Global Plasma Derived Medicine Market By Product (Immunoglobulin, Albumin, Coagulation Factors, and Others), By Application (Bleeding Disorders, Multifocal Motor Neuropathy, Liver Disease, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2024

- Report ID: 152959

- Number of Pages: 211

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

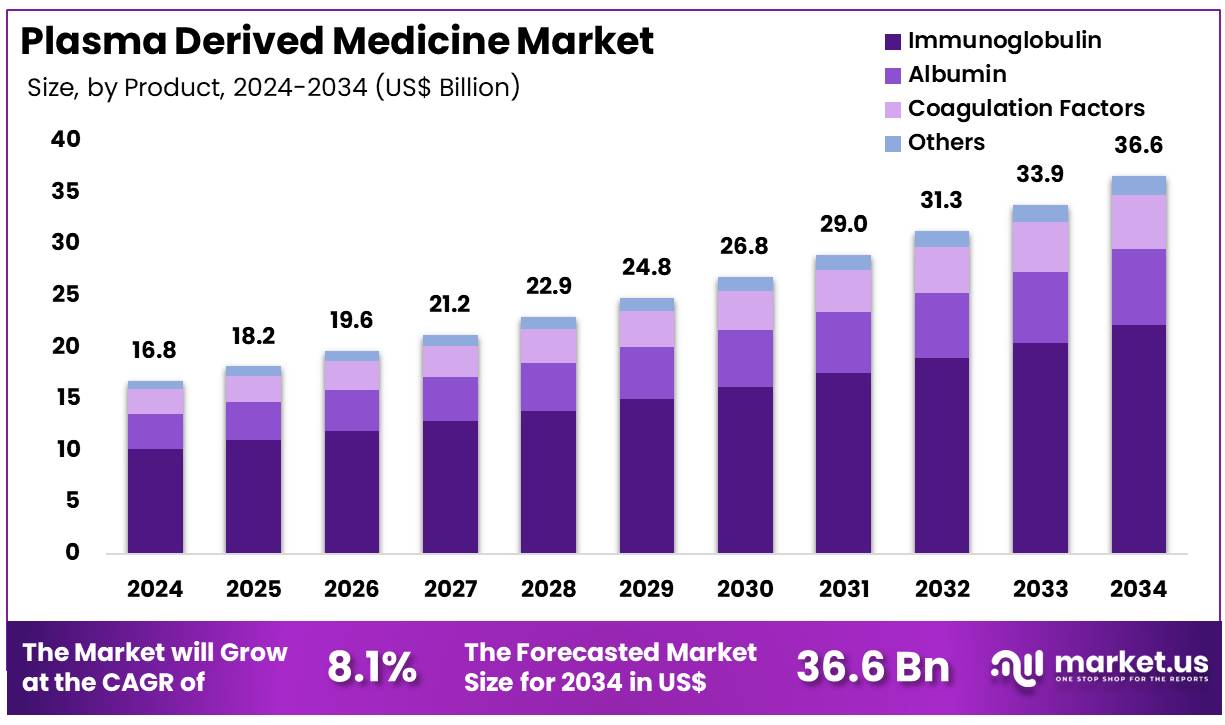

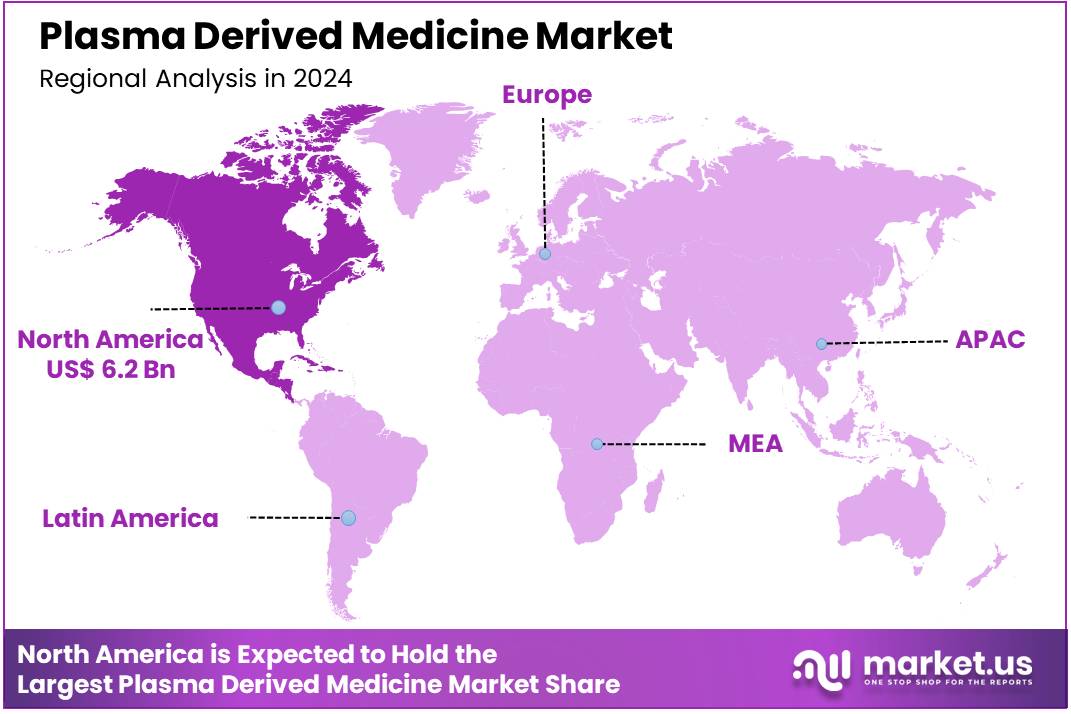

Global Plasma Derived Medicine Market size is expected to be worth around US$ 36.6 Billion by 2034 from US$ 16.8 Billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 37.2% share with a revenue of US$ 6.2 Billion.

Increasing demand for life-saving treatments and the growing prevalence of chronic conditions are driving the expansion of the plasma-derived medicine market. Plasma-derived medicines, such as immunoglobulins, clotting factors, and albumin, are vital in treating a range of serious conditions, including immune deficiencies, bleeding disorders like hemophilia, and liver diseases.

The rising incidence of such conditions, coupled with advancements in biotechnology, has significantly boosted the need for high-quality plasma-derived therapies. The market also benefits from the increasing focus on personalized medicine, where treatments are tailored to the genetic and immunological profiles of patients, enhancing therapeutic efficacy.

Data from the Chinese National Health Commission indicates that voluntary blood donations in China reached a record high in 2023, totaling 16.99 million donations, marking a 5.9% increase compared to 2022. This surge in blood donations directly contributes to the supply of plasma, facilitating the production of these critical medicines.

Additionally, the rise in demand for plasma-derived therapies in emerging markets presents significant growth opportunities, as healthcare infrastructure improves and awareness of such therapies expands. Recent trends in the market include the development of recombinant technologies, which allow for the production of clotting factors and other proteins without relying on human plasma, enhancing safety and scalability.

The market also witnesses increasing investments in plasma fractionation technologies, improving the efficiency and yield of plasma-derived products. With ongoing innovations and rising demand, the plasma-derived medicine market continues to evolve, offering better and more accessible treatment options for patients worldwide.

Key Takeaways

- In 2024, the market for plasma derived medicine generated a revenue of US$ 16.8 Billion, with a CAGR of 8.1%, and is expected to reach US$ 36.6 billion by the year 2034.

- The product segment is divided into immunoglobulin, albumin, coagulation factors, and others, with immunoglobulin taking the lead in 2024 with a market share of 60.5%.

