Global Preparative and Process Chromatography Market Analysis By Product (Process Chromatography, Preparative Chromatography), By Type (Liquid Chromatography, Gas Chromatography, Thin Layer Chromatography, Paper Chromatography, Gel-permeation (Molecular Sieve) Chromatography, Hydrophobic Interaction Chromatography), By End-use (Pharmaceutical Industry, Biotechnology, Food Industry, Nutraceutical Industry, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149397

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

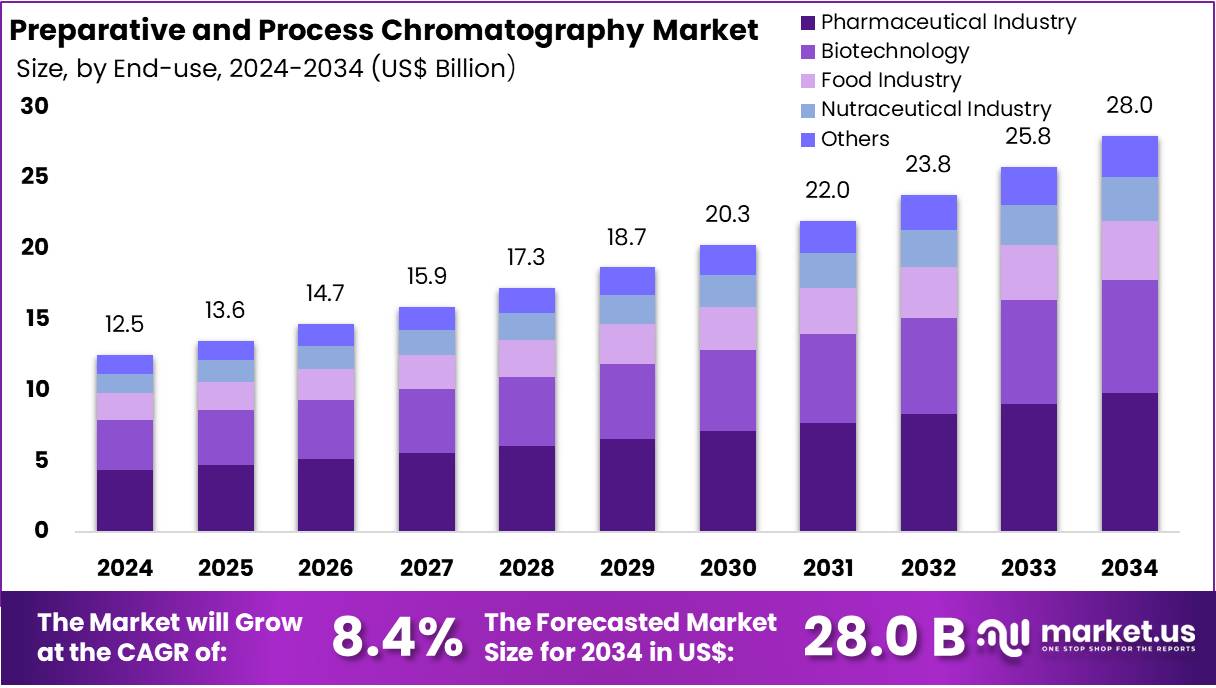

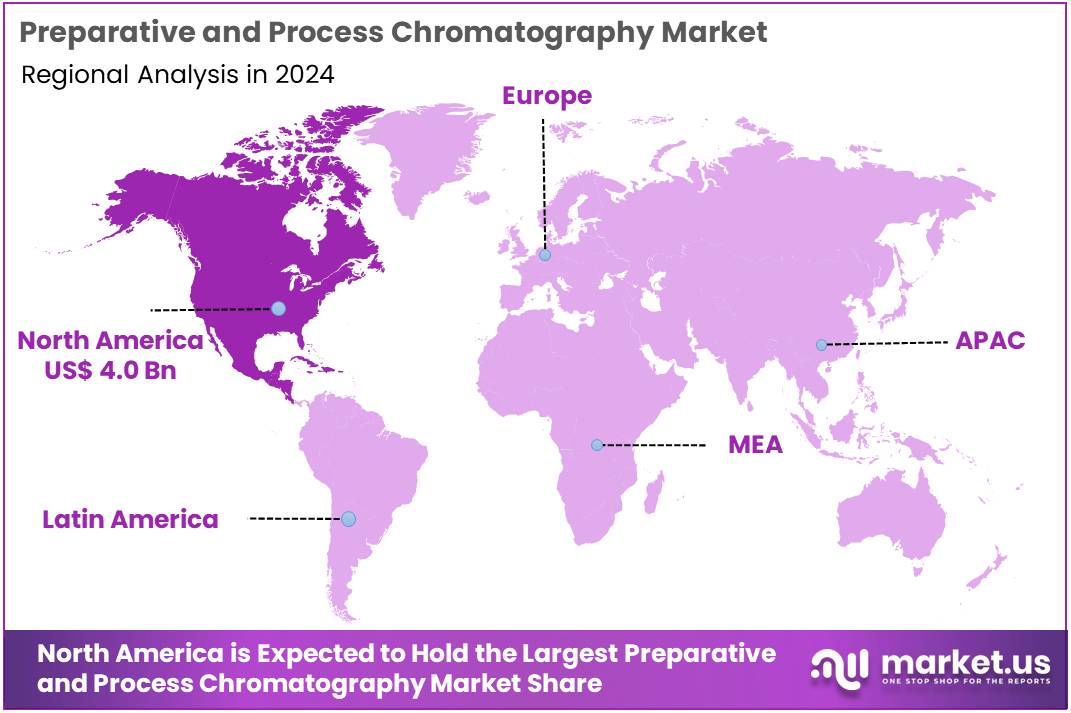

The Global Preparative and Process Chromatography Market Size is expected to be worth around US$ 28 Billion by 2034, from US$ 12.5 Billion in 2024, growing at a CAGR of 8.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 32.2% share and holds US$ 4 Billion market value for the year.

Preparative and process chromatography play a critical role in the purification of biopharmaceuticals, including therapeutic proteins, vaccines, and monoclonal antibodies. These techniques are integral to downstream processing, helping manufacturers isolate target biomolecules from complex mixtures. According to BioProcess International, advances in purification strategies have significantly improved yield and purity outcomes. For instance, biosimilar production has seen purity levels rise from 40% to 80% during the capture chromatography stage, while overall downstream yield has improved from 11.3% to 33.4%.

One of the primary growth drivers is the global demand for high-purity biologics. As the pharmaceutical industry continues to shift toward monoclonal antibodies and recombinant proteins, there is a greater emphasis on efficient purification methods. Preparative chromatography meets this need by ensuring the removal of host cell proteins, DNA, and other impurities. According to a study published by PubMed, however, approximately 20% of proteins may still be lost at each purification stage, highlighting the need for process optimization.

