Pneumonia Diagnostics Market By Product Type (Instruments and Reagents & Consumables), By Technology (Streptococcus Based, Viral Pneumonia Based, Mycoplasma Pneumonia Based, Legionella Based, and Chlamydophilla Based), By End-user (Hospitals & Clinics, Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164091

- Number of Pages: 327

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

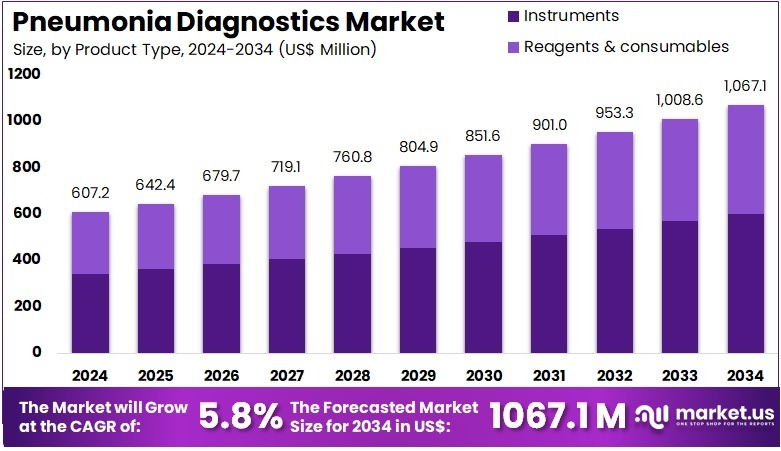

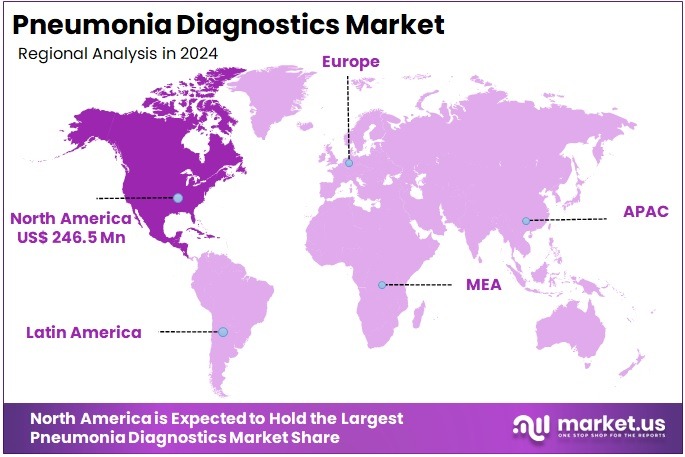

The Pneumonia Diagnostics Market size is expected to be worth around US$ 1067.1 million by 2034 from US$ 607.2 million in 2024, growing at a CAGR of 5.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 40.6% share and holds US$ 246.5 Million market value for the year.

Increasing adoption of multiplex PCR panels drives the Pneumonia Diagnostics Market, as clinicians require comprehensive pathogen identification for targeted therapy. Emergency departments utilize these assays to detect bacterial, viral, and atypical organisms in sputum samples from community-acquired pneumonia cases. These diagnostics support intensive care by guiding antimicrobial stewardship in ventilator-associated pneumonia, reducing broad-spectrum antibiotic overuse.

Research laboratories apply them to differentiate etiologies in immunocompromised patients, informing prophylactic strategies. In October 2025, bioMérieux introduced its WATCHFIRE™ Respiratory (R) Panel, detecting 22 pathogens via the BIOFIRE® platform, reinforcing multiplex PCR leadership in clinical pneumonia diagnostics. This launch accelerates market growth by enhancing rapid, syndromic testing capabilities.

Growing infrastructure investments create opportunities in the Pneumonia Diagnostics Market, as expanded healthcare access broadens diagnostic deployment. Hospitals integrate point-of-care lateral flow assays for Streptococcus pneumoniae antigen in urine, enabling bedside decisions in resource-constrained settings. These tools aid pediatric diagnostics by confirming Mycoplasma pneumoniae in school-age children with atypical symptoms.

