Global Portable OLED Monitor Market Size, Share Analysis Report By Connectivity Type (VGA Connectivity, USB Connectivity, HDMI Connectivity), By Screen Size (Under 14 Inch, 14 Inch-20Inch, Above 20 Inch), By End User (Residential, Commercial, Industrial), By Sales/Channel (Online/ E-commerce, Offline), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151490

- Number of Pages: 228

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

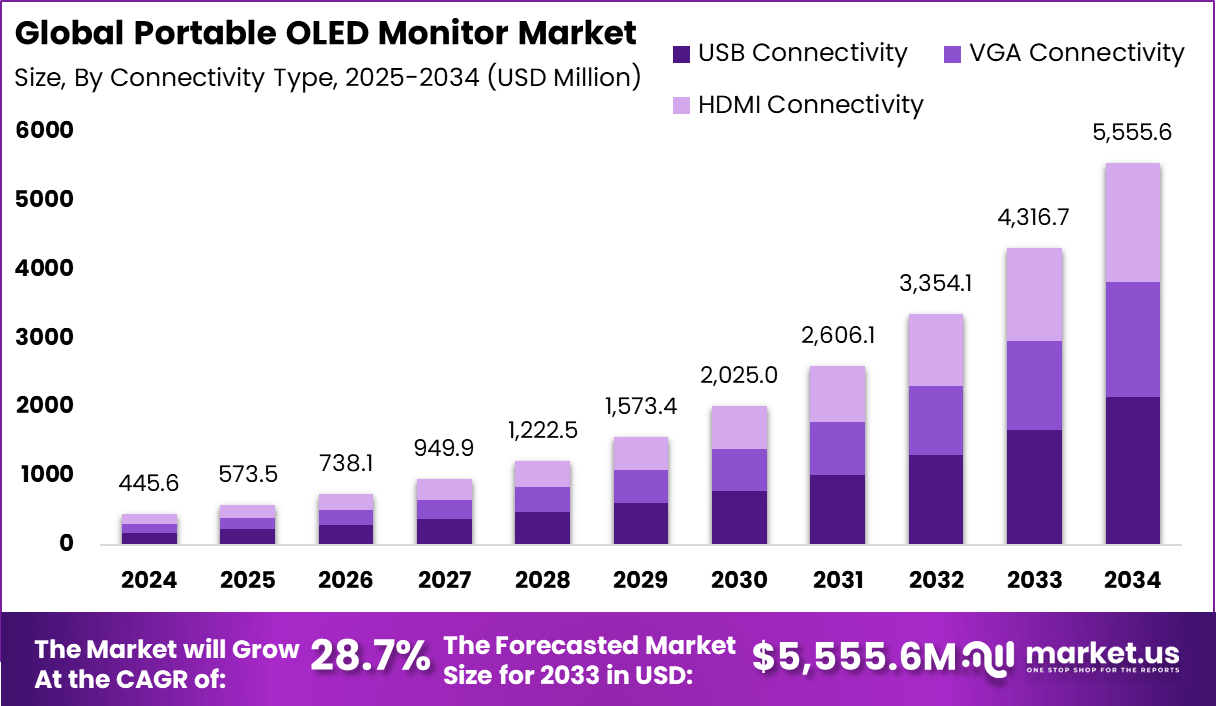

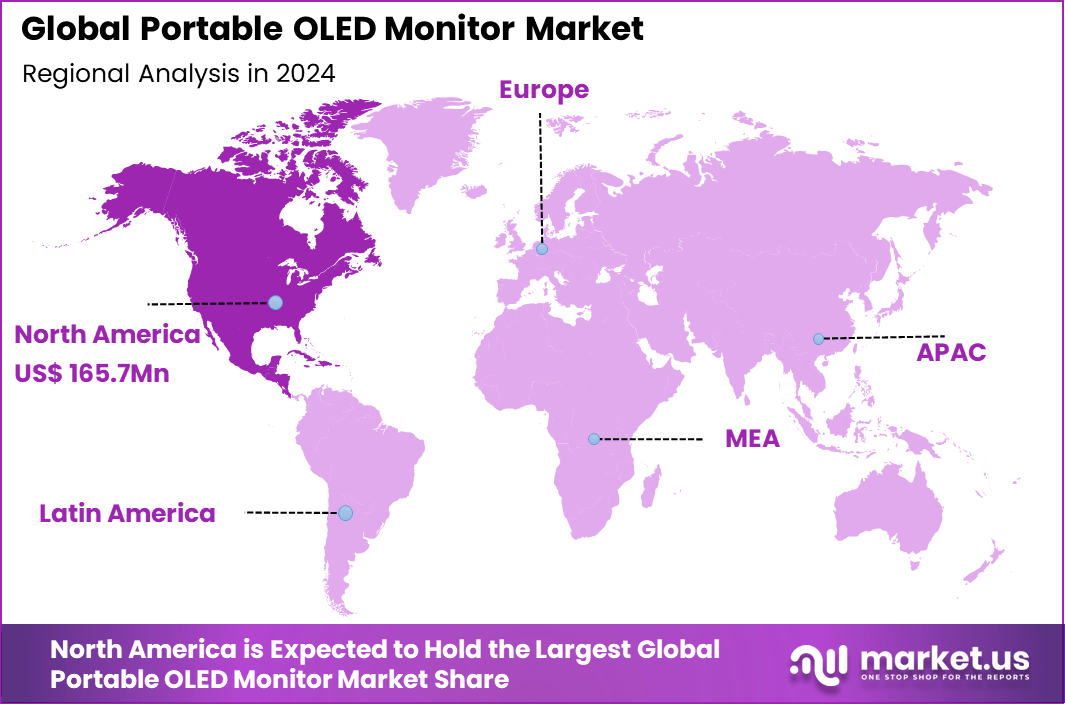

The Global Portable OLED Monitor Market size is expected to be worth around USD 5,555.6 Million By 2034, from USD 445.6 Million in 2024, growing at a CAGR of 28.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 37.2% share, holding USD 165.7 Billion revenue.

A portable OLED monitor refers to a compact, lightweight external display that uses Organic Light‑Emitting Diode (OLED) technology and is designed for on‑the‑go use. These displays typically range from 12″ to 16″, and offer high contrast, deep blacks, rapid response times, and exceptional color accuracy – attributes valued by professionals, gamers, and content creators.

