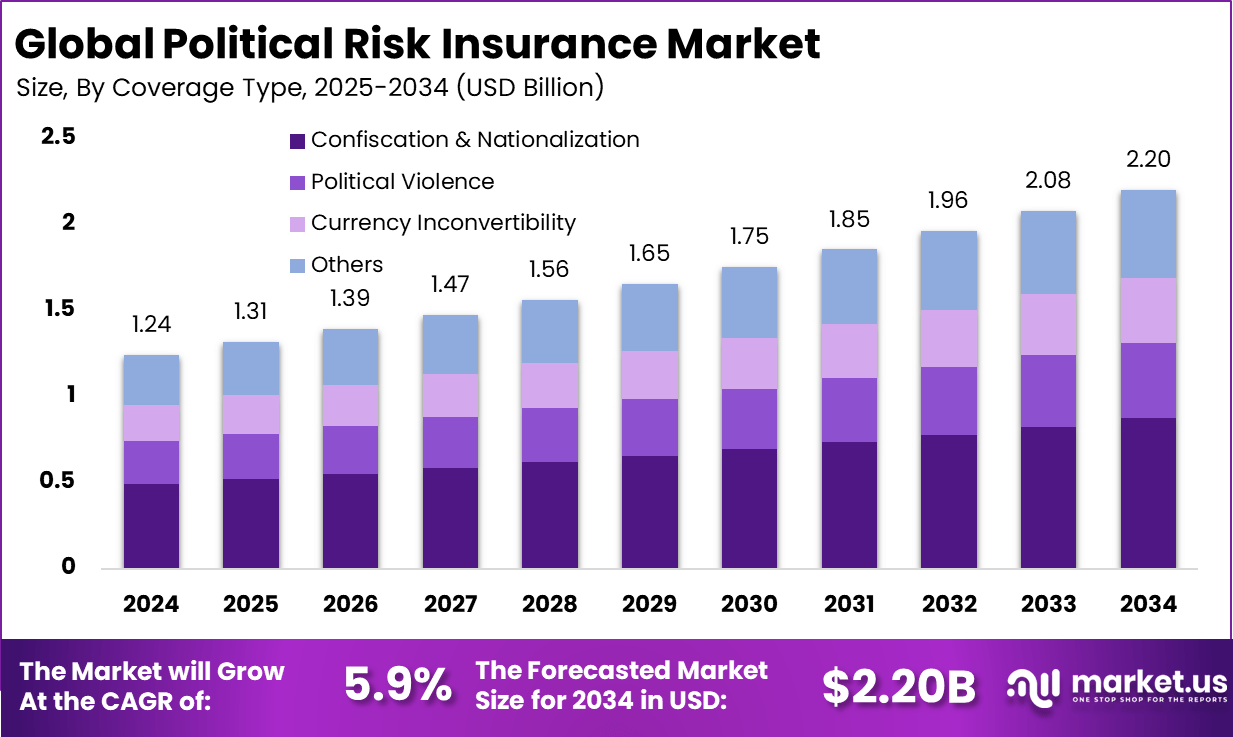

Global Political Risk Insurance Market Size, Share, Industry Analysis Report By Coverage Type (Confiscation & Nationalization, Political Violence, Currency Inconvertibility, Others), By End-User (Multinational Corporations, Financial Institutions, Exporters & Importers, Project Developers, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 167280

