Global Procure-to-Pay Software Market Size, Share, Statistics Analysis Report By Deployment (On-premise, Cloud-based), By Enterprise Size (SMEs, Large Enterprises), By End-use Industry (Retail & E-commerce, Manufacturing, Healthcare, BFSI, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Nov. 2024

- Report ID: 133249

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Deployment Insights

- Enterprise Size Insights

- End-use Industry Insights

- Best 7 Procure to Pay Software Vendors

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

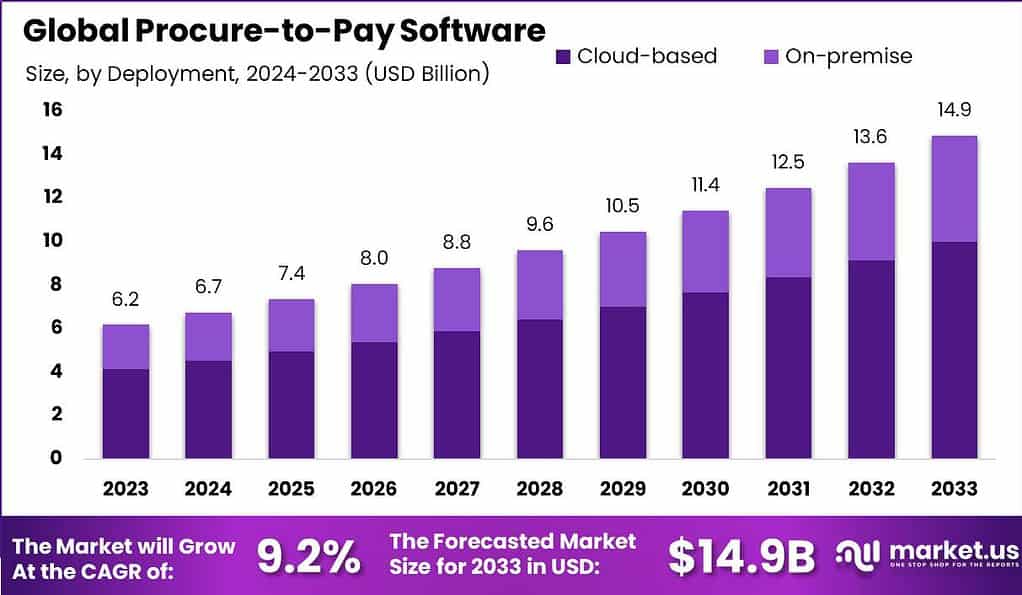

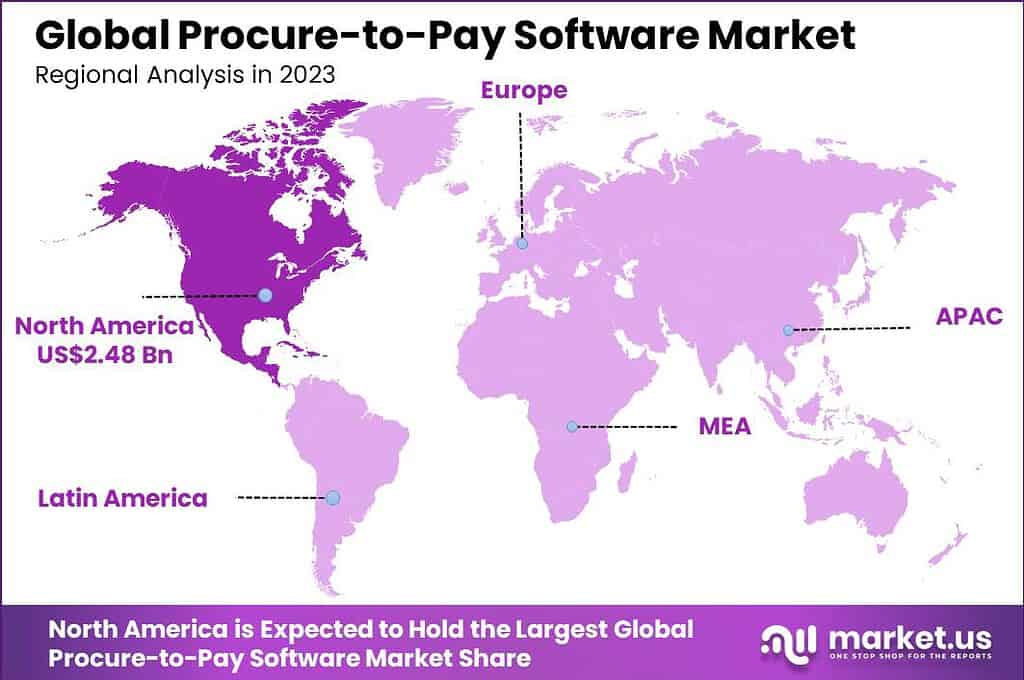

The Global Procure-to-Pay Software Market size is expected to be worth around USD 14.9 Billion By 2033, from USD 6.2 billion in 2023, growing at a CAGR of 9.2% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 40% share, holding USD 2.48 Billion revenue.

Procure-to-Pay (P2P) software is a system that organizations use to manage the entire process of purchasing goods and services. This software streamlines the steps from raising a purchase order through to the payment of the invoice. The key functionality of P2P software includes automating approvals, matching invoices to purchase orders and receipts, and facilitating quick payments to suppliers.

The market for Procure-to-Pay software is evolving as businesses of all sizes recognize the necessity of optimizing their purchasing processes. This market includes a range of software solutions from cloud-based platforms to on-premise installations, catering to diverse industries such as manufacturing, healthcare, and retail. As businesses seek more agility and integration in their operations, the demand for sophisticated, scalable, and secure P2P solutions is rising, driving growth in this sector.

The primary drivers for the growth of the procure-to-pay software market include the need for improved operational efficiency and the automation of manual tasks, which reduce the time and cost associated with procurement and payments. Technological advancements such as artificial intelligence and machine learning are increasingly being integrated into P2P solutions, enhancing their capability to provide real-time analytics and smarter spend management solutions.