The portable OLED monitor market encompasses lightweight, secondary display devices that utilize OLED technology and are designed for mobility. These devices, often featuring slim profiles, USB-C connectivity, and high-resolution panels, serve as travel-friendly additions to laptops, gaming consoles, and tablets. The market is evolving from a specialty accessory to a mainstream productivity tool due to increasing hybrid work, gaming, and creative demands.

The adoption of portable OLED monitors is driven primarily by the shift toward hybrid work models and mobile productivity. Users now require dual-screen setups that can be carried between home, office, and travel environments. OLED technology offers vivid color reproduction, deep contrast, low latency, and lightweight form factors, appealing especially to designers, gamers, and digital nomads.

The market is being driven by the convergence of high‑quality display demands and mobility needs. Remote working trends and hybrid office models have led to a surge in dual‑screen portability. Gamers and creative professionals are also increasingly adopting OLED because of its fast 1 ms response times, high contrast, and precise color rendering, fulfilling needs unmet by standard portable monitors.

Key Takeaways

- The Global Portable OLED Monitor Market is expected to grow from USD 445.6 Million in 2024 to USD 5,555.6 Million by 2034, advancing at a CAGR of 28.7%.

- North America accounted for the largest regional share at 37.2%, generating around USD 165.7 Million in 2024 revenue.