Automated blood culture systems improve bacteremia detection in severe pneumonia, optimizing sepsis management protocols. In October 2025, Abbott Laboratories launched the AVEIR™ dual chamber leadless pacemaker, strengthening global medical technology infrastructure that indirectly supports advanced pneumonia diagnostics access. This expansion drives market potential through improved healthcare delivery ecosystems.

Rising demand for high-throughput viral detection propels the Pneumonia Diagnostics Market, as innovations enable precise differentiation of respiratory pathogens. Pulmonologists employ TAGS-based PCR tests to identify influenza and RSV in hospitalized adults, facilitating isolation and antiviral administration.

These assays support outbreak investigations by quantifying viral loads in nasopharyngeal swabs, tracking transmission dynamics. Trends toward flexible panel configurations allow customization for seasonal pathogen prevalence. In September 2024, F. Hoffmann-La Roche Ltd. launched the cobas Respiratory Flex Test using TAGS technology for 12 viruses, advancing early viral pneumonia diagnosis. This advancement positions the market for sustained growth through enhanced precision and efficiency in respiratory infection management.

Key Takeaways

- In 2024, the market generated a revenue of US$ 607.2 million, with a CAGR of 5.8%, and is expected to reach US$ 1067.1 million by the year 2034.

- The product type segment is divided into instruments and reagents & consumables, with instruments taking the lead in 2023 with a market share of 56.3%.

- Considering technology, the market is divided into streptococcus based, viral pneumonia based, mycoplasma pneumonia based, legionella based, and chlamydophilla based. Among these, streptococcus based held a significant share of 38.9%.

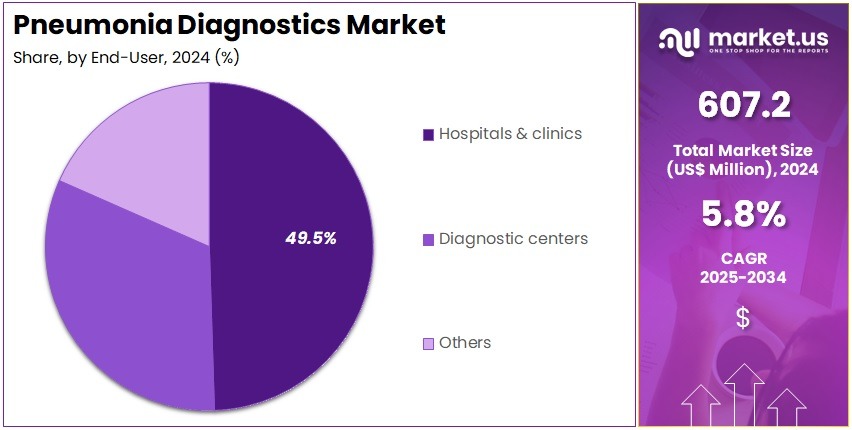

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, diagnostic centers, and others. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 49.5% in the market.

- North America led the market by securing a market share of 40.6% in 2023.

Product Type Analysis

Instruments hold 56.3% of the Pneumonia Diagnostics market and are projected to remain the largest segment due to continuous advancements in diagnostic technologies and the growing adoption of automated systems in clinical laboratories. The increasing prevalence of community-acquired and hospital-acquired pneumonia drives strong demand for reliable diagnostic equipment, including PCR analyzers, immunoassay systems, and molecular detection platforms.

The need for rapid pathogen identification and antimicrobial resistance profiling promotes the use of high-performance diagnostic instruments. Hospitals and laboratories increasingly invest in compact, user-friendly analyzers capable of detecting multiple pneumonia-causing pathogens simultaneously. Continuous R&D in point-of-care instruments enhances accessibility in resource-limited settings. Manufacturers are focusing on integrating AI-driven imaging systems and digital diagnostic platforms for real-time data analysis.

