Global Private Cloud Services Market Size, Share, Industry Analysis Report By Service (Infrastructure as a Service (IAAS), Platform as a Service (PAAS), Software as a Service (SAAS), By Enterprise Size (SMEs (Small & Medium Enterprises), Large Enterprises), By Vertical (BFSI, IT & Telecom, Healthcare & Lifesciences, Government & Public Sector, Retail & Consumer Goods, Manufacturing, Energy & Utilities, Other Verticals), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sept. 2025

- Report ID: 157037

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

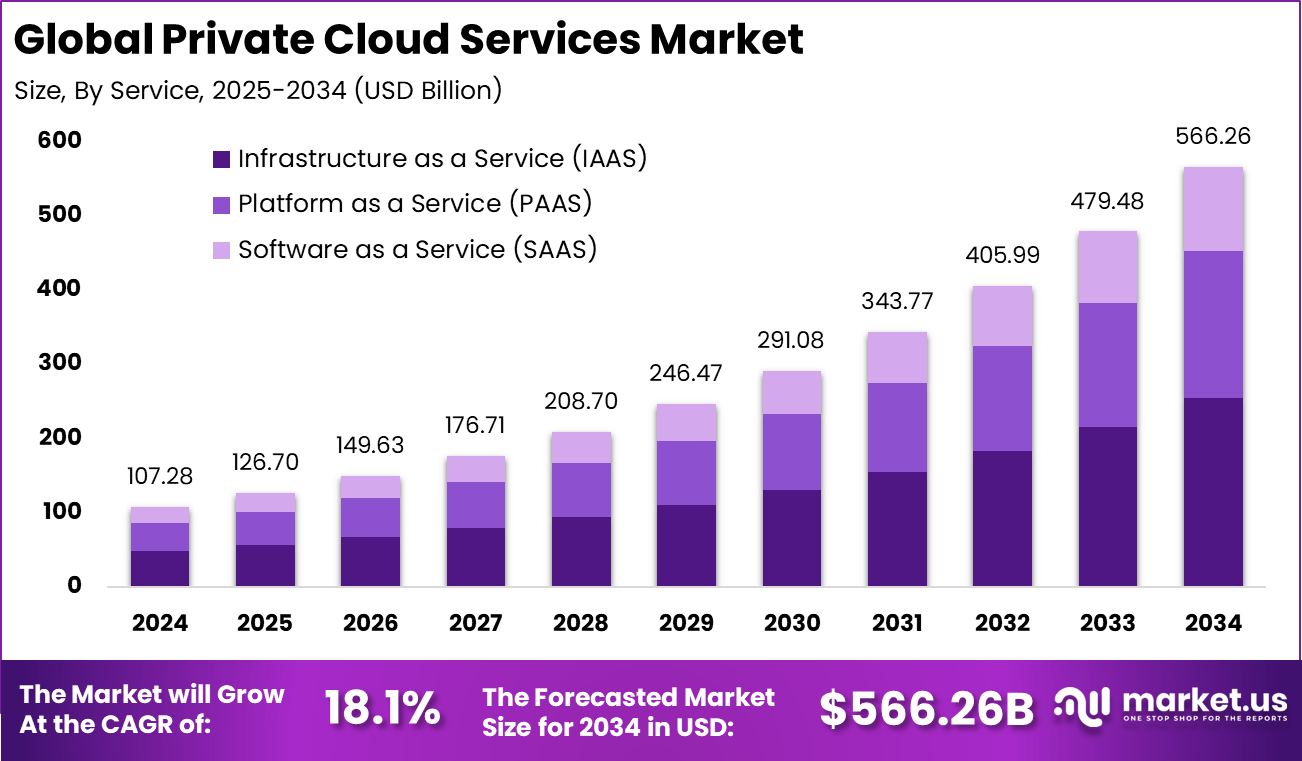

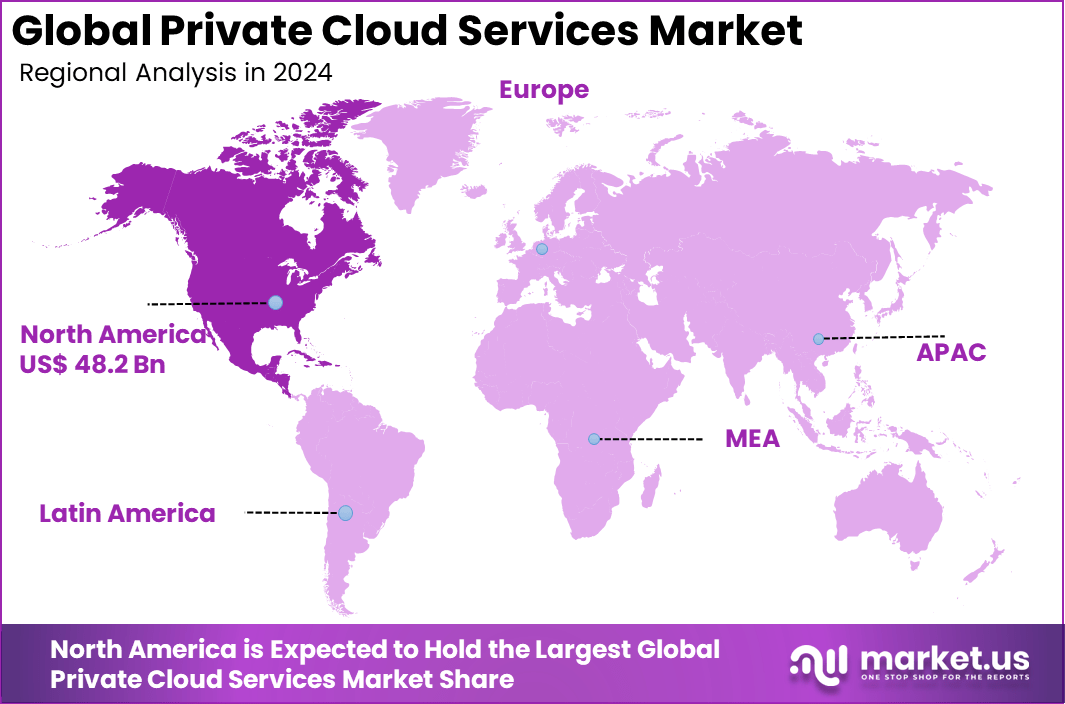

The Global Private Cloud Services Market size is expected to be worth around USD 566.26 billion by 2034, from USD 107.28 billion in 2024, growing at a CAGR of 18.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45% share, holding USD 48.2 billion in revenue.

The Private Cloud Services Market can be described as a dedicated, secure, and customizable computing environment that is entirely reserved for a single organization. It provides controlled infrastructure, enabling enterprises to host sensitive applications and data with stringent governance, unlike shared public cloud settings. The design of private clouds emphasizes autonomy, high performance, and tailored access controls, thus fulfilling the needs of entities seeking both flexibility and oversight.

Top driving factors behind this market include the rising awareness around data security and the need for regulatory compliance. As cyber threats escalate globally, organizations prioritize environments where they can enforce robust security measures such as encryption, intrusion detection, and access control.

