Global Pre-Made Pouch Packaging Market Market Size, Share, Growth Analysis By Pouch Type (Stand Up Pouches, Flat Pouches, Spout Pouches, Zipper Pouches, Retort Pouches), By Application (Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Pet Food, Household Products, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171976

- Number of Pages: 325

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

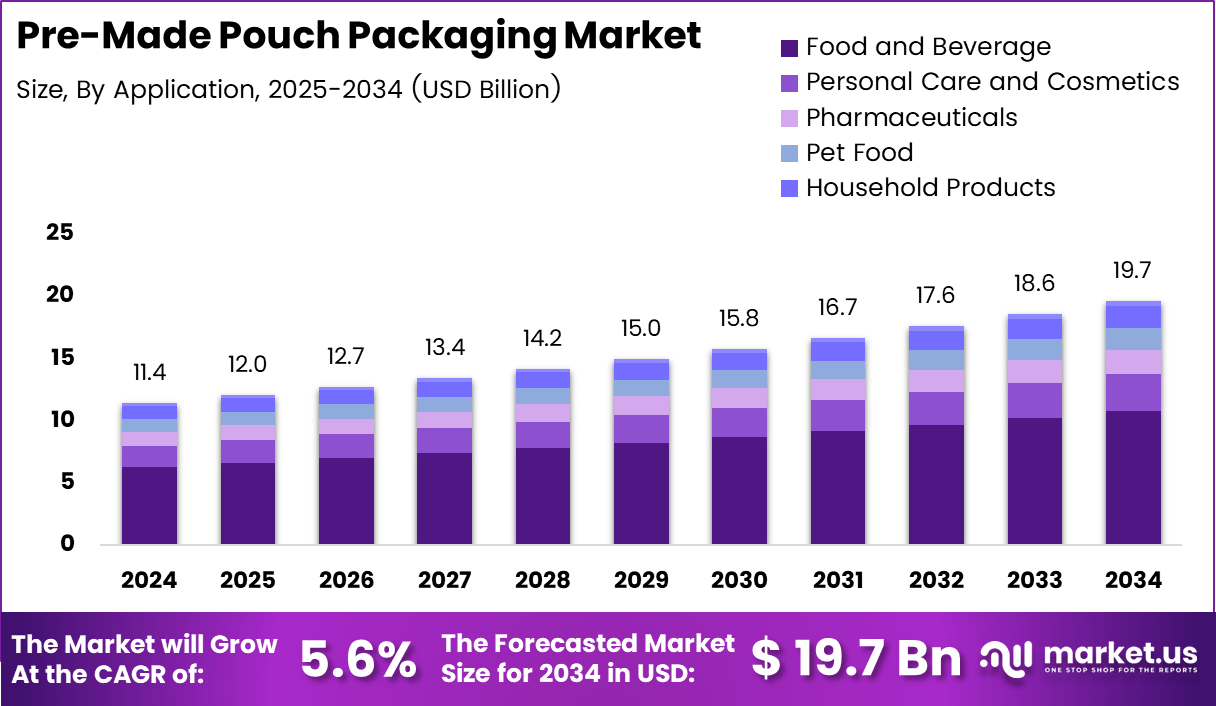

The Global Pre-Made Pouch Packaging Market size is expected to be worth around USD 19.7 billion by 2034, from USD 11.4 billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

The Pre-Made Pouch Packaging Market refers to ready-formed flexible pouches supplied to brand owners for filling and sealing operations. These pouches remove the need for in-house pouch forming and improve operational efficiency. As a result, they are widely used across food, home care, pharmaceutical, and personal care packaging applications.

From a market standpoint, growth is expected to remain consistent due to rising demand for flexible packaging solutions. Moreover, manufacturers increasingly favor pre-made pouches to reduce downtime and labor dependency. Consequently, adoption is expanding among small and mid-sized facilities seeking scalable and cost-efficient packaging formats.

In terms of opportunity, sustainability-focused packaging transformation continues to be a major growth driver. Governments are tightening plastic reduction regulations and expanding extended producer responsibility frameworks. Therefore, recyclable, mono-material, and lightweight pre-made pouch designs are increasingly aligned with regulatory and procurement priorities.

