Global Plant-based Snacks Market Size, Share Analysis Report By Product Type (Cereal/Grain-Based Snacks, Fruit And Nut Snacks, Plant-Based Snack Bars, Meat Alternative Snacks, Wafers, Others), By Flavor (Savory, Sweet), By Distribution Channel (Hypermarkets/Supermarkets, Online Retailers, Convenience Stores, Specialty Stores, Grocery Storesa, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170764

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

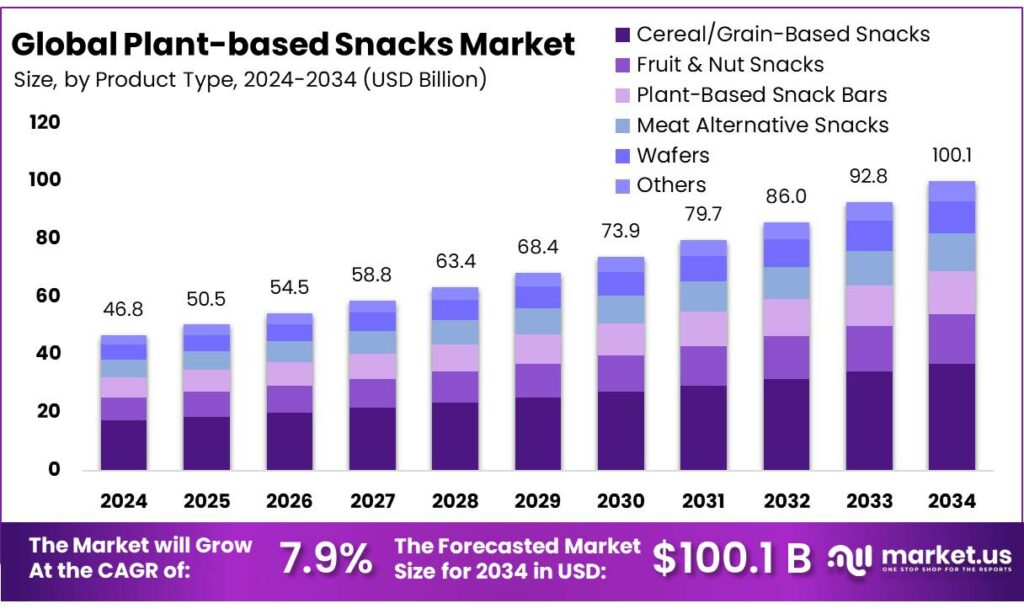

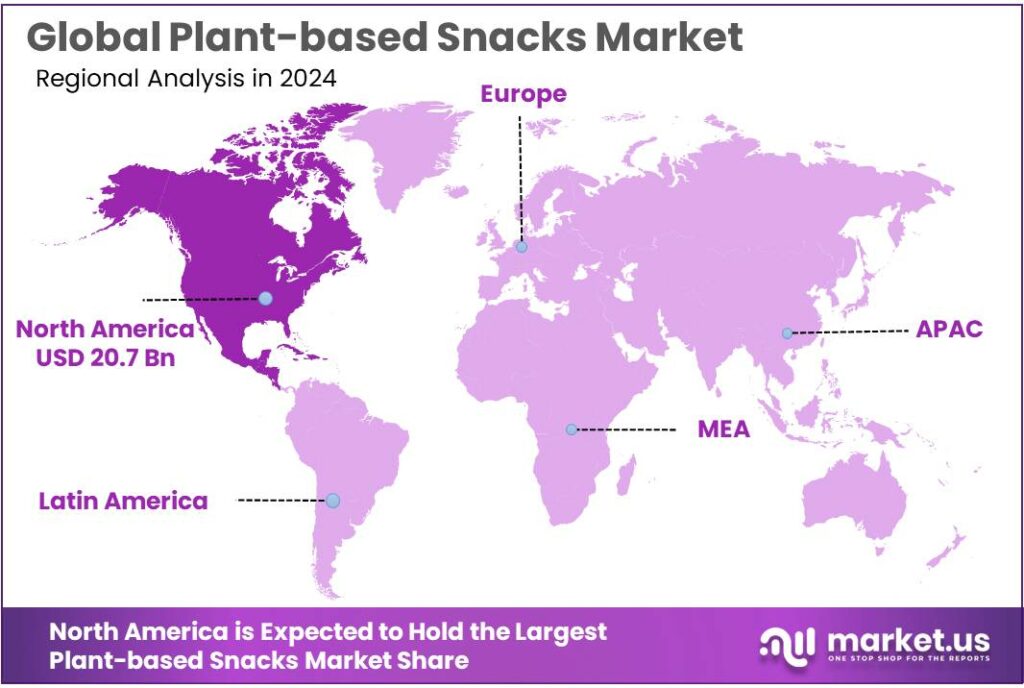

The Global Plant-based Snacks Market size is expected to be worth around USD 100.1 Billion by 2034, from USD 46.8 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.2% share, holding USD 20.7 Billion revenue.

