Global Polyurethane Adhesives in Electronics Market Size, Share Analysis Report By Product Type (Electrically Conductive PU Adhesive, Thermally Conductive PU Adhesive, UV Curing PU Adhesive, and Others), By Application (Surface Mounting, Conformal Coatings, Wire Tacking, Potting, Encapsulation, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169556

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

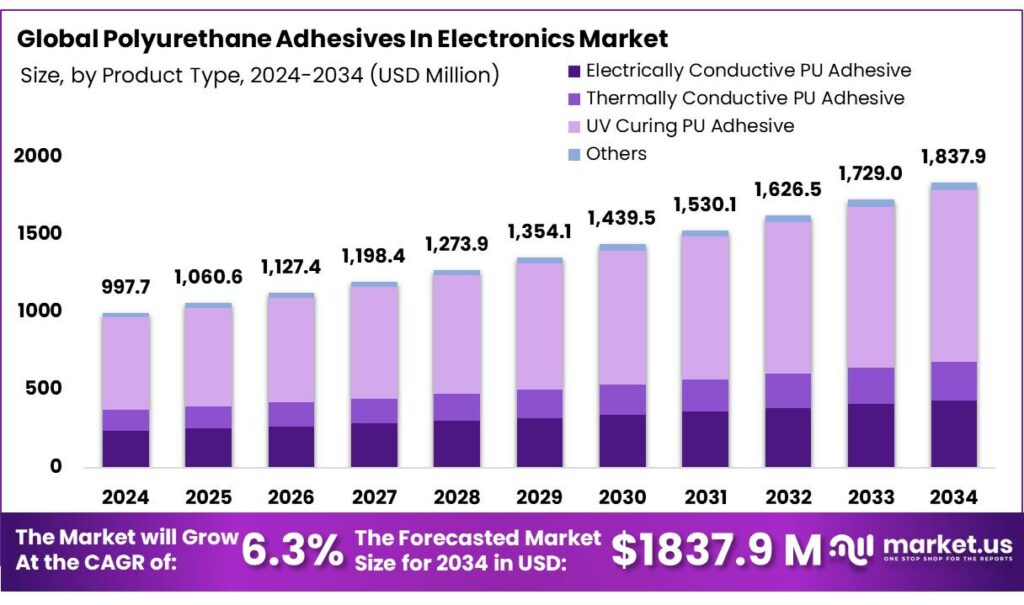

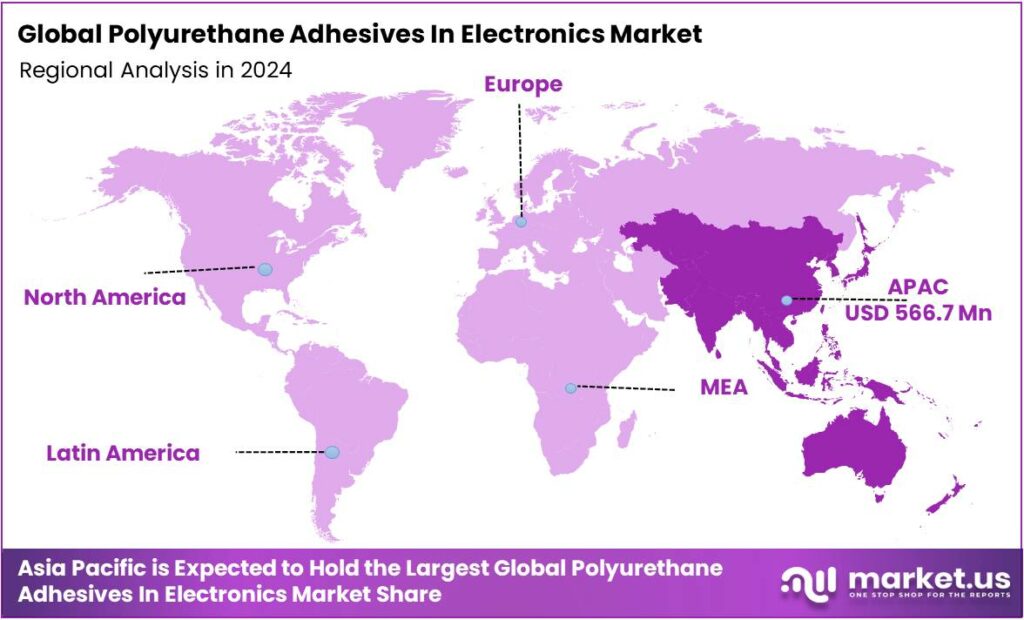

The Global Polyurethane Adhesives in Electronics Market size is expected to be worth around USD 1837.9 Million by 2034, from USD 997.7 Million in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 56.8% share, holding USD 566.7 Million revenue.