Demand in the procure-to-pay software market is particularly robust among large enterprises and the healthcare sector, where the management of extensive procurement activities and compliance with regulatory standards are crucial. The shift towards digital transformation, coupled with the global expansion of businesses, presents significant opportunities for the market. Moreover, the integration of advanced technologies like AI to analyze spend data and automate workflows offers potential for market expansion.

Businesses benefit from procure-to-pay software through enhanced visibility into spending, which aids in better financial planning and budget management. The automation provided by P2P systems also reduces the likelihood of errors and improves compliance with corporate policies and external regulations. These systems support strategic decision-making by providing detailed insights into procurement data, which can identify cost-saving opportunities and optimize supplier relationships.

Recent innovations in procure-to-pay software focus on enhancing user experience through intuitive interfaces and mobile accessibility, which accommodate on-the-go approvals and real-time decision-making. Providers are increasingly leveraging cloud technology to offer more scalable and secure solutions that can adapt to varying organizational needs. Additionally, the integration of AI and machine learning continues to advance, offering smarter and more predictive capabilities in spend analysis and vendor management.

According to llcbuddy, Transforming the traditional finance department into a modern, data-driven finance office has the potential to reduce costs by 20%-30% in the procure-to-pay (P2P) process. One major issue affecting suppliers is the inability to track invoices and payments, with 27% of respondents identifying it as highly detrimental to their operations. Late payments also continue to plague businesses, with nearly one in three respondents reporting 20% of their invoices are overdue.

Supplier pain points extend beyond late payments. Match exception errors – discrepancies between purchase orders, receipts, and invoices – were flagged by 29% of respondents as influencing their accounts payable procedures. Late payments top concerns for accounts receivable teams, with 66% of suppliers citing them as a significant challenge. Improving these processes requires precision and prioritization to reduce inefficiencies and improve supplier relationships.

