Global Prebiotic Soda Market By Type(Dairy-based, Plant-based), By Packaging(Bottles, Tetra Packs, Cans, Others), By Flavors(Fruit, Cola, Others), By Form(Liquid, Powder), By Distribution Channel(Supermarkets/Hypermarkets, Retail sales, Online sales, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121342

- Number of Pages: 366

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

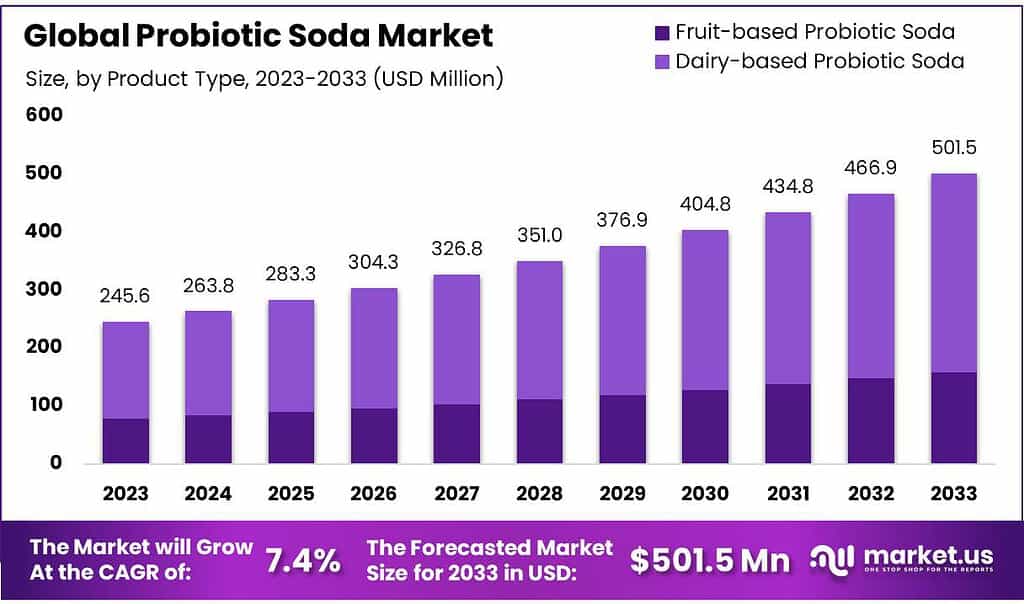

The global Prebiotic Soda Market size is expected to be worth around USD 501.5 billion by 2033, from USD 245.6 Million in 2023, growing at a CAGR of 7.4% during the forecast period from 2023 to 2033.

The prebiotic soda market refers to a segment of the beverage industry that focuses on producing soft drinks enriched with prebiotics. Prebiotics are types of dietary fiber that feed the good bacteria in the gut. Unlike probiotics, which are live bacteria, prebiotics help nourish and promote the growth of beneficial bacteria already present in the digestive system.

Prebiotic sodas are designed to offer health benefits, such as improved digestion, enhanced immune function, and increased absorption of minerals. They are often marketed as a healthier alternative to traditional sodas, which are typically high in sugar and calories and offer little nutritional value. Prebiotic sodas usually contain lower amounts of sugar, and some are sweetened with natural sweeteners to appeal to health-conscious consumers.

This market is growing as more people become interested in functional foods and beverages—products that have a potentially positive effect on health beyond basic nutrition. The rise in digestive health issues and increased awareness about the importance of gut health are significant drivers behind the popularity of prebiotic sodas. Consumers are looking for convenient ways to improve their gut health, and prebiotic sodas provide a tasty and accessible solution.

Moreover, prebiotic sodas often come in various flavors and are positioned as lifestyle beverages suitable for consumption at any time of the day. They appeal to a broad demographic, from health enthusiasts to consumers seeking alternatives to conventional soft drinks. As interest in digestive health continues to grow, the prebiotic soda market is expected to expand, incorporating more innovative flavors and functional ingredients.

