Global Pre-book Airport Transfer Market Size, Share, Growth Analysis By Traveler Type (Independent Traveler, Group Traveller), By Transportation Type (Private Transportation, Public Transportation), By Age Group (23-25 years, 26-45 years, 45-60 years, More Than 60 years), By Purpose/Tourist Type (Leisure, Business, Visit Friends/Relatives, Education, Conventions, Religious, Health Treatment), By Booking Channel (Online Booking, Phone Booking, In-Person Booking), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 176090

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Traveler Type Analysis

- Transportation Type Analysis

- Age Group Analysis

- Purpose/Tourist Type Analysis

- Booking Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Regions and Countries

- Key Company Insights

- Recent Developments

- Report Scope

Report Overview

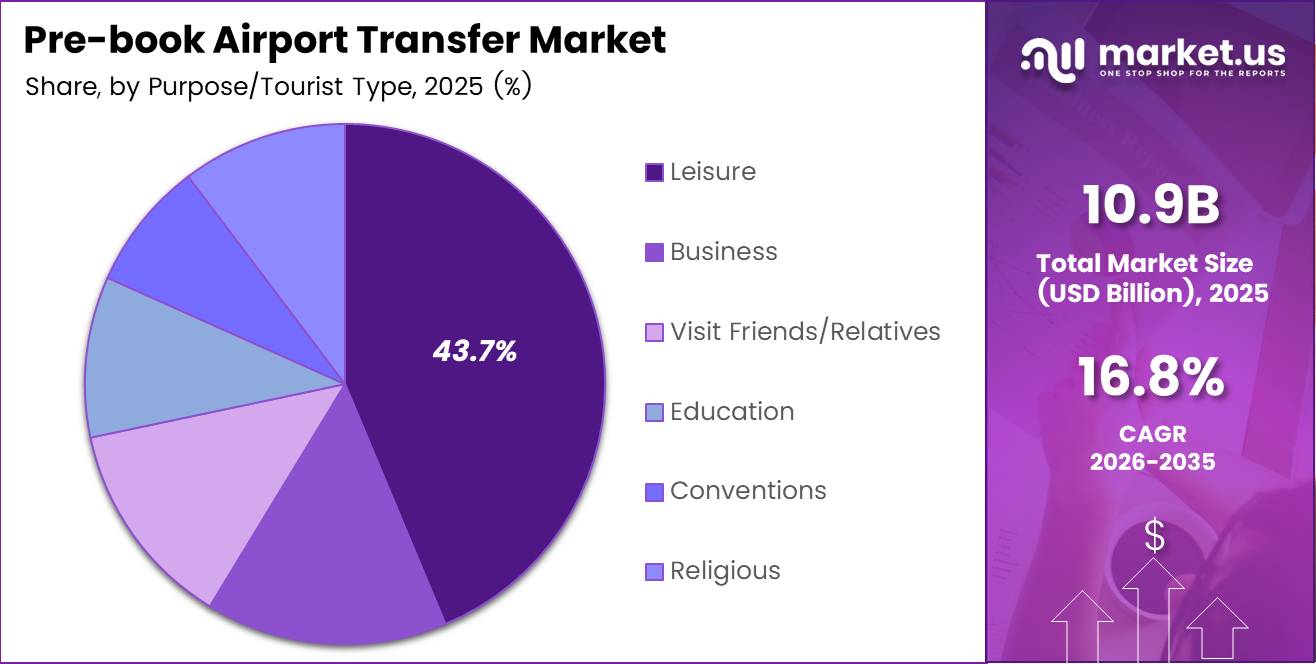

Global Pre-book Airport Transfer Market size is expected to be worth around USD 51.5 Billion by 2035 from USD 10.9 Billion in 2025, growing at a CAGR of 16.8% during the forecast period 2026 to 2035.

Pre-book airport transfer services connect travelers with reliable ground transportation before they arrive at airports. These services include shuttle vans, private cars, taxis, and shared ride options. Travelers reserve their rides through mobile apps, websites, or phone bookings.

The market encompasses various transportation modes serving different passenger needs. Private vehicles dominate due to convenience and safety preferences. Public transportation options provide budget-friendly alternatives. Moreover, service providers continuously upgrade their fleets to meet evolving customer expectations.

