Global Powder Coatings Market By Resin(Epoxy, Polyester, Epoxy-Polyester (Hybrid), Acrylic, Polyurethane, Others), By Coating Method(Electrostatic spray, Fluidized Bed, Others), By Application(Consumer Goods, Architectural, Automotive, General Industries, Furniture, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: Sep 2024

- Report ID: 128597

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

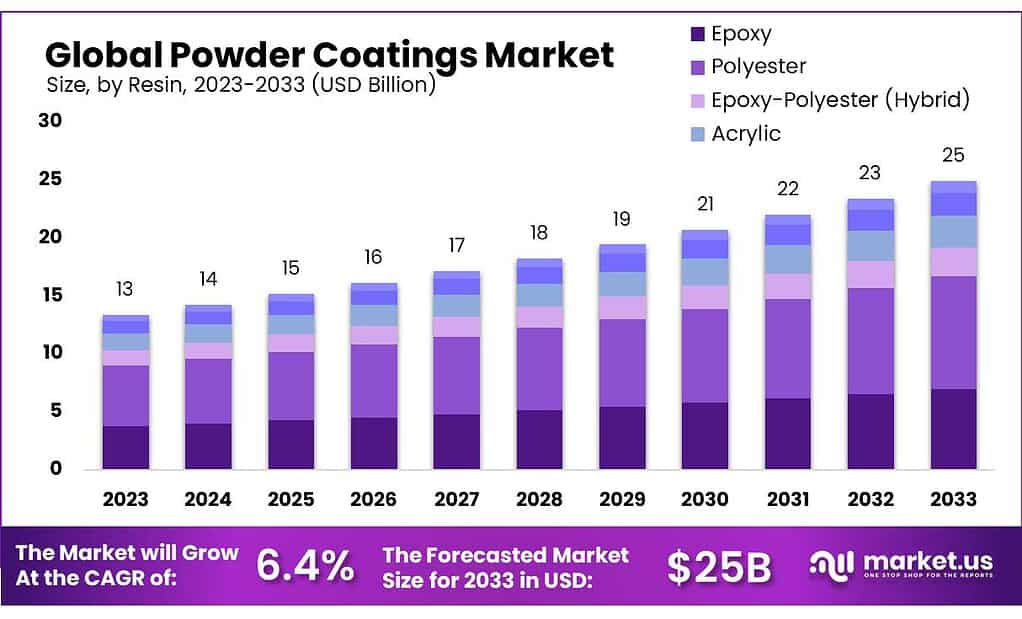

The global Powder Coatings Market size is expected to be worth around USD 25 billion by 2033, from USD 13 billion in 2023, growing at a CAGR of 6.4% during the forecast period from 2023 to 2033.

The powder coatings market, valued at approximately $10 billion in 2023, is experiencing robust growth with a projected compound annual growth rate (CAGR) of 6% over the next five years. This market advancement is driven by the increasing application of powder coatings in key industries such as automotive, appliances, architecture, and general industrial sectors.

In automotive applications, these coatings are applied to enhance durability and weather resistance on parts like wheels, frames, and bumpers. Similarly, in the appliance sector, powder coatings are used to improve the aesthetic and protective qualities of products like refrigerators and washers.

Powder coatings are favored in these industries for their ability to provide a high-quality finish and durability. They are particularly significant in the automotive industry for improving the corrosion resistance and aesthetic appeal of components. The appliance industry also benefits from the efficiency and superior finish provided by these coatings, which are essential for functionality and design appeal.

Stringent environmental regulations in regions like North America and Europe further bolster the appeal of powder coatings. These regulations, enforced by bodies such as the U.S. Environmental Protection Agency (EPA) and the European Union, promote the use of powder coatings due to their low volatile organic compound (VOC) emissions compared to traditional liquid coatings. This regulatory environment supports the market as industries seek to reduce air pollution and enhance workplace safety.

Significant import-export activities also shape the global dynamics of the powder coatings market. China, with its extensive manufacturing capabilities, is a major exporter, while the United States and European countries are key importers. This trade is driven by technological advancements and the regulatory push towards environmentally friendly products, with notable growth expected in the Asia-Pacific region due to increasing industrialization and urbanization.

Governments worldwide are fostering this growth through initiatives that encourage the use of sustainable products. For example, the European Union’s Horizon 2020 program supports the development of sustainable industrial processes, including advanced powder coating technologies.