For effective cost management, achieving at least 90% categorization accuracy is the baseline. However, 95% or higher accuracy is essential for uncovering cost-saving opportunities and monitoring savings effectively. Companies striving for these benchmarks should focus on leveraging authentic data insights that cover 100% of their expenditure data for better decision-making.

Adopting automation and going paperless can cut invoice processing costs by up to 80%, freeing personnel to focus on strategic work rather than repetitive tasks. With rising demand for e-procurement, Europe is expected to dominate the market, holding 27.28% of the global procure-to-pay software market, driven by countries like the UK, France, and Germany.

Key Takeaways

- The Global Procure-to-Pay Software Market is projected to reach a market value of USD 14.9 billion by 2033, growing from USD 6.2 billion in 2023 at a robust CAGR of 9.2% over the forecast period (2024–2033).

- In 2023, North America held a commanding lead in the global market, generating over USD 2.48 billion in revenue and accounting for more than 40% of the total market share.

- The cloud-based solutions segment emerged as a significant growth driver, holding a dominant position with over 67% share of the global procure-to-pay software market in 2023. This reflects a strong shift toward scalable and flexible digital procurement solutions.

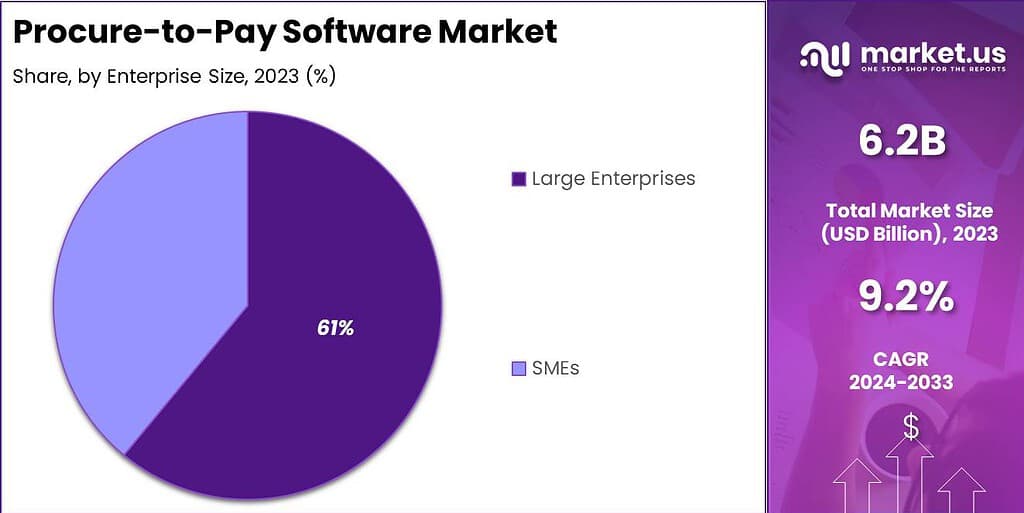

- Large Enterprises dominated the customer base, contributing over 61% of the total market share in 2023. Their need for streamlined procurement and payment processes fueled the adoption of these solutions.

- The Manufacturing industry stood out as a key end-user segment, capturing over 25% of the global market in 2023, driven by the sector’s complex supply chains and demand for enhanced operational efficiency.

Deployment Insights

In 2023, the cloud-based segment of the procure-to-pay software market held a dominant position, capturing more than a 67% share of the global market. This significant market share can be attributed to several compelling advantages that cloud-based solutions offer over traditional on-premise deployments.

Firstly, cloud-based procure-to-pay solutions provide greater scalability, which is essential for businesses experiencing growth or with fluctuating demand. These systems allow organizations to easily adjust their usage without the need for significant upfront investment in IT infrastructure. This flexibility is particularly valuable in dynamic market conditions where quick adaptation is crucial for maintaining operational efficiency.