Additionally, regulatory pressures like GDPR and HIPAA encourage adoption as private clouds support customizable compliance frameworks tailored to industry-specific needs. The digital transformation wave and the ever-increasing volume of data that businesses manage also fuel demand for secure, dedicated cloud infrastructure that maintains control without sacrificing flexibility.

For instance, in May 2025, Dell Technologies announced advancements in its private cloud infrastructure, including support for VMware and Red Hat software. These enhancements aim to provide enterprises with flexible and scalable private cloud solutions, accommodating diverse workload requirements.

According to G2, cloud adoption has become nearly universal, with 94% of enterprise organizations now relying on cloud computing. More than 60% of all corporate data is stored in the cloud, while global spending on cloud services is expected to reach $1.3 trillion by 2025. Amazon Web Services held the largest share of the market in 2024 at 31%, reflecting its leadership position.

Despite this growth, challenges remain. Companies waste nearly 32% of their cloud spend, and more than one-third of cloud data breaches are linked to misconfiguration or human error. In response, 83% of enterprise CIOs planned to repatriate at least some workloads in 2024, indicating a push toward optimizing costs, improving security, and balancing hybrid infrastructure strategies.

Key Takeaway

- In 2024, Infrastructure as a Service (IaaS) led the market, holding a 45% share.

- Large Enterprises were the primary adopters, accounting for 58% share of the market.

