Global Polymer Fillers Market By Product Type [Organic Fillers (Natural Fibers, Carbon and Others) Inorganic Fillers (Oxides, Hydro-oxides, Salts, Silicates and Others)] By End-Use Industry (Building & Construction, Automotive, Electrical & Electronics, Industrial Products, Packaging and Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 20041

- Number of Pages: 358

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

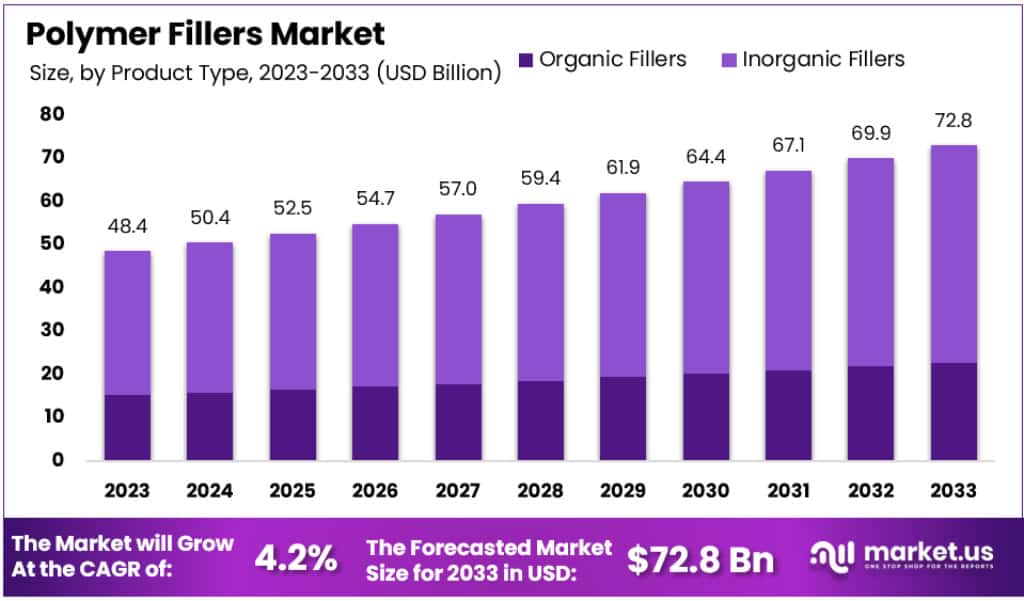

The Global Polymer Fillers Market size is expected to be worth around USD 72.8 Billion by 2033, from USD 48.4 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

The Polymer Filler Market is witnessing a surge in demand, driven by the need for strong yet lightweight materials in automotive and industrial applications. These fillers, known for their robust impact strength, are increasingly being considered as alternatives to expensive plastic resins. This trend is evident across various countries, including the U.S., India, Germany, and Brazil, where low-cost fillers are gaining popularity.

Environmental regulations and stringent guidelines are significantly shaping the global Polymer Filler Market. Factors like the growing need for high-strength, low-cost materials, and continuous innovation are key drivers of this industry’s expansion.

The growing trend towards electric vehicles in the automotive industry presents new opportunities for market expansion. The building and construction industry, in particular, is expected to dominate the market, owing to polymer fillers’ ability to replace expensive plastic resins. The Asia-Pacific region, led by China and India, is the largest consumer in the global polymer filler market.

This demand is attributed to polymer fillers’ wide-ranging benefits, including cost-effectiveness, electrical resistivity, lower flammability, fracture toughness, stiffness, and UV resistance. The shift towards organic fillers like natural fibers and wood flour in various industries is also propelling market growth. With high-quality optical properties, impact resistance, and the ability to replace expensive plastics, polymer fillers are increasingly preferred across diverse applications, predicting substantial growth in the Polymer Filler Market in the forthcoming period.

Key Takeaways

- The Global Polymer Fillers Market is expected to reach approximately USD 72.8 billion by 2033, up from USD 48.4 billion in 2023.

