Global Processed And Frozen Fruits Market Size, Share Analysis Report By Fruit Type (Berries, Tropical Fruits, Citrus Fruits, Pome Fruits, Stone Fruits, Melons and Grapes), By Processing Type (Canned Fruits, Dried Fruits, Pureed Fruits, Freeze-Dried Fruits), By Distribution Channel (Supermarkets/Hypermarkets, Foodservice, Convenience Stores, Online Retail Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 162127

- Number of Pages: 238

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

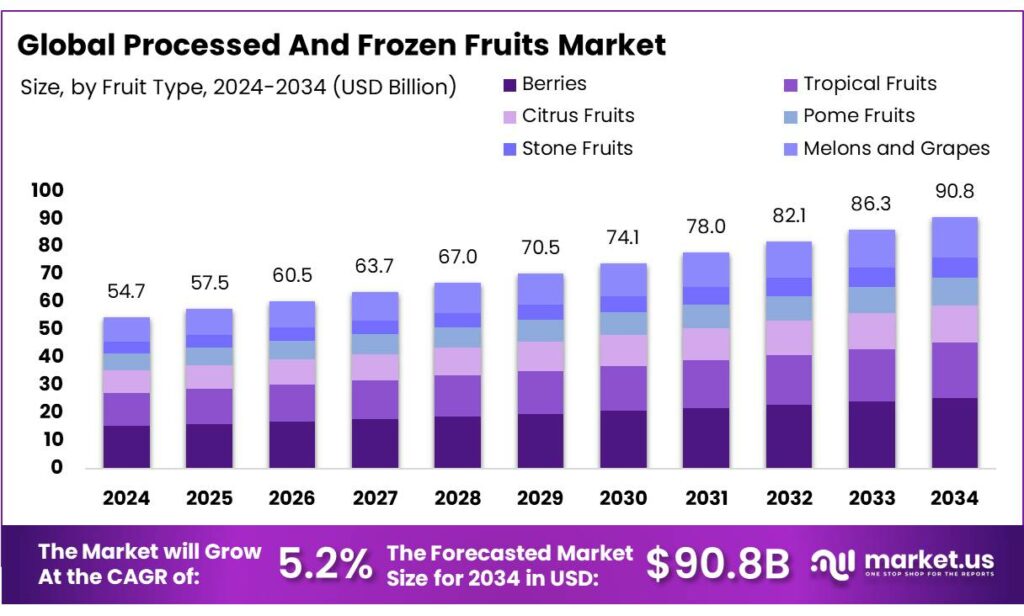

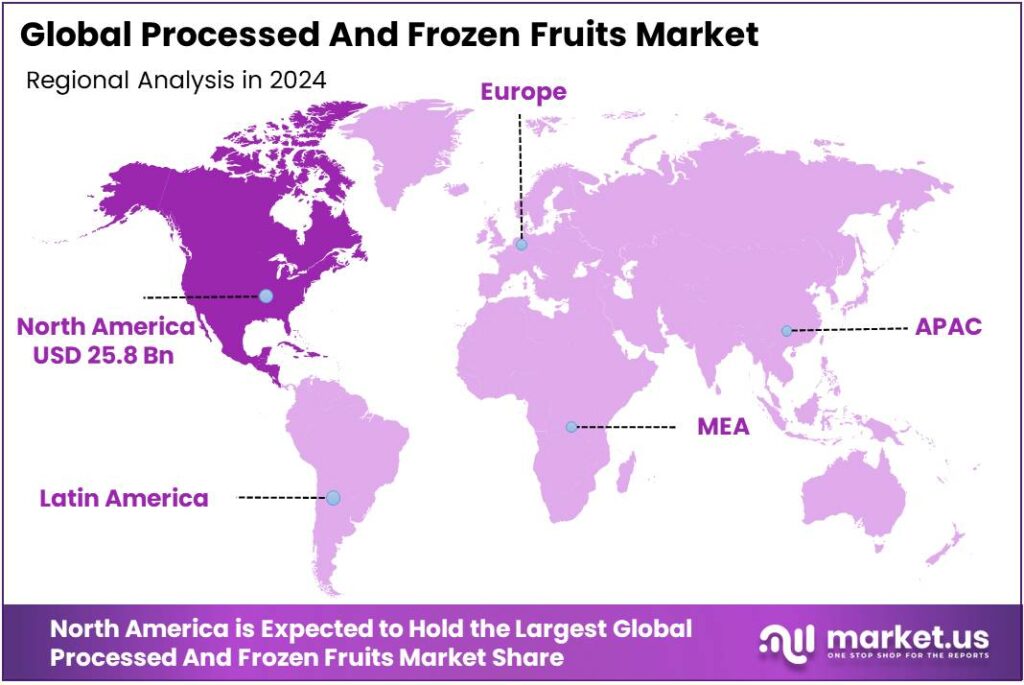

The Global Processed And Frozen Fruits Market size is expected to be worth around USD 90.8 Billion by 2034, from USD 54.7 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 47.30% share, holding USD 25.8 Billion in revenue.

Processed and frozen fruits sit at the intersection of food security, cold-chain infrastructure, and energy systems. Globally, inefficiencies from farm to retail are still material: the FAO estimates 13.3% of food output is lost between harvest and retail—around 1.31 billion tonnes—underscoring the role of freezing, drying, canning, and aseptic processing to stabilize supply and extend shelf life. The segment’s energy exposure is rising with heat and electrification: in India, the IEA observed that each +1 °C increase in outdoor temperature in 2024 added about 7 GW to peak power demand, a trend that strains processing plants and refrigerated logistics during heat waves.

Industrial structure is anchored by cold storage and temperature-controlled transport, where large 3PLs aggregate capacity and reliability. Global Cold Chain Alliance (GCCA) publishes annual “Top 25” lists of the world’s and North America’s largest refrigerated warehousing providers, signaling capacity consolidation and service standardization across key fruit export/import corridors. Technology adoption is also shaped by refrigerant policy: under the U.S. AIM Act, aligned to the Kigali Amendment, HFC production/consumption is scheduled to be cut 85% by 2036, accelerating transitions to lower-GWP refrigerants and new system designs in fruit processing/freezing lines.

