Global Process Orchestration Market Size, Share, Industry Analysis Report By Component (Solution, Services: Managed Services, Professional Services: Consulting, Training & Education, Support & Maintenance),By Business Function (Supply Chain Management and Order Fulfillment, Marketing, Human Resource Management, Finance and Accounting, Customer Service and Support),By Deployment (On-premises, Cloud),By Organization Size (Large Enterprises, Small & Mid-sized Enterprises (SMEs)),By End-User Vertical (BFSI, IT and Telecom, Healthcare and Life Sciences, Manufacturing, Retail and e-Commerce, Energy and Utilities, Government and Public Sector, Other End-User Verticals) , By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034.

- Published date: Dec. 2025

- Report ID: 167853

- Number of Pages: 365

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

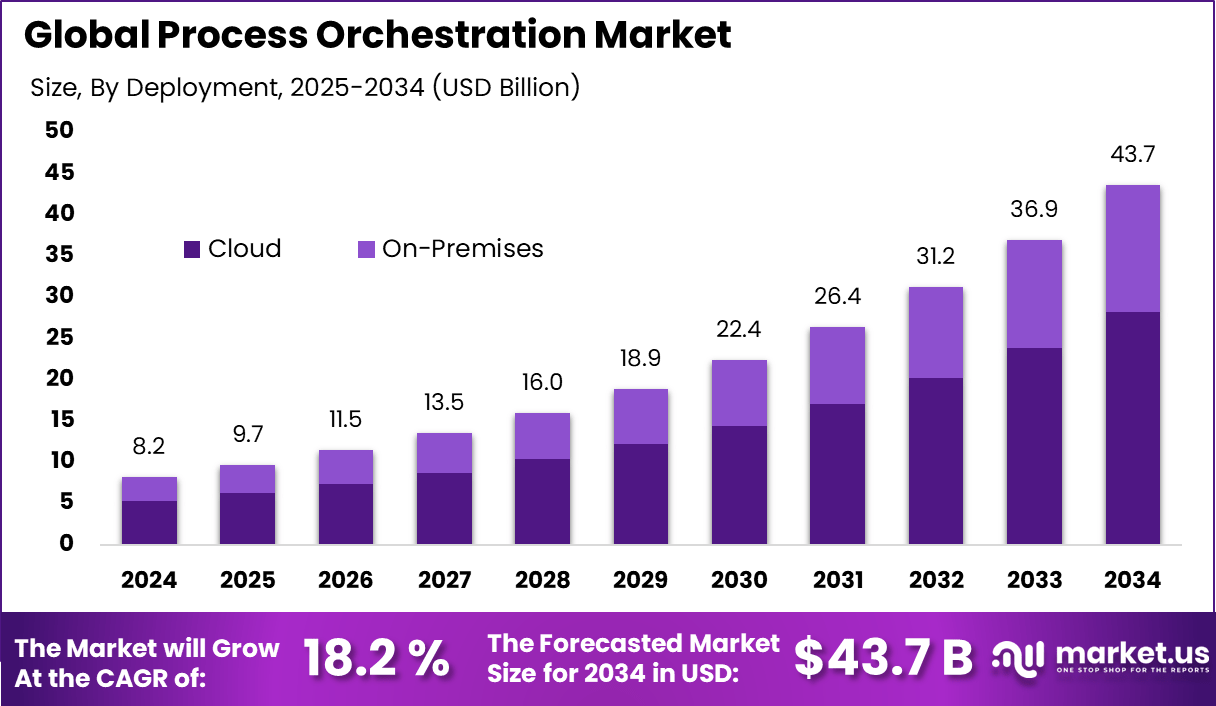

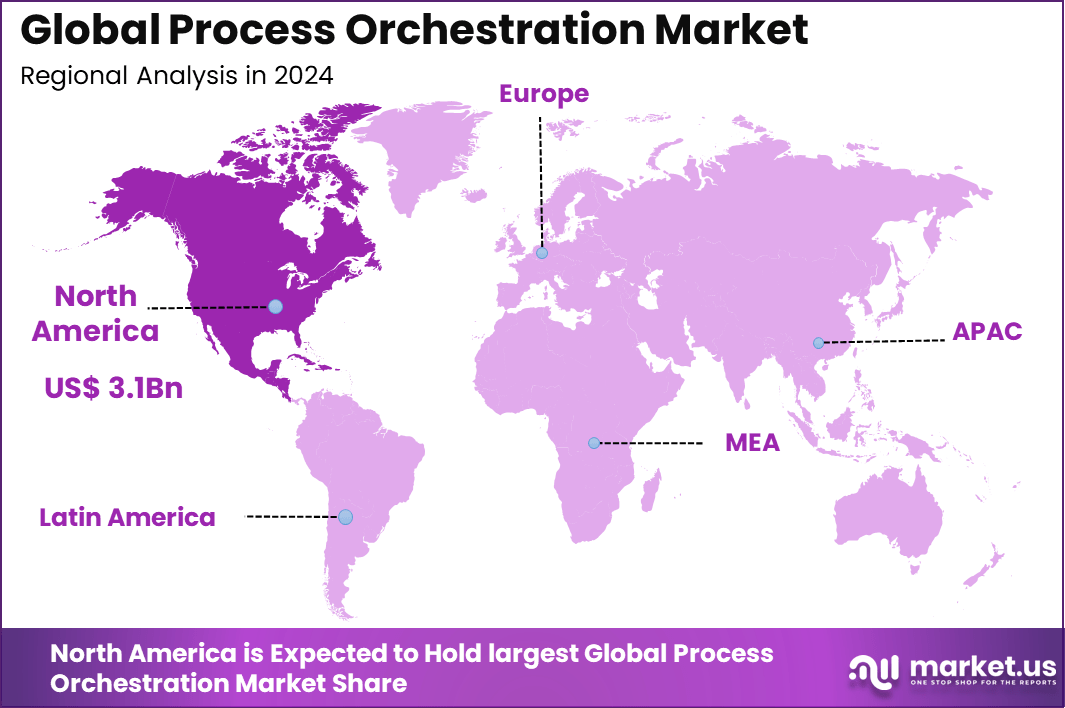

The Global Process Orchestration Market generated USD 8.2 Billion in 2024 and is predicted to register growth to about USD 43.7 Billion by 2034, recording a CAGR of 18.2% throughout the forecast span. In 2024, North America held a dominant market position, capturing more than a 38.7% share, holding USD 3.1 Billion revenue.

The process orchestration market focuses on software platforms that coordinate and manage multiple automated workflows, systems, and services across an organization. These solutions ensure that different applications, data flows, and business processes work together in a structured and efficient manner. Process orchestration is widely used to connect legacy systems with modern digital platforms, enabling end to end process visibility and control.

