and the presence of substitutes pose challenges, along with stringent regulatory requirements and limited stability/storage conditions.

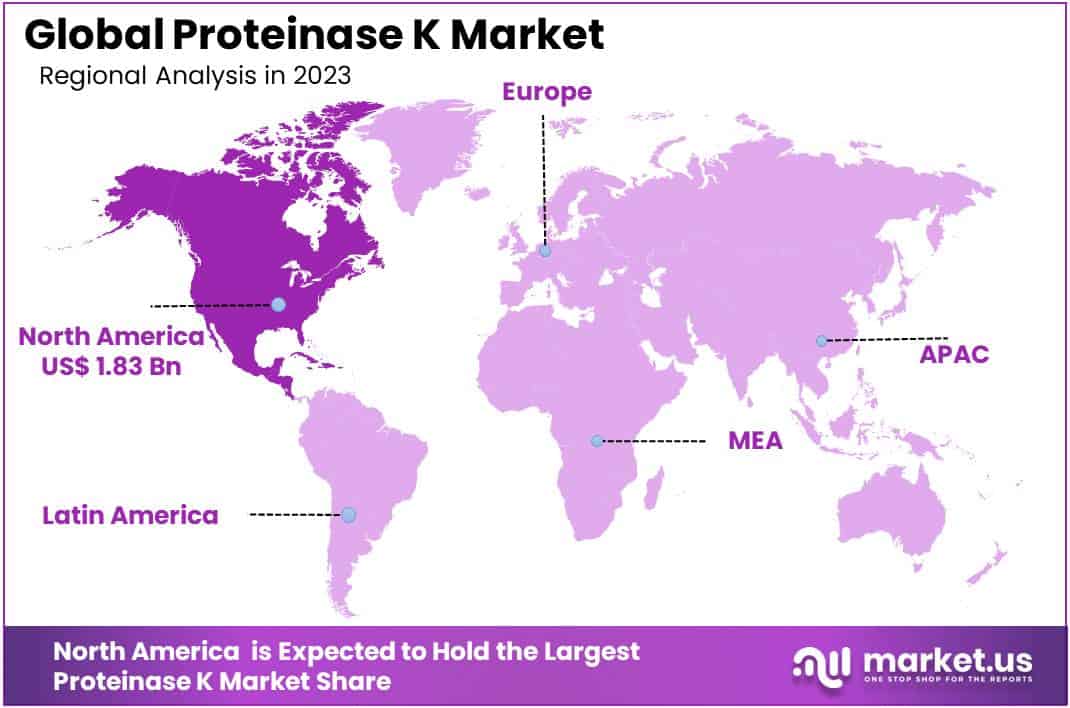

- Regional Dominance: North America leads with 41.7% market share and USD 1.8 billion value, driven by awareness, research infrastructure, and strategic initiatives.

Form Analysis

In 2023, the Proteinase K market showcased a clear trend with the Powder segment taking the lead, securing a robust market position by claiming over 54.7% of the overall share. This dominance can be attributed to the convenience and versatility offered by Proteinase K in its powdered form.

Powdered Proteinase K has gained significant favor among end-users due to its ease of storage, handling, and transportation. This format provides a longer shelf life, ensuring stability and reliability for various applications across industries. Moreover, the powdered form allows for precise and controlled measurements, enhancing its appeal for research and diagnostic purposes.

On the other hand, the Liquid segment, while holding a substantial market share, faced stiff competition from its powdered counterpart. Liquid Proteinase K, although valued for its ready-to-use convenience, struggled to match the efficiency and cost-effectiveness offered by the powdered variant.

The choice between Powder and Liquid Proteinase K often boils down to user preferences, application requirements, and cost considerations. The dominance of the Powder segment in 2023 reflects a preference for practicality, stability, and overall performance, making it the go-to choice for a wide range of end-users in the Proteinase K market. As the industry evolves, keeping an eye on the dynamic interplay between these segments will be crucial for market participants and stakeholders to adapt and innovate.