Polyurethane (PU) adhesives in electronics are polymer glues that provide strong, flexible, and durable bonding for sensitive components, offering moisture/chemical resistance, vibration dampening, and thermal stability, making them crucial for protecting circuits in electronic devices. They act as protective barriers, sealing against environmental damage while accommodating thermal expansion and shocks, ensuring device performance and longevity. The polyurethane adhesives market in the electronics industry is characterized by a diverse range of applications driven by the demand for high-performance bonding solutions.

- According to the American Chemistry Council, a two-year study by the Center for the Polyurethanes Industry (CPI) revealed that in the United States, Canada, and Mexico, overall polyurethane production totaled 9.1 billion pounds in 2023.

These adhesives are widely used in surface mounting, where their superior bonding strength, flexibility, and durability ensure reliable assembly of electronic components. UV-curing polyurethane adhesives, known for their fast curing time and precision, dominate the sector, offering advantages such as minimal environmental impact and efficient manufacturing processes. As the electronics industry evolves towards more sustainable practices, there is an increasing shift toward eco-friendly PU adhesives, such as low-VOC formulations. The growing demand for consumer electronics, electric vehicles, and advanced devices presents significant growth opportunities, while competition remains intense due to the availability of alternative adhesives such as epoxy and silicone.

Key Takeaways

- The global polyurethane adhesives in electronics market was valued at USD 997.7 million in 2024.

- The global polyurethane adhesives in electronics market is projected to grow at a CAGR of 6.3% and is estimated to reach USD 1837.9 Million by 2034.

- Based on the types of adhesives, UV-curing PU adhesive dominated the market, with a substantial market share of around 60.1%.

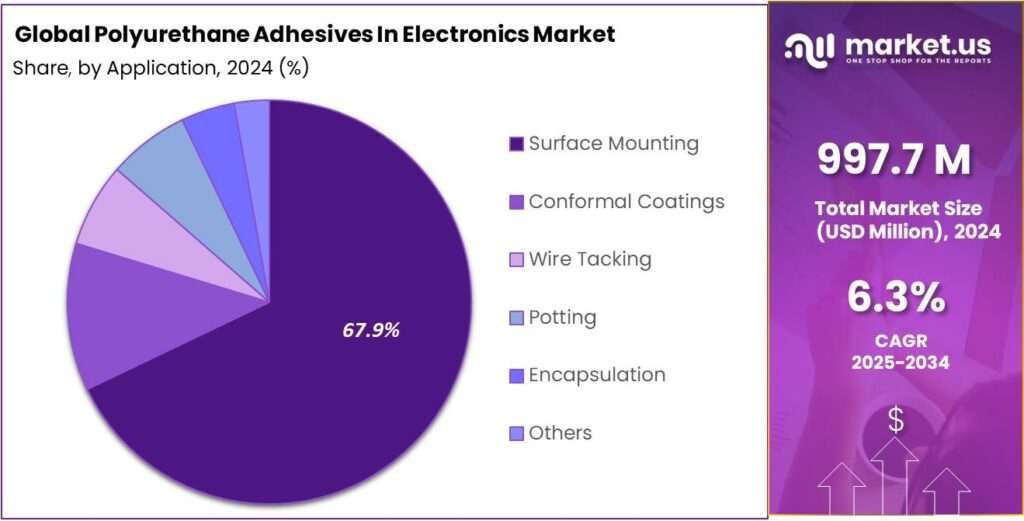

- Among the applications of polyurethane adhesives in the electronics industry, surface mounting held a major share in the market, 67.9% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the polyurethane adhesives in electronics market, accounting for around 56.8% of the total global consumption.

Product Type Analysis

UV Curing PU Adhesive Held the Largest Share in the Polyurethane Adhesives In Electronics Market.

