Global Pressure Sensors Market By Technology (Piezoresistive, Capacitive, Piezoelectric, Resonant Solid State, Electromagnetic, Optical, and Other Technologies), By Type (Wired, Wireless) By Application (Automotive, Consumer Electronics, Oil and Gas, Medical, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Oct. 2023

- Report ID: 22921

- Number of Pages: 393

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

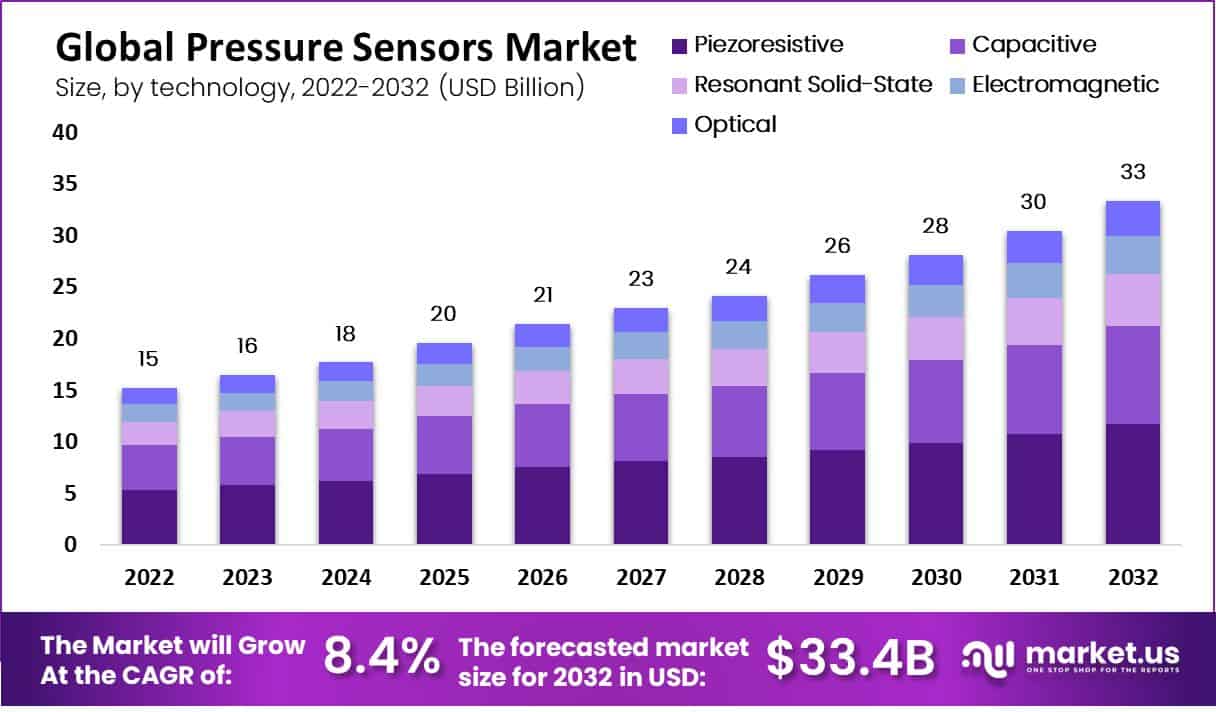

The global pressure sensors market was valued at USD 16 billion in 2023 and it is expected to reach USD 33.4 billion in 2032, growing at a CAGR of 8.4% during the forecast period of 2023 to 2032.

A pressure sensor is a device consisting of a pressure-sensitive element that determines the actual pressure exerted on the sensor (using various principles of operation) and several components that convert this information into an output signal. In addition, the COVID-19 pandemic has increased the demand for pressure sensors in various sectors.

The demand for pressure sensors is being driven by the increasing use of pressure sensors in household appliances like washing machines and refrigerators. Additionally, numerous suppliers of pressure sensors are concentrating on the creation of novel products aimed at improving the customer experience. For instance, Bosch Sensortec, a manufacturer of pressure sensors, introduced the robust barometric pressure sensor BMP384 in March 2021.

Note: Actual Numbers Might Vary In The Final Report

The high performance and low power consumption of the BMP384 make it an excellent choice for harsh industrial applications, wearable devices, and home appliances. Pressure sensors for Internet of Things systems are the primary focus of a number of international businesses. In IoT systems, pressure sensors are used to monitor devices and systems that are driven by pressure signals.