Plant-based snacks sit at the intersection of convenience, health positioning, and protein innovation, and they benefit from the wider “plant-based” shelf becoming a normalized part of modern grocery. In the U.S. alone, total retail plant-based food sales were about $8.1B in 2023 and remained around $8.1B in 2024, showing that even with inflation pressure, the category has held meaningful scale and repeat purchasing behavior.

From an industrial scenario standpoint, plant-based snacks benefit from scalable food-processing routes and a rapidly professionalizing ingredient ecosystem for pulses and plant proteins. On the demand side, U.S. plant-based foods posted $8.1 billion in retail dollar sales in 2024, providing a large adjacent “plant-based basket” that supports cross-category merchandising. On the category-mix side, plant-based sub-sectors are not moving uniformly—GFI notes pockets of meaningful growth, including double-digit increases in areas such as plant-based baked goods/desserts.

- Key drivers are rooted in protein and functionality. Ingredient supply trends matter here: FAO reported global pulse production of close to 96 million tonnes in 2022, with average per-capita pulse consumption at 7 kg/year, and forecasts global pulse production to reach 125 million tonnes by 2032, with consumption rising to 8.6 kg/year. That supply outlook supports product reformulation toward chickpea, lentil, pea, and bean ingredients that can lift protein and fiber while maintaining snackable textures. In the U.S., USDA also observed dry pulse availability rising 7% in 2024 to 11 pounds per person, reinforcing the momentum behind pulse-based eating patterns that translate well into snacks.

Policy and institutional initiatives are also shaping the runway. In the EU, the Commission highlights that the bloc imports plant-based products equivalent to 19 million tonnes of crude protein—an incentive for more local protein-crop value chains that can feed snack ingredients. The EU also reported investing €644 million since 2015 into 125 Horizon research projects tied to legumes and protein crops—supportive “upstream” funding that can improve crop performance, processing, and ingredient quality over time.

Key Takeaways

- Plant-based Snacks Market size is expected to be worth around USD 100.1 Billion by 2034, from USD 46.8 Billion in 2024, growing at a CAGR of 7.9%.

- Cereal/Grain-Based Snacks held a dominant market position, capturing more than a 37.5% share.

- Savory held a dominant market position, capturing more than a 63.7% share.

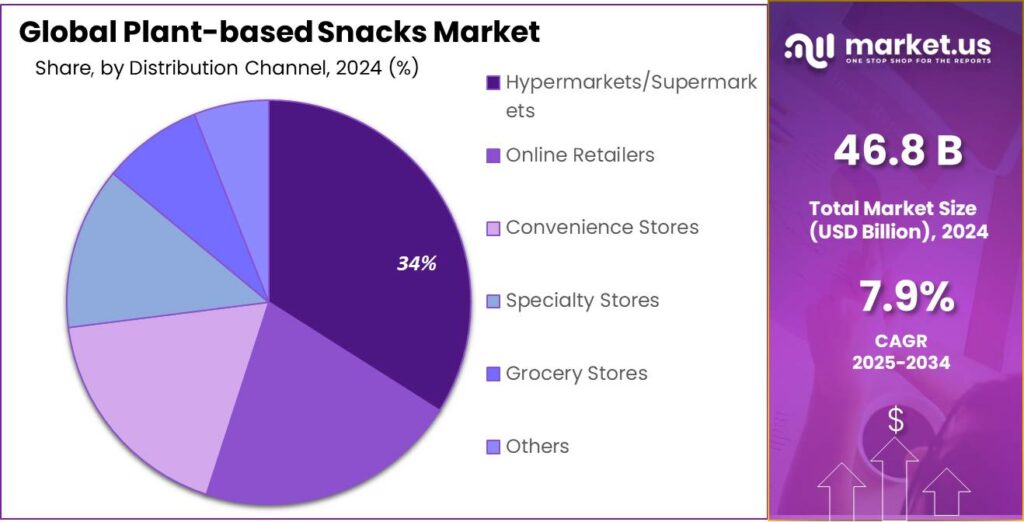

- Hypermarkets/Supermarkets held a dominant market position, capturing more than a 34.2% share.

