Global Proptech Market By Solution (Software [Property Management (Rental Listings Management, Applicant Management, Others), Asset Management (On/Offline Rent Payments, Others), Sales and Advertisements, Work Order Management, Customer Relationship Management (Customer Service, Customer Experience Management), Others], Services [Professional Services, Managed Services]), By Deployment (Cloud-based, On-premises), By End-user (Housing Associations, Property Managers/Agents, Property Investors, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 178517

- Number of Pages: 324

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Restraints Impact Analysis

- By Solution

- By Deployment

- By End User

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Key Challenges

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

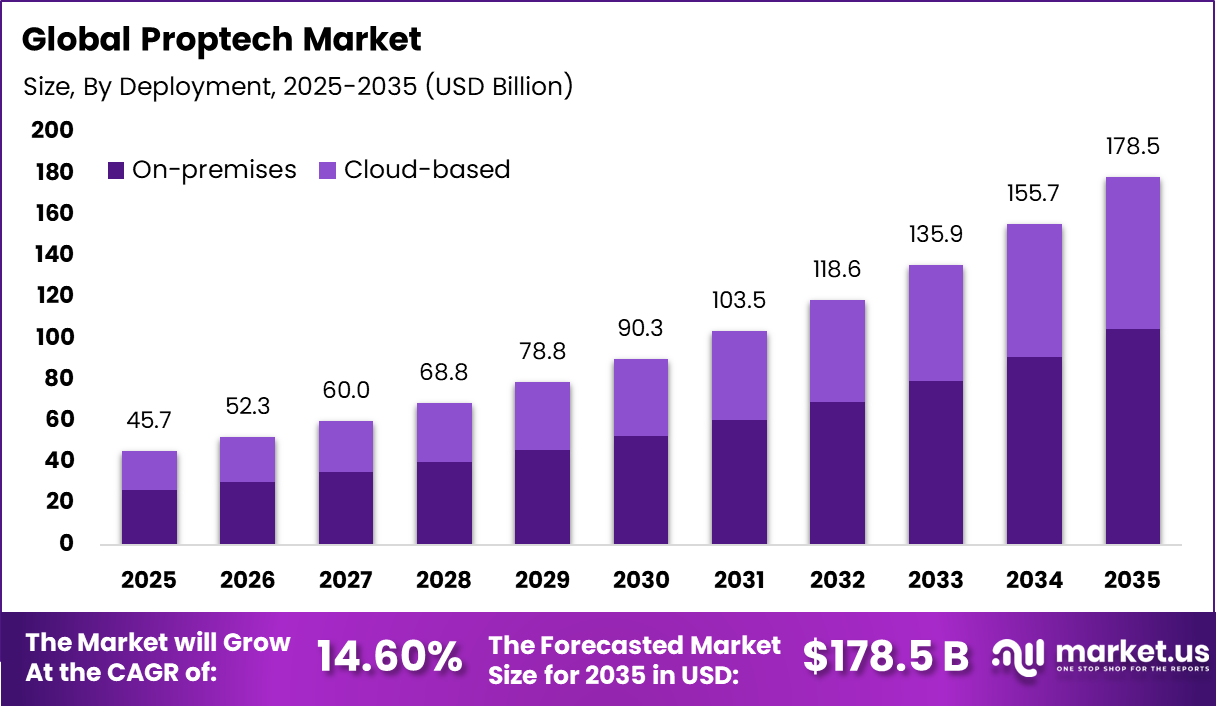

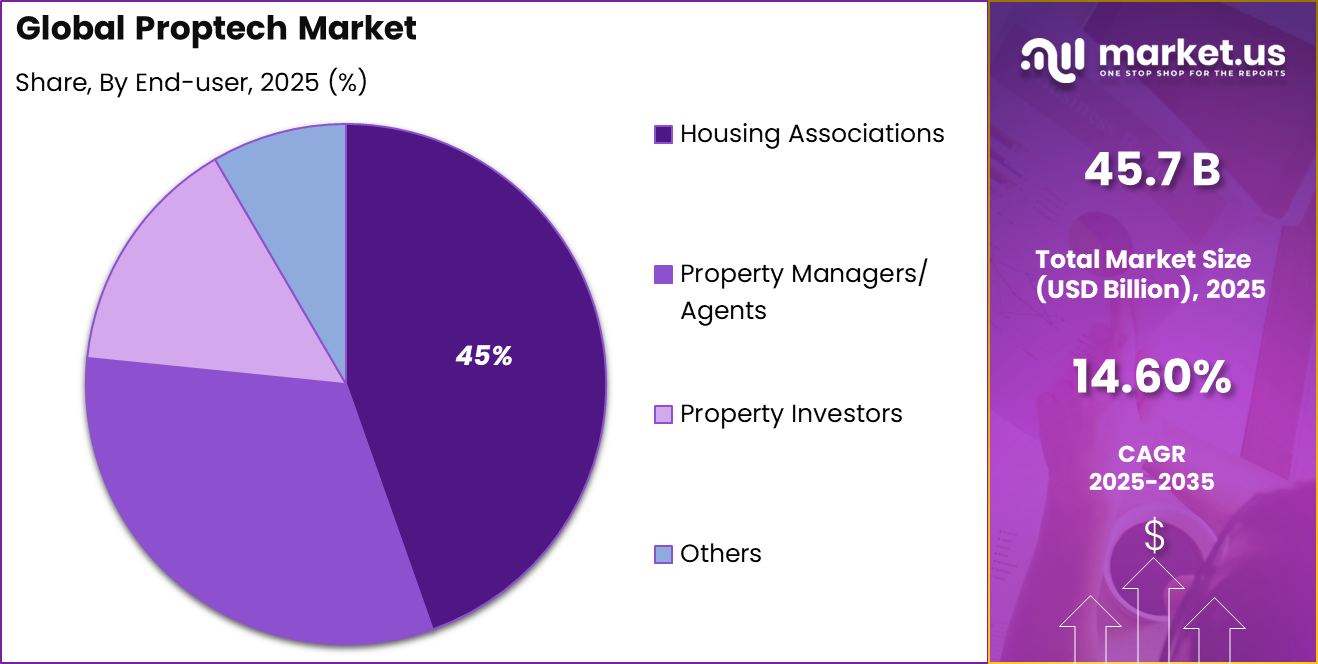

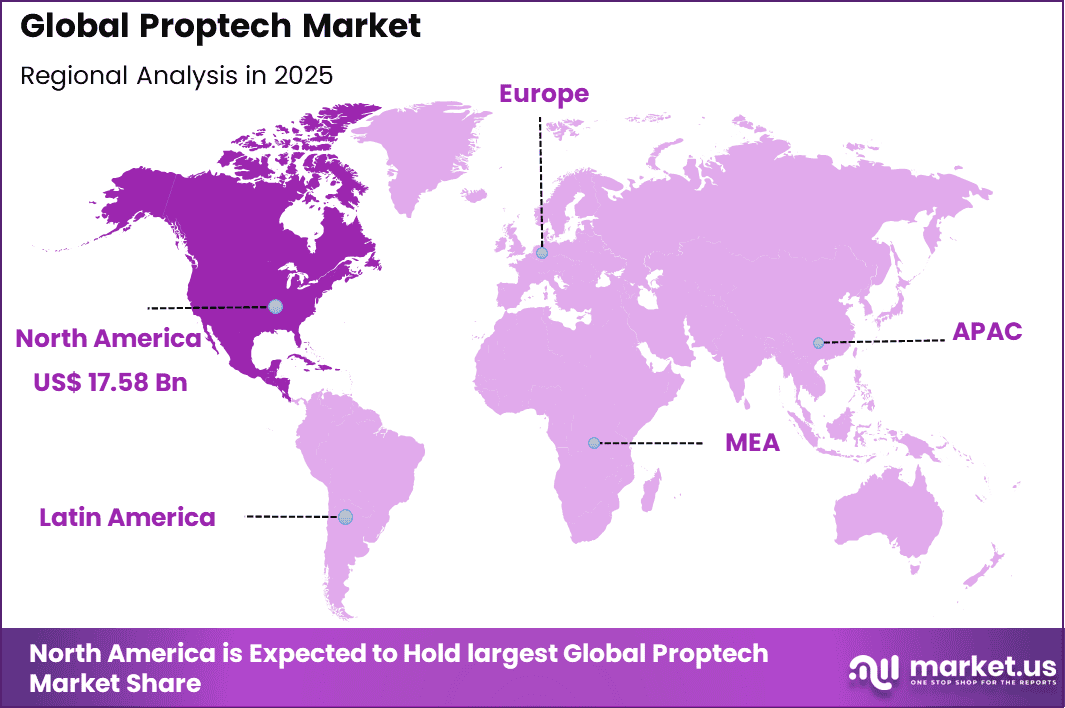

The Global Proptech Market generated USD 45.7 billion in 2025 and is predicted to register growth from USD 52.3 billion in 2026 to about USD 178.5 billion by 2035, recording a CAGR of 14.60% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 38.7% share, holding USD 17.58 Billion revenue.

