Global Postbiotics Market Size, Share, And Business Benefits By Source (Bacteria, Yeast), By Form (Dry, Liquid), By Application (Functional Food and Beverages, Dietary Supplements, Cosmetics and Personal Care Products, Animal Feed, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162014

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

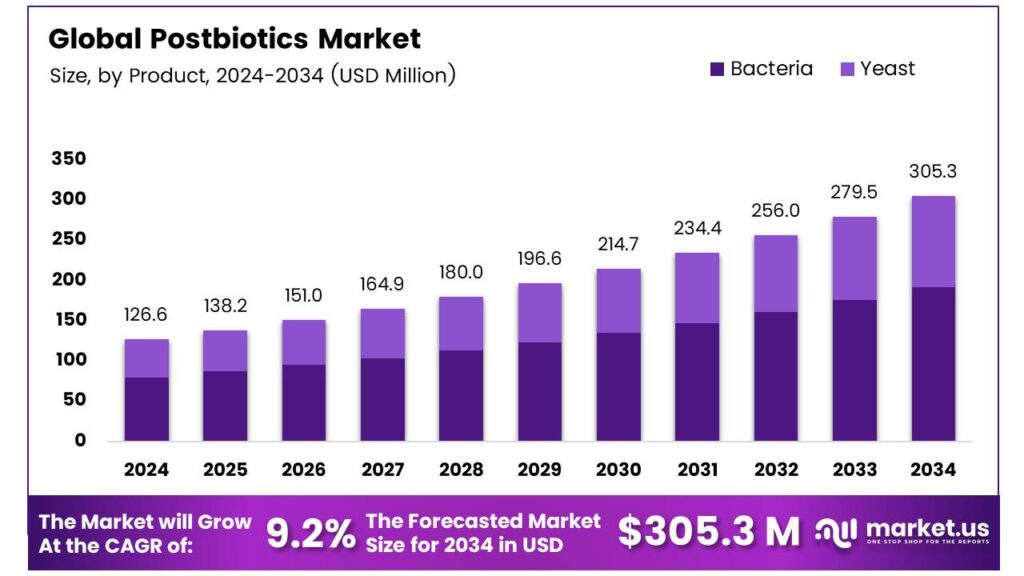

The Global Postbiotics Market size is expected to be worth around USD 305.3 Million by 2034, from USD 126.6 Million in 2024, growing at a CAGR of 9.2% during the forecast period from 2025 to 2034.

Probiotics are live microorganisms present in foods like yogurt, sauerkraut, and certain cheeses. They support healthy digestion by fostering a balanced gut microbiome, which consists of approximately 100 trillion microorganisms residing in the intestines. Prebiotics serve as nourishment for probiotics. Found in fiber-rich foods such as beans, whole grains, and specific vegetables, prebiotics break down in the body to produce substances that support the growth and activity of probiotics in the gut.

- In a hypothetical case, a probiotic supplement designed to deliver 60 billion colony-forming units (CFU) at the end of its shelf life may lose 75% of its viability during storage. To compensate, manufacturers could overfill the product to 240 billion CFU at production. By the end of its shelf life, the supplement would still provide 60 billion live cells, but also contain 180 billion non-viable cells. The effects of such a high proportion of non-viable cells in commercial products remain unexplored in current research.

Postbiotics are non-viable microbial products, including metabolites, proteins, lipids, carbohydrates, vitamins, organic acids, and cell wall components, produced during fermentation. Unlike probiotics, their efficacy does not depend on viability but on the bioactive compounds generated in the fermented matrix. These compounds can influence health outcomes, such as simulating immune cells in organs to release anti-inflammatory cytokines (e.g., IL-10, IL-4) while reducing pro-inflammatory cytokines (e.g., IL-8, IL-6).

