Global Precision Turned Product Manufacturing Market Size, Share, Growth Analysis By Operation (CNC Operation, Manual Operation), By Machine Types (Computer Numerically Controlled (CNC), Automatic Screw Machines, Rotary Transfer Machines, Lathes or Turning Centers), By Material Type (Steel, Plastic, Others), By End-user (Automobile, Electronics, Defense, Healthcare, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175183

- Number of Pages: 263

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

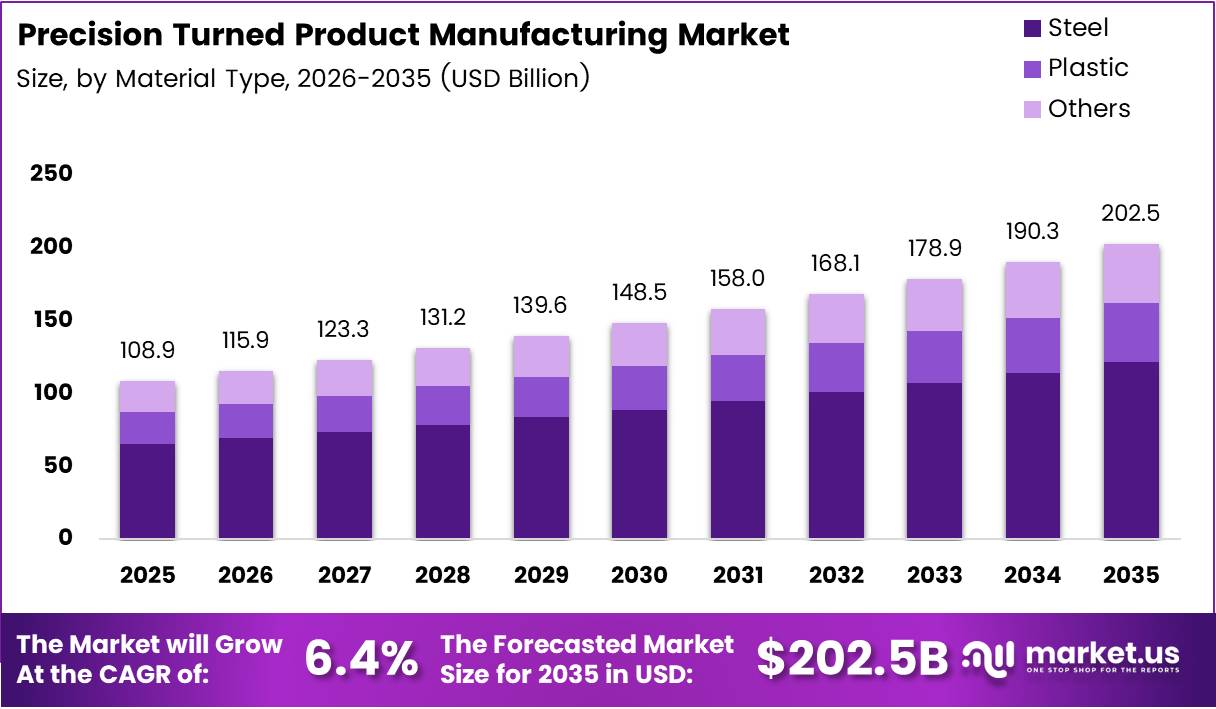

Global Precision Turned Product Manufacturing Market size is expected to be worth around USD 202.5 Billion by 2035 from USD 108.9 Billion in 2025, growing at a CAGR of 6.4% during the forecast period 2026 to 2035.

Precision turned product manufacturing involves creating high-tolerance components through machining processes such as turning, boring, and threading. These products are essential across automotive, aerospace, medical, and electronics industries. Moreover, they enable critical functionality in machinery, instruments, and devices requiring exact specifications.

The market encompasses CNC operations, manual turning, and various machine types including Swiss-type lathes and rotary transfer machines. Manufacturers produce components from steel, plastic, and specialty alloys. Consequently, the industry serves diverse applications requiring micrometer-level accuracy and consistent quality standards.

Demand growth stems from expanding automotive production, aerospace manufacturing, and medical device innovation. Additionally, electronics miniaturization drives requirements for smaller, more precise turned components. Therefore, contract manufacturers and specialized suppliers continue expanding capabilities to meet evolving customer specifications.

