Global Polishing/Lapping Film Market Size, Share, And Business Benefit By Types (Stretch Film, Metallized Film, Adhesive Film, Shrink Film), By Raw Material (Poly Vinyl Chloride, Polyamide, PE, LLDPE, Laminated Materials), By Application (Packaging Film, Food and Medicine Film, Cling Film, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162739

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

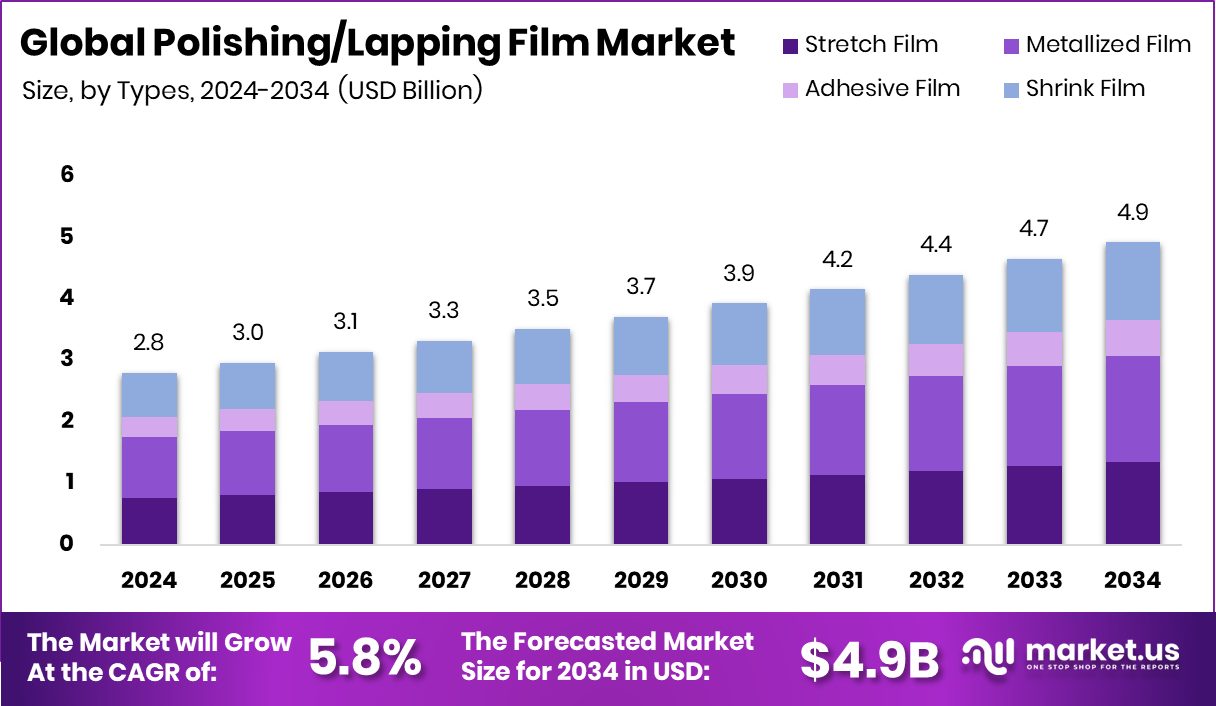

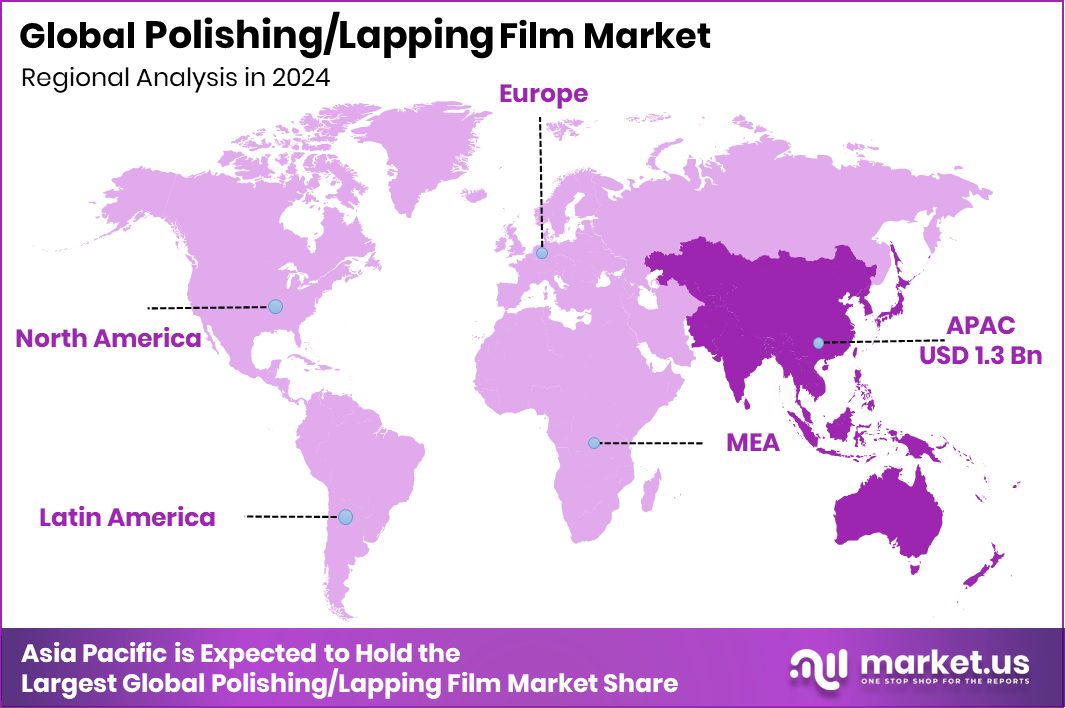

The Global Polishing/Lapping Film Market is expected to be worth around USD 4.9 billion by 2034, up from USD 2.8 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034. Asia-Pacific accounted for a 48.30% share, reaching a market value of USD 1.3 Bn.

Polishing or lapping film is a precision abrasive material used to achieve high surface smoothness on metals, semiconductors, glass, fiber optics, and ceramics. These films are coated with micro-graded abrasives like aluminum oxide, silicon carbide, or diamond, ensuring consistent removal rates and minimal surface damage. They are vital in industries requiring tight dimensional accuracy, such as electronics, optics, and automotive finishing. Their flexible backing and uniform grit distribution make them ideal for both manual and machine-assisted polishing operations.

The Polishing/Lapping Film Market is witnessing steady expansion driven by its widespread use in electronics, fiber optics, and advanced manufacturing. Growing semiconductor production and precision engineering needs are key drivers. Technological innovations enhancing abrasive uniformity and product durability are improving polishing efficiency. The market also benefits from rapid adoption in aerospace, medical devices, and optical lens fabrication, where high surface quality is critical.

Increasing demand for precision polishing in semiconductor wafer fabrication and electronic components is a major growth factor. The miniaturization trend in electronics requires ultra-smooth surfaces, elevating the role of lapping films. Holdson’s £1.5 million investment in specialist polishing technology underlines market advancement. Similarly, ChEmpower’s $18.7 million funding for microchip polishing tech strengthens innovation and supports high-performance production systems.

Demand is rising due to rapid industrial automation and the surge in microelectronic manufacturing. The shift toward smaller, more complex components in data storage, sensors, and chips requires controlled surface finishing. Holdson securing £1.5 M to scale electroform polishing technology showcases how industry players are enhancing manufacturing precision, reducing defects, and boosting yield rates in critical production environments.

Opportunities lie in sustainable and precision-based manufacturing processes where surface perfection is essential. The integration of advanced materials and smart abrasives opens new frontiers for high-value industries like optics and photonics. Supported by regional funding such as the Northern Powerhouse Investment Fund, companies are expanding, polishing capabilities, and fostering innovations that align with cleaner, more efficient production standards.