For instance, in July 2020, the electrical engineering and software company Yokogawa Electric Corporation announced the introduction of new temperature and pressure sensors for the Sushi Sensor wireless industrial IoT solutions in specific Southeast Asian markets, Europe, and North America. The early detection of signs of equipment abnormalities was made possible by these sensors, which provided equipment condition monitoring based on broader plant data.

Key Takeaways

- Pressure Sensors Market Valued at USD 15.2 billion in 2022, the market is estimated to reach USD 33.4 billion by 2032, with a CAGR of 8.4%.

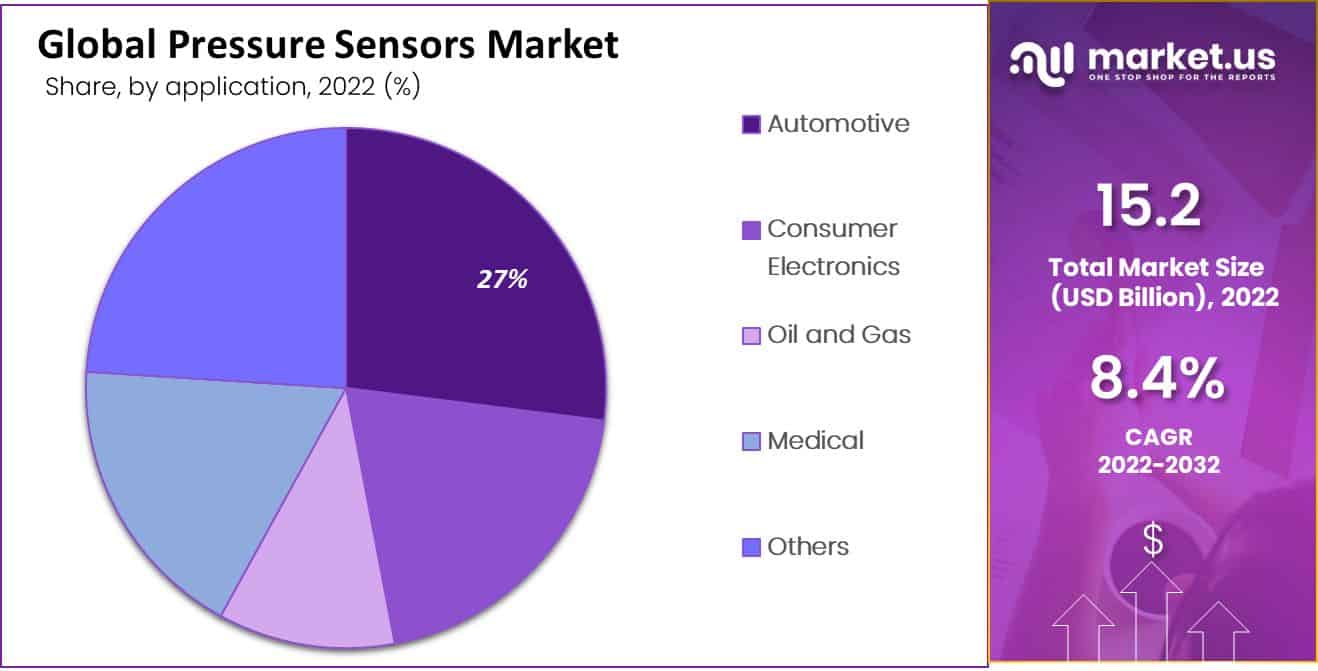

- Increased demand is observed across various sectors, including automotive, consumer electronics, oil and gas, and medical industries.

- The wired segment dominates the market, holding over 85% of the total global market share.

- The automotive segment currently commands the largest market share, accounting for over 27% of global sales.

- Industrial applications, particularly in oil and gas and medical sectors, are expected to witness rapid growth.