At the same time, advancements in automation compatibility are strengthening market attractiveness. Pre-made pouches now support faster changeovers and multi-format filling lines. As a result, contract packers and private-label manufacturers are adopting these solutions to enable short production runs and rapid SKU diversification.

From a regulatory perspective, packaging waste directives and circular economy initiatives are shaping material choices. Governments across Europe and Asia are offering incentives for recyclable packaging investments. Consequently, pre-made pouch packaging that supports material recovery targets is gaining stronger regulatory acceptance.

According to studies, flexible pouches reduce plastic usage for 2-litre products by up to 80% and lower carbon footprint by up to 64% compared to rigid PET formats. These benefits support sustainability compliance and government-backed emissions reduction goals.

Furthermore, material performance documentation highlights recycle-ready retort films such as polypropylene based mono-material structures that withstand aggressive processing conditions. These solutions run on existing equipment while maintaining speed and performance, enabling compliance without additional capital expenditure.

Finally, industry packaging specifications show wicketted bakery bags are collated in quantities ranging from 200 to 500 units, enabling fast automated packing. High-quality flexographic and HD printing in up to 8 colors enhances shelf visibility, reinforcing the commercial value of pre-made pouch packaging.

Key Takeaways

- The Global Pre-Made Pouch Packaging Market is projected to reach USD 19.7 billion by 2034, up from USD 11.4 billion in 2024, growing at a CAGR of 5.6%.

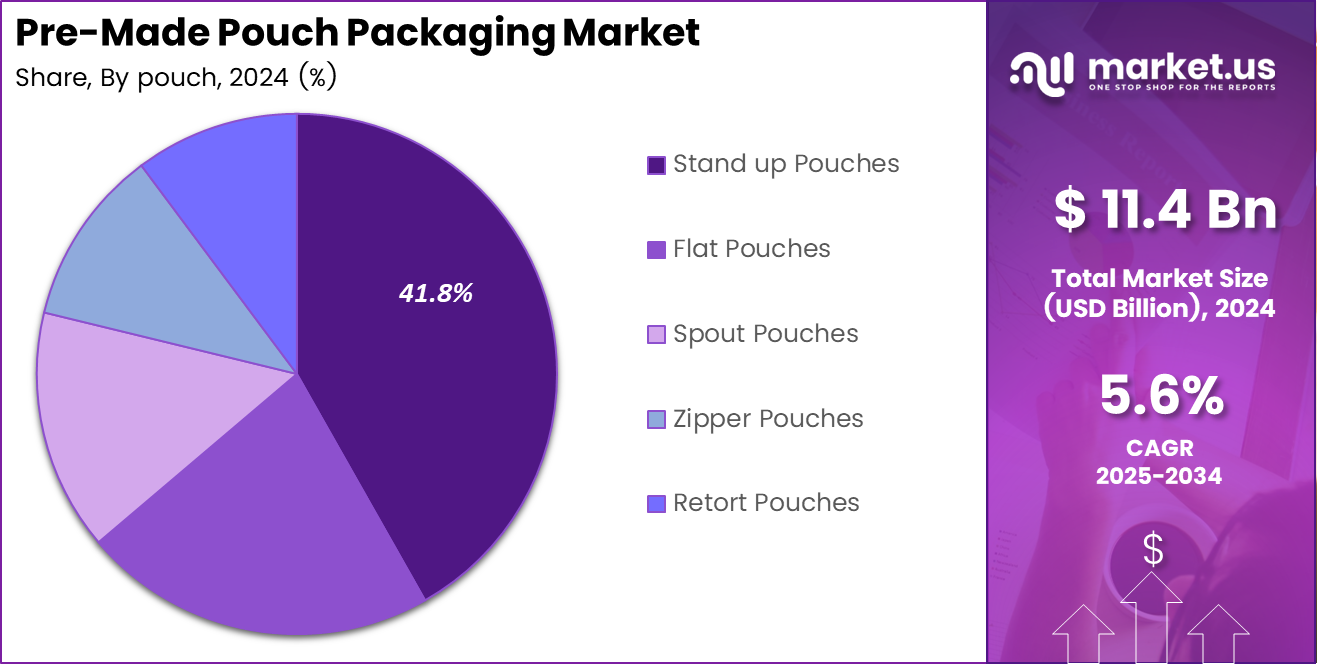

- Stand Up Pouches dominate the market by pouch type, accounting for a leading share of 41.8% due to strong shelf visibility and consumer convenience.