Demand is supported by waste-reduction economics and health-convenience trends, but the decisive macro driver is cooling demand. The IEA projects residential air-conditioning alone will require an additional 700 TWh of electricity by 2035, which raises system-wide capacity needs and tariffs that directly impact blast freezers, cold rooms, and refrigerated transport OPEX. On the supply-side, reducing post-harvest losses in fruits/vegetables is particularly impactful; historical FAO work places losses for these categories as high as 44% along the chain in some contexts, strengthening the economic case for pack-houses, rapid precooling, IQF lines, and regional cold stores proximate to orchards and collection centers.

Government initiatives are increasingly targeted at value-chain gaps. In India, the Cabinet increased the outlay for Pradhan Mantri Krishi Sampada Yojana to ₹6,520 crore, with an additional ₹1,920 crore through FY26 to strengthen agro-processing and cooperatives—key for fruit grading, cold rooms, and reefer connectivity. The scheme’s cold-chain component spans farm-gate precooling through ripening chambers and integrated pack-houses, improving utilization for fruit processors.

- In Europe, the Commission will co-fund €132 million in 2025 to promote sustainable, high-quality agri-food—supportive of premium frozen/processed fruit categories and origin labeling. Member-state actions add momentum: Spain requested €391 million under CAP to support fruit and vegetable producer organizations in 2025, reinforcing upstream supply for processors.

Key Takeaways

- Processed And Frozen Fruits Market size is expected to be worth around USD 90.8 Billion by 2034, from USD 54.7 Billion in 2024, growing at a CAGR of 5.2%.

- Berries held a dominant market position, capturing more than a 35.2% share of the processed and frozen fruits market.