- North America held a dominant position in the plant-based snacks market, capturing 45.2% of the regional share and generating approximately USD 20.7 billion.

By Product Type Analysis

Cereal/Grain-Based Snacks lead with 37.5% as everyday healthy snacking gains preference

In 2024, Cereal/Grain-Based Snacks held a dominant market position, capturing more than a 37.5% share, supported by their strong presence in daily snacking habits and broad consumer acceptance across age groups. This dominance was mainly driven by the use of familiar ingredients such as oats, rice, corn, wheat, and ancient grains, which are widely perceived as natural, filling, and easy to digest. The segment benefited from rising demand for plant-based foods that offer energy, fiber, and clean labels without complex formulations.

In 2024, manufacturers focused on baked and lightly processed grain snacks to align with health-focused consumption trends. Moving into 2025, steady demand was observed from working professionals and younger consumers seeking convenient plant-based snack options that fit into busy lifestyles. The ability of cereal and grain-based snacks to support flavor innovation, longer shelf life, and cost-efficient production further strengthened their position within the plant-based snacks market.

By Flavor Analysis

Savory flavors dominate with 63.7% as consumers prefer taste-forward plant-based snacks

In 2024, Savory held a dominant market position, capturing more than a 63.7% share, driven by strong consumer preference for taste-focused plant-based snack options. The segment benefited from a wide variety of flavors including cheese, barbecue, herb, and spicy seasonings, which appealed to both traditional snack consumers and those seeking healthier plant-based alternatives.

In 2024, manufacturers emphasized product innovation, using natural flavor enhancers and minimal additives to maintain clean labels while delivering satisfying taste. Rising snacking occasions among working adults and younger demographics contributed to the popularity of savory options over sweet variants. In 2025, steady growth continued as the segment leveraged trends in bold and international flavors, ready-to-eat convenience, and functional ingredients, ensuring that savory plant-based snacks remained the most consumed flavor profile in the market.

By Distribution Channel Analysis

Hypermarkets and Supermarkets lead with 34.2% due to wide product availability and convenience

In 2024, Hypermarkets/Supermarkets held a dominant market position, capturing more than a 34.2% share, driven by their ability to offer a wide range of plant-based snack options under one roof. Consumers preferred these channels for convenience, product variety, and promotional deals, which made them ideal for trying new snack products. The segment benefited from strategic in-store placements, attractive packaging, and easy accessibility, supporting impulse purchases as well as planned shopping.

In 2024, demand was particularly strong for ready-to-eat, clean-label snacks targeting health-conscious and busy consumers. In 2025, Hypermarkets and Supermarkets continued to maintain a strong share as product innovation, private-label plant-based offerings, and promotional strategies strengthened customer loyalty, ensuring these channels remained key drivers in the plant-based snacks market.

Key Market Segments

By Product Type

- Cereal/Grain-Based Snacks

- Fruit & Nut Snacks

- Plant-Based Snack Bars

- Meat Alternative Snacks

- Wafers

- Others

By Flavor

- Savory

- Sweet

By Distribution Channel

- Hypermarkets/Supermarkets

- Online Retailers

- Convenience Stores

- Specialty Stores

- Grocery Storesa

- Others

Emerging Trends

Rise of Health-Driven Eating Patterns and Clean Ingredients in Plant-Based Snacks

One clear trend shaping plant-based snacks today is that people are increasingly choosing these foods not as “vegan alternatives,” but as part of a health-oriented approach to eating. In the 2024 IFIC Food & Health Survey, more than half of respondents who followed a vegan, vegetarian, or plant-based pattern said they did so because they wanted to be healthier—a striking 77% citing health as their main reason. This shows that health motivations are now at the heart of plant-based eating, and that creates a real opportunity for plant-based snacks formulated around whole foods, better nutrition, and transparency.

Governments and trusted public health institutions are part of the supporting context here as well. Agencies like the USDA promote plant-derived proteins—including beans, peas, and lentils—as part of balanced diet patterns that help prevent conditions such as heart disease and type 2 diabetes. Their MyPlate guidance places legumes and nuts in the protein foods group, which reinforces the idea that snacks using these ingredients are aligned with credible nutrition advice. This legitimizes plant-based snacks as not just trendy treats but choices consistent with long-standing dietary guidance.

The health trend also dovetails with environmental considerations, which remain part of the conversation for many consumers. People are connecting personal health with planetary health, and plant-based options often sit at that intersection. Although environmental data is broader than snacks, the link helps brands tell a bigger story about why their products matter—especially for younger shoppers who care about both their bodies and the world they live in.