Government initiatives supporting advanced manufacturing and Industry 4.0 adoption accelerate market development. Investment in automation technologies enhances production efficiency and quality control. Furthermore, regulatory standards for medical and aerospace components ensure rigorous quality requirements that drive precision manufacturing capabilities.

Trade policies and nearshoring trends influence supply chain strategies within the precision turning sector. Companies increasingly establish regional manufacturing hubs to reduce lead times and transportation costs. However, skilled labor availability and technical expertise remain critical factors for operational success.

Technological advancements in multi-axis CNC systems enable production of increasingly complex geometries. Integration of real-time monitoring and quality inspection systems improves process control and reduces scrap rates. Additionally, adoption of advanced materials requires specialized tooling and machining parameters.

According to the Federal Reserve, capacity utilization for the manufacturing sector stepped up to 76.3% in December 2025. This indicator reflects strengthening industrial demand and improved production efficiency across precision manufacturing operations, supporting sustained market growth through the forecast period.

Key Takeaways

- Global Precision Turned Product Manufacturing Market projected to reach USD 202.5 Billion by 2035 from USD 108.9 Billion in 2025

- Market expected to grow at a CAGR of 6.4% during the forecast period 2026-2035

- CNC Operation segment dominates By Operation category with 68.3% market share in 2025

- Computer Numerically Controlled (CNC) leads By Machine Types segment holding 51.2% share

- Steel material type commands 67.9% market share in By Material Type segment

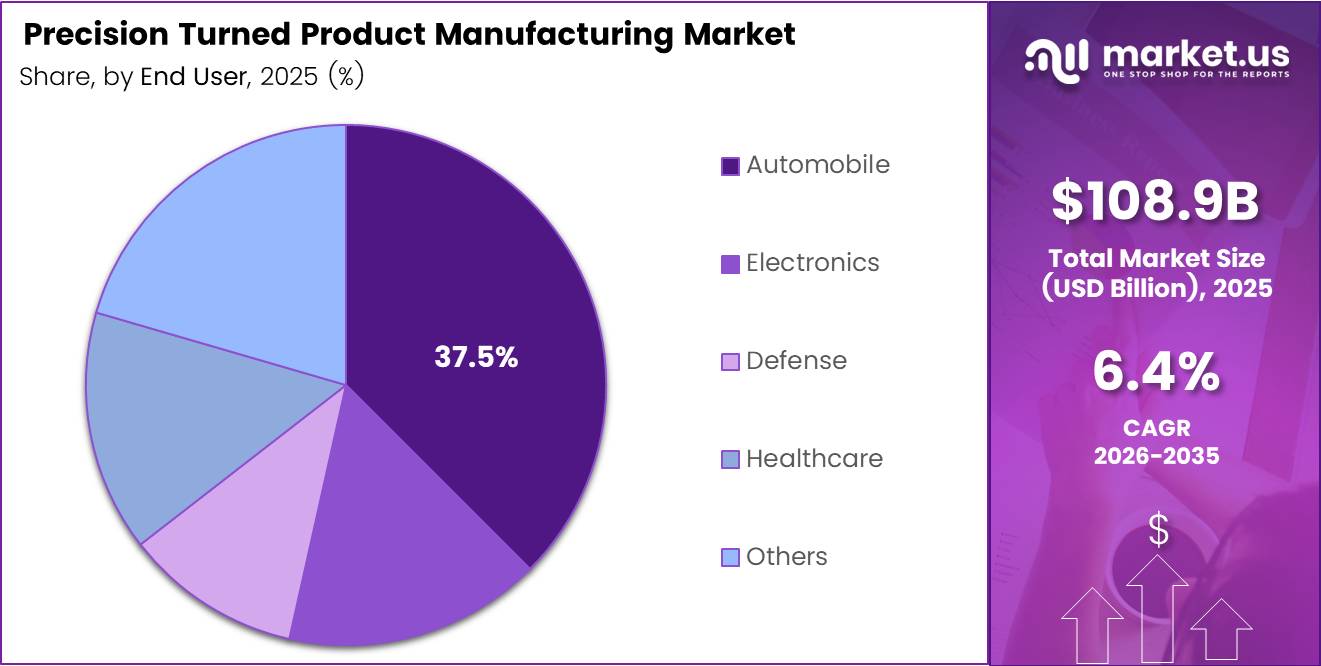

- Automobile end-user segment captures 37.5% share, representing largest application area