The shift toward decentralized diagnostics and increased testing capacity post-COVID-19 pandemic further strengthen the segment. Rising government initiatives to modernize hospital diagnostic infrastructure also contribute to growth. As healthcare systems prioritize faster turnaround times and higher testing accuracy, the instruments segment is anticipated to remain a cornerstone of the pneumonia diagnostics market.

Technology Analysis

Streptococcus-based testing represents 38.9% of the Pneumonia Diagnostics market and is expected to dominate due to the high global prevalence of Streptococcus pneumoniae as a leading cause of bacterial pneumonia. Increasing pneumococcal infections among children, the elderly, and immunocompromised patients drives diagnostic demand. Streptococcus pneumoniae accounts for a significant proportion of community-acquired pneumonia cases, reinforcing the need for early and accurate detection.

Laboratories and hospitals prefer rapid antigen detection tests, PCR assays, and culture-based methods for Streptococcus identification due to their proven reliability. The development of multiplex assays that differentiate pneumococcal strains enhances diagnostic precision. Growing vaccination programs against pneumococcal diseases also increase the need for confirmatory testing and surveillance.

Research initiatives focusing on antibiotic resistance monitoring among Streptococcus strains further support segment growth. Integration of molecular techniques with traditional microbiological workflows enhances clinical decision-making. As awareness and healthcare funding for respiratory disease management rise, Streptococcus-based testing remains the preferred diagnostic category for effective pneumonia treatment and public health monitoring.

End-User Analysis

Hospitals & clinics account for 49.5% of the Pneumonia Diagnostics market and are projected to dominate due to their crucial role in managing acute respiratory infections and conducting high-volume testing. Hospitals remain the primary centers for diagnosing and treating both community-acquired and nosocomial pneumonia cases. The integration of advanced diagnostic systems, including PCR, ELISA, and imaging-assisted diagnostic tools, enhances diagnostic accuracy and clinical efficiency.

Hospitals benefit from established laboratory infrastructure, skilled personnel, and access to rapid testing instruments. The increasing burden of respiratory infections among inpatients and ICU cases drives consistent testing demand. The growing elderly population and rising comorbidities such as COPD and diabetes contribute to hospital-based pneumonia screening.

Governments worldwide emphasize early diagnosis in hospitals to prevent severe complications and reduce mortality rates. The collaboration between hospitals and diagnostic manufacturers facilitates access to innovative testing platforms. As hospitals expand capacity for molecular and immunodiagnostic testing, their contribution to pneumonia diagnosis is expected to strengthen, reinforcing their position as the largest end-user segment in this market.

Key Market Segments

By Product Type

- Instruments

- Reagents & consumables

By Technology

- Streptococcus based

- Viral Pneumonia based

- Mycoplasma Pneumonia based

- Legionella based

- Chlamydophilla based

By End-user

- Hospitals & Clinics

- Diagnostic Centers

- Others

Drivers

Escalating Incidence of Pneumonia Cases is Driving the Market

The persistent increase in pneumonia cases has notably expanded the pneumonia diagnostics market, as heightened clinical urgency demands swift and accurate pathogen identification to facilitate appropriate antimicrobial therapy.

Pneumonia, encompassing bacterial, viral, and atypical etiologies, requires comprehensive testing like sputum cultures and PCR panels to differentiate causes and optimize patient outcomes. This driver is particularly acute in pediatric and elderly populations, where delayed diagnosis exacerbates morbidity, prompting widespread adoption of multiplex assays in emergency departments.

Medical institutions are bolstering diagnostic infrastructures to handle surging volumes, integrating biomarkers such as procalcitonin for severity assessment. The condition’s seasonality, intensified by respiratory viruses, further underscores the need for year-round preparedness in surveillance systems. Health organizations advocate for enhanced testing to curb antibiotic misuse, driving investments in automated platforms.