The polyurethane adhesives in the electronics market are segmented based on product type into electrically conductive PU adhesive, thermally conductive PU adhesive, UV curing PU adhesive, and others. The UV-curing PU adhesives dominated the market, comprising around 60.1% of the market share, due to their unique advantages in terms of fast curing times, precision, and ease of application. These adhesives are ideal for high-speed, automated assembly lines where efficiency is crucial. UV curing allows for rapid bonding without the need for heat or mixing, making it suitable for sensitive electronic components such as circuit boards and displays.

According to a study, UV-curing PU adhesives may cure in a few seconds to several minutes, while curing time for electrically conductive PU adhesives might vary, ranging from 10-30 minutes at 65-80°C to 24-72 hours at room temperature. Furthermore, UV-curable adhesives offer excellent optical clarity, which is particularly important in applications such as touchscreens and optical sensors. Compared to electrically or thermally conductive polyurethane adhesives, UV-curing PU adhesives are less complex to formulate and more cost-effective while providing the required strength and durability. Their versatility and ability to cure on demand make them the preferred choice for electronics manufacturers.

Application Analysis

The Polyurethane Adhesives In the Electronics Industry Were Mostly Utilized for Surface Mounting.

Based on the applications of polyurethane adhesives in the electronics industry, the market is divided into surface mounting, conformal coatings, wire tacking, potting, encapsulation, and others. The surface mounting dominated the market, with a market share of 67.9%. It involves attaching components such as chips, resistors, and capacitors to printed circuit boards (PCBs), a process that requires precise and reliable adhesion. PU adhesives are known for their surface mounting capacity as they provide strong, durable bonds while maintaining flexibility, which is essential to withstand thermal and mechanical stresses during operation.

Additionally, they offer resistance to moisture and chemicals, which enhances the reliability of electronic devices. In contrast, other applications such as conformal coatings, wire tacking, or potting often require adhesives with specific attributes such as higher viscosity, electrical conductivity, or thermal stability, which PU adhesives are less suited for. The surface mounting remains the most common use of polyurethane adhesives in electronics due to the adhesives’ versatility, speed, and performance in high-precision environments.

Key Market Segments

By Product Type

- Electrically Conductive PU Adhesive

- Thermally Conductive PU Adhesive

- UV Curing PU Adhesive

- Others

By Application

- Surface Mounting

- Conformal Coatings

- Wire Tacking

- Potting

- Encapsulation

- Others

Drivers

The Increasing Demand for Consumer Electronics Drives the Polyurethane Adhesives In the Electronics Market.

The growing demand for consumer electronics has significantly contributed to the expansion of the polyurethane adhesives market in the electronics sector. As electronic devices become more advanced and compact, the demand for efficient bonding solutions to assemble components such as displays, batteries, and sensors has surged.

- According to the Digital 2024 study, 97.6% of the world’s population had a smartphone in 2024. Similarly, in 2024, PC vendors shipped 253 million PCs, up 2.6% from 2023. Additionally, there are over 454 million smartwatch users worldwide.

Polyurethane adhesives are favored for their durability, flexibility, and ability to withstand environmental stress, making them ideal for use in mobile phones, laptops, wearables, and other electronic gadgets. The trend towards thinner and lighter devices, combined with an increased focus on improving product longevity, has further driven the adoption of polyurethane adhesives.

Additionally, as sustainability gains importance, these adhesives are increasingly seen as environmentally friendly due to their low emissions and non-toxic properties after curing. Companies in the consumer electronics industry are leveraging these adhesives to enhance the performance and reliability of their products.

Restraints

Availability of Effective Alternatives Poses a Challenge to the Polyurethane Adhesives In the Electronics Market.

The presence of alternative adhesives, such as epoxy and silicone, poses a significant challenge to the growth of polyurethane adhesives in the electronics sector. Epoxy adhesives are often preferred for strong, protective bonds, acting as insulators or conductors, used in PCB assembly, semiconductor packaging (die-attach), conformal coating, and potting, shielding components from moisture, dust, heat, and vibrations while facilitating electrical/thermal paths, particularly with conductive fillers such as silver.