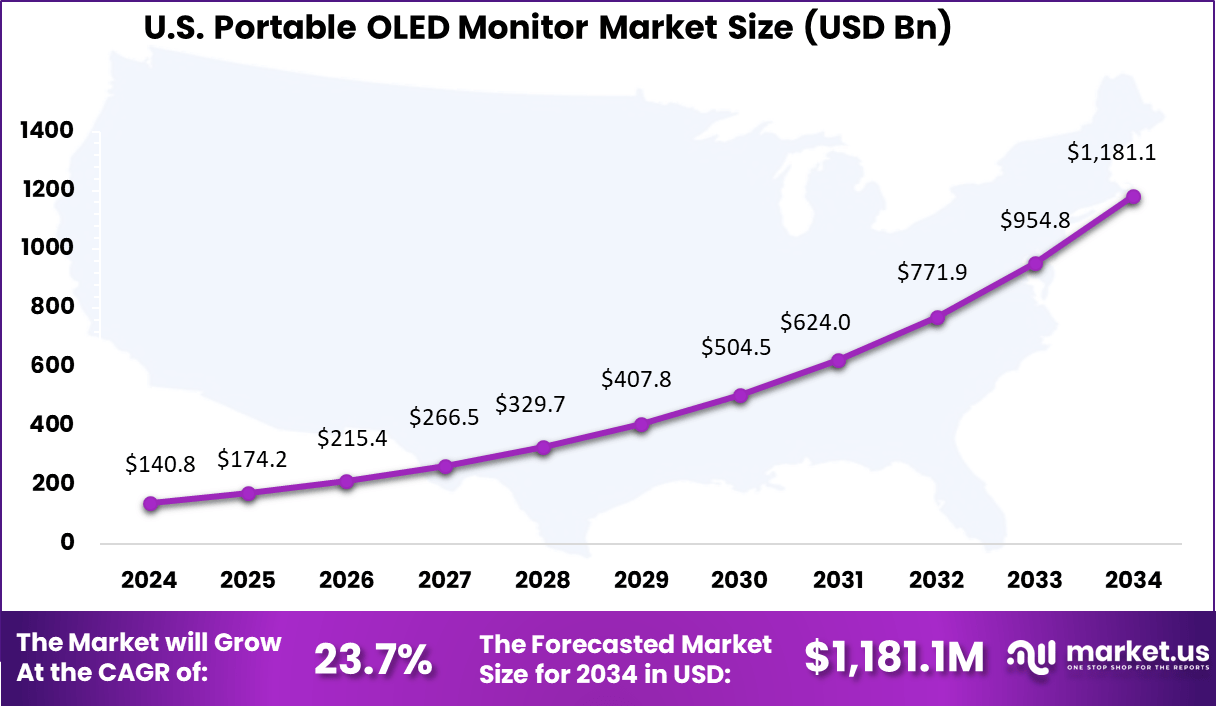

- The United States contributed USD 140.8 Million, expanding steadily at a CAGR of 23.7% through the forecast period.

- USB connectivity was the most preferred type, holding 38.7% share, driven by plug-and-play compatibility and universal port availability.

- The 14 Inch-20 Inch screen size segment dominated the market due to its portability and favorable balance between size and productivity.

- The commercial end-user segment led with a 38.7% share, boosted by remote work demand and professional-grade display needs.