Additionally, innovation within the market is catalyzed by the introduction of new application methods and more efficient curing processes that minimize energy use and enhance production efficiency. Major market players, such as AkzoNobel and PPG Industries, are expanding their reach through strategic acquisitions, broadening their technological capabilities and market presence.

Key Takeaways

- The global powder coatings market will grow from USD 13 billion in 2023 to USD 25 billion by 2033, with a 6.4% CAGR.

- Asia Pacific leads the market, holding a 40% share in 2023, valued at USD 5.4 billion, driven by rapid industrialization in China and India.

- Electrostatic Spray held a 76.5% market share in 2023, preferred for its efficient application in automotive, appliance, and industrial sectors.

- Polyester resins held the largest share, 39.7%, in 2023 due to their balance of cost, durability, and UV resistance, ideal for outdoor applications.

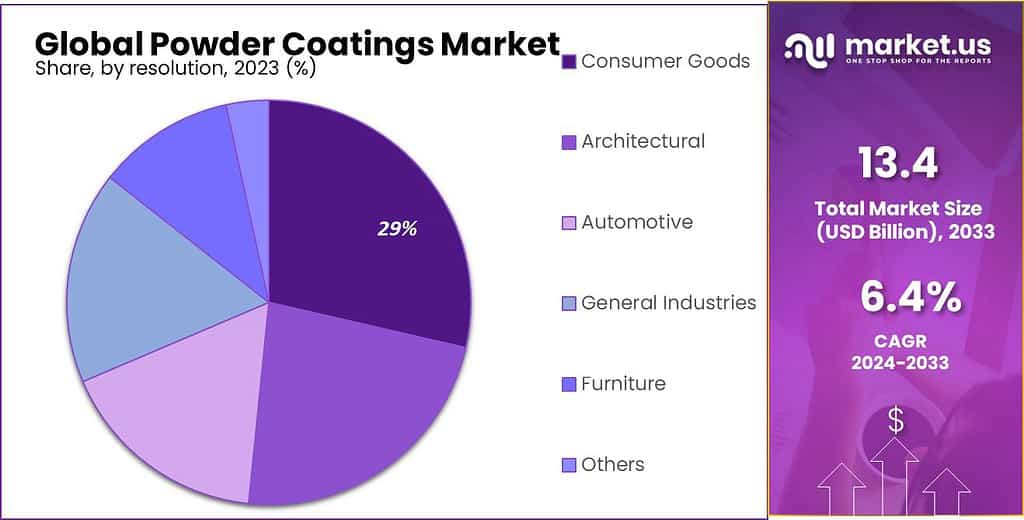

- The Consumer Goods sector held 28.6% of the market in 2023, driven by powder coatings’ durability and aesthetic appeal in electronics and appliances.

By Resin

In 2023, Polyester held a dominant market position in the powder coatings market, capturing more than a 39.7% share. Polyester resins are highly favored for their excellent balance of durability, cost-effectiveness, and aesthetic qualities. They are particularly popular in applications that require UV resistance and color stability, such as outdoor furniture, automotive finishes, and architectural coatings.

Following Polyester, Epoxy resins also play a significant role in the market. Known for their superior chemical resistance and excellent adhesion properties, epoxy coatings are ideal for industrial applications, including coatings for metal cans and appliances where protection against chemicals and corrosion is crucial.

The Epoxy-Polyester (Hybrid) segment combines the best attributes of both epoxy and polyester resins, offering good chemical resistance with enhanced flexibility and finish quality. These hybrids are commonly used in general metal applications, including shelving and fixtures, where both aesthetic appeal and durability are required.

Acrylic resins in powder coatings are appreciated for their excellent clarity and resistance to weathering, making them suitable for automotive and clear topcoat applications. They ensure a glossy finish and provide long-lasting color and gloss retention.

Polyurethane resins are notable for their exceptional impact resistance and flexibility, which make them ideal for applications that require a tough yet attractive finish, such as in automotive exteriors and high-performance machinery.

By Coating Method

In 2023, Electrostatic Spray held a dominant market position in the powder coatings market, capturing more than a 76.5% share. This method is widely favored due to its efficiency and effectiveness in achieving uniform and durable coatings. Electrostatic spray utilizes electrical charges to attract the powder particles to the target surface, which ensures thorough coverage and minimizes waste. It is particularly popular in automotive, appliance, and general industrial applications where high-quality finishes are essential.