- This growth is projected at a CAGR of 4.2% annually from 2024 to 2033.

- In 2023, inorganic fillers accounted for over 62.7% of the market, mainly due to their availability and properties like strength.

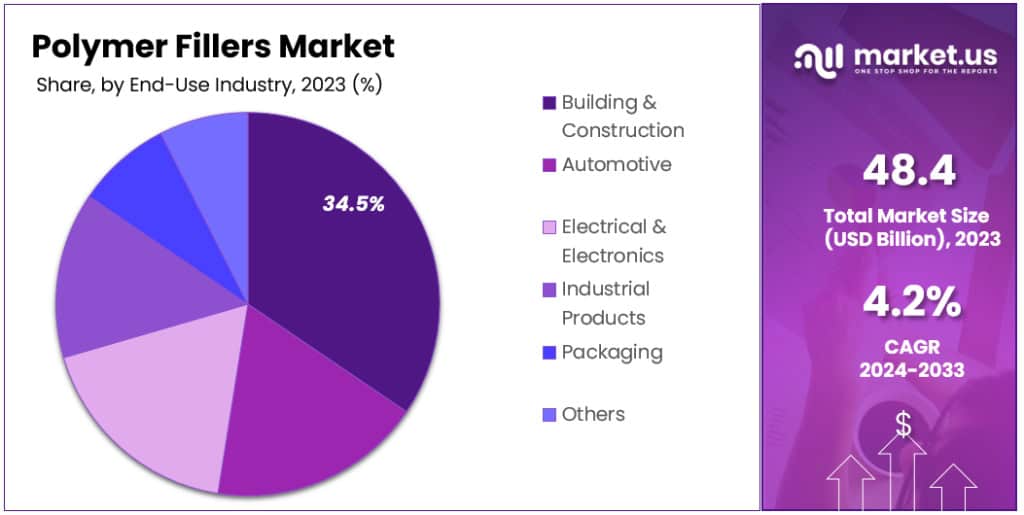

- The building and construction industry leads the market, capturing 34.9% in 2023, driven by the demand for eco-friendly construction materials.

- Over 70% of plastics used in automobiles come from polymers with added fillers to enhance properties.