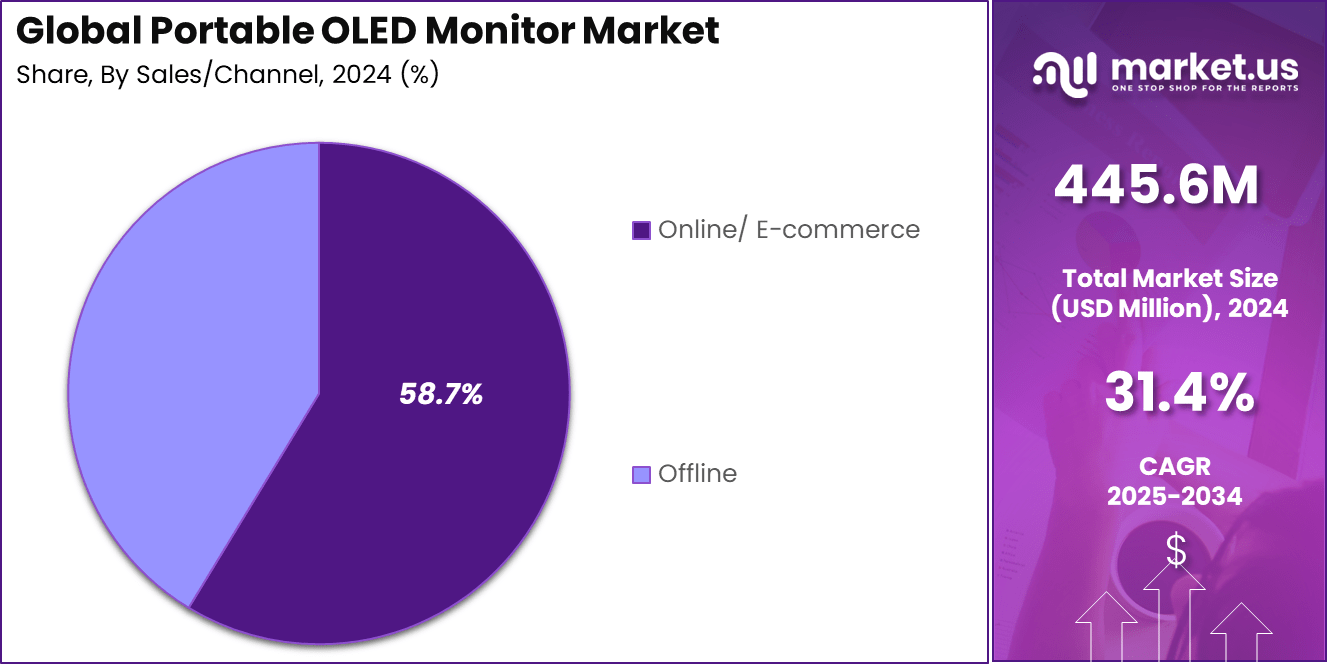

- Online and e-commerce channels captured the highest sales share at 58.7%, reflecting strong digital retail penetration and consumer convenience.

US Market Expansion

The US Portable OLED Monitor Market is valued at USD 140.8 Million in 2024 and is predicted to increase from USD 407.8 Million in 2029 to approximately USD 1,181.1 Million by 2034, projected at a CAGR of 23.7% from 2025 to 2034.

In 2024, North America held a dominant market position, capturing more than a 37.2% share, holding USD 165.7 million in revenue in the global portable OLED monitor market. This leadership can be attributed to the region’s strong base of digital professionals, remote workers, content creators, and tech-savvy consumers who demand high-performance, on-the-go visual solutions.

The early adoption of OLED display technology across computing and gaming sectors has supported this growth. Additionally, the availability of advanced infrastructure – such as high-speed internet, 5G, and cloud ecosystems – has encouraged users to adopt portable secondary displays that can seamlessly integrate into their mobile workflows.

By Connectivity Type Analysis

In 2024, USB Connectivity segment held a dominant market position, capturing more than a 38.7% share in the global portable OLED monitor market. This dominance can be attributed to the growing preference for plug-and-play functionality, where USB-C has become the most versatile and user-friendly interface.

Unlike VGA or HDMI, USB-C allows not only video transmission but also power delivery and data transfer through a single cable, simplifying setup for mobile professionals, remote workers, and gamers. The segment’s rapid growth is also supported by the increasing number of laptops, tablets, and smartphones now equipped with USB-C ports, reflecting a broader shift across the consumer electronics ecosystem.

The expansion of USB-C adoption across multiple industries – especially in IT hardware, consumer devices, and digital media creation – has strengthened the demand for USB-compatible portable OLED monitors. These monitors are widely used in dual-display setups for productivity enhancement, particularly in hybrid work environments where portability, power efficiency, and minimal cable clutter are prioritized.

By Screen Size Analysis

In 2024, 14 Inch – 20 Inch segment held a dominant market position, capturing the largest share in the global portable OLED monitor market. This segment leads due to its optimal balance between portability and screen real estate, making it highly suitable for both professional and personal applications.

Users in creative fields such as graphic design, video editing, and photography prefer this size range as it offers enhanced visibility without compromising mobility. The increased resolution quality and color accuracy provided by OLED panels in this size category also make it ideal for media consumption, remote work, and on-the-go productivity tasks.

