Global Powdered Fats Market Size, Share, Growth Analysis By Source (Palm and Palm Kernel, Coconut, Milk, Sunflower, Canola, Corn, Others), By Processing Technology (Spray Drying, Drum Drying, Freeze Drying, Others), By Application (Bakery and Confectionery, Dairy and Non-dairy Products, Frozen Desserts, Baby Food and Infant Formula, Supplements and Nutritional Products, Beverages, Seasonings and Flavorings, Sauces, Dressings, and Condiments, Others) – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157151

- Number of Pages: 361

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

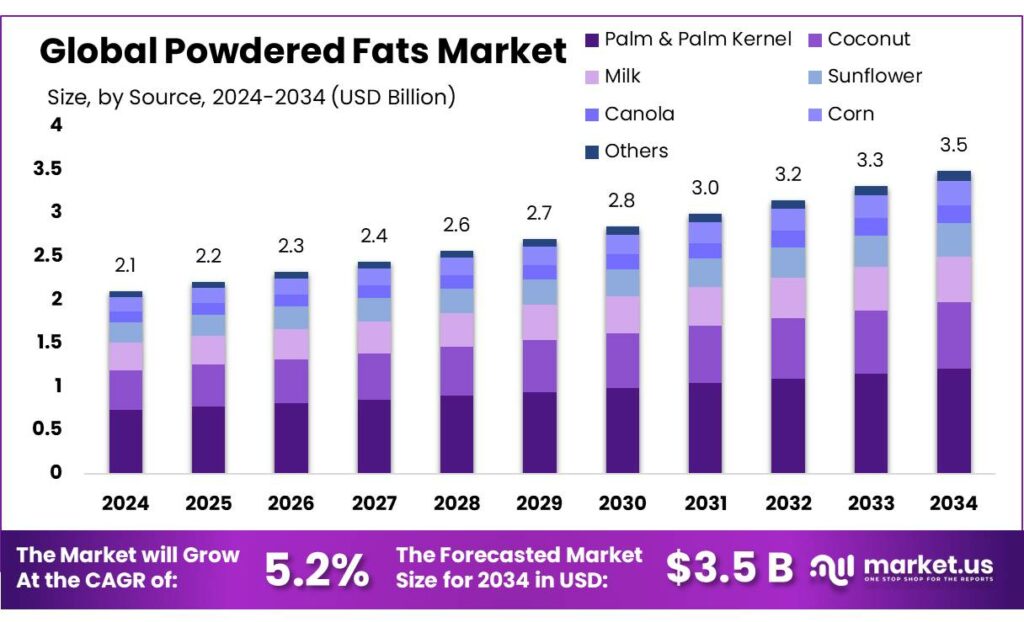

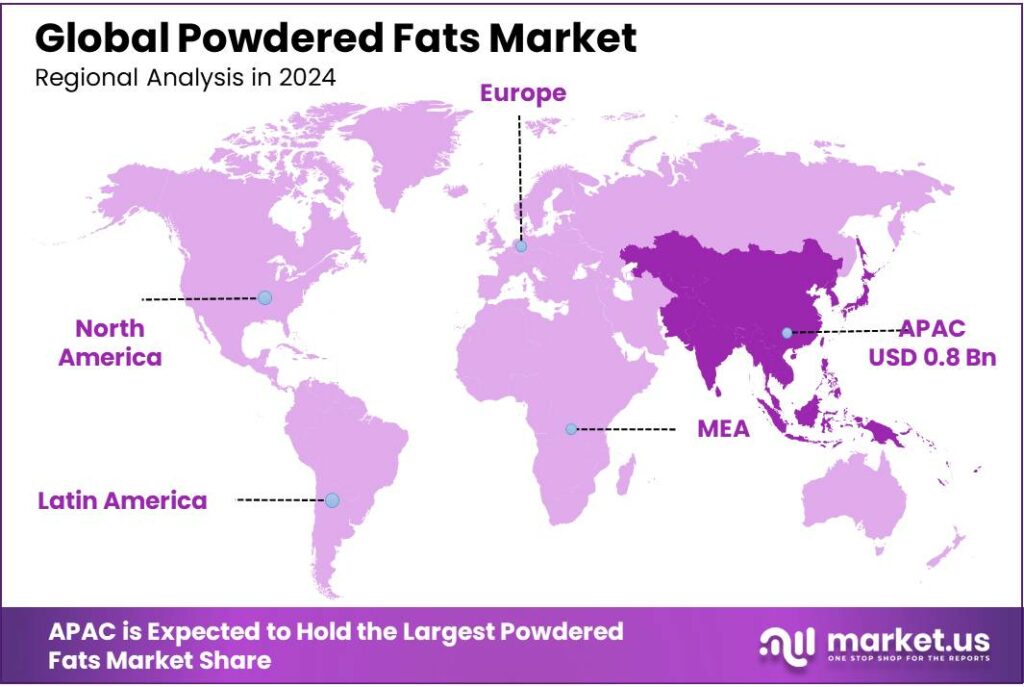

The Global Powdered Fats Market size is expected to be worth around USD 3.5 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024 Asia‑Pacific held a dominant market position, capturing more than a 38.4% share, holding USD 0.8 Billion in revenue.

Powdered fats—solid fats converted into a dry, free‑flowing powder—play a vital role in the food industry, offering ease of handling, longer shelf life, and improved incorporation into formulations such as baked goods, snacks, and ready‑to‑eat meals.

Government data on actual powdered fats is sparse, as most official agencies categorize fats under broader dairy or fat powders. Nonetheless, analysis of related dairy fat products offers context: for example, in India, exports of “other milk fats and oils” (HS 040590) were valued at approximately USD 6.88 per kg in 2023, underscoring the commercial value of fat derivatives in export markets.

