Global Plastic Surgery Instruments Market Analysis By Type [Handheld Surgical Instruments (Forceps, Retractors, Graspers, Auxiliary Instruments, Cutter Instruments, Elevators, Others), Electrosurgical Instruments (Bipolar Instruments, Monopolar Instruments)], By Procedure [Face and Head Procedures (Brow Lift, Ear Surgery, Eyelid Surgery, Face and Neck Lift Surgery, Face and Bone Contouring, Rhinoplasty), Breast Procedures (Breast Augmentation, Breast Lift, Breast Reduction, Gynecomastia), Body and Extremities Procedures (Buttock Augmentation, Thigh Lift, Upper and Lower Body Lift, Arm lift, Labiaplasty), Reconstruction Surgeries (Abdominoplasty, Liposuction)], By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2024

- Report ID: 73708

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Plastic Surgery Instruments Market size is expected to be worth around USD 3.6 Billion by 2033, from USD 1.5 Billion in 2023, growing at a CAGR of 9.1% during the forecast period from 2024 to 2033.

Plastic surgery instruments are specialized tools designed for procedures aimed at enhancing, reconstructing, or altering the human body’s appearance and function. These instruments play a critical role in various plastic surgery operations, ranging from facial surgeries to body contouring and breast augmentation. The market for these instruments is a dynamic sector within the medical device industry, characterized by continuous technological innovation and evolving procedural trends.

According to a study by the International Society of Aesthetic Plastic Surgery (ISAPS), the global plastic surgery industry witnessed over 25 million cosmetic procedures in 2022, highlighting the market’s expansive nature. In the U.S. alone, the American Society of Plastic Surgeons (ASPS) reported over 18.1 million procedures in 2023, underlining the market’s significant growth trajectory. This surge can be attributed to several key drivers.

Firstly, the rise in global disposable income, paired with heightened awareness about aesthetic enhancements, has markedly bolstered demand. Technological advancements in surgical instruments and techniques further accelerate market growth, with facial procedures leading in popularity. End-use sectors, such as cosmetic clinics, hospitals, and ambulatory surgical centers, form a substantial market segment, with specialized dermatology and plastic surgery practices playing a pivotal role.

The regulatory landscape, notably the U.S. FDA’s stringent oversight and the EU’s Medical Device Regulation (MDR), significantly influences the market dynamics, impacting product development and costs. The import-export scenario also shapes this landscape, with the U.S. emerging as a key exporter and countries like Germany, Japan, and China as notable import markets.

Investments in the sector are robust, exemplified by Merz Aesthetics’ $100 million investment in bioengineered breast implants and Sientra’s $80 million Series D funding for minimally invasive breast augmentation technologies. Innovations like Allergan’s 3D-printed breast implants and strategic market movements, including AbbVie’s acquisition of Allergan Aesthetics, further depict a market ripe with opportunity and growth potential.

The plastic surgery instruments market is poised for sustained expansion, driven by technological progress, increasing disposable incomes, and a growing inclination towards aesthetic procedures. However, this growth is tempered by strict regulatory requirements and evolving trade policies, presenting a complex but promising landscape for stakeholders.

Key Takeaways

- Market Growth Projection: The Plastic Surgery Instruments Market is set to reach USD 3.6 Billion by 2033, with a robust CAGR of 9.1% from 2024 to 2033.

- Dominant Segment: Handheld surgical instruments claimed over 63% market share in 2023, showcasing their versatility in various plastic surgery procedures.

- Global Procedure Volume: In 2023, face and head procedures dominated the plastic surgery instruments market, holding a significant share of over 44.6%.