- Food and Beverage remains the largest application segment, holding a dominant share of 54.9% driven by rising packaged food consumption.

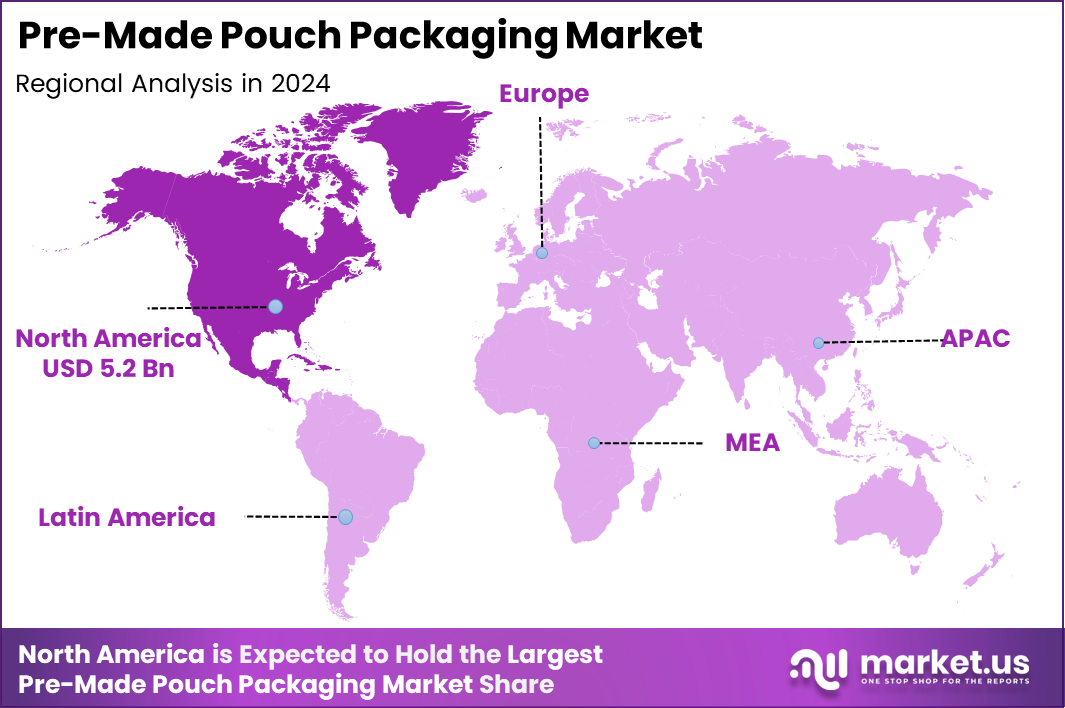

- North America leads the global market with a share of 45.8%, generating approximately USD 5.2 billion in revenue.

- Sustainability benefits such as up to 80% plastic reduction and up to 64% lower carbon footprint are strengthening adoption of pre-made pouches.

By Pouch Type Analysis

Stand up pouches dominate with 41.8% due to their shelf visibility, convenience, and wide acceptance across multiple consumer product categories.

Stand up Pouches held a dominant market position in the By Pouch Type Analysis segment of Pre-Made Pouch Packaging Market Market, with a 41.8% share. This dominance is supported by their strong shelf presence, efficient space utilization, and compatibility with branding requirements. Moreover, their resealability and lightweight structure continue to attract food, beverage, and personal care manufacturers.