Government initiatives have played a pivotal role in supporting the growth of the powdered fats industry. The Ministry of Food Processing Industries (MoFPI) has been instrumental in formulating policies and providing infrastructure support to enhance the food processing sector. Additionally, the National Food Security Strategy 2051 aims to meet the growing demand for processed foods, indirectly benefiting the powdered fats market by promoting food processing activities.

The National Programme for Dairy Development (NPDD) enhances infrastructure such as milk testing and chilling facilities, improving the base for downstream value-added products. Simultaneously, the Animal Husbandry Infrastructure Development Fund (AHIDF), with a corpus of ₹15,000 crore, and Dairy Entrepreneurship Development Scheme, offering capital subsidies of 25‑33%, foster private investment in processing units and infrastructure.

Key Takeaways

- Powdered Fats Market size is expected to be worth around USD 3.5 Billion by 2034, from USD 2.1 Billion in 2024, growing at a CAGR of 5.2%.

- Palm & Palm Kernel held a dominant market position, capturing more than a 34.8% share of the global powdered fats market.

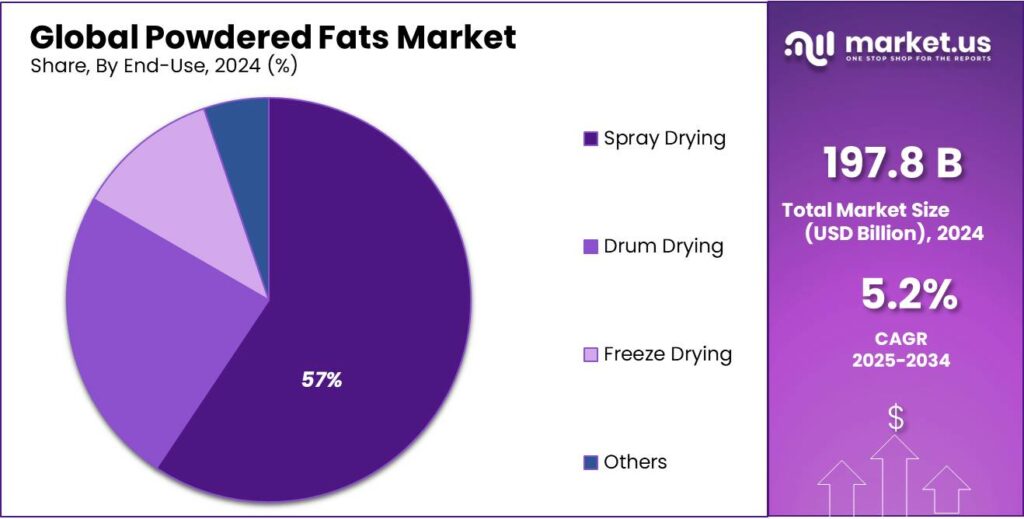

- Spray Drying held a dominant market position, capturing more than a 57.5% share of the powdered fats market.

- Bakery & Confectionery held a dominant market position, capturing more than a 26.9% share.

- Asia‑Pacific region emerged as the dominant force in the global powdered fats market, capturing 38.4% of total revenue—equivalent to about USD 0.8 billion.

