Protein Diagnostics Market By Product Type (Analyzers, Reagents, Calibrators & Controls Kits/Reagents, Lipoprotein Test Kits, and Others), By Application (Drug Discovery & Development, Protein Measurement, Immunocomplex Reaction, Cancer, Antigen-Antibody Reaction, and Others), By End-user (Hospital, Speciality Clinics/Standalone, Reference Labs, Diagnostic Labs, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 168064

- Number of Pages: 242

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

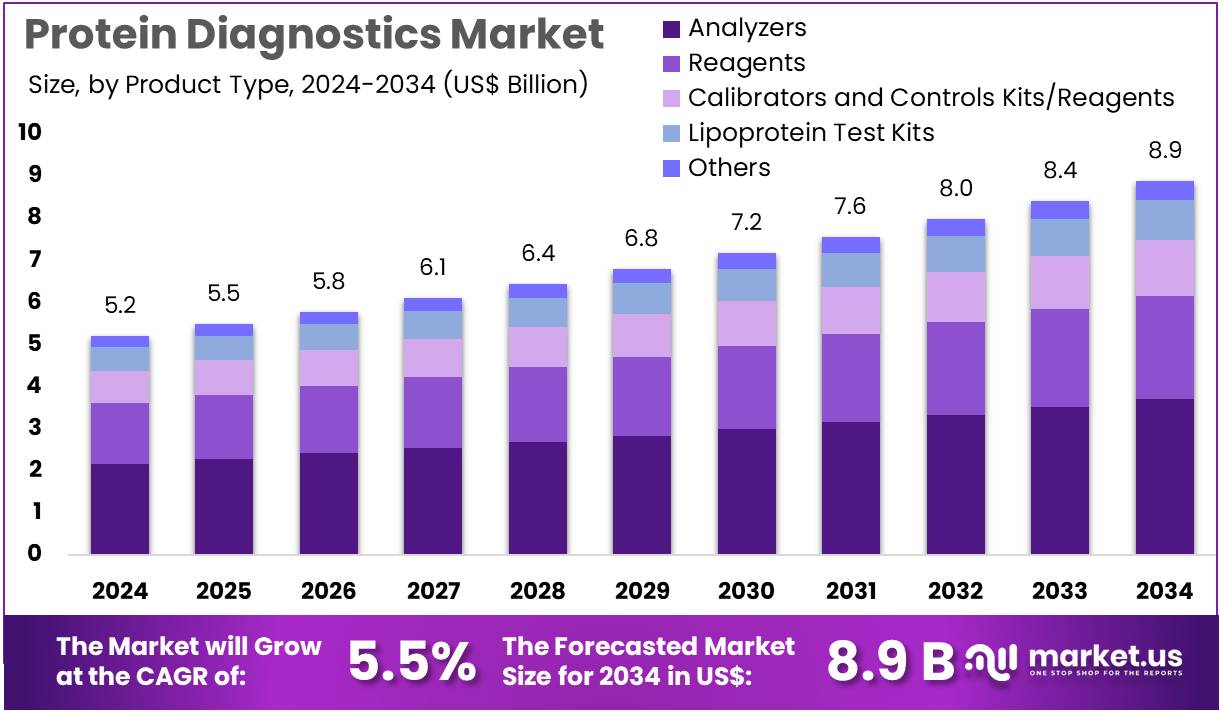

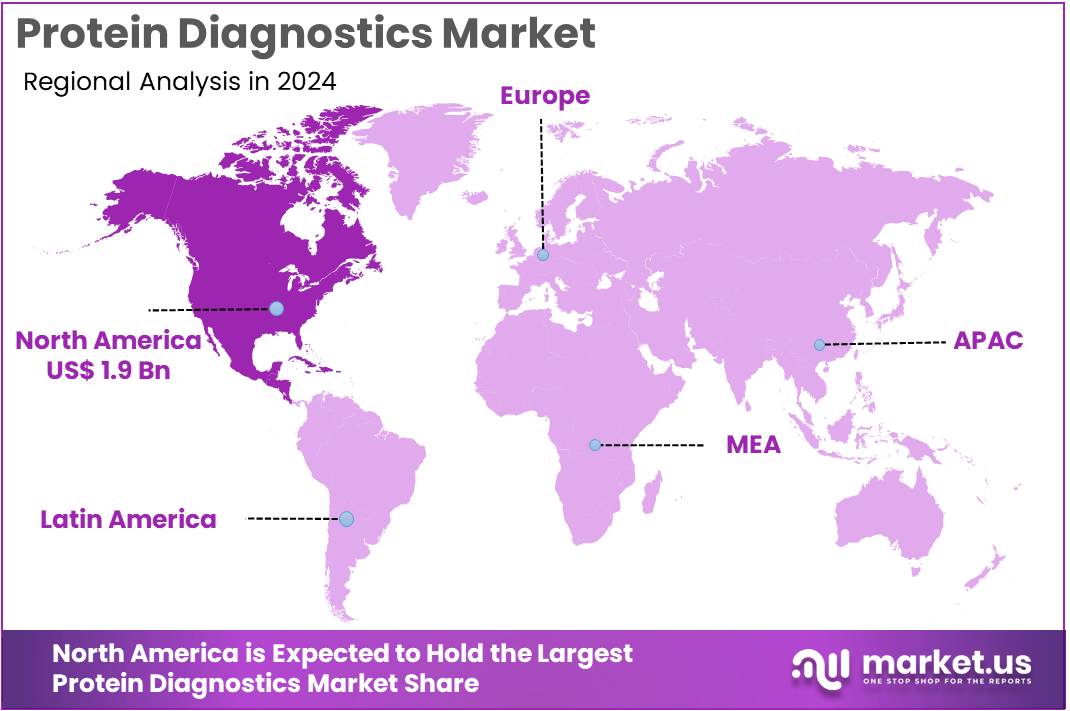

The Protein Diagnostics Market Size is expected to be worth around US$ 8.9 billion by 2034 from US$ 5.2 billion in 2024, growing at a CAGR of 5.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.4% share and holds US$ 1.9 Billion market value for the year.

Increasing demand for personalized medicine propels the Protein Diagnostics market, as healthcare providers integrate proteomic profiling to tailor treatments based on individual biomarker expressions. Diagnostic firms develop immunoassay panels and mass spectrometry kits that quantify low-abundance proteins with minimal sample volumes. These tools enable early detection of Alzheimer’s through cerebrospinal fluid amyloid-beta assays, cardiovascular risk assessment via high-sensitivity troponin measurements, autoimmune disorder diagnosis with anti-nuclear antibody panels, and therapeutic drug monitoring for biologics in rheumatoid arthritis.

Advanced instrumentation creates opportunities for multiplexed testing that combines multiple analytes into single workflows, reducing costs and turnaround times. Bruker introduced the timsTOF Ultra AIP in June 2025, an ultra-sensitive mass spectrometry system optimized for single-cell proteomics and immunopeptidomics, which facilitates precise biomarker exploration in translational research. This launch enhances the market’s capacity for complex, low-input analyses across clinical and preclinical applications.

