Global Process Water Treatment Market Size, Share Analysis Report By Treatment Type (Membrane Filtration, Ion Exchange, Chemical Treatment, Physical Treatment), By Source (Industrial Discharge, Surface Water, Ground Water, Wastewater), By Process Unit (Pretreatment, Primary Treatment, Secondary Treatment, Tertiary Treatment, Ultrafiltration), By End-Use (Chemical and Petrochemical, Automotive, Pharmaceuticals, Food and Beverage, Oil and Gas, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153414

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

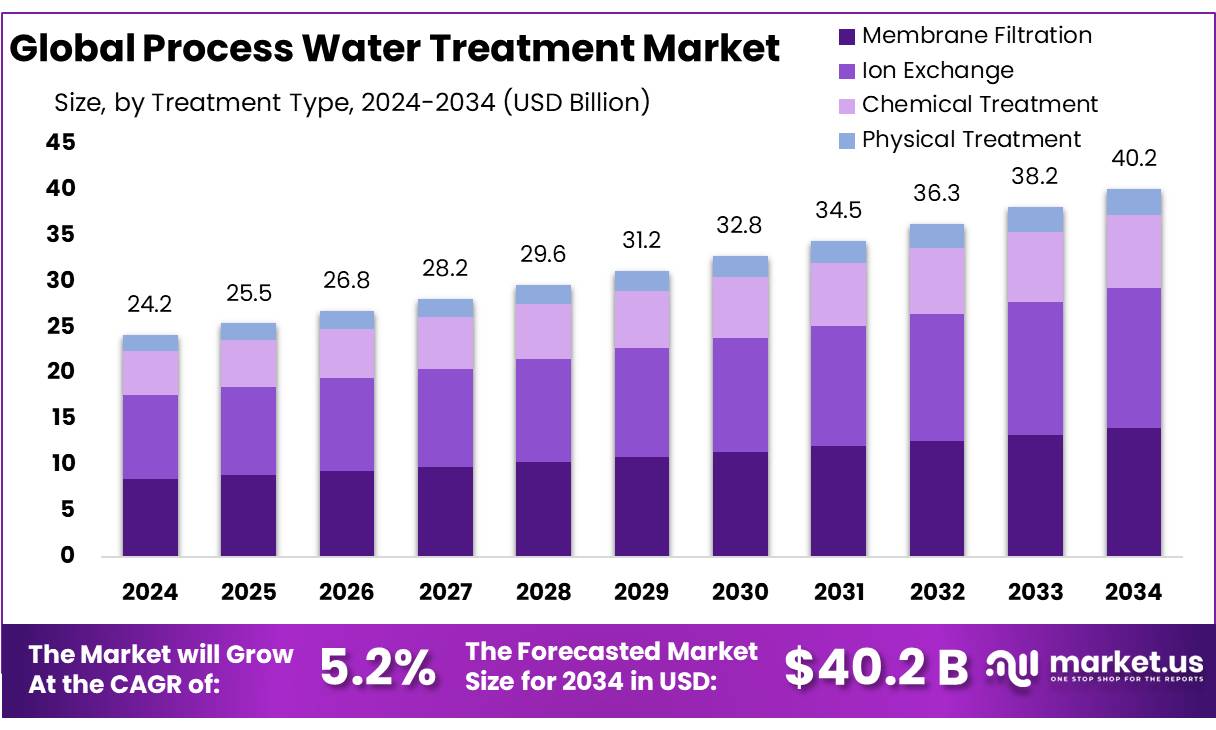

The Global Process Water Treatment Market size is expected to be worth around USD 40.2 Billion by 2034, from USD 24.2 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 47.2% share, holding USD 11.4 Billion revenue.

Process water treatment concentrates are specialized chemical additives—such as antiscalants, biocides, and coagulants—designed to purify and condition water streams in industrial operations. These chemicals ensure compliance with discharge standards and protect critical equipment, such as boilers, cooling towers, and membrane filtration units. Their usage is particularly critical in power generation, oil and gas extraction, and heavy manufacturing, where process water quality influences operational efficiency and regulatory adherence.

Industries such as textiles, pharmaceuticals, and food processing are significant contributors to the generation of treatment concentrates. For instance, the South Gujarat Textile Processors Association is leading a project to develop a 600 million litres per day (MLD) deep-sea discharge pipeline, aiming to support industrial expansion in Surat and surrounding regions . This initiative highlights the industry’s commitment to addressing the challenges posed by treatment concentrates.