The Centers for Disease Control and Prevention reported 1.2 million emergency department visits for pneumonia due to infectious organisms as the primary diagnosis in 2022, reflecting the substantial burden on healthcare resources. This figure illustrates the diagnostic imperative, as rapid tests avert complications through targeted interventions.

Advancements in lateral flow assays improve bedside utility, managing diverse sample types. Economically, their deployment shortens hospital stays, endorsing expansions in reagent supplies. Multinational collaborations establish uniform protocols, aiding resource allocation in varied settings. This case escalation not only elevates testing frequency but also solidifies diagnostics’ integration in respiratory care protocols. In essence, it propels refinements in syndromic panels, aligning evaluations with stewardship objectives.

Restraints

Reimbursement Limitations for Advanced Molecular Tests is Restraining the Market

Inadequate reimbursement structures for sophisticated molecular diagnostics continue to restrict the pneumonia diagnostics market, as payers favor cost-effective traditional methods over innovative panels. These tests, offering rapid multiplex pathogen detection, incur high upfront costs that exceed coverage caps, deterring routine clinical use. This barrier disproportionately impacts community hospitals, where financial pressures prioritize basic imaging over comprehensive assays. Policy variances across regions compound the challenge, with Medicare’s fee schedules lagging behind technological evolutions.

Manufacturers allocate resources to advocacy rather than innovation, stalling pipeline advancements. The resulting underutilization prolongs empirical therapy durations, heightening resistance risks. The Centers for Medicare & Medicaid Services reported clinical laboratory test expenditures under Medicare Part B totaling $8.4 billion in 2022, yet molecular pneumonia diagnostics encountered persistent coverage restrictions amid escalating volumes. These allocations expose systemic bottlenecks, as rate adjustments curbed broader implementations.

Clinician preferences shift toward reimbursable options, sidelining promising multiplex tools. Efforts for policy reforms advance methodically, hindered by cost-utility validations. These reimbursement constraints not only impede scalability but also perpetuate disparities in diagnostic access. Accordingly, they necessitate unified frameworks to equate fiscal viability with clinical benefits.

Opportunities

Rise in Point-of-Care Testing Adoption is Creating Growth Opportunities

The growing embrace of point-of-care testing has unveiled substantial prospects for the pneumonia diagnostics market, empowering on-site evaluations that expedite therapy initiation in ambulatory and remote environments. These portable devices, utilizing cartridge-based PCR, deliver results within hours, bypassing central lab dependencies for bacterial and viral differentiation.

Opportunities proliferate in decentralized networks, where subsidies support validations for resource-scarce clinics amid outbreak surges. Corporate alliances fund cartridge innovations, addressing turnaround voids in primary care. This immediacy counters hospitalization delays, framing POC as enablers of outpatient management. Appropriations for frontline diagnostics hasten procurements, extending to integrated syndromic arrays.

The Centers for Disease Control and Prevention noted a 9.0-fold increase in excess Mycoplasma pneumoniae cases from late 2023 through 2024, fostering opportunities for POC platforms in pediatric surveillance. This surge validates adaptable models, with deployments anticipating expanded kit demands. Formulations with ambient-stable reagents bolster field robustness, easing supply disruptions. As connectivity matures, POC data generate epidemiological yields. These on-site evolutions not only broaden application realms but also fuse the market into ambulatory health constructs.

Impact of Macroeconomic / Geopolitical Factors

Rising healthcare expenditures amid economic recovery spur investments in advanced pneumonia diagnostic tools, enabling providers to enhance patient outcomes through timely interventions, while the expanding geriatric demographic amplifies demand for rapid testing solutions that mitigate hospitalization risks.

Sustained inflation, however, erodes budgets for non-essential upgrades, forcing laboratories to delay procurement of cutting-edge analyzers and consumables essential for multiplex assays. Geopolitical frictions, particularly escalating trade disputes with China, interrupt the flow of critical reagents and imaging components, compelling manufacturers to navigate rerouted logistics that inflate timelines and expose the sector to shortages during peak respiratory seasons.