Therapeutic Area Analysis

In 2023, the Infectious Diseases segment dominates in the Proteinase K market, capturing a substantial market share of over 32%. This dominance can be attributed to the critical role Proteinase K plays in research and diagnostics related to infectious diseases. The enzyme’s effectiveness in breaking down proteins, including those in infectious agents, has fueled its widespread use in developing diagnostic assays and therapies.

Furthermore, Diabetes stood out as another significant therapeutic area, contributing significantly to the Proteinase K market landscape. With a notable share, it underlines the enzyme’s relevance in diabetes research and treatment development. Proteinase K’s application in studying proteins associated with diabetes has propelled its demand within this therapeutic domain.

Oncology, a key player in the Proteinase K market, showcased a robust presence, capturing a substantial market share. The enzyme’s role in cancer research, particularly in isolating nucleic acids and proteins from tumor tissues, has been pivotal. Researchers and clinicians alike rely on Proteinase K to extract vital information for advancing oncological diagnostics and treatment strategies.

Cardiology and Nephrology segments also contributed significantly to the Proteinase K market, reflecting the enzyme’s diverse applications in cardiovascular and kidney-related research. Its ability to efficiently break down proteins has made Proteinase K a valuable tool in unraveling crucial insights into these therapeutic areas.

The Autoimmune Diseases segment witnessed notable traction in the Proteinase K market, emphasizing the enzyme’s importance in understanding the underlying mechanisms of autoimmune disorders. Researchers leverage Proteinase K to dissect proteins implicated in autoimmune responses, facilitating advancements in diagnostic approaches and therapeutic interventions.

Moreover, Neurology emerged as a noteworthy segment, showcasing a growing reliance on Proteinase K for studying proteins associated with neurological conditions. The enzyme’s efficacy in breaking down complex structures has proven instrumental in neuroscientific research, contributing to a notable market share within this therapeutic domain.

End-Use Analysis

In 2023, the Proteinase K market showcased a robust performance with distinct segments contributing to its overall growth. Among these, the Isolation and Purification of Genomic DNA & RNA segment emerged as a frontrunner, holding a dominant market position by capturing more than a 61% share.

This segment’s prominence can be attributed to the increasing demand for Proteinase K in the field of genomics. Researchers and laboratories heavily relied on Proteinase K for its pivotal role in efficiently isolating and purifying genomic DNA and RNA. The method’s simplicity and reliability made it a preferred choice, facilitating precise genetic studies and diagnostics.

In addition to its stronghold in genomic applications, Proteinase K found substantial usage in the realm of In Situ Hybridization. This technique, vital for visualizing specific DNA or RNA sequences within cells or tissues, further propelled the market forward. The versatility of Proteinase K in optimizing hybridization conditions contributed significantly to its adoption in this segment.

Mitochondria Isolation emerged as another key end-use, underscoring the expanding applications of Proteinase K. Laboratories and biotechnological industries turned to Proteinase K for its efficacy in isolating mitochondria, crucial for various research endeavors related to cell biology and bioenergetics.

*Note: Actual Numbers Might Vary In Final Report

Application Analysis

In 2023, the Biotechnology Companies segment emerged as a frontrunner in the Proteinase K market, boasting a commanding market share of over 37.2%. This significant dominance can be attributed to the pivotal role played by biotechnology companies in various research and development endeavors.

Contract Research Organizations (CROs) also made substantial strides, showcasing a notable presence in the Proteinase K market. With their expertise in outsourcing research activities, CROs contributed to the market dynamics, securing a considerable market share.

Academic Institutes, known for their role in advancing scientific knowledge, secured a noteworthy position in the Proteinase K market. Their contribution is vital in supporting educational and research initiatives, making them a substantial segment in the overall market landscape.

Furthermore, Diagnostic Laboratories played a crucial role in the Proteinase K market, leveraging the enzyme for diagnostic purposes. Their demand for Proteinase K was fueled by the need for accurate and reliable testing procedures, solidifying their standing in the market.