Driving factors for the management of process water treatment concentrates include the need to comply with environmental standards set by regulatory bodies, the economic benefits of water reuse, and the technological advancements in treatment processes. AMRUT 2.0, cities with populations exceeding 100,000 are required to recycle a minimum of 20% of their wastewater, which directly impacts the management of treatment concentrates.

Government policies play a pivotal role in shaping the landscape of water treatment in India. The Atal Mission for Rejuvenation and Urban Transformation (AMRUT) and the National Mission for Clean Ganga (NMCG) are among the key initiatives aimed at improving urban water infrastructure and wastewater management. For instance, in Chandigarh, a project under AMRUT-2 with a budget of ₹77 crore aims to lay 175 km of tertiary treated water pipelines, enhancing the city’s water reuse capabilities.

In the United States, the Department of Energy (DOE) has allocated USD 27.8 million toward decarbonization projects for water resource recovery facilities. The Energy-Water Nexus initiative underscores interconnected optimization of energy and water systems. The EPA Clean Watersheds Needs Survey catalogs over 27,000 wastewater facilities, helping inform infrastructure planning. Further, investment requirements in U.S. wastewater infrastructure are projected at USD 600 billion over 20 years, with about USD 298 billion needed for capital upgrades.

Key Takeaways

- The global Process Water Treatment Market is projected to grow from USD 24.2 billion in 2024 to approximately USD 40.2 billion by 2034, expanding at a CAGR of 5.2%.

- Membrane Filtration led the market with a 34.9% share, making it the most widely adopted process water treatment technology globally.

- Industrial Discharge emerged as the dominant application segment, accounting for more than 36.1% of the global market share.

- Secondary Treatment captured a significant position, holding over 28.2% share in the overall process water treatment market.

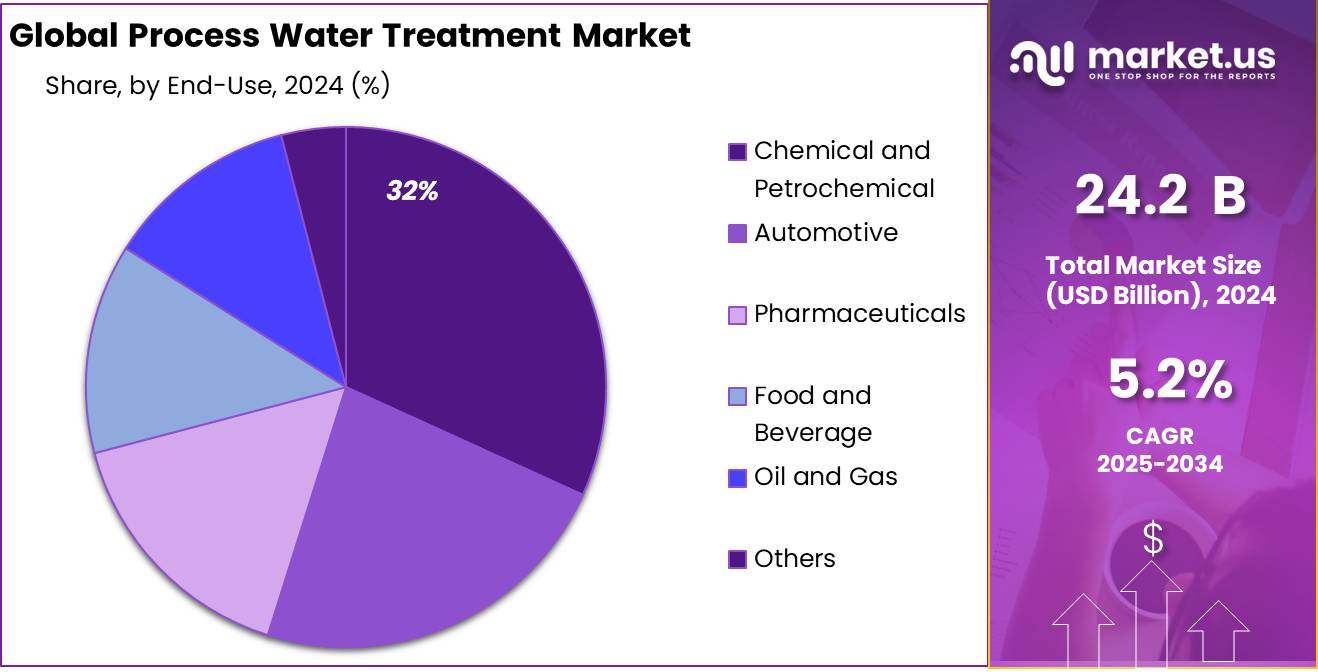

- The Chemical and Petrochemical sector was the leading end-user, contributing more than 31.7% share to the global market.