Current US tariffs, enforcing a 10% baseline on imported diagnostic equipment as of April 2025, escalate acquisition costs for foreign-sourced PCR kits and portable scanners, straining margins for mid-tier clinics and potentially curtailing access in underserved regions. Yet, these tariffs catalyze a pivot toward US-centric production hubs, igniting local innovation in AI-enhanced molecular diagnostics that promise superior accuracy and reduced turnaround times.

Latest Trends

ATS Guideline Updates on Diagnostic Imaging is a Recent Trend

The revision of clinical practice guidelines has exemplified a critical refinement in pneumonia diagnostics during 2025, emphasizing lung ultrasound as a viable imaging alternative to chest X-rays in resource-variable settings.

The American Thoracic Society’s 2025 updates advocate conditional use of point-of-care ultrasound for community-acquired pneumonia, contingent on trained personnel and equipment availability. This revision denotes a maturation toward accessible modalities, accommodating bedside assessments to streamline triage in emergency departments.

Accreditation bodies corroborate its efficacy, hastening protocol adoptions amid imaging backlogs. This accessibility complements radiographic standards, interfacing findings with stewardship algorithms for pathogen-directed care. The guideline rectifies access disparities, prioritizing ultrasound’s portability for austere deployments.

The American Thoracic Society released the 2025 Clinical Practice Guideline Updates for the Diagnosis and Management of Community-Acquired Pneumonia, incorporating lung ultrasound recommendations based on low-quality evidence. These directives underscore practicality, as validations match conventional benchmarks.

Forecasters project embedding in training curricula, elevating its prominence in initial evaluations. Sequential appraisals demonstrate variance reductions, optimizing workflow efficiencies. The vista foresees hybrid integrations, envisioning AI-assisted interpretations. This ultrasound-centric revision not only heightens diagnostic agility but also coordinates with equitable care mandates.

Regional Analysis

North America is leading the Pneumonia Diagnostics Market

The market in North America is anticipated to have held a 40.6% share of the global pneumonia diagnostics landscape in 2024, advanced by CDC’s sustained surveillance of respiratory pathogens that emphasized multiplex PCR panels for distinguishing bacterial from viral etiologies in community-acquired cases, enabling targeted antibiotic stewardship in emergency departments amid seasonal surges. Labs broadened adoption of FilmArray Respiratory Panel expansions, achieving detection rates over 90% for Streptococcus pneumoniae in pediatric cohorts, correlating with federal funding for AR Lab Network sites that accelerated susceptibility testing for resistant strains in ICU admissions.

The FDA’s November 2024 clearance for the BioFire FilmArray Pneumonia Panel plus facilitated rapid identification of 33 pathogens and 9 resistance genes from sputum, reducing empirical therapy durations by 24-48 hours in hospitalized patients with ventilator-associated infections. Demographic vulnerabilities, including a 7.2-fold increase in Mycoplasma pneumoniae ED visits for children aged 2-4 years from 1.0% to 7.2% between March and October 2024, amplified reagent procurement for atypical pneumonia profiling in outpatient networks.

Technological shifts toward point-of-care multiplex formats minimized false negatives in immunocompromised adults, appealing to Medicare-backed programs for cost-effective triage. These elements positioned the region as a pioneer in pathogen-specific diagnostic agility. The CDC documented a 7.2-fold rise in Mycoplasma pneumoniae-associated pneumonia ED visits for children aged 2-4 years from 1.0% to 7.2% between March and October 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The market in Asia Pacific is projected to expand during the forecast period, as governmental priorities target respiratory surveillance to counter pneumonia burdens in densely settled tropical economies. Officials in India and Indonesia invest in PCR kits, outfitting primary centers to identify pneumococcal serotypes in malnourished infants from monsoon-affected zones. Testing providers team with national labs to standardize sputum culture assays, estimating faster interventions for viral-bacterial co-infections in urban migrant groups.

