Global Pork Meat Market Size, Share, And Business Benefits By Type (Chilled, Frozen), By Nature (Conventional, Organic), By Cut Type (Ham, Ribs, Others), By Application (Household, Commercial), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: September 2025

- Report ID: 157909

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

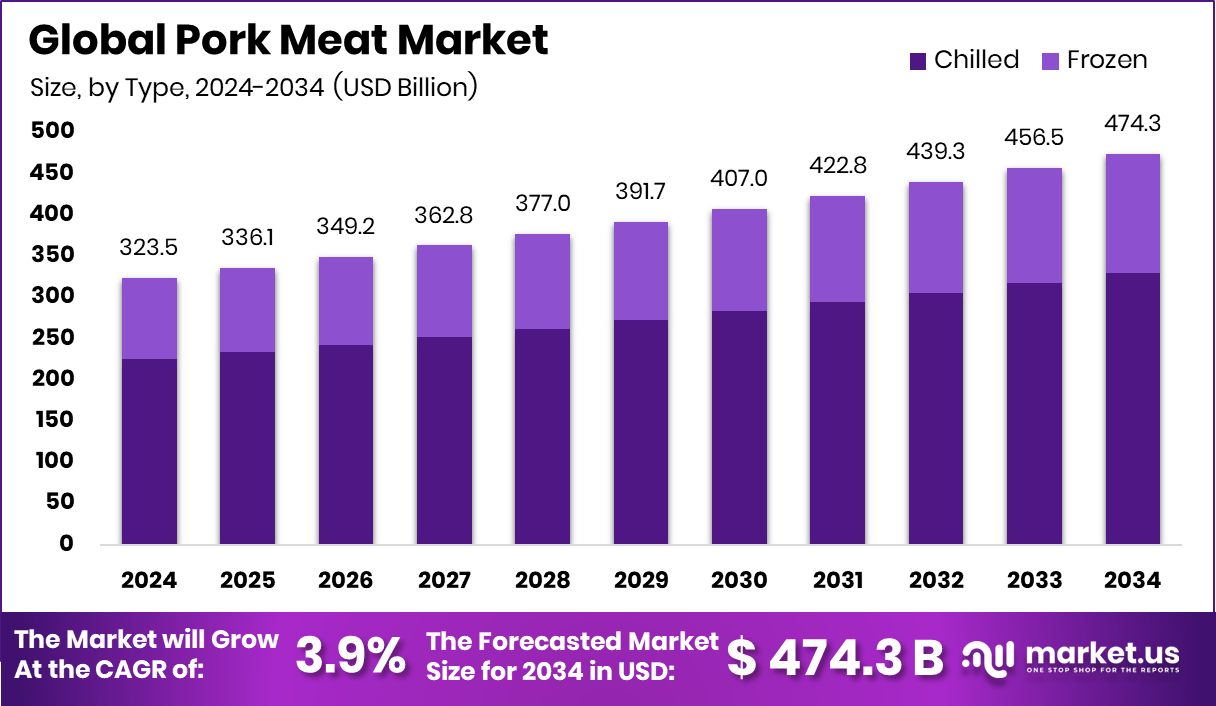

The Global Pork Meat Market is expected to be worth around USD 474.3 billion by 2034, up from USD 323.5 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034. Expanding urbanization in the Asia Pacific fueled the Pork Meat Market growth, capturing 46.80% and USD 151.3 Bn.

Pork meat is the edible flesh of domestic pigs, consumed worldwide as one of the most popular sources of animal protein. It is highly versatile, used in fresh, processed, and cured forms, and holds cultural significance in many cuisines. Pork is valued for its flavor, nutritional content, and adaptability in various cooking methods, making it a staple in both traditional and modern diets.

The pork meat market refers to the global trade and consumption of pork, covering fresh cuts, processed products, and value-added varieties. It is influenced by factors like changing dietary habits, urbanization, and technological improvements in processing and preservation. This market plays a vital role in the food industry, driven by strong consumer demand and expanding distribution channels across retail, food service, and export markets.

Growth factors for the pork meat market include rising protein consumption, population growth, and improvements in supply chains that ensure freshness and accessibility. Increasing health awareness has also boosted demand for leaner cuts and high-quality pork products, supporting steady growth. According to an industry report, Mewery has obtained $3.3 million in government grants to accelerate the scaling of its cultivated pork production.