In cancer, postbiotics may promote apoptosis and inhibit tumor cell proliferation. Yeast cell wall components, recognized by epithelial pattern recognition receptors, can trigger the release of SBD-1. The composition of postbiotics can be altered by food processing techniques, such as heat, sonication, irradiation, or high pressure. Heat may denature bacterial proteins, while irradiation could cause nucleic acid mutations. Consequently, the host’s response to postbiotics depends on the specific microorganisms and processing methods used in production.

Key Takeaways

- The Global Postbiotics Market is expected to grow from USD 126.6 million in 2024 to USD 305.3 million by 2034 at a 9.2% CAGR.

- Bacteria dominated the By Source segment in 2024 with a 62.8% share due to immunomodulatory and digestive benefits.

- Dry form led the By Form segment in 2024 with a 69.9% share for its storage, transport, and heat stability advantages.

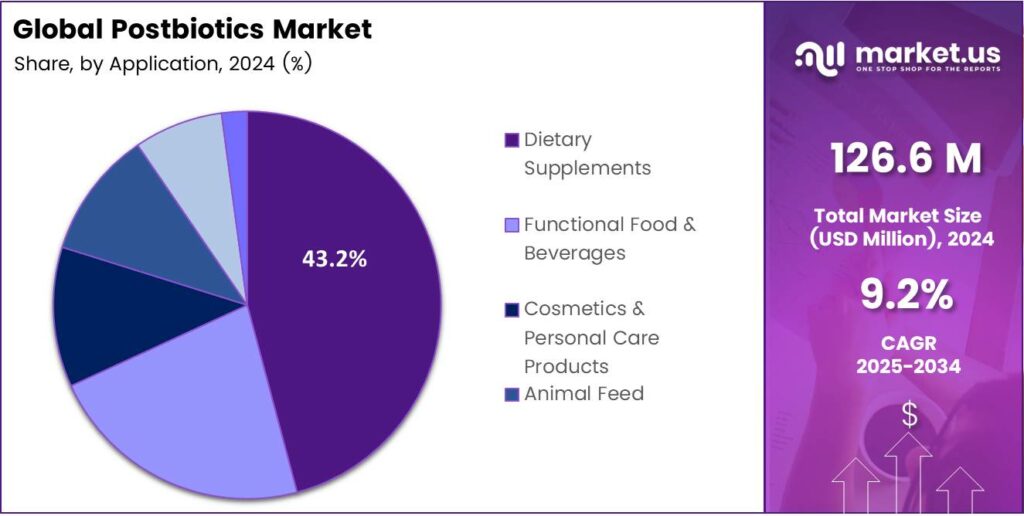

- Dietary Supplements held a 43.2% share in the By Application segment in 2024, driven by demand for digestive and immunity products.

- North America captured 42.8% of the market in 2024, valued at USD 54.3 million, fueled by consumer focus on gut health and wellness.

By Source

Bacteria dominate with 62.8% due to their proven efficacy and stability.

In 2024, Bacteria held a dominant market position in the By Source Analysis segment of the Postbiotics Market, with a 62.8% share. Bacterial postbiotics are widely utilized due to their strong immunomodulatory properties and digestive health benefits.

They enhance gut barrier function and help reduce inflammation, making them ideal for dietary supplements and functional foods. Yeast-based postbiotics are gaining gradual traction, supported by research highlighting their rich nutrient composition and skin-health properties.

They offer advantages in cosmetics and beverages owing to their antioxidant and moisture-retaining characteristics. Although holding a smaller market share, yeast postbiotics are expected to see steady adoption in specialized applications across wellness and food industries.

By Form

Dry form dominates with 69.9% owing to better stability and longer shelf life.

In 2024, Dry form held a dominant market position in the By Form Analysis segment of the Postbiotics Market, with a 69.9% share. Dry postbiotics are preferred for their easy storage, convenient transportation, and compatibility with powdered dietary supplements. Their heat stability enhances usability in processed foods and fortified health formulations.