Technological innovation has been key to the sector’s growth. The development of systems like Multicolumn Countercurrent Solvent Gradient Purification (MCSGP) has enabled up to 90% purity and 93% yield in monoclonal antibody purification. This technique also offers a tenfold increase in productivity and reduces solvent usage by 90% compared to traditional batch processes. Additionally, single-use chromatography systems have become popular for reducing contamination risks and simplifying validation procedures.

The importance of stringent quality control and regulatory compliance cannot be overstated. According to the U.S. Food and Drug Administration (FDA), quality control in pharmaceuticals is regulated under CGMP (Current Good Manufacturing Practice) guidelines. The FDA evaluates pharmaceutical laboratories at least once every two years. Furthermore, its Center for Drug Evaluation and Research (CDER) conducts ongoing surveillance programs to test marketed drugs for identity, assay accuracy, and impurity levels.

Preparative and process chromatography are also vital in the food industry for ensuring safety and compliance. The FDA, in collaboration with the CDC, monitors foodborne pathogens. For example, the CDC estimates that foodborne diseases cause about 48 million illnesses annually in the U.S., leading to 128,000 hospitalizations and 3,000 deaths. Programs like the Food Emergency Response Network (FERN) have been pivotal, although recent budget reductions have affected some initiatives, such as the FERN Proficiency Testing Program.

The preparative and process chromatography market is expanding due to rising demand for biopharmaceuticals, advanced purification technologies, and strict regulatory requirements. As personalized medicine grows, the need for efficient and specialized purification techniques is expected to accelerate, further strengthening the role of chromatography in global healthcare and safety systems.

Key Takeaways

- By 2034, the global Preparative and Process Chromatography Market is projected to reach around US$ 28 billion, growing from US$ 12.5 billion in 2024.

- The market is expected to grow at a compound annual growth rate (CAGR) of 8.4% between 2025 and 2034, indicating strong long-term demand.