Growing prevalence of chronic diseases accelerates the Protein Diagnostics market, as clinicians rely on protein-based assays to identify inflammation markers and predict disease progression accurately. Biotechnology companies innovate with turbidimetry and enzyme-linked immunosorbent assays that offer rapid, point-of-care quantification from serum or plasma samples.

Applications encompass oncology subtyping through HER2 and PD-L1 expression profiling, infectious disease confirmation via C-reactive protein elevation, endocrine evaluations with thyroid-stimulating hormone levels, and nutritional status assessment through prealbumin tracking in malnutrition cases. Technological refinements open avenues for integration with AI algorithms that automate result interpretation and enhance predictive modeling. Pharmaceutical developers increasingly adopt these diagnostics in clinical trials to stratify patients and evaluate response endpoints. This momentum drives sustained innovation in assay sensitivity and specificity.

Rising adoption of AI-powered platforms invigorates the Protein Diagnostics market, as laboratories leverage machine learning to analyze proteomic datasets for novel biomarker discovery and validation. Service providers expand reagent kits compatible with automated analyzers that handle high-throughput screening in diverse sample types. These diagnostics support drug discovery by quantifying target engagement in pharmacokinetic studies, disease monitoring through serial cytokine profiling in immunotherapy, allergy testing via specific IgE quantification, and toxicology assessments with acute phase reactant panels.

Collaborative partnerships among key players foster opportunities for standardized protocols and regulatory approvals of companion diagnostics. The shift toward multiplexing and digital integration positions protein diagnostics as foundational elements in precision healthcare ecosystems. This evolution ensures broader accessibility and improved outcomes across therapeutic areas.

Key Takeaways

- In 2024, the market generated a revenue of US$ 5.2 billion, with a CAGR of 5.5%, and is expected to reach US$ 8.9 billion by the year 2034.