Flat Pouches held a notable position in the By Pouch Type Analysis segment of Pre-Made Pouch Packaging Market Market. These pouches are increasingly adopted due to their cost efficiency, material reduction, and suitability for single-use or sample-sized products. Additionally, they are favored for applications where compact packaging and logistical efficiency remain priorities.

Spout Pouches maintained steady adoption within the By Pouch Type Analysis segment of Pre-Made Pouch Packaging Market Market. Their growing use is driven by convenience in liquid and semi-liquid packaging, especially for beverages and household products. Furthermore, controlled dispensing and reduced product wastage enhance their functional appeal.

Zipper Pouches continued to gain traction in the By Pouch Type Analysis segment of Pre-Made Pouch Packaging Market Market. These pouches support multiple opening and closing cycles, which improves product freshness and consumer usability. As a result, they are increasingly preferred for snacks, pet food, and dry food applications.

Retort Pouches represented a specialized yet important part of the By Pouch Type Analysis segment of Pre-Made Pouch Packaging Market Market. Their ability to withstand high-temperature sterilization makes them suitable for ready-to-eat meals and shelf-stable foods. Consequently, they support extended shelf life without refrigeration.

By Application Analysis

Food and Beverage leads with 54.9% driven by rising packaged food consumption, convenience trends, and extended shelf-life requirements.

Food and Beverage held a dominant market position in the By Application Analysis segment of Pre-Made Pouch Packaging Market Market, with a 54.9% share. This leadership is reinforced by demand for flexible packaging that supports freshness, portability, and visual branding. Additionally, changing lifestyles continue to accelerate packaged food adoption globally.

Personal Care and Cosmetics occupied a significant position in the By Application Analysis segment of Pre-Made Pouch Packaging Market Market. The segment benefits from growing use of travel-friendly, lightweight packaging formats. Moreover, premium pouch designs support branding differentiation and sustainable packaging strategies across skincare and hygiene products.

Pharmaceuticals demonstrated stable demand within the By Application Analysis segment of Pre-Made Pouch Packaging Market Market. The segment relies on pouches for unit-dose packaging, compliance-friendly formats, and moisture protection. Furthermore, pouches enable efficient distribution while supporting safety and regulatory packaging requirements.

Pet Food continued expanding within the By Application Analysis segment of Pre-Made Pouch Packaging Market Market. Growth is driven by rising pet ownership and demand for portion-controlled, resealable packaging. As a result, pouches help maintain freshness while improving convenience for pet owners.

Household Products showed consistent adoption in the By Application Analysis segment of Pre-Made Pouch Packaging Market Market. These pouches are increasingly used for detergents and cleaning solutions due to reduced plastic usage. Meanwhile, the Others segment serves niche applications, supporting diversification across specialty consumer goods.

Key Market Segments

By Pouch Type

- Stand Up Pouches

- Flat Pouches

- Spout Pouches

- Zipper Pouches

- Retort Pouches

By Application

- Food and Beverage

- Personal Care and Cosmetics

- Pharmaceuticals

- Pet Food

- Household Products

- Others

Drivers

Growing Preference for Lightweight Packaging Formats Drives Market Growth

The pre-made pouch packaging market is witnessing steady growth due to the rising adoption of high-speed horizontal and vertical pouch filling lines across FMCG production facilities. Manufacturers are increasingly shifting toward automated pouch filling systems to improve production speed, reduce labor dependency, and maintain consistent packaging quality. These advanced lines support faster changeovers and allow brands to manage multiple product variants efficiently.

Another strong driver is the growing preference for lightweight packaging formats. Pre-made pouches consume significantly less material compared to rigid packaging, which helps reduce transportation weight and overall logistics costs. This advantage is particularly important for large-scale FMCG producers managing high-volume distribution across regional and global markets.

Retail transformation is also supporting market growth. Modern trade channels favor shelf-ready and retail-friendly packaging designs that enhance visual appeal and reduce in-store handling time. Pre-made pouches offer excellent shelf presence, better space utilization, and improved merchandising flexibility.

Additionally, the expansion of contract packaging services is accelerating adoption. Contract packers provide flexible, scalable pouch solutions that enable brands to enter new markets or launch products without heavy capital investments, strengthening overall market demand.