Following Electrostatic Spray, the Fluidized Bed method also plays a crucial role in the market. This technique involves heating the items to be coated and then dipping them into a fluidized bed of powder, which sticks and melts onto the hot surface, forming a smooth coating. It is especially useful for coating objects with complex shapes or those requiring a thicker coating than what electrostatic spray can typically provide.

By Application

In 2023, Consumer Goods held a dominant market position in the powder coatings market, capturing more than a 28.6% share. This segment benefits significantly from powder coatings due to their durability, cost-effectiveness, and aesthetic versatility, making them ideal for household appliances, electronics, and other consumer products where appearance and longevity are crucial.

Following Consumer Goods, the Architectural segment also utilizes powder coatings extensively. These coatings are favored in architectural applications for their ability to provide excellent weather resistance and color retention on exterior surfaces and fixtures, enhancing building aesthetics and protection against environmental elements.

The Automotive sector represents another significant application area for powder coatings. In this industry, powder coatings are used for their superior finish and corrosion resistance on car components such as wheels, frames, and body parts, supporting the industry’s needs for durability and quality.

General Industries include a broad range of applications, from machinery and equipment to tools and fittings, where powder coatings are applied for their protective qualities and ability to withstand tough industrial environments.

Furniture, both outdoor and indoor, benefits from powder coatings for their aesthetic appeal and protective properties, which help extend the life of furniture items by guarding against wear and environmental damage.

Key Market Segments

By Resin

- Epoxy

- Polyester

- Epoxy-Polyester (Hybrid)

- Acrylic

- Polyurethane

- Others

By Coating Method

- Electrostatic spray

- Fluidized Bed

- Others

By Application

- Consumer Goods

- Architectural

- Automotive

- General Industries

- Furniture

- Others

Drivers

Growing Demand for Eco-Friendly Coatings: One major driving factor for the powder coatings market is the increasing demand for eco-friendly coatings. Powder coatings are widely recognized for their environmental benefits compared to traditional liquid coatings. This is largely due to their low volatile organic compound (VOC) emissions, which help in reducing air pollution and improving workplace safety. According to the U.S. Environmental Protection Agency (EPA), powder coatings produce almost zero VOC emissions, making them a preferred choice for industries aiming to comply with stringent environmental regulations.

Rising Regulatory Pressure: Regulatory frameworks have significantly influenced the growth of the powder coatings market. In the European Union, the REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) regulations enforce stringent standards for chemicals, including coatings. This has driven manufacturers to adopt powder coatings to meet these environmental compliance standards. The European Powder Coatings Association (EPCA) reports that more than 60% of new coating applications in Europe are now powder-based, driven by the need to adhere to environmental regulations.

Expanding End-Use Industries: The expansion of various end-use industries also fuels the powder coatings market. For example, the automotive industry increasingly adopts powder coatings due to their superior durability and aesthetic qualities. The automotive sector alone is projected to grow at a CAGR of 4.5% from 2023 to 2028, according to the International Automotive Industry Association. Powder coatings are used extensively on components such as wheels, frames, and bumpers, where they provide high resistance to corrosion and wear.

Technological Advancements: Technological advancements in powder coating applications have also played a crucial role. Innovations such as advanced curing processes and the development of high-performance powders have enhanced the efficiency and effectiveness of powder coatings. For instance, improvements in electrostatic spray technology have increased application precision and reduced waste. The American Coatings Association highlights that these advancements have enabled powder coatings to be used in a broader range of applications, further driving market growth.

Government Initiatives and Investments: Government initiatives and investments in sustainable manufacturing practices contribute significantly to the market’s expansion. In the United States, the Department of Energy (DOE) has supported research into energy-efficient coating technologies, including powder coatings. This has led to the development of new powder formulations that require less energy for curing, thereby reducing production costs and environmental impact. Additionally, the European Union’s Horizon 2020 program funds projects aimed at enhancing the sustainability of industrial processes, including powder coatings.

Increased Industrialization in Emerging Markets: The rise of industrialization in emerging markets, particularly in Asia-Pacific, is another key factor driving the powder coatings market. Countries such as China and India are experiencing rapid industrial growth, which is boosting the demand for durable and cost-effective coatings. The Asian Powder Coatings Association reports that the region’s market for powder coatings is expected to grow at a CAGR of 7.2% from 2023 to 2028, driven by expanding manufacturing and construction sectors.