Key Takeaways

- The Global Polishing/Lapping Film Market is expected to be worth around USD 4.9 billion by 2034, up from USD 2.8 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In 2024, the Stretch Film segment held a 27.4% share in the Polishing/Lapping Film Market.

- The LLDPE segment accounted for a 28.8% share in the Polishing/Lapping Film Market in 2024.

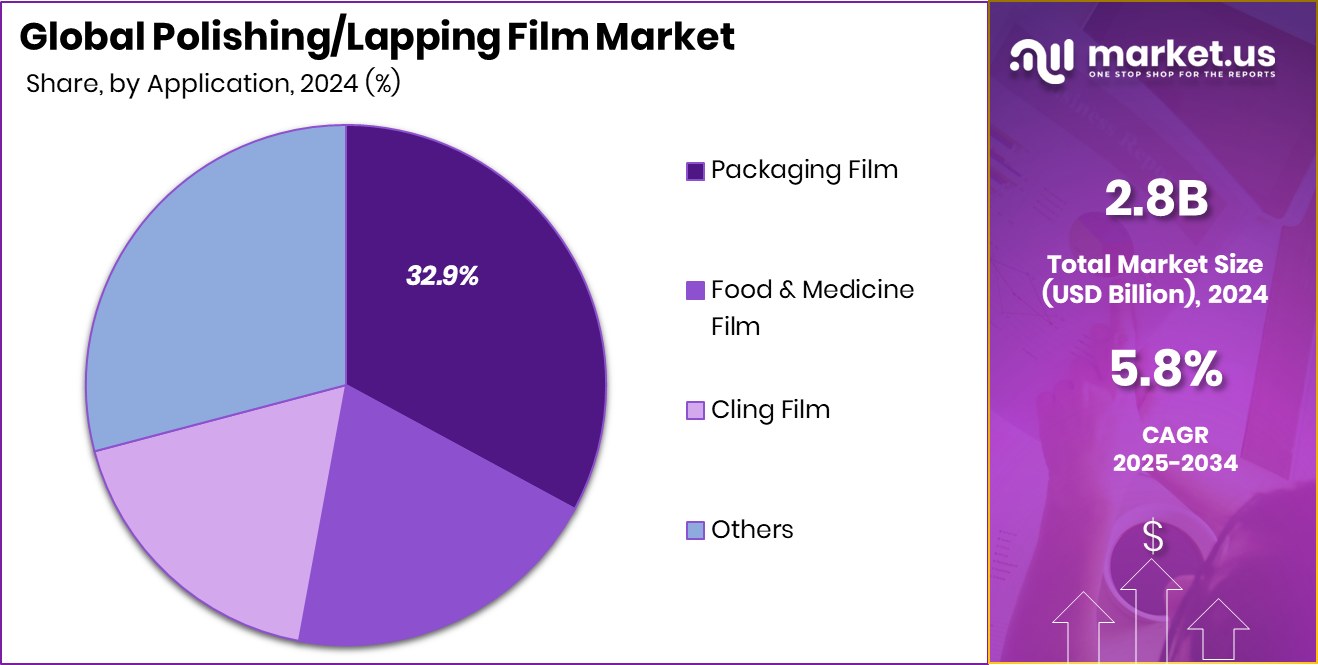

- In 2024, the Packaging Film segment dominated with a 32.9% share in the Polishing/Lapping Film Market.

- The Asia-Pacific region, worth USD 1.3 Bn, dominated with a strong 48.30% share.

By Types Analysis

In 2024, Stretch Film dominated the Polishing/Lapping Film Market with a 27.4% share.

In 2024, Stretch Film held a dominant market position in the By Types segment of the Polishing/Lapping Film Market, with a 27.4% share. This dominance reflects its extensive use in precision surface finishing applications where flexibility, consistent film thickness, and fine abrasive uniformity are critical.

Stretch films are widely preferred for polishing metal surfaces, semiconductor wafers, and optical components due to their superior adaptability and high material removal accuracy. Their capability to conform to complex geometries while maintaining stable surface quality enhances productivity and reduces processing time.