Key Takeaways

- Market Growth: Prebiotic Soda Market expected to reach USD 501.5 billion by 2033, growing at 7.4% CAGR from 2023’s USD 245.6 million.

- Type: Dairy-based prebiotic sodas hold a dominant market share of over 59.3%, while plant-based variants are rapidly gaining traction.

- Packaging: Bottles are the preferred packaging type, capturing over 38.5% of the market share, followed by Tetra Packs and cans.

- Flavors: Fruit flavors dominate the market, with a share of over 45.3%, while cola flavors also hold a significant position.

- Form: Liquid prebiotic sodas are the most preferred, accounting for over 62.4% of the market share, followed by powdered variants.

- Distribution Channel: Supermarkets/hypermarkets lead in distribution, capturing over 45.9% of the market, followed by retail sales and online channels.

- Asia Pacific region emerges as a significant player, capturing a dominant market share of 46.9%.

By Type

In 2023, Dairy-based prebiotic sodas held a dominant market position, capturing more than a 59.3% share. This segment benefits from the established familiarity and acceptance of dairy products as healthy additions to the diet.

Dairy-based prebiotic sodas often include ingredients like yogurt or kefir, which naturally contain beneficial bacteria, enhanced with added prebiotics that support digestive health. Their creamy texture and rich flavor profile make them appealing to a broad audience who seek health benefits without compromising on taste.

On the other hand, Plant-based prebiotic sodas are rapidly gaining traction, reflecting the growing consumer interest in vegan and lactose-free alternatives. These beverages are typically made from non-dairy sources such as almond, soy, oat, or coconut bases that are fortified with prebiotics.

The plant-based segment caters to the dietary preferences of vegans, vegetarians, and those with dairy intolerances or allergies. With an increasing number of consumers adopting plant-based diets for health, environmental, and ethical reasons, this segment is well-positioned for growth and innovation in flavor and functionality.

By Packaging

In 2023, Bottles held a dominant market position, capturing more than a 38.5% share. Bottles are favored for their convenience and consumer familiarity, making them a popular choice for prebiotic sodas. They are typically made from glass or plastic, which are both recyclable and considered safe for food products. Bottles also offer excellent branding opportunities, allowing manufacturers to showcase their products attractively on shelves.

Tetra Packs are recognized for their environmental benefits and shelf stability. This packaging type is lightweight and made from renewable resources, appealing to environmentally conscious consumers. Tetra Packs also provide effective protection against light and air, which helps preserve the quality and efficacy of prebiotic ingredients over time.

Cans are another popular option, known for their portability and durability. Aluminum cans are completely recyclable and efficient to transport, which reduces their carbon footprint. The convenience of cans, along with their cool, modern appeal, particularly resonates with younger demographics.

By Flavors

In 2023, Fruit flavors held a dominant market position in the prebiotic soda market, capturing more than a 45.3% share. Fruit-flavored prebiotic sodas are popular due to their refreshing taste and wide appeal among consumers looking for healthy beverage options. These flavors typically include a variety of fruits such as berry, citrus, apple, and tropical fruits, which are often perceived as more natural and healthier choices.

Cola flavors also hold a significant place in the market, appealing to traditional soda drinkers seeking healthier alternatives without departing from the classic cola taste. This flavor segment capitalizes on the familiarity and popularity of traditional cola while integrating the benefits of prebiotics.

By Form

In 2023, Liquid form held a dominant market position in the prebiotic soda market, capturing more than a 62.4% share. This preference is largely due to the convenience and familiarity associated with ready-to-drink beverages. Liquid prebiotic sodas are favored for their ease of consumption and are typically available in bottles, cans, and Tetra Packs, making them accessible for on-the-go hydration and enjoyment.