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

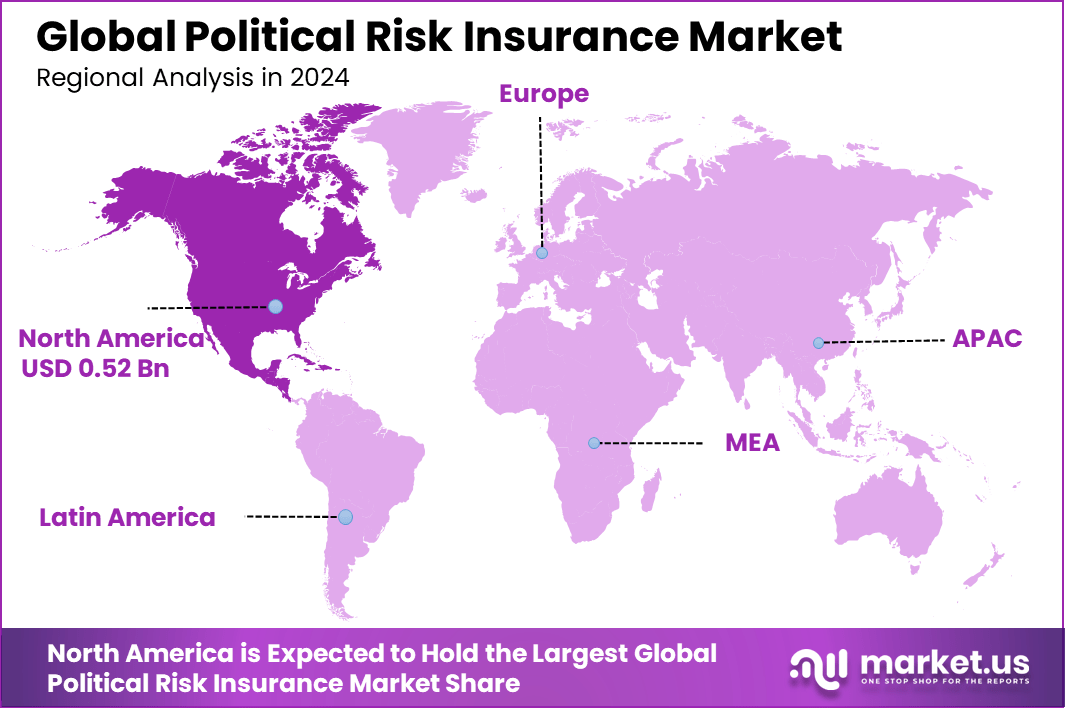

The Global Political Risk Insurance Market size is expected to be worth around USD 2.20 billion by 2034, from USD 1.24 billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42% share, holding USD 0.52 billion in revenue.

Political Risk Insurance (PRI) is protection that businesses and investors buy to shield themselves against losses caused by disruptions from political events. These events can include things like government actions that block money transfers, expropriation (taking of assets without fair compensation), political violence, war, or sudden changes in regulations. The main goal is to help firms operate confidently in countries where political conditions might create financial uncertainty or risks to investment.

Top driving factors for the PRI market include rising geopolitical tensions, increasing nationalism, and macroeconomic uncertainties globally. There has been a recorded 33% increase in demand for political risk insurance recently due to these factors. The growing volatility in global politics, coupled with competition for critical resources, pushes businesses to seek protection through PRI.

The market for Political Risk Insurance is driven by the increasing need for businesses to protect their investments in unstable political environments. As companies expand globally, especially into emerging markets, they face risks such as political violence, expropriation, and currency restrictions. This has heightened demand for insurance solutions that provide financial security against these unpredictable events.

For instance, in April 2025, Willis Towers Watson (WTW) reported increased appetite for longer-term political risk insurance tenors, reflecting strong market capacity growth for up to 20-year coverage. This signals North America’s robust dominance and innovation in political risk solutions as companies seek to hedge against government interference and geopolitical uncertainties.

Key Takeaway

- The Confiscation & Nationalization segment accounted for 39.6% of the Global Political Risk Insurance Market in 2024.