Restraints

Limited Application Range Due to Performance Characteristics: One major restraining factor for the growth of the powder coatings market is the limited range of applications due to certain performance characteristics of powder coatings. Despite the many advantages, such as environmental friendliness and cost-effectiveness, powder coatings face challenges related to their physical properties that restrict their use in some industries.

Thickness Limitations: Powder coatings typically create a thicker coating compared to liquid coatings, which is not always desirable. Industries that require ultra-thin finishes, such as the automotive body and consumer electronics, often find powder coatings unsuitable. This thickness can lead to issues such as edge coverage and the filling in of small or intricate details, which can be critical in high-specification applications. The International Coatings Organization notes that thickness control remains a significant challenge, particularly in achieving uniformity across complex shapes.

Curing Process Requirements: The curing process for powder coatings requires a high-temperature oven, which can be a limitation for materials sensitive to high heat. Industries that work with heat-sensitive substrates, such as certain plastics and composites, often cannot employ powder coatings. This necessity for thermal curing restricts the use of powder coatings in a broader range of applications, especially in sectors pushing for low-energy consumption and low-heat processes.

Technological and Material Incompatibilities: The application technology for powder coatings also poses restrictions. The need for electrostatic equipment and recovery systems for applying powder coatings requires significant upfront investment, which can be a barrier for small to medium-sized enterprises. Moreover, the compatibility of powder coatings with certain metallic substrates can be problematic due to issues like outgassing, which affects the finish quality.

Economic Factors and Market Adoption: Economic factors also play a role in restraining the market growth of powder coatings. The setup and operational costs associated with the transition to powder coating systems can be high, deterring companies, particularly in developing countries, from adopting this technology. The American Powder Coatings Association highlights that the initial costs and the learning curve associated with switching to powder coatings can slow down market penetration and adoption rates.

Global Market Trends and Accessibility: While powder coatings are gaining popularity for their environmental benefits, the global accessibility and supply chain dynamics can also limit market growth. In regions with less developed industrial infrastructure, the availability of appropriate application technology and skilled labor for powder coatings is limited, which can hinder the adoption rate.

Opportunities

Expansion into Emerging Markets: One of the major growth opportunities for the powder coatings market lies in its expansion into emerging markets. As countries in regions such as Asia-Pacific, Latin America, and parts of Africa continue to industrialize and develop their manufacturing capabilities, the demand for durable and efficient coatings is expected to rise significantly.

Industrial Growth in Emerging Economies: Emerging markets are experiencing rapid industrial growth, particularly in sectors like automotive, construction, and electronics, which are key users of powder coatings. For instance, the Asian Development Bank reports robust industrialization trends in Southeast Asia, with significant investments in infrastructure and manufacturing facilities that require high-quality coatings for protection and finish.

Government Initiatives for Infrastructure Development: Many governments in these regions are launching initiatives to support industrial and infrastructure development, which often include incentives for using environmentally friendly products like powder coatings. For example, India’s government has introduced policies aimed at boosting manufacturing sectors under its ‘Make in India’ initiative, which includes the benefits of adopting green technologies.

Technological Advancements Making Powder Coatings More Competitive: Technological advancements in powder coating formulations are making these products suitable for a broader range of applications, including those that previously faced limitations due to the thermal sensitivity of substrates. Innovations that lower curing temperatures and enhance finish quality are making powder coatings more competitive against traditional liquid coatings, even in industries like consumer electronics and interior design.

Increasing Environmental Regulations Worldwide: Globally, there is a push toward stricter environmental regulations, which is driving the adoption of powder coatings due to their low VOC emissions. For example, the European Union’s REACH regulations have tightened the limits on VOC emissions from coatings, promoting the shift to powder coatings. Such regulations are gradually being implemented in emerging markets as well, creating a significant push for local industries to adopt more sustainable practices.

Market Development and Local Production: Establishing local production units for powder coatings in these emerging markets could also present significant growth opportunities. Local production can reduce logistical costs and lead times, enhance supply chain reliability, and provide more competitive pricing, making the adoption of powder coatings more accessible for local industries.

Latest Trends

Increasing Adoption of Low-Temperature Cure Powder Coatings: One of the latest trends in the powder coatings market is the increasing adoption of low-temperature cure powder coatings. This technological advancement is primarily driven by the need to reduce energy consumption during the curing process and to expand the application range to substrates that are sensitive to high heat.