Restraints

Higher Initial Investment for Advanced Machinery Limits Adoption

One of the major restraints in the pre-made pouch packaging market is the high initial investment required for advanced filling and sealing machinery. Modern pouch packaging systems involve significant capital expenditure, which can be a barrier for small and medium-sized manufacturers with limited financial resources.

Compatibility challenges with existing equipment further restrict adoption. Many legacy packaging lines are not designed to handle diverse pouch formats, forcing manufacturers to invest in upgrades or limit the range of pouch types they can offer. This reduces operational flexibility and slows technology adoption.

Fluctuating prices of multilayer films and specialty laminates also impact market growth. These materials are sensitive to changes in raw material and polymer prices, leading to unpredictable cost structures for pouch producers and brand owners.

Moreover, advanced machinery requires skilled operators and regular maintenance. Training costs and technical complexity increase operating expenses, especially in developing markets, making adoption slower among cost-sensitive manufacturers.

Growth Factors

Rising Demand for Premium Packaging Creates New Opportunities

The increasing demand for premium and specialty food products is creating strong growth opportunities for the pre-made pouch packaging market. Brands are focusing on packaging that delivers enhanced aesthetics, superior barrier protection, and added functionality to support premium positioning.

Pharmaceutical and medical device packaging is another emerging opportunity area. Pre-made pouches are gaining traction for unit-dose, sterile, and protective packaging applications where precise sealing and product integrity are critical.

Sustainability-focused innovation is also opening new avenues. Manufacturers are developing recyclable and mono-material pouch structures to align with regulatory requirements and corporate sustainability goals, attracting environmentally conscious brands.

In addition, private-label brands are expanding rapidly across retail channels. These brands seek flexible, low-volume packaging solutions that allow quick product launches and frequent design updates, making pre-made pouches a highly suitable format.

Emerging Trends

Automation and Smart Features Shape Market Trends

Digital printing packaging is emerging as a key trend in the pre-made pouch packaging market. It supports short production runs, faster design changes, and cost-effective customization, enabling brands to respond quickly to evolving consumer preferences.

Smart packaging features are also gaining popularity. The use of QR codes and track-and-trace labels helps improve supply chain visibility, product authentication, and consumer engagement through digital interaction.

Consumer demand for convenience is driving the popularity of spouted and reclosable pouches. These formats improve ease of use, enhance portability, and help reduce product waste across food, beverage, and personal care categories.

Furthermore, the integration of automation and robotics in pouch packaging lines is improving operational efficiency. Automated handling, filling, and inspection systems reduce errors, increase throughput, and support consistent quality across high-volume production environments.

Regional Analysis

North America Dominates the Pre-Made Pouch Packaging Market with a Market Share of 45.8%, Valued at USD 5.2 Billion

North America holds the dominant position in the pre-made pouch packaging market, accounting for 45.8% of the total share and generating approximately USD 5.2 billion in revenue. This dominance is supported by advanced FMCG manufacturing infrastructure, high adoption of automated pouch filling lines, and strong demand for lightweight, shelf-ready packaging formats. The region also benefits from well-established modern retail channels and a high focus on packaging efficiency and sustainability.

Europe Pre-Made Pouch Packaging Market Trends

Europe represents a mature and steadily growing market for pre-made pouch packaging, driven by strong regulatory emphasis on sustainable packaging and waste reduction. Manufacturers across the region are increasingly shifting toward recyclable and mono-material pouch structures. Demand is further supported by premium food, beverage, and personal care brands seeking high-quality packaging with enhanced aesthetics and barrier performance.

Asia Pacific Pre-Made Pouch Packaging Market Trends

Asia Pacific is emerging as a high-growth region for pre-made pouch packaging, supported by rapid urbanization, expanding middle-class populations, and increasing consumption of packaged foods. Rising investments in FMCG production capacity and the growing presence of contract packaging services are accelerating adoption. The region also benefits from cost-efficient manufacturing and rising demand for flexible, small-volume packaging formats.