This market plays a crucial role in enabling seamless integration between people, systems, and technologies. Process orchestration ensures that tasks are executed in the correct order, with proper data exchange and exception handling. It supports cross department coordination in areas such as finance, supply chain, IT operations, and customer service. By centralizing control, orchestration platforms help organizations monitor performance, reduce errors, and maintain compliance across automated processes.

Growth is driven by the rapid adoption of digital transformation initiatives and enterprise automation. Organizations are deploying multiple software tools, which has increased the need for centralized coordination. Rising use of cloud services, microservices, and application programming interfaces has further accelerated demand. Process orchestration also supports regulatory compliance by maintaining clear audit trails. Industry surveys indicate that over 65% of enterprises struggle with fragmented workflows, driving interest in orchestration platforms.

Demand for process orchestration solutions is increasing steadily across banking, healthcare, manufacturing, retail, and telecommunications. Enterprises are using these platforms to manage complex workflows that span multiple systems and vendors. Demand is particularly strong among organizations scaling automation initiatives beyond isolated tasks. Studies show that nearly 60% of large enterprises are prioritizing orchestration to improve automation success rates and operational consistency.

Key Takeaways

- The process orchestration market is chiefly dominated by solutions, accounting for 61.2% of the market share.

- Supply chain management and order fulfillment functions contribute to 30.7% of the demand for process orchestration.