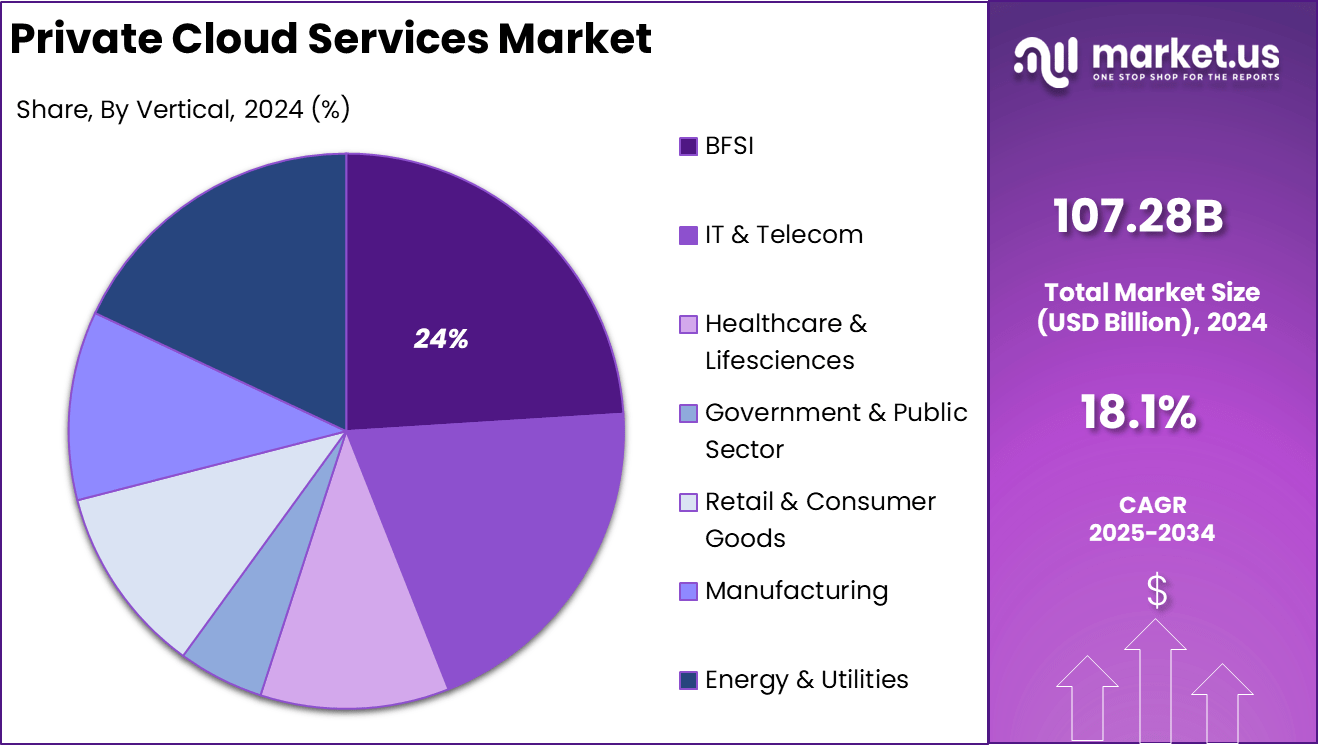

- The BFSI sector dominated among end users, contributing 24% share in 2024.