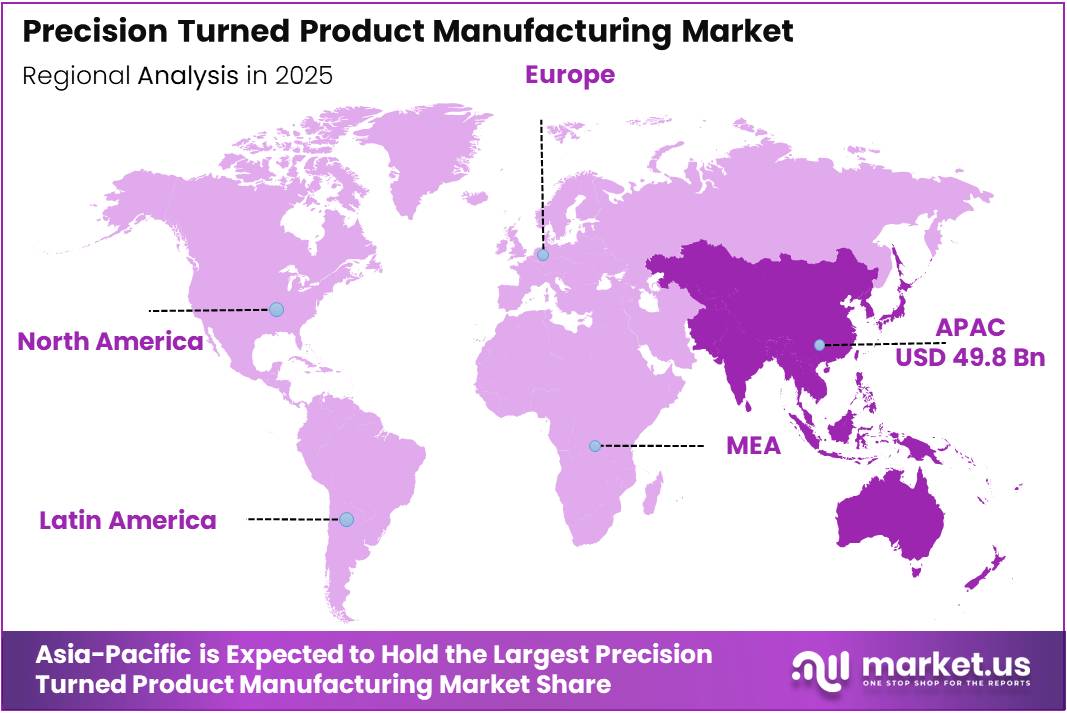

- Asia-Pacific region dominates with 45.8% market share, valued at USD 49.8 Billion

- Rising demand for high-tolerance components across automotive, aerospace, and medical sectors drives growth

Operation Analysis

CNC Operation dominates with 68.3% due to superior precision, repeatability, and automation capabilities.

In 2025, CNC Operation held a dominant market position in the By Operation segment of Precision Turned Product Manufacturing Market, with a 68.3% share. Computer numerical control technology enables automated machining with exceptional accuracy and consistency. Moreover, CNC systems reduce human error while increasing production speeds and throughput capabilities across complex component geometries.

Manual Operation maintains relevance for specialized applications requiring artisan craftsmanship and low-volume production runs. Skilled machinists utilize manual lathes for prototype development and custom parts manufacturing. However, labor costs and slower production rates limit manual operation adoption compared to automated alternatives in high-volume environments.

Machine Types Analysis

Computer Numerically Controlled (CNC) dominates with 51.2% due to versatility, precision capabilities, and widespread industrial adoption.

In 2025, Computer Numerically Controlled (CNC) held a dominant market position in the By Machine Types segment of Precision Turned Product Manufacturing Market, with a 51.2% share. CNC machines offer programmable control for complex operations and multi-axis machining. Additionally, they integrate seamlessly with CAD/CAM systems, enabling rapid setup changes and consistent quality output.