The Powder form serves as an alternative for those seeking portability and longer shelf life. Powdered prebiotic sodas can be mixed with water or added to smoothies, offering flexibility in use and control over the intensity of flavor. This form is particularly appealing to consumers who prioritize convenience in storage and the ability to customize their drink experience.

By Distribution Channel

In 2023, Supermarkets/Hypermarkets held a dominant market position in the prebiotic soda market, capturing more than a 45.9% share. This channel’s success is attributed to its widespread accessibility and the convenience it offers consumers who prefer to buy groceries and beverages in one location. Supermarkets and hypermarkets typically provide a wide range of prebiotic soda brands and flavors, making it easier for consumers to explore and purchase these products during their regular shopping trips.

Retail sales also play a significant role, encompassing small grocery stores, specialty health food stores, and convenience shops. These outlets cater to localized consumer bases and can offer more personalized customer service, which is valuable for educating consumers about the benefits of prebiotic sodas.

Online sales have shown significant growth, driven by the broader trend of e-commerce expansion. This distribution channel appeals particularly to tech-savvy consumers and those who value the convenience of home delivery. Online platforms often provide a broader selection of prebiotic soda products, including niche or premium brands not available in traditional retail settings.

Key Market Segments

By Type

- Dairy-based

- Plant-based

By Packaging

- Bottles

- Tetra Packs

- Cans

- Others

By Flavors

- Fruit

- Cola

- Others

By Form

- Liquid

- Powder

By Distribution Channel

- Supermarkets/Hypermarkets

- Retail sales

- Online sales

- Others

Drivers

Major Driver for Prebiotic Soda Market: Growing Consumer Awareness of Gut Health Benefits

One of the primary drivers fueling the growth of the prebiotic soda market is the increasing consumer awareness of the health benefits associated with gut health. As more people become conscious of the link between gut health and overall wellness, including immune function, mental health, and disease prevention, there is a rising demand for products that contribute positively to the gut microbiome. Prebiotic sodas, enriched with dietary fibers that stimulate the growth and activity of beneficial gut bacteria, cater to this health-conscious segment.

Prebiotics are nondigestible fibers that act as food for probiotics—the good bacteria in the gut. Unlike probiotics, which are live organisms, prebiotics are about creating the ideal environment for these beneficial bacteria to thrive. The enhanced understanding of this mechanism among consumers, largely due to widespread health and wellness information through digital media, health practitioners, and scientific research, has positioned prebiotic sodas as a desirable choice for health-savvy individuals.

Moreover, the shift towards healthier beverages has been accelerating as more consumers move away from high-sugar, high-calorie drinks due to the associated health risks such as obesity, diabetes, and heart disease. Prebiotic sodas often offer a lower calorie, lower sugar alternative, with the added benefit of contributing to digestive health. This attribute makes them particularly appealing in markets where health regulations and consumer preferences are steering away from traditional sugary sodas.

The food and beverage industry’s innovation in flavors and formulations also plays a crucial role in the market’s expansion. Manufacturers are continuously expanding their product lines to include a variety of flavors and ingredients that appeal to different palates and preferences, making prebiotic sodas a palatable option not just for health reasons but also for taste.

Restraints

Major Restraint for Prebiotic Soda Market: High Production Costs and Pricing Challenges

A significant restraint facing the prebiotic soda market is the high production costs associated with developing and manufacturing these beverages, which can subsequently lead to higher retail prices for consumers. The inclusion of prebiotic ingredients often requires sophisticated formulation and processing techniques to ensure that the final product maintains its intended health benefits while also providing good taste and stability. The ingredients themselves, especially high-quality prebiotics that are effective in small doses and can withstand processing conditions, tend to be more expensive than those used in traditional sodas.

The process of integrating these functional ingredients into a beverage that is both palatable and remains stable over time requires substantial R&D investment. Companies must also navigate food safety regulations, which can vary significantly by region and add further complexity and cost to production. This can make prebiotic sodas less competitive price-wise when compared to traditional sodas and even other health-focused beverages, potentially limiting their market penetration among cost-conscious consumers.

