Global Polyurethane Resin Market Size, Share Analysis Report By Resin Type (Solvent-Based Resin, Water-Based Resins, Others), By Applications (Construction, Transportation, Pharmaceuticals, Paints And Coatings, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 163748

- Number of Pages: 371

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

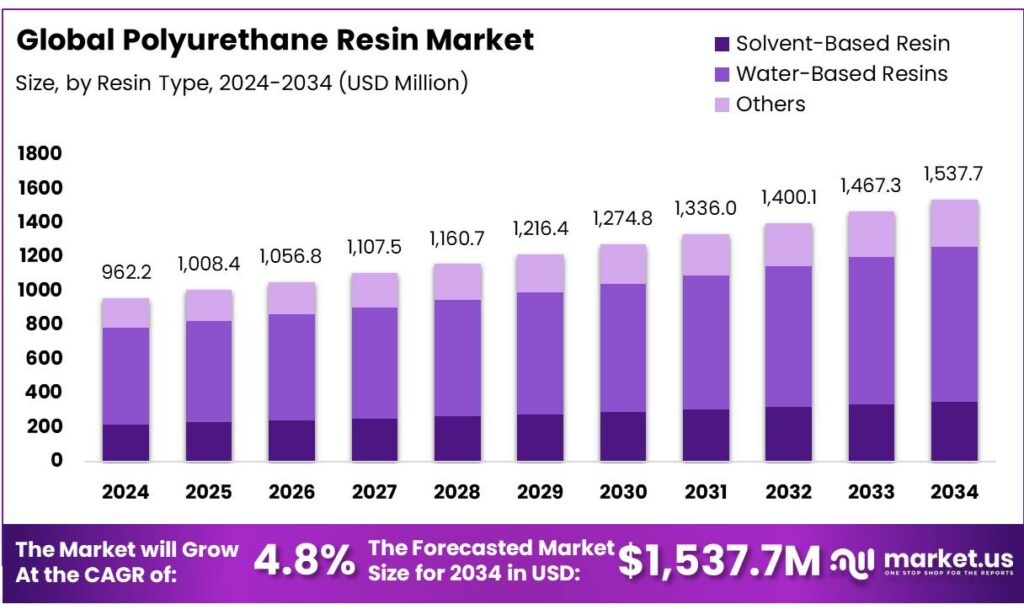

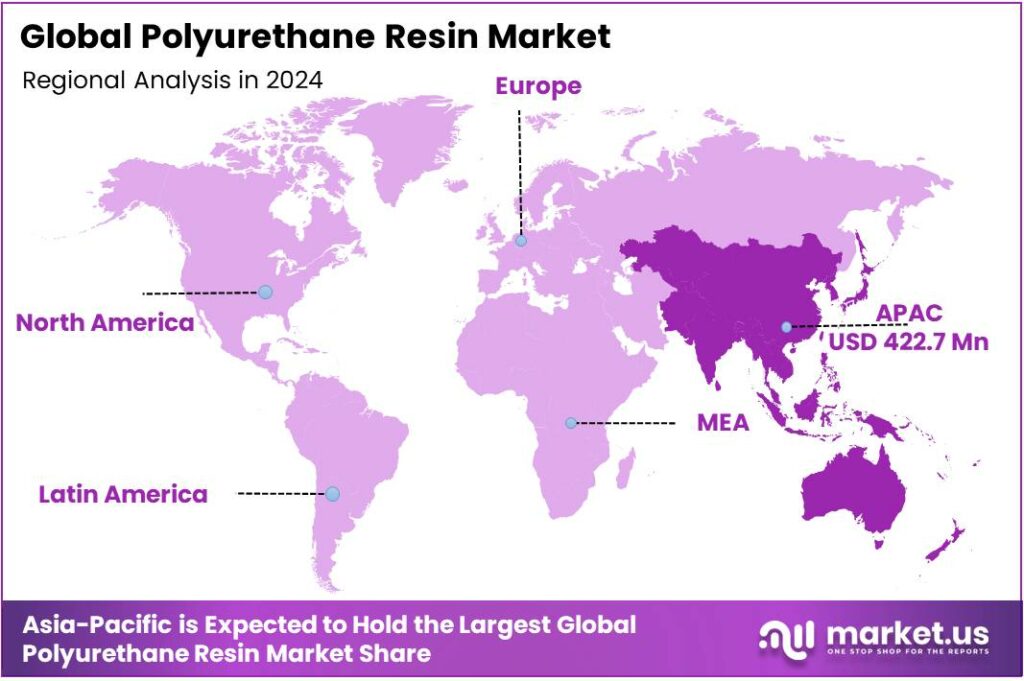

The Global Polyurethane Resin Market size is expected to be worth around USD 1537.7 Million by 2034, from USD 962.2 Million in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific (APAC) held a dominant market position, capturing more than a 43.9% share, holding USD 422.7 Million in revenue.