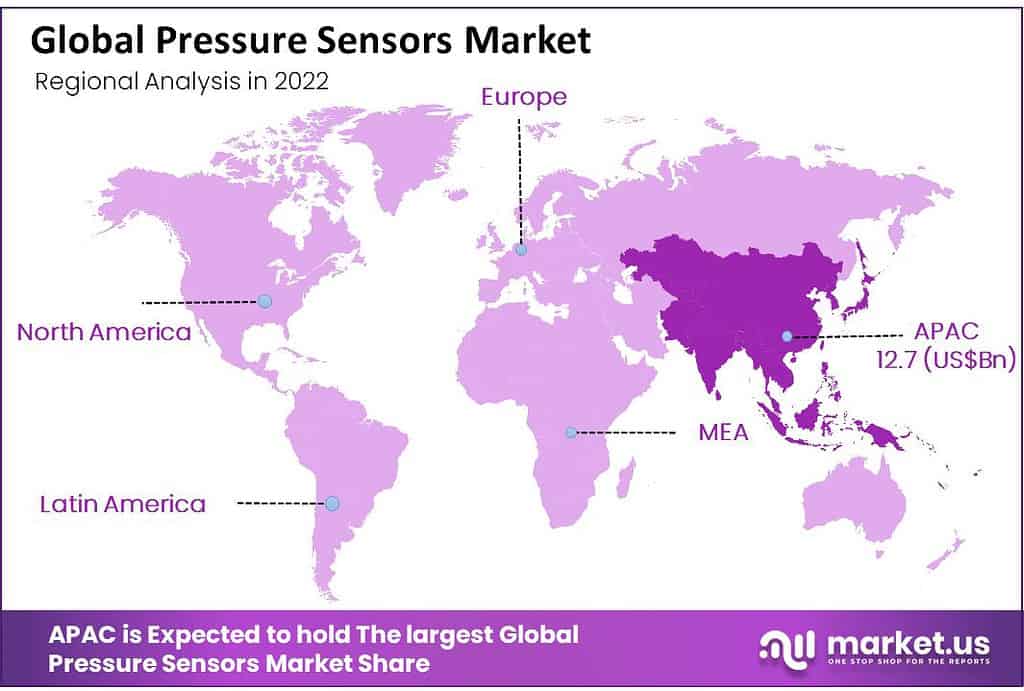

- The Asia-Pacific region leads the market, contributing more than 38.0% of the global revenue in 2022.

- North America is projected to be the fastest-growing regional market, focusing on automotive applications like EGR and TPMS systems.

- Notable companies actively participating in the market include AlphaSense, Robert Bosch LLC, Siemens AG, and others, employing strategies like partnerships and product innovations to bolster their market presence.

Driving Factors

Automotive sectors drive the growth of the pressure sensor market

The government plays an important role in the growth of the pressure sensor market, mainly in the automotive sector. A law called (TREAD), also called the Transportation Recall Enhancement, Accountability, and Documentation Act in the United States, made the installation of the (TPMS), also known as the Tyre Pressure Monitoring System, mandatory for all vehicles.

This TPMS measures the tire’s pressure and the tire’s temperature and alerts the driver within 20 minutes of the detection of the low inflation of the tire. The US government has also made all commercial vehicles have passenger airbags and side airbags installed with pressure sensors, which is currently driving the market. Growing demand for wearable devices is expected to drive the growth of the wireless pressure sensor segment.

Similarly, the European Union also has a compulsion on all the passenger car models (M1) to have TPMS. This will create concern regarding human and road safety and vehicle safety, eventually boosting the market growth. The European Union has also passed a zero-emission act that aims to reduce the CO2 levels in the environment. According to this Act, passenger vehicles that weigh less than 3.5 tons must emit less than 50 g of CO2 per km. Due to this, an increase in the adoption of electric vehicles in America, Europe, and APAC has been observed, increasing demand for the Pressure Sensor market. An increase in EV sales is expected, with growth rates Four to Eight times for the light vehicle markets. This will increase the production of Electric vehicles and the pressure sensor market.

In braking, cooling, and fuel systems, pressure sensors are widely used to measure and control the pressure of various automotive fluids like engine oil, gearbox and transmission oil, and hydraulic oil. Due to various government safety requirements, the automotive industry is seeing an increase in demand for pressure sensors. For instance, in engine management systems, pressure sensors are necessary to precisely monitor engine conditions like air volume and exhaust gas pressure of the EGR system in order to improve the efficiency of automobile engines. The pressure sensor market is also expanding as a result of the mandate to monitor tire pressure.

Type Analysis

The wired segment was on top in 2022 and is estimated for more than 85% of the total market share globally. A wired pressure sensor is available in various technologies, such as capacitive, inductive, and photoelectric. Increased demand for wired pressure sensors in automotive, industrial, and other sectors will grow during the forecast period due to reduced radio frequency interference, smaller size, cross-manufacturer compatibility, and cost-effective installation characteristics. It is expected to drive the growth of the wired pressure sensor segment. The low power consumption of wired pressure sensors will further increase the segment’s growth.