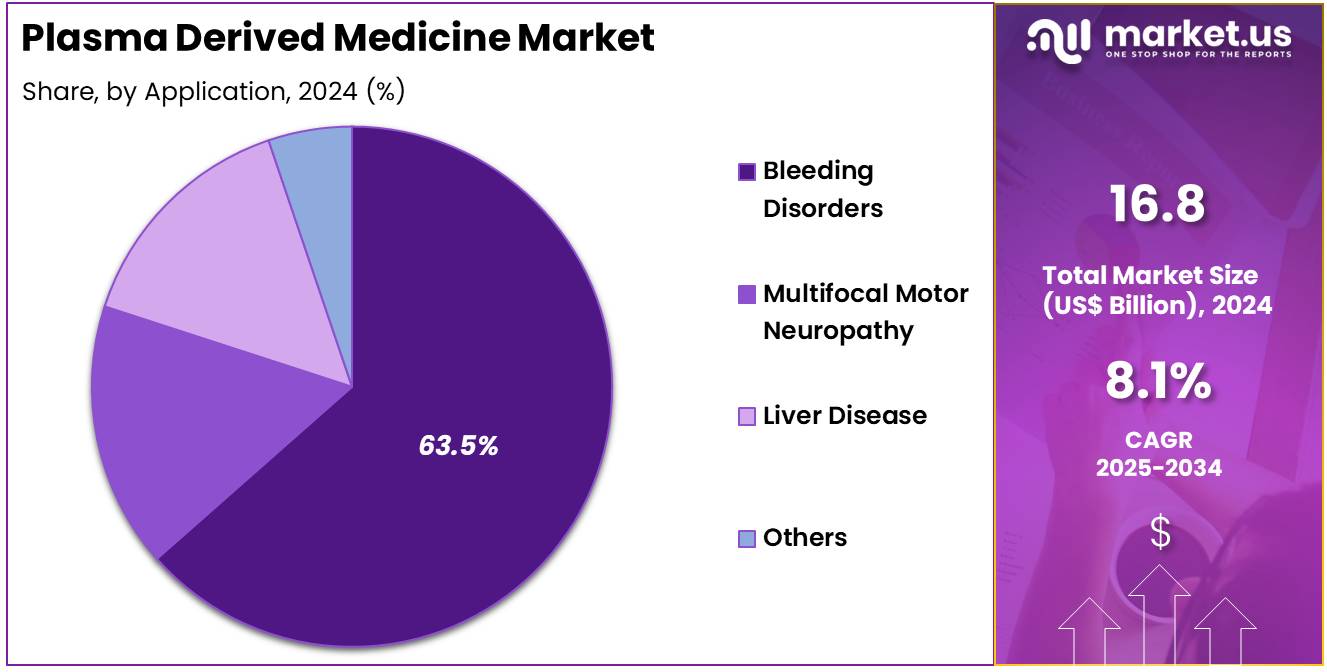

- Considering application, the market is divided into bleeding disorders, multifocal motor neuropathy, liver disease, and others. Among these, bleeding disorders held a significant share of 63.5%.

- North America led the market by securing a market share of 37.2% in 2024.

Product Analysis

Immunoglobulin dominates the plasma-derived medicine market, holding a share of 60.5%. This growth is expected to continue as immunoglobulin is widely used to treat a range of conditions, including primary and secondary immunodeficiencies, autoimmune diseases, and neurological disorders. The increasing prevalence of immune system disorders is projected to drive sustained demand for immunoglobulin products.

Additionally, advancements in immunoglobulin therapy, including the development of subcutaneous formulations that are easier for patients to self-administer, are likely to enhance adoption rates. The growing recognition of the efficacy of immunoglobulin in reducing infection rates and improving the quality of life for patients with chronic conditions is expected to further propel market growth.

The expanding availability of immunoglobulin in different regional markets, especially in developing countries, is anticipated to open new growth opportunities. Moreover, with the increasing acceptance of immunoglobulin as a first-line treatment for various conditions, this segment is likely to see continued expansion. As healthcare systems evolve and diagnostic technologies improve, the demand for immunoglobulin therapies is expected to remain strong in the coming years.

Application Analysis

Bleeding disorders, particularly hemophilia and other clotting factor deficiencies, dominate the application segment of the plasma-derived medicine market, holding a share of 63.5%. This segment’s growth is expected to be driven by the increasing prevalence of bleeding disorders globally, especially as diagnoses improve with advances in genetic testing. The growing number of hemophilia patients, particularly in emerging markets, is anticipated to further expand the demand for plasma-derived medicines, including clotting factor therapies.

Furthermore, ongoing innovations in bleeding disorder treatments, such as longer-acting clotting factors and combination therapies, are projected to increase the effectiveness of treatments and boost market growth. The rising emphasis on personalized medicine and the development of more targeted treatments are likely to drive adoption rates for plasma-derived products in this segment.

Additionally, the increasing number of patients receiving regular infusions and the development of preventive therapies will likely contribute to the segment’s expansion. With significant investment in bleeding disorder research, this segment is projected to remain a key driver of growth within the plasma-derived medicine market, particularly in both developed and developing regions.

