Global POS Printer Market Size, Share, Industry Analysis Report By Type (Thermal Printers, Impact/Dot Matrix Printers, Inkjet Printers), By Design (Desktop POS Printers, Mobile POS Printers, Kiosk POS Printers), By Connectivity (Wired, Wireless), By Output Type (Receipt Printers, Label Printers, Ticket Printers, Multi-functional Printers, Others), By End Use (Restaurant, Hospitality, Healthcare, Retail, Warehouse, Entertainment, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 160565

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

- POS Printer Market Size

- Top Market Takeaways

- Market Overview

- Role of Generative AI

- Investment and Business Benefits

- US Market Size

- By Type: Thermal Printers

- By Design: Desktop POS Printers

- By Connectivity: Wired

- By Output Type: Receipt Printers

- By End Use: Restaurant

- Emerging Trends

- Growth Factors

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Recent Developments

- Report Scope

POS Printer Market Size

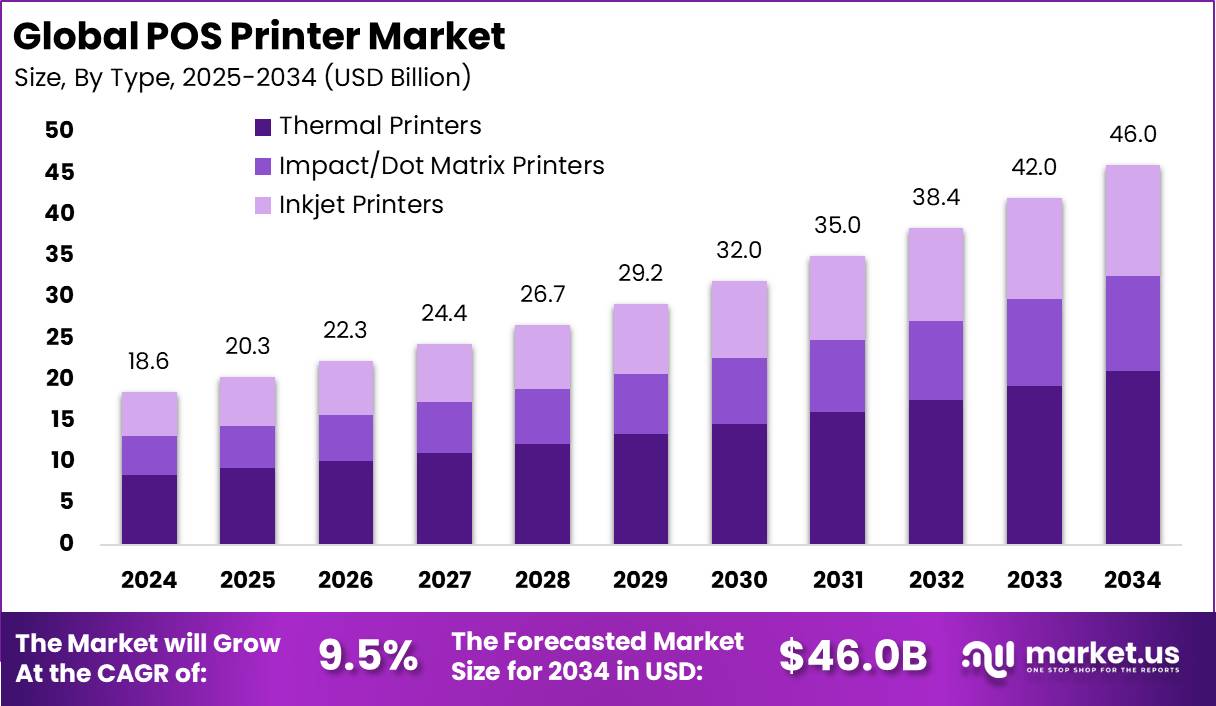

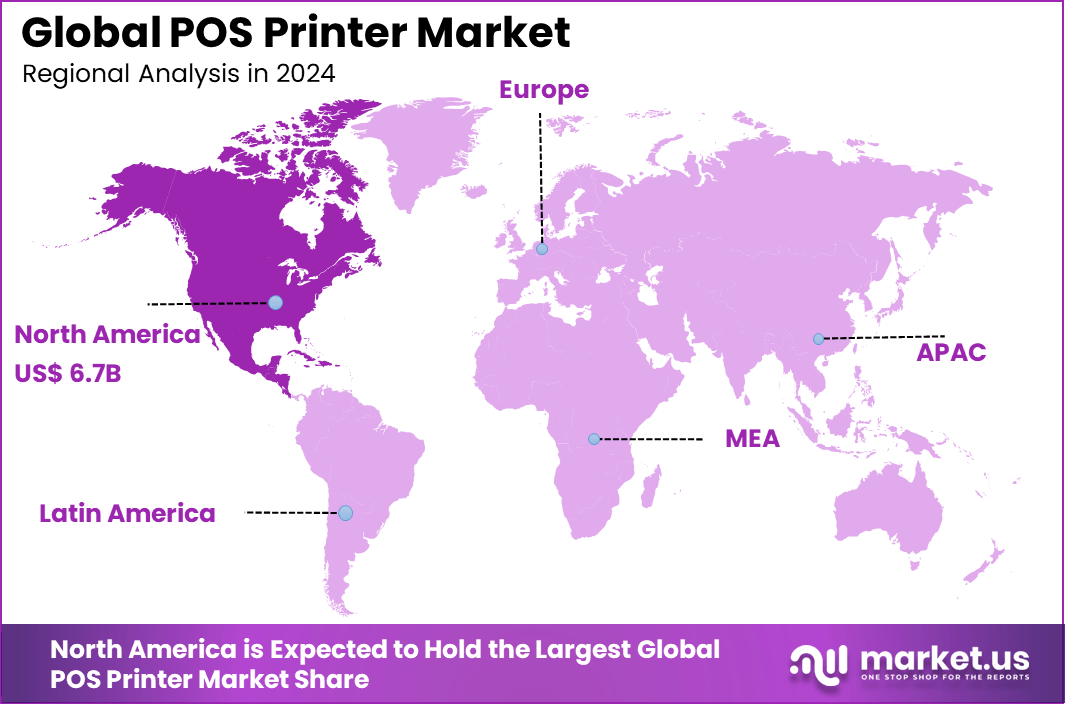

The Global POS Printer Market generated USD 18.6 billion in 2024 and is predicted to register growth from USD 20.3 billion in 2025 to about USD 46 billion by 2034, recording a CAGR of 9.5% throughout the forecast span. In 2024, North America held a dominan market position, capturing more than a 36.3% share, holding USD 6.7 Billion revenue.

The POS printer market is growing due to increasing digital payments and the expansion of retail and hospitality sectors. More businesses need fast, reliable devices that print receipts and transaction records instantly. With over 70% of modern retail outlets integrating POS printers with cloud-based transaction systems, these printers have become essential for smooth transaction management and customer service.

According to Keevee, 79% of businesses rely on POS systems to manage inventory, track sales, and process transactions, highlighting their role as a core operational tool across industries. Around 82% of retailers are actively upgrading to faster and more accurate solutions to enhance customer experience.

Mobile POS platforms are projected to expand at 20% annually, offering portability for businesses operating in dynamic environments. Cloud-based adoption has reached 64%, driven by lower upfront investment and remote management capabilities. In the hospitality sector, nearly 70% of restaurants depend on specialized POS systems to streamline orders, table allocation, and payment handling.

Top Market Takeaways

- Thermal printers lead with 45.8%, favored for speed, low maintenance, and cost efficiency.

