Global Polyester Staple Fibre Market Size, Share, And Business Benefits By Product (Solid, Hollow), By Origin (Virgin, Recycled, Blended), By Application (Apparel, Automotive, Home Furnishing, Filtration, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152033

- Number of Pages: 285

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

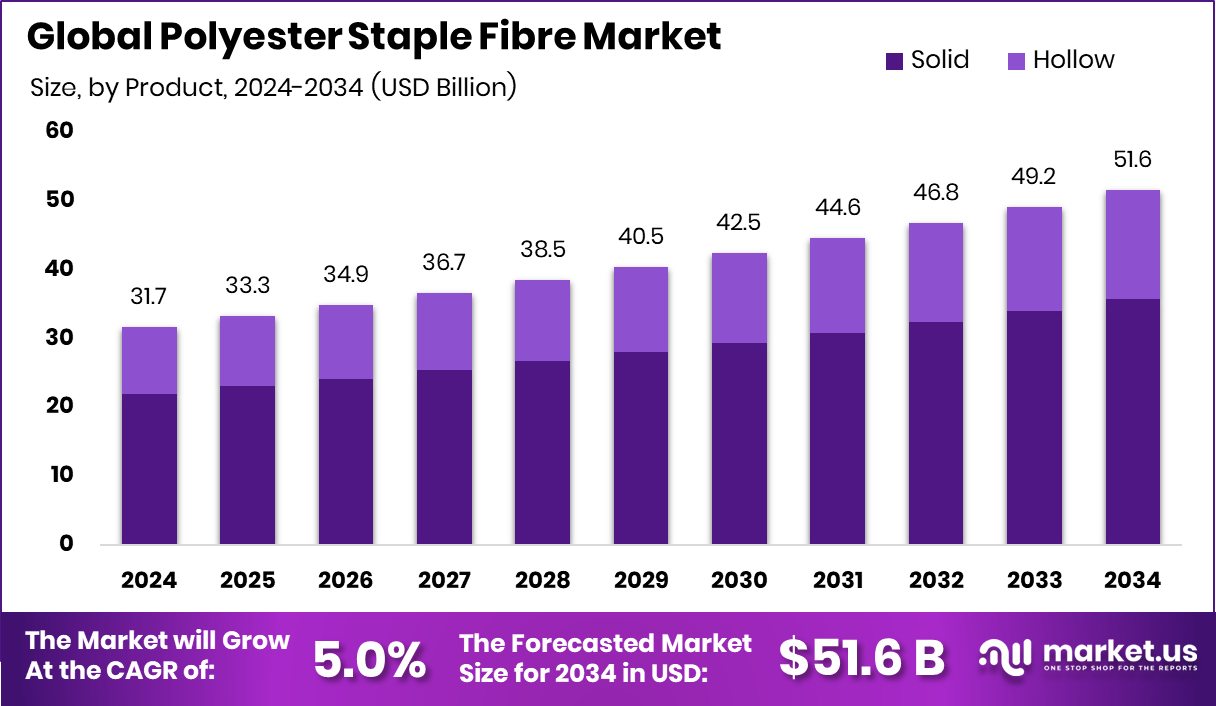

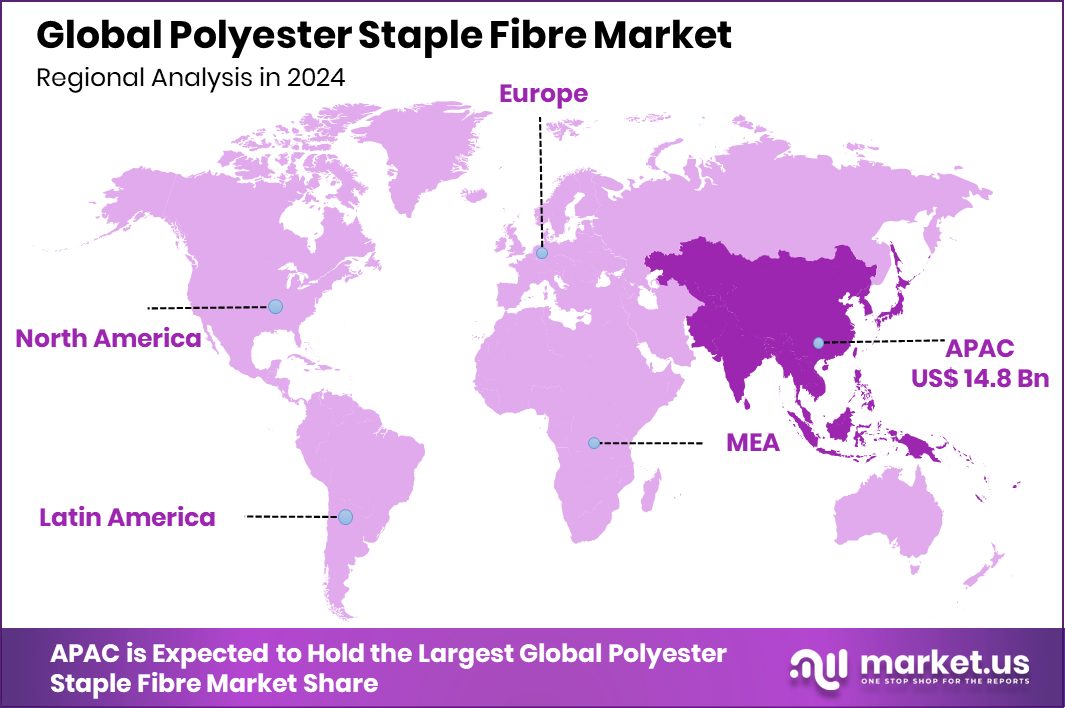

Global Polyester Staple Fibre Market is expected to be worth around USD 51.6 billion by 2034, up from USD 31.7 billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034. Strong manufacturing base and consumer growth supported Asia-Pacific’s dominant USD 14.8 billion position.

Polyester Staple Fibre (PSF) is a synthetic fibre made from polyester, commonly used in the textile industry for spinning yarns, non-woven fabrics, and fiberfill applications. It is manufactured through the polymerisation of purified terephthalic acid (PTA) and monoethylene glycol (MEG), followed by a melt-spinning process. PSF is available in different lengths, textures, and deniers, which allows it to be blended with other natural or synthetic fibres for various end-use applications such as clothing, home furnishings, automotive interiors, and industrial textiles.