Similarly, silicone adhesives are known for their flexibility, high-temp resistance, and insulation, used for potting, sealing, conformal coating, and thermal management to protect components from moisture, shock, and heat, enhancing device reliability and lifespan, with specialized types for electrical conductivity or heat transfer.

These alternatives often provide superior performance in specific areas, leading some manufacturers to opt for them instead of polyurethane-based solutions. The polyurethane adhesives market must continue to innovate and offer unique advantages, such as better cost-efficiency or eco-friendliness, to maintain its position in the industry.

Opportunity

Catering to the Booming Electric Vehicles Sector Creates Opportunities in the Polyurethane Adhesives In Electronics Market.

The rapid expansion of the electric vehicle (EV) sector presents significant opportunities for the polyurethane adhesives market, particularly in the automotive electronics domain. As EV manufacturers increasingly focus on improving vehicle performance and efficiency, the demand for advanced adhesives that offer durability, thermal stability, and lightweight properties has surged.

Polyurethane adhesives are being used in various EV applications, including bonding battery components, electronic control units, wiring harnesses, and interior displays. These adhesives are particularly valued for their strong adhesion to different substrates, such as metals, plastics, and glass, which are commonly found in EVs.

Furthermore, their ability to withstand high temperatures and vibration makes them ideal for the demanding conditions within electric vehicles. With the growing shift towards electric mobility, polyurethane adhesives are becoming a critical component in enhancing the performance, safety, and overall design of EVs, thus opening new avenues for market growth.

- According to the International Energy Agency, electric car sales exceeded 17 million globally in 2024, reaching a sales share of more than 20%. Additionally, as a result of continued strong growth, 1 in 10 cars on Chinese roads is electric. EV sales in 2025 are expected to exceed 20 million worldwide to represent more than one-quarter of cars sold worldwide.

Trends

Shift Towards Eco-Friendly Polyurethane Adhesives in Electronics Industry.

The ongoing shift towards eco-friendly polyurethane adhesives, particularly low-VOC (volatile organic compound) solutions, is becoming a prominent trend in the electronics industry. As environmental regulations tighten and consumer preferences evolve towards sustainable products, manufacturers are increasingly adopting low-VOC polyurethane adhesives to reduce harmful emissions and improve workplace safety. For instance, in April 2025, Tex Year introduced its product, R3220, a bio-based polyurethane reactive (PUR) hot melt adhesive, comprised of 40% bio-based materials, and engineered particularly for electronic product assembly.

These adhesives are designed to provide the same high-performance characteristics, such as strong bonding, flexibility, and durability, while minimizing their environmental footprint. For instance, in September 2023, Covestro unveiled its upgraded portfolio of polyurethane dispersions (PUDs) and partially bio-based products, including Dispercoll U2682, designed to meet the demanding needs of the consumer electronics industry in temperature-sensitive lamination applications. This shift aligns with the broader trend of sustainability in manufacturing, as electronics companies strive to meet stricter environmental standards and respond to growing consumer demand for greener products. By leveraging eco-friendly solutions, companies enhance their brand reputation in an increasingly environmentally conscious market.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Polyurethane Adhesives In Electronics Market by Shifting Trade Flows.

The geopolitical tensions have had a notable impact on the polyurethane adhesives market in the electronics sector, particularly through supply chain disruptions, rising material costs, and shifting trade dynamics. Ongoing trade conflicts, especially between major manufacturing hubs such as the U.S., China, and Europe, have created uncertainty in the global supply chain. For instance, US tariffs on isocyanates, a key raw material used in polyurethane adhesives, under section 301, have resulted in delays and higher production costs of the adhesives in the region.

These disruptions can lead to challenges in meeting the growing demand for adhesives in electronics manufacturing, affecting industries that rely heavily on imports, such as consumer electronics and automotive sectors. Additionally, tariffs and trade barriers have compelled companies to rethink their sourcing strategies, often increasing the complexity and cost of procurement. In contrast, the growing focus on national security and reducing dependence on foreign suppliers has led to increased investment in local manufacturing capabilities in some regions. While this shift offers opportunities for localized production and innovation, it requires adaptation to new regulatory frameworks and supply chain models.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Polyurethane Adhesives In the Electronics Market.