The Proptech Market refers to technologies and digital solutions that are applied to real estate processes, assets, and transactions to improve efficiency and user experience. These solutions include digital property listings, intelligent building management systems, virtual tours, data analytics platforms, and automated transaction tools. Proptech brings software driven capabilities to sectors such as residential sales, commercial leasing, facilities management, and property investment.

The market has grown as investors, developers, brokers, and tenants seek greater transparency and faster decision making in property activities. Proptech platforms enable enhanced access to data, optimized workflows, and reduced manual effort in processes such as property search, valuation, and asset performance monitoring. Increasing demand for digital engagement and remote access further reinforces the use of technology in property markets.

One principal driver of the Proptech Market is the rising demand for data driven insights in real estate decision making. Stakeholders require real time information on pricing trends, tenant behaviour, occupancy levels, and market dynamics to guide investment and management actions. Proptech solutions aggregate and analyse these data points, offering predictive analytics and performance benchmarks.

Demand for Proptech solutions is particularly strong among commercial real estate firms, property management companies, and real estate investors. Commercial landlords use digital systems to monitor asset performance, track lease expirations, and manage building operations with higher efficiency. Investors leverage analytics platforms to assess risk, compare opportunities, and forecast returns.

Top Market Takeaways

- By solution, software accounts for 74.6% of the market, powering property management platforms, CRM systems, virtual tours, and analytics dashboards.

- By deployment, on-premises solutions represent 58.5%, favored by organizations prioritizing data sovereignty, legacy integrations, and customization control.

- By end-user, housing associations hold 44.6% share, adopting Proptech for tenant portals, maintenance tracking, rent collection, and compliance reporting.