The Polyester Staple Fibre market is experiencing steady growth, driven by increasing global demand for cost-effective and versatile textile solutions. The rising need for lightweight, wrinkle-resistant, and high-strength fabrics in both developed and emerging economies is fueling PSF consumption. Additionally, as consumers become more conscious of sustainability, the shift toward recycled PSF—produced from post-consumer PET bottles—is gaining traction, further expanding market scope.

One of the key growth factors behind the increasing demand for PSF is its cost-efficiency compared to natural fibres like cotton or wool. Polyester is less affected by seasonal variability in raw material supply and prices, making it a more stable and scalable solution for manufacturers. According to an industry report, DePoly secures $23 million to advance recycling of PET and polyester waste.

The demand for PSF is also rising in the context of urbanisation and industrial growth. With the expansion of the middle class in regions such as Asia and Africa, there is higher consumption of ready-made garments and home textiles. PSF’s compatibility with fast fashion cycles, owing to its affordability and ease of dyeing, has further bolstered its uptake in the global textile supply chain.

Key Takeaways

- Global Polyester Staple Fibre Market is expected to be worth around USD 51.6 billion by 2034, up from USD 31.7 billion in 2024, and grow at a CAGR of 5.0% from 2025 to 2034.

- Solid polyester staple fibre holds a 69.2% market share due to its strength and durability.

- Virgin polyester staple fibre dominates the market with 56.1%, driven by consistent quality and performance.