Furthermore, cloud-based solutions offer enhanced accessibility, enabling users to access the platform from any location at any time, provided they have internet connectivity. This feature supports remote work environments and facilitates better collaboration between departments and geographically dispersed teams. The ability to process procurements and payments remotely has become increasingly important, particularly in light of shifts in work patterns following global events such as the COVID-19 pandemic.

Another significant advantage is the lower total cost of ownership associated with cloud-based procure-to-pay systems. Unlike on-premise solutions, which often require substantial initial capital expenditure for hardware and software licenses, cloud services typically operate on a subscription basis. This model spreads the cost over time and includes regular updates and maintenance, reducing the burden on internal IT teams and lowering the barriers to entry for smaller businesses that may lack extensive IT resources.

Lastly, cloud-based procure-to-pay software frequently incorporates the latest security measures, managed by expert service providers. This setup ensures that data is securely handled and maintained, adhering to compliance standards without requiring additional investment from the user.

Enhanced security features, coupled with automatic updates and the integration of emerging technologies like AI and machine learning for improved data analysis and fraud detection, contribute to the growing preference for cloud-based solutions over on-premise options in the procure-to-pay software market. These factors collectively drive the continued dominance and expansion of the cloud-based segment in the marketplace.

Enterprise Size Insights

In 2023, the Large Enterprises segment held a dominant market position within the procure-to-pay software market, capturing more than a 61% share. This predominance is largely due to several factors that align with the operational needs and financial capabilities of large organizations.

Firstly, large enterprises often manage complex and voluminous procurement transactions that necessitate robust software solutions capable of handling such scale and complexity. Procure-to-pay software offers comprehensive features that streamline procurement processes, enhance compliance, and provide detailed spend analytics, which are crucial for large organizations looking to maintain control over their extensive procurement activities.

This level of functionality is critical for large enterprises that need to integrate their procurement activities with other business systems to achieve efficiency and strategic spending insights. Moreover, large enterprises typically have the financial resources to invest in advanced procure-to-pay solutions that might be cost-prohibitive for smaller businesses.

These investments are seen as strategically important for sustaining growth and maintaining competitive advantage through optimized supply chain management and reduced operational costs. The ability to customize procure-to-pay solutions to fit the specific needs of a large organization is also a significant factor driving the adoption in this segment.

Additionally, large enterprises are often more likely to operate across multiple geographical regions, necessitating a procure-to-pay system that can support different languages, comply with various regional regulations, and handle multiple currencies seamlessly. The availability of sophisticated cloud-based procure-to-pay solutions fulfills these requirements by offering globally accessible, compliant, and scalable systems that align with the operational demands of large multinational corporations.

The significant market share held by the Large Enterprises segment is reflective of the critical need for efficient, scalable, and compliant procure-to-pay solutions that can support the complex and expansive operations of large businesses. These solutions not only facilitate seamless global operations but also provide strategic insights that are vital for maintaining competitiveness in a rapidly evolving market landscape.

End-use Industry Insights

In 2023, the Manufacturing segment held a dominant market position in the Procure-to-Pay software market, capturing more than a 25% share. This prominence is attributed to the complex supply chain networks and the high volume of transactions typical in the manufacturing industry.

Manufacturers are increasingly relying on P2P solutions to streamline their procurement processes, reduce procurement cycle times, and manage supplier relationships more efficiently. This trend is particularly pronounced in sectors with high production outputs, where managing raw materials and component supplies is critical to maintaining steady production lines without interruptions.

Manufacturers are also facing growing pressures to comply with regulatory standards and to adopt sustainable practices. Procure-to-Pay software assists in enforcing compliance by ensuring that all procurement activities adhere to predefined regulations and standards.