The consistent performance and ease of handling of stretch films have made them a preferred choice in precision engineering and microfabrication processes, sustaining their leading market position.

By Raw Material Analysis

LLDPE held a 28.8% share in the Polishing/Lapping Film Market.

In 2024, LLDPE held a dominant market position in the By Raw Material segment of the Polishing/Lapping Film Market, with a 28.8% share. This dominance is attributed to its excellent flexibility, strength, and resistance to tearing during precision polishing applications.

LLDPE-based films provide uniform surface tension and durability, ensuring stable performance in high-precision environments such as electronics, optics, and metal finishing. Their superior adaptability to varied substrates and compatibility with different abrasive coatings enhance overall polishing efficiency.

The growing preference for LLDPE in advanced manufacturing processes is driven by its balance of mechanical strength and smoothness, making it ideal for achieving consistent surface finishes across delicate and complex components.

By Application Analysis

Packaging Film led the Polishing/Lapping Film Market with 32.9% share.

In 2024, Packaging Film held a dominant market position in the By Application segment of the Polishing/Lapping Film Market, with a 32.9% share. This strong position reflects its widespread utilization in protective wrapping and precision packaging of high-value components after polishing operations.

Packaging films offer excellent surface protection, ensuring finished products maintain their refined texture and appearance during storage or transport. Their ability to resist abrasion, moisture, and contamination makes them ideal for safeguarding sensitive materials in electronics, optics, and precision machinery.

The consistent adoption of packaging films in surface finishing processes highlights their role in maintaining quality standards and enhancing the durability of polished components across diverse industrial applications.

Key Market Segments

By Types

- Stretch Film

- Metallized Film

- Adhesive Film

- Shrink Film

By Raw Material

- Poly Vinyl Chloride

- Polyamide

- PE

- LLDPE

- Laminated Materials

By Application

- Packaging Film

- Food and Medicine Film

- Cling Film

- Others

Driving Factors

Rising Precision Demand Fuels Market Expansion

The Polishing/Lapping Film Market is growing as industries demand smoother and more accurate surface finishes. These films are vital for electronics, semiconductors, and optics, where even tiny imperfections affect performance. The push toward miniaturized and high-performance components has made precision finishing more critical than ever. Moreover, increased investments are supporting this growth. Rhône wrapping up its sixth fund at $2.4 billion highlights expanding private capital interest in advanced manufacturing technologies.

Similarly, Iowa Public Media’s seeking $3 million in funding amid budget cuts reflects the broader trend of organizations prioritizing funding for technological modernization and efficiency improvements. Together, such financial movements indirectly support growth in precision processing industries relying on polishing and lapping films for quality consistency.

Restraining Factors

High Production Cost Limits Market Expansion

One major restraining factor in the Polishing/Lapping Film Market is the high cost of raw materials and production processes. Achieving consistent surface uniformity requires premium abrasives and precision coating technologies, both of which increase manufacturing expenses. The complexity of producing films that meet demanding industrial standards makes large-scale production challenging for smaller firms.

Additionally, fluctuations in polymer and abrasive material prices affect profit margins. This cost sensitivity often discourages adoption in cost-focused industries. Meanwhile, industrial investment continues in certain regions—Scientex investing US$25 million to set up a stretch film plant in the US shows manufacturers are trying to localize production and reduce costs, though such investments highlight how capital intensity remains a major market restraint.

Growth Opportunity

Eco-Friendly Innovation Creates New Market Opportunities

A major growth opportunity in the Polishing/Lapping Film Market lies in developing sustainable and biodegradable films. With industries shifting toward greener solutions, demand for eco-friendly materials is rising sharply. Manufacturers are exploring bio-based polymers and recyclable abrasives to minimize waste and meet global environmental goals. The movement away from petroleum-based products is accelerating innovation in film manufacturing.

Recent initiatives reflect this change—a Victorian couple raised $24 million to tackle plastic waste, and Great Wrap also raised $24 million to develop biodegradable stretch wrap. Such efforts showcase strong investor confidence in sustainable materials. This momentum is opening doors for polishing and lapping film producers to adopt similar green technologies, driving future growth through environmentally responsible innovation.