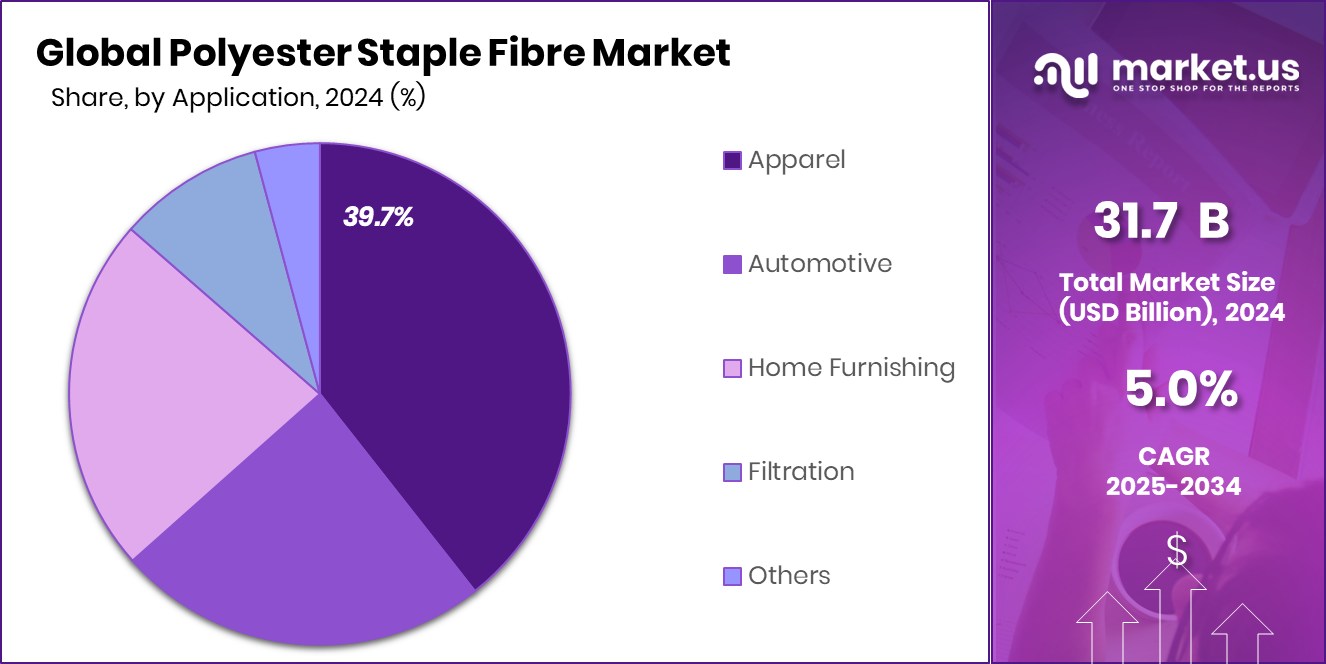

- Apparel accounts for 39.7% of PSF demand, supported by rising clothing production and consumer textile needs.

- The Asia-Pacific market value reached USD 14.8 billion due to rising textile demand.

By Product Analysis

Solid polyester staple fibre holds 69.2% market share globally.

In 2024, Solid held a dominant market position in the By Product segment of the Polyester Staple Fibre Market, with a 69.2% share. This strong performance reflects the widespread usage of solid polyester staple fibre across various textile and industrial applications.

Solid PSF is preferred due to its high tensile strength, resilience, and superior blending characteristics with natural fibres, making it suitable for a wide range of end-use products such as garments, home textiles, non-woven fabrics, and automotive interiors. The segment’s dominance is also supported by its adaptability in both virgin and recycled forms, aligning well with increasing demand for sustainable and cost-efficient materials in the global textile industry.

Moreover, solid PSF offers excellent dyeing properties and thermal stability, which enhances its appeal among manufacturers looking for consistency and performance in finished goods. The extensive deployment of solid PSF in fiberfill applications—such as pillows, cushions, and insulation—is another contributing factor to its market leadership.

As production technologies continue to improve and sustainability remains a central concern, the demand for solid-type fibres is expected to maintain its stronghold in the market. Its large-scale availability and well-established processing infrastructure further reinforce its dominant position within the polyester staple fibre landscape.

By Origin Analysis

Virgin-origin fibre dominates with a 56.1% share in usage.

In 2024, Virgin held a dominant market position in the By Origin segment of the Polyester Staple Fibre Market, with a 56.1% share. This leadership is largely attributed to the consistent quality, uniformity, and performance characteristics offered by virgin polyester fibres, making them a preferred choice across various industrial and textile applications.

Virgin PSF is produced directly from petrochemical sources, which ensures higher purity and superior mechanical properties, including strength, durability, and dyeability—factors crucial for demanding end-use sectors such as apparel, home furnishings, and automotive interiors.

The dominance of virgin PSF is also supported by its wide availability and established supply chain infrastructure, which facilitates large-scale production and consistent product quality. Manufacturers favour virgin fibres where stringent specifications are required, especially in high-performance or technical textile applications.

Additionally, the virgin segment continues to maintain its position due to ongoing innovation in polymer processing and fibre enhancement techniques that improve functionality and cost-efficiency. As consumer demand continues to favor products with high strength and finish quality, virgin polyester staple fiber remains a staple raw material in textile manufacturing, helping to sustain its majority share within the origin-based segmentation of the polyester staple fibre market.

By Application Analysis

Apparel segment leads applications, accounting for 39.7% of market demand.