Polyurethane (PU) resins are versatile polymers used in rigid and flexible foams, coatings, adhesives, sealants, elastomers, and composites. Their relevance is rising at the intersection of energy efficiency, lightweighting, and electrification: rigid PU insulation reduces building heat loss; structural PU and foams enable lighter vehicles; and PU infusion resins are increasingly applied in wind blades. These vectors align with macro energy spending: global energy investment is set to exceed USD 3 trillion in 2024, with USD 2 trillion channelled to clean energy technologies—creating durable downstream demand for insulation and lightweight materials.

Industrial activity is being reshaped by building-sector policies and weather-driven cooling demand. In 2022, space cooling registered the largest demand increase across all building end uses, up >3% year-on-year, underscoring the need for high-R-value insulation where rigid PU foams are established. Concurrently, despite efficiency gains since 2010, heating energy demand in buildings is ~10% higher, reinforcing thermal retrofit priorities where PU systems fit well.

The EU’s recast Energy Performance of Buildings Directive mandates renovation of the 16% worst-performing non-residential buildings by 2030 and 26% by 2033, while residential stock must reduce average primary energy use by 16% by 2030 and 20–22% by 2035—a sizable trigger for insulation upgrades that frequently specify PU solutions. In India, the Energy Conservation Building Code tiers quantify savings: ECBC ~25%, ECBC+ ~35%, and SuperECBC ~50% versus typical buildings, supporting specification of high-performance envelopes where PU foams are relevant.

Key demand drivers converge around efficiency investment and transport decarbonization. The IEA estimates efficiency investment must triple from ~USD 660 billion today to ~USD 1.9 trillion by 2030 to align with its Net Zero scenario—capital that cascades into building retrofits, cold-chain upgrades, and industrial insulation where PU resins are standard. In mobility, lightweighting remains a proven lever: a 10% vehicle mass reduction yields an estimated 6–8% fuel-economy improvement, supporting continued use of PU foams, structural adhesives, and NVH systems in ICE and EV platforms.

Renewable energy infrastructure is a growing specialty outlet. IRENA reports global wind capacity at ~1,133 GW by end-2024 after adding ~113 GW in 2024, with continued multi-GW annual additions. Turbine housings, blade core materials, cable sheathing, and protective coatings are PU-intensive niches that benefit from this sustained build-out and the sector’s long-life asset requirements.

Key Takeaways

- Polyurethane Resin Market size is expected to be worth around USD 1537.7 Million by 2034, from USD 962.2 Million in 2024, growing at a CAGR of 4.8%.

- Water-Based Resins held a dominant market position, capturing more than a 58.9% share.

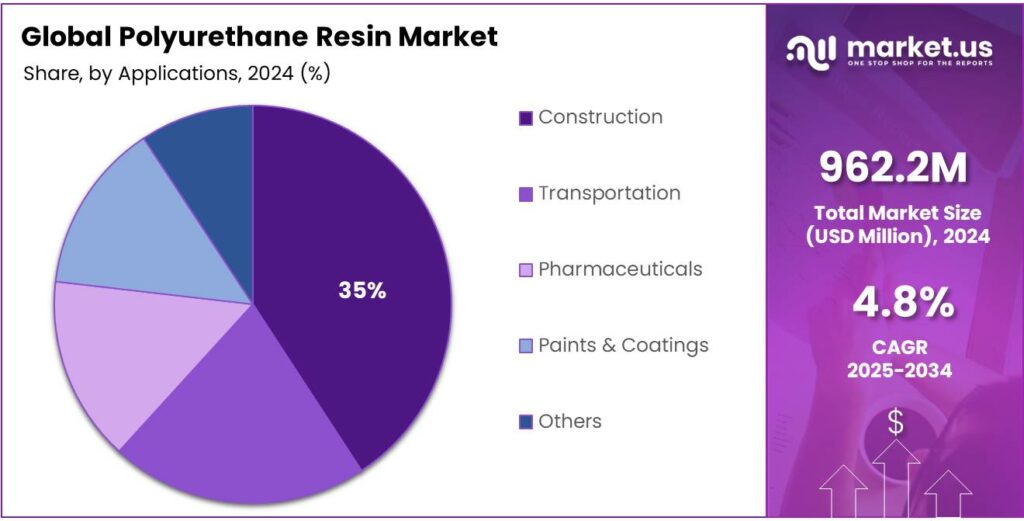

- Construction held a dominant market position, capturing more than a 35.2% share of the polyurethane resin market.