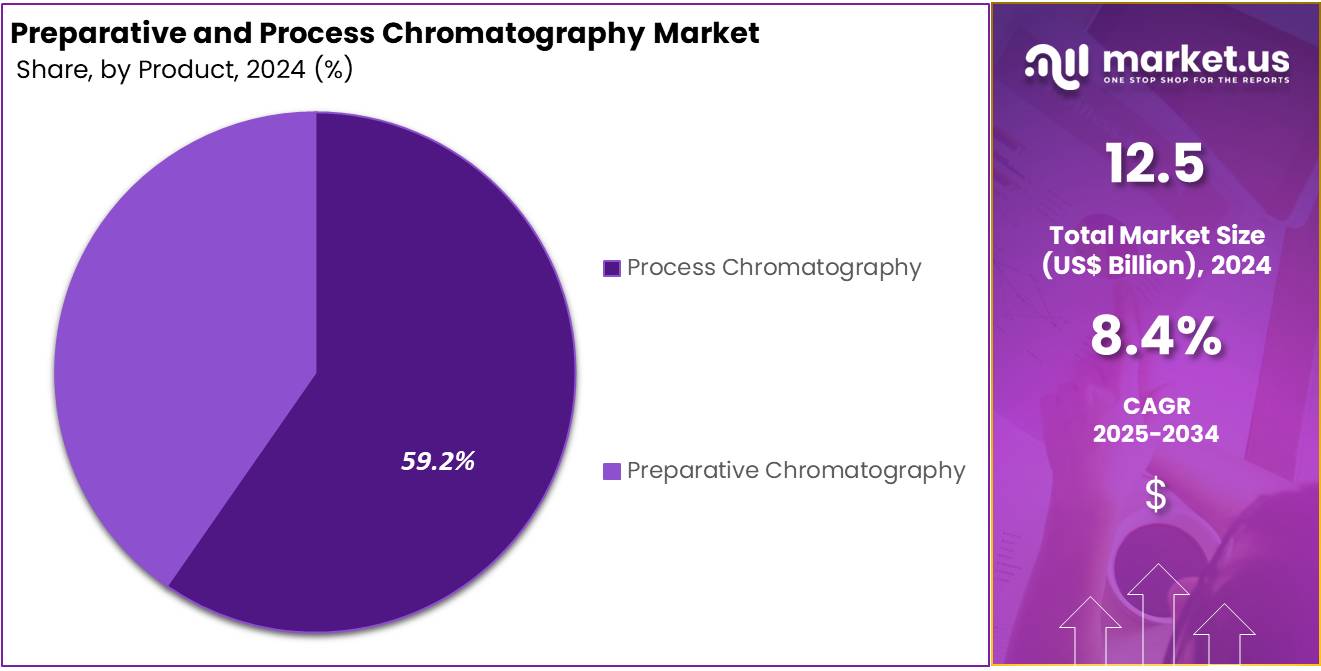

- In 2024, the Process Chromatography segment led the product category, capturing over 59.2% of the total market due to its scalability and efficiency.

- The Liquid Chromatography segment held a leading position by type in 2024, accounting for more than 28.4% of the global market share.

- The Pharmaceutical Industry emerged as the dominant end-use segment in 2024, contributing over 43.6% to the market, driven by growing drug development needs.

- North America maintained its leadership position in 2024, capturing more than 32.2% of the market, valued at approximately US$ 4 billion.

Product Analysis

In 2024, the Process Chromatography section held a dominant market position in the product segment of the Preparative and Process Chromatography Market and captured more than a 59.2% share. This strong position was mainly due to its wide use in large-scale purification processes. It is commonly used for purifying monoclonal antibodies, therapeutic proteins, and vaccines. Process chromatography systems are designed for high-volume operations. They allow efficient separation and support regulatory compliance, making them ideal for pharmaceutical production.

These systems are preferred for their scalability and ability to handle continuous workflows. Many biopharmaceutical manufacturers rely on process chromatography to reduce production time and costs. The rising number of biologic drugs in development has further increased demand. As companies move toward continuous manufacturing, the need for robust purification systems has grown. These factors help maintain the segment’s dominance. Their application in GMP-compliant facilities makes them essential to industrial-scale bioprocessing.

Meanwhile, preparative chromatography also plays a vital role in the market. It is mostly used in laboratories for research, small-batch production, and analytical purposes. This method supports the separation of pure compounds from complex mixtures. It is useful in drug discovery, food analysis, and chemical synthesis. Preparative chromatography is ideal when high-purity substances are needed in small quantities. Growth in R&D investments and partnerships between academia and industry are helping expand its use. While smaller in scale, its relevance in early development stages remains significant.