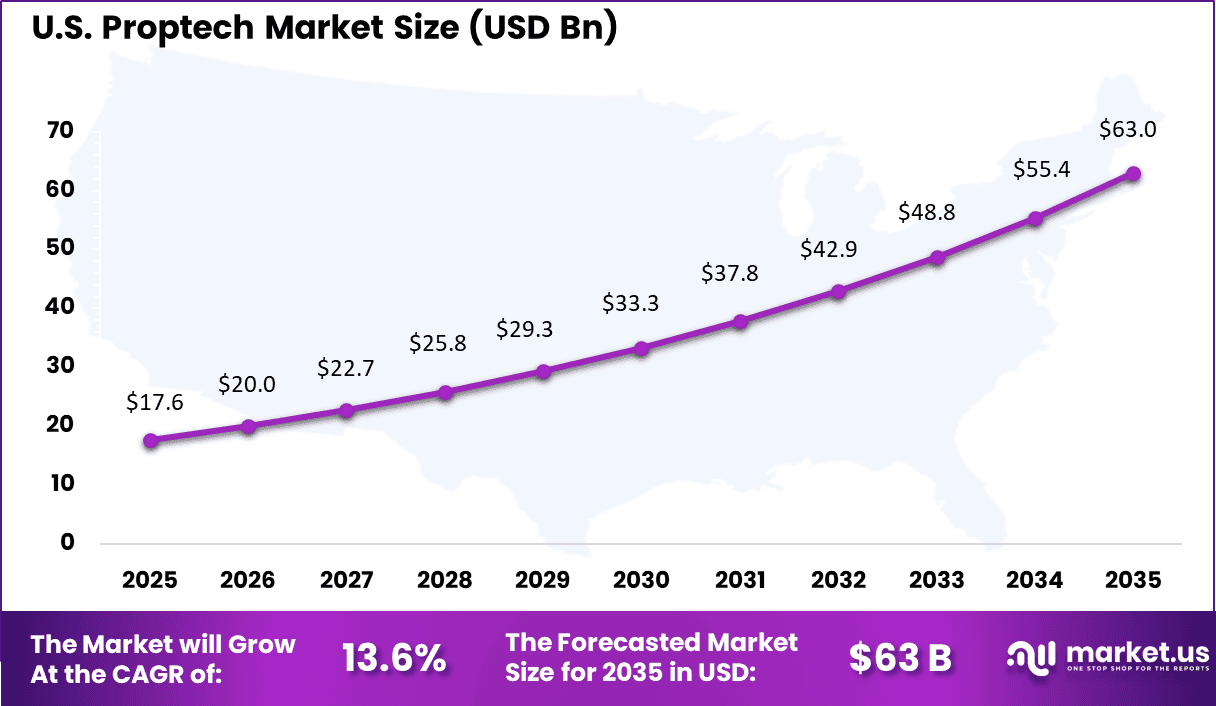

- By region, North America leads with 38.5% of the global market, where the U.S. is valued at USD 17.59 billion with a projected CAGR of 13.6%, driven by digital transformation in real estate and robust VC funding.

Drivers Impact Analysis

Growth Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rising adoption of digital property listing and transaction platforms +2.4% North America, Europe Short to Medium Term Increasing demand for smart buildings and IoT-enabled property management +2.1% North America, APAC, Middle East Medium Term Expansion of fractional ownership and real estate tokenization models +1.8% North America, Europe Medium to Long Term Growth in remote property management and virtual leasing solutions +1.6% Global Short to Medium Term Strong venture capital funding in real estate technology startups +1.9% North America, APAC Short Term Restraints Impact Analysis

Market Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Data privacy and cybersecurity concerns in digital property platforms -1.7% Global Short Term Regulatory uncertainty around tokenized real estate assets -1.5% Europe, North America Medium Term High integration costs with legacy real estate systems -1.3% Global Short to Medium Term Limited digital maturity among traditional real estate operators -1.2% Emerging Markets Medium Term Economic slowdown impacting property transaction volumes -1.8% Global Cyclical By Solution

Software accounts for 74.6% of the proptech market. Real estate stakeholders are increasingly adopting digital platforms to manage property listings, tenant communication, lease administration, and analytics. Software solutions improve operational transparency and streamline property lifecycle management.

Automation of rent collection, maintenance tracking, and reporting enhances efficiency across residential and commercial portfolios. As digital transformation accelerates in real estate, software continues to dominate the solution landscape. Advanced analytics and data-driven insights further strengthen the role of software platforms.

Property managers use dashboards to monitor occupancy rates, financial performance, and asset utilization. Integration with payment gateways and customer management systems improves service delivery. Cloud connectivity and mobile accessibility also enhance user engagement. These technological advantages explain the strong market share held by software solutions.

By Deployment

On-premises deployment represents 58.5% of the proptech market. Many real estate organizations prefer localized control over sensitive tenant and financial data. On-premises systems provide direct oversight of security configurations and compliance processes. This is particularly important for housing authorities and large property portfolios managing regulated data.

Internal infrastructure ensures stable performance and customized integration with legacy systems. Organizations operating under strict regulatory requirements often prioritize data sovereignty. On-premises deployment allows tailored security frameworks aligned with national compliance standards.

Real estate firms with established IT infrastructure also benefit from predictable long-term operational control. Although cloud adoption is growing, on-premises systems remain relevant for data-sensitive environments. These factors support the continued dominance of on-premises deployment.