As we navigate through the diverse applications of Proteinase K, it becomes evident that each segment plays a unique and indispensable role. Biotechnology Companies currently lead the way, showcasing the dynamic and evolving nature of the Proteinase K market in 2023.

Key Market Segments

Form

- Powder

- Liquid

Therapeutic Area

- Infectious Diseases

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune Diseases

- Neurology

- Others

End-use

- Isolation and Purification of Genomic DNA & RNA

- In Situ Hybridization

- Mitochondria Isolation

Application

- Contract Research Organization

- Academic Institutes

- Biotechnology Companies

- Diagnostic Laboratories

Drivers

Biotechnological Advancements

The continuous progress in biotechnology, particularly in areas like molecular biology and genetic engineering, is driving the demand for Proteinase K. This enzyme plays a crucial role in various biotechnological applications, such as DNA and RNA extraction, making it an essential component in research and diagnostic activities.

Increasing Demand in Pharmaceutical Research

The growing focus on drug development and the need for reliable enzymes in pharmaceutical research contribute significantly to the Proteinase K market. This enzyme is employed in the purification of nucleic acids and proteins, making it indispensable for various stages of drug discovery.

Rising Application in Forensic Science

Proteinase K finds widespread use in forensic science for DNA extraction from forensic samples. As forensic investigations continue to advance, the demand for Proteinase K as a key reagent in DNA isolation processes is expected to rise, boosting the market growth.

Expanding Molecular Diagnostics Sector

With the increasing prevalence of genetic disorders and infectious diseases, the molecular diagnostics sector is expanding rapidly. Proteinase K is a vital component in nucleic acid isolation for diagnostic purposes, contributing to the growth of the Proteinase K market as molecular diagnostics gain prominence.

Restraints

High Cost of Enzymes

The cost associated with Proteinase K can be a significant restraining factor for its market growth. The high production costs and purification processes contribute to elevated prices, limiting accessibility for smaller research laboratories and institutions.

Availability of Substitutes

The presence of alternative enzymes and methods for nucleic acid and protein extraction poses a challenge to the Proteinase K market. Researchers may opt for alternative reagents that offer similar functionalities but at a lower cost, impacting the market for Proteinase K.

Stringent Regulatory Requirements

The regulatory landscape for enzymes in research and diagnostics is stringent. Meeting these regulatory standards can be challenging for manufacturers, leading to delays in product approvals and market entry, which may hinder the growth of the Proteinase K market.

Limited Stability and Storage Conditions

Proteinase K has specific stability and storage requirements. Maintaining optimal conditions for its storage can be challenging during transportation and handling, potentially affecting its effectiveness and shelf life, thus posing a constraint on the market.

Opportunities

Expansion in Emerging Markets

There is a significant opportunity for market expansion in emerging economies where biotechnological and pharmaceutical research activities are on the rise. Penetrating these markets with cost-effective and high-quality Proteinase K products presents a growth avenue.

Customized Enzyme Solutions

Offering customized enzyme solutions to cater to specific research and diagnostic needs provides a growth opportunity. Manufacturers can develop and market Proteinase K variants tailored for particular applications, addressing the diverse requirements of researchers.

Collaborations and Partnerships

Collaborations between manufacturers, research institutions, and pharmaceutical companies can drive innovation and product development. Partnerships can lead to the creation of new formulations and applications for Proteinase K, expanding its market presence.

Technological Advancements in Enzyme Engineering

Investing in enzyme engineering technologies can lead to the development of improved versions of Proteinase K with enhanced stability, specificity, and cost-effectiveness. Embracing advancements in enzyme engineering offers a pathway for sustained market growth.

Trends

Rising Demand for Recombinant Proteinase K

The market is witnessing a trend toward the adoption of recombinant Proteinase K. Recombinant enzymes offer advantages such as consistent quality, scalability, and reduced batch-to-batch variability, aligning with the industry’s focus on reproducibility.