Latest Trends

Sustainable Materials Transforming Surface Finishing Trends

A key trend shaping the Polishing/Lapping Film Market is the shift toward sustainable and recycled materials. Manufacturers are increasingly adopting eco-friendly raw materials and production processes to meet growing environmental standards. The development of films using post-consumer recycled (PCR) content and biodegradable polymers is gaining strong momentum. For example, Trioplast launched a machine stretch film with more than 50% PCR, showcasing the industry’s commitment to circular solutions.

Similarly, Great Wrap closed its Series A funding round with sustainability investors, achieving a $24 million raise, highlighting financial support for green innovation. These advancements reflect how sustainability, recyclability, and carbon reduction are becoming central themes in the evolution of polishing and lapping film technologies globally.

Regional Analysis

In 2024, Asia-Pacific held a 48.30% share, valued at USD 1.3 Bn overall.

In 2024, the Asia-Pacific region dominated the Polishing/Lapping Film Market with a 48.30 % share, valued at USD 1.3 billion. The region’s growth is supported by rapid industrialization, expanding semiconductor manufacturing, and increased adoption of precision polishing in electronics and optics.

North America shows steady growth, driven by technological advancement in surface finishing and strong demand across the aerospace and medical industries. Europe maintains a stable share, supported by precision machining and automotive component production.

The Middle East & Africa region is gradually developing, with industrial modernization projects creating demand for precision polishing materials. Latin America displays moderate growth, mainly in electronics assembly and metal fabrication. Asia-Pacific’s manufacturing strength and expanding production capacities continue to secure its leading market position globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Diagrind, Mipox, and Okamoto Machine Tool Works played significant roles in shaping the global Polishing/Lapping Film Market through product innovation and manufacturing precision.

Diagrind continued strengthening its position by focusing on high-quality abrasive technologies designed for accuracy in fine finishing applications. Its expertise in micro-grinding and polishing solutions supports industries requiring tight dimensional control and superior surface finishes.

Mipox emphasized its technological capabilities in developing advanced polishing films with consistent abrasive distribution, serving electronics, optical, and semiconductor applications where surface quality is critical. The company’s focus on performance improvement and sustainability aligns with modern precision manufacturing demands.

Okamoto Machine Tool Works leveraged its engineering excellence to enhance polishing efficiency and process stability. The firm’s integration of precision equipment with lapping films underscores its strong commitment to surface perfection, further reinforcing its reputation in global precision engineering sectors.

Top Key Players in the Market

- Diagrind

- Mipox

- Okamoto Machine Tool Works

- 3M

- Saint-Gobain

- Strasbaugh

- Sak Industries

- Naniwa

- Tokyo Diamond

Recent Developments

- In June 2024, Mipox completed a polishing test on 8-inch silicon carbide (SiC) wafers using its specialised polishing film method. The test targeted edge and notch chamfering on SiC wafers, achieving improved chamfer quality and efficient processing.

- In December 2024, 3M announced a collaboration with US Conec to expand optical interconnect technology for data centers. While not strictly a polishing/lapping film launch, this move underscores their investment in high-precision finishing and connectivity components.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Billion Forecast Revenue (2034) USD 4.9 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Types (Stretch Film, Metallized Film, Adhesive Film, Shrink Film), By Raw Material (Poly Vinyl Chloride, Polyamide, PE, LLDPE, Laminated Materials), By Application (Packaging Film, Food and Medicine Film, Cling Film, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Diagrind, Mipox, Okamoto Machine Tool Works, 3M, Saint-Gobain, Strasbaugh, Sak Industries, Naniwa, Tokyo Diamond Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Polishing/Lapping Film MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample

Polishing/Lapping Film MarketPublished date: October 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Diagrind

- Mipox

- Okamoto Machine Tool Works

- 3M

- Saint-Gobain

- Strasbaugh

- Sak Industries

- Naniwa

- Tokyo Diamond