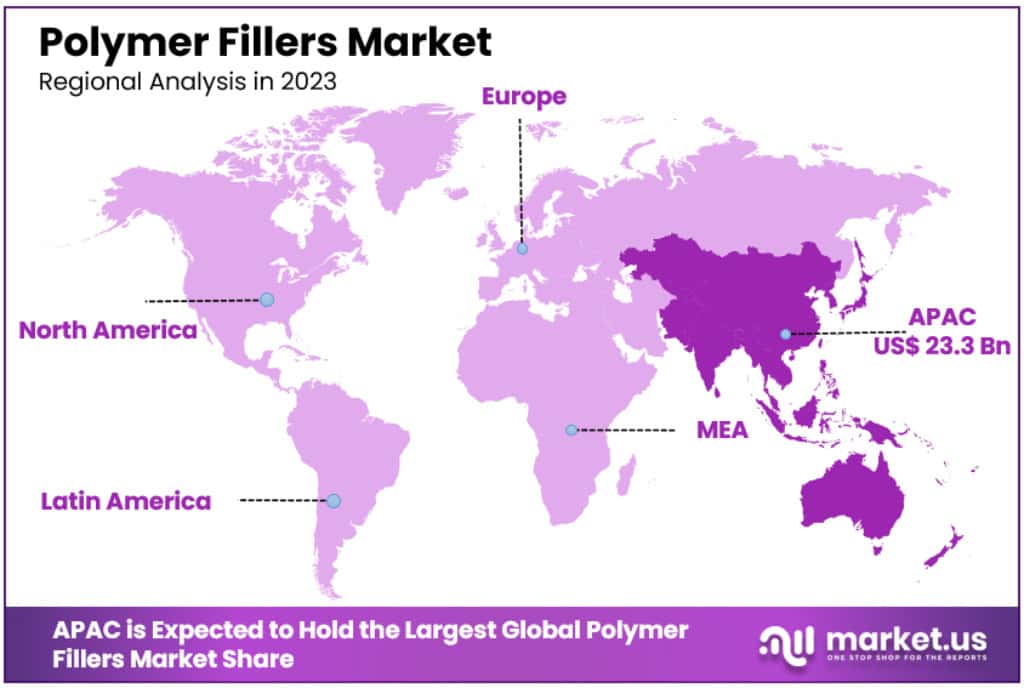

- The Asia-Pacific region is leading the Polymer Fillers Market with a dominant share of 48.2%, valued at USD 23.3 billion in 2023.

Product Type Analysis

In 2023, the inorganic fillers segment commanded a substantial presence in the Polymer Fillers Market, securing over 62.7% market share. This dominance is rooted in the traditional use of inorganic polymer fillers, attributed to their readily available nature and superior properties. Salts, particularly calcium carbonate and calcium sulfate, have been pivotal in the market, holding over ~61% of the inorganic segment in 2020. Their cost-effectiveness coupled with adequate strength has made them a preferred choice in the building and construction industry.

Inorganic fillers, often mined, pose environmental concerns. Hence, mining regulations will critically affect raw material availability. Meanwhile, robust manufacturing growth in emerging economies, such as China and India, and the recovery of Europe’s industrial sector are boosting demand for composite plastics, further fueling the need for polymer fillers in industrial products.

Organic fillers, on the other hand, The market is also experiencing a shift towards organic fillers, favored for their eco-friendly attributes. The ready availability and cost-effectiveness of natural fibers like cellulose and wood are major contributors to this rising demand. However, limitations due to the inflammability and hygroscopic nature of organic products, as well as the potential replacement by other filler types, could restrain market growth.

Recently, organic polymer fillers, such as shell and wood flour, have become more popular. These fillers are light and can help reduce costs when mixed with resins. However, they have some drawbacks. The level of resistance to fire and chemicals can change depending on how much filler is used. Also, some types, like carbon fiber, are expensive to process. Despite its great strength, the high cost of carbon fiber could slow down market growth.

End-Use Analysis

In 2023, the Building & Construction industry is leading the Polymer Fillers Market, capturing an impressive 34.9% share. This sector’s growth is driven by the increasing demand for environmentally friendly construction materials, which is boosting the use of polymer fillers. The popularity of calcium carbonate fillers in construction applications is a significant factor in this market expansion.

The rapid growth of the building and construction industry, fueled by a growing population and accelerated industrialization and urbanization, is expected to further enhance the demand for polymer fillers. The US Census Bureau’s February 2020 data, showing a 6% increase in total construction from the previous year, further underlines the sector’s robust growth and its significant impact on the Polymer Fillers Market.

Polymer Fillers Market’s growth is also influenced by its applications in the automotive and packaging industries. This growth is driven by a combination of innovative product development, strategic partnerships, and a focus on sustainability by key market players such as Imerys, 20 Microns Limited, GCR Group, and Minerals Technologies Inc.

In the automotive sector, polymer fillers play a crucial role in manufacturing high-performance, lightweight parts. The demand in this industry is fueled by the need for lightweight and fuel-efficient vehicles. Over 70% of the plastic used in automobiles comes from polymers like polyurethane, polyamides, and PVC, with fillers added to enhance the properties of these plastics. This not only reduces the overall cost of the vehicle but also improves strength and fuel efficiency. Stringent regulations governing vehicular emissions further drive the demand for polymer fillers in this sector.

As for the packaging industry, the United States is promoting sustainable and eco-friendly packaging materials to reduce carbon footprints and environmental impacts. Polymer fillers contribute to this initiative by enhancing the molding properties of new materials and driving growth in the market. Manufacturers are investing in research and development to innovate different types of polymer fillers for various end-use industries to fulfill their requirements, focusing particularly on biodegradable and sustainable options.