Digital transformation reshapes how travelers book and manage airport transfers today. Mobile platforms enable seamless reservations with real-time tracking capabilities. Consequently, passengers enjoy greater control over their travel arrangements. Payment integration through digital wallets simplifies transactions significantly.

Airport infrastructure expansion across emerging markets creates substantial growth opportunities. New terminals and international routes increase demand for transfer services. Additionally, rising air travel volumes drive consistent market expansion. Government investments in transportation connectivity further support industry development.

Sustainability initiatives influence vehicle selection and operational strategies within the market. Electric and hybrid vehicles gain traction among environmentally conscious travelers. Furthermore, operators adopt green practices to reduce carbon footprints. These changes align with global climate action commitments.

According to IATA, 54% of global passengers in 2025 prefer managing their travel on mobile apps including booking and payments. This shift demonstrates strong consumer preference for digital convenience over traditional booking methods. The trend accelerates market digitalization and improves operational efficiency for service providers.

According to IATA, digital wallet usage for travel payments increased from 20% in 2024 to 28% in 2025. This growth reflects rising trust in contactless payment solutions among travelers. The adoption enhances transaction speed and reduces friction during booking processes.

In September 2025, Joby Aviation and Uber announced Blade air mobility integration into the Uber app following their acquisition. This development signals emerging competition from aerial transfer solutions. Traditional ground transportation providers must innovate to maintain market relevance.

Key Takeaways

- Global Pre-book Airport Transfer Market projected to reach USD 51.5 Billion by 2035 from USD 10.9 Billion in 2025

- Market expected to grow at CAGR of 16.8% during forecast period 2026-2035

- Independent Travelers segment dominates with 69.2% market share in 2025

- Private Transportation holds 78.3% share in transportation type segment

- Age Group 26-45 years leads with 49.9% market share

- Leisure travel purpose accounts for 43.7% of bookings

- Online Booking channel captures 67.1% of total reservations

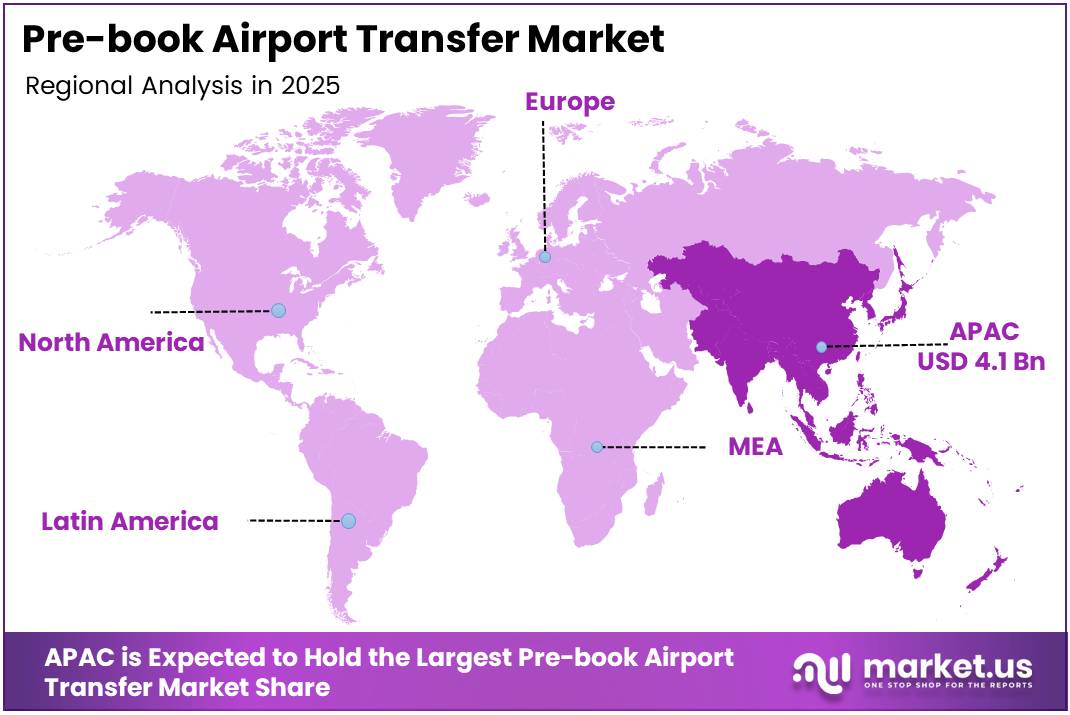

- Asia Pacific region dominates with 38.50% market share valued at USD 4.1 Billion