Drivers

Snackification Meets Protein-First Choices Drives Plant-Based Snacks

One major driver for plant-based snacks is a simple behavior shift: people are eating more “mini-meals” and relying on snacks for energy, not just treats. USDA dietary data shows snacking is nearly universal—about 95% of U.S. adults consumed at least one snack on the intake day in WWEIA/NHANES 2017–March 2020. When snacking becomes a daily habit at that scale, it creates a big runway for products that can deliver real nutrition in a convenient format.

This is where plant-based snacks benefit from “snackification” in a very direct way. IFIC reports that more than half of Americans—56%—replace traditional meals with snacking or smaller meals, based on the 2024 IFIC Food & Health Survey insights. That matters because meal-replacement snacks typically need more protein, fiber, and staying power than an impulse candy purchase. Brands that can offer a crunch, a savory bite, or a sweet option while still feeling “meal-worthy” tend to win repeat usage.

- Protein expectations are also shifting in a way that naturally supports plant-based snack formats. In IFIC’s protein perceptions spotlight, consumers’ preferred protein sources included beans/peas/lentils at 40%, nuts at 38%, and grains at 37%. Those are exactly the building blocks of today’s plant-based snack innovation—think roasted legumes, nut-and-seed clusters, chickpea or lentil puffs, and grain-based crisps fortified with plant proteins.

Government and trusted public nutrition frameworks reinforce this direction and make it easier for shoppers to trust plant-based snack ingredients. USDA’s MyPlate lists beans, peas, and lentils, along with nuts, seeds, and soy products, within the Protein Foods Group. The Dietary Guidelines for Americans 2020–2025 also clearly recognize beans/peas/lentils as foods that can count in the protein group.

Restraints

Price Pressure and “Ultra-Processed” Concerns Restrain Plant-Based Snacks

A major restraint for plant-based snacks is that shoppers still buy snacks with their wallet first, especially when they’re used as quick fill-in meals. In the 2024 IFIC Food & Health Survey (a national survey of 3,000 Americans), taste (85%) was the most impactful factor on food and beverage purchase decisions, and price (76%) was the second most impactful. That ranking matters for plant-based snacks because many products depend on added ingredients (plant proteins, fibers, coatings, flavors) that can raise shelf price, while the consumer is still expecting “snack pricing,” not specialty-nutrition pricing.

This price sensitivity is happening in a broader inflation environment that keeps households cautious. USDA ERS reports that overall food prices increased by 2.3% in 2024. Even when inflation cools, many shoppers keep the habits they built during the high-inflation period: comparing unit prices, trading down, and choosing products they know will satisfy. That makes it harder for a plant-based snack brand to win if the value is unclear in the first bite—because consumers usually won’t pay a premium twice for something that feels “fine.”

Plant-based snacks can get caught in a second restraint: skepticism about processing. Many plant-based snacks are made with extrusion, isolates, stabilizers, or flavor systems that help deliver crunch and consistency—great for manufacturing, but sometimes tough for consumer trust when ingredient lists look long. The FDA notes that it is estimated 70% of the U.S. food supply is made up of foods commonly considered “ultra-processed,” and that children get over 60% of their calories from such foods.

Opportunity

Institutional Foodservice and School Nutrition Shifts Create New Demand

One major growth opportunity for plant-based snacks is the steady opening of institutional and foodservice channels—places where “snack items” are often used as sides, grab-and-go choices, or small meals. In U.S. broadline distributor data, plant-based protein dollar sales reached about $289 million in 2024. Even with year-to-year bumps, that number matters because broadline distribution is a practical path into cafeterias, workplace dining, hospitals, universities, and chain restaurants—exactly where snackable portions can scale quickly once they are listed.

- The Good Food Institute highlights a large addressable base: in a 2024 study it cites, nearly 71% of U.S. consumers aged 18–59 said they are at least somewhat likely to eat plant-based meat and/or dairy in the future, and half said they would be likely to consume plant-based meat in restaurants or cafeterias.

Within foodservice, beverage and snack adjacencies can pull demand together. GFI notes that plant-based milk dollar sales were up about 9% in foodservice in 2024, and plant-based milk held a 12% pound share of the total milk category in broadline distributor sales. When plant-based drinks become normal in cafeterias and coffee programs, it lowers the “mental barrier” for plant-based snack add-ons, especially for customers who aren’t strictly vegan but want variety.