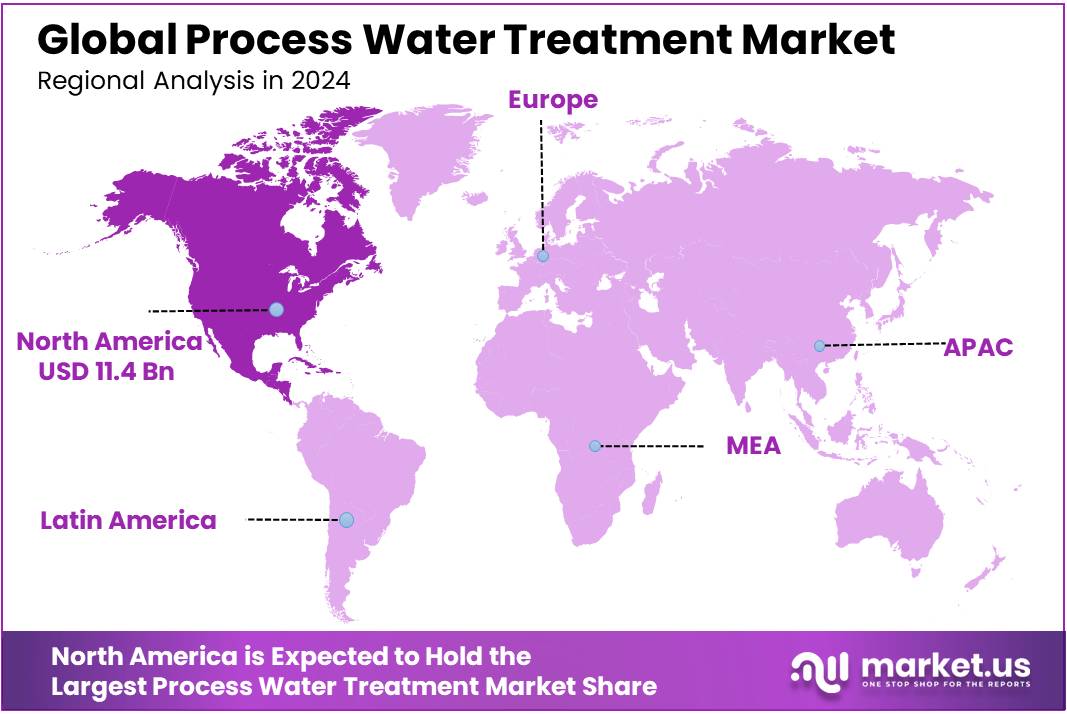

- North America held the largest regional market share at 47.2%, which translates to a market value of approximately USD 11.4 billion.

By Treatment Type Analysis

Membrane Filtration leads the way with 34.9% share due to its high efficiency and broad industrial adoption.

In 2024, Membrane Filtration held a dominant market position, capturing more than a 34.9% share of the global process water treatment market. This leadership can be attributed to its ability to effectively remove suspended solids, bacteria, and dissolved contaminants across diverse industries including pharmaceuticals, food and beverage, and power generation. The technology’s precision and low chemical dependency have made it a preferred choice for industries aiming to meet strict water discharge regulations.

Furthermore, the ongoing shift toward zero-liquid discharge (ZLD) systems has increased reliance on membrane-based processes such as ultrafiltration and reverse osmosis. By 2025, this segment is expected to maintain strong growth momentum, driven by increasing demand for high-purity water in critical manufacturing operations and the growing adoption of water recycling practices in both developed and emerging economies.

By Source Analysis

Industrial Discharge dominates with 36.1% share owing to rising industrial effluent volumes and stricter treatment norms.