Automatic Screw Machines excel in high-volume production of small diameter turned parts with multiple operations. These machines efficiently produce fasteners, fittings, and connector components at rapid cycle times. Consequently, they remain essential for industries requiring mass production of standardized precision components.

Rotary Transfer Machines provide efficient multi-station processing for medium to high-volume production requirements. Workpieces rotate through sequential machining stations, enabling complex operations in single setups. Therefore, automotive and hardware manufacturers favor these systems for efficient component production.

Lathes or Turning Centers encompass traditional and modern turning equipment for diverse manufacturing applications. Conventional lathes serve smaller shops and specialized operations, while advanced turning centers incorporate live tooling and sub-spindle capabilities for complete part processing in single operations.

Material Type Analysis

Steel dominates with 67.9% due to superior strength, machinability, and cost-effectiveness for industrial applications.

In 2025, Steel held a dominant market position in the By Material Type segment of Precision Turned Product Manufacturing Market, with a 67.9% share. Various steel grades provide optimal strength-to-weight ratios for automotive, aerospace, and machinery components. Moreover, steel’s excellent machinability and surface finish capabilities make it ideal for precision turning operations.

Plastic materials gain increasing adoption for lightweight components in electronics, medical, and consumer products. Engineering plastics offer corrosion resistance, electrical insulation properties, and design flexibility. Additionally, thermoplastics enable cost-effective production while meeting specific application requirements across diverse industries.

Others category encompasses specialty materials including titanium, brass, aluminum, and high-performance alloys. These materials serve critical applications requiring specific properties such as biocompatibility, conductivity, or extreme temperature resistance. Consequently, aerospace and medical device manufacturers increasingly specify advanced materials for precision turned components.

End-user Analysis

Automobile dominates with 37.5% due to extensive use of precision turned components in engines, transmissions, and vehicle systems.

In 2025, Automobile held a dominant market position in the By End-user segment of Precision Turned Product Manufacturing Market, with a 37.5% share. Automotive manufacturing requires millions of precision turned parts including shafts, pins, fasteners, and fuel system components. Moreover, electric vehicle production introduces new requirements for battery components and powertrain parts.

Electronics sector demands miniaturized precision turned components for connectors, terminals, and device assemblies. Smartphone manufacturing, consumer electronics, and telecommunications equipment drive steady component demand. Additionally, semiconductor production equipment requires ultra-precise turned parts for critical processing machinery.

Defense applications utilize precision turned components in weapons systems, aircraft, and military vehicles requiring exacting specifications. Stringent quality standards and traceability requirements characterize this segment. Furthermore, defense modernization programs worldwide support sustained demand for specialized precision manufacturing capabilities.

Healthcare industry relies on precision turned parts for surgical instruments, diagnostic equipment, and implantable medical devices. Biocompatible materials and cleanroom manufacturing environments ensure regulatory compliance. Therefore, medical device innovation drives increasing sophistication in precision turning applications.

Others end-users encompass construction equipment, industrial machinery, energy systems, and consumer products. These diverse applications require precision components meeting specific performance and durability standards. Consequently, the breadth of end-user applications supports market stability and growth.

Key Market Segments

By Operation

- CNC Operation

- Manual Operation

By Machine Types

- Computer Numerically Controlled (CNC)

- Automatic Screw Machines

- Rotary Transfer Machines

- Lathes or Turning Centers

By Material Type

- Steel

- Plastic

- Others

By End-user

- Automobile

- Electronics

- Defense

- Healthcare

- Others

Drivers

Rising Demand for High-Tolerance Components Drives Market Expansion

Automotive manufacturers increasingly require precision turned components for advanced powertrains, safety systems, and electronic control units. Aerospace production demands exacting tolerances for flight-critical components and engine assemblies. Moreover, medical device innovation requires biocompatible precision parts for minimally invasive surgical instruments and implantable devices meeting stringent regulatory standards.

Industrial automation growth accelerates demand for precision turned parts in robotics, machinery, and production equipment. Manufacturing facilities worldwide invest in automated systems requiring reliable, high-tolerance components. Additionally, semiconductor manufacturing equipment utilizes ultra-precise turned parts for wafer processing and handling systems.