By End User

Housing associations account for 44.6% of the proptech market. These organizations manage large residential portfolios that require structured tenant management and maintenance coordination. Digital property management tools improve rent tracking, compliance reporting, and communication with residents. Automation enhances operational transparency and reduces administrative workload.

As housing demand rises, associations increasingly adopt digital solutions to optimize performance. Regulatory oversight in affordable and public housing further drives technology adoption. Software platforms support documentation, inspection tracking, and financial accountability.

Centralized data systems improve service delivery and tenant satisfaction. Real-time reporting also supports better asset planning and budgeting decisions. The operational scale of housing associations explains their significant share in the market.

Investor Type Impact Matrix

Investor Type Impact on CAGR Forecast (~%) Geographic Relevance Investment Horizon Venture Capital in Proptech Startups +2.4% North America, Europe Medium Term Private Equity in Real Estate Platforms +1.9% North America Medium to Long Term Corporate Real Estate Developers +1.5% Asia Pacific, North America Medium Term Institutional Asset Managers +1.1% Global Long Term Strategic Technology Firms +0.8% North America Short to Medium Term Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline AI Driven Property Valuation Tools +2.8% North America, Europe Immediate to Medium Term IoT Enabled Smart Building Systems +2.3% Asia Pacific, North America Medium Term Blockchain for Secure Transactions +1.7% Europe, North America Medium to Long Term Cloud Based Property Management Platforms +1.4% Global Immediate Digital Twin Technology +0.9% North America Long Term Key Challenges

- Resistance from traditional real estate players to adopt new digital tools

- High implementation cost for integrating technology with existing property systems

- Data privacy concerns related to tenant and buyer information

- Regulatory differences across regions affecting platform deployment

- Dependence on accurate property data for reliable analytics and valuation tools

Emerging Trends

In the Proptech market, a clear trend is the integration of digital tools that improve transparency and accessibility for property stakeholders. Market participants are adopting platforms that provide clearer insights into leasing terms, maintenance records, and tenant feedback in a single view. This trend reflects a shift from fragmented, paper-based processes to unified digital records that help owners, agents, and occupiers understand property performance and obligations more easily.

Another emerging pattern is the use of simple analytics to identify patterns in property usage and service requests, so that decisions about repairs, space allocation, and tenant engagement can be made with greater confidence and speed.

Growth Factors

A key growth driver in this market is the rising expectation for convenience and clarity among property users. Tenants and buyers increasingly value easy access to information about pricing, availability, and property condition, and digital solutions help meet these expectations. By making data easier to find and understand, organisations improve satisfaction and strengthen long-term relationships.

Another important driver is the need to improve operational efficiency for property owners and managers. Manual tracking of leases, payments, and maintenance schedules can be time consuming and prone to error. Digital systems that centralise these tasks reduce administrative burden, freeing staff to focus on improving service quality and responding to tenant needs in a timely way.

Key Market Segments

By Solution

- Software

- Property Management

- Rental Listings Management

- Applicant Management

- Reporting & Analytics

- Maintenance Activities Management

- Others

- Property Management

- Asset Management

- On/Offline Rent Payments

- Portfolio Management

- Evaluation and Financial Management

- Others

- Sales and Advertisements

- Work Order Management

- Customer Relationship Management (CRM)

- Customer Service

- Customer Experience Management

- CRM Analytics

- Marketing Automation

- Social Media Monitoring

- Others

- Services

- Professional Services

- Managed Services

By Deployment

- Cloud-based

- On-premises

By End-user

- Housing Associations

- Property Managers/Agents

- Property Investors

- Others

Regional Analysis

North America accounts for 38.5% of the proptech market, supported by advanced real estate infrastructure and high digital adoption across commercial and residential segments. Property developers, asset managers, and brokerage firms in the region are increasingly deploying digital platforms for property management, virtual transactions, and data-driven asset valuation. Demand is driven by rising investment in smart buildings, automation of leasing processes, and the need to improve operational efficiency across large property portfolios.