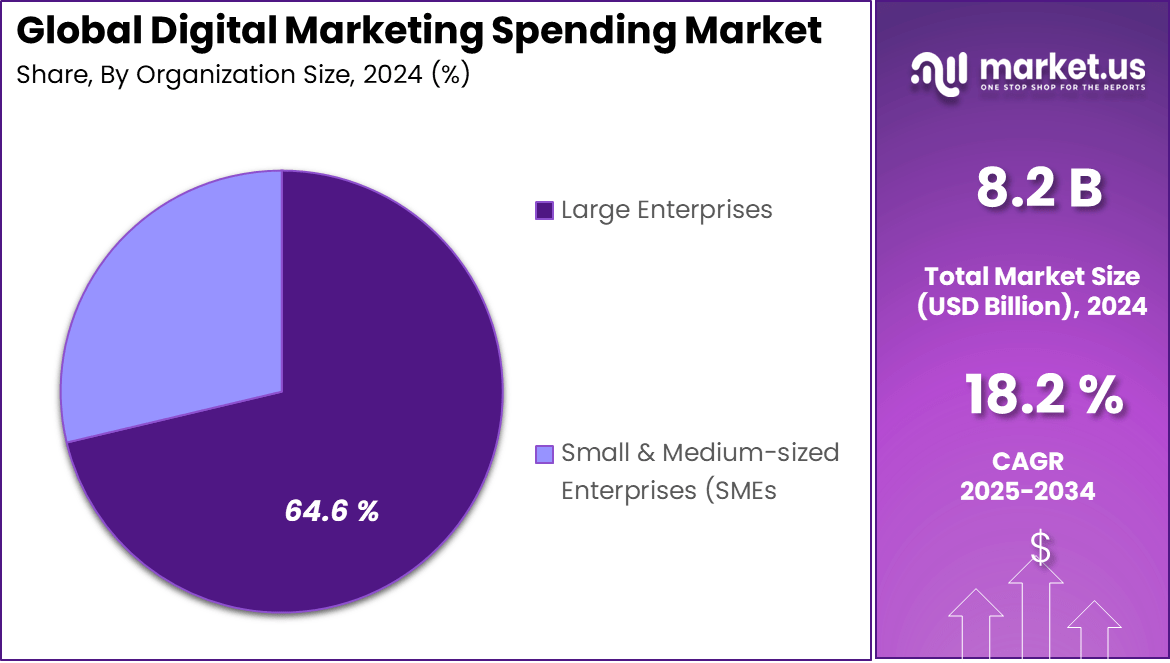

- Cloud deployment leads with 64.6% adoption in the process orchestration market.

- Large enterprises dominate this segment with a 71.3% share in process orchestration adoption.

- The Banking, Financial Services, and Insurance (BFSI) vertical accounts for 22.8% of process orchestration usage.

- North America holds a significant portion of the process orchestration market with a 38.7% share, reflecting the region’s strong commitment to digital transformation.