- The product type segment is divided into analyzers, reagents, calibrators & controls kits/reagents, lipoprotein test kits, and others, with analyzers taking the lead in 2024 with a market share of 41.8%.

- Considering application, the market is divided into drug discovery & development, protein measurement, immunocomplex reaction, cancer, antigen-antibody reaction, and others. Among these, drug discovery & development held a significant share of 43.5%.

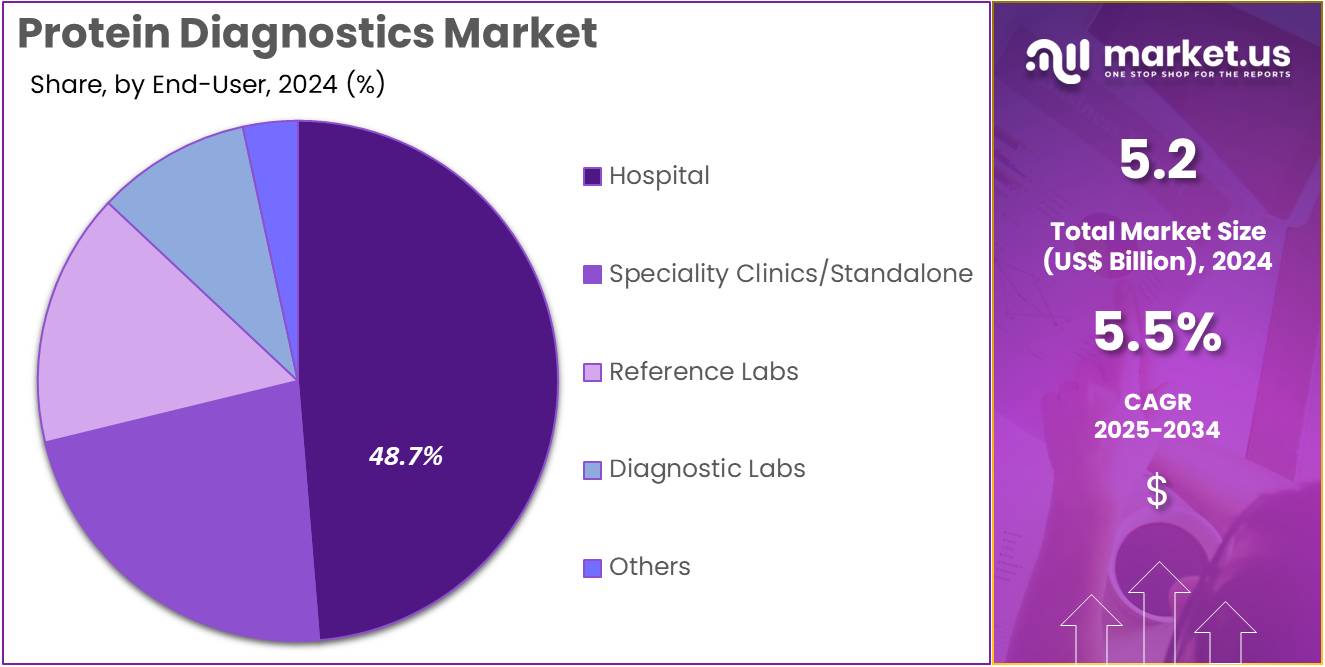

- Furthermore, concerning the end-user segment, the market is segregated into hospital, Speciality clinics/standalone, reference labs, diagnostic labs, and others. The hospital sector stands out as the dominant player, holding the largest revenue share of 48.7% in the market.

- North America led the market by securing a market share of 37.4% in 2024.

Product Type Analysis

Analyzers, holding 41.8%, are expected to dominate as laboratories depend on high-throughput platforms for accurate protein quantification, immunoassay processing, and biomarker evaluation. Pharmaceutical and research institutions require advanced analyzers to support complex protein-expression studies. Automation trends improve workflow efficiency, driving strong adoption across clinical labs. Manufacturers introduce upgraded systems with enhanced sensitivity and multiplexing capability, strengthening laboratory productivity.

Rising incidence of chronic and metabolic diseases increases demand for protein-based diagnostic panels processed through analyzers. Integration of digital reporting and LIS connectivity enhances clinical decision support. Hospitals expand analyzer installations as test menus broaden. High reliability and reproducibility make analyzers essential to routine and specialized diagnostics. These drivers keep analyzers anticipated to remain the leading product type.