- Canned fruits held a dominant market position, capturing more than a 34.8% share of the processed and frozen fruits market.

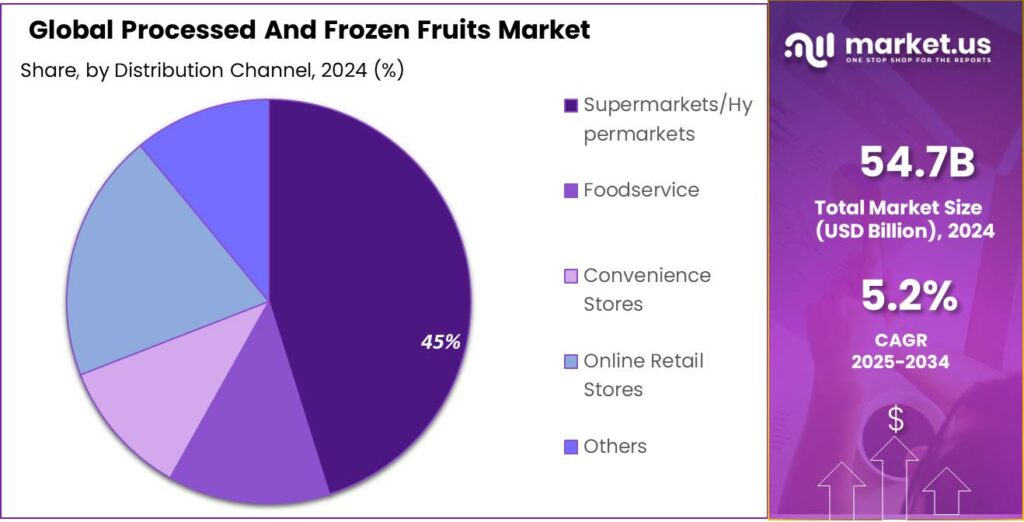

- Supermarkets and Hypermarkets held a dominant market position in the processed and frozen fruits sector, capturing more than a 45.3% share.

- North America maintained a commanding position in the processed and frozen fruits market, holding 47.30% of regional share and an estimated market value of USD 25.8 billion.

By Fruit Type Analysis

Berries Lead Processed and Frozen Fruits Market with 35.28% Share in 2024

In 2024, berries held a dominant market position, capturing more than a 35.2% share of the processed and frozen fruits market. This segment’s prominence is attributed to the high nutritional value, versatility, and year-round availability of berries such as strawberries, blueberries, raspberries, and blackberries. These fruits are rich in antioxidants, vitamins, and fiber, aligning with the growing consumer preference for health-conscious food choices.

The segment is expected to maintain its dominant position as consumer demand for convenient, ready-to-use fruit products continues to grow. Advancements in freezing technology and cold chain logistics have preserved the flavor, texture, and nutritional quality of berries, encouraging increased consumption across retail and foodservice channels. Additionally, rising awareness about the role of antioxidants in immunity and overall health supports the segment’s sustained growth.

By Processing Type Analysis

Canned Fruits Segment Captures 34.8% Market Share in 2024

In 2024, canned fruits held a dominant market position, capturing more than a 34.8% share of the processed and frozen fruits market. This segment’s prominence is attributed to the long shelf life, affordability, and widespread availability of canned fruits, making them a staple in households and foodservice industries worldwide. Canned fruits offer convenience and versatility, retaining essential nutrients and flavors, which appeal to consumers seeking ready-to-eat options.

The market share of canned fruits has demonstrated a steady growth trajectory. From 2023 to 2024, the segment experienced an increase in its share, reflecting the growing consumer preference for convenient and shelf-stable fruit options. This growth is further supported by advancements in canning technology and improved distribution networks, ensuring the availability of high-quality canned fruits year-round.

By Distribution Channel Analysis

Supermarkets/Hypermarkets Dominate Processed and Frozen Fruits Market with 45.3% Share in 2024

In 2024, supermarkets and hypermarkets held a dominant market position in the processed and frozen fruits sector, capturing more than a 45.3% share. This retail channel’s prominence is attributed to its extensive reach, established infrastructure, and the convenience it offers to consumers seeking a wide variety of frozen fruit products under one roof.