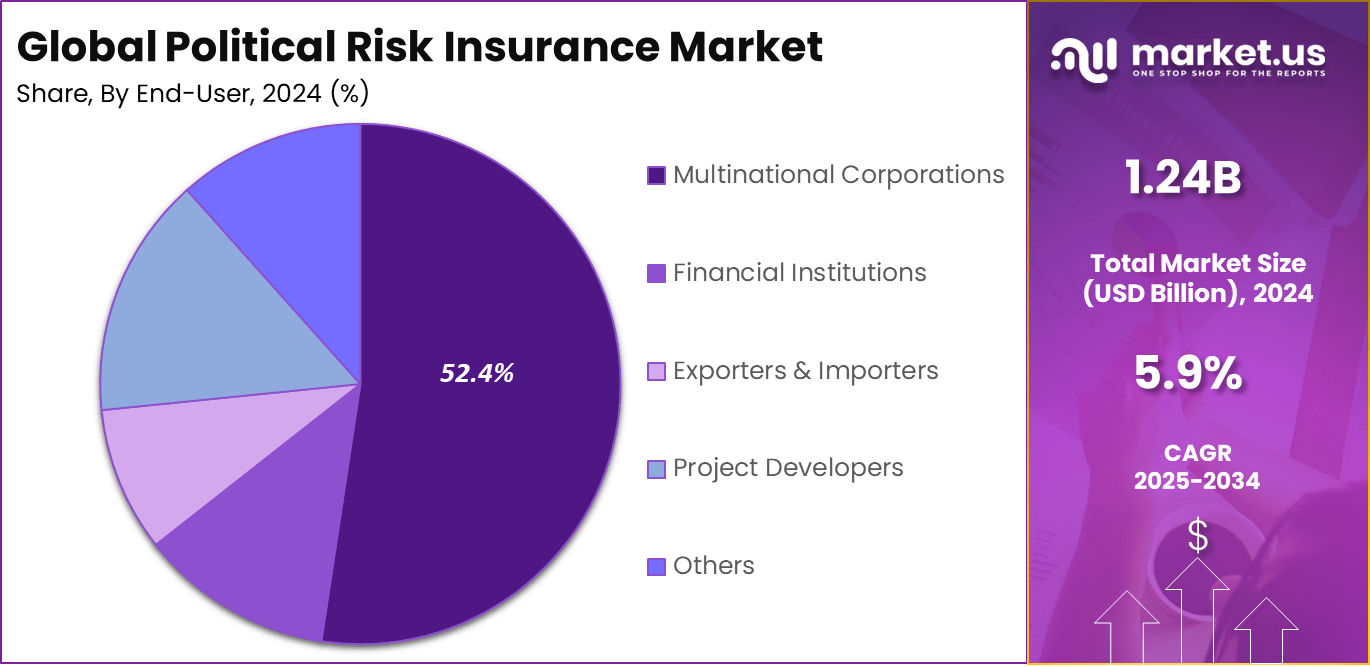

- The Multinational Corporations segment held 52.4% of the global market in 2024.

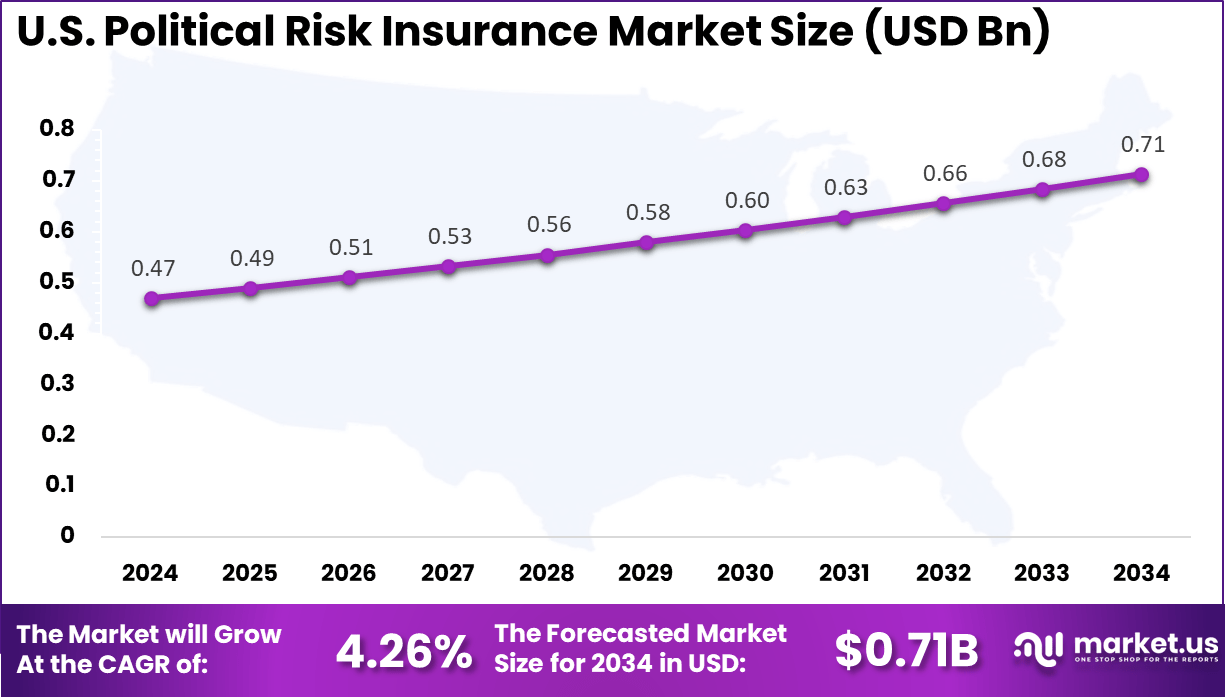

- The U.S. Political Risk Insurance Market reached USD 0.47 Billion in 2024 with a 4.26% CAGR.

- North America led the global market in 2024 with a 42% share.