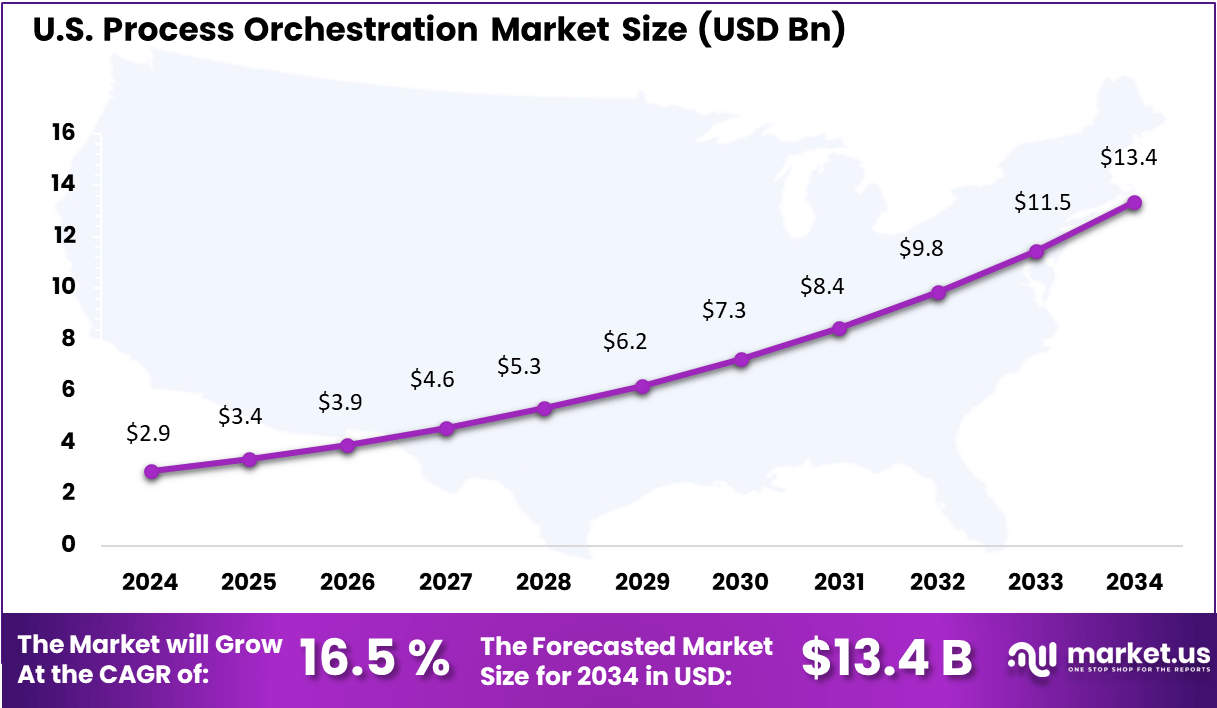

- The U.S. market specifically commands a substantial USD 2.9 billion segment or 16.5% share within the global process orchestration industry.

Adoption Statistics and Trends

- 87% of organizations report higher business growth after adopting process automation in the past year.

- 83% of organizations plan to raise automation investment by 10% or more, showing strong long-term commitment.

- Over 80% of enterprises already intend to increase spending on automation tools.

- 72% of respondents say current automation efforts struggle to keep up with rapid organizational change.

- 83% of IT leaders are evaluating orchestration tools to coordinate tasks across systems, devices, and teams.

- Organizations now manage an average of 50 endpoints, up 19% over five years, increasing process complexity.

- Process orchestration delivers results quickly, with managers reporting 15% efficiency gains within six months.

- At scale, some enterprises project over USD 1 billion in savings and up to 40% efficiency improvement through orchestration.

U.S Market Size

The U.S. market specifically commands a substantial USD 2.9 billion segment or 16.5% share within the global process orchestration industry. The U.S. is a key hub for orchestration technology adoption, leveraging an extensive ecosystem of technology providers and end users. Strong automation trends in banking, healthcare, manufacturing, and retail fuel this growth, with a focus on integrating AI for smarter workflow management.

U.S. organizations emphasize cloud and hybrid deployment models, which offer both agility and compliance with strict data privacy rules. The country’s technological innovation and infrastructure create fertile conditions for process orchestration, significantly enhancing operational efficiencies in large enterprises and enabling better customer experiences across various sectors.

North America holds a significant portion of the process orchestration market with a 38.7% share, reflecting the region’s strong commitment to digital transformation. Businesses here prioritize automation and workflow integration, especially in sectors such as BFSI, retail, and telecommunications. This demand is supported by advanced technological infrastructure and widespread cloud adoption, which enhance the scalability and flexibility of orchestration solutions.

The region’s dominant position is also due to proactive investments in AI integration and cloud-based orchestration platforms. Enterprises in North America focus on streamlining operations and accelerating innovation to maintain competitive advantages in highly regulated and fast-paced markets. Public sector bodies also drive growth by adopting orchestration for improved efficiency and service delivery.

By Component

Solutions account for 61.2%, showing that most organizations rely on dedicated process orchestration platforms rather than standalone services. These solutions help design, automate, and monitor end-to-end business processes across multiple systems and applications.

Adoption is driven by the need to reduce manual workflows and improve operational visibility. Solution-based platforms allow organizations to coordinate tasks, manage exceptions, and ensure process consistency across departments.

Business Function

Supply chain management and order fulfillment represent 30.7%, making them the leading business function for process orchestration adoption. Organizations use orchestration tools to coordinate inventory updates, order processing, logistics, and supplier communication.

This segment is growing as supply chains become more complex and time sensitive. Process orchestration improves responsiveness, reduces delays, and supports real time decision making across supply and distribution networks.