The ability to maintain a transparent audit trail of procurement activities enhances accountability and reporting accuracy, which are crucial for manufacturers facing strict compliance requirements. Furthermore, P2P systems support sustainability initiatives by facilitating the selection of suppliers who meet certain environmental and social governance criteria.

Technological advancements within P2P software, such as the integration of artificial intelligence and machine learning, have made these systems even more attractive to the manufacturing sector. These technologies enhance the software’s ability to predict supply needs, optimize inventory levels, and anticipate potential disruptions in the supply chain.

Consequently, manufacturers can mitigate risks and make more informed decisions, which is essential in a sector where timing and precision are paramount. Overall, the manufacturing industry’s adoption of Procure-to-Pay software is driven by the need to enhance operational efficiency, ensure compliance and sustainability, and harness the power of data for better decision-making.

As manufacturers continue to face global competition and supply chain complexities, the reliance on sophisticated P2P solutions is expected to grow, further solidifying this segment’s leading position in the market.

Best 7 Procure to Pay Software Vendors

- Coupa: Recognized for its AI-driven spend management, Coupa provides comprehensive procurement solutions that integrate seamlessly with existing financial systems. It’s particularly noted for operational procurement and invoice management, making it a leader in the space.

- SAP Ariba: A key player in procurement analytics and supplier management, SAP Ariba offers a wide range of capabilities from procurement to financial supply chain management, making it ideal for organizations looking for extensive integration capabilities and a robust supplier network.

- Procurify: Suitable for mid-size companies, Procurify offers a feature-rich platform with capabilities such as real-time budget visibility and approval workflows. It’s praised for its user-friendly interface and extensive features that cater to comprehensive procure-to-pay processes.

- Stampli: This cloud-based platform excels in enhancing efficiency across the procure-to-pay cycle, integrating cognitive AI for high accuracy in PO matching and streamlining invoice processing. It’s designed to adapt to existing ERP systems, making it flexible for various business needs.

- Tipalti: Known for its global payments and AP automation capabilities, Tipalti simplifies complex, multinational procure-to-pay processes. It’s particularly valued for its ability to handle mass payments and compliance management across various countries.

- Spendflo: Aimed at optimizing the power of SaaS spending, Spendflo offers tailored solutions to manage contracts, track renewals, and negotiate SaaS procurement effectively. Its platform is designed to save costs and streamline approvals, especially beneficial for businesses heavily invested in SaaS tools.

- Peakflo: As an all-in-one financial management powerhouse, Peakflo automates tasks like managing invoices and paying vendors. It’s praised for simplifying purchasing and payment tasks, making it easier for teams to handle procurement efficiently.

Key Market Segments

By Deployment

- On-premise

- Cloud-based

By Enterprise Size

- SMEs

Large Enterprises

By End-use Industry

- Retail & E-commerce

- Manufacturing

- Healthcare

- BFSI

- Others

Driver

Increasing Demand for Automation and Efficiency in Procurement Processes

The procure-to-pay software market is experiencing significant growth, primarily driven by the escalating demand for automation within procurement processes. Organizations are increasingly adopting these solutions to enhance efficiency, reduce operational costs, and streamline procurement activities.

Automation facilitates faster processing, minimizes manual errors, and ensures compliance with industry regulations, making it a critical factor in improving the procurement cycle. This trend is supported by the integration of advanced technologies such as artificial intelligence (AI) and machine learning, which further refine the procurement process by offering predictive analytics and risk management capabilities.

Restraint

High Implementation Costs and Complexity

One of the major restraints in the procure-to-pay software market is the high cost of implementation and the complexity associated with integrating new systems into existing IT infrastructure. Many organizations face significant challenges during the deployment phase, including the need for substantial upfront investment and the potential disruption of existing processes.

Additionally, the ongoing maintenance costs and the need for training staff to effectively use new software systems can further deter businesses from adopting procure-to-pay solutions. These challenges are often more pronounced in smaller organizations that may lack the necessary resources or expertise to manage such transitions effectively.