Adoption Rates

Growing Concern and Demand

- Political risk has become a major enterprise concern, with 74% of globalized companies listing it among their top five risks in 2025 surveys.

- Thirty percent of business leaders identified political risk as their biggest threat in 2024.

- Demand for political risk cover is expected to rise by 33% as trade uncertainty and geopolitical instability continue.

High Incidence of Loss

- About 70% of surveyed companies in 2024 reported losses linked to geopolitical supply chain disruptions, including attacks on shipping routes.

- Insurance protection remains extremely limited, illustrated by the aftermath of the Russia–Ukraine conflict where only 1% of an estimated $130 billion in infrastructure damage was insured.

Barriers to Adoption

- Only around 10% of buyers who request private market quotes ultimately purchase coverage.

- Barriers include high premiums, complex policy terms, and reliance on alternative risk mitigation approaches such as direct government engagement or gradual investment strategies.

Providers and Market Share

- Export Credit Agencies (ECAs) dominate the sector, providing 78% of all political risk insurance issued over the past decade.

- Private insurers hold a 15% market share, reflecting their smaller but growing presence.

- Multilateral institutions such as MIGA contribute the remaining 7%.

- The top five firms among contributing banks account for 51% of total reported insured exposure.

Role of Generative AI

Generative AI is reshaping how political risk insurance operates by improving risk assessment and underwriting processes. It analyzes massive datasets to detect emerging risks and anomalies in real time, enabling faster and more accurate decision-making. This technology also automates policy generation and regulatory compliance, reducing manual errors and costs.

One insight reveals that generative AI speeds up tasks such as claims processing and risk modeling, allowing insurers to better predict changes in political risk and adjust strategies proactively. By automating data analysis, AI helps insurers manage risks with greater precision while enhancing customer service and retention efforts.

The adoption of generative AI in insurance is growing rapidly, providing a competitive edge through improved efficiency and insights. About 30% of insurance processes now incorporate AI-driven analytics, which has led to a measurable reduction in underwriting time and better fraud detection. These capabilities allow political risk insurers to stay ahead of evolving geopolitical threats, safeguard investments, and fine-tune premium pricing more dynamically.

U.S. Market Size

The market for Political Risk Insurance within the U.S. is growing tremendously and is currently valued at USD 0.47 billion, the market has a projected CAGR of 4.26%. The political risk insurance market in the U.S. is experiencing strong growth, supported by increasing demand from businesses seeking protection against political uncertainties abroad.

Companies are expanding their global operations, facing risks such as government actions, political violence, and contract disruptions. This drives the need for insurance coverage to manage financial losses from such events. Additionally, ongoing geopolitical tensions and regulatory changes are prompting firms to adopt risk mitigation strategies, making political risk insurance an essential tool for safeguarding international investments.

For instance, in November 2025, AIG (American International Group) reported excellent third-quarter results and announced a long-term strategic investment in top-performing global specialty operations, strengthening its political risk insurance capabilities to address evolving geopolitical risks faced by clients globally.

In 2024, North America held a dominant market position in the Global Political Risk Insurance Market, capturing more than a 42% share, holding USD 0.52 billion in revenue. This dominance stems from a well-established insurance infrastructure in the United States, which makes up the majority of the region’s market.

The U.S. market benefits from strong demand by companies protecting themselves against growing geopolitical tensions, trade uncertainties, and the expansion of global supply chains. The region’s leadership is also supported by advanced risk management practices and regulatory support that encourage the adoption of political risk insurance.

For instance, in October 2025, Marsh highlighted its global political risk team’s role in providing specialized advice and tailored insurance coverage to help companies mitigate losses from political instability, supporting U.S. and North American businesses in managing international exposures.

Coverage Type Analysis

In 2024, the Confiscation & Nationalization segment held a dominant market position, capturing a 39.6% share of the Global Political Risk Insurance Market. This type of insurance protects businesses and investors against losses resulting from government actions that seize or nationalize assets without fair compensation.

It is crucial for companies operating in regions where political instability or changes in government policy may lead to the abrupt takeover of assets. This coverage offers peace of mind by mitigating the financial impact of sudden political decisions that can disrupt operations or investments. As political environments fluctuate worldwide, this protection remains a cornerstone for businesses seeking security in uncertain territories.

For Instance, in October 2025, AXA XL provides tailored political risk insurance, including coverage for confiscation, expropriation, and nationalization. Their product helps corporations secure assets overseas against these risks and protect payment flows.