In 2024, Industrial Discharge held a dominant market position, capturing more than a 36.1% share of the global process water treatment market. This strong position is largely driven by the growing volume of wastewater generated from sectors like chemicals, pharmaceuticals, textiles, and metal processing. As industrial activity expands, especially in developing economies, the need to treat contaminated water before discharge has become a regulatory priority.

Governments across regions have implemented tighter discharge standards, pushing industries to invest in advanced treatment technologies. By 2025, the segment is projected to retain its lead, supported by the rising enforcement of zero-liquid discharge systems and the increasing focus on sustainability. The growing pressure on freshwater sources is also compelling industries to recycle treated water, further strengthening demand for robust treatment solutions tailored to industrial discharge.

By Process Unit Analysis

Secondary Treatment leads with 28.2% share as industries focus on biological purification standards.

In 2024, Secondary Treatment held a dominant market position, capturing more than a 28.2% share in the global process water treatment market. This segment’s leadership reflects the widespread use of biological processes such as activated sludge, trickling filters, and bio-towers to remove organic contaminants from industrial wastewater. Industries across sectors are increasingly required to meet discharge norms that target biochemical oxygen demand (BOD) and suspended solids, making secondary treatment a vital step.

Its proven effectiveness in reducing pollutant loads before further processing or safe discharge has driven steady adoption. By 2025, the segment is expected to maintain its position, bolstered by stricter wastewater regulations and the need to treat high-strength effluents from chemical and food processing industries. The rising integration of energy-efficient aeration systems and enhanced bio-reactors also supports its continued growth across both established and emerging markets.

By End-Use Analysis

Chemical and Petrochemical leads with 31.7% share driven by heavy water usage and strict discharge norms.

In 2024, Chemical and Petrochemical held a dominant market position, capturing more than a 31.7% share in the global process water treatment market. This strong presence is mainly due to the sector’s high water consumption and the complex nature of contaminants released during chemical processing and refining activities.

Treatment of process water in this industry is essential not only for compliance with environmental regulations but also to prevent corrosion, scaling, and fouling in critical equipment. With petrochemical plants increasingly focused on water reuse and efficiency, advanced treatment technologies are being widely adopted. By 2025, the segment is expected to maintain its lead, supported by ongoing expansion of refining capacities, especially in Asia-Pacific and the Middle East, along with stricter effluent discharge regulations aimed at minimizing environmental impact.

Key Market Segments

By Treatment Type

- Membrane Filtration

- Ion Exchange

- Chemical Treatment

- Physical Treatment

By Source

- Industrial Discharge

- Surface Water

- Ground Water

- Wastewater

By Process Unit

- Pretreatment

- Primary Treatment

- Secondary Treatment

- Tertiary Treatment

- Ultrafiltration

By End-Use

- Chemical and Petrochemical

- Automotive

- Pharmaceuticals

- Food and Beverage

- Oil and Gas

- Others

Emerging Trends

Adoption of Smart Water Technologies in the Food Industry

In 2024, the food and beverage industry is increasingly turning to smart water technologies to enhance water management practices. These technologies, including real-time monitoring systems, advanced filtration methods, and automated control systems, are being integrated to optimize water usage, reduce waste, and ensure compliance with stringent environmental regulations.

A notable example is the implementation of smart water meters and sensors that provide real-time data on water consumption and quality. This data enables companies to identify inefficiencies, detect leaks promptly, and make informed decisions to conserve water. For instance, the U.S. Environmental Protection Agency (EPA) has reported that industries adopting smart water technologies have seen up to a 20% reduction in water usage.

Furthermore, advancements in filtration technologies, such as reverse osmosis and ultraviolet (UV) disinfection, are being employed to treat wastewater effectively, making it suitable for reuse within the production process. This not only conserves freshwater resources but also reduces the environmental impact of wastewater discharge.

Governments are also supporting these initiatives through various programs. For example, the U.S. Department of Agriculture (USDA) has invested $400 million to assist farmers in adopting water-saving technologies and practices. Similarly, the Food Safety and Standards Authority of India (FSSAI) has established guidelines encouraging the use of treated water in food processing, promoting sustainability within the industry.