By Source Analysis

Powdered Fats by Palm & Palm Kernel dominate with 34.8% share for their reliability and cost-effectiveness

In 2024, Palm & Palm Kernel held a dominant market position, capturing more than a 34.8% share of the global powdered fats market. This leading position makes sense—palm-based fats are plentiful, inexpensive to produce, and prized for their high melting point and oxidative stability. These traits make powdered palm fats ideal for a wide range of applications, from bakery goods to confectionery and animal feed, where shelf stability and performance matter most.

Beyond their functional strengths, palm-derived powdered fats benefit from a robust supply chain rooted in regions like Indonesia and Malaysia, where palm oil plantations and processing facilities are well-established. That helps keep costs manageable and market availability high. Meanwhile, rising interest in sustainable sourcing has prompted many suppliers to pursue certifications like RSPO, ensuring environmental accountability in response to growing consumer awareness.

By Processing Technology Analysis

Spray Drying dominates with 57.5% share because it’s fast, efficient, and gentle on fats

In 2024, Spray Drying held a dominant market position, capturing more than a 57.5% share of the powdered fats market by processing technology. This is no surprise—spray drying turns liquid or emulsified fats into fine powder by simply spraying them into hot air, which quickly dries them into a stable, easy-to-handle form. It’s a favorite among manufacturers because it preserves heat-sensitive nutrients, achieves consistent particle size, and scales well from small batches to industrial volumes. This method not only maintains the quality of sensitive fatty ingredients but also supports smooth manufacturing workflows.

By Application Analysis

Bakery & Confectionery leads with 26.9% share, sweetening products with precision

In 2024, Bakery & Confectionery held a dominant market position, capturing more than a 26.9% share in the powdered fats sector. This prominence isn’t surprising—bakers and confectioners rely on powdered fats for their ability to deliver consistent texture, rich mouthfeel, and controlled melt in muffins, cakes, chocolates, and fillings. Powdered fats blend easily, helping create uniform batches whether for artisanal pastries or high-speed production lines. While official figures vary by source, the importance of this application shines through, especially as consumers continue to crave clean-label, high-quality indulgences.

Looking toward 2025, powdered fats in bakery and confectionery are set to remain a mainstay, backed by innovations in natural sourcing, heat-sensitive encapsulation techniques, and supply chains tuned for cost-efficiency. In short, if you’ve ever bitten into a perfectly tender cookie or a melty truffle, there’s a high chance powdered fats helped deliver that sensory magic—making them quietly essential in turning recipes into consistently delicious memories.

Key Market Segments

By Source

- Palm & Palm Kernel

- Coconut

- Milk

- Sunflower

- Canola

- Corn

- Others

By Processing Technology

- Spray Drying

- Drum Drying

- Freeze Drying

- Others

By Application

- Bakery & Confectionery

- Dairy & Non-dairy Products

- Frozen Desserts

- Baby Food & Infant Formula

- Supplements & Nutritional Products

- Beverages

- Seasonings & Flavorings

- Sauces, Dressings, & Condiments

- Others

Emerging Trends

Government Support for Sustainable Turf Management

A significant trend shaping the turf protection industry is the increasing implementation of government-backed incentives aimed at promoting sustainable turf management practices. These initiatives are designed to encourage homeowners, businesses, and municipalities to adopt eco-friendly landscaping solutions, thereby reducing water consumption, minimizing chemical usage, and enhancing environmental resilience.

In the United States, several states and municipalities have introduced rebate programs to incentivize the replacement of traditional turf with drought-tolerant or synthetic alternatives. For instance, the City of Los Angeles offers a rebate of $5 per square foot for both residential and commercial customers who convert their lawns into sustainable, low-water-use landscapes. This initiative is part of the SoCal Water$mart Rebate Program, in partnership with the Metropolitan Water District of Southern California.

Similarly, the Metropolitan Water District of Southern California received a $38 million state grant in 2023 to increase its turf replacement rebate from $2 to $3 per square foot. This funding is expected to help convert up to 30 million square feet of non-functional turf into water-efficient landscaping, building upon the program’s success in removing approximately 218 million square feet of grass, saving enough water to serve about 68,000 households annually.

Internationally, the United Kingdom’s Catchment Sensitive Farming program offers free advice and grant support to farmers and landowners to improve water and air quality through sustainable land management practices. The program has been instrumental in reducing agricultural pollutant losses by 4–12% across targeted areas in England.