End-User Analysis

In 2024, the Multinational Corporations segment held a dominant market position, capturing a 52.4% share of the Global Political Risk Insurance Market. Multinational corporations represent the largest group of users for political risk insurance, as they make up over half of the market demand. These companies often operate globally and face a wide range of political risks in different countries.

Political risk insurance provides these corporations with confidence to expand internationally. It safeguards important contracts and assets by transferring the potential risk of loss due to unstable political environments to insurers, allowing them to focus on growth without excessive exposure to political uncertainty.

For instance, in May 2025, IBM was recognized as a market leader in insurance services, embracing AI and data analytics to help insurers and large multinational corporations better manage risk, including political risks in global operations.

Emerging Trends

The political risk insurance market is evolving to cover new kinds of risks linked to geopolitical instability and emerging technologies. The industry is developing products addressing risks from cyber threats, AI misuse, and supply chain vulnerabilities. More than 70% of corporates now view political risk as a permanent part of doing business, driving demand for PRI products that address broader economic and geopolitical uncertainty beyond traditional definitions.

Another key trend is the growing integration of PRI with legal and trade frameworks to provide comprehensive protection. Investment treaties and international agreements increasingly complement PRI products to offer investors both financial and legal risk mitigation. This combined approach enhances political risk hedging and supports sustained investment flows into unstable or emerging markets. It reflects heightened awareness of the complexity and interconnection of investment risks in a globalized economy.

Growth Factors

Growth in political risk insurance is largely driven by increasing geopolitical tensions and the globalization of businesses. As companies venture into foreign markets with unstable political environments, the need to mitigate risks linked to government actions, currency controls, and political violence becomes vital.

Recent data shows that sectors such as manufacturing, infrastructure, and natural resources are among the largest beneficiaries of political risk coverage, accounting for significant portions of insured investments. The rise in political uncertainty following global events has also pushed more companies toward political risk insurance for protection.

Businesses now recognize the value of having insurance that can cover losses from sudden political upheavals or regulatory changes. Innovations in policy design and more tailored coverage help maintain this growth by meeting the specific and evolving needs of investors in a complex global environment.

Investment and Business Benefits

Political risk insurance offers promising opportunities for investors and insurers due to growing global instability. New markets and emerging economies present an expanding need for PRI products, especially in infrastructure, energy, natural resources, and manufacturing sectors.

Insurers are also exploring innovative products that cover a broader array of risks and longer policy durations, creating space for new market entrants and portfolio diversification. The dynamic geopolitical environment fuels demand for tailored PRI solutions, making it an attractive area for investment expansion.

PRI delivers clear business advantages by providing financial protection that helps companies sustain operations amid political turmoil. It lowers the cost of capital in higher-risk countries by reducing the risk premium lenders and investors face.

Companies with PRI often see lower average losses and improved risk management outcomes compared to uninsured peers. PRI also supports strategic decision-making by enabling firms to plan for the long term with greater confidence, fostering resilience and competitive advantage in complex international markets.

Key Market Segments

By Coverage Type

- Confiscation & Nationalization

- Political Violence

- Currency Inconvertibility

- Others

By End-User

- Multinational Corporations

- Financial Institutions

- Exporters & Importers

- Project Developers

- Others

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

Growing Global Business Risks

The rise in global business operations, especially in emerging markets, has driven the demand for political risk insurance. Companies investing internationally face threats like political violence, expropriation, and currency restrictions. As businesses expand across borders, they seek PRI to protect their investments against unpredictable political events, increasing market growth.

Additionally, rising geopolitical tensions and protectionism have heightened awareness of political risks. This environment pushes firms to prioritize risk management through insurance, boosting the adoption of political risk insurance solutions globally. This demand trend is especially strong amid current geopolitical uncertainties and trade tensions.

For instance, in June 2025, Lloyd’s announced a substantial increase in political and financial risk line sizes by 50%, raising coverage capacity from $20 million to $30 million to meet growing market demand. This move highlights how rising global business risks and geopolitical tensions are driving capacity expansion to support customers needing more robust political risk coverage. Lloyd’s initiative reflects the increasing demand for protection in volatile international markets.

Restraint

High Cost and Limited Accessibility

One major restraint for the political risk insurance market is its high cost, which can deter smaller businesses from purchasing coverage. Premiums are often steep due to the complexity and uncertainty of political risks, making it an expensive risk-transfer option.

Moreover, political risk insurance is not widely accessible in all countries. Some regions with significant risks face limited insurance availability or coverage limits, restricting the market’s reach. This uneven service landscape challenges the broader expansion of PRI despite growing demand.