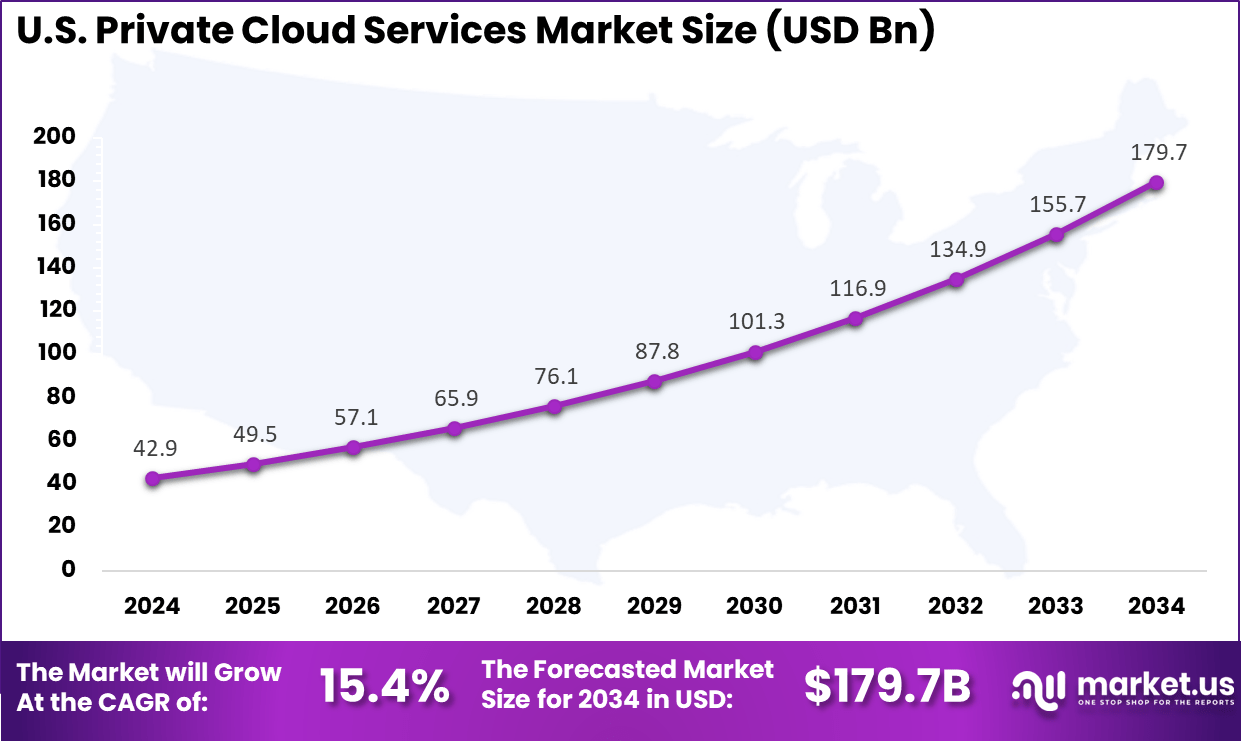

- The U.S. Private Cloud Services Market was valued at USD 42.9 Billion in 2024, expanding at a 15.4% CAGR.

- North America was the leading regional market, capturing over 45% share in 2024.

U.S. Market Size

The market for Private Cloud Services within the U.S. is growing tremendously and is currently valued at USD 42.9 billion, the market has a projected CAGR of 15.4%. The market is growing due to the increasing need for enhanced data security, privacy, and compliance with strict regulations.

Sectors such as healthcare, finance, and government are prioritizing private cloud solutions to manage sensitive data securely and meet regulatory standards. Additionally, digital transformation efforts, federal initiatives supporting cloud adoption, and the rise of AI-driven solutions are significantly contributing to the expansion of private cloud services across the U.S.

For instance, in August 2025, Broadcom announced its partnership with USSF Federal Credit Union (USSFCU) to power financial wellness through Broadcom’s private cloud and AI solutions. This collaboration underscores the growing dominance of private cloud services in the U.S. market, particularly in highly regulated sectors like finance.

In 2024, North America held a dominant market position in the Global Private Cloud Services Market, capturing more than a 45% share, holding USD 48.2 billion in revenue. This dominance is due to the early adoption of advanced cloud technologies and substantial investments in IT infrastructure.

The presence of major cloud service providers like AWS, Microsoft, and Google, along with stringent data security and compliance needs, has driven the demand for private cloud solutions. Furthermore, the rapid pace of digital transformation, federal initiatives promoting cloud adoption, and the growing integration of AI and automation technologies have contributed to the expansion of private cloud services in North America.

For instance, in December 2023, CenturyLink updated its private cloud service by integrating VMware and HPE’s technologies to enhance its cloud offerings. This move emphasizes North America’s dominance in the private cloud services market, with U.S.-based companies like CenturyLink leading innovations and improving cloud infrastructure.

Service Analysis

In 2024, the Infrastructure as a Service (IaaS) segment held a dominant market position, capturing a 45% share of the Global Private Cloud Services Market. This dominance is due to the increasing demand for scalable, flexible, and cost-effective IT infrastructure.