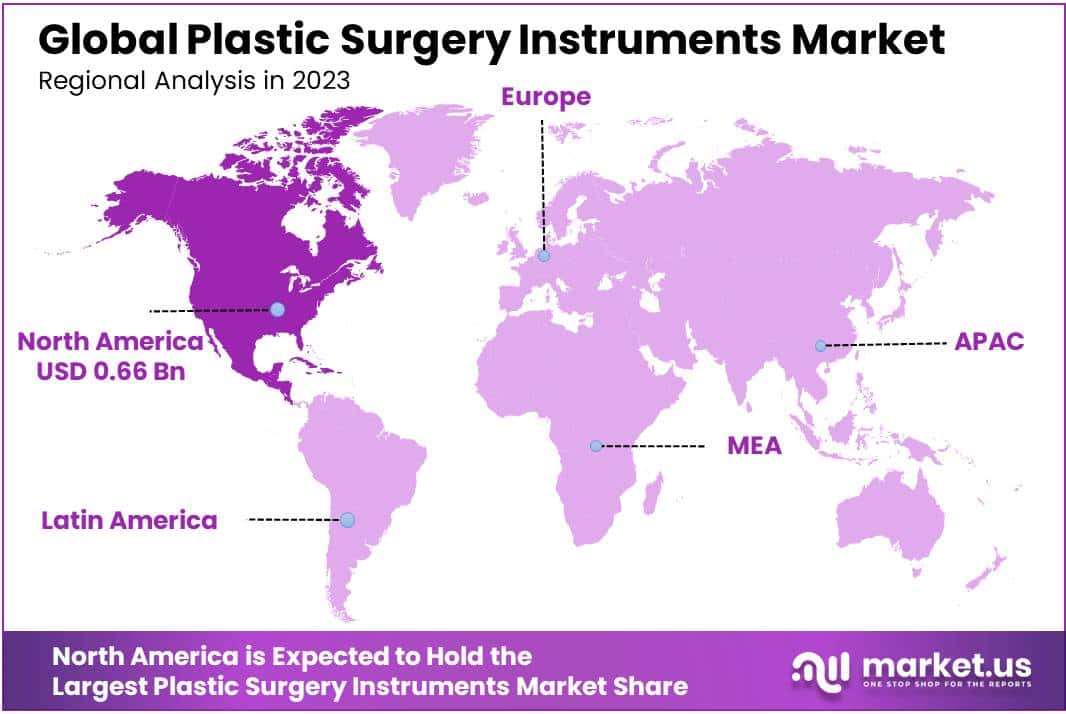

- Regional Dominance: North America holds a dominant market position with a 44% share, driven by high disposable incomes and advanced healthcare infrastructure.

- Global Expansion: The Asia-Pacific region is emerging as a significant market, driven by increasing disposable incomes, growing awareness, and an expanding healthcare sector.

Type Analysis

In 2023, the plastic surgery instruments market saw the handheld surgical instruments segment holding a prominent position, securing over 63% of the market share. This category encompasses a diverse range of tools crucial for various plastic surgery procedures, including forceps, retractors, graspers, auxiliary instruments, cutter instruments, and elevators. These instruments are indispensable in a wide spectrum of surgical procedures, from basic incisions to intricate reconstructions. The versatility of these tools, coupled with advancements in design and materials, has driven their widespread adoption in the realm of plastic surgery.

Key components of this dominant segment are forceps and retractors, essential for surgeons in ensuring precision and control during operations. Cutter instruments and elevators, with their specialized applications in cutting and reshaping tissues, also contribute significantly to the segment’s dominance. The continual introduction of ergonomic designs and technologically advanced materials further cements the handheld surgical instruments segment’s leading position.

While smaller in size, the electrosurgical instruments segment, comprising bipolar and monopolar instruments, plays a pivotal role in the plastic surgery instruments market. These instruments are crucial for procedures requiring high precision and minimal invasiveness. Bipolar instruments, known for refined coagulation capabilities, are preferred in procedures demanding meticulous hemostasis. Monopolar instruments, offering versatility and efficiency, find wide use in tissue dissection and cauterization.

The demand for electrosurgical instruments is driven by technological innovations enhancing safety and efficacy, such as improved energy delivery systems and advanced control mechanisms. Despite a smaller market share, these instruments are integral to modern plastic surgery practices, especially in procedures requiring detailed sculpting and minimal tissue trauma. In essence, the plastic surgery instruments market in 2023 witnessed the dominance of handheld surgical instruments, complemented by the crucial role of electrosurgical instruments in ensuring precision and technological advancements.

Procedure Analysis

In 2023, the plastic surgery instruments market was notably influenced by the face and head procedures segment, securing a dominant position with a share exceeding 44.6%. This category encompasses various enhancements like brow lift, ear surgery, eyelid surgery, face and neck lift surgery, facial bone contouring, and rhinoplasty, showcasing a growing emphasis on facial aesthetics. The visibility of the face in social and professional interactions has significantly driven the demand for these procedures, with advancements in surgical techniques making them more accessible and less invasive.