- Asia Pacific held a dominant position in the global polyurethane resin market, accounting for 43.9% of the total market share and reaching a valuation of approximately USD 422.7 million.

By Resin Type Analysis

Water-Based Resins dominate with 58.9% share in 2024 thanks to lower emissions and regulatory preference.

In 2024, Water-Based Resins held a dominant market position, capturing more than a 58.9% share. This position was supported by growing regulatory pressure to reduce volatile organic compound (VOC) emissions and by heightened demand from building, furniture and industrial coatings segments where low-odor, fast-dry and environmentally compliant formulations are preferred. The technology shift toward waterborne polyurethanes has been enabled by advances in polymer stabilization and co-solvent reduction, which have improved application performance while keeping production costs competitive.

The industrial scenario is characterized by formulation innovation and downstream adoption. Manufacturers were observed to prioritize waterborne polyols and modified isocyanates to meet performance requirements for abrasion resistance, flexibility and weathering. Procurement decisions have been influenced by lifecycle considerations; customers have increasingly selected water-based systems because end-of-life handling and indoor-air quality impacts are reduced relative to solventborne alternatives. Supply-chain dynamics remain linked to global polyol and isocyanate markets, but the pace of conversion to waterborne chemistries has moderated sensitivity to feedstock price swings.

By Applications Analysis

Construction dominates with 35.2% share in 2024 driven by insulation demand and infrastructure growth.

In 2024, Construction held a dominant market position, capturing more than a 35.2% share of the polyurethane resin market. The strong performance of this segment was driven by rising demand for energy-efficient insulation materials, waterproof coatings, and high-strength adhesives in residential, commercial, and industrial construction projects. Polyurethane resins are widely used in sealants, protective coatings, and rigid foam panels due to their excellent thermal resistance, flexibility, and long service life. The global push for green buildings and stricter energy codes further strengthened the preference for polyurethane-based materials that contribute to improved energy conservation.

The year 2024 also saw large-scale infrastructure development across Asia-Pacific, Europe, and North America, where polyurethane-based construction materials were increasingly specified in public infrastructure and urban housing projects. Renovation and retrofit activities in developed economies, supported by government efficiency programs, enhanced product utilization across roofing, flooring, and structural applications. The material’s ability to reduce heat transfer and improve moisture protection made it a preferred choice for sustainable construction solutions.

Key Market Segments

By Resin Type

- Solvent-Based Resin

- Water-Based Resins

- Others

By Applications

- Construction

- Transportation

- Pharmaceuticals

- Paints & Coatings

- Others

Emerging Trends

Food-safe, low-waste cold chains are reshaping PU resin design

A defining trend in polyurethane (PU) resins is their rapid shift toward food-safe, energy-efficient systems tailored for modern cold chains. The driver is stark: the UN’s Food Waste Index reports 1.05 billion tonnes of food were wasted in 2022, equal to 19% of food available to consumers, with households at 60%, food service 28%, and retail 12%—about 132 kg per person. These numbers are now the benchmark that retailers, processors, and logistics firms use to justify high-performance envelopes where rigid PU foam, spray foam, and PU gasketing lock in temperature and humidity.

Food safety gives this trend moral weight and regulatory pull. WHO estimates 600 million people fall ill and 420,000 die each year from unsafe food, with US$110 billion lost annually in low- and middle-income countries. Cold-chain integrity reduces microbial risks in dairy, meat, seafood, and ready-to-eat products; that is pushing end-users toward PU systems that combine insulation efficiency with hygienic, cleanable surfaces and tight seals. Suppliers are responding with food-contact-compliant coatings, low-emission adhesives, and long-life gaskets that hold their compression set under repeated door cycles.