Key Market Segments

By Product

- Immunoglobin

- Albumin

- Coagulation Factors

- Others

By Application

- Bleeding Disorders

- Multifocal Motor Neuropathy

- Liver Disease

- Others

Drivers

Increasing Prevalence of Immunological, Neurological, and Hematological Disorders is Driving the Market

The increasing global prevalence of a wide range of immunological, neurological, and hematological disorders is a primary driver fueling the demand for plasma derived medicines. These life-threatening and often chronic conditions frequently require lifelong treatment with these therapies to manage symptoms, prevent complications, and improve patients’ quality of life.

Immunoglobulins (Ig), for example, are crucial for treating primary immunodeficiency disorders (PIDDs), a group of inherited conditions that impair the immune system, and a growing number of autoimmune and neurological conditions. Albumin is widely used in critical care for conditions like shock, burns, and liver failure. Coagulation factors derived from plasma are indispensable for individuals with bleeding disorders like hemophilia.

The consistent diagnosis and growing patient populations for these complex diseases ensure a steady and increasing demand for plasma derived medicines. For instance, the Centers for Disease Control and Prevention (CDC) continuously monitors conditions like hemophilia; as of 2022, approximately 33,000 individuals in the United States were living with hemophilia, many of whom rely on plasma-derived factor concentrates.

Furthermore, the rising awareness and improved diagnostic capabilities for rare diseases, many of which are treated with plasma-derived therapies, contribute significantly to this demand. This sustained need for essential treatments directly drives pharmaceutical companies to expand their production and supply of plasma derived medicines to meet the critical medical requirements of these patient populations.

Restraints

Challenges in Plasma Collection and Supply Chain Vulnerabilities are Restraining the Market

Significant challenges in maintaining a consistent and sufficient global plasma collection, coupled with inherent vulnerabilities in the plasma supply chain, are notably restraining the plasma derived medicine market. The production of plasma derived medicines is entirely dependent on human plasma donations, making the supply chain uniquely reliant on donor availability, the efficiency of collection centers, and complex logistical networks.

Factors such as donor fatigue, public health crises (like pandemics), and economic incentives for donors can directly impact collection volumes. Furthermore, the process of collecting, testing, transporting, and fractionating plasma is highly complex and time-consuming, involving stringent regulatory oversight. Any disruption in this multi-stage process can lead to supply imbalances.

While global plasma collection figures are typically reported by industry associations, the Centro Nazionale Sangue, an official Italian government body, reported in January 2025 that the global volume of plasma for fractionation (source and recovered) represented about 72 million liters in 2022.

They also noted that in 2023, source plasma volume grew 12-14% over 2022, primarily driven by US collections, while European collections increased by about 3-6%. Despite this growth, meeting the ever-increasing demand for life-saving plasma derived therapies remains a persistent challenge, impacting the overall production capacity and market expansion potential.

Opportunities

Expansion of Approved Indications and Orphan Drug Designations is Creating Growth Opportunities

The continuous expansion of approved indications for existing plasma derived medicines and the increasing number of orphan drug designations are creating significant growth opportunities in the market. Pharmaceutical companies are actively investing in clinical research to identify new therapeutic applications for these therapies, extending their utility beyond traditional uses. This includes exploring their efficacy in various autoimmune conditions, neurological disorders, and critical care settings. Gaining approval for new indications allows manufacturers to address previously unmet medical needs and expand their patient base.

Furthermore, governments worldwide offer incentives for developing “orphan drugs,” which are treatments for rare diseases, many of which are severe and chronic conditions effectively treated by plasma derived medicines. These incentives, such as tax credits, fee waivers, and periods of market exclusivity, encourage pharmaceutical companies to invest in research and development for these conditions, even with smaller patient populations.

The US Food and Drug Administration (FDA) Center for Drug Evaluation and Research (CDER) continues to show a strong focus on rare diseases. For instance, in 2024, 26 of CDER’s 50 novel drug approvals (52%) were approved to treat rare or orphan diseases. In 2023, 28 of CDER’s 55 novel drug approvals (51%) received orphan drug designation. This consistent trend of prioritizing and facilitating the development of treatments for rare diseases directly benefits the plasma derived medicine market by creating new avenues for therapeutic application and fostering innovation in this critical area.

Impact of Macroeconomic / Geopolitical Factors

Global economic pressures, including inflationary trends and the allocation of national health budgets, are significantly influencing the plasma derived medicine market. The rising costs of energy, labor, and specialized raw materials, exacerbated by global inflationary cycles, directly impact the production expenses of plasma derived therapies, which are complex biologics with intricate manufacturing processes.