Breast procedures, addressing both aesthetic and medical concerns through augmentation, lift, reduction, and gynecomastia surgery, also held a substantial market share. Technological advancements in implants and surgical instruments played a crucial role in enhancing the safety and effectiveness of these procedures.

The body and extremities procedures segment, covering buttock augmentation, thigh lift, upper and lower body lift, arm lift, and labiaplasty, experienced a steady rise in demand, driven by the prevailing trends in physical fitness and body image.

Additionally, reconstruction surgeries such as abdominoplasty and liposuction played a vital role in the market, addressing both cosmetic and medical needs. The growth of this segment is propelled by advancements in minimally invasive techniques and precision instruments.

Key Market Segments

Type

- Handheld Surgical Instruments

- Forceps

- Retractors

- Graspers

- Auxiliary Instruments

- Cutter Instruments

- Elevators

- Others

- Electrosurgical Instruments

- Bipolar Instruments

- Monopolar Instruments

Procedure

- Face and Head Procedures

- Brow Lift

- Ear Surgery

- Eyelid Surgery

- Face and Neck Lift Surgery

- Face and Bone Contouring

- Rhinoplasty

- Breast Procedures

- Breast Augmentation

- Breast Lift

- Breast Reduction

- Gynecomastia

- Body and Extremities Procedures

- Buttock Augmentation

- Thigh Lift

- Upper and Lower Body Lift

- Arm lift

- Labiaplasty

- Reconstruction Surgeries

- Abdominoplasty

- Liposuction

Drivers

Technological Advancements in Surgery Instruments and Techniques

Innovations in minimally invasive surgery tools, laser technology, and computer-assisted systems have revolutionized the field of plastic surgery. For instance, according to the American Society of Plastic Surgeons (ASPS), the use of minimally invasive techniques has led to a 200% increase in procedures like soft tissue fillers and laser skin resurfacing since 2000.

These advancements significantly enhance the precision and efficiency of both cosmetic and reconstructive procedures, thereby improving patient outcomes. The reduced recovery times associated with minimally invasive methods have also contributed to an increase in the volume of procedures performed annually. Furthermore, the advent of advanced technologies such as 3D imaging and high-definition cameras provides surgeons with unparalleled clarity and control during operations.

This technological progression not only broadens the scope of possible procedures but also attracts a wider patient demographic, seeking both aesthetic enhancements and medical corrections. Consequently, the continuous evolution in surgical instruments and techniques is a fundamental driver, underpinning the steady growth and expansion of the plastic surgery instruments market.

Restraints

High Cost of Plastic Surgery Procedures and Instruments

The high cost of plastic surgery procedures and instruments represents a significant restraint for the global plastic surgery instruments market. Acquiring advanced surgical instruments, which often incorporate cutting-edge technology and specialized materials, entails substantial investment. For instance, according to the American Society of Plastic Surgeons, the average surgeon’s fee for a single cosmetic procedure can range from a few thousand dollars to over ten thousand, not including additional costs for hospital stays, anesthesia, and other expenses. This financial burden is further compounded in procedures requiring specialized equipment or advanced technology. As a result, the overall expense can be prohibitive for healthcare providers, particularly in smaller clinics or regions with less developed healthcare infrastructure.

For patients, especially those in countries with lower disposable incomes, the high costs can render plastic surgery inaccessible, thereby limiting the market’s expansion. This economic barrier is a critical factor that restricts the market growth, as it directly affects the accessibility and affordability of plastic surgery services and the instruments they require.

Opportunities

Rising Demand for Cosmetic Procedures in Emerging Economies

As per the International Society of Aesthetic Plastic Surgery (ISAPS), there has been a notable increase in cosmetic procedures in emerging economies, with countries like Brazil, India, and China experiencing a surge in demand. For instance, Brazil reported over 1.5 million cosmetic procedures in 2022, a clear reflection of the growing market in such regions. This upswing is largely fueled by rising disposable incomes and a shifting cultural landscape that increasingly accepts and values cosmetic surgery. As these economies continue to develop, their healthcare infrastructures are also improving, making advanced plastic surgery techniques more accessible.

Consequently, the demand for specialized plastic surgery instruments is escalating, as practitioners seek to meet the growing need for diverse and sophisticated cosmetic procedures. This trend not only highlights a lucrative market for manufacturers of these instruments but also underscores the global expansion of the plastic surgery industry, driven by changing economic and social dynamics in emerging markets.