Application Analysis

Drug discovery and development, holding 43.5%, is anticipated to remain the dominant application due to increasing industry focus on protein biomarkers, therapeutic targets, and pathway analysis. Biopharmaceutical companies depend on protein diagnostics to evaluate drug efficacy, toxicity, and mechanism of action. The rise of biologics, monoclonal antibodies, and gene therapies drives strong demand for protein-level validation tools.

Preclinical and clinical studies require sensitive assays to monitor protein expression changes, strengthening adoption. Research teams use protein diagnostics to characterize disease-associated proteins in oncology, neurology, and metabolic disorders. High-throughput screening platforms expand protein-analysis workloads. Regulatory expectations for biomarker-based evidence increase utilization. Collaborative R&D programs across global biotech hubs raise test volumes. These factors keep drug discovery and development projected to remain the most influential application segment.

End-User Analysis

Hospitals, holding 48.7%, are expected to dominate end-user adoption as they manage large patient volumes requiring protein-based diagnostic assessments. Clinicians rely on protein tests to evaluate cardiac markers, inflammatory proteins, hormone levels, tumor markers, and autoimmune indicators. Emergency departments increasingly use rapid protein assays for critical care decisions. Hospitals invest in advanced immunoassay analyzers to support expanding diagnostic menus. Growing incidence of chronic diseases increases routine protein testing across inpatient and outpatient departments.

Integration of automated systems improves turnaround time and testing precision. Hospitals participate in screening programs that use protein biomarkers for early disease identification. Expansion of multi-specialty hospital networks across emerging economies boosts procurement volumes. These dynamics keep hospitals anticipated to remain the dominant end-user segment in the protein diagnostics market.

Key Market Segments

By Product Type

- Analyzers

- Reagents

- Calibrators & Controls Kits/Reagents

- Lipoprotein Test Kits

- Others

By Application

- Drug Discovery & Development

- Protein Measurement

- Immunocomplex Reaction

- Cancer

- Antigen-Antibody Reaction

- Others

By End-user

- Hospital

- Speciality Clinics/Standalone

- Reference Labs

- Diagnostic Labs

- Others

Drivers

Increasing Prevalence of Chronic Diseases is Driving the Market

The escalating prevalence of chronic diseases globally has established a primary driver for the protein diagnostics market, as these conditions necessitate frequent protein-based biomarker testing for effective monitoring and management. Protein diagnostics, encompassing assays for markers like C-reactive protein and troponins, enable early identification of inflammation and tissue damage in disorders such as cardiovascular disease and diabetes.

Healthcare systems are increasingly relying on these tools to support population-level screening, reducing the burden of advanced-stage interventions. Manufacturers are compelled to enhance assay sensitivity to detect subtle protein variations indicative of disease progression. Regulatory frameworks prioritize validation of protein panels for multiplex testing, aligning with precision medicine paradigms.

Collaborative efforts among health organizations facilitate standardized protocols, ensuring interoperability across diagnostic platforms. The economic rationale underscores investments, as timely diagnostics avert costly complications and hospitalizations. Professional guidelines from medical associations endorse routine protein profiling, embedding products in clinical workflows. This driver stimulates innovation in point-of-care formats, broadening accessibility beyond specialized laboratories.

Educational programs for providers emphasize the prognostic value of protein biomarkers, promoting adherence to testing regimens. The Centers for Disease Control and Prevention reported that in 2023, 76.4% of U.S. adults, representing 194 million individuals, had at least one chronic condition. Consequently, the market experiences robust expansion through heightened demand for reliable protein-based solutions.

Restraints

Regulatory Validation Challenges are Restraining the Market

The rigorous and protracted regulatory validation processes for protein diagnostic assays continue to impose a significant restraint, delaying product commercialization and escalating development expenditures. Agencies require comprehensive clinical data demonstrating assay reproducibility across diverse populations, prolonging timelines for approvals. This barrier disproportionately impacts emerging innovators, who face resource constraints in conducting multi-center studies.

Laboratories encounter hesitancy in adopting novel tests due to liability concerns over unproven performance metrics. The restraint perpetuates reliance on legacy immunoassays, limiting advancements in high-throughput protein profiling. Policy harmonization initiatives, though underway, introduce additional layers of scrutiny on specificity thresholds. Manufacturers must navigate evolving standards for protein stability in storage, diverting budgets from R&D to compliance.