Energy Efficiency and Sustainability: Low-temperature cure powder coatings typically cure at temperatures between 100°C and 140°C, significantly lower than the traditional curing temperatures of 180°C to 200°C. This reduction in curing temperature translates to substantial energy savings and lower carbon emissions, aligning with global initiatives for greater industrial sustainability. For example, the U.S. Environmental Protection Agency (EPA) has been promoting energy efficiency in industrial processes through its ENERGY STAR program, and low-temperature cure coatings directly contribute to achieving these efficiency goals.

Expansion to Heat-Sensitive Substrates: This trend is particularly significant because it opens up new application opportunities in markets such as automotive plastics, electronics, and wood coatings, where traditional high-temperature curing could damage the substrates. The ability to apply powder coatings to these new substrates without compromising their integrity or performance is a significant breakthrough, allowing industries to benefit from the durability and quality finish of powder coatings while maintaining the integrity of heat-sensitive materials.

Technological Innovations and Product Development: Advancements in resin chemistry and crosslinker technology have been crucial in developing low-temperature cure coatings. Manufacturers are investing in research and development to create formulations that provide the same high-quality finishes and durability as traditional powder coatings but at reduced curing temperatures. Companies like AkzoNobel and PPG Industries have introduced several low-temperature cure products in recent years, responding to the market’s demand for more versatile and sustainable coating solutions.

Market Growth and Consumer Demand: The market demand for these innovative products is growing, driven by consumer preferences for more environmentally friendly products and processes. According to industry reports, the segment of low-temperature cure powder coatings is expected to grow at a faster rate than the overall powder coatings market, with significant adoption expected in both established and emerging markets.

Government and Regulatory Support: Furthermore, regulatory support for products that reduce environmental impact continues to bolster the adoption of low-temperature cure powder coatings. In regions like Europe, where regulations such as the EU’s Industrial Emissions Directive (IED) encourage the use of technologies that reduce industrial emissions, the shift towards these coatings is particularly pronounced.

Regional Analysis

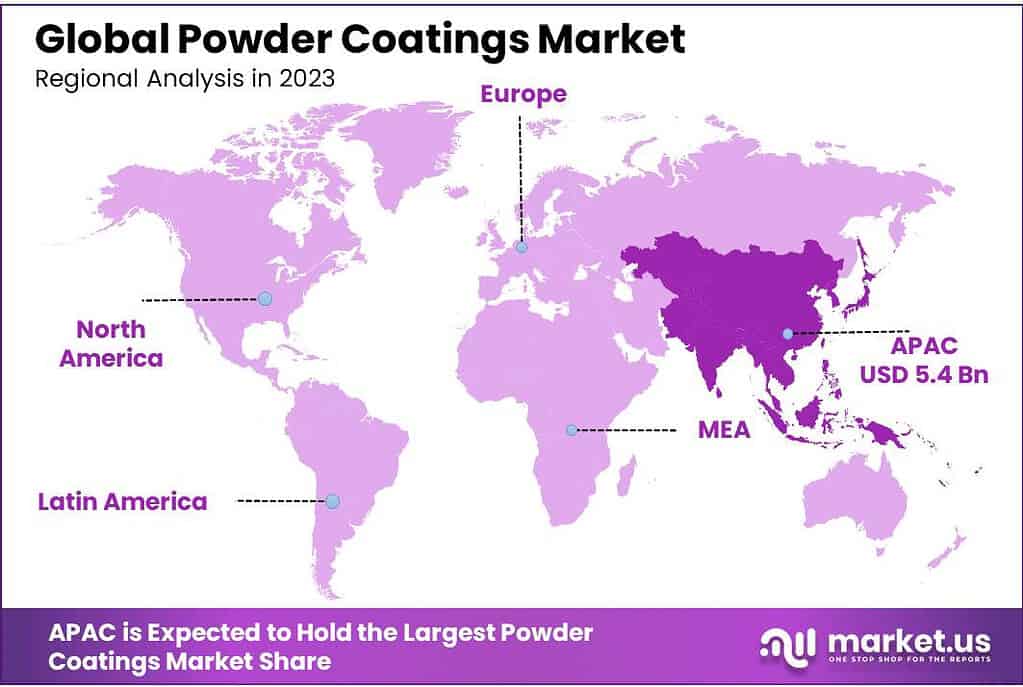

The Powder Coatings Market is segmented into key regions, including North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America. Among these, Asia Pacific (APAC) leads the global market, capturing 40% of the market share, equivalent to a value of USD 5.4 billion in 2023. The region’s dominance is driven by rapid industrialization and urbanization, particularly in countries like China, India, and Japan, where powder coatings are extensively used in the automotive, construction, and consumer goods industries. Government initiatives supporting eco-friendly coatings, coupled with expanding manufacturing sectors, further fuel market growth in APAC.