Increasing Application in Next-Generation Sequencing (NGS)

Proteinase K is finding expanded applications in NGS workflows, particularly in library preparation. The trend toward high-throughput sequencing methods is driving the demand for Proteinase K in NGS applications, influencing market dynamics.

Growing Popularity of Lyophilized Proteinase K

Lyophilized or freeze-dried forms of Proteinase K are gaining popularity due to their enhanced stability and longer shelf life. This trend aligns with the industry’s emphasis on convenient and stable reagents for molecular biology applications.

Focus on Sustainable Production Practices

There is a growing trend toward sustainable and environmentally friendly production practices in the enzyme industry. Manufacturers focusing on eco-friendly production methods for Proteinase K are likely to attract environmentally conscious researchers and contribute to market differentiation.

Regional Analysis

In 2023, North America led the Proteinase K Market, holding a strong position with over 41.7% market share and a substantial market value of USD 1.8 billion for the year. This signifies a robust presence and significant demand for Proteinase K in the region.

The impressive market dominance in North America is driven by a combination of factors. Firstly, a growing awareness of Proteinase K’s applications in various industries, including biotechnology and pharmaceuticals, has fueled its adoption. Additionally, the well-established research and development infrastructure in the region has further propelled the market’s expansion.

The demand surge can also be attributed to the region’s increasing focus on advanced research activities, particularly in the life sciences sector. Laboratories and research institutions across North America are increasingly incorporating Proteinase K for its pivotal role in DNA and RNA extraction processes.

Furthermore, the strategic initiatives taken by key market players, such as product innovations and collaborations with research institutions, have contributed to North America’s dominance in the Proteinase K Market. This not only meets the evolving needs of end-users but also strengthens the regional market position.

North America’s leading position in the Proteinase K Market in 2023 is a result of heightened awareness, robust research infrastructure, and strategic industry collaborations. This marks the region as a key player in shaping the trajectory of the Proteinase K Market, with continued growth anticipated in the coming years.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the dynamic landscape of the Proteinase K market, several key players play a pivotal role, each contributing to the industry’s growth and innovation. Merck KGaA stands out as a prominent player, leveraging its expertise to develop cutting-edge solutions in enzymatic processes. The company’s commitment to research and development positions it as a key influencer in shaping market trends.

QIAGEN, another major player, brings its specialized knowledge to the Proteinase K arena. With a focus on sample technologies and molecular diagnostics, QIAGEN contributes to the market’s evolution by providing robust solutions that cater to the diverse needs of researchers and professionals.

Thermo Fisher Scientific Inc. is a key force driving advancements in the Proteinase K market. Renowned for its comprehensive range of scientific products and services, Thermo Fisher Scientific plays a vital role in enhancing the efficiency and reliability of proteinase K applications across various industries.

F. Hoffmann-La Roche Ltd, a stalwart in the pharmaceutical and diagnostics sector, brings a wealth of experience to the Proteinase K market. Its commitment to developing innovative solutions underscores its significance in influencing market dynamics and addressing emerging challenges.

Abcam plc. adds a unique perspective to the Proteinase K landscape, focusing on providing high-quality antibodies and protein research tools. As a key player, Abcam contributes to the market’s vibrancy by offering essential components for proteinase K-related applications, fostering advancements in biological research.

Beyond these major players, other key contributors further diversify the Proteinase K market. These players, through their distinctive strengths and capabilities, collectively shape the competitive landscape, fostering an environment of innovation and continuous improvement.

Market Key Players

- Merck KGaA

- QIAGEN

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd

- Abcam plc.

- Agilent Technologies Inc.

- Biocatalysts

- Minerva Biolabs GmbH

- Promega Corporation

- Takara Bio Inc.

- New England Biolabs

- MP BIOMEDICALS.