Type Analysis

In 2024, the Liquid Chromatography section held a dominant market position in the type segment of the preparative and process chromatography market and captured more than a 28.4% share. This leadership was due to its accuracy, reliability, and efficiency in large-scale biomolecule separation. Pharmaceutical companies widely used it for drug development and purification. Its scalable performance and consistent results made it the most preferred option among laboratories and manufacturing units.

Gas Chromatography emerged as a vital technique, particularly in sectors like petrochemicals and food safety. It is known for fast analysis and precise separation of volatile compounds. Thin Layer Chromatography (TLC) also maintained relevance in research and academic labs. Although TLC is less used in industry-scale operations, it remains popular for small-scale experiments due to its low cost and ease of use. Paper Chromatography retained minimal demand, mostly for teaching purposes and simple separations in low-resource environments.

Gel-permeation Chromatography, also called molecular sieve chromatography, gained momentum in polymer testing and biopharma quality control. It allows molecule separation by size, making it useful for protein analysis. Hydrophobic Interaction Chromatography (HIC) also grew in demand, especially for purifying monoclonal antibodies. HIC supports gentle processing and preserves protein structures in aqueous conditions. These methods have become essential as the industry shifts towards biologics and personalized treatments. Each chromatography type serves a specific need in the expanding life sciences sector.

End-use Analysis

In 2024, the Pharmaceutical Industry section held a dominant market position in the End-use segment of the Preparative and Process Chromatography Market. It captured more than a 43.6% share. This lead was attributed to the rising production of biologics and demand for high-purity pharmaceuticals. Chromatography was widely used for purifying active pharmaceutical ingredients (APIs) and monoclonal antibodies. The push for personalized medicine and stricter purity regulations further drove usage. Large-scale manufacturing needs in pharma continued to boost the segment’s growth.

The Biotechnology segment was the second-largest contributor to the market. The demand for chromatography in protein purification and genetic research was a key driver. Biotech firms and research labs increased their reliance on these techniques to isolate and analyze biomolecules. Ongoing innovations and rising investments in life sciences supported this trend. Academic institutions also adopted preparative chromatography for research. Overall, the biotech sector saw steady adoption of chromatography in both commercial and experimental settings.

Food and nutraceutical industries showed growing interest in chromatography. In the food sector, it was applied to detect chemical residues, additives, and contaminants. Compliance with safety standards pushed adoption further. Meanwhile, the nutraceutical segment used chromatography to extract active ingredients from natural sources. Health-conscious consumers and demand for plant-based supplements contributed to this trend. The Others category, including environmental labs and academic research centers, saw limited but essential use in chemical analysis and testing applications.

Key Market Segments

By Product

- Process Chromatography

- Preparative Chromatography

By Type

- Liquid Chromatography

- Gas Chromatography

- Thin Layer Chromatography

- Paper Chromatography

- Gel-permeation (Molecular Sieve) Chromatography

- Hydrophobic Interaction Chromatography

By End-use

- Pharmaceutical Industry

- Biotechnology

- Food Industry

- Nutraceutical Industry

- Others

Drivers

Rising Demand for Biopharmaceuticals Fuels Chromatography Adoption

The preparative and process chromatography market is experiencing notable growth, driven by the rising demand for biopharmaceuticals such as monoclonal antibodies, recombinant proteins, and vaccines. These biologics require precise and scalable purification methods to ensure product safety and efficacy. Chromatography techniques offer high resolution and purity, making them essential in the downstream processing of complex biological products. The expansion of the global biopharma industry is reinforcing the demand for these advanced separation technologies.

As therapeutic innovations progress, particularly in areas like oncology, autoimmune disorders, and chronic diseases, the reliance on biopharmaceutical products continues to increase. Preparative and process chromatography is a key enabling technology that supports the large-scale production of biologics. It plays a vital role in ensuring consistency, purity, and regulatory compliance across batches. The growth of biosimilars and next-generation biologics further amplifies the need for robust and efficient chromatographic systems in manufacturing facilities.

Moreover, global investment in biopharmaceutical manufacturing infrastructure is rising, with a focus on quality and scalability. Governments and private firms are building new bioproduction sites and expanding existing facilities. This expansion increases the requirement for chromatography systems tailored to meet high-throughput purification needs. As a result, chromatography technologies are being integrated into both clinical and commercial production lines, driving their sustained adoption across the biopharmaceutical value chain.