The increasing trend of weekly grocery shopping trips, coupled with the preference for fresh-looking yet long-shelf-life frozen products, reinforces supermarkets and hypermarkets as the primary purchase points. Additionally, enhanced cold-chain logistics and in-store storage facilities ensure that the quality and nutritional content of frozen fruits are preserved, boosting consumer confidence.

Key Market Segments

By Fruit Type

- Berries

- Tropical Fruits

- Citrus Fruits

- Pome Fruits

- Stone Fruits

- Melons and Grapes

By Processing Type

- Canned Fruits

- Dried Fruits

- Pureed Fruits

- Freeze-Dried Fruits

By Distribution Channel

- Supermarkets/Hypermarkets

- Foodservice

- Convenience Stores

- Online Retail Stores

- Others

Emerging Trends

Clean-Label & Sustainability Take Center Stage in Frozen Fruits

One of the most notable trends driving the processed and frozen fruits industry is the rising consumer demand for clean-label products and sustainable supply chains. People today are more aware of what they eat — not just tasting good, but also made simply, with fewer additives, and in ways that respect the environment.

- For example, the American Frozen Food Institute (AFFI) reports that 83% of U.S. consumers view frozen foods as a smart way to reduce household food waste, and 79% appreciate the ability to prepare exact portions instead of tossing leftovers.

Sustainability also ties in: frozen fruits help reduce spoilage, especially when fresh supply is erratic or during off-season periods. Research shows that frozen produce has significantly lower waste rates compared to fresh produce — one survey found discarded frozen food items made up about 6% of wasted household food in the U.S., implying that frozen formats play a meaningful role in curbing waste. For a fruit processor, this is not just a marketing point—it translates into improved yields, fewer write-offs, and a stronger value proposition for foodservice and retail customers looking to control waste.

From a policy and programmatic standpoint, health authorities are also signalling openness to frozen fruit formats. The Dietary Guidelines for Americans (2020-2025) clearly states that the “Fruit group includes all fruits… fresh, frozen, canned, or dried/dehydrated.” This recognition supports frozen fruits being considered nutritionally equivalent to fresh in institutional settings (schools, hospitals, elder-care), which in turn opens demand channels for processors.

Drivers

Cutting post-harvest fruit losses through cold-chain expansion

A single, powerful force is pushing demand for processed and frozen fruits: the urgent need to reduce post-harvest losses. The Food and Agriculture Organization (FAO) estimates that 13.2% of all food produced is lost between harvest and retail. For fruits and vegetables specifically, losses can reach up to 40% in some contexts due to inadequate cooling, handling, and storage.

Waste at the consumer end is also massive, creating price and supply volatility that processors can help smooth. The United Nations Environment Programme (UNEP) reports that 1.05 billion tonnes of food were wasted in 2022, equal to 19% of food available to consumers across households, food service, and retail. Households alone account for 631 million tonnes, showing the scale of inefficiency and the opportunity for longer-life formats like individually quick frozen (IQF) fruit.

Energy and cooling dynamics reinforce this driver. Space cooling is the fastest-growing source of buildings energy demand and is rising by almost 4% annually to 2035 under today’s policies, according to the International Energy Agency (IEA). As grids in emerging markets face hotter summers and tighter capacity, locating efficient cold rooms and IQF lines near farms lowers transport times and shrinkage while managing energy peaks more effectively.

- The International Renewable Energy Agency (IRENA) also projects global energy demand for cooling to increase by about 45% by 2050, underscoring why energy-efficient refrigeration and heat-pump systems are core to fruit value chains.