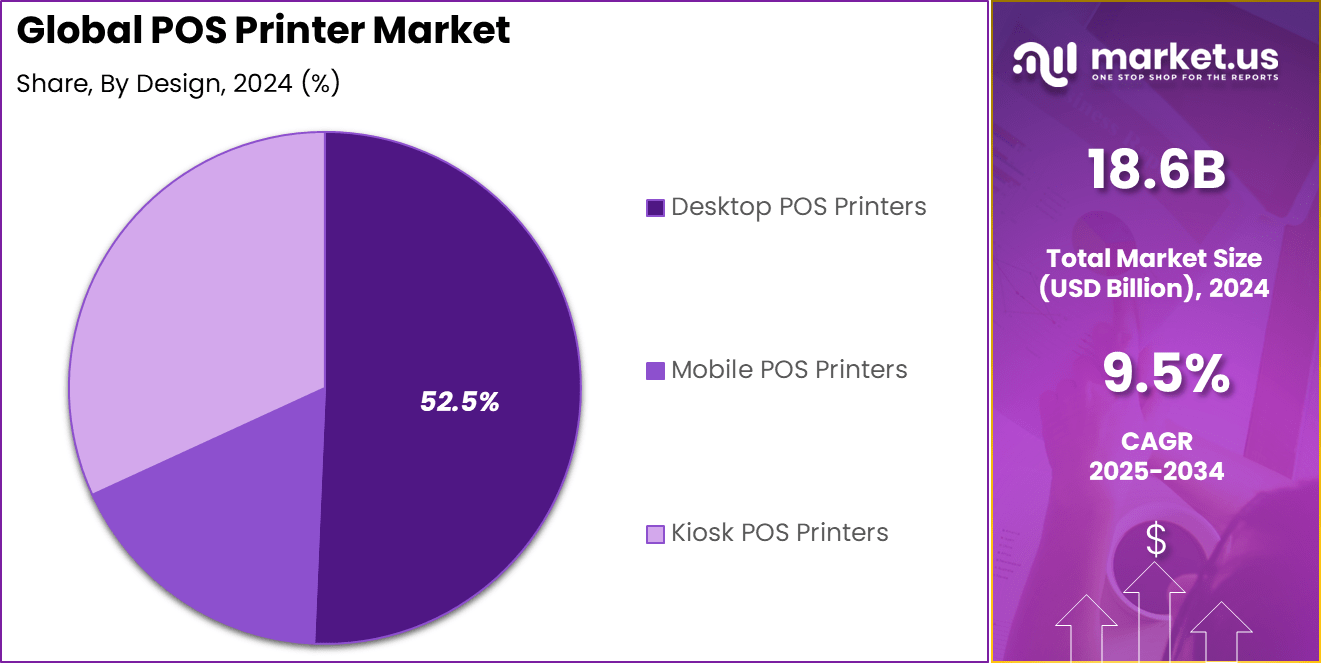

- Desktop POS printers account for 52.5%, reflecting their widespread use in retail and hospitality environments.

- Wired connectivity dominates with 65.7%, ensuring reliability and stability in high-volume transaction settings.

- Receipt printers hold 40.7%, driven by demand for quick and accurate billing solutions.

- Restaurants represent 34.6%, highlighting adoption in food service for seamless order and payment processing.

- North America contributes 36.3%, supported by advanced payment infrastructure and high transaction volumes.