Public policy is hard-wiring this momentum. The European Union has committed to halve per-capita food waste by 2030, and has proposed legally binding reductions for processing/manufacturing (10%) and for retail plus consumption (30%)—a clear demand signal for high-efficiency materials in plants and stores. In India, the PMKSY program reports 399 approved cold-chain projects since 2008 (to 31 Oct 2024), and in July 2025 the Cabinet raised the outlay to ₹6,520 crore, including ₹1,000 crore for 50 irradiation units that strengthen safety and shelf-life—each project an immediate consumer of PU foams, panels, sealants, and gaskets.

Drivers

Cold-chain expansion to cut food loss and improve safety

The strongest demand engine for polyurethane (PU) resins is the rapid build-out of reliable cold chains to reduce food loss and protect public health. Food loss and waste remain staggering: the UN Environment Programme’s latest Food Waste Index shows 1.05 billion tonnes of food were wasted in 2022, equal to 19% of food available to consumers, with 60% from households, 28% from food service, and 12% from retail. That is about 132 kg per person in a single year—an enormous efficiency gap that better temperature control can shrink. Beyond consumer-level waste, the FAO estimates about 13–14% of food is lost between harvest and the retail stage due to handling, storage, and transport—precisely where cold storage and insulated logistics matter most.

Public health adds urgency. The World Health Organization finds 600 million people fall ill and 420,000 die each year from unsafe food, imposing about US$110 billion in productivity and medical costs on low- and middle-income countries. Better cold-chain coverage and more reliable temperature holding reduce microbial growth and contamination risks across dairy, meat, seafood, and ready-to-eat categories. As governments set tougher food safety rules and retailers adopt “cold-chain integrity” programs, the market needs more insulated facilities, vehicles, and last-mile solutions—applications where PU foams, panels, adhesives, and gasketing deliver high R-values, low weight, and durable moisture barriers.

Policy is now translating the problem into funded projects. In India, the Ministry of Food Processing Industries reports ₹8,853 crore in approved grants under PMKSY for 1,601 projects, with 52 new projects sanctioned since 2024—explicitly emphasizing cold-chain interventions to curb wastage in fruits, dairy, and fisheries. These are direct catalysts for new cold rooms, reefer fleets, and pack-houses that specify PU insulation and sealing systems.

Restraints

Tightening food-contact rules are slowing polyurethane resin use

Regulators are tightening how plastics and adhesives touch food, and polyurethane (PU) resins sit right in the middle of that pressure. In the European Union, the plastics framework (Regulation (EU) No 10/2011) caps the overall migration of any substances from a food-contact material at 10 mg per dm² of packaging surface, which equates to 60 mg per kg of food for a typical 1 kg pack. That sounds abstract until you translate it into testing time, lab costs, and rejected lots when limits are exceeded—especially for laminated structures using PU adhesives.

On the U.S. side, the Food and Drug Administration keeps a tight specification for what kinds of PU chemistries can touch food and the conditions under which they can be used. The FDA’s regulation for polyurethane resins in food contact (21 CFR §177.1680) allows only certain isocyanates and polyols and sets conditions like food type and temperature—meaning many common “industrial” PU mixes aren’t automatically cleared for food contact without further justification.

Health protections around isocyanates—the core building blocks of most PU systems—have also tightened, affecting everything from plant training budgets to product labeling. The EU amended REACH with Regulation (EU) 2020/1149, which requires mandatory training for all professional and industrial users of diisocyanates when concentrations exceed 0.1% by weight, with refreshers at intervals set by national authorities. Labels must explicitly state that training is required.

Worker-safety exposure limits compound the burden. Guidance from authorities such as SafeWork NSW sets workplace exposure standards for isocyanates at 0.02 mg/m³ (8-hour TWA) and 0.07 mg/m³ (15-minute STEL)—numbers that demand effective ventilation, monitoring, and PPE programs.

Opportunity

Cold-chain buildout for safer, less-wasteful food systems

A clear growth opening for polyurethane (PU) resins lies in the global push to expand and modernize cold chains—so food moves safely from farm to fork with less waste. The opportunity is visible in the scale of today’s losses and the policy momentum to fix them. The UN’s 2024 Food Waste Index estimates 1.05 billion tonnes of food were wasted in 2022, equal to 19% of food available to consumers; households caused 60%, food service 28%, and retail 12%—about 132 kg per person in a single year.

Loss before retail is just as material. FAO’s SDG 12.3.1 indicator places global food losses after harvest through processing at 13.3% in 2023, reinforcing the need for reliable pre-cooling, pack-houses, and cold storage in producing regions. These nodes depend on high-R-value insulation and durable gasketing—sweet spots for rigid PU foam, spray foam, and PU sealants. Safety imperatives add urgency: the WHO reports 600 million people fall ill and 420,000 die annually from unsafe food, with US$110 billion lost in productivity and medical costs in low- and middle-income countries; cold-chain integrity directly lowers microbial risks in dairy, meat, seafood, and ready-to-eat products.