Trends

Increasing Focus on Aesthetic Appearance and Anti-Aging Procedures

This trend is significantly shaping the global plastic surgery instruments market. Fueled by heightened societal emphasis on physical appearance and the desire to maintain a youthful look, there’s a surge in demand for cosmetic procedures. According to the American Society of Plastic Surgeons (ASPS), in 2023, procedures like facelifts, botox, and body contouring saw a remarkable increase, with over 15 million cosmetic procedures performed in the United States alone.

This trend transcends beyond traditional markets such as the United States and Europe, with emerging economies also showing a growing interest. The influence of media and social platforms, portraying idealized beauty standards, plays a crucial role in this uptrend. Consequently, this shift in societal norms and beauty ideals is driving the demand for advanced surgical instruments, as they are essential in performing these intricate aesthetic and anti-aging procedures. The market for plastic surgery instruments is thus experiencing robust growth, adapting to these evolving consumer preferences and technological advancements in surgery techniques.

Regional Analysis

In 2023, North America held a dominant market position in the Plastic Surgery Instruments Market, capturing more than a 44% share and holding a market value of USD 0.66 Billion for the year. This dominance can be attributed to several factors, including high disposable incomes, advanced healthcare infrastructure, and a strong presence of leading plastic surgery practitioners and instrument manufacturers in the region. The United States, in particular, plays a pivotal role in driving the market, with an increasing number of cosmetic procedures being performed annually, as reported by the American Society of Plastic Surgeons.

Europe follows North America closely, buoyed by similar factors such as advanced healthcare systems, high disposable incomes, and a growing acceptance of cosmetic procedures. Countries like Germany, France, and the UK are key contributors to the market in this region. The European market is also characterized by stringent regulatory standards, which ensure high-quality and safe surgical instruments, thereby fostering trust and demand among healthcare providers and patients.

The Asia-Pacific region is emerging as a significant market, driven by increasing disposable incomes, growing awareness about cosmetic procedures, and an expanding healthcare sector. Countries like South Korea, China, and India are becoming hotspots for cosmetic surgery, both for local populations and medical tourists. The region’s market growth is further supported by advancements in healthcare infrastructure and the presence of skilled plastic surgeons.

Latin America and the Middle East & Africa, while holding smaller shares in the global market, are showing promising growth. These regions are witnessing gradual improvements in healthcare infrastructure, coupled with a rising interest in cosmetic procedures among the population. The increasing influence of Western beauty standards and the growing middle class in these regions are factors contributing to market growth.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Plastic Surgery Instruments Market showcases a dynamic competitive landscape. Sklar Surgical Instruments, a key player, excels with a diverse range of high-quality instruments. Their well-established brand and extensive distribution are notable strengths. Zimmer Biomet Holdings Inc. is distinguished by its innovation in surgical solutions, underpinned by robust financial growth and a varied product portfolio. Their challenge lies in adapting to rapid technological changes. B. Braun Melsungen AG, another major competitor, is recognized for its commitment to quality and patient safety, reflected in its comprehensive surgical instrument offerings. Their ongoing innovation is crucial for maintaining market competitiveness.

Blink Medical Ltd., though smaller in scale, has made impactful strides with its focus on single-use instruments, addressing the market’s need for convenience and hygiene. This strategy has led to notable financial growth, but expanding market presence remains a challenge. Additionally, numerous other key players contribute to the market’s diversity. These entities, each with unique strategies and niche focuses, add to the market’s dynamism and drive continuous innovation. Collectively, these players create a competitive environment that fosters advancements and growth in the Plastic Surgery Instruments Market.

Market Key Players

- Sklar Surgical Instruments

- Zimmer Biomet Holdings Inc.

- B. Braun Melsungen AG

- Blink Medical Ltd.

- Bolton Surgical Ltd.

- Integra Life Sciences

- TEKNO-MEDICAL Optik-Chirurge GmbH

- Karlz Storz

- BMT Medizintechnik GmbH

- Anthony Product Inc.

- Other Key Players

Recent Developments

- In December 2023, Zimmer Biomet Holdings Inc. acquired OrthoSensor, a developer of smart surgical tools with integrated sensors. These tools provide real-time feedback during plastic surgery procedures, enhancing precision and safety, particularly in operations like rhinoplasty and liposuction.