North America holds a significant share of the global market, with increasing demand from the automotive and aerospace industries. The U.S. leads the region’s market due to the growing adoption of powder coatings for their environmental benefits and high durability. North America accounted for approximately 25% of the global market in 2023.

Europe follows closely, driven by stringent environmental regulations and a strong automotive industry, particularly in countries like Germany and France. Europe held about 22% of the global market in 2023. The region’s focus on reducing volatile organic compounds (VOCs) is contributing to the increased adoption of powder coatings.

In Latin America and the Middle East & Africa (MEA), the market is steadily growing due to rising construction activities and infrastructure development. These regions, while smaller in market share, are expected to witness gradual growth, with Latin America and MEA together contributing around 13% of the global market, driven by increasing industrial applications and government investments in sustainable technologies.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The Powder Coatings Market is highly competitive, with several global key players dominating the industry. Akzo Nobel N.V., Sherwin-Williams Company, and PPG Industries, Inc. are among the leading companies, known for their strong market presence and diverse product portfolios. These companies focus on expanding their operations and strengthening their R&D capabilities to meet the growing demand for eco-friendly coatings.

BASF SE and Arkema are other significant players, particularly in Europe, where stringent environmental regulations promote the use of powder coatings that reduce volatile organic compound (VOC) emissions. These companies emphasize innovation and sustainable solutions to cater to the automotive, industrial, and construction sectors.

Jotun, Nippon Paint Holdings Co., Ltd., and RPM International, Inc. have a strong foothold in Asia Pacific, leveraging the region’s rapid industrial growth. Companies like Tiger Coatings and Axalta Coating Systems focus on expanding their product lines in the industrial and architectural sectors, emphasizing high-performance powder coatings.

Smaller players such as IFS Coatings and Kansai Nerolac Paints Limited are growing steadily through regional expansion and strategic partnerships, while Valspar Corporation, now part of Sherwin-Williams, continues to play a critical role in North American and European markets. These companies contribute to the market’s growth by focusing on technological advancements and offering tailored coating solutions across various industries.

Top Key Players

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc.

- BASF SE

- Arkema

- JOTUN

- Nippon Paint Holdings Co., Ltd.

- RPM International, Inc.

- Tiger Coatings

- PPG Industries Inc

- Sherwin Williams

- IFS Coatings

- Axalta Coating Systems

- The Valspar Corporation

- Kansai Nerolac Paints Limited

Recent Developments

In 2023, Akzo Nobel continued to strengthen its market position, achieving significant growth through strategic investments and product advancements. The company’s powder coatings segment saw a notable revenue increase, driven by strong demand in industrial and architectural applications.

In 2023, Sherwin-Williams continued its strong performance in the powder coatings segment, driven by growing demand in automotive, industrial, and architectural applications.

Report Scope

Report Features Description Market Value (2023) US$ 13 Bn Forecast Revenue (2033) US$ 25 Bn CAGR (2024-2033) 6.4% Base Year for Estimation 2023 Historic Period 2020-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Resin(Epoxy, Polyester, Epoxy-Polyester (Hybrid), Acrylic, Polyurethane, Others), By Coating Method(Electrostatic spray, Fluidized Bed, Others), By Application(Consumer Goods, Architectural, Automotive, General Industries, Furniture, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Akzo Nobel N.V., The Sherwin-Williams Company, PPG Industries, Inc., BASF SE, Arkema, JOTUN, Nippon Paint Holdings Co., Ltd., RPM International, Inc., Tiger Coatings, PPG Industries Inc, Sherwin Williams, IFS Coatings, Axalta Coating Systems, The Valspar Corporation, Kansai Nerolac Paints Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Akzo Nobel N.V.

- The Sherwin-Williams Company

- PPG Industries, Inc.

- BASF SE

- Arkema

- JOTUN

- Nippon Paint Holdings Co., Ltd.

- RPM International, Inc.

- Tiger Coatings

- PPG Industries Inc

- Sherwin Williams

- IFS Coatings

- Axalta Coating Systems

- The Valspar Corporation

- Kansai Nerolac Paints Limited