Traveler Type Analysis

Independent Traveler dominates with 69.2% due to increasing preference for personalized travel experiences.

In 2025, Independent Traveler held a dominant market position in the By Traveler Type segment of Pre-book Airport Transfer Market, with a 69.2% share. Solo travelers prioritize flexibility and customized transportation solutions matching their schedules. Moreover, business professionals frequently book individual transfers for efficiency. Digital platforms make independent bookings straightforward and convenient.

Group Traveller represents families, corporate teams, and organized tour participants requiring coordinated transportation. These customers seek cost-effective shared transfer options accommodating multiple passengers. Additionally, event attendees and convention participants utilize group services. However, scheduling complexity and coordination challenges limit this segment’s growth compared to independent bookings.

Transportation Type Analysis

Private Transportation dominates with 78.3% due to enhanced safety, comfort, and personalized service preferences.

In 2025, Private Transportation held a dominant market position in the By Transportation Type segment of Pre-book Airport Transfer Market, with a 78.3% share. Travelers prioritize direct routes without multiple stops or passenger pickups. Furthermore, premium vehicles offer superior comfort levels for business executives. The COVID-19 pandemic accelerated demand for private transportation ensuring minimal contact with strangers.

Public Transportation includes shared shuttles, buses, and train connections serving price-sensitive travelers. These options provide economical alternatives for budget-conscious passengers and backpackers. However, fixed schedules and multiple stops reduce convenience significantly. Additionally, luggage handling challenges and longer travel times discourage many customers from choosing public transfer options.

Age Group Analysis

26-45 years dominates with 49.9% due to high travel frequency among working professionals and young families.

In 2025, 26-45 years held a dominant market position in the By Age Group segment of Pre-book Airport Transfer Market, with a 49.9% share. This demographic represents peak earning professionals with substantial travel budgets. Moreover, tech-savvy individuals in this range readily adopt mobile booking platforms. Business trips and family vacations drive consistent demand from this age cohort.

23-25 years represents young professionals and students beginning their travel journeys independently. Limited budgets influence their transportation choices toward economical shared services. Additionally, this group demonstrates high mobile app engagement and digital payment adoption. However, lower travel frequency compared to older demographics limits their market impact.

45-60 years includes established professionals and pre-retirement travelers with significant disposable income. This segment values reliability and comfort over price considerations. Furthermore, business travel remains frequent within this age range. They prefer premium transfer services ensuring punctuality for important meetings.

More Than 60 years encompasses retirees and senior travelers prioritizing safety and convenience. Health considerations and mobility challenges influence their transportation preferences significantly. Additionally, this demographic appreciates door-to-door services minimizing physical exertion. However, lower travel frequency and digital adoption rates constrain segment growth compared to younger groups.

Purpose/Tourist Type Analysis

Leisure dominates with 43.7% due to rising vacation travel and tourism recovery post-pandemic.

In 2025, Leisure held a dominant market position in the By Purpose/Tourist Type segment of Pre-book Airport Transfer Market, with a 43.7% share. Vacation travelers prioritize hassle-free airport connections to enjoy relaxing starts and endings. Moreover, families with children value convenient pre-booked transportation avoiding taxi queues. Tourism industry recovery drives consistent demand across beach destinations, cultural sites, and adventure locations.

Business travelers require reliable punctual transfers ensuring they reach meetings and conferences promptly. Corporate travel policies often mandate pre-booked transportation for employee safety and cost control. Additionally, business professionals value productivity during transfers through vehicle amenities. However, economic fluctuations and remote work trends periodically impact business travel volumes.