IaaS allows businesses to optimize resource usage, reduce capital expenditure, and ensure high levels of security and control over their cloud environments. The ability to quickly scale computing resources as needed, coupled with the growing adoption of digital transformation, further fueled the growth of IaaS in private cloud services.

For Instance, in May 2025, Microsoft announced the migration of its IT infrastructure management to the cloud using Microsoft Azure, further emphasizing the growth of Infrastructure as a Service (IaaS) in private cloud services. By shifting to Azure, Microsoft enhances its ability to efficiently manage, scale, and secure infrastructure resources while reducing reliance on traditional hardware.

Enterprise Size Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing a 58% share of the Global Private Cloud Services Market. The demand in this sector has been driven mainly by The demand in this sector has been driven mainly by the need for enhanced data security, regulatory compliance, and the ability to manage large-scale IT infrastructure.

Large enterprises require private cloud solutions to handle sensitive data, ensure business continuity, and support complex workloads. Additionally, their focus on digital transformation and cost optimization has further accelerated the adoption of private cloud services.

For instance, in July 2025, Rackspace launched OpenStack Business, an open-source private cloud service designed for large enterprises with regulated workloads. This service offers a cost-effective and secure solution, enabling organizations to modernize their application development while avoiding vendor lock-in.

Vertical Analysis

In 2024, the BFSI (Banking, Financial Services, and Insurance) segment held a dominant market position, capturing a 24% share of the Global Private Cloud Services Market. This dominance is due to the sector’s stringent requirements for data security, privacy, and regulatory compliance.

Private cloud solutions offer BFSI organizations enhanced control over sensitive financial data, ensuring compliance with regulations. Additionally, the need for scalability, high performance, and disaster recovery capabilities in BFSI has significantly contributed to the sector’s adoption of private cloud services.

For Instance, in May 2025, Taishin Bank advanced its application platform and hybrid cloud architecture by leveraging VMware Cloud Foundation. This move is a significant example of private cloud services adoption in the banking sector. By integrating VMware’s cloud technologies, the bank enhances its infrastructure, improving scalability, security, and operational efficiency.

Key Market Segments

By Service

- Infrastructure as a Service (IAAS)

- Platform as a Service (PAAS)

- Software as a Service (SAAS)

By Enterprise Size

- SMEs (Small & Medium Enterprises)

- Large Enterprises

By Vertical

- BFSI

- IT & Telecom

- Healthcare & Lifesciences

- Government & Public Sector

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Other Verticals

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Rising Use of Cloud Services

The global acceleration of digital transformation has significantly amplified the adoption of cloud services. Enterprises increasingly rely on private cloud environments to meet demands for scalability, compliance, and performance.

This surge is driven by the need for secure data handling, agility in application deployment, and cost predictability. As hybrid and multi-cloud strategies become mainstream, private clouds offer businesses the control and customization required to optimize operations while maintaining governance across complex IT ecosystems.

For instance, in June 2025, Oracle’s shares saw a significant rise, driven by the growing demand for cloud services. The surge in cloud adoption, particularly in private cloud solutions, reflects businesses’ increasing reliance on cloud infrastructure to support digital transformation, scalability, and operational efficiency.

Restraint

High Initial Capital & Operational Costs

Deploying private cloud infrastructure involves significant upfront investments in servers, storage, data center facilities, cooling systems, and energy. Additionally, specialized personnel and ongoing maintenance add to the total cost of ownership.

These financial burdens often pose challenges for small to mid-sized enterprises lacking the scale or capital to absorb such costs. Without clear long-term ROI or internal IT capabilities, organizations may hesitate to commit to private cloud solutions, opting instead for more affordable public or hybrid alternatives.

For instance, in May 2025, HPE expanded its private cloud portfolio, focusing on simplifying virtualization to reduce the complexities and high costs associated with private cloud deployments. While private clouds offer enhanced security and control, the initial capital investment in hardware, software, and infrastructure, along with ongoing operational costs, remains a significant challenge.

Opportunities

AI & Automation for Infrastructure Optimization

AI and automation present a transformative opportunity for optimizing private cloud operations. Intelligent algorithms can dynamically allocate resources, predict workloads, and automate routine tasks, significantly enhancing efficiency. This reduces operational overhead, minimizes downtime, and improves system performance.