Drivers

Growing Demand for Clean Water in the Food and Beverage Industry

One of the major driving factors for the process water treatment market is the increasing demand for clean and safe water in industries such as food and beverage. Water is an essential component in the production of food and beverage products, and maintaining high-quality standards for water used in food processing is crucial to ensure product safety and quality. The growing global population and increasing urbanization have led to heightened awareness about the need for sustainable water management solutions across industries, especially in the food sector.

According to the World Health Organization (WHO), about 2 billion people worldwide lack access to safe drinking water, and industries must find solutions to address this issue to ensure public health and food safety. As a result, food and beverage manufacturers are increasingly investing in advanced water treatment systems to meet stringent water quality standards set by regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Food Safety Authority (EFSA). These regulations mandate the removal of harmful pathogens, chemicals, and other contaminants that could compromise the quality of food products.

Furthermore, in India, the Food Safety and Standards Authority of India (FSSAI) has outlined specific guidelines for water used in food production, which has pushed local industries to adopt efficient water treatment technologies. According to data from the Indian Ministry of Water Resources, the food and beverage industry in India is expected to invest over US$ 500 million by 2025 in upgrading water treatment facilities to ensure compliance with these standards.

The increasing awareness of water scarcity, combined with the rising importance of sustainable practices, has led many food and beverage companies to seek innovative water treatment solutions. These systems help minimize water waste, reduce operational costs, and improve the overall quality of products, making process water treatment a critical aspect of industry growth.

Restraints

High Operational Costs for Water Treatment Systems

One of the major restraining factors for the process water treatment market is the high operational costs associated with advanced water treatment systems. While the demand for clean and safe water is growing, especially in sectors like food and beverage, the cost of installing, maintaining, and operating water treatment systems remains a significant barrier, particularly for small and medium-sized enterprises (SMEs). These costs encompass energy consumption, chemical use, maintenance, and the need for skilled personnel to operate these systems.

In the U.S., a report by the U.S. Environmental Protection Agency (EPA) indicates that over 50% of the operational costs in water treatment plants are driven by energy consumption, making it one of the highest costs for water treatment processes. The energy required for reverse osmosis systems, filtration units, and other technologies can be substantial, and this can place a heavy financial burden on businesses, especially those with high water usage in food production.

Additionally, a study from the National Restaurant Association highlights that small food producers and restaurants often find the costs of compliance with water quality standards prohibitive. For example, an average-sized restaurant in the U.S. spends approximately US$ 10,000–15,000 annually on water treatment and waste management to meet regulatory standards. This amount does not even include the costs of upgrading old water treatment systems, which can further escalate expenses.

While government initiatives like the Clean Water State Revolving Fund (CWSRF) in the U.S. provide financial assistance for water infrastructure improvements, many businesses, especially those in developing countries, struggle to secure these funds due to complex application processes and limited availability. Moreover, the long-term costs of maintaining cutting-edge water treatment systems can deter new investments, slowing market growth.

Opportunity

Technological Advancements in Water Recycling and Reuse

A significant growth opportunity in the process water treatment market is the increasing adoption of advanced water recycling and reuse technologies. With the growing concern over water scarcity and the need for more sustainable practices, industries like food and beverage are increasingly turning to water recycling solutions to reduce their water consumption and operational costs. These technologies allow companies to treat and reuse water multiple times in their production processes, significantly lowering their reliance on freshwater sources.

The U.S. Food and Drug Administration (FDA) has recognized the importance of water recycling in food processing and has issued guidelines encouraging the use of treated water for non-consumable applications. According to the Water Environment Federation, implementing water reuse systems in food production facilities can reduce water consumption by up to 50% while ensuring compliance with health and safety standards.

In Europe, the European Commission has launched several initiatives to promote water reuse in industrial applications. For example, the EU Water Reuse Regulation allows the use of treated water for irrigation and industrial cooling, helping food companies reduce their dependence on potable water. This regulation is expected to open up significant opportunities for water treatment companies providing recycling technologies, with the European Commission investing €6.3 billion in water management projects by 2027.

In India, a key emerging market, the government’s National Mission for Clean Ganga (NMCG) has been promoting water reuse as a part of its initiatives to protect the Ganga River. The Ministry of Jal Shakti has announced plans to increase funding for water reuse projects in industries, including food processing, which could lead to a US$ 2 billion investment in water recycling technologies by 2025.

Regional Insights

North America dominates with a 47.2% share, amounting to USD 11.4 billion, led by robust regulatory standards and industrial demand.