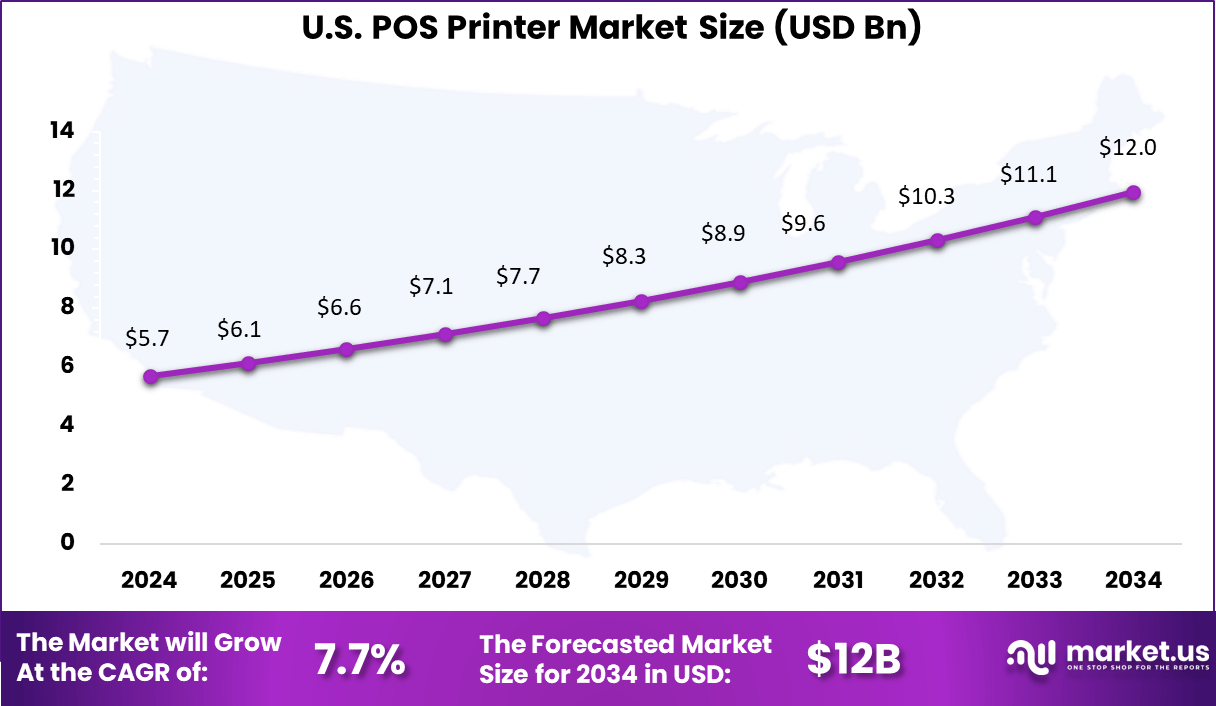

- The US market reached USD 5.72 billion and is expanding at a CAGR of 7.7%, underscoring steady growth in POS technology adoption.

Market Overview

Top driving factors include the rapid shift to contactless payments, e-commerce growth, and consumer preference for instant transactional proof. Businesses seek advanced POS printers compatible with mobile devices and digital wallets because they support high transaction volumes and improve customer experience.

The adoption of mobile POS systems allows businesses, especially small and medium-sized ones, to operate flexibly in settings like food trucks or pop-up shops. Over 65% of retailers now rely on thermal or mobile POS printers which also lower maintenance costs significantly. The growing demand for cloud and mobile connectivity further drives market growth.

Demand analysis reveals increasing uptake of POS printers in emerging urban markets and retail expansions globally. Compact desktop POS printers hold a substantial revenue share – over 50% in 2024, due to their reliability and space-saving design, ideal for fixed checkout points. Meanwhile, mobile POS printers are forecasted for strong growth because of their convenience and wireless connectivity capabilities such as Wi-Fi and Bluetooth.

Role of Generative AI

Generative AI is increasingly becoming a transformative force in POS printer technology. It helps optimize printing processes by enabling smarter predictive maintenance, reducing downtime through AI-driven alerts that foresee equipment wear or failure before it occurs. This not only keeps printers running smoothly but also cuts maintenance costs.

Additionally, generative AI facilitates improved design automation and error reduction by dynamically adapting print settings based on real-time data, enhancing print quality and operational efficiency. Studies show that over 70% of modern retail outlets that use POS printers integrate AI-powered features to support cloud-based transaction systems, highlighting how AI is embedded into everyday commerce technology.

Statistically, 54% of business users acknowledge that generative AI training boosts their operational efficiency, while 39% indicate a need for better understanding of safe AI usage. These numbers reflect a rising reliance on AI-driven enhancements in POS printing solutions, allowing quicker receipt generation and better transaction accuracy. .

Investment and Business Benefits

Investment opportunities in the POS printer market appear strong due to increasing digitization and expanding retail infrastructure worldwide. Manufacturers innovating in mobile and wireless POS printing solutions offer promising growth potential. There is also opportunity in emerging markets where SMEs are digitizing sales processes.

Investing in energy-efficient and cloud-enabled POS printers is attractive as these meet both business performance and sustainability goals. Strategic focus on secure, integrated solutions compliant with local and international regulations can differentiate offerings in this increasingly competitive sector.