Кеу Маrkеt Ѕеgmеntѕ

By Product Type

- Organic Fillers

- Natural Fibers

- Carbon

- Others

- Inorganic Fillers

- Oxides

- Hydro-Oxides

- Salts

- Silicates

- Metals

- Others

By End-Users

- Automotive

- Building & Construction Industry

- Electrical & Electronics

- Industrial Products

- Packaging Materials

- Others

Drivers

- End-Use Industry Growth: The market is propelled by the expansion of end-use industries globally, especially the automotive sector, where polymer fillers are used for developing lightweight and high-performance materials.

- Building and Construction Demand: The increasing need for polymer fillers in building and construction activities, driven by government initiatives like ‘100 smart cities’ and ‘Housing for All by 2022’ in India, and the growth in construction investment in countries like Germany, significantly boosts the market. The US Census Bureau reported a seasonally adjusted annual rate of 1,366,697 in total construction in February 2020, marking a 6.0% increase from February 2019.

- Aerospace Industry Expansion: Demand from the aerospace sector, especially for lightweight and strong materials like carbon nanotubes and graphene oxide, is rising. The growth in the aviation industry, as evidenced by Boeing’s forecast of India’s need for 2,300 aircrafts worth US$320 billion over 20 years, further amplifies this demand.

Restraints

- Price Fluctuations: The volatility in prices of raw materials such as calcium carbonate, silica, and carbon black can impact manufacturers’ profitability and market growth.

- High Production Costs: The increasing cost of traditional fillers like carbonate and glass fibers, which are essential for reinforcing the mechanical properties of polymers, alongside the high processing costs of manufacturing polymer fillers, pose significant challenges.

Opportunities

- Versatile Applications: Polymer fillers’ ability to substitute expensive plastic resins opens new opportunities in various sectors, particularly in automotive and industrial applications where there’s a demand for high-strength, lightweight materials.

- Electric Vehicles Market: The anticipated growth of the electric vehicle market in the Asia-Pacific region, with a predicted CAGR of over ~21% to reach USD 360 billion by 2029, presents lucrative opportunities for polymer fillers.

Challenges

- Environmental and Health Concerns: The use of non-biodegradable polymer fillers raises environmental and health concerns, leading to stricter regulations which can hinder market growth.

- Alternative Materials: The emergence of alternative materials like natural, glass, and carbon fibers poses a challenge to the polymer fillers market.

Trends

- Manufacturing Sector Growth: The market is bolstered by the growing manufacturing sectors in countries like China and India, driving the demand for composite plastics.

- Packaging Applications: The use of polymer fillers in packaging, due to their sealing properties and ability to maintain freshness, is on the rise.

Regional Analysis

The Asia-Pacific region is leading the Polymer Fillers Market with a dominant share of 48.2%, valued at USD 23.3 billion in 2023. This region’s dominance is attributed to several key factors:

- End-User Industry Growth: Countries like China and India are experiencing a surge in demand for polymer fillers due to the growth of various end-user industries such as automotive, packaging, and construction & building.

- Manufacturing Sector Expansion: Rapid industrialization in China and India is leading to increased demand for composite plastics, thereby propelling the polymer fillers market.

- Packaging Industry Demand: The growing need for polymer fillers in packaging applications is driven by their ability to enhance sealing properties and maintain food freshness for longer durations.

- Automotive Production Increases: In 2018, automotive production in key Asia-Pacific countries like India, Thailand, Indonesia, and Malaysia showed significant growth. This increase is aligned with the rising per capita income and is leading to heightened demand for polymer fillers in automotive applications.

- Government Initiatives: In India, the government has implemented investment promotion programs to support companies in the polymer and composite production sector, further enhancing market growth.

- China’s Market Influence: China, holding a ~5.5% share of the market, is a major producer and consumer of polymer fillers. The country’s advancements in the construction and automotive sectors are driving the demand for polymer fillers. China’s role as a leading producer of automobiles further amplifies this demand.