For example, the International Monetary Fund (IMF) reported in April 2024 that while global inflation was projected to decline, it remained persistently high in many economies, affecting various industrial sectors, including pharmaceuticals. This upward pressure on costs can lead to higher prices for plasma derived medicines, potentially straining the budgets of national healthcare systems and affecting the affordability of these critical treatments for patients, particularly in lower-income countries.

Simultaneously, geopolitical events, such as ongoing regional conflicts or humanitarian crises, can shift global health priorities and resource allocation away from routine treatments towards emergency responses. This diversion of funds or logistical resources can indirectly impact the consistent supply and distribution of plasma derived medicines, especially for regions affected by instability.

However, these challenges also compel pharmaceutical companies to innovate in efficiency and diversify their supply chains, ultimately strengthening the market’s long-term resilience by fostering more robust and adaptable production and distribution networks.

Evolving US trade policies, including the strategic application of tariffs, are actively reshaping the plasma derived medicine market, influencing both its cost structure and the drive towards domestic production. While direct tariffs on life-saving finished plasma derived medicines are generally avoided, duties on specific imported components, specialized manufacturing equipment, or certain raw materials utilized in plasma collection and fractionation can escalate production costs for US-based pharmaceutical companies.

For example, the US Bureau of Economic Analysis (BEA) reported in its annual 2024 trade data that imports of pharmaceutical preparations increased by US$43.6 billion in 2024, highlighting the significant volume of cross-border trade in this sector where tariff implications on inputs can accumulate. This increase in input costs compels manufacturers to either absorb the expenses, impacting their profitability and capacity for reinvestment in R&D, or to pass them on, potentially increasing prices for patients and healthcare payers in the US.

Conversely, US trade policies and domestic incentive programs are increasingly aimed at strengthening the domestic biopharmaceutical supply chain. This encourages major plasma fractionators to invest in and expand their manufacturing capabilities within the United States. This strategic push for onshore production helps reduce reliance on potentially volatile international sources, enhances national medical security, and creates domestic jobs, ultimately fostering a more secure and independent market for plasma derived medicines within the US.

Latest Trends

Advancements in Manufacturing Technology and Purification Methods is a Recent Trend

A prominent recent trend significantly impacting the plasma derived medicine market in 2024 and continuing into 2025 is the accelerated pace of technological advancements in plasma fractionation and purification processes. Manufacturers are investing heavily in innovative technologies aimed at enhancing the efficiency, safety, and yield of plasma-derived therapeutic proteins. These advancements include the implementation of more sophisticated chromatographic techniques, advanced viral inactivation and removal methods, and improved filtration systems.

The goal is to maximize the recovery of valuable proteins from donated plasma while simultaneously ensuring an even higher level of product purity and safety, thereby reducing the risk of pathogen transmission. These technological upgrades not only improve the quality of existing products but also enable the extraction of novel plasma components for new therapeutic applications.

Leading companies in the industry are actively adopting these advanced manufacturing processes. For example, CSL Behring, a major player, announced in May 2025 that its new plasma processing facility in Broadmeadows, Australia, received a significant industry award, recognizing its advanced design, automation, and ability to process over 10 million liters of plasma per year, enhancing capacity for key components for immune disorders and bleeding conditions. This continuous technological evolution is crucial for meeting the escalating global demand for these life-saving products efficiently and safely, pushing the boundaries of what is possible in plasma derived therapeutics.

Regional Analysis

North America is leading the Plasma Derived Medicine Market

North America dominated the market with the highest revenue share of 37.2% owing to the increasing diagnosis of rare and chronic diseases that necessitate these life-saving therapies, coupled with a robust recovery and expansion of plasma collection volumes. Conditions such as primary immunodeficiencies (PI), hemophilia, and neurological disorders increasingly rely on these specialized treatments.

The Immune Deficiency Foundation estimates that approximately 250,000 people in the United States live with primary immunodeficiency, with a portion of these requiring immunoglobulin replacement therapy, a key plasma-derived product. Consistent efforts by plasma collection centers across the US and Canada have helped stabilize and increase plasma supply, which is critical for meeting rising patient demand.