- In November 2023, TEKNO-MEDICAL Optik-Chirurge GmbH announced a strategic partnership with Stratasys. Together, they aim to offer 3D-printed patient-specific surgical guides for facial reconstruction surgeries. This collaboration combines Stratasys’ 3D printing expertise with TEKNO-MEDICAL’s surgical knowledge to personalize procedures and improve overall outcomes.

- In October 2023, Integra Life Sciences launched Silimed Essential Silicone Gel Breast Implants, a new line of textured breast implants. These implants feature enhanced tissue integration and reduced risks of capsular contracture, addressing the growing demand for natural-looking and durable breast augmentation solutions.

Report Scope

Report Features Description Market Value (2023) USD 1.5 Bn Forecast Revenue (2033) USD 3.6 Bn CAGR (2024-2033) 9.1% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type [Handheld Surgical Instruments (Forceps, Retractors, Graspers, Auxiliary Instruments, Cutter Instruments, Elevators, Others), Electrosurgical Instruments (Bipolar Instruments, Monopolar Instruments)], By Procedure [Face and Head Procedures (Brow Lift, Ear Surgery, Eyelid Surgery, Face and Neck Lift Surgery, Face and Bone Contouring, Rhinoplasty), Breast Procedures (Breast Augmentation, Breast Lift, Breast Reduction, Gynecomastia), Body and Extremities Procedures (Buttock Augmentation, Thigh Lift, Upper and Lower Body Lift, Arm lift, Labiaplasty), Reconstruction Surgeries (Abdominoplasty, Liposuction)] Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Sklar Surgical Instruments, Zimmer Biomet Holdings Inc., B. Braun Melsungen AG, Blink Medical Ltd., Bolton Surgical Ltd., Integra Life Sciences, TEKNO-MEDICAL Optik-Chirurge GmbH, Karlz Storz, BMT Medizintechnik GmbH, Anthony Product Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of the Plastic Surgery Instruments market in 2023?The Plastic Surgery Instruments market size is USD 1.5 billion in 2023.

What is the projected CAGR at which the Plastic Surgery Instruments market is expected to grow at?The Plastic Surgery Instruments market is expected to grow at a CAGR of 9.1% (2024-2033).

List the segments encompassed in this report on the Plastic Surgery Instruments market?Market.US has segmented the Plastic Surgery Instruments market by geographic (North America, Europe, APAC, South America, and Middle East and Africa). By Type the market has been segmented into Handheld Surgical Instruments (Forceps, Retractors, Graspers, Auxiliary Instruments, Cutter Instruments, Elevators, Others), Electrosurgical Instruments (Bipolar Instruments, Monopolar Instruments). By Procedure the market has been segmented into Face and Head Procedures (Brow Lift, Ear Surgery, Eyelid Surgery, Face and Neck Lift Surgery, Face and Bone Contouring, Rhinoplasty), Breast Procedures (Breast Augmentation, Breast Lift, Breast Reduction, Gynecomastia), Body and Extremities Procedures (Buttock Augmentation, Thigh Lift, Upper and Lower Body Lift, Arm lift, Labiaplasty), Reconstruction Surgeries (Abdominoplasty, Liposuction).

List the key industry players of the Plastic Surgery Instruments market?Sklar Surgical Instruments, Zimmer Biomet Holdings Inc., B. Braun Melsungen AG, Blink Medical Ltd., Bolton Surgical Ltd., Integra Life Sciences, TEKNO-MEDICAL Optik-Chirurge GmbH, Karlz Storz, BMT Medizintechnik GmbH, Anthony Product Inc., Other Key Players

Which region is more appealing for vendors employed in the Plastic Surgery Instruments market?North America is expected to account for the highest revenue share of 44% and boasting an impressive market value of USD 0.66 billion. Therefore, the Plastic Surgery Instruments industry in North America is expected to garner significant business opportunities over the forecast period.

Name the key areas of business for Plastic Surgery Instruments?The US, Canada, India, China, UK, Japan, & Germany are key areas of operation for the Plastic Surgery Instruments Market.

Plastic Surgery Instruments MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample

Plastic Surgery Instruments MarketPublished date: Jan 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Sklar Surgical Instruments

- Zimmer Biomet Holdings Inc.

- B. Braun Melsungen AG

- Blink Medical Ltd.

- Bolton Surgical Ltd.

- Integra Life Sciences

- TEKNO-MEDICAL Optik-Chirurge GmbH

- Karlz Storz

- BMT Medizintechnik GmbH

- Anthony Product Inc.

- Other Key Players