The Liquid form of postbiotics is increasingly applied in functional beverages and skincare formulations. It allows faster absorption and flexible blending with other active ingredients. Despite lower adoption compared to dry form, liquid postbiotics are attracting attention for personalized nutrition and cosmetic applications where rapid bioavailability is beneficial.

By Application

Dietary Supplements dominate with 43.2% due to rising health awareness and gut wellness trends.

In 2024, Dietary Supplements held a dominant market position in the By Application Analysis segment of the Postbiotics Market, with a 43.2% share. The surge in digestive health awareness and demand for immunity-boosting products has boosted supplement-based formulations. Their strong presence in capsule and powder forms has ensured consistent consumer trust.

Functional Food and Beverages are witnessing growing use of postbiotics in yogurts, fermented drinks, and nutritional bars. They enhance flavor stability while offering probiotic-like benefits without live cultures. Rising preference for ready-to-drink and fortified foods is expected to elevate their usage in this segment further.

Cosmetics and Personal Care Products utilize postbiotics for their soothing, anti-inflammatory, and microbiome-balancing properties. Their integration into creams, serums, and shampoos addresses skin barrier repair and sensitivity reduction. Increasing consumer demand for microbiome-friendly skincare products continues to expand their applications across the beauty and wellness sectors.

Key Market Segments

By Source

- Bacteria

- Yeast

By Form

- Dry

- Liquid

By Application

- Functional Food and Beverages

- Dietary Supplements

- Cosmetics and Personal Care Products

- Animal Feed

- Pharmaceutical

- Others

Emerging Trends

Growing Functional Food Adoption

In the world of nutrition and gut health, one prominent trend for postbiotics is their increasing use in functional foods and beverages. Research shows strong momentum. A narrative review points out that postbiotics are non-viable microbial ingredients that confer beneficial physiological effects when administered through food and are being developed for functional food uses.

To put some numbers around this: while not exclusively broken out for postbiotics, one source states that more than 40% of the global population experiences some form of functional gastrointestinal disorder, which helps explain why formulations targeting gut health are accelerating.

Consumers are increasingly looking beyond just probiotics and favour options with stability, clear safety profiles, and simpler supply chains. Postbiotics deliver on that by being non-live (so fewer concerns about viability, refrigeration, etc.) yet still offering health‐supportive properties.

Drivers

Stability & Safety Advantages Over Live Microbes

A major driving factor for the adoption of postbiotics in food systems is their enhanced stability and safety profile compared to live probiotic microbes. Many food producers and regulators view postbiotics as simpler to handle: since they are non-viable (or inanimate) microorganisms or their components, the logistical difficulties of maintaining live cultures (cold chain, viability loss, contamination risk) are mitigated.

From an industry/regulatory vantage, the U.S. Food & Drug Administration (FDA) lays out strict rules around live microbial products when they are marketed as dietary supplements or foods, particularly concerning their viability (colony-forming units) and labeling under its Draft Guidance.

Moreover, from the research side, the definition and meta‐analysis of postbiotics pointed out that they can strengthen the epithelial barrier and modulate immune responses (via inanimate microbial matter) in ways analogous to live microbes but with fewer live-organism concerns.

Restraints

Regulatory Uncertainty for Postbiotics

One major restraint facing the growth and wider adoption of postbiotics in food products is regulatory uncertainty and a lack of clear standards. Simply put, while the idea of using non-live microbial cells or their components (that is, postbiotics) sounds promising for health and food innovation, many food manufacturers hesitate because the rules are still fuzzy.

In practical terms, this means: a company developing a postbiotic has to figure out whether it will be regulated as a traditional food ingredient, a dietary supplement, or even a novel food — and the pathway is unclear. The same source explains that this uncertainty presents a formidable challenge in developing safety standards.

Furthermore, in the US context, although the Food and Drug Administration (FDA) has issued draft guidance for microbial dietary supplements and live microbials (for example, requiring disclosure of colony-forming units for live microbes). The U.S. Food and Drug Administration has not issued specific guidance or classification for postbiotics (non-live-microbe derivatives).