For instance, in October 2025, Willis Towers Watson’s 2025 survey pointed to capacity challenges for longer-term political risk insurance tenors, with appetite reducing in 2024 but partially returning in 2025. The limited insurance availability for extended periods highlights cost and service accessibility issues that constrain market growth.

Opportunities

Expansion into New Markets and Assets

The political risk insurance market has a strong opportunity to grow by entering untapped regions and exploring new asset classes. Emerging economies with rising foreign direct investments represent fertile ground for PRI providers to develop tailored products.

Increased innovation in risk modeling and underwriting also enables insurers to expand their offerings. As global trade evolves, insurers can meet the needs of clients operating in newer markets with diverse political risk profiles, creating sustained growth opportunities for the market.

For instance, in October 2025, AXA XL emphasized its global political risk and credit insurance products that cover diverse risks, including expropriation, political violence, and contract frustration. Their broad offering targets corporations, financial institutions, and developmental agencies worldwide, clearly focusing on expanding into new regions and asset classes. This exemplifies how PRI providers are seizing opportunities for growth by innovating and tailoring policies for emerging market needs.

Challenges

Political Instability and Market Volatility

The unpredictable nature of political instability creates a significant challenge for the PRI market. Sudden changes like coups, escalating conflicts, or government policy shifts can result in increased claims and loss exposure for insurers.

Furthermore, the market faces difficulty in pricing risk accurately due to volatile geopolitical conditions, making underwriting riskier. This uncertainty can reduce insurers’ willingness to provide coverage or restrict limits, limiting market capacity and product availability.

For instance, in October 2024, Allianz reported that political risks and violence were rising due to election instability, civil unrest, and conflicts in regions like Ukraine and the Middle East. The report noted that this volatility makes it harder for businesses to manage risk and for insurers to price exposure accurately.

Key Players Analysis

Lloyd’s of London, AIG, Zurich, Chubb, and AXA XL lead the political risk insurance market with strong underwriting expertise and global risk-assessment capabilities. Their solutions cover risks related to expropriation, contract frustration, currency inconvertibility, and political violence. These companies support multinational corporations, lenders, and investors operating in high-risk regions.

Allianz, Berkshire Hathaway, Marsh, Willis Towers Watson, and Aon strengthen the competitive environment through advisory-driven political risk solutions and comprehensive brokerage services. Their offerings integrate scenario modeling, country-risk ratings, and tailored coverage structures. These providers help clients navigate regulatory uncertainty, supply-chain disruptions, and government-related interruptions.

Sompo International, Liberty Mutual, Travelers, Swiss Re, Munich Re, and other participants expand the market with specialized reinsurance capacity and risk-transfer products. Their solutions enhance resilience for global businesses exposed to emerging-market volatility. These companies focus on long-term stability, diversified portfolios, and innovative coverage formats.

Top Key Players in the Market

- Lloyd’s of London

- AIG

- Zurich Insurance Group

- Chubb

- AXA XL

- Allianz

- Berkshire Hathaway

- Marsh

- Willis Towers Watson

- Aon

- Sompo International

- Liberty Mutual

- Travelers

- Swiss Re

- Munich Re

- Others

Recent Developments

- In October 2025, AXA XL highlighted its tailored political risk insurance solutions with coverage up to 20 years per policy. They offer protection against confiscation, expropriation, political violence, and credit risks, emphasizing strong financial backing from high credit ratings.

- In February 2025, Allianz Trade reported renewed concerns about trade wars and rising political polarization that impact investment risk globally. Their Country Risk Atlas showed increased risk ratings for many countries, emphasizing the growing importance of political risk insurance.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 2.2 Bn CAGR(2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Confiscation & Nationalization, Political Violence, Currency Inconvertibility, Others), By End-User (Multinational Corporations, Financial Institutions, Exporters & Importers, Project Developers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lloyds of London, AIG, Zurich Insurance Group, Chubb, AXA XL, Allianz, Berkshire Hathaway, Marsh, Willis Towers Watson, Aon, Sompo International, Liberty Mutual, Travelers, Swiss Re, Munich Re, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Political Risk Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Political Risk Insurance MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Lloyd's of London

- AIG

- Zurich Insurance Group

- Chubb

- AXA XL

- Allianz

- Berkshire Hathaway

- Marsh

- Willis Towers Watson

- Aon

- Sompo International

- Liberty Mutual

- Travelers

- Swiss Re

- Munich Re

- Others