The fastest growth of the wireless segment is expected during the forecast period. The advantages offered by wireless pressure sensors, such as ease of portability, increased safety, and cost-effectiveness, are expected to drive the growth of this segment. Recently, the use of Wireless pressure sensor consumer products has increased. Manufacturing, industrial automation, air compressor monitoring, and swimming pool pumping systems are expected to drive growth. Segment growth during the forecast period. Automated, battery-powered, and casing pressure monitoring solutions are driving the growth of the wireless pressure sensor segment.

Application Insights

The automotive segment dominated the market in 2022 and accounted for more than 27% of global sales. In electric cars, pressure sensors are used to prevent doors from jamming fingers. In addition, many pressure sensing companies worldwide are developing and launching new pressure sensors and systems for measuring dynamic pressure systems in moving vehicles.

For example, in May 2020, Luna, a supplier of pressure sensors, launched a new innovative pressure sensor and system that is used to measure dynamic pressure on the surface of moving vehicles by how to use Luna’s fiber and detectors and to collect data. Pressure sensors have a wide range of programs in purchaser electronics for comfort, indoor navigation, and user-pleasant interfaces.

The industrial segment is expected to record the fastest growth during the forecast period. Differential pressure sensors are used to monitor process flows where liquids must pass through barriers such as filters. Differential pressure sensors used in industrial applications offer benefits such as oil-free design, high-pressure ratings, increased resolution, and better accuracy. In addition, the growing use of pressure sensors in applications such as gearboxes and oil and gas equipment is driving the growth of this segment.

Note: Actual Numbers Might Vary In The Final Report

Technology Analysis

A major driver of the growth of this market is the increasing use of piezoresistive pressure sensors in automobiles and passenger vehicles to improve safety and reduce emissions. Due to their robustness, quick response time, and high frequency, piezoresistive pressure sensors are utilized in numerous aerospace and industrial applications. A number of manufacturers of pressure sensors are concentrating on creating waterproof sensors that are resistant to disturbances from the outside.

Key Market Segments

Based on the Type

- Wired Sensors

- Wireless Sensors

Based on Technology

- Piezoresistive

- Capacitive

- Resonant Solid-State

- Electromagnetic

- Optical

- Other Technologies

Based on Application

- Automotive

- Consumer Electronics

- Oil and Gas

- Medical

- Others

Latest Trends

Technological transformation is taking place in the automotive industry with the important goal of enhancing safety, comfort, and entertainment, offering many opportunities for pressure sensors. The tiny size of pressure sensors, such as MEMS, affects their need in the design scheme of the automotive industry, making them important for mass adoption. The miniature pressure sensor is best suited for measuring automotive brake system pressure, tire pressure, transmission fluid pressure, engine oil pressure, and intake manifold pressure, such as application. Several aspects need to be controlled in the pressure sensors, and the automotive sector contributes significantly to developments in these aspects.

With technology enabling the development of self-driving and self-driving cars, sensor adoption in vehicles is expected to grow even more. Pressure sensors are also integrated into automotive safety regulations enforced by government organizations. Due to a thriving automotive industry, the US automotive sector leads the market studied. Environmental and safety regulations in different countries are expected to increase automotive pressure sensors’ accuracy, quality, and price.

Hybrid vehicles have led to the widespread adoption of sophisticated vapor pressure measurement systems. The measurement system is more complicated than that of an ICE (internal combustion engine), so this seems necessary. There has been a start to top development. For example, Melexis announced a pressure sensor IC specifically for the engine’s EVAP system in October 2019. A relative pressure sensing IC designed for shallow pressure measurement in automotive applications demonstrates the company’s support for hybrid vehicle development. As the core of the EVAP system, the MLX90821 can detect the smallest vapor leaks.

Several expansion strategies have been observed from the supplier’s point of view to indicate the pressure sensor demand, which is increasing day by day. For example, in September 2019, TE Connectivity acquired Elmos’ pressure sensor business. The acquisition of Silicon Microstructures will provide TE with an expanded portfolio of low and medium MEMS pressure sensors in digital and analog versions. With the rise of tire pressure monitoring, tire manufacturers have entered the field of smart sensors. Since January 2020, JK Tire, the Indian tire manufacturer, has introduced the tire pressure monitoring system (TPMS) through previously purchased TREEL mobile solutions, the TREEL sensors, which monitor vital tire statistics, including pressure and temperature.