Visit Friends/Relatives represents passengers traveling for social connections and family gatherings. These travelers seek affordable transportation solutions accommodating luggage and multiple passengers. Furthermore, this segment experiences seasonal peaks during holidays and special occasions. Cost sensitivity influences booking decisions more significantly than business or leisure segments.

Education includes international students and academic professionals attending universities and conferences. This segment requires reliable transfers between airports and educational institutions. Additionally, students often book services during semester starts and breaks. However, budget constraints limit premium service adoption within this category.

Conventions encompasses attendees traveling for trade shows, exhibitions, and professional gatherings. Event organizers frequently arrange group transfer services for participants. Moreover, convention centers in major cities drive concentrated demand during event schedules. This segment values punctuality ensuring attendees reach venues on time.

Religious travelers journey to pilgrimage sites and spiritual destinations worldwide. This segment experiences predictable seasonal peaks during religious festivals and holy periods. Additionally, group bookings dominate as pilgrims often travel together. However, price sensitivity influences transportation choices within this category significantly.

Health Treatment represents medical tourists and patients seeking specialized healthcare services abroad. These travelers require comfortable transportation accommodating medical conditions and equipment. Furthermore, hospitals and clinics often partner with transfer providers. However, this niche segment remains smaller compared to mainstream leisure and business travel.

Booking Channel Analysis

Online Booking dominates with 67.1% due to convenience, transparency, and real-time availability features.

In 2025, Online Booking held a dominant market position in the By Booking Channel segment of Pre-book Airport Transfer Market, with a 67.1% share. Digital platforms enable travelers to compare prices, read reviews, and confirm reservations instantly. Moreover, mobile apps provide seamless booking experiences with saved payment methods. The shift toward contactless transactions accelerated following pandemic-related hygiene concerns among passengers.

Phone Booking serves customers preferring personal assistance and verbal confirmations for their reservations. Older demographics and passengers with complex requirements utilize phone channels frequently. Additionally, customer service representatives address special requests like child seats or accessibility needs. However, longer processing times and limited availability outside business hours reduce convenience compared to online alternatives.

In-Person Booking occurs at airport counters, hotel concierge desks, and travel agency offices. This traditional method appeals to last-minute travelers and those uncomfortable with technology. Furthermore, in-person channels enable immediate problem resolution and face-to-face communication. However, limited operating hours, language barriers, and queue times discourage many modern travelers from using this channel.

Key Market Segments

By Traveler Type

- Independent Traveler

- Group Traveller

By Transportation Type

- Private Transportation

- Public Transportation

By Age Group

- 23-25 years

- 26-45 years

- 45-60 years

- More Than 60 years

By Purpose/Tourist Type

- Leisure

- Business

- Visit Friends/Relatives

- Education

- Conventions

- Religious

- Health Treatment

By Booking Channel

- Online Booking

- Phone Booking

- In-Person Booking

Drivers

Increasing International and Domestic Air Travel Demand Fueling Pre-Booked Transfers

Global air passenger traffic continues expanding as economies recover and travel restrictions ease. Airlines add new routes connecting secondary cities to international destinations. Consequently, airports experience higher arrival volumes requiring efficient ground transportation solutions. Business travel resumes alongside leisure tourism creating sustained demand for reliable transfer services.

According to IATA, 78% of passengers want a single smartphone travel credential combining digital wallet, digital passport, and loyalty cards. This integration demonstrates how travelers seek seamless end-to-end journey management including ground transportation. The demand drives transfer providers to enhance digital capabilities and integrate with airline ecosystems.

Rising middle-class populations in emerging markets increase air travel participation significantly. First-time flyers prioritize safe convenient transportation from unfamiliar airports to destinations. Moreover, airports in tier-two cities develop infrastructure attracting commercial flights. These developments expand the addressable market for pre-booked transfer services substantially.

Restraints

High Operational Costs and Fuel Price Volatility Affecting Profit Margins

Transportation providers face escalating expenses from vehicle maintenance, insurance, and driver wages. Fuel costs fluctuate unpredictably impacting pricing strategies and profitability margins. Consequently, operators struggle balancing competitive rates with sustainable business operations. Small providers often exit markets unable to absorb cost increases.