Middle East and Africa Pre-Made Pouch Packaging Market Trends

The Middle East and Africa region is witnessing gradual growth in the pre-made pouch packaging market, driven by expanding retail infrastructure and increasing demand for packaged food and personal care products. Adoption is supported by the need for lightweight packaging that can withstand long distribution cycles. However, market growth remains moderate due to slower automation penetration in some countries.

Latin America Pre-Made Pouch Packaging Market Trends

Latin America shows steady adoption of pre-made pouch packaging, particularly in food, beverage, and household product segments. The market is supported by growing modern trade formats and increasing awareness of cost-efficient packaging solutions. Brands in the region are gradually adopting pouches to reduce logistics costs and improve shelf appeal, supporting long-term market expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pre-Made Pouch Packaging Company Insights

In 2024, Amcor plc continues to play a pivotal role in shaping the global pre made pouch packaging market through its strong focus on flexible packaging innovation and sustainability aligned pouch solutions. The company’s analyst perspective reflects its ability to address brand requirements for lightweight, high barrier, and recyclable pouch formats. Its emphasis on material science, operational scale, and global manufacturing footprint supports consistent supply to FMCG, food, and healthcare packaging segments, reinforcing its leadership position.

Mondi Group maintains a strategically important position in the pre made pouch packaging landscape by combining integrated paper and flexible packaging capabilities with strong sustainability credentials. From an analyst viewpoint, Mondi’s strength lies in its development of mono material and recyclable pouch structures while maintaining functional performance. Its close collaboration with brand owners and retailers allows it to deliver retail ready, shelf optimized pouch solutions tailored to evolving regulatory and consumer expectations.

Sealed Air Corporation remains a key contributor to the market through its expertise in protective and performance driven flexible packaging solutions. In 2024, its analyst profile highlights a strong focus on pouch formats that enhance product protection, extend shelf life, and reduce food waste. The company’s technology driven approach supports advanced sealing, barrier enhancement, and automation compatibility, making its pouch offerings attractive for high value food and protein applications.

Sonoco Products Company demonstrates steady influence in the global pre made pouch packaging market by leveraging its broad packaging portfolio and focus on operational efficiency. From an analyst standpoint, Sonoco’s strength is its ability to integrate flexible pouch solutions within multi format packaging strategies. Its investments in sustainable materials and customer specific pouch designs support brand differentiation while aligning with long term packaging optimization and cost management goals.

Top Key Players in the Market

- Amcor plc

- Mondi Group

- Sealed Air Corporation

- Sonoco Products Company

- Coveris Holdings

- ProAmpac

- Huhtamaki Group

- Glenroy Inc.

- Constantia Flexibles

Recent Developments

- In November 2024, Mespack and Amcor launched a recycle-ready 2 litre stand-up pouch for the home care industry, designed for products such as soaps, cleaners, and laundry detergents.The collaboration combined Mespack’s packaging machinery and Amcor’s recycle-ready materials to address technical challenges in scaling larger flexible packaging formats.

- In October 2025, International Paper offloaded its bag converting operations to ProAmpac as part of a broader portfolio streamlining strategy.

This move followed ProAmpac’s acquisitions of PAC Worldwide, Gelpac, and UP Paper, strengthening its position in flexible packaging solutions.

Report Scope

Report Features Description Market Value (2024) USD 11.4 billion Forecast Revenue (2034) USD 19.7 billion CAGR (2025-2034) 5.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Pouch Type (Stand Up Pouches, Flat Pouches, Spout Pouches, Zipper Pouches, Retort Pouches), By Application (Food and Beverage, Personal Care and Cosmetics, Pharmaceuticals, Pet Food, Household Products, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amcor plc, Mondi Group, Sealed Air Corporation, Sonoco Products Company, Coveris Holdings, ProAmpac, Huhtamaki Group, Glenroy Inc., Constantia Flexibles Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pre-Made Pouch Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Pre-Made Pouch Packaging MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- Mondi Group

- Sealed Air Corporation

- Sonoco Products Company

- Coveris Holdings

- ProAmpac

- Huhtamaki Group

- Glenroy Inc.

- Constantia Flexibles