These demands exacerbate supply inconsistencies, as validated kits incur premium pricing. International variances in requirements further complicate global market entries. Mitigation efforts, including accelerated pathways, remain limited in scope. According to the U.S. Food and Drug Administration, only about 35% of medical devices, including diagnostic technologies, receive market approval within the first submission cycle, which can extend timelines for protein assays. Such inefficiencies underscore the administrative hurdles constraining timely innovation.

Opportunities

Advancements in Multiplex Protein Assays are Creating Growth Opportunities

The progression of multiplex protein assays capable of simultaneous biomarker detection is unveiling substantial growth opportunities within the protein diagnostics market, revolutionizing efficiency in disease profiling. These innovations allow comprehensive analysis of multiple proteins from minimal sample volumes, ideal for chronic condition monitoring. Opportunities emerge in tailoring panels for specific comorbidities, such as cardiovascular and renal markers, enhancing therapeutic guidance.

Regulatory incentives for breakthrough designations expedite validations, fostering pharmaceutical-diagnostic collaborations. Partnerships with research consortia accelerate evidence generation, supporting reimbursement expansions. This landscape diversifies revenue streams through customizable kits for academic and clinical applications. Economic projections indicate cost efficiencies from reduced per-test expenses, appealing to high-volume laboratories.

Global scalability arises as multiplex formats adapt to emerging market infrastructures. These developments position suppliers for integrations with digital health ecosystems, enabling remote data interpretations. Sustained investments in automation promise broader adoption in primary care. The U.S. National Institutes of Health reported a 7% increase in funding for personalized medicine and biomarker discovery research from 2022 to 2023. This upliftment exemplifies the supportive environment for multiplex advancements.

Impact of Macroeconomic / Geopolitical Factors

Economic volatility and elevated production expenses squeeze lab budgets, compelling diagnostic centers to scale back on advanced protein assays amid tighter fiscal controls. Robust healthcare investments and personalized medicine trends, however, fuel demand as providers integrate protein biomarkers for precise disease profiling. Geopolitical frictions in Indo-Pacific shipping lanes snag reagent deliveries from Asian hubs, prolonging inventory cycles and spiking overheads for assay developers. These same strains prompt diversified vendor ties and regional stockpiling that fortify continuity and trim exposure risks.

Recent U.S. tariffs at 25% on imported diagnostic reagents from non-exempt nations, active since mid-2025, burden American facilities with higher procurement fees and disrupt routine testing volumes. Labs counter this smartly by tapping USMCA-sourced alternatives and pushing for exemptions via domestic blending, which evens out costs over time. In the big picture, these elements sharpen supply tactics and collaborative edges. The protein diagnostics market charges ahead with solid promise, turning pressures into pathways for faster, more reliable insights that elevate patient care globally.

Latest Trends

FDA Approval of Phospho-Tau 217 Biomarker Assay is a Recent Trend

The U.S. Food and Drug Administration’s approval of advanced protein biomarker assays for neurodegenerative diseases has crystallized as a salient trend in 2024, emphasizing blood-based diagnostics for Alzheimer’s pathology. This development focuses on phospho-tau 217 as a highly specific indicator of amyloid accumulation, facilitating earlier interventions without invasive procedures.

The trend prioritizes integration with automated platforms, streamlining workflows in neurology clinics. Developers are refining assay thresholds for diverse demographics, addressing variability in protein expression. Regulatory endorsements underscore companion diagnostic potential, linking tests to emerging anti-amyloid therapies. Adoption in primary care surges, where simplified sampling enhances screening accessibility. This shift intersects with AI-driven interpretations, improving prognostic accuracy for cognitive decline.

Competitive responses include expansions to multi-protein panels incorporating neurofilament light chain. Broader ramifications extend to longitudinal monitoring, adapting assays for treatment response evaluations. The trend fosters global alignments, harmonizing standards for international validations. Roche secured FDA approval for an expanded Alzheimer’s biomarker panel including phospho-tau 217 in 2024. This milestone highlights the trend’s pivotal role in transforming dementia diagnostics.

Regional Analysis

North America is leading the Protein Diagnostics Market

North America accounted for 37.4% of the overall market in 2024, and the region experienced strong growth as hospitals, oncology centers, and reference labs expanded proteomic testing for cancer, cardiovascular disease, and autoimmune disorders. Clinicians adopted advanced immunoassays and mass-spectrometry panels to improve early biomarker detection and treatment stratification. Growth accelerated as precision-medicine programs increasingly relied on protein-based signatures for therapeutic decision-making.