The U.S. market is valued at USD 17.59 Bn and is growing at a CAGR of 13.6%, reflecting strong integration of technology within real estate transactions and management systems. Adoption is influenced by growing use of digital marketplaces, AI-driven property analytics, and cloud-based property management solutions. Growth is further supported by increasing investor focus on transparency, improved tenant experience, and data-backed decision-making across commercial and residential real estate sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Analysis

The Proptech Market is supported by a mix of property technology platforms and digital real estate solution providers. Ascendix Technologies delivers CRM and data driven tools for commercial real estate professionals. Zumper Inc. and Opendoor focus on digital property transactions and rental marketplaces. Zillow, Inc. strengthens online property search and valuation services. Altus Group provides analytics and advisory solutions for real estate assets.

Guesty Inc., ManageCasa, and Qualia specialize in property management and transaction workflow automation. Homelight enhances digital brokerage matching and agent performance insights. Reggora supports appraisal modernization, while Coadjute improves secure data exchange in property transactions. These firms focus on cloud based platforms that simplify documentation, tenant communication, and compliance processes.

Emerging players such as HoloBuilder, Inc., Vergesense, Enertiv, Proptech Group, and other regional vendors expand the market with smart building analytics and construction technology solutions. These companies integrate IoT sensors, data analytics, and building performance monitoring tools. Their solutions support energy efficiency and space optimization. Strategic partnerships with developers and property operators strengthen adoption.

Top Key Players in the Market

- Ascendix Technologies

- Zumper Inc.

- Opendoor

- Altus Group

- Guesty Inc.

- HoloBuilder, Inc.

- Zillow, Inc.

- ManageCasa

- Coadjute

- Vergesense

- Reggora

- Enertiv

- Homelight

- Proptech group

- Qualia

- Others

Future Outlook

The future outlook for the Proptech Market is positive as technology adoption in real estate continues to increase. Demand for proptech solutions is expected to grow because these tools help improve property search, management, transactions, and analytics. Adoption of digital platforms, artificial intelligence, and data-driven insights will support faster decision making and better customer experiences.

Growth can be attributed to rising demand for efficiency, transparency, and automation in real estate operations. Overall, the market is expected to expand as businesses and consumers prioritize connected and tech-enabled property solutions.

Recent Developments

- In February 2025, Bayut Egypt launched a new marketing campaign aimed at advancing digital transformation in Egypt’s real estate sector. The platform draws on more than 15 years of experience in the MENA region to deliver a technology driven and streamlined property search experience.

- In April 2025, a Canadian property technology company introduced UNLOCKLAND to address challenges linked to the national affordable housing shortage. The platform is designed to reduce site evaluation timelines from an average of 10 weeks to nearly 10 minutes, improving planning efficiency and accelerating housing development decisions.

- In March 2025, the Dubai Land Department partnered with REACH, an accelerator supported by the National Association of REALTORS, to launch REACH Middle East. The initiative is intended to attract emerging proptech firms to Dubai and strengthen innovation across the regional real estate ecosystem.

Report Scope

Report Features Description Market Value (2025) USD 45.7 Billion Forecast Revenue (2035) USD 178.5 Billion CAGR(2025-2035) 14.60% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Solution (Software [Property Management (Rental Listings Management, Applicant Management, Others), Asset Management (On/Offline Rent Payments, Others), Sales and Advertisements, Work Order Management, Customer Relationship Management (Customer Service, Customer Experience Management), Others], Services [Professional Services, Managed Services]), By Deployment (Cloud-based, On-premises), By End-user (Housing Associations, Property Managers/Agents, Property Investors, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Ascendix Technologies, Zumper Inc., Opendoor, Altus Group, Guesty Inc., HoloBuilder, Inc., Zillow, Inc., ManageCasa, Coadjute, Vergesense, Reggora, Enertiv, Homelight, Proptech Group, Qualia, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Ascendix Technologies

- Zumper Inc.

- Opendoor

- Altus Group

- Guesty Inc.

- HoloBuilder, Inc.

- Zillow, Inc.

- ManageCasa

- Coadjute

- Vergesense

- Reggora

- Enertiv

- Homelight

- Proptech group

- Qualia

- Others