In 2024, Apparel held a dominant market position in the By Application segment of the Polyester Staple Fibre Market, with a 39.7% share. This leading position is primarily driven by the fibre’s suitability for producing a wide range of garments, including casual wear, sportswear, and innerwear.

Polyester staple fibre is widely favoured in the apparel industry due to its durability, wrinkle resistance, lightweight nature, and ability to retain shape, even after repeated washing. These properties make it highly functional for everyday clothing, particularly in fast fashion and mass-produced garments, where cost-effectiveness and efficiency are key.

The dominance of the apparel segment is further supported by the global demand for affordable and versatile textile solutions, especially in regions witnessing rapid urbanisation and a growing middle-class population. The ease of blending polyester staple fibre with natural fibres such as cotton enhances fabric versatility, which is important in meeting varying consumer preferences.

Additionally, the consistent quality and dyeing efficiency of polyester staple fibre contribute to its widespread adoption in fashion manufacturing. With apparel production continuing to expand across emerging markets and established manufacturing hubs, the segment’s stronghold in the polyester staple fibre market remains firmly supported by both supply chain efficiency and consumer demand patterns.

Key Market Segments

By Product

- Solid

- Hollow

By Origin

- Virgin

- Recycled

- Blended

By Application

- Apparel

- Automotive

- Home Furnishing

- Filtration

- Others

Driving Factors

Growing Textile and Apparel Industry Worldwide

One of the top driving factors for the Polyester Staple Fibre (PSF) market is the continuous growth of the global textile and apparel industry. As more people buy clothes due to rising incomes, fast fashion trends, and changing lifestyles, the demand for polyester staple fibre is increasing. PSF is used widely in making clothes because it is affordable, strong, and easy to maintain.

It is also wrinkle-resistant and dries quickly, making it ideal for everyday wear. Countries in Asia, like China, India, and Bangladesh, have become major hubs for garment production, which is boosting PSF consumption. As the clothing industry keeps growing globally, the need for polyester staple fibre is expected to rise steadily in the coming years.

Restraining Factors

Environmental Concerns and Plastic Waste Generation

One of the main restraining factors for the Polyester Staple Fibre (PSF) market is the increasing concern over its environmental impact. Since PSF is made from petroleum-based products, it is non-biodegradable and contributes to long-term plastic pollution. When disposed of, it can take hundreds of years to break down, leading to serious environmental harm, especially in landfills and oceans.

Governments and environmental groups are raising awareness about the dangers of synthetic fibres, urging industries to shift toward more sustainable materials. As a result, some consumers are moving away from polyester products, preferring natural or biodegradable alternatives.

Growth Opportunity

Expansion of Recycled Polyester Staple Fibre Market

A major growth opportunity in the Polyester Staple Fibre (PSF) market lies in the expansion of recycled polyester staple fibre. This material is made by reprocessing used plastics, like PET bottles, into polyester fibres again. It helps reduce plastic waste and lowers energy use compared to making new polyester. Businesses making clothes, carpets, and upholstery are starting to use recycled PSF more because customers and governments want sustainable products.

The recycling process is also improving, making higher-quality fibres that match virgin polyester in performance. As demand for eco-friendly textiles grows, manufacturers have a real chance to scale up recycled PSF production. This shift supports environmental goals and opens new markets for responsible and green fibre solutions.

Latest Trends

Rise of Smart and Functional Polyester Textiles

A leading trend in the Polyester Staple Fibre (PSF) market is the rise of smart and functional textiles. Manufacturers are combining PSF with special coatings or treatments to create fabrics that offer additional benefits, like moisture-wicking, UV protection, anti-odour properties, or even temperature regulation. These advanced textiles are increasingly found in sportswear, outdoor gear, medical supplies, and automotive interiors.

The integration of such features does not compromise the basic PSF qualities of strength, durability, and ease of care. This shift toward added functionality responds to growing consumer interest in performance-enhanced materials, offering clothing and products that not only look and feel good but also support active and healthy lifestyles.

Regional Analysis

In 2024, Asia-Pacific led the Polyester Staple Fibre market with 46.8% share.

In 2024, Asia-Pacific emerged as the leading region in the Polyester Staple Fibre (PSF) market, accounting for 46.8% of the global share, with a total market value of USD 14.8 billion. The region’s dominance is primarily driven by its strong textile manufacturing base, large population, and expanding consumer demand for affordable synthetic fibres. Countries like China, India, and Bangladesh are key contributors, supported by well-established supply chains and robust export capabilities.