Pharmaceutical companies widened biomarker-driven clinical-trial activity, which boosted demand for high-sensitivity protein-analysis workflows. The CDC reported 1,958,310 new cancer cases in the United States in 2022 (CDC – U.S. Cancer Statistics), and this rising diagnostic burden strengthened the need for accurate, protein-level disease profiling. Academic institutions expanded translational proteomics, while diagnostic manufacturers increased availability of multiplex kits. These combined advancements significantly reinforced regional market expansion in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record sustained growth during the forecast period as healthcare systems expand precision-medicine initiatives and increase adoption of proteomic biomarker testing across oncology and chronic-disease management. Hospitals enhance molecular-diagnostic infrastructure to support earlier disease detection, while research institutes scale proteogenomics programs through government-backed innovation funding.

Diagnostic laboratories introduce high-throughput immunoassay platforms to meet rising testing demand from urban populations. Pharmaceutical companies intensify regional clinical trials, creating stronger demand for protein-based biomarker validation. The National Cancer Center Japan reported 380,400 cancer deaths in 2022 (NCC Japan – Cancer Statistics), and this high disease load underscores the need for improved protein-based diagnostic strategies. Technology providers broaden regional distribution, ensuring faster access to specialized reagents and analytical instruments. These developments position the region for strong and consistent growth over the forecast horizon.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Market leaders pursue multiple strategic levers to expand their footprint in the protein-based diagnostics sector by broadening test panels to cover emerging biomarkers across oncology, infectious disease and immunology and by offering multiplex assays that raise “value per sample” revenue. They invest in automation and high-throughput reagent systems to push throughput higher, reduce per-test cost and appeal to large centralized laboratories seeking scale. They deepen clinical partnerships and publish performance data that demonstrate improved sensitivity and specificity, thereby gaining preferential adoption among lab networks.

They drive geographic expansion into Asia Pacific and Latin America through tailored regulatory-compliant offerings and strengthened local distributor networks. They pursue inorganic growth by acquiring niche firms with complementary technologies and integrate them to accelerate time to market. Bio-Techne Corporation provides a representative case: this U.S. life-sciences firm develops and sells reagents, instruments and services aimed at diagnostics and research markets, has grown via acquisitions of specialty tools businesses, and leverages its global platform to support diagnostics workflows where protein analytics matter.

Top Key Players in the Protein Diagnostics Market

- Beckman Coulter, Inc.

- Siemens Healthineers

- F. Hoffmann‑La Roche Ltd.

- Agilent Technologies, Inc.

- Shenzhen Mindray Bio‑Medical Electronics Co., Ltd.

- Elabscience Biotechnology Inc.

- Goldsite Diagnostics Inc.

- Getein Biotech, Inc.

Recent Developments

- On November 12, 2025: Thermo Fisher Scientific received FDA 510(k) clearance for its EXENT® Analyzer along with the Immunoglobulin Isotypes (GAM) Assay. The system offers automated testing with high analytical sensitivity and is intended to support the detection of low-level M-proteins, helping clinicians evaluate multiple myeloma and related plasma-cell disorders more effectively.

- In June 2025: Illumina and SomaLogic entered into an agreement aimed at strengthening Illumina’s multiomics efforts by incorporating SomaLogic’s proteomics operations. The collaboration brings together genomic sequencing with broad-scale protein measurement technologies, supporting advances in personalized medicine, disease profiling, and biomarker research.

Report Scope

Report Features Description Market Value (2024) US$ 5.2 billion Forecast Revenue (2034) US$ 8.9 billion CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Analyzers, Reagents, Calibrators & Controls Kits/Reagents, Lipoprotein Test Kits, and Others), By Application (Drug Discovery & Development, Protein Measurement, Immunocomplex Reaction, Cancer, Antigen-Antibody Reaction, and Others), By End-user (Hospital, Speciality Clinics/Standalone, Reference Labs, Diagnostic Labs, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Beckman Coulter, Inc., Siemens Healthineers, F. Hoffmann‑La Roche Ltd., Agilent Technologies, Inc., Shenzhen Mindray Bio‑Medical Electronics Co., Ltd., Elabscience Biotechnology Inc., Goldsite Diagnostics Inc., Getein Biotech, Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Beckman Coulter, Inc.

- Siemens Healthineers

- F. Hoffmann‑La Roche Ltd.

- Agilent Technologies, Inc.

- Shenzhen Mindray Bio‑Medical Electronics Co., Ltd.

- Elabscience Biotechnology Inc.

- Goldsite Diagnostics Inc.

- Getein Biotech, Inc.