Regulatory compliance requirements impose additional financial burdens on transfer service companies. Licensing fees, vehicle inspections, and safety certifications demand ongoing investments. Moreover, labor regulations mandate minimum wages and benefits increasing operational expenses. These factors pressure providers to raise prices potentially reducing customer demand.

Competition from ride-hailing platforms creates pricing pressures limiting revenue growth opportunities. Established players invest heavily in technology and marketing to maintain market share. Additionally, customer acquisition costs rise as digital advertising becomes more expensive. However, premium service offerings help some providers differentiate and sustain healthy margins.

Growth Factors

Integration of AI-Based Route Optimization to Enhance Customer Experience

Artificial intelligence transforms transfer operations through intelligent routing and predictive analytics. Machine learning algorithms analyze traffic patterns reducing travel times and fuel consumption. Consequently, customers enjoy faster journeys while providers lower operational costs. Real-time adjustments ensure punctual arrivals even during unexpected delays.

According to IATA, use of electronic bag tags rose from 28% in 2024 to 35% in 2025. This technological adoption demonstrates passenger willingness to embrace digital travel solutions. Transfer providers leverage similar innovations creating seamless connections between flight and ground transportation experiences.

According to Biometric Update, 70% of passengers are planning at least one intermodal trip combining air with rail or road in 2025. This multimodal preference opens opportunities for transfer providers offering integrated booking solutions. Companies partnering with airlines, hotels, and railways capture larger transaction values and improve customer retention.

In January 2026, Kiwitaxi launched its first mobile app for pre-booked airport transfers. This development reflects industry recognition that mobile-first strategies drive customer acquisition. Apps enable personalized experiences, loyalty programs, and push notifications improving engagement rates significantly.

Emerging Trends

Surge in Electric and Sustainable Vehicle Options for Airport Transfers

Environmental consciousness drives transfer providers adopting electric and hybrid vehicle fleets. Cities implement low-emission zones around airports encouraging green transportation solutions. Consequently, operators invest in charging infrastructure and eco-friendly vehicles. Customers increasingly select services demonstrating environmental responsibility and sustainability commitments.

According to Biometric Update, 50% of passengers globally have used biometric identification at airports in 2025, up from 46% in 2024. This technology adoption extends beyond security checkpoints into transportation services. Transfer providers experiment with biometric check-ins enabling passwordless vehicle access and automated billing processes.

Real-time tracking systems transform customer experience through transparency and predictive communication. Passengers receive notifications about driver location, estimated arrival time, and vehicle details. Moreover, smart alerts notify travelers about flight delays automatically adjusting pickup schedules. These innovations reduce anxiety and improve satisfaction scores significantly.

Subscription models and loyalty programs gain popularity among frequent business travelers. Monthly packages offer unlimited transfers at discounted rates encouraging repeat usage. Additionally, airlines and hotels integrate transfer benefits into premium membership tiers. However, providers must balance subscription economics ensuring profitability while delivering value propositions.

Regional Analysis

Asia Pacific Dominates the Pre-book Airport Transfer Market with a Market Share of 38.50%, Valued at USD 4.1 Billion

Asia Pacific leads global market growth with a commanding 38.50% market share valued at USD 4.1 Billion in 2025. The region benefits from rapidly expanding aviation infrastructure and rising passenger volumes across major economies. Countries like China, India, and Southeast Asian nations invest billions in new airports and terminal expansions. Moreover, growing middle-class populations increase leisure and business travel dramatically. Digital payment adoption and smartphone penetration enable seamless online booking experiences across the region.

North America Pre-book Airport Transfer Market Trends

North America demonstrates mature market characteristics with high digital adoption and established service providers. Major airports in the United States and Canada offer comprehensive transfer options. Additionally, business travel remains robust supporting premium service demand. However, market saturation limits growth rates compared to emerging regions.

Europe Pre-book Airport Transfer Market Trends

Europe benefits from extensive rail and road connectivity linking airports to city centers efficiently. Environmental regulations push operators toward electric vehicles and sustainable practices. Furthermore, tourism recovery drives leisure travel demand across Mediterranean and Western European destinations. Cross-border travel within Schengen Zone creates opportunities for multi-country transfer services.