The growing demand for hybrid work setups and mobile entertainment has driven the adoption of 14 to 20-inch OLED monitors across various user groups. This size range is widely compatible with laptops, gaming consoles, and tablets, offering seamless integration without requiring bulky peripherals.

Moreover, technological improvements have allowed thinner bezels, lighter weight, and integrated features such as touchscreen support and USB-C connectivity within this form factor. As a result, users are increasingly choosing monitors within this size band for their versatility, user-friendly experience, and high performance – solidifying its dominance in the current market landscape.

By End User Analysis

In 2024, Commercial segment held a dominant market position, capturing more than a 38.7% share in the global portable OLED monitor market. The strong demand from business users, IT professionals, digital creators, and the education sector has been a key factor behind this dominance.

Commercial environments increasingly require mobile and high-resolution displays for presentations, dual-screen workstations, remote collaboration, and live content previews. OLED technology, known for its deep contrast, vibrant colors, and energy efficiency, aligns perfectly with the visual quality and performance standards expected in professional settings.

Additionally, the rapid expansion of coworking spaces and mobile offices has fueled adoption across enterprises and institutions. This segment is also benefiting from the rising trend of BYOD (Bring Your Own Device), where employees use portable monitors to extend their laptop screens for productivity on the move.

Corporate training, digital signage, and sales demonstrations are also driving use cases where portable OLED monitors provide a sleek and effective visual solution. The commercial sector values both the aesthetic appeal and the technical reliability of OLED screens, which offer better viewing angles and thinner designs compared to traditional LCDs.

By Sales/Channel Analysis

In 2024, Online/E-commerce segment held a dominant market position, capturing more than a 58.7% share in the global portable OLED monitor market. The dominance of this channel is driven by the convenience, wider product availability, and competitive pricing offered through digital platforms.

E-commerce has made it easier for consumers and businesses alike to compare models, read user reviews, and make informed decisions without visiting physical stores. Furthermore, the availability of exclusive online discounts, seasonal promotions, and global shipping options has significantly increased consumer preference for purchasing electronics – including portable OLED monitors – through online channels.

The growth of this segment is further supported by the rise in direct-to-consumer (DTC) models and the increasing role of third-party marketplaces that offer a vast range of brands and specifications. Tech-savvy buyers, especially professionals and freelancers, tend to prefer online platforms due to easy access to product specifications, demo videos, and customer support features.

Key Market Segments

By Connectivity Type

- VGA Connectivity

- USB Connectivity

- HDMI Connectivity

By Screen Size

- Under 14 Inch

- 14 Inch – 20 Inch

- Above 20 Inch

By End User

- Residential

- Commercial

- Industrial

By Sales/Channel

- Online/ E-commerce

- Offline

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Emerging Trends

Rapid adoption of OLED in portable monitors

A notable trend in the portable monitor segment is the increasing shift from LED to OLED panels. OLED technology now accounts for a significant share in the broader portable monitor market and has seen shipment volumes rise sharply.

In the first quarter of 2025, global OLED monitor shipments reached approximately 507,000 units – an increase of 175 % year-on-year – driven by strong demand for high-quality, portable 27‑inch UHD devices. This rapid uptake reflects consumers’ preference for features such as deeper blacks, wide color gamut, and faster response times, signaling a shift toward premium display experiences in mobility-focused setups.

Driver

USB-C & AI‑enhanced display integration

A principal driver behind the market growth is the seamless integration of USB‑C connectivity combined with intelligent display features. Portable monitors now leverage USB‑C for single-cable power and data transmission, allowing plug-and-play compatibility across laptops, tablets, and smartphones.

Enhanced by AI-driven technologies, these displays can automatically adjust brightness, contrast, and color profiles in real‑time, improving image consistency and reducing eye strain. This enhanced convenience and smarter functionality make portable OLED monitors increasingly attractive for business travelers, creative professionals, and mobile gamers seeking premium visual quality.