Supervisory agencies in China and South Korea fund multiplex panels, enabling district facilities to profile Mycoplasma strains without central lab reliance. Countrywide efforts anticipate merging diagnostic outputs with digital platforms, hastening antibiotic adjustments for ventilator cases in high-density hospitals. Area pathologists develop fluorescence-based tools, aligning with WHO networks to monitor resistance in avian flu-overlap scenarios. These strategies yield a fortified system for outbreak containment. The WHO estimated over 1,400 pneumonia cases per 100,000 children under five globally in 2022, with South Asia exhibiting 2,500 cases per 100,000.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Pneumonia Diagnostics Market drive growth by launching point-of-care molecular platforms for rapid pathogen detection, promoting antibiotic stewardship. They merge with assay experts to add AI-enhanced imaging for accurate results in limited settings. Companies invest in syndromic multiplex panels for co-infections, aligning with global guidelines. Leaders partner with surveillance networks for endorsements and grants. They expand in Africa and South Asia with infrastructure-tailored devices for subsidized programs.

Additionally, they offer cloud analytics subscriptions for trend insights, boosting engagement and revenue. bioMérieux SA, founded in 1963 in Marcy-l’Étoile, France, develops diagnostic solutions with its BioFire FilmArray Pneumonia Panel detecting over 30 targets via multiplex PCR. CEO Marc Y. Lorin leads operations in 150 countries, focusing on innovation and interoperability. The firm collaborates on protocols to enhance respiratory threat responses through precise, scalable testing.

Top Key Players in the Pneumonia Diagnostics Market

- Abbott Laboratories

- Hoffmann‑La Roche Ltd.

- Thermo Fisher Scientific Inc.

- bioMérieux SA

- Becton, Dickinson and Company

- Hologic Inc.

- Bio‑Rad Laboratories, Inc.

- Meridian Bioscience

- Quidel Corporation

- Curetis GmbH

Recent Developments

- In February 2025: Cue Health Inc. expanded its partnership with Cardinal Health to distribute its molecular COVID-19 tests for professional and over-the-counter use. By leveraging Cardinal Health’s extensive hospital and pharmacy network, Cue is improving accessibility and adoption of its nucleic acid amplification test (NAAT) technology. This broad distribution directly strengthens diagnostic availability for respiratory infections, supporting faster and more accurate pneumonia testing in both clinical and non-traditional care settings.

- In October 2025: Thermo Fisher Scientific announced plans to acquire Clario Holdings, Inc. to enhance its clinical insight and drug development capabilities. This acquisition improves the company’s ability to deliver data-driven diagnostics and accelerates the development of pneumonia treatments by enabling better integration of real-world clinical data into therapeutic research and trial monitoring.

Report Scope

Report Features Description Market Value (2024) US$ 607.2 million Forecast Revenue (2034) US$ 1067.1 million CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Instruments and Reagents & Consumables), By Technology (Streptococcus Based, Viral Pneumonia Based, Mycoplasma Pneumonia Based, Legionella Based, and Chlamydophilla Based), By End-user (Hospitals & Clinics, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Abbott Laboratories, F. Hoffmann‑La Roche Ltd., Thermo Fisher Scientific Inc., bioMérieux SA, Becton, Dickinson and Company, Hologic Inc., Bio‑Rad Laboratories, Inc., Meridian Bioscience, Quidel Corporation, Curetis GmbH. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pneumonia Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Pneumonia Diagnostics MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Abbott Laboratories

- Hoffmann‑La Roche Ltd.

- Thermo Fisher Scientific Inc.

- bioMérieux SA

- Becton, Dickinson and Company

- Hologic Inc.

- Bio‑Rad Laboratories, Inc.

- Meridian Bioscience

- Quidel Corporation

- Curetis GmbH