Opportunity

Growing Consumer Demand for Gut Health and Microbiome-Friendly Ingredients

One of the key growth factors for the postbiotics space is the rising consumer interest in gut health, immunity, and microbiome-friendly ingredients. The International Food Information Council (IFIC) found that in their 2021 Food & Health Survey, nearly 24% of U.S. consumers identified digestive health as the most important aspect of their overall health.

- Further, about 32% said they actively try to consume probiotics; among these, 60% try to consume them at least once a day. Although postbiotics specifically are newer to many consumers — 35% said they were unfamiliar with the term, and 30% had never heard of it.

This shift in consumer mindset matters for postbiotics because, unlike live probiotics, postbiotics (non-living microbial cells or their components) have advantages in terms of stability, formulation, and shelf life. As explained by the International Scientific Association for Probiotics and Prebiotics (ISAPP), a postbiotic is defined as a preparation of inanimate microorganisms and/or their components that confers a health benefit on the host.

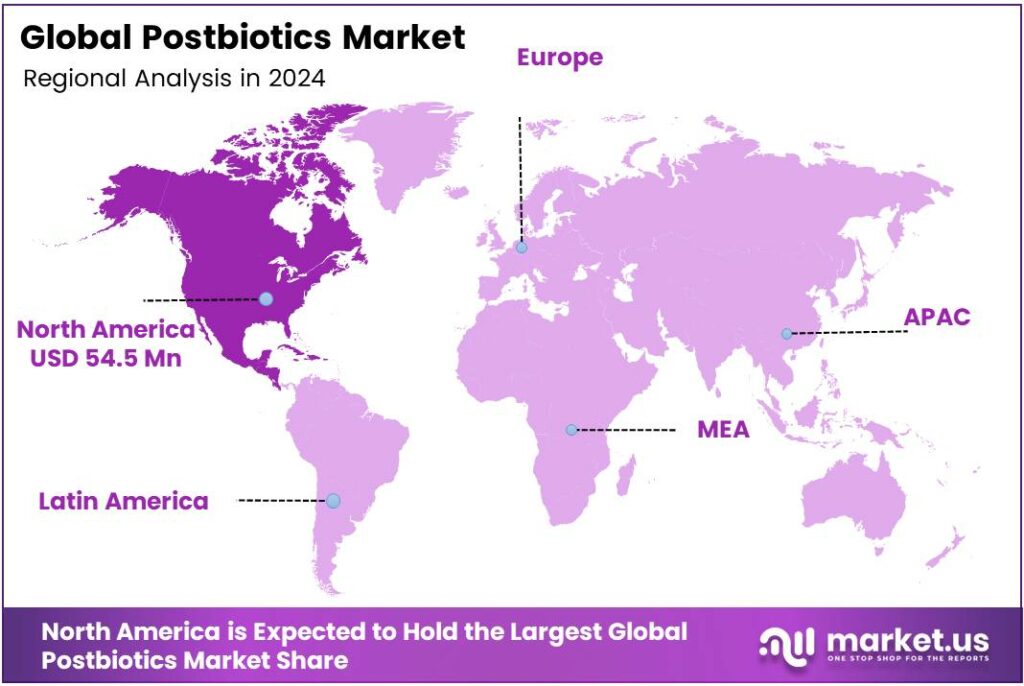

Regional Analysis

North America leads with a 42.8% share and a USD 54.3 Million market value.

In 2024, North America held a dominant market position, capturing 42.8% of the global postbiotics market, valued at approximately USD 54.3 million. The region’s leadership stems from the rapid consumer shift toward digestive health and immunity-boosting food supplements. Increasing awareness of the benefits of postbiotics in supporting gut microbiota balance and overall wellness has driven adoption across dietary supplements and functional foods.