Demand for pork meat is fueled by its widespread culinary use, affordability compared to some other meats, and rising popularity in ready-to-eat and convenience foods. Cultural acceptance in major markets further drives consistent consumption. According to an industry report, Meanwhile, Cambridge-based Uncommon successfully raised €28 million to expand its cultivated pork operations and move closer to mainstream adoption.

Key Takeaways

- The Global Pork Meat Market is expected to be worth around USD 474.3 billion by 2034, up from USD 323.5 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- In the Pork Meat Market, chilled products dominate with 69.5%, showing strong consumer preference globally.

- Conventional pork leads the Pork Meat Market with 89.4%, reflecting affordability and widespread consumption across regions.

- Ham captures 34.7% share in the Pork Meat Market, driven by versatile use in global cuisines.

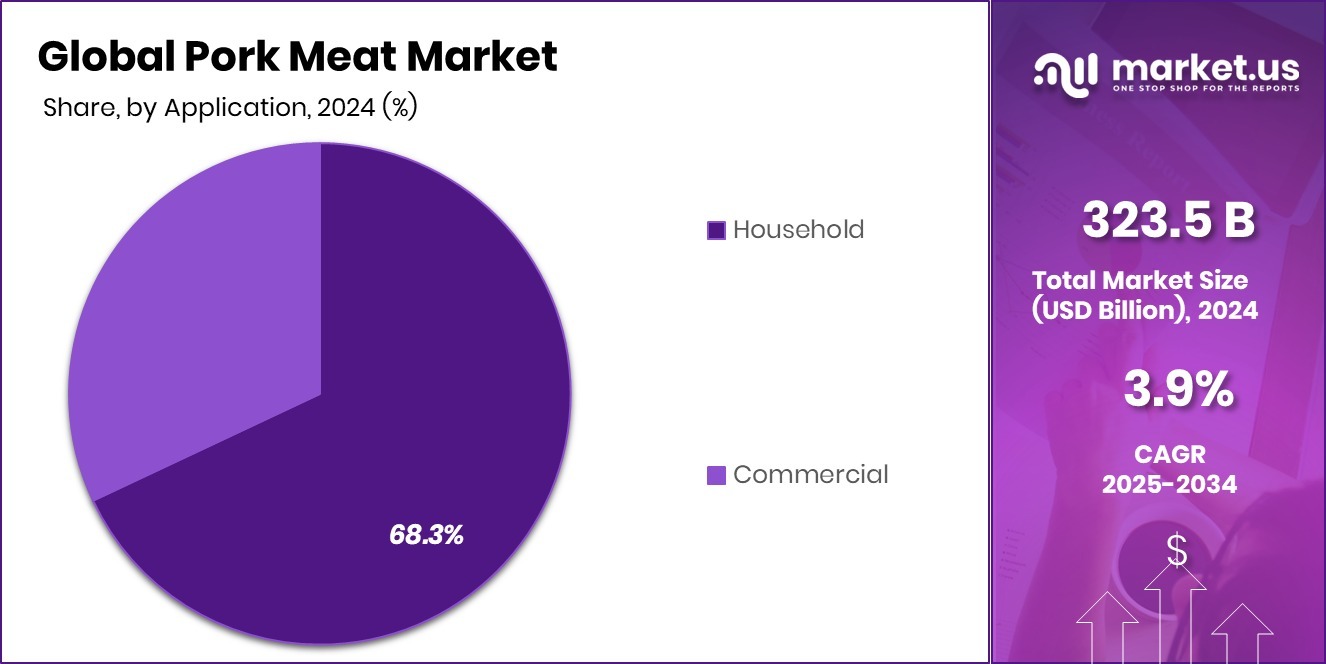

- Household application holds 68.3% in the Pork Meat Market, highlighting pork’s role as a daily protein source.

- Supermarkets and hypermarkets contribute 46.9% to the Pork Meat Market, ensuring accessibility through established retail networks.