Drivers

Surge in Dairy Production and Consumer Demand

Concurrently, consumer behavior is shifting towards convenience foods due to urbanization, busy lifestyles, and changing dietary patterns. The demand for processed foods that are easy to prepare and have a longer shelf life is on the rise. This trend is propelling the need for ingredients like powdered fats that align with these consumer preferences. Moreover, the increasing health consciousness among consumers is driving the demand for products with cleaner labels and healthier fat profiles, further influencing the types of powdered fats being produced and consumed.

- According to the U.S. Department of Agriculture’s Foreign Agricultural Service (FAS), India’s total milk production is projected to reach 216.5 million metric tons (MMT) in 2025, up from 211.7 MMT in 2024 .

This consistent growth is attributed to factors such as improved animal husbandry practices, better feed quality, and increased farmer awareness. Additionally, the National Dairy Development Board (NDDB) has been instrumental in enhancing milk production through initiatives like the Kamdhenu Dairy Scheme, which supports the establishment of high-yielding dairy farms.

Government initiatives are also playing a pivotal role in shaping the dairy and powdered fats industries. The ‘Eat Right India’ movement, launched by the Food Safety and Standards Authority of India (FSSAI), aims to promote safe, healthy, and sustainable food practices. Through this initiative, over 12 lakh food handlers have been trained, and more than 55 lakh liters of used cooking oil have been repurposed into biodiesel . Such programs not only enhance food safety but also encourage the adoption of healthier ingredients in food processing, indirectly impacting the demand for powdered fats.

Restraints

Regulatory Challenges and Compliance Costs

One significant challenge hindering the growth of the powdered fats industry in India is the complex and evolving regulatory landscape. The Food Safety and Standards Authority of India (FSSAI) plays a pivotal role in regulating food products, including fats and oils. While these regulations aim to ensure food safety and quality, they can impose substantial compliance costs on manufacturers.

For instance, the FSSAI mandates stringent quality standards, labeling requirements, and regular inspections, which can be resource-intensive for producers, especially small and medium enterprises (SMEs). These regulatory burdens may deter new entrants and strain the financial resources of existing companies, potentially affecting their competitiveness in the market.

Moreover, India’s dairy sector faces challenges related to surplus production. As of July 2024, cooperative and private dairies were holding an estimated 3–3.25 lakh tonnes of skimmed milk powder (SMP) stocks at the start of the production year. This surplus can lead to price fluctuations and financial strain on dairy farmers and processors. The Ministry of Food Processing Industries (MOFPI) has been working to address these issues by promoting value addition and reducing wastage. However, balancing production with market demand remains a persistent challenge.

Additionally, the Indian government has been focusing on reducing trans fats in food products due to their adverse health effects. The FSSAI has set limits on trans fat content in partially hydrogenated oils and fats. While these regulations aim to improve public health, they also require manufacturers to invest in reformulation processes and quality control measures. Such regulatory changes can lead to increased production costs and necessitate adjustments in manufacturing processes, posing challenges for the industry.

Opportunity

Expansion of Dairy Processing and Value Addition

As milk production escalates, there is a corresponding rise in the demand for dairy processing and value-added products. The FAS anticipates that India’s fluid milk consumption will reach 91 MMT in 2025, up from 89 MMT in 2024. This surge in consumption is driven by factors including population growth, rising disposable incomes, and increased urbanization. Consequently, there is a growing need for efficient processing methods and the development of value-added dairy products.

The powdered fats industry stands to benefit from this trend, as powdered fats are essential ingredients in various dairy products such as ice creams, butter, dairy desserts, yogurts, and cheese. These products require stable and cost-effective fat sources to maintain quality and extend shelf life. Powdered fats, derived from sources like milk, butter, and vegetable oils, offer a convenient solution for manufacturers aiming to meet the increasing demand for processed dairy products.

Government initiatives further bolster this growth opportunity. In the 2025-26 fiscal budget, the Government of India allocated INR 48.4 billion (approximately USD 565 million) for the Department of Animal Husbandry and Dairying, marking an over 7% increase from the previous year. These funds are directed towards enhancing dairy infrastructure, improving animal health, and promoting sustainable practices within the sector.

Additionally, state-level initiatives contribute to the sector’s growth. For example, Madhya Pradesh aims to double its milk production from 9% to 20% through enhanced collaboration with the National Dairy Development Board (NDDB). This objective underscores the state’s commitment to expanding dairy production, which in turn increases the availability of raw materials for powdered fat production.