Business benefits of POS printers cover increased operational efficiency, better customer experience, and cost savings. Automating receipt printing speeds up checkout processes and reduces manual errors, which helps maintain customer loyalty.

The ability to produce detailed transaction reports supports financial accuracy and accountability. Multi-functional printers that consolidate printing tasks cut down on equipment needs and maintenance, lowering overall costs. Moreover, POS printers enhance branding opportunities by allowing logos and promotions on receipts, thus reinforcing customer engagement.

US Market Size

The U.S. POS printer market is a critical subset with a value reaching approximately USD 5.72 Billion (as of 2024), fueled by widespread digitization in retail and hospitality. The robust demand reflects the increasing shift towards cashless payments and omnichannel retail strategies that require seamless receipt printing.

U.S. businesses favor thermal and desktop POS printers for their reliability and cost-efficiency in handling high volumes of transactions. Investments in smart POS technology and wireless capabilities further support the dynamic and fast-paced retail landscape.

In 2024, North America holds a significant 36.3% share of the global POS printer market, underscored by advanced retail infrastructure and rapid digital payment adoption. The region’s mature retail and hospitality industries drive demand for efficient, high-performance POS printing solutions, supporting transactions across multiple channels.

This market is characterized by the early adoption of cutting-edge printing technologies such as AI-enhanced and cloud-integrated printers, catering to large enterprises and small retailers alike. The focus on improving operational efficiency and customer convenience continues to fuel growth opportunities.

By Type: Thermal Printers

In 2024, Thermal printers dominate the POS printer market with a substantial 45.8% share. These printers are favored because they provide fast, quiet, and reliable printing without the need for ink or toner. Their ability to print receipts quickly and efficiently makes them ideal for high-traffic retail environments and restaurants, where speed and accuracy are critical for customer satisfaction.

In addition to efficiency, thermal printers offer lower maintenance costs and reduced downtime since they have fewer moving parts compared to traditional impact printers. Businesses benefit from both operational cost savings and improved transaction flow, reinforcing thermal technology’s hold on the market.

By Design: Desktop POS Printers

In 2024, Desktop POS printers lead the market with a commanding 52.5% share, reflecting their widespread use in fixed-location setups like retail counters and restaurants. These printers provide steady, high-volume output capability suited for environments requiring uninterrupted printing services. Their robust build and superior printing quality make them an industry staple for front-of-house operations.

The stability and durability of desktop POS printers are preferred in busy settings where continuous performance is non-negotiable. Furthermore, the growing integration with cloud-based and advanced POS software systems has increased the adoption of desktop designs for effective inventory and transaction management.

By Connectivity: Wired

In 2024, Wired POS printers account for a dominant 65.7% share due to their reliable, stable connections essential for uninterrupted printing in fixed business environments. These connections minimize disruptions often caused by network interference, ensuring that printing operations keep pace with transaction volumes, especially in large retail stores and hospitality venues.

Wired connectivity remains the backbone of POS operations where security and speed are prioritized. Despite the rise of wireless alternatives offering mobility, wired options are still trusted for consistent data transfer and ease of integration with legacy systems.

By Output Type: Receipt Printers

In 2024, Receipt printers hold the highest share within output types at 40.7%, illustrating their critical role in point-of-sale processes. They are essential for generating quick and clear customer receipts in retail, hospitality, and service industries, contributing directly to smooth customer transactions and legal documentation.

The demand for receipt printers is buoyed by their adaptability to new payment methods, including contactless and mobile payments, supporting retailers in providing efficient checkout experiences. Additionally, technological improvements have enhanced print quality and speed, further cementing their market position.

By End Use: Restaurant

In 2024, the restaurant sector represents the largest end-use segment with 34.6% of the market demand. POS printers in restaurants are vital for order management, receipt printing, and kitchen communication, directly influencing service speed and order accuracy. Thermal printers, in particular, are widely adopted in restaurants due to their ability to produce smudge-free, high-quality prints necessary for busy service environments.

Integrating POS printers into kitchen and service operations helps reduce errors, accelerates order processing, and enhances overall customer experience. This sector’s continuous evolution towards faster, digital ordering solutions boosts reliance on efficient POS printing technology.