Moreover, the challenge extends beyond production and into the marketing realm. Educating consumers about the benefits of prebiotics is essential, as the concept may not be as widely understood as that of probiotics. Consumer education and marketing are crucial but also add to the overall cost of bringing prebiotic sodas to the market. These activities must be well-funded to effectively communicate the value proposition of these products and justify their higher price point.

Additionally, the global reach of supply chains for quality prebiotic ingredients can be subject to volatility in raw material costs, further compounding the pricing challenges. Fluctuations in these costs can affect the stability of production budgets and pricing strategies, making it difficult for companies to maintain consistent pricing and profitability.

Opportunity

Major Opportunity for Prebiotic Soda Market: Expanding into Emerging Markets

A major opportunity for the prebiotic soda market lies in expanding into emerging markets, where increasing urbanization, rising disposable incomes, and growing health awareness are creating new consumer bases for health-oriented products. As these markets continue to develop economically, there is a notable shift in consumer preferences towards products that offer health benefits beyond traditional nutrition. Prebiotic sodas, which promote digestive health and offer a healthier alternative to conventional sugary sodas, are well-positioned to capitalize on these trends.

In regions like Asia, Latin America, and Africa, rapid urbanization has led to more sedentary lifestyles and a rise in diet-related health issues such as obesity and diabetes. This shift has prompted a growing segment of the population to seek out healthier food and beverage options, a demand that prebiotic sodas can meet. These beverages provide a functional benefit by supporting gut health, which is increasingly recognized as essential to overall well-being. The natural and health-centric positioning of prebiotic sodas makes them attractive to health-conscious consumers in these regions.

Furthermore, the young demographic in these emerging markets, which is typically more open to trying new products and adopting new health trends, represents a significant opportunity for prebiotic soda brands. Leveraging digital marketing and e-commerce can also enhance accessibility and visibility among these younger, tech-savvy consumers.

Moreover, local production and sourcing in these emerging markets could help reduce costs and address pricing issues associated with importing ingredients and finished products. Establishing partnerships with local distributors and tailoring flavors to suit regional tastes can further drive acceptance and integration into local consumption habits.

Capitalizing on this opportunity requires a nuanced understanding of the regulatory environment, local market dynamics, and consumer behavior in these emerging markets. Companies that can navigate these complexities while delivering a product that aligns with the local consumer’s price sensitivity and taste preferences are likely to see success. This strategic expansion not only diversifies the market presence of prebiotic soda brands but also contributes to the global growth of healthier beverage options, reflecting a broader trend towards functional and wellness-oriented products.

Trends

Major Trend in the Prebiotic Soda Market: The Rise of Clean Label and Natural Ingredients

A significant trend reshaping the prebiotic soda market is the increasing consumer demand for clean label products and natural ingredients. As consumers become more health-conscious and aware of the effects of artificial additives and chemicals in their diets, there is a growing preference for beverages that are made from natural, simple, and easily recognizable ingredients. This trend is influencing the prebiotic soda market, where manufacturers are innovating and reformulating products to meet these clean label standards.

Clean label products generally imply a minimal ingredient list without synthetic chemicals or additives, and with components that consumers understand and deem to be wholesome. In the context of prebiotic sodas, this means using natural sweeteners, natural flavors, and ensuring that the prebiotic fibers and other functional ingredients are derived from natural sources. For instance, instead of synthetic fibers, brands might use naturally occurring prebiotics like inulin from chicory root or agave to enhance the beverage’s health benefits without compromising on the ‘natural’ tag.

Furthermore, the movement towards natural ingredients is often paired with an emphasis on sustainability, both in terms of the product’s content and the packaging. Sustainable sourcing of natural ingredients and eco-friendly packaging options are becoming equally important to the modern consumer. This dual focus on health and environmental impact is making prebiotic sodas more appealing to a broader audience.