In 2024, the Asia Pacific dominated the global polyurethane adhesives in electronics market, holding about 56.8% of the total global consumption. The region holds the largest share of the global polyurethane adhesives market in electronics due to the region’s strong manufacturing base and rapidly expanding electronics industry. Countries such as China, Japan, South Korea, and India are home to some of the world’s largest electronics manufacturers, contributing to a significant demand for advanced adhesives in the assembly of devices such as smartphones, televisions, and automotive electronics.

China has the largest market of consumer electronics driven by digitalization, strong demand for smartphones, smart home devices, and replacement cycles, with significant manufacturing prowess in displays (OLED/LCD), leading to a high global market share and increasing innovation. Additionally, the region is the largest OSAT (Outsourced Semiconductor Assembly and Test) market, with companies such as Taiwan Semiconductor Manufacturing Company (TSMC) demanding large volumes of adhesives for electronics.

Similarly, Asia Pacific’s push towards electric vehicles, renewable energy, and IoT (Internet of Things) applications further fuels the need for specialized adhesives in electronics. As the region leads in production as well as consumption of electronics, the demand for high-performance polyurethane adhesives is expected to remain dominant, solidifying Asia Pacific’s position in the global market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Companies in the polyurethane (PU) adhesives sector for electronics employ a variety of strategies to stay competitive and increase sales. The companies focus on continuous product innovation, emphasizing enhancing the performance of PU adhesives, such as improving curing speeds, adhesion strength, and environmental sustainability. For instance, manufacturers are developing low-VOC, eco-friendly formulations to meet increasing regulatory and consumer demand for greener products.

Additionally, various companies focus on strengthening their relationships with major electronics manufacturers by offering tailored solutions that meet specific needs, such as adhesives for high-temperature applications or ultra-thin bonding. Similarly, the companies invest in expanding their global footprint, particularly in the emerging markets of the Asia Pacific and Latin America, where electronics production is growing rapidly.

The Major Players in The Industry

- 3M Company

- Arkema

- Ashland

- Avery Dennison Corporation

- BASF SE

- Covestro AG

- DELO Industrie

- Dow

- Dymax

- Epic Resins

- B. Fuller Company

- Henkel AG & Co. KGaA

- Huitian New Materials

- Huntsman International LLC

- Sika AG

- ITW Performance Polymers

- Kangda New Materials (Group) Co., Ltd

- Master Bond

- Parker Hannifin Corp

- Permabond

- Other Key Players

Key Development

- In May 2024, Permabond announced the launch of another product, UV643, an ultra-fast curing UV adhesive, which is designed to bond both rigid plastics and thermoplastics. The potential applications of the adhesive, according to the company, are electronics, automotive applications, and others.

- In May 2024, Dow announced the mechanical completion of its VORATRON polyurethane systems adhesive and gap filler production line in Germany, intended to increase the capacity of its VORATRON polyurethane systems product family tenfold to meet increasing demand for these materials in battery assembly solutions for the e-mobility segment.

Report Scope

Report Features Description Market Value (2024) USD 997.7 Mn Forecast Revenue (2034) USD 1837.9 Mn CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Electrically Conductive PU Adhesive, Thermally Conductive PU Adhesive, UV Curing PU Adhesive, and Others), By Application (Surface Mounting, Conformal Coatings, Wire Tacking, Potting, Encapsulation, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape 3M Company, Arkema, Ashland, Avery Dennison Corporation, BASF SE, Covestro AG, DELO Industries, Dow, Dymax, Epic Resins, H.B. Fuller Company, Henkel AG & Co. KGaA, Huitian New Materials, Huntsman International LLC, Sika AG, ITW Performance Polymers, Kangda New Materials (Group) Co., Ltd., Master Bond, Parker Hannifin Corp., Permabond, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Polyurethane Adhesives in Electronics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Polyurethane Adhesives in Electronics MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M Company

- Arkema

- Ashland

- Avery Dennison Corporation

- BASF SE

- Covestro AG

- DELO Industrie

- Dow

- Dymax

- Epic Resins

- B. Fuller Company

- Henkel AG & Co. KGaA

- Huitian New Materials

- Huntsman International LLC

- Sika AG

- ITW Performance Polymers

- Kangda New Materials (Group) Co., Ltd

- Master Bond

- Parker Hannifin Corp

- Permabond

- Other Key Players