Opportunity

Expansion into New Markets and Sectors

The growing adoption of cloud-based solutions presents significant opportunities for the expansion of the procure-to-pay software market. As businesses increasingly move towards digital operations, the flexibility, scalability, and cost-effectiveness of cloud-based platforms make them attractive options for managing procurement processes.

This trend is particularly relevant in developing regions, where businesses are rapidly modernizing their operations to keep pace with global standards. Furthermore, the expansion of the e-commerce sector and the increasing complexity of supply chains across industries provide additional growth avenues for procure-to-pay solutions, catering to the needs for enhanced spend visibility and supplier management.

Challenge

Cybersecurity Threats and Data Privacy Concerns

As procure-to-pay systems handle sensitive financial data, they are frequent targets for cyber threats and data breaches. The challenge of ensuring data security and privacy is compounded by the stringent regulatory requirements such as the General Data Protection Regulation (GDPR) and other industry-specific guidelines.

Vendors must continually invest in robust cybersecurity measures and ensure their solutions comply with these regulations to protect client data and maintain trust. The dynamic nature of cybersecurity threats requires ongoing vigilance and adaptation, which can be resource-intensive and requires a proactive approach from both providers and users of procure-to-pay software.

Growth Factors

The procure-to-pay software market is primarily driven by the increasing need for streamlined procurement processes and enhanced efficiency in financial operations. Organizations across various industries are turning to procure-to-pay solutions to manage their spending, improve procurement efficiency, and reduce costs associated with manual procurement processes.

The integration of advanced technologies like AI and machine learning enhances these systems’ capabilities, providing better spend analytics and decision support, which further propels market growth. Additionally, the shift towards digital transformation and the adoption of cloud-based solutions are significant growth factors.

Emerging Trends

A key trend in the procure-to-pay software market is the increasing adoption of cloud-based solutions, which provide organizations with cost-effective, scalable, and accessible procurement solutions. Another trend is the focus on enhancing cybersecurity measures within these platforms, as data security is a paramount concern for companies handling sensitive financial information.

The market is also seeing a shift towards mobile-friendly solutions, catering to the needs of on-the-go access to procurement data and operations, aligning with the increasing use of mobile devices in the workplace.

Furthermore, the incorporation of artificial intelligence and machine learning continues to evolve, enabling more predictive analytics and smarter spend management practices. These technological advancements are setting new standards for efficiency and innovation in the procure-to-pay sector.

Business Benefits

Procure-to-pay software offers a multitude of benefits for businesses, particularly in enhancing operational efficiencies and controlling expenses. By automating key procurement processes such as purchase orders, invoicing, and payments, businesses can significantly reduce the time and labor associated with manual processing.

This not only cuts costs but also minimizes errors and improves compliance with company policies and external regulations. Additionally, these systems provide comprehensive visibility into organizational spend, enabling better financial management and strategic decision-making. Companies using procure-to-pay solutions often experience improved supplier relationships due to more timely and accurate payment processes, further adding to the operational benefits of these systems.

Regional Analysis

In 2023, North America held a dominant market position in the Procure-to-Pay software market, capturing more than a 40% share, with revenue reaching USD 2.48 billion. This leadership can be attributed to several factors, primarily the region’s quick adoption of advanced technologies and the strong presence of leading software developers.

North American businesses, particularly in the United States and Canada, are pioneers in digital transformation, seeking new technologies that can streamline operations and enhance business efficiencies. This readiness to embrace innovation has naturally led to the early and widespread adoption of Procure-to-Pay solutions across various industries, including manufacturing, healthcare, and retail.

Moreover, North America boasts a robust financial sector that demands meticulous financial management and compliance with strict regulatory standards. Procure-to-Pay software helps businesses in this region manage their spending and procurement processes more transparently and compliantly, which is essential for adhering to the complex regulations that govern these industries.