Regional Analysis

The Asia-Pacific region market will dominate the pressure sensor market in 2022 and account for more than 38.0% of global revenue. After APAC, America leads the Pressure Sensor market size. The increase in this phase may be attributed to the large-scale manufacturing of digital additives in addition to expanded funding in R&D. Growing demand for consumer electronics such as tablets, wearables, and smartphones is driving the demand for pressure sensors in this region.

India and China contribute a large portion of the regional pressure sensor market. China is a mature market and offers strong business opportunities. Danfoss Group, a market leader in engineering software and technology, has invested heavily in the pressure sensor market and is expected to accelerate the growth of the pressure sensor market in China Country. South Korea is home to the main key players likes of Kia, Hyundai, and Renault, and is expected to see steady growth in auto demand.

North America is expected to become the fastest-growing regional market during the forecast period. The North American market is expected to witness growth due to the rising demand for pressure sensors in EGR and TPMS system applications in the automotive segment. The presence of key players in the region is also one of the key drivers of market growth. At the same time, the growing demand for pressure sensors in industries such as gas and oil, petrochemical, and medical is also driving the market growth in this region.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the market is very fragmented. Market participants are focusing on strategies such as partnerships, joint ventures, product innovation, research and development, and geographic expansion to strengthen their position in the market. For example, in June 2018, ABB acquired GE Industrial Solutions (GEIS) to strengthen its position in the electrification sector and expand its presence in the region. Additionally, in August 2017, Omron Corporation acquired Microscan Systems, Inc., a subsidiary of Spectris plc. The acquisition allows Omron Group to improve control of its production equipment and production lines. The big players are focusing on improving their product offerings to better meet users’ changing needs and stay competitive. Below are some major players in the market.

Market Key Players

- AlphaSense

- City Technology Ltd.

- Dynamite Ltd.

- Figaro Engineering Inc.

- Membrapor AG.

- Nemoto & Co., Ltd.

- Robert Bosch LLC.

- ABB Ltd.

- Siemens AG.

- GfG Europe Ltd

Recent Developments

- In June 2023, Infineon Technologies AG introduced the KP464 and KP466 XENSIV barometric air pressure (BAP) sensors, emphasizing their use in automotive applications. The KP464 sensor was specifically designed for precise engine control management, while the KP466 BAP sensor was tailored to enhance seat comfort functions.

- In January 2023, Disrupt-X, a prominent IoT solutions provider, unveiled its latest creation: an advanced IoT solution for continuous air pressure monitoring within buildings. This groundbreaking system enables real-time air pressure monitoring in industrial and commercial settings, offering essential data and insights to improve safety, efficiency, and regulatory compliance. Leveraging IoT sensors, the Air Pressure Monitoring solution gathers data on air pressure levels in specific areas or entire facilities.

Report Scope

Report Features Description Market Value (2022) US$ 15.2 Bn Forecast Revenue (2032) US$ 33.4 Bn CAGR (2023-2032) 8.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Technology (Piezoresistive, Capacitive, Piezoelectric, Resonant Solid State, Electromagnetic, Optical, and Other Technologies), By Type (Wired, Wireless) By Application (Automotive, Consumer Electronics, Oil and Gas, Medical, and Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape AlphaSense, City Technology Ltd., Dynamite Ltd., Figaro Engineering Inc., Membrapor AG., Nemoto & Co., Ltd., Robert Bosch LLC., ABB Ltd., Siemens AG., GfG Europe Ltd Customization Scope Customization for segments and region/country level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a pressure sensor?A pressure sensor is a device that detects pressure and converts it into an analog or digital signal that can be measured or monitored.

How Big is pressure sensors market?The global pressure sensors market was valued at USD 15.2 billion in 2022 and it is expected to reach USD 33.4 billion in 2032, growing at a CAGR of 8.4% during the forecast period of 2023 to 2032.

What industries utilize pressure sensors?Pressure sensors find applications in various industries such as automotive, healthcare, aerospace, manufacturing, consumer electronics, and oil and gas, where they are used for monitoring, control, and safety purposes.

What is the study period of this market?The global Pressure Sensors Market is studied from 2020 - 2033 [updated].

Which region has highest growth rate in Pressure Sensors Market?The Asia-Pacific region market will dominate the pressure sensor market in 2022 and account for more than 38.0% of global revenue.

-

-

- AlphaSense

- City Technology Ltd.

- Dynamite Ltd.

- Figaro Engineering Inc.

- Membrapor AG.

- Nemoto & Co., Ltd.

- Robert Bosch LLC.

- ABB Ltd.

- Siemens AG.

- GfG Europe Ltd