Deployment

Cloud deployment holds 64.6%, reflecting strong preference for scalable and flexible orchestration platforms. Cloud-based solutions allow organizations to connect distributed systems and manage workflows without heavy on-site infrastructure.

The growth of cloud deployment is supported by rising use of digital platforms and remote operations. Cloud orchestration enables faster updates, easier integration, and improved collaboration across business units.

Organization Size

Large enterprises account for 71.3%, highlighting their strong reliance on process orchestration to manage complex operations. These organizations operate across multiple regions and systems, which increases the need for centralized workflow coordination. Adoption among large enterprises is driven by digital transformation and efficiency goals. Process orchestration helps standardize operations, reduce operational risk, and improve service delivery at scale.

End-User Vertical

The BFSI sector holds 22.8%, reflecting its need for structured and compliant process management. Financial institutions use orchestration platforms to coordinate customer onboarding, transaction processing, and regulatory workflows.

This segment benefits from increasing regulatory pressure and demand for faster service delivery. Process orchestration improves transparency, reduces processing errors, and supports consistent compliance across financial operations.

Key Market Segments

- By Component

- Solution

- Services

- Managed Services

- Professional Services

- Consulting

- Training & Education

- Support & Maintenance

- By Business Function

- Supply chain management and order fulfillment

- Marketing

- Human Resource Management

- Finance and Accounting

- Customer Service and Support

- By Deployment

- On-premises

- Cloud

- By Organization Size

- Large Enterprises

- Small & Mid-sized Enterprises (SMEs)

- By End-User Vertical

- BFSI

- IT and Telecom

- Healthcare and Life Sciences

- Manufacturing

- Retail and e-Commerce

- Energy and Utilities

- Government and Public Sector

- Other End-User Verticals

Driver Analysis

Growing Need for Efficient Workflow Coordination

A key driver of this market is the increasing complexity of business operations. Modern organizations work with many applications, departments, and external partners. Coordinating tasks manually becomes difficult as the number of processes grows. Process orchestration offers a structured way to manage these workflows and ensures that all steps are aligned with business goals.

Another driver is the expanding use of automation in daily operations. Automated systems generate large amounts of data and require smooth coordination to avoid delays. Process orchestration tools help manage these automated steps while maintaining clarity and control. Companies see value in adopting orchestration platforms because they support consistency and reduce the risk of operational disruptions.

Restraint Analysis

High Implementation and Integration Effort

A major restraint comes from the time and cost involved in integrating orchestration tools with existing systems. Many organizations operate on older software or fragmented infrastructure that requires customization before orchestration can be introduced. This increases project timelines and can delay benefits for the business.

Another restraint is the requirement for skilled staff to manage and maintain orchestration frameworks. Organizations must train employees to understand workflow design and system behavior. Without proper training, the platform may not deliver its full value. Some companies hesitate to adopt orchestration tools because they lack the expertise needed for long-term support.

Opportunity Analysis

Rising Adoption of Automation Across Industries

There is a strong opportunity as industries expand their use of automation for routine tasks. Process orchestration ensures that automated activities follow the correct sequence and remain aligned with business objectives. Organizations that depend on real-time data flow, such as finance, healthcare, and manufacturing, can benefit from orchestration solutions that improve accuracy and reliability.

Another opportunity appears in sectors adopting hybrid or multi-cloud environments. As data and applications spread across different platforms, orchestration helps maintain consistency and performance. Providers who offer flexible orchestration tools that work across various deployment models can capture significant interest from enterprises seeking stronger control over digital operations.

Challenge Analysis

Managing Continuous Changes in Business Processes

A key challenge is the need to update workflows as business requirements evolve. Processes change frequently in growing organizations, and orchestration tools must be adjusted to match these changes. This can create maintenance pressure, especially in environments with many interconnected systems.

Another challenge lies in ensuring visibility across all components of a workflow. Large enterprises often operate with multiple departments and external systems, making it difficult to monitor performance in real time. If visibility is limited, issues may go unnoticed and reduce the effectiveness of the orchestration system. Addressing this challenge requires strong monitoring tools and consistent oversight.