Electronics miniaturization drives requirements for increasingly smaller precision components with tighter tolerances. Smartphone production, wearable devices, and IoT sensors incorporate micro-sized turned parts. Furthermore, outsourcing trends enable OEMs to leverage specialized contract manufacturers’ expertise, capacity, and quality systems for precision component production.

Restraints

High Capital Requirements and Material Cost Volatility Challenge Market Growth

Advanced CNC turning equipment requires substantial capital investment ranging from hundreds of thousands to millions of dollars. Multi-axis Swiss-type machines, automated loading systems, and quality inspection equipment increase initial expenditures. Moreover, ongoing maintenance costs, tooling replacement, and skilled operator training add to operational expenses for precision manufacturing facilities.

Raw material price fluctuations impact production costs and profit margins across the precision turning industry. Steel, aluminum, and specialty alloy prices vary with global commodity markets and trade policies. Additionally, supply chain disruptions can affect material availability and lead times for critical manufacturing inputs.

Smaller manufacturers face challenges competing with established players possessing advanced equipment and technical capabilities. Technology obsolescence requires periodic equipment upgrades to maintain competitive precision and efficiency standards. Consequently, capital intensity creates barriers to entry and limits market participation for under-capitalized operations.

Growth Factors

Electric Vehicle Adoption and Medical Innovation Accelerate Market Opportunities

Electric vehicle production introduces new requirements for precision turned components in battery systems, electric motors, and power electronics. EV manufacturers require specialized parts for thermal management, charging systems, and drivetrain assemblies. Moreover, the global transition toward electric mobility creates substantial demand for precision manufacturing suppliers supporting this transformation.

Medical device innovation drives demand for precision turned components in surgical instruments, orthopedic implants, and diagnostic equipment. Minimally invasive procedures require increasingly sophisticated instruments with micro-precision parts. Additionally, aging populations worldwide increase healthcare demand, supporting sustained growth in medical device manufacturing and precision component requirements.

Renewable energy equipment manufacturing utilizes precision turned parts for wind turbines, solar tracking systems, and energy storage applications. Aerospace manufacturing expansion in emerging economies creates opportunities for local precision turning suppliers. Furthermore, supplier localization strategies reduce supply chain risks and support regional manufacturing ecosystem development.

Emerging Trends

Advanced Technologies Transform Precision Turning Manufacturing Landscape

Multi-axis CNC Swiss-type turning machines enable production of increasingly complex micro components in single operations. These advanced systems combine turning, milling, and drilling capabilities with sub-micron accuracy. Moreover, reduced setup times and improved material utilization enhance productivity while maintaining exceptional quality standards for demanding applications.

Automation integration includes robotic loading systems, automated tool changers, and lights-out manufacturing capabilities. In-process quality monitoring with laser measurement and machine vision systems ensures real-time defect detection. Additionally, predictive maintenance technologies utilizing sensor data reduce unplanned downtime and optimize equipment utilization across production facilities.

Advanced materials including titanium alloys, Inconel superalloys, and high-performance polymers require specialized machining expertise. Cutting tool innovations and optimized machining parameters enable efficient processing of difficult-to-machine materials. Furthermore, nearshoring strategies and regional supply chain development reduce logistics costs while improving delivery responsiveness for time-sensitive precision component requirements.

Regional Analysis

Asia-Pacific Dominates the Precision Turned Product Manufacturing Market with a Market Share of 45.8%, Valued at USD 49.8 Billion

Asia-Pacific leads global precision turning manufacturing driven by extensive automotive production, electronics manufacturing, and machinery industries in China, Japan, India, and South Korea. The region benefits from established supply chains, skilled workforce availability, and competitive manufacturing costs. Moreover, government initiatives supporting advanced manufacturing and infrastructure development strengthen the regional market position with 45.8% share valued at USD 49.8 Billion.

North America Precision Turned Product Manufacturing Market Trends

North America maintains strong precision turning capabilities serving aerospace, defense, medical device, and automotive sectors. Advanced technology adoption, stringent quality standards, and innovation-focused manufacturers characterize the regional market. Additionally, nearshoring initiatives and domestic manufacturing incentives support continued investment in precision machining capacity and capabilities.