North America also holds a notable position in the PSF market, driven by demand from the automotive, home furnishings, and apparel sectors. Europe, meanwhile, reflects steady growth with the presence of advanced textile processing technologies and increasing focus on fibre quality and performance. The Middle East & Africa region is showing gradual progress, driven by growing investments in textile production and industrial fabrics.

Latin America remains a smaller but developing market, with demand largely centred around domestic textile consumption and urban lifestyle changes. Across all these regions, the role of PSF remains central to meeting the growing need for cost-effective, durable, and versatile fibre solutions. However, it is Asia-Pacific’s manufacturing scale and export strength that firmly places it at the forefront of the global PSF market landscape in both value and volume.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, key players in the global Polyester Staple Fibre (PSF) market demonstrated distinct competitive advantages and strategic positioning.

Bombay Dyeing leveraged its established reputation in the textile sector to strengthen its presence in PSF. With a strong domestic supply chain and diversified product portfolio, it optimized production efficiencies and maintained a competitive cost base. This allowed the company to cater effectively to garment manufacturers, home textiles producers, and non-woven fabric sectors.

China Petrochemical Corporation, a major player in petrochemicals, utilized its large-scale integration across feedstock, fibre production, and downstream processing to drive value creation. Its ability to source raw materials internally enabled cost control and production scalability. By focusing on process optimization and capacity expansion, the company achieved significant economies of scale. This strategic advantage translated into greater resilience amid fluctuating petroleum prices and raw material supply chain disruptions. In addition, its global reach facilitated access to international markets, bolstering its role in the PSF supply chain.

Indorama Ventures Public Company Limited maintained a strong position through its focus on forward integration and sustainable practices. The company’s initiatives in recycled polyester staple fibre underscored its commitment to environmental responsibility. By investing in recycling technologies and closed-loop production systems, Indorama advanced its green credentials while tapping into the growing demand for eco-friendly fibres.

Top Key Players in the Market

- Alpek S.A.B. de C.V.

- Bombay Dyeing

- China Petrochemical Corporation

- Indorama Ventures Public Company Limited.

- Reliance Industries Limited.

- TORAY INDUSTRIES, INC.

- Tongkun Holding Group

- Shenghonggroup.cn (Shenghong)

- Xin Feng Ming Group

- XINDA Corp

- Barnet GmbH & Co. KG

- Far Eastern New Century

- Ganesha Ecosphere

- Indorama Ventures

- Jiangsu Sanfangxiang Group Co., Ltd.

- Komal Fibres

Recent Developments

- In June 2025, Toray introduced Toray Cetex® TC1130 PESU, a new thermoplastic composite material aimed at lightweight aircraft interiors. Designed for automotive use, this PESU-based composite highlights the company’s focus on high-performance and specialised fibre solutions. This innovation underscores Toray’s efforts to extend its expertise across advanced materials and polyester derivatives .

- In July 2024, Indorama joined a consortium across five countries to create the world’s first CO₂-derived and bio-based polyester fibre supply chain. The initiative brings together seven companies—including Goldwin and Mitsubishi—to produce sustainable PSF for The North Face in Japan using renewable feedstocks and carbon capture materials.

Report Scope

Report Features Description Market Value (2024) USD 31.7 Billion Forecast Revenue (2034) USD 51.6 Billion CAGR (2025-2034) 5.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Solid, Hollow), By Origin (Virgin, Recycled, Blended), By Application (Apparel, Automotive, Home Furnishing, Filtration, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alpek S.A.B. de C.V., Bombay Dyeing, China Petrochemical Corporation, Indorama Ventures Public Company Limited, Reliance Industries Limited, TORAY INDUSTRIES, INC., Tongkun Holding Group, Shenghong Group.cn (Shenghong), Xin Feng Ming Group, XINDA Corp, Barnet GmbH & Co. KG, Far Eastern New Century, Ganesha Ecosphere, Indorama Ventures, Jiangsu Sanfangxiang Group Co., Ltd., Komal Fibres Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polyester Staple Fibre MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Polyester Staple Fibre MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Alpek S.A.B. de C.V.

- Bombay Dyeing

- China Petrochemical Corporation

- Indorama Ventures Public Company Limited.

- Reliance Industries Limited.

- TORAY INDUSTRIES, INC.

- Tongkun Holding Group

- Shenghonggroup.cn (Shenghong)

- Xin Feng Ming Group

- XINDA Corp

- Barnet GmbH & Co. KG

- Far Eastern New Century

- Ganesha Ecosphere

- Indorama Ventures

- Jiangsu Sanfangxiang Group Co., Ltd.

- Komal Fibres