Restraints

High Cost of Chromatography Systems and Consumables

The Preparative and Process Chromatography market faces a significant restraint due to the high cost of systems and consumables. Even with continuous innovations, these technologies remain capital-intensive. Initial investment in chromatography instruments is substantial, particularly for large-scale purification processes. This includes sophisticated hardware, software, and infrastructure setup. Additionally, specialized accessories such as high-performance resins, columns, and detectors further increase capital expenditure, making it less accessible for institutions with limited financial capacity.

Operational expenses also contribute to the financial burden of chromatography. The regular replacement of consumables like filters, solvents, and resins adds recurring costs. Maintenance of systems and calibration procedures demand consistent spending. Furthermore, energy consumption, compliance requirements, and facility upkeep contribute to long-term expenses. These factors make chromatography operations cost-intensive, discouraging frequent adoption among mid-sized laboratories and contract research organizations that operate under tight budgets.

Moreover, skilled personnel are essential for the operation of chromatography systems. Hiring and retaining trained professionals require additional investments in human resources. Without adequate expertise, the risk of errors increases, leading to wastage and lower productivity. This combination of high procurement costs, operating expenditures, and talent dependency presents a notable challenge. As a result, market growth may be limited among research and production entities with constrained resources.

Opportunities

Expansion of Bioprocessing Infrastructure in Emerging Markets

Emerging economies across Asia-Pacific, Latin America, and the Middle East are showing strong commitment to expanding their bioprocessing capacities. These regions are witnessing a rise in pharmaceutical manufacturing investments supported by national healthcare programs and foreign direct investment. As local demand for biologics increases, the need for advanced purification technologies such as preparative and process chromatography is growing. This trend presents a key opportunity for chromatography suppliers to expand their presence and establish strong regional distribution networks.

Favorable government policies and regulatory reforms are further supporting the growth of biologics manufacturing in these emerging regions. Countries like India, Brazil, and the UAE have introduced incentives, streamlined approvals, and infrastructure funding to boost local production. These developments are creating a conducive environment for adopting high-throughput purification systems. As a result, suppliers of chromatography equipment and consumables are well-positioned to benefit from early entry into these maturing markets.

Additionally, the strategic interest of multinational pharmaceutical companies in relocating or expanding manufacturing operations to lower-cost regions is intensifying demand for advanced bioprocessing tools. Preparative and process chromatography systems are essential for scalable production of vaccines, monoclonal antibodies, and biosimilars. The rise of contract manufacturing organizations in emerging markets further strengthens this opportunity, creating a favorable landscape for long-term business growth.

Trends

Rising Adoption of Single-Use Technologies and Continuous Processing

Preparative and process chromatography is witnessing a notable transition towards single-use systems and continuous processing techniques. This shift is being driven by the need to reduce cross-contamination risks and operational complexities. Single-use systems eliminate the need for extensive cleaning and validation, making them ideal for multiproduct facilities. These technologies support rapid turnaround times and minimize downtime. As a result, biopharmaceutical manufacturers are increasingly favoring them to streamline workflows and enhance operational efficiency in both clinical and commercial production settings.

The adoption of continuous processing is also accelerating, particularly in downstream purification. Traditional batch chromatography often leads to resource inefficiencies and longer processing times. In contrast, continuous chromatography enables uninterrupted purification with higher product yield and better process control. This approach also allows for smaller facility footprints and lower buffer consumption. As manufacturers seek cost-effective and scalable solutions, continuous processing technologies are gaining significant traction within modern bioprocessing facilities.

Furthermore, sustainability is becoming a key focus in biopharmaceutical production. Single-use systems contribute to lower water and energy consumption compared to stainless-steel setups. Continuous processes reduce material waste and support greener manufacturing practices. These environmental advantages, combined with enhanced flexibility and lower capital investment requirements, are encouraging widespread adoption. Overall, the growing use of single-use and continuous technologies is reshaping preparative and process chromatography across global biomanufacturing operations.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 32.2% share and holds US$ 4 billion market value for the year. This leadership was driven by the region’s strong pharmaceutical and biopharmaceutical presence. Investments in drug development and purification processes supported widespread adoption of chromatography systems. North American companies prioritized advanced manufacturing techniques, including large-scale molecule separation. As a result, preparative and process chromatography became a core component in therapeutic production workflows.