For businesses, such capabilities translate into measurable cost savings and improved return on infrastructure investments. By integrating AI-driven tools into cloud management, enterprises can unlock smarter, more responsive, and future-ready infrastructure aligned with evolving digital and business needs.

For instance, in July 2025, Oracle announced a $2 billion investment in AI and cloud infrastructure to enhance its cloud services and expand its AI capabilities. This strategic investment aims to accelerate the development of next-generation AI-driven solutions, which will be integrated into Oracle’s cloud offerings, including its private cloud services.

Challenges

Cybersecurity Threat Landscape

Despite their inherently secure architecture, private cloud environments remain vulnerable to evolving cyber threats. Internal misconfigurations, unauthorized access, and advanced persistent threats can compromise sensitive data.

Organizations must invest in robust cybersecurity frameworks, including identity and access management, encryption, and network segmentation, to mitigate these risks. Additionally, the complexity of compliance with industry-specific regulations adds further pressure. Maintaining a secure, resilient private cloud infrastructure demands continuous vigilance, skilled personnel, and adaptive security strategies.

For instance, in July 2025, Scale Computing and Bitdefender partnered to enhance cybersecurity for edge computing and private cloud infrastructures. This collaboration addresses the growing cybersecurity threats within private cloud services, where vulnerabilities such as internal misconfigurations, unauthorized access, and data breaches are significant concerns.

Key Players Analysis

In the Private Cloud Services Market, leading technology giants such as Amazon Web Services, Microsoft Azure, and Google Cloud Platform have established a strong influence. Their offerings are widely recognized for scalability, integration, and enterprise-grade security. IBM Cloud and Oracle Cloud Infrastructure continue to strengthen their positions with hybrid and industry-focused solutions.

Global IT infrastructure providers also contribute significantly. Cisco, Dell Technologies, Hewlett Packard Enterprise, and Rackspace Technology deliver advanced hardware, virtualization, and managed services. Their focus remains on building reliable private cloud environments that are customized for different industries.

Professional service providers and regional cloud leaders complete the competitive landscape. Accenture, Wipro, TCS, and Infosys support organizations with consulting, migration, and management expertise. In Asia, Alibaba Cloud, Tencent Cloud, and Huawei Cloud have expanded aggressively, leveraging strong local ecosystems. Other key players across regions continue to bring innovation in niche solutions.

Top Key Players in the Market

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Oracle Cloud Infrastructure (OCI)

- Cisco

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Rackspace Technology

- Salesforce

- SAP

- Accenture

- Wipro

- TCS

- Infosys

- Alibaba Cloud

- Tencent Cloud

- Huawei Cloud

- Other Key Players

Recent Developments

- In May 2025, IBM and Oracle expanded their partnership to integrate IBM’s WatsonX AI portfolio with Oracle Cloud Infrastructure (OCI). This collaboration aims to drive multi-agentic, AI-driven productivity and efficiency across enterprises, enhancing private cloud capabilities.

- In April 2025, Cisco introduced a comprehensive suite of private cloud solutions, including on-demand infrastructure and network optimization tools. These offerings aim to simplify and automate private cloud deployments, providing enterprises with a scalable and secure foundation for their IT operations.

Report Scope

Report Features Description Market Value (2024) USD 107.28 Bn Forecast Revenue (2034) USD 566.26 Bn CAGR(2025-2034) 18.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, nd Emerging Trends Segments Covered By Service (Infrastructure as a Service (IAAS), Platform as a Service (PAAS), Software as a Service (SAAS), By Enterprise Size (SMEs (Small & Medium Enterprises), Large Enterprises), By Vertical (BFSI, IT & Telecom, Healthcare & Lifesciences, Government & Public Sector, Retail & Consumer Goods, Manufacturing, Energy & Utilities, Other Verticals) Regional Analysis North America: US, Canada; Europe: Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific: China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America: Brazil, Mexico, Rest of Latin America; Middle East & Africa: South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud Infrastructure (OCI), Cisco, Dell Technologies, Hewlett Packard Enterprise (HPE), Rackspace Technology, Salesforce, SAP, Accenture, Wipro, TCS, Infosys, Alibaba Cloud, Tencent Cloud, Huawei Cloud, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)  Private Cloud Services MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample

Private Cloud Services MarketPublished date: Sept. 2025add_shopping_cartBuy Now get_appDownload Sample -

-