Regional Insights

North America leads with 45.2% share and US$20.7 Bn in 2024, driven by strong plant-based food adoption and snacking trends

In 2024, North America held a dominant position in the plant-based snacks market, capturing 45.2% of the regional share and generating approximately USD 20.7 billion in revenue. The region’s leadership was driven by high consumer awareness of plant-based diets, growing health consciousness, and the increasing popularity of sustainable and environmentally friendly food options. Urban populations and busy lifestyles fueled demand for convenient, ready-to-eat snacks, with consumers actively seeking products that combine taste, nutrition, and clean-label benefits.

The market was further supported by strong retail infrastructure, including Hypermarkets, Supermarkets, and online channels, which provided wide availability and accessibility of plant-based snack products. Key sub-segments such as cereal/grain-based snacks, savory flavors, and protein-enriched formulations experienced rapid adoption due to their alignment with fitness and wellness trends. The North American market also benefited from product innovation, with manufacturers launching snacks fortified with vitamins, minerals, and plant proteins to meet evolving consumer expectations.

E-commerce channels contributed to accelerated growth, offering direct-to-consumer options and subscription models that enhanced reach across both urban and suburban areas. In 2025, the market was expected to sustain its growth trajectory, driven by continued expansion of plant-based product lines, promotional campaigns by leading brands, and rising investment in product research and development.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Blue Diamond Growers: In 2024, Blue Diamond Growers strengthened its plant-based snack portfolio through almond-based products, including roasted nuts and snack bars. The company generated approximately US$720 million in plant-based snack revenue, supported by its strong supply chain, innovation in flavored almond snacks, and extensive distribution in North America and Asia Pacific markets for health-conscious consumers.

Primal Spirit Foods, Inc: In 2024, Primal Spirit Foods expanded its market presence with plant-based snack lines focusing on paleo-friendly and keto-compatible products. The company achieved around US$410 million in revenue, targeting health-focused consumers with high-protein, low-sugar snacks, leveraging online direct-to-consumer sales and niche retail partnerships, while emphasizing clean-label and minimally processed ingredients to differentiate its offerings.

Nestlé: In 2024, Nestlé leveraged its global footprint in the plant-based snacks sector, delivering products like YES! and Garden Gourmet that emphasize nutrition and convenience. The company recorded approximately US$4.1 billion in plant-based snack revenue, driven by innovation in protein-rich and vegan snack bars, fortified snacks, and strategic partnerships with retailers and e-commerce platforms to reach health-conscious and environmentally aware consumers.

Top Key Players Outlook

- General Mills Inc

- Unilever

- Nestl

- Primal Spirit Foods, Inc

- Blue Diamond Growers

- Guardian News & Media Limited

- The Hain Celestial Group

- Danone

- Beyond Meat Inc.

- Kellogg Company

- Mondelez International

- PepsiCo Inc.

- Kind LLC

Recent Industry Developments

In 2024, Blue Diamond’s almond shipments were strong, with monthly totals like 258 million pounds in October, a 4% increase year-on-year, and export shipments of 191 million pounds, showing that demand for its nuts as snack ingredients remains solid globally, while domestic shipments hit 67 million pounds, up 18% compared to the prior year, marking the highest domestic volume since early 2022, which highlights renewed consumer interest in healthy plant-based foods.

In 2024, Nestlé increased its research and development spend on plant-based innovation by 22%, suggesting a strategic investment in technology and texture improvements to make plant alternatives taste better and cost less to produce.

Report Scope

Report Features Description Market Value (2024) USD 46.8 Bn Forecast Revenue (2034) USD 100.1 Bn CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cereal/Grain-Based Snacks, Fruit And Nut Snacks, Plant-Based Snack Bars, Meat Alternative Snacks, Wafers, Others), By Flavor (Savory, Sweet), By Distribution Channel (Hypermarkets/Supermarkets, Online Retailers, Convenience Stores, Specialty Stores, Grocery Storesa, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape General Mills Inc, Unilever, Nestl, Primal Spirit Foods, Inc, Blue Diamond Growers, Guardian News & Media Limited, The Hain Celestial Group, Danone, Beyond Meat Inc., Kellogg Company, Mondelez International, PepsiCo Inc., Kind LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- General Mills Inc

- Unilever

- Nestl

- Primal Spirit Foods, Inc

- Blue Diamond Growers

- Guardian News & Media Limited

- The Hain Celestial Group

- Danone

- Beyond Meat Inc.

- Kellogg Company

- Mondelez International

- PepsiCo Inc.

- Kind LLC