The United States emerged as the key contributor to regional market growth. This was due to the presence of major biotechnology firms and contract manufacturing organizations. Research institutions and academic labs in the country consistently employed chromatography tools for protein and compound purification. Public sector funding and favorable regulatory policies also boosted adoption. These efforts helped create a robust environment for innovation and application of chromatography technologies across pharmaceutical and research sectors.

Rising demand for biologics, monoclonal antibodies, and gene therapies further strengthened North America’s market position. Preparative and process chromatography was widely used to ensure purity and quality in these advanced treatments. The shift toward precision medicine also encouraged increased use of purification systems. This trend is expected to continue, as manufacturers scale up production for complex biologics. With continued innovation and high clinical demand, North America is projected to maintain its dominance in this market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Preparative and Process Chromatography market is experiencing dynamic growth, driven by rising demand in pharmaceutical, biotechnology, and food industries. Key players are engaged in strategic initiatives such as acquisitions, product innovation, and expansion of production capacities. GE Healthcare has remained a major contributor, offering automated and large-scale purification systems through its integration with Cytiva. Similarly, Danaher Corporation, with its subsidiaries Cytiva and Pall, has focused on expanding its resin development and single-use technologies. Their efforts support advanced bioprocessing needs and enhance high-throughput workflows across global operations.

Merck KGaA, known as MilliporeSigma in North America, is a key provider of preparative chromatography tools. The company offers a broad range of resins, columns, and software for high-purity biomanufacturing. Merck’s innovations in membrane chromatography and process optimization are noteworthy. It continues to invest in partnerships and bioproduction infrastructure to expand its market influence. Bio-Rad Laboratories supports both academic and pharmaceutical sectors with scalable purification systems and resin technologies. Their focus on reproducibility and novel resin development supports growth in biopharmaceutical process development.

Thermo Fisher Scientific serves a wide user base with lab-scale and industrial-scale chromatography solutions. It provides HPLC systems, preparative columns, and end-to-end purification services. The firm’s investments in bioproduction and custom solutions strengthen its position in the global market. Other companies such as Sartorius AG, Agilent Technologies, Shimadzu Corporation, and Tosoh Corporation are also advancing in this space. Their work on resin innovation, process integration, and academic collaborations enhances the overall industry. The market continues to benefit from innovations in purification and scalable downstream technologies.

Market Key Players

- GE Healthcare

- Danaher Corp.

- Merck KGaA

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Shimadzu Corp.

- Agilent Technologies

- Waters Corp.

- Novasep Holding S.A.S

- Sartorius

Recent Developments

- In November 2023: GE HealthCare announced a significant investment of approximately $2.2 billion since 2022 in research and development to enhance its bioprocessing capabilities. This investment focuses on expanding manufacturing capacity for life-science products, including chromatography resins and single-use technologies. The initiative aims to meet the growing demand for biopharmaceuticals and to support advancements in preparative and process chromatography techniques.

- In May 2024: Merck KGaA signed a definitive agreement to acquire Mirus Bio, a U.S.-based life science company specializing in transfection reagents, for approximately US$600 million. This acquisition aims to enhance Merck’s capabilities in viral vector manufacturing, a critical component in gene therapy and biopharmaceutical production processes. By integrating Mirus Bio’s expertise, Merck strengthens its portfolio in preparative and process chromatography, particularly in the purification and processing of biomolecules.

Report Scope

Report Features Description Market Value (2024) US$ 12.5 Billion Forecast Revenue (2034) US$ 28 Billion CAGR (2025-2034) 8.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Process Chromatography, Preparative Chromatography), By Type (Liquid Chromatography, Gas Chromatography, Thin Layer Chromatography, Paper Chromatography, Gel-permeation (Molecular Sieve) Chromatography, Hydrophobic Interaction Chromatography), By End-use (Pharmaceutical Industry, Biotechnology, Food Industry, Nutraceutical Industry, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GE Healthcare, Danaher Corp., Merck KGaA, Bio-Rad Laboratories Inc., Thermo Fisher Scientific Inc., Shimadzu Corp., Agilent Technologies, Waters Corp., Novasep Holding S.A.S, Sartorius Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Preparative and Process Chromatography MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Preparative and Process Chromatography MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- GE Healthcare

- Danaher Corp.

- Merck KGaA

- Bio-Rad Laboratories Inc.

- Thermo Fisher Scientific Inc.

- Shimadzu Corp.

- Agilent Technologies

- Waters Corp.

- Novasep Holding S.A.S

- Sartorius