Recent Developments

- In October 2023, Sigma-Aldrich unveiled an advanced Proteinase K with heightened purity, aiming to offer researchers a more dependable tool for protein digestion applications. This enzyme is crafted through an exclusive purification process, resulting in reduced impurities. This enhancement is anticipated to boost the enzyme’s efficiency and precision while minimizing the risk of unintended protein digestion.

- In September 2023, Thermo Fisher Scientific successfully acquired ProteinSimple, a trailblazer in innovative protein analysis technologies. This acquisition brings ProteinSimple’s Single-Molecule, Real-Time (SMRT) technology into Thermo Fisher’s array of protein analysis solutions. The incorporation of SMRT technology is poised to expedite the creation of novel tools and applications for studying protein interactions and dynamics.

- In August 2023, Collaboration between Merck and New England Biolabs (NEB) to advance Proteinase K development. Merging their expertise, the two companies aim to produce new Proteinase K variants boasting improved characteristics such as heightened activity, enhanced stability, and superior specificity.

- In July 2023, Promega introduced a cutting-edge Proteinase K buffer designed to optimize protein digestion. This proprietary buffer is formulated with a special blend of components to amplify the enzyme’s activity and stability. Notably, the buffer is compatible with a diverse range of downstream applications.

Report Scope

Report Features Description Market Value (2023) USD 4.5 Bn Forecast Revenue (2033) USD 10.4 Bn CAGR (2024-2033) 8.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid), By Therapeutic Area (Infectious Diseases, Diabetes, Oncology, Cardiology, Nephrology, Autoimmune Diseases, Neurology, Others), By End-use (Isolation and Purification of Genomic DNA & RNA, In Situ Hybridization, Mitochondria Isolation), By Application (Contract Research Organization, Academic Institutes, Biotechnology Companies, Diagnostic Laboratories) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Merck KGaA, QIAGEN, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Abcam plc., Agilent Technologies Inc., Biocatalysts, Minerva Biolabs GmbH, Promega Corporation, Takara Bio Inc., New England Biolabs, MP BIOMEDICALS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Proteinase K market in 2023?The Proteinase K market size is USD 4.5 billion in 2023.

What is the projected CAGR at which the Proteinase K market is expected to grow at?The Proteinase K market is expected to grow at a CAGR of 8.8% (2024-2033).

List the segments encompassed in this report on the Proteinase K market?Market.US has segmented the Proteinase K market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Form the market has been segmented into Powder, and Liquid. By Therapeutic Area the market has been segmented into Infectious Diseases, Diabetes, Oncology, Cardiology, Nephrology, Autoimmune Diseases, Neurology, and Others. By End-use the market has been segmented into Isolation and Purification of Genomic DNA & RNA, In Situ Hybridization, and Mitochondria Isolation. By Application the market has been segmented into Contract Research Organization, Academic Institutes, Biotechnology Companies, and Diagnostic Laboratories.

List the key industry players of the Proteinase K market?Merck KGaA, QIAGEN, Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Abcam plc., Agilent Technologies Inc., Biocatalysts, Minerva Biolabs GmbH, Promega Corporation, Takara Bio Inc., New England Biolabs, MP BIOMEDICALS, and Others

Which region is more appealing for vendors employed in the Proteinase K market?North America is expected to account for the highest revenue share of 41.7% and boasting an impressive market value of USD 1.8 billion for the year 2023. Therefore, the Proteinase K industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Proteinase K?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Proteinase K Market.

Which segment accounts for the greatest market share in the Proteinase K industry?With respect to the Proteinase K industry, vendors can expect to leverage greater prospective business opportunities through the pharmaceutical segment, as this area of interest accounts for the largest market share.

-

-

- Roche Holding AG (Roche CustomBiotech.)

- Thermo Fisher Scientific, Inc.

- Merck KGaA

- Takara Holdings Inc. (Takara Bio Inc.)

- QIAGEN NV

- Promega Corporation

- Meridian Bioscience, Inc. (Bioline)

- Minerva Biolabs GmbH

- Worthington Biochemical Corporation

- Norgen Biotek Corp.

- BIORON GmbH

- Others.