Additionally, the trend extends to transparency in labeling, where consumers expect clear information about the contents and health benefits of their beverages. This transparency helps build trust and loyalty in brands that commit to honest marketing and provide educational content about the health advantages of their prebiotic sodas.

Regional Analysis

In the Prebiotic Soda market, the Asia Pacific region emerges as a significant player, capturing a dominant market share of 46.9%. Projections suggest a valuation of USD 113.9 Million by the forecast period’s end. This growth is fueled by substantial adoption across vital sectors like beverages, health supplements, and wellness products.

Leading economies in the region, such as China, India, Japan, and South Korea, are driving this growth trajectory. These nations exhibit a notable surge in Prebiotic Soda consumption, reflecting increasing demand for healthier beverage alternatives in various industries, including food and beverage, healthcare, and fitness. Additionally, the region’s commitment to innovative beverage formulations and export-oriented strategies further solidifies its position in the global Prebiotic Soda market.

In North America, the Prebiotic Soda market experiences consistent expansion. This upward trend is propelled by rising demand from industries utilizing Prebiotic Soda in beverages, dietary supplements, and functional beverages. The region’s well-established beverage manufacturing infrastructure and advancements in beverage formulation contribute significantly to the adoption of Prebiotic Soda-based products.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In the Prebiotic Soda market, key players like Nexba, Poppi, Olipop, Humm Kombucha, and Phocus lead the industry with innovative formulations and strategic market positioning. These companies dominate the market share, leveraging consumer trends towards healthier beverage options and functional drinks. With a focus on natural ingredients and prebiotic benefits, they cater to a growing demand for gut health-conscious beverages.

Market Key Players

- Bio-K Plus International Inc.

- Chobani LLC

- Danone S.A.

- Fonterra Co-operative Group.

- GCMMF (Amul)

- Harmless Harvest

- Nestle SA

- NextFoods

- Lifeway Foods, Inc

- PepsiCo

- Yakult Honsha Co. Ltd.

Recent Developments

In 2023, Bio-K Plus International Inc. continues to make strides in the prebiotic soda sector, capitalizing on its expertise in probiotic beverages.

In 2023, Chobani LLC, a prominent player in the prebiotic soda sector, continues to innovate its product offerings.

Report Scope

Report Features Description Market Value (2023) US$ 1.5 Bn Forecast Revenue (2033) US$ 35.3 Bn CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Dairy-based, Plant-based), By Packaging(Bottles, Tetra Packs, Cans, Others), By Flavors(Fruit, Cola, Others), By Form(Liquid, Powder), By Distribution Channel(Supermarkets/Hypermarkets, Retail sales, Online sales, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Bio-K Plus International Inc., Chobani LLC, Danone S.A., Fonterra Co-operative Group., GCMMF (Amul), Harmless Harvest, Nestle SA, NextFoods, Lifeway Foods, Inc, PepsiCo, Yakult Honsha Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the Size of Prebiotic Soda Market?Prebiotic Soda Market size is expected to be worth around USD 501.5 billion by 2033, from USD 245.6 Million in 2023

What is the CAGR for the Prebiotic Soda Market?The Prebiotic Soda Market is expected to grow at a CAGR of 7.4% during 2024-2033.Name the major industry players in the Prebiotic Soda Market?Bio-K Plus International Inc., Chobani LLC, Danone S.A., Fonterra Co-operative Group., GCMMF (Amul), Harmless Harvest, Nestle SA, NextFoods, Lifeway Foods, Inc, PepsiCo, Yakult Honsha Co. Ltd.

-

-

- Bio-K Plus International Inc.

- Chobani LLC

- Danone S.A.

- Fonterra Co-operative Group.

- GCMMF (Amul)

- Harmless Harvest

- Nestle SA

- NextFoods

- Lifeway Foods, Inc

- PepsiCo

- Yakult Honsha Co. Ltd.