In 2024, North America held a commanding share of 47.2% in the global process water treatment market, equivalent to approximately USD 11.4 billion. This dominance reflects a mature market underpinned by advanced infrastructure, a strong regulatory environment, and high adoption rates of treatment technologies.

The region’s stringent environmental standards—enforced through laws such as the Clean Water Act in the United States and comparable regulations in Canada—have driven widespread industrial compliance through investment in tertiary and advanced treatment systems. Manufacturing, chemical processing, power generation, and petrochemical facilities form the backbone of this demand, as each sector increasingly prioritises water reuse, zero‑liquid discharge, and pollutant removal to meet both environmental goals and cost efficiencies.

Looking ahead to 2025, the region is well-positioned to maintain its dominance. Increasing public-private infrastructure funding, incentives for clean-water technologies, and parallel progress in digital monitoring and energy-efficient systems will reinforce this trend. North America will thus continue to serve as the global benchmark in process water treatment deployment, earning its leading status through a blend of regulatory leadership, technological sophistication, and proactive investment.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Ion Exchange (India) Limited is a leading water treatment company that offers a comprehensive range of solutions for industrial and municipal water treatment. Known for its expertise in water softening, reverse osmosis, and desalination, the company serves a broad spectrum of industries, including power, textiles, and chemicals. Ion Exchange is recognized for its innovative solutions and commitment to sustainable water management, backed by strong research and development efforts to enhance water quality across various sectors.

GE Water Process Technologies, a division of General Electric, is a leader in water treatment solutions for industrial and municipal sectors. The company specializes in providing water purification, wastewater treatment, and water reuse systems. With its advanced technologies such as reverse osmosis, filtration, and chemical treatments, GE Water Process Technologies offers customized solutions to optimize water use and improve water quality. Its global reach and commitment to sustainability make it a key player in the water treatment industry.

Xylem Inc. is a global water technology company specializing in water treatment, flow control, and analytical instrumentation. The company provides innovative solutions for water and wastewater treatment, water distribution, and management. Xylem’s portfolio includes advanced products such as pumps, filtration systems, and treatment chemicals. With a strong focus on sustainability, Xylem serves various industries, including municipal, industrial, and commercial sectors, addressing the growing demand for efficient water management systems worldwide.

Top Key Players Outlook

- Ion Exchange (India) Limited

- WABAG Ltd.

- Xylem Inc.

- GE Water Process Technologies

- Evoqua Water Technologies LLC

- Ecolab

- Culligan International Company

- SUEZ Water Technologies Solutions

- Siemens Water Technologies

- Pentair plc

- Veolia Water Technologies

- Aquatech

- Lenntech B.V.

Recent Industry Developments

In 2024 Ion Exchange (India) Limited, reported a consolidated revenue of ₹2,390 crore, marking a significant increase from ₹2,030 crore in the previous year.

In May 2023, Evoqua was acquired by Xylem Inc. in an all-stock transaction valued at $7.5 billion, enhancing Xylem’s capabilities in addressing global water challenges.

Report Scope

Report Features Description Market Value (2024) USD 24.2 Bn Forecast Revenue (2034) USD 40.2 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Treatment Type (Membrane Filtration, Ion Exchange, Chemical Treatment, Physical Treatment), By Source (Industrial Discharge, Surface Water, Ground Water, Wastewater), By Process Unit (Pretreatment, Primary Treatment, Secondary Treatment, Tertiary Treatment, Ultrafiltration), By End-Use (Chemical and Petrochemical, Automotive, Pharmaceuticals, Food and Beverage, Oil and Gas, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Ion Exchange (India) Limited, WABAG Ltd., Xylem Inc., GE Water Process Technologies, Evoqua Water Technologies LLC, Ecolab, Culligan International Company, SUEZ Water Technologies Solutions, Siemens Water Technologies, Pentair plc, Veolia Water Technologies, Aquatech, Lenntech B.V. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Process Water Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Process Water Treatment MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Ion Exchange (India) Limited

- WABAG Ltd.

- Xylem Inc.

- GE Water Process Technologies

- Evoqua Water Technologies LLC

- Ecolab

- Culligan International Company

- SUEZ Water Technologies Solutions

- Siemens Water Technologies

- Pentair plc

- Veolia Water Technologies

- Aquatech

- Lenntech B.V.