Public programs are turning goals into funded projects. In India—one of the fastest-growing food systems—the government reports 399 approved cold-chain projects since 2008 with total project cost ₹11,682.83 crore, while an additional outlay raised PMKSY allocations to ₹6,520 crore for the current cycle, including ₹1,000 crore for 50 irradiation units under the integrated cold-chain component. These schemes finance pre-cooling, pack-houses, ripening rooms, cold stores, and reefer transport—each a direct consumer of PU panels, foams, adhesives, and door seals.

Regional Insights

Asia Pacific leads the Polyurethane Resin Market with 43.9% share valued at USD 422.7 million in 2024.

In 2024, Asia Pacific held a dominant position in the global polyurethane resin market, accounting for 43.9% of the total market share and reaching a valuation of approximately USD 422.7 million. The region’s dominance was supported by rapid industrialization, rising infrastructure investments, and expanding manufacturing activities across China, India, Japan, and South Korea. Strong construction growth, coupled with large-scale residential and commercial development projects, significantly boosted demand for polyurethane-based coatings, adhesives, and insulation materials.

The Indian government’s “Housing for All” and “Smart Cities Mission” programs have accelerated polyurethane resin use in roofing, sealants, and waterproofing systems. In addition, growing investments in automotive manufacturing and consumer electronics in the region have driven the use of polyurethane resins in lightweight components and protective coatings.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Arakawa Chemical Industries, Ltd., headquartered in Japan, manufactures advanced polyurethane resins under its “UREARNO” brand for coatings, adhesives, and lamination printing inks. These resins offer superior flexibility, adhesion, and abrasion resistance. In 2024, the company reported total sales of ¥72,222 million, with growing focus on environmentally safe resin technologies. Arakawa continues to expand its polyurethane portfolio by integrating rosin-based derivatives and waterborne solutions, supporting sustainable growth in industrial coatings and packaging applications globally.

BASF SE is one of the world’s leading chemical producers with a major focus on polyurethane resin systems. In 2024, BASF recorded total sales of €65,260 million, with €6,848 million generated by its Performance Materials division, which includes polyurethane products. The company emphasizes innovation in water-based and bio-based polyurethane technologies, supporting industries such as automotive, construction, and consumer goods. BASF’s new Polyurethane Technical Development Center in India highlights its strategy to serve sustainable and regional growth markets.

Covestro AG, headquartered in Germany, is a global leader in polyurethane materials and systems for construction, automotive, and electronics sectors. In 2024, the company achieved total sales of €14,179 million, with its Performance Materials segment contributing €6,970 million. Covestro is investing in a new polyurethane dispersion plant in Shanghai to meet rising Asia-Pacific demand. The company focuses on circularity and low-carbon polyurethane technologies, reinforcing its leadership in sustainable resin innovation and next-generation polymer materials.

Top Key Players Outlook

- Alchemie

- Arakawa Chemical

- BASF SE

- Bond Polymers

- Covestro A.G.

- DIC CorporationÂ

- DSM

- DuPont

- Eastman Chemical Co.

- Huntsman Corp.

Recent Industry Developments

In 2024 Arakawa Chemical Industries, reported net sales of ¥72,222 million and a profit attributable to owners of the parent of ¥ -1,042 million.

In 2024, BASF generated total group sales of €65,260 million, with its Materials segment contributing €13,510 million, of which the Performance Materials division—covering polyurethanes and thermoplastic polyurethanes—accounted for €6,848 million.

Report Scope

Report Features Description Market Value (2024) USD 962.2 Mn Forecast Revenue (2034) USD 1537.7 Mn CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Resin Type (Solvent-Based Resin, Water-Based Resins, Others), By Applications (Construction, Transportation, Pharmaceuticals, Paints And Coatings, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alchemie, Arakawa Chemical, BASF SE, Bond Polymers, Covestro A.G., DIC CorporationÂ, DSM, DuPont, Eastman Chemical Co., Huntsman Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alchemie

- Arakawa Chemical

- BASF SE

- Bond Polymers

- Covestro A.G.

- DIC CorporationÂ

- DSM

- DuPont

- Eastman Chemical Co.

- Huntsman Corp.