Restraint

High unit costs limit mass-market adoption

Despite rising demand, the cost of OLED panels remains a significant restraint on broader adoption. Manufacturing costs for OLED are substantially higher than those for conventional LCD panels, which limits price competitiveness in mass-market segments.

As a result, many portable OLED monitors are still positioned at the premium end of the spectrum, making them less accessible to cost-sensitive users. Until economies of scale or process improvements reduce unit costs, the market may continue to face resistance from buyers prioritizing budget over performance.

Opportunity

Expanding use among remote workers and content creators

A major opportunity lies in targeting professionals who demand high-performance, portable displays. With remote work and digital content creation now mainstream, demand has surged among individuals who require dual-screen setups beyond their laptops.

Portable monitors offer efficiency gains in productivity, and OLED variants add superior color accuracy and visual clarity. While LED-based portable monitors comprise the majority today, the addition of OLED options allows vendors to cater to premium niches – such as photo/video editing and on-site design work – where quality cannot be compromised.

Challenge

Balancing durability and power efficiency with OLED technology

A key challenge for manufacturers is developing rugged, energy-efficient portable OLED displays that can withstand daily handling. Although OLED provides unmatched image quality, organic panel materials are known to degrade faster and consume more power in bright scenes compared to LCDs.

This poses issues in designing units that offer long battery life and maintain display uniformity over time. Achieving the right engineering balance – through robust construction, efficient power management, and improved panel longevity – will be critical to meeting user expectations and driving long-term adoption.

Key Player Analysis

Leading brands shape the portable OLED monitor landscape. ASUS delivers premium build quality and sleek design. Lenovo integrates portability with productivity. Dell focuses on high‑resolution panels and enterprise support. HP offers balanced performance and competitive pricing. Acer targets both professionals and gamers.

All invest in innovation, panel quality, and global distribution to gain market share. Their efforts enhance user experience across business travel, creative work, and hybrid setups. This underscores their dominant position in the market. LG Electronics and ViewSonic significantly contribute through panel development and display expertise. LG leverages its OLED manufacturing capabilities. It supplies advanced display panels for portable usage.

ViewSonic brings display hardware expertise and portable design innovation. AOC emphasizes entry‑level and mid‑range models. Gaems focuses on gaming‑oriented portable displays with integrated protective cases. GeChic offers ultra‑light, USB‑powered monitors for mobile professionals. These brands complement the ecosystem. They address niche needs spanning gaming, enterprise, and content‑creation use cases.

Top Key Players Covered

- ASUS

- Lenovo

- Dell

- HP

- Acer

- LG Electronics

- ViewSonic

- AOC (Admiral Overseas Corporation)

- Gaems

- GeChic

- Others

Recent Developments

- In January 2025, Dell introduced its 32‑inch 4K QD‑OLED “32 Plus” monitor at US $799.99, offering a 120 Hz refresh rate, 0.03 ms response time, AMD FreeSync Premium support, and an AI‑powered head‑tracking audio beamforming system. Commercial availability began in 2025.

- December 2024 saw LG set to ship UltraGear OLED 45GX990A, a 45‑inch 5K2K bendable OLED gaming monitor with adjustable curvature, DisplayPort 2.1, HDMI 2.1, and USB‑C PD, albeit without a confirmed release date

Report Scope

Report Features Description Market Value (2024) USD 445.6 Mn Forecast Revenue (2034) USD 5,555.6 Mn CAGR (2025-2034) 28.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Connectivity Type (VGA Connectivity, USB Connectivity, HDMI Connectivity), By Screen Size (Under 14 Inch, 14 Inch-20Inch, Above 20 Inch), By End User (Residential, Commercial, Industrial), By Sales/Channel (Online/ E-commerce, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ASUS, Lenovo, Dell, HP, Acer, LG Electronics, ViewSonic, AOC (Admiral Overseas Corporation), Gaems, GeChic, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Portable OLED Monitor MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Portable OLED Monitor MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ASUS

- Lenovo

- Dell

- HP

- Acer

- LG Electronics

- ViewSonic

- AOC (Admiral Overseas Corporation)

- Gaems

- GeChic

- Others