Regional Insights

Asia Pacific leads with 38.4% share, contributing roughly USD 0.8 billion to the powdered fats market

In 2024, the Asia‑Pacific region emerged as the dominant force in the global powdered fats market, capturing 38.4% of total revenue—equivalent to about USD 0.8 billion. This leadership isn’t just about numbers—it reflects the region’s deep ties to ingredient supply, demand trends, and industrial evolution. This local supply advantage supports cost-effective sourcing for powdered fat producers while meeting booming demand from evolving food sectors—especially in baked goods, savory snacks, and ready-to-drink beverages.

Consumers across Asia Pacific are embracing convenience, fortified nutrition, and clean-label ingredients—pushing powdered fats into everyday food applications. In China, urbanization and changing dietary habits have increased reliance on processed and instant foods, helping powdered fats become standard ingredients. In parallel, India is seeing particularly strong growth, with manufacturers customizing offerings for infant nutrition, bakery products, and supplements. The technologies behind powdered fats—especially spray drying—fit this trend by producing fine, stable powders that are easy to blend and store.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kerry Group, headquartered in Ireland, is a major global player in taste, nutrition, and food ingredients, with revenues of €8,020 million in 2023 and over 23,000 employees worldwide. While not exclusively focused on fats, Kerry supplies a wide range of dairy and fat-related ingredients used in powdered fats and non-dairy creamer applications, leveraging its flavor and functional food expertise. From a market analyst’s view, Kerry’s financial heft and strong R&D make it a reliable innovator in ingredient systems.

FrieslandCampina offers a robust range of fat powders—both dairy-based and vegetable-based—with products like the Kievit® Vana‑Grasa line, which packs up to 80% fat for creamy mouthfeel and milk‑replacement functionality. Their powders serve bakery, dessert, and beverage markets, with “plant-based or dairy” flexibility reflecting their forward-looking innovation. Analysts highlight the company’s ability to blend sensory quality with clean-label trends through thoughtful powder design.

Castle Dairy, founded in 1934, specializes in functional dairy blends, including spray-dried, fat-filled milk powders that incorporate up to 80% palm fat, often RSPO-certified and halal-approved. Their solutions span bakery, ice cream, chocolate, sauces, and vending products, and they also lean into sustainability—operating via solar‑powered facilities.

Top Key Players Outlook

- Kerry Group plc

- FrieslandCampina N.V.

- Aarkay Food Products Ltd.

- Insta Foods

- Castle Dairy s.a.

- Zeon Lifesciences Ltd.

- LUS Health Ingredients BV

- Hill Natural Extract

- Tiba Starch & Glucose Manufacturing Co. S.A.E

Recent Industry Developments

In 2024, Insta Foods—an ISO 22000:2018 certified food ingredients player based in Vadodara, India—continued serving the powdered fats market with specialty offerings. Their fat powders, made via spray drying, contain up to 70% fat and are crafted from vegetable sources like palm, palm kernel, coconut, high-oleic sunflower, and canola oil.

In 2024, FrieslandCampina reported total revenue of €12.9 billion, despite pressures from currency fluctuations and lower milk prices—yet achieved a strong operating income of €527 million, up significantly from €75 million the year before.

Report Scope

Report Features Description Market Value (2024) USD 2.1 Bn Forecast Revenue (2034) USD 3.5 Bn CAGR (2025-2034) 5.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Palm and Palm Kernel, Coconut, Milk, Sunflower, Canola, Corn, Others), By Processing Technology (Spray Drying, Drum Drying, Freeze Drying, Others), By Application (Bakery and Confectionery, Dairy and Non-dairy Products, Frozen Desserts, Baby Food and Infant Formula, Supplements and Nutritional Products, Beverages, Seasonings and Flavorings, Sauces, Dressings, and Condiments, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kerry Group plc, FrieslandCampina N.V., Aarkay Food Products Ltd., Insta Foods, Castle Dairy s.a., Zeon Lifesciences Ltd., LUS Health Ingredients BV, Hill Natural Extract, Tiba Starch & Glucose Manufacturing Co. S.A.E Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kerry Group plc

- FrieslandCampina N.V.

- Aarkay Food Products Ltd.

- Insta Foods

- Castle Dairy s.a.

- Zeon Lifesciences Ltd.

- LUS Health Ingredients BV

- Hill Natural Extract

- Tiba Starch & Glucose Manufacturing Co. S.A.E