Public policy is aligning behind this loss-reduction agenda. India’s government has expanded support for integrated cold chains under the Pradhan Mantri Kisan Sampada Yojana (PMKSY): a total outlay of ₹6,520 crore for 2021–2026, including an additional ₹1,920 crore approved in 2025, with operational guidelines detailing precooling, grading, packing, ripening, and reefer transport coverage. By June 2025, 1,601 projects had been approved under PMKSY, with 1,133 operational or completed—benefiting over 3.4 million farmers—an indicator that upstream supply for processors is broadening and becoming more reliable.

Restraints

Energy-intensive cold chains and refrigerant compliance costs

A major brake on the processed and frozen fruits market is the rising cost and complexity of keeping products cold end-to-end. The food cold chain already accounts for an estimated 4% of global greenhouse-gas emissions—from refrigeration equipment, electricity use, and avoidable losses where cold capacity is missing or unreliable. That footprint brings pressure to decarbonize and adds compliance and capital costs for processors, warehouses, and reefer fleets planning expansions.

Electricity demand dynamics intensify the challenge. The International Energy Agency (IEA) notes that space cooling is the fastest-growing energy use in buildings and is on track to rise by almost 4% annually to 2035 under today’s policies—tightening grids and raising peak-demand charges that directly feed into blast freezers, IQF tunnels, and cold rooms. In hotter years, the stress is visible at system level: in 2024, higher temperatures added +208 TWh to global electricity consumption versus 2023, lifting demand by 0.7%—a headwind for power-intensive food freezing and storage operations that run continuously.

These energy and compliance burdens cascade through logistics. The Global Cold Chain Alliance (GCCA) shows that capacity is concentrated among a few large providers, underlining how tough it is to finance and operate temperature-controlled space at scale; the 2024 Global Top 25 list includes multiple operators with capacities above 100 million ft³, reflecting high capital intensity that can deter new entrants and limit coverage in secondary horticulture regions. For fruit processors, limited local storage means longer hauls to third-party sites, higher fuel and handling costs, and greater risk of temperature abuse.

- Governments are trying to ease the bottlenecks, but the scale is large and timelines are long. India’s Pradhan Mantri Kisan SAMPADA Yojana (PMKSY) approved 1,601 projects by 30 June 2025, with 1,133 completed/operational, creating 255.66 LMT/year of preservation and processing capacity and supporting 3.42 million farmers. These are important steps, yet they also illustrate how much public subsidy and coordination are needed to close gaps—and how progress depends on sustained budget flows and timely grid upgrades.

Opportunity

Public nutrition programs and low-waste fruit formats

Public nutrition buying is creating steady, scalable demand for processed and frozen fruits. The European Union’s School Fruit, Vegetables and Milk Scheme allocates about €221 million for the 2024/25 school year, including up to €130.6 million specifically for fruit and vegetables. These funds support regular deliveries and education activities, giving processors predictable institutional offtake and room to plan capacity.

In sub-Saharan Africa, governments have expanded school meal programmes to reach an additional 20 million children between 2022 and 2024, lifting total reach to about 87 million children, according to the World Food Programme. Frozen and shelf-stable fruit ingredients fit these programmes because they are portionable, safer to transport, and usable year-round.

Trade channels are already meaningful and can absorb more product as capacity grows. In 2023, global trade in frozen fruits and nuts (HS 0811) reached US $7.1 billion; processors with reliable cold chains and certifications can target these flows with differentiated origin stories and consistent specifications. Government capital is crowding in to close infrastructure gaps.

- India’s Pradhan Mantri Kisan Sampada Yojana (PMKSY) carries a ₹6,520 crore outlay for 2021–26, including an additional ₹1,920 crore approved in 2025, to fund integrated cold chains, testing labs, and processing capacity—precisely the assets fruit processors need to lift throughput and reduce shrink.

Health policy adds another tailwind. The World Health Organization recommends at least 400 g/day of fruit and vegetables to lower non-communicable disease risk. Frozen and processed fruit formats help schools, foodservice, and households reach that target with consistent portioning, minimal prep time, and less spoilage. For exporters and contract manufacturers, the combination of rising public nutrition budgets, expanding school feeding coverage, and large, addressable waste pools defines a clear growth lane: build near-farm precooling and IQF capacity, secure institutional contracts, and position product lines as low-waste nutrition solutions.