Emerging Trends

In 2025, POS printer technology is shifting toward intelligent and highly connected systems. Thermal printers continue to lead with over 63% revenue share, supported by fast output, low energy use, and minimal maintenance needs. Wireless connectivity through Bluetooth, Wi-Fi, and Ethernet is becoming standard, allowing direct pairing with mobile devices and cloud-based POS software.

Sustainability is emerging as a key differentiator. Digital receipts delivered via email or SMS are gaining traction, while energy-efficient thermal models reduce electricity consumption by roughly 20% compared to legacy printers. Retailers are also prioritizing printers that sync with inventory systems in real time, enabling automated tagging and smarter stock tracking across multiple outlets.

Growth Factors

The POS printer market is growing strongly due to widespread digital payment adoption and increasing e-commerce activity. As consumers prefer contactless and mobile payments, businesses need reliable printing solutions that keep pace with high transaction volumes.

The shift from traditional cash systems to card and mobile payments drives demand for printers that quickly generate receipts while connecting to cloud and mobile POS software. Another growth driver is the expansion of small and medium businesses adopting mobile and wireless POS systems. These setups require compact, adaptable printers with fast printing speeds and multiple connectivity options.

The retail, hospitality, healthcare, and banking sectors are key adopters seeking both operational efficiency and enhanced customer experience. About 70% of retailers now use POS printers integrated with cloud-based platforms, pushing manufacturers to innovate and meet these evolving demands.

Key Market Segments

By Type

- Thermal Printers

- Impact/Dot Matrix Printers

- Inkjet Printers

By Design

- Desktop POS Printers

- Mobile POS Printers

- Kiosk POS Printers

By Connectivity

- Wired

- Wireless

By Output Type

- Receipt Printers

- Label Printers

- Ticket Printers

- Multi-functional Printers

- Others

By End Use

- Restaurant

- Hospitality

- Healthcare

- Retail

- Warehouse

- Entertainment

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

Increasing Adoption of Digital and Contactless Payments

The primary driver for the POS printer market is the growing adoption of digital payment methods. As businesses shift from cash-based transactions to card and mobile payments, there is a rising demand for POS printers capable of producing fast, accurate receipts to support these transactions.

This trend is particularly strong in retail, hospitality, healthcare, and banking sectors where customer transactions are frequent and speed matters. Retailers and service providers are increasingly upgrading to thermal and mobile POS printers that support wireless connectivity like Bluetooth and Wi-Fi, which cater to modern, flexible payment environments including pop-up shops and food trucks.

Restraint Analysis

High Initial Investment and Maintenance Costs

Despite the growth prospects, the POS printer market faces notable restraints in the form of high initial costs and ongoing maintenance expenses. Small and medium-sized enterprises (SMEs) often find it challenging to invest in advanced POS printer solutions due to budget limitations.

Maintenance costs for newer technologies like thermal printers, while lower than older models, can still be significant, especially for enterprises with large fleets of devices. These financial constraints can slow down adoption among smaller businesses, limiting the expansion of the market. Additionally, competition from low-cost alternatives and the pressure to upgrade continually adds to the cost burden for users.

Opportunity Analysis

Integration with Self-Service Kiosks and Healthcare

One major opportunity in the POS printer market lies in its integration with self-service kiosks, which are increasingly popular in retail, healthcare, and transportation. These kiosks require robust and reliable printing solutions for receipts, tickets, and vouchers, creating demand for compatible POS printers.

Additionally, the healthcare sector offers growing potential as facilities adopt electronic health records and digital billing. Efficient printing of prescriptions, patient receipts, and billing statements is essential to these operations. The need for reliable, secure, and fast POS printers in these high-demand environments presents a promising growth avenue for manufacturers.

Challenge Analysis

Competition from Digital and Paperless Transactions

A significant challenge for the POS printer market is the increasing shift towards digital receipts and paperless transactions. As more consumers and businesses prefer electronic records to reduce waste and improve convenience, the reliance on physical receipt printing diminishes. This trend is accelerated by environmental concerns and regulatory pushes towards sustainability, which pressure organizations to reduce paper use.