Key Players Analysis

IBM, SAP, Microsoft, Oracle, and ServiceNow lead the process orchestration market with enterprise platforms that automate, coordinate, and monitor complex business workflows across applications and systems. Their solutions support end to end process visibility, rule-based execution, and integration with ERP, CRM, and IT service tools. These companies focus on scalability, security, and governance. Rising demand for digital process automation across large enterprises continues to reinforce their leadership.

Camunda, Red Hat, Appian, MuleSoft, Boomi, Software AG, Pega Systems, and TIBCO strengthen the market with API-led orchestration, low-code workflow design, and event-driven process management. Their platforms help organizations connect cloud and on-premise systems while improving process agility. These providers emphasize flexibility, faster deployment, and real-time orchestration. Growing adoption of hybrid IT and microservices architectures supports wider use of their solutions.

Micro Focus, BMC Software, Argo Workflows, Kubernetes, Tray.io, SnapLogic, UiPath, Nintex, and other players expand the landscape with specialized orchestration for DevOps, RPA, and integration automation. Their offerings support scalable workflows, error handling, and continuous optimization. These companies focus on developer productivity and operational efficiency. Increasing complexity of digital operations continues to drive sustained demand for process orchestration platforms.

Top Key Players in the Market

- IBM Corporation

- SAP SE

- Microsoft Corporation

- Oracle Corporation

- Camunda Services GmbH

- Red Hat, Inc.

- ServiceNow, Inc.

- Appian Corporation

- MuleSoft LLC (Salesforce)

- Boomi, LP

- Software AG

- Pega Systems Inc.

- TIBCO Software Inc.

- Micro Focus International plc

- BMC Software, Inc.

- Argo Workflows (Intuit Inc.)

- Kubernetes (Cloud Native CNCF)

- Tray.io Inc.

- SnapLogic, Inc.

- UiPath Inc.

- Nintex Global Ltd.

- Others

Recent Developments

- In July 2024, Celonis launched an AI driven process orchestration solution in partnership with Emporix to enable end to end process optimization. The Emporix Orchestration Engine applies real time process intelligence to streamline operations, support large scale transformation, and continuously improve workflow efficiency through AI.

- In January 2024, Kyndryl Holdings introduced AI enabled workflow orchestration services designed to automate business processes and enhance productivity. The solution combines real time visibility, intuitive management tools, strong access controls, and advanced encryption to simplify orchestration across complex digital workplace environments.

Report Scope

Report Features Description Market Value (2024) USD 8.2 Bn Forecast Revenue (2034) USD 43.7 Bn CAGR(2025-2034) 18.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Solution, Services: Managed Services, Professional Services: Consulting, Training & Education, Support & Maintenance),By Business Function (Supply Chain Management and Order Fulfillment, Marketing, Human Resource Management, Finance and Accounting, Customer Service and Support),By Deployment (On-premises, Cloud),By Organization Size (Large Enterprises, Small & Mid-sized Enterprises (SMEs)),By End-User Vertical (BFSI, IT and Telecom, Healthcare and Life Sciences, Manufacturing, Retail and e-Commerce, Energy and Utilities, Government and Public Sector, Other End-User Verticals) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape IBM Corporation, SAP SE, Microsoft Corporation, Oracle Corporation, Camunda Services GmbH, Red Hat Inc., ServiceNow Inc., Appian Corporation, MuleSoft LLC (Salesforce), Boomi LP, Software AG, Pega Systems Inc., TIBCO Software Inc., Micro Focus International plc, BMC Software Inc., Argo Workflows (Intuit Inc.), Kubernetes (Cloud Native CNCF), Tray.io Inc., SnapLogic Inc., UiPath Inc., Nintex Global Ltd., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Process Orchestration MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Process Orchestration MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- SAP SE

- Microsoft Corporation

- Oracle Corporation

- Camunda Services GmbH

- Red Hat, Inc.

- ServiceNow, Inc.

- Appian Corporation

- MuleSoft LLC (Salesforce)

- Boomi, LP

- Software AG

- Pega Systems Inc.

- TIBCO Software Inc.

- Micro Focus International plc

- BMC Software, Inc.

- Argo Workflows (Intuit Inc.)

- Kubernetes (Cloud Native CNCF)

- Tray.io Inc.

- SnapLogic, Inc.

- UiPath Inc.

- Nintex Global Ltd.

- Others