Regional Insights

North America Leads Processed and Frozen Fruits Market with 47.30% Share in 2024

In 2024, North America maintained a commanding position in the processed and frozen fruits market, holding 47.30% of regional share and an estimated market value of USD 25.8 billion. This dominance can be attributed to well-developed cold-chain infrastructure, high per-capita consumption of convenience foods, and concentrated production of high-value fruits—notably berries and stone fruits—processed for frozen and canned formats. Large retail networks and private-label programs within supermarkets/hypermarkets have supported year-round availability and steady demand, while investments in individually quick freezing (IQF) and packaging innovations have preserved product quality and extended shelf life.

The United States is the principal contributor within the region, with the U.S. frozen fruits sector alone representing several billion dollars in retail value and accounting for the majority share of North American consumption; this market structure has encouraged scale efficiencies in processing and distribution. Seasonal supply stabilisation through imports from Mexico and Central America further underpins the region’s year-round supply.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Conagra Brands Inc., headquartered in Chicago, is a leading player in the processed and frozen fruits market through brands such as Birds Eye and Healthy Choice. In fiscal year 2024, the company reported net sales of USD 12.28 billion, with the frozen foods segment contributing approximately 38% of total revenue. The company’s focus on innovation, sustainability, and cold-chain logistics has strengthened its position in North America, where demand for convenient, nutrient-rich frozen fruits continues to expand.

Dole Food Company remains one of the largest global producers of fresh and processed fruits. In 2024, the company generated total revenue of USD 9.2 billion, with its Diversified Fresh Produce and Value-Added Products segments contributing significantly to growth. Dole’s frozen fruit portfolio, including strawberries, pineapples, and tropical blends, saw strong demand in North America and Europe. The company continues to invest in sustainable farming and processing facilities to enhance quality and traceability.

Del Monte Foods Inc., a major U.S. food producer, plays a key role in the processed and frozen fruits segment. In fiscal 2024, the company reported net sales of USD 4.28 billion, supported by strong growth in its fresh and value-added products line, which includes frozen fruit cups and fruit blends. Despite facing market pressures in banana exports, Del Monte has focused on modernizing production, improving packaging technology, and expanding its global distribution network for long-term growth.

Top Key Players Outlook

- Conagra Brands Inc.

- Dole Food Company

- Del Monte Foods Inc.

- SunOpta

- Rhodes Food Group

- AGRANA Beteiligungs AG

- Seneca Foods

- Gulong Food

- Kangfa Foods

- CHB Group

Recent Industry Developments

December 31 2024 Dole Food Company, reported revenue of USD 8,475 million, marking a growth of 2.8 % over the prior year.

In 2024 Del Monte Foods Inc, reported net sales of USD 4,280.2 million, reflecting a slight decline compared with the previous year.

Report Scope

Report Features Description Market Value (2024) USD 54.7 Bn Forecast Revenue (2034) USD 90.8 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fruit Type (Berries, Tropical Fruits, Citrus Fruits, Pome Fruits, Stone Fruits, Melons and Grapes), By Processing Type (Canned Fruits, Dried Fruits, Pureed Fruits, Freeze-Dried Fruits), By Distribution Channel (Supermarkets/Hypermarkets, Foodservice, Convenience Stores, Online Retail Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Conagra Brands Inc., Dole Food Company, Del Monte Foods Inc., SunOpta, Rhodes Food Group, AGRANA Beteiligungs AG, Seneca Foods, Gulong Food, Kangfa Foods, CHB Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Processed And Frozen Fruits MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Processed And Frozen Fruits MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Conagra Brands Inc.

- Dole Food Company

- Del Monte Foods Inc.

- SunOpta

- Rhodes Food Group

- AGRANA Beteiligungs AG

- Seneca Foods

- Gulong Food

- Kangfa Foods

- CHB Group