For instance, Grifols, a leading global producer of plasma-derived medicines, reported that its Biopharma revenue in the first quarter of 2025 reached EUR 1,521 million (approximately US$1,784.69 million), growing 9.6% year-over-year at constant currency and like-for-like, largely driven by an increase in immunoglobulin franchise revenue of 17.5% at constant currency and like-for-like, demonstrating strong momentum for these therapies across its markets, including North America.

Similarly, CSL Behring’s total revenue for the half-year ended December 31, 2024, increased by 5% to US$8.483 billion (5% at constant currency), reflecting strong underlying demand for immunoglobulins, which are essential for treating various conditions, particularly primary immune deficiency and chronic inflammatory demyelinating polyneuropathy (CIDP). These developments underscore the robust expansion of the market, driven by both medical necessity and an improving supply chain.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to improving healthcare infrastructure, increasing diagnosis rates for relevant conditions, and a growing emphasis on rare disease management by regional governments. Many countries across Asia Pacific are actively enhancing their diagnostic capabilities and awareness programs, leading to earlier identification of conditions like primary immunodeficiencies, which often require lifelong plasma-derived treatments.

The World Health Organization (WHO) and regional health ministries acknowledge a significant unmet need for diagnosis and treatment of rare diseases across Asia. For instance, China’s National Health Commission continues to refine its policies related to blood products and rare disease treatments, aiming to improve accessibility for patients. Japan’s Ministry of Health, Labour and Welfare consistently supports the development and provision of orphan drugs, which often include plasma-derived therapies, to its population.

Leading global manufacturers of these specialized products are likely to increase their investment and presence in the region. Takeda, for example, a key player in plasma-derived therapies, reported core revenue growth of 2.8% at constant exchange rates for its overall business in fiscal year 2024 (ended March 31, 2025), reflecting strong performance across its global markets including Asia Pacific. This sustained commitment by pharmaceutical companies, coupled with governmental efforts to improve rare disease care, is projected to significantly accelerate the adoption and growth of these essential medicines across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the plasma derived medicine market implement several strategies to accelerate growth. They focus on expanding their product portfolios to address a wider range of conditions, including immune deficiencies, bleeding disorders, and neurological diseases. Companies invest heavily in research and development to create more effective treatments and improve manufacturing technologies.

They also form strategic alliances with healthcare providers, academic institutions, and biotechnology companies to foster innovation. Expanding production capacity and ensuring consistent supply chain management allow them to meet the increasing global demand. Furthermore, they prioritize regulatory compliance and patient access programs to improve treatment accessibility.

One key player, Takeda Pharmaceutical Company, is a global leader in plasma-derived therapies. The company offers a broad range of products for immunodeficiencies and bleeding disorders. Takeda’s strong focus on innovation and patient-centered care drives its commitment to expanding its portfolio and improving treatment outcomes. With extensive global operations and a robust pipeline of plasma-derived therapies, Takeda remains a key player in the market.

Top Key Players

- Shanghai RAAS

- Kedrion

- Kameda Pharmaceuticals

- Grifols

- CSL Limited

- Biotest AG

- Bio Products Laboratory

- ADMA Biologics

Recent Developments

- In June 2024, CSL Behring, a leading division of a global biotechnology company, introduced Haemocomplettan P (Human Fibrinogen Concentrate) through Bengaluru-based PlasmaGen Biosciences, a company specializing in Plasma Protein and Specialty Care Therapy.

- In February 2024, Jorg Schuttrumpf, Chief Scientific Innovations Officer at Grifols, announced that the company plans to release Phase III results of its long-term albumin therapy in 2024. This treatment aims to extend the survival of patients with decompensated cirrhosis and ascites.

Report Scope

Report Features Description Market Value (2024) US$ 16.8 Billion Forecast Revenue (2034) US$ 36.6 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Immunoglobulin, Albumin, Coagulation Factors, and Others), By Application (Bleeding Disorders, Multifocal Motor Neuropathy, Liver Disease, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Shanghai RAAS, Kedrion, Kameda Pharmaceuticals, Grifols, CSL Limited, Biotest AG, Bio Products Laboratory, ADMA Biologics. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Plasma Derived Medicine MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample

Plasma Derived Medicine MarketPublished date: July 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Shanghai RAAS

- Kedrion

- Kameda Pharmaceuticals

- Grifols

- CSL Limited

- Biotest AG

- Bio Products Laboratory

- ADMA Biologics