Additionally, the integration capabilities of P2P systems with other enterprise software are highly valued in North America, where businesses often use a range of IT solutions to manage their operations. Another contributing factor to North America’s leading position is the region’s strong focus on optimizing operational efficiency to sustain competitiveness in global markets.

P2P software supports this objective by automating key procurement processes, reducing errors, and enabling more strategic decision-making through data analytics and management dashboards. As North American companies continue to seek ways to cut costs and enhance productivity, the demand for sophisticated P2P solutions is expected to grow.

The combination of a tech-savvy business culture, stringent regulatory requirements, and a continuous drive for operational excellence keeps North America at the forefront of the Procure-to-Pay software market. As these trends persist, the region’s dominance in the global market is likely to continue, supported by technological advancements and the deep integration of P2P systems into broader business practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The procure-to-pay (P2P) software market has seen significant activity among its leading companies, particularly in terms of acquisitions, product launches, and mergers.

SAP has been actively enhancing its P2P offerings through strategic acquisitions and product developments. In June 2024, SAP agreed to acquire WalkMe, a digital adoption platform provider, for approximately $1.5 billion. This acquisition aims to enhance SAP’s business artificial intelligence offerings. Additionally, SAP has been integrating advanced analytics and artificial intelligence into its Procurement Cloud solutions to improve procurement efficiency and decision-making processes.

Coupa Software has also been a key player in the P2P market, focusing on expanding its capabilities through acquisitions and product enhancements. In December 2022, private equity firm Thoma Bravo announced its intention to acquire Coupa Software for $8 billion. The deal was completed in the first half of 2023, marking a significant consolidation in the P2P software market.

Oracle has been strengthening its position in the P2P market through continuous product enhancements and strategic partnerships. Throughout 2023 and 2024, Oracle has continued to enhance its Procurement Cloud offerings, integrating advanced analytics and artificial intelligence to improve procurement efficiency and decision-making processes. These developments reflect Oracle’s commitment to providing comprehensive and efficient procurement solutions to its clients.

Top Key Players in the Market

- SAP

- Coupa Software

- Oracle

- GEP Smart

- Ivalua

- Jaggaer

- Zycus

- Basware

- Proactis

- Comarch

- Tradeshift

- Precoro

- Other Key Players

Recent Developments

- In November 2023, Payhawk launched its new Purchase Orders system, aiming to simplify and automate procure-to-pay processes for businesses. This upgrade addresses inefficiencies in procurement, helping organizations streamline requests, approvals, and payments. With companies increasingly seeking solutions to manage global spending, this move positions Payhawk as a more competitive player in the spend management space, tackling a market estimated to grow at CAGR 10.2% annually.

- Earlier in May 2023, Zip enhanced its Intake-to-Procurement platform with fresh procure-to-pay features, delivering a seamless experience through its Intake-to-Pay solution. This all-in-one platform integrates spend requests, approvals, and payment processing under one system. By reducing complexity and improving transparency in procurement workflows, Zip targets the growing demand for unified platforms, aiming to capture a larger share of the $15 billion spend management market.

Report Scope

Report Features Description Market Value (2023) USD 6.2 Bn Forecast Revenue (2033) USD 14.9 Bn CAGR (2024-2033) 9.2% Largest Market North America Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Deployment (On-premise, Cloud-based), By Enterprise Size (SMEs, Large Enterprises), By End-use Industry (Retail & E-commerce, Manufacturing, Healthcare, BFSI, Others) Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape SAP, Coupa Software, Oracle, GEP Smart, Ivalua, Jaggaer, Zycus, Basware, Proactis, Comarch, Tradeshift, Precoro, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Procure-to-Pay Software MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Procure-to-Pay Software MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP

- Coupa Software

- Oracle

- GEP Smart

- Ivalua

- Jaggaer

- Zycus

- Basware

- Proactis

- Comarch

- Tradeshift

- Precoro

- Other Key Players