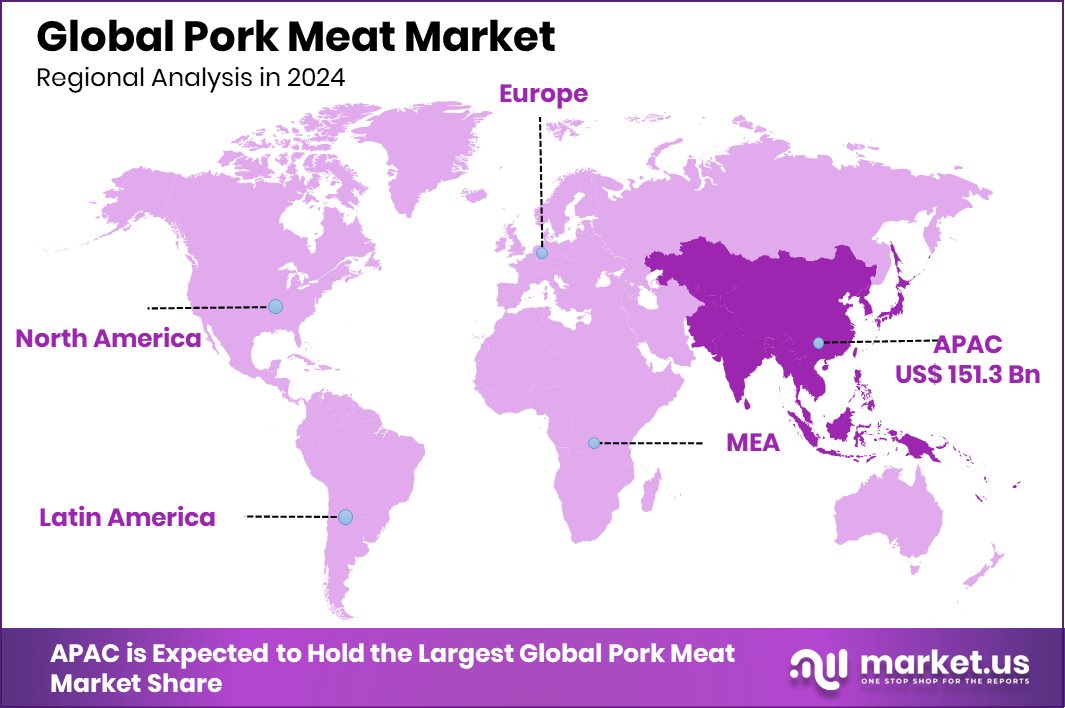

- Strong consumer demand in the Asia Pacific supported the Pork Meat Market’s 46.80% share worth USD 151.3 Bn.

By Type Analysis

In 2024, chilled pork dominated the market with 69.5% share.

In 2024, Chilled held a dominant market position in the By Type segment of the Pork Meat Market, with a 69.5% share. This strong lead is largely driven by consumer preference for fresh-tasting products with higher nutritional retention compared to frozen alternatives. Chilled pork meat is favored in both household consumption and food service due to its superior texture, flavor, and shorter preparation time.

The segment also benefits from expanding cold-chain infrastructure, which ensures better preservation and wider availability across retail outlets. Rising demand for minimally processed and high-quality meat, coupled with increasing urbanization and preference for premium food experiences, continues to reinforce the strong market position of chilled pork meat in global consumption trends.

By Nature Analysis

Conventional pork remained the top choice, holding a strong 89.4% presence.

In 2024, Conventional held a dominant market position in the By Nature segment of the Pork Meat Market, with an 89.4% share. This dominance is attributed to its wide-scale production, cost-effectiveness, and easy availability across global markets. Conventional pork meat continues to be the preferred choice for the majority of consumers due to its affordability and consistent supply through established farming and distribution networks.

Its large share is further supported by strong demand in household consumption, foodservice, and processing industries, where it serves as a versatile ingredient in various cuisines. The segment’s growth is reinforced by the efficiency of conventional farming practices, ensuring stable production volumes to meet rising global protein requirements.

By Cut Type Analysis

Among cut types, ham led the market, capturing 34.7% demand.

In 2024, Ham held a dominant market position in the By Cut Type segment of the Pork Meat Market, with a 34.7% share. This leadership is supported by its wide popularity as a versatile cut, consumed both in fresh and processed forms. Ham is favored for its rich flavor, ease of preparation, and adaptability in various culinary traditions, ranging from festive meals to everyday dining.

Its strong demand is also linked to the growing availability of value-added and ready-to-eat options, appealing to busy urban consumers. With an established presence in retail, foodservice, and export channels, ham continues to secure a leading share, reflecting its importance as a staple cut in global pork consumption.

By Application Analysis

Household consumption dominated, accounting for 68.3% of total pork meat usage.

In 2024, Household held a dominant market position in the By Application segment of the Pork Meat Market, with a 68.3% share. This strong presence is largely driven by rising household consumption of pork as a primary source of protein in daily diets. Consumers prefer pork for its taste, versatility, and affordability, making it a regular choice for home-cooked meals across diverse cuisines.