To compete, POS printer manufacturers must innovate by incorporating digital capabilities or enhancing printer efficiency. Failure to adapt to this shift could lead to reduced demand and market contraction, especially in progressive markets focused on technology adoption and environmental responsibility.

Competitive Analysis

The POS Printer Market is led by established hardware manufacturers such as Epson Corporation, Star Micronics Co., Ltd., and Zebra Technologies Corporation. These companies dominate retail and hospitality sectors by offering high-speed thermal and impact printers with robust durability and multi-interface connectivity.

Key contributors including HP Development Company, Honeywell International Inc., Toshiba Tec Corporation, and Citizen Systems provide integrated POS hardware with advanced compatibility for mobile, cloud, and kiosk-based applications.

Emerging and regional players such as Bixolon, Posiflex Technology, Inc., Sewoo Tech, Shenzhen Xprinter Technology Co., Ltd., NGX Technologies, Mitsubishi Electric Corporation, and TSC Auto ID Technology Co., Ltd. offer cost-effective alternatives with customizable features. Their growing presence in Asia-Pacific and developing markets increases market competition.

Top Key Players in the Market

- Bixolon

- Citizen Systems

- Epson Corporation

- Honeywell International Inc.

- HP Development Company

- Mitsubishi Electric Corporation

- NGX Technologies

- Posiflex Technology, Inc.

- Seiko Instruments Inc.

- Sewoo Tech

- Shenzhen Xprinter Technology Co., Ltd.

- Star Micronics Co., Ltd.

- Toshiba Tec Corporation

- TSC Auto ID Technology Co., Ltd.

- Zebra Technologies Corporation

- Other Major Players

Recent Developments

- In February 2025, BIXOLON launched the SRP-380plus, a 3-inch POS printer capable of reaching 500 mm/sec print speeds with 180 or 203 dpi resolution. Engineered for durability, it includes a 70 million-line MCBF and a 3 million-cut auto cutter, making it suitable for high-demand retail and service environments.

- In January 2025, Epson introduced the TM-T20IV thermal receipt printer, optimized for seamless integration with both PC-POS and mPOS systems. Its compact build combines speed, cost efficiency, and reliability, targeting retailers and hospitality operators seeking flexible and scalable printing solutions.

- In January 2025: Honeywell announced plans to separate its Automation and Aerospace businesses into three publicly traded companies by the second half of 2026. This strategic move signals a focus on core automation technologies, including POS-related industrial solutions, with ongoing strategic acquisitions planned to support growth.

Report Scope

Report Features Description Market Value (2024) USD 18.6 Bn Forecast Revenue (2034) USD 46 Bn CAGR(2025-2034) 9.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Thermal Printers, Impact/Dot Matrix Printers, Inkjet Printers), By Design (Desktop POS Printers, Mobile POS Printers, Kiosk POS Printers), By Connectivity (Wired, Wireless), By Output Type (Receipt Printers, Label Printers, Ticket Printers, Multi-functional Printers, Others), By End Use (Restaurant, Hospitality, Healthcare, Retail, Warehouse, Entertainment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bixolon, Citizen Systems, Epson Corporation, Honeywell International Inc., HP Development Company, Mitsubishi Electric Corporation, NGX Technologies, Posiflex Technology, Inc., Seiko Instruments Inc., Sewoo Tech, Shenzhen Xprinter Technology Co., Ltd., Star Micronics Co., Ltd., Toshiba Tec Corporation, TSC Auto ID Technology Co., Ltd., Zebra Technologies Corporation, Other Major Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bixolon

- Citizen Systems

- Epson Corporation

- Honeywell International Inc.

- HP Development Company

- Mitsubishi Electric Corporation

- NGX Technologies

- Posiflex Technology, Inc.

- Seiko Instruments Inc.

- Sewoo Tech

- Shenzhen Xprinter Technology Co., Ltd.

- Star Micronics Co., Ltd.

- Toshiba Tec Corporation

- TSC Auto ID Technology Co., Ltd.

- Zebra Technologies Corporation

- Other Major Players