Europe Precision Turned Product Manufacturing Market Trends

Europe demonstrates excellence in precision engineering with strong automotive, aerospace, and industrial machinery sectors. Germany, Italy, and Switzerland lead in advanced manufacturing technologies and quality standards. Furthermore, emphasis on Industry 4.0 adoption and sustainable manufacturing practices drives technological advancement across European precision turning operations.

Latin America Precision Turned Product Manufacturing Market Trends

Latin America develops precision turning capabilities supporting automotive manufacturing, agricultural equipment, and industrial sectors. Brazil and Mexico attract investment as regional manufacturing hubs with proximity to North American markets. However, economic volatility and infrastructure limitations present challenges for sustained market expansion.

Middle East & Africa Precision Turned Product Manufacturing Market Trends

Middle East and Africa region develops precision manufacturing capabilities supporting oil and gas, construction equipment, and emerging automotive sectors. Investment in industrial diversification and manufacturing infrastructure supports gradual market development. Consequently, opportunities exist for precision turning suppliers serving regional industrial growth initiatives.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Cox Manufacturing Co. operates as a leading precision turned products manufacturer serving automotive, aerospace, and industrial markets. The company leverages advanced CNC turning capabilities and quality management systems to deliver high-tolerance components. Moreover, Cox Manufacturing maintains strong customer relationships through technical expertise and reliable delivery performance across diverse industry applications.

Citizen FINEDEVICE specializes in ultra-precision turning utilizing advanced Swiss-type CNC technology for micro-component manufacturing. The company serves electronics, medical device, and automotive sectors requiring exceptional accuracy. Additionally, Citizen FINEDEVICE integrates automation and quality inspection systems ensuring consistent production of complex miniaturized parts meeting stringent customer specifications.

RW Screw Products provides comprehensive precision turning services including CNC machining, secondary operations, and assembly capabilities. The company focuses on automotive, electronics, and industrial applications requiring volume production with tight tolerances. Furthermore, RW Screw Products invests in advanced equipment and workforce development maintaining competitive manufacturing capabilities.

E&H Precision delivers specialized precision machining solutions for aerospace, defense, and medical device industries. The company maintains certifications and quality systems meeting rigorous industry standards. Consequently, E&H Precision establishes long-term partnerships with OEMs requiring reliable suppliers for critical precision turned components throughout complex supply chains.

Key Players

- Cox Manufacturing Co.

- Citizen FINEDEVICE

- RW Screw Products

- E&H Precision

- KDK Finish-Turning

- Astro Machine Works

- B Melling Tool Co.

- E. J. Basler Co.

- Hall Industries Incorporated

- Supreme Machined Products Company

Recent Developments

- August 2024 – CORE Industrial Partners portfolio company PrecisionX Group acquired MSK Precision Products, Inc., expanding precision manufacturing capabilities and customer base across automotive and industrial sectors. This strategic acquisition enhances PrecisionX Group’s market position and operational capacity for high-tolerance component production.

- July 2025 – PrecisionX Group continued strategic build-out by acquiring Hudson Technologies, further strengthening precision turning capabilities and geographic reach. The acquisition supports the company’s growth strategy in serving diverse industrial markets requiring specialized precision machining expertise and advanced manufacturing technologies.

Report Scope

Report Features Description Market Value (2025) USD 108.9 Billion Forecast Revenue (2035) USD 202.5 Billion CAGR (2026-2035) 6.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Operation (CNC Operation, Manual Operation), By Machine Types (Computer Numerically Controlled (CNC), Automatic Screw Machines, Rotary Transfer Machines, Lathes or Turning Centers), By Material Type (Steel, Plastic, Others), By End-user (Automobile, Electronics, Defense, Healthcare, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Cox Manufacturing Co., Citizen FINEDEVICE, RW Screw Products, E&H Precision, KDK Finish-Turning, Astro Machine Works, B Melling Tool Co., E. J. Basler Co., Hall Industries Incorporated, Supreme Machined Products Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Precision Turned Product Manufacturing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Precision Turned Product Manufacturing MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Cox Manufacturing Co.

- Citizen FINEDEVICE

- RW Screw Products

- E&H Precision

- KDK Finish-Turning

- Astro Machine Works

- B Melling Tool Co.

- E. J. Basler Co.

- Hall Industries Incorporated

- Supreme Machined Products Company