The growing elderly population and rising prevalence of gastrointestinal disorders have further accelerated demand for scientifically backed, non-living microbial products that offer stability and safety advantages over probiotics. The United States accounts for the largest share within the region, supported by strong research initiatives from organizations like the National Institutes of Health (NIH) and increased investments by nutraceutical and functional food manufacturers.

Several food and beverage producers have begun integrating postbiotic ingredients into daily wellness products, especially in beverages, yogurts, and fortified snacks. Additionally, favorable regulatory recognition by the U.S. Food and Drug Administration (FDA) regarding postbiotic safety has enhanced market confidence. Canada has also witnessed growing demand for postbiotics in preventive healthcare and animal nutrition sectors.

Supportive initiatives focusing on microbiome innovation and health-based food labeling continue to push product development. Collectively, the region’s robust R&D infrastructure, strong consumer inclination toward natural health solutions, and well-established supplement distribution networks will continue reinforcing North America’s leading market position over the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF applies its deep expertise in human nutrition and biotechnology to the postbiotics sector. They focus on developing scientifically-backed, efficacious postbiotic strains for specific health applications. Their strategy involves robust clinical research to validate health claims, targeting the premium dietary supplement and pharmaceutical industries. BASF’s strong B2B relationships and commitment to science position them as a key innovator.

Beekeeper’s Naturals, Inc. champions a consumer-facing, natural wellness approach. They differentiate by incorporating postbiotics into accessible, branded consumer products like propolis sprays and gut health blends. Their strategy focuses on direct-to-consumer marketing, clean labels, and leveraging the holistic health trend. Beekeeper’s Naturals captures a niche market of health-conscious consumers seeking functional.

Bioflag Group operates as a specialized biotech firm, concentrating on the research, development, and B2B manufacturing of probiotic and postbiotic raw materials. Their focus is on providing high-purity, clinically-studied bacterial strains and postbiotic metabolites to other brands and formulators. This B2B model makes them a crucial behind-the-scenes enabler for the broader market, supplying the essential ingredients that allow other companies to create finished postbiotic products for various end-use applications.

Top Key Players in the Market

- Archer Daniels Midland Company

- BASF SE

- Beekeeper’s Naturals, Inc.

- Bioflag Group

- Cargill, Incorporated

- DSM-Firmenich AG

- Essential Formulas Incorporated

- Glac Biotech Co., Ltd.

- Ildong Pharmaceutical Co., Ltd.

- Kerry Group plc

Recent Developments

- In 2024, opened a dedicated R&D center in Rolle, Switzerland, for animal microbiome research, focusing on postbiotics for gut health in pets, livestock, and aquaculture. Early trials include postbiotics for canine dental health and feline intestinal stability during diet changes.

- In 2024, Bioflag continues as a key player in bacterial-derived postbiotics for functional foods. The company supports microbiome-targeted innovations, with ongoing emphasis on heat-killed strains for stability in supplements.

Report Scope

Report Features Description Market Value (2024) USD 126.6 Million Forecast Revenue (2034) USD 305.3 Million CAGR (2025-2034) 9.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Bacteria, Yeast), By Form (Dry, Liquid), By Application (Functional Food and Beverages, Dietary Supplements, Cosmetics and Personal Care Products, Animal Feed, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Archer Daniels Midland Company, BASF SE, Beekeeper’s Naturals, Inc., Bioflag Group, Cargill, Incorporated, DSM-Firmenich AG, Essential Formulas Incorporated, Glac Biotech Co., Ltd., Ildong Pharmaceutical Co., Ltd., Kerry Group plc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Archer Daniels Midland Company

- BASF SE

- Beekeeper's Naturals, Inc.

- Bioflag Group

- Cargill, Incorporated

- DSM-Firmenich AG

- Essential Formulas Incorporated

- Glac Biotech Co., Ltd.

- Ildong Pharmaceutical Co., Ltd.

- Kerry Group plc