Latin America Pre-book Airport Transfer Market Trends

Latin America experiences growing aviation activity as economies develop and tourism expands. Brazil and Mexico lead regional market share with large populations and business hubs. However, infrastructure limitations and safety concerns challenge service quality in some areas. Digital payment adoption accelerates enabling broader market participation.

Middle East & Africa Pre-book Airport Transfer Market Trends

Middle East attracts significant transfer demand through major aviation hubs like Dubai and Doha. Luxury service offerings cater to premium travelers and business executives. Meanwhile, Africa demonstrates emerging potential as airport infrastructure improves gradually. However, regulatory inconsistencies and economic volatility create operational challenges for providers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

SuperShuttle International Company operates extensive shared-ride networks across major airports in North America and international locations. The company pioneered affordable group shuttle services connecting travelers with hotels and residential addresses. Moreover, SuperShuttle maintains strong airport partnerships ensuring convenient pickup locations. Their blue vans remain recognizable brands among frequent travelers seeking economical transfer options.

Uber Technologies, Inc. revolutionized pre-booked transfers through its mobile-first ride-hailing platform offering instant reservations. The company dominates urban markets with extensive driver networks and competitive pricing strategies. Additionally, Uber integrates flight tracking automatically adjusting pickup times for delays. Their global presence and technology infrastructure position them as market leaders in digital transportation solutions.

Lyft, Inc. competes aggressively in North American markets through competitive pricing and customer-friendly policies. The company emphasizes driver quality and passenger safety creating differentiated service experiences. Furthermore, Lyft expands airport partnerships securing dedicated pickup zones and priority access. Their pink branding and community-focused marketing resonate strongly with younger traveler demographics.

The Hertz Corporation leverages its established car rental infrastructure to offer comprehensive transfer services worldwide. The company provides both chauffeur-driven options and self-drive rentals meeting diverse customer needs. Moreover, Hertz maintains premium vehicle fleets appealing to business executives and luxury travelers. Their airport counter presence and loyalty programs drive consistent customer retention rates.

Key players

- SuperShuttle International Company

- Lyft, Inc.

- Uber Technologies, Inc.

- Keys Shuttle

- A&M Rentals

- Avis Company

- The Hertz Corporation

- Greyhound Lines, Inc.

- Alamo Enterprise

- Avis Budget Group

Recent Developments

- September 2025 – Joby Aviation and Uber announced Blade air mobility integration into the Uber app following their acquisition. This strategic partnership brings electric vertical takeoff and landing aircraft into mainstream ride-hailing platforms. The collaboration represents significant innovation in premium airport transfer solutions offering faster travel times for high-value customers.

- August 2025 – WHILL debuted autonomous mobility services at Munich Airport providing self-driving wheelchair and passenger assistance. The technology demonstrates growing automation in airport transportation supporting elderly and disabled travelers. This launch positions Munich as a leading hub for accessible transportation innovation within European aviation markets.

Report Scope

Report Features Description Market Value (2025) USD 10.9 Billion Forecast Revenue (2035) USD 51.5 Billion CAGR (2026-2035) 16.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Traveler Type (Independent Traveler, Group Traveller), By Transportation Type (Private Transportation, Public Transportation), By Age Group (23-25 years, 26-45 years, 45-60 years, More Than 60 years), By Purpose/Tourist Type (Leisure, Business, Visit Friends/Relatives, Education, Conventions, Religious, Health Treatment), By Booking Channel (Online Booking, Phone Booking, In-Person Booking) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape SuperShuttle International Company, Lyft Inc., Uber Technologies Inc., Keys Shuttle, A&M Rentals, Avis Company, The Hertz Corporation, Greyhound Lines Inc., Alamo Enterprise, Avis Budget Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pre-book Airport Transfer MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Pre-book Airport Transfer MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- SuperShuttle International Company

- Lyft, Inc.

- Uber Technologies, Inc.

- Keys Shuttle

- A&M Rentals

- Avis Company

- The Hertz Corporation

- Greyhound Lines, Inc.

- Alamo Enterprise

- Avis Budget Group