The segment also benefits from the increasing availability of chilled and packaged pork in supermarkets and online platforms, offering convenience and quality assurance to families. With growing urbanization, higher disposable incomes, and the popularity of quick-to-cook and fresh options, household consumption continues to reinforce its dominant role in shaping pork meat demand worldwide.

By Distribution Channel Analysis

Supermarkets and hypermarkets drove sales, representing 46.9% of market distribution.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Pork Meat Market, with a 46.9% share. This dominance is supported by their ability to offer a wide variety of fresh, chilled, and processed pork products under one roof, ensuring convenience and accessibility for consumers. Modern retail formats provide quality assurance, attractive packaging, and promotional offers that strengthen consumer trust and preference.

The growth of organized retail chains, coupled with advanced cold storage facilities, has further enhanced product availability and shelf life. With increasing urban lifestyles and demand for one-stop shopping experiences, supermarkets and hypermarkets remain the leading choice for pork meat purchases globally.

Key Market Segments

By Type

- Chilled

- Frozen

By Nature

- Conventional

- Organic

By Cut Type

- Ham

- Ribs

- Others

By Application

- Household

- Commercial

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Driving Factors

Government Subsidies in Piggery Boost Pork Supply Growth

One of the leading driving factors behind the growth of the pork meat market is robust government support for pig farming infrastructure and entrepreneurship. In India, for example, the National Livestock Mission (NLM) provides a capital subsidy of up to 50% (capped at ₹30 lakh) to eligible entrepreneurs setting up piggery units, covering costs like housing, breeding stock, equipment, transportation, and insurance.

Additionally, schemes such as the Animal Husbandry Infrastructure Development Fund (AHIDF) offer interest subvention of up to 3%, helping reduce financial burdens for new pig farmers. These targeted subsidies and concessional finance schemes encourage private investment, expand production capacity, enhance biosecurity and productivity, and thereby strengthen overall pork meat supply, contributing significantly to market expansion.

Restraining Factors

African Swine Fever Outbreaks Hamper Pork Growth

One major factor restricting the pork meat market’s potential is the recurring threat of African Swine Fever (ASF), a highly contagious virus that leads to large-scale pig mortality and severe production disruptions. This disease forces mass culling of pigs, decimates herds, and decreases the availability of pork in the market. Governments must step in with financial support to aid affected farmers.

For instance, under India’s Assistance to States for Control of Animal Diseases (ASCAD) scheme, central and state governments share compensation costs on a 50:50 basis for culling pigs and destroyed feed in ASF-affected zones. This compensation, ranging from approximately INR 2,200 to INR 15,000 per pig depending on weight, alongside payment for feed losses, helps manage farmer losses.

However, the outbreaks disrupt production cycles, raise costs, undermine consumer confidence, and strain supply chains, acting as a strong restraint on market growth despite government interventions.

Growth Opportunity

Value-Added Processing via Cold-Chain Infrastructure Expansion

A compelling growth opportunity in the pork meat market is the government’s focus on expanding cold-chain facilities and meat processing infrastructure. Under the Integrated Cold Chain and Value Addition Infrastructure Scheme, part of the Pradhan Mantri Kisan Sampada Yojana (PMKSY), the government offers a grant-in-aid of up to 35% of project cost in general areas and up to 50% in difficult areas or for those run by SC/ST groups, FPOs, and SHGs—capped at ₹10 crore per project.

Additionally, through the Animal Husbandry Infrastructure Development Fund (AHIDF), support is extended for establishing and strengthening meat processing and value-addition units catering to products like ham, sausages, bacon, and other processed items.

These measures lower the barrier to entry for entrepreneurs, upgrade processing capacity, ensure better hygiene, and reduce post-harvest losses. As a result, there’s strong scope for growth in processed pork products and improved supply reliability—creating a thriving opportunity for market expansion.

Latest Trends

Rise of Alternative Proteins Influencing Pork Trends

One of the latest trends impacting the pork meat market is the growing interest in alternative proteins—plant-based, cultured, or fermentation-derived products that mimic traditional meats like pork. Governments are increasingly supporting research, innovation, and startups in this domain to diversify protein sources and promote food sustainability.

In India, the Department of Biotechnology launched the BioE3 Policy under which the “functional foods and smart proteins” sector receives significant focus, backed by the Biotechnology Research Innovation and Entrepreneurship Development (Bio-RIDE) funding scheme that allocates approximately ₹9,197 crore through 2026.