- Raw Material and Labor Advantages: The Asia-Pacific region, particularly China and India, offers low costs of raw materials and labor, along with a minimal demand for technological know-how, which attracts new market entrants and boosts the polymer fillers industry.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Due to increasing demand for innovative products from key end-use sectors, the global polymer fillers market is likely to continue to be under pressure. Alternative materials, such as scrap and waste materials, will also be a threat to market participants. Concrete is made from scrap or other waste materials.

Due to the presence of many manufacturers and high product differentiation, the Polymer Filler Market segmentation has a large fragmentation. Quarzwerke Group, 20 Micron Limited, and GCR Group are the major players in this market.

Маrkеt Кеу Рlауеrѕ

- Cabot Corporation

- Covia Holdings Corporation

- Aditya Birla Group

- Imerys S.A.

- LKAB Minerals

- Hoffmann Mineral

- INEOS Group AG

- J.M. Huber Corporation

- 20 Microns Limited

- Karntner Montanindustrie Gesellschaft M.B.H.

- Minerals Technologies Inc.

- Nyco Minerals

- OMYA AG

- Owens Corning

- Jushi Group

- Evonik Industries AG

- Wacker Chemie AG

- Unimin Corporation

- Mondo Minerals

- Quarzwerke Group

- Huber Engineered Materials

- GCR Group

- Other Companies

Recent Developments

- Evonik Industries AG’s Acquisition: In 2021, Evonik Industries AG expanded its business through the acquisition of Porocel Group. This move aimed to leverage Porocel Group’s expertise and technology.

- Huber Engineered Materials’ Expansion: Also in 2021, Huber Engineered Materials initiated a new manufacturing facility for carbonate production in Georgia, responding to growing demand from end-use industries like plastics and coatings.

- Cabot Corporation’s New Product Launch: Cabot Corporation launched the LITX G700 series in 2020, designed to enhance car battery safety and performance.

- Minerals Technologies Inc.’s Sustainable Product: Minerals Technologies Inc. introduced a new product named Synthetic Magnesium Hydroxide in 2020, offering a sustainable alternative to traditional flame retardants.

Report Scope

Report Features Description Market Value (2023) USD 48.4 Billion Forecast Revenue (2033) USD 72.8 Billion CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type [Organic Fillers (Natural Fibers, Carbon and Others) Inorganic Fillers (Oxides, Hydro-oxides, Salts, Silicates and Others)] By End-Use Industry (Building & Construction, Automotive, Electrical & Electronics, Industrial Products, Packaging and Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Cabot Corporation, Covia Holdings Corporation, Aditya Birla Group, Imerys S.A., LKAB Minerals, Hoffmann Mineral, INEOS Group AG, J.M. Huber Corporation, 20 Microns Limited, Karntner Montanindustrie Gesellschaft M.B.H., Minerals Technologies Inc., Nyco Minerals, OMYA AG, Owens Corning, Jushi Group, Evonik Industries AG, Wacker Chemie AG, Unimin Corporation, Mondo Minerals, Quarzwerke Group, Huber Engineered Materials, GCR Group. and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the market size of the Polymer Filler in 2023?The market size of the Polymer Filler Market was USD 48.4 Billion in 2023.

What is the CAGR of the polymer fillers market?The polymer fillers market is growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

-

-

- Cabot Corporation

- Covia Holdings Corporation

- Aditya Birla Group

- Imerys S.A.

- LKAB Minerals

- Hoffmann Mineral

- INEOS Group AG

- J.M. Huber Corporation

- 20 Microns Limited

- Karntner Montanindustrie Gesellschaft M.B.H.

- Minerals Technologies Inc.

- Nyco Minerals

- OMYA AG

- Owens Corning

- Jushi Group

- Evonik Industries AG

- Wacker Chemie AG

- Unimin Corporation

- Mondo Minerals

- Quarzwerke Group

- Huber Engineered Materials

- GCR Group

- Other Companies