This policy encourages R&D aimed at developing new protein alternatives, including those that could replicate pork textures and tastes. By providing infrastructure support, regulatory clarity, and research grants, governments are enabling the rise of smart proteins. For the pork industry, this trend means increasing competition from novel protein sources, pushing traditional producers to innovate, diversify product lines, or embrace hybrid offerings to stay relevant.

Regional Analysis

In 2024, the Asia Pacific dominated the Pork Meat Market with a 46.80% share, reaching USD 151.3 Bn.

Asia Pacific is the dominant region in the Pork Meat Market, accounting for 46.80% of the regional share valued at USD 151.3 Bn, supported by dense urban populations, modern cold-chain upgrades, and strong retail penetration across major cities.

North America shows resilient household demand and mature processing capabilities, with sustained growth from convenience cuts and widely available chilled offerings across supermarkets and online channels.

Europe benefits from established animal-health standards and premiumization trends, where consumers increasingly choose traceable, high-quality pork supported by efficient distribution networks and advanced packaging that extends shelf life.

The Middle East & Africa is expanding from a low base, aided by improving logistics, rising quick-service formats, and diversified import sources that enhance year-round availability for targeted consumer segments.

Latin America continues to strengthen on the back of productive farming clusters, export-oriented processing hubs, and widening domestic retail access that brings consistent chilled assortments to urban buyers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Danish Crown continued to showcase its strong role as a leading global pork processor with a focus on sustainability and high-quality meat offerings. The company has actively invested in improving traceability systems and sustainable farming practices, ensuring its pork products meet rising consumer demand for ethically produced and premium-quality meat. Its strong export footprint across Europe and Asia strengthens its competitive edge, especially in markets where pork is a dietary staple.

Triumph Foods, a U.S.-based cooperative, reinforced its position through efficiency in large-scale pork processing and consistent supply to both domestic and international markets. The company’s vertically integrated model allows it to control quality and optimize costs, ensuring a reliable flow of chilled and processed pork. Its operational efficiency, combined with long-standing industry partnerships, makes it a significant contributor to stable supply chains in the global pork market.

Yurun Group, a major pork supplier in China, leveraged its extensive domestic distribution and brand recognition to capture rising demand in Asia’s largest pork-consuming nation. With its scale and reach, the company plays a vital role in ensuring steady pork availability in both urban and semi-urban markets. In 2024, Yurun’s focus on processed and packaged pork aligned well with shifting consumer preferences for convenience and safety, reinforcing its importance in the global landscape.

Top Key Players in the Market

- Danish Crown

- Triumph Foods

- Yurun Group

- Vion Food Group Ltd.

- WH Group

- Smithfield Foods

- JBS S.A.

- Tönnies Zerlegebetrieb GmbH

- Tyson Foods Inc.

- Shuanghui Development

Recent Developments

- In August 2025, Yurun Group’s chilled pork sales fell to HK$54 million, much lower than HK$270 million in the same period of 2024—a sharp drop indicating challenges in its chilled meat segment.

- In July 2025, Danish Crown sold its pork processing plant in Pinghu, China, to a COFCO-affiliated company. The plant, opened in 2019, consistently underperformed financially, prompting Danish Crown to exit that operation. This move is part of the company’s strategy to refocus on more profitable regions and streamline its global operations.

- In July 2024, a federal judge upheld a Massachusetts law restricting the sale of pork from pigs kept in tight confinement. Triumph Foods had challenged this law, arguing it conflicted with federal inspection standards. However, the court found the state law only prohibited non-compliant pork from being sold and did not interfere with plant operations. Triumph Foods decided to appeal the ruling.

Report Scope

Report Features Description Market Value (2024) USD 323.5 Billion Forecast Revenue (2034) USD 474.3 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Chilled, Frozen), By Nature (Conventional, Organic), By Cut Type (Ham, Ribs, Others), By Application (Household, Commercial), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Danish Crown, Triumph Foods, Yurun Group, Vion Food Group Ltd., WH Group, Smithfield Foods, JBS S.A., Tönnies Zerlegebetrieb GmbH, Tyson Foods Inc., Shuanghui Development Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Danish Crown

- Triumph Foods

- Yurun Group

- Vion Food Group Ltd.

- WH Group

- Smithfield Foods

- JBS S.A.

- Tönnies Zerlegebetrieb GmbH

- Tyson Foods Inc.

- Shuanghui Development