Glonal Pine Components Market Size, Share, And Enhanced Productivity By Treatment (Untreated, Pressure Treated, Heat Treated, Primed/Painted), By Product Type (Finger-Jointed Pine, Laminated Pine), By Grade / Quality (Clear Grade, Industrial Grade, Knotty Grade),By Application (Window Frames, Door Frames, Furniture Components, Mouldings and Trims, Structural Components, Interior Paneling), By End-Use Industry (Construction, Furniture Manufacturing, Joinery Workshops, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 175224

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Treatment Analysis

- By Product Type Analysis

- By Grade / Quality Analysis

- By Application Analysis

- By End-Use Industry Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

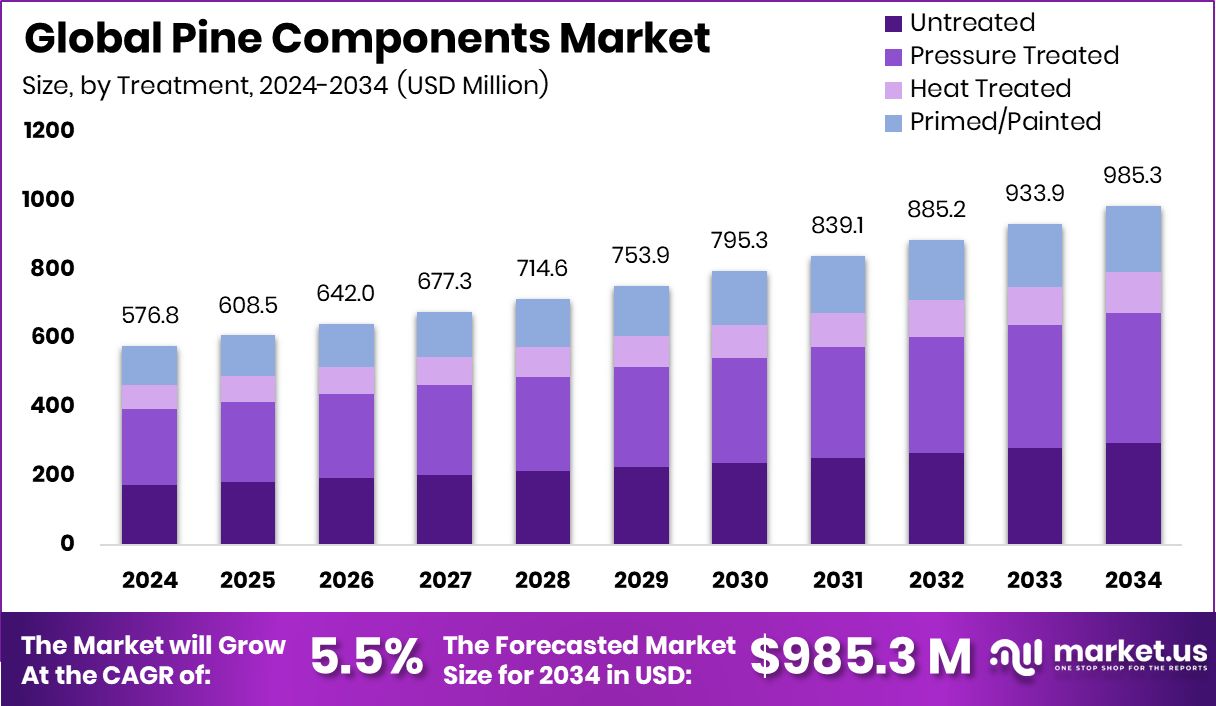

The Global Pine Components Market is expected to be worth around USD 985.3 million by 2034, up from USD 576.8 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. The Pine Components Market in North America recorded 32.10%, totaling USD 185.1 Mn.

Pine components refer to the processed parts made from pine wood, including boards, mouldings, panels, frames, and structural pieces used in homes, commercial buildings, furniture, and interior applications. These components are valued for their strength, smooth workability, and natural appearance, making them suitable for both functional and decorative uses. As construction materials evolve, pine remains a dependable option because it is renewable, lightweight, and widely adaptable for both structural and aesthetic needs.

The Pine Components Market represents the global demand, trade, and production of these pine-based materials across construction, interiors, and industrial uses. The market grows as builders and manufacturers continue choosing pine for its reliability and affordability. Strong activity in modern construction also supports this market, especially as new technologies reshape building processes and require stable wood materials.

Growth factors are closely linked to rising construction momentum worldwide. New investments like a $3 million pre-Series A round for a construction tech startup and $7.3 million raised by a construction fintech platform show increasing activity that indirectly boosts demand for wood components. As construction workflows modernize, the need for easy-to-install pine parts strengthens.

Demand is also supported by large-scale infrastructure trends. Record $61 billion in data center deals in 2025 highlights ongoing facility development, which elevates needs for framing, interior finishing, and durable pine elements within expanding commercial spaces.

Opportunities continue to widen as innovation enters the construction space. Advancements like Polyuse’s ¥2.7 billion Series B funding for 3D-printing development and an AI-powered procurement startup securing $20 million Series A, along with Contineu’s $1.2 million seed round, all point toward faster, tech-driven building cycles that open new pathways for standardized pine components to be incorporated in modern construction systems.

Key Takeaways

- The Global Pine Components Market is expected to be worth around USD 985.3 million by 2034, up from USD 576.8 million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

- The Pine Components Market grows steadily as pressure-treated variants hold a strong 38.4% share.

- Finger-jointed pine dominates product type demand with its superior stability, capturing 59.1% market share.

- Knotty grade pine remains popular for aesthetic applications, accounting for 38.7% of total volume.

- Window frames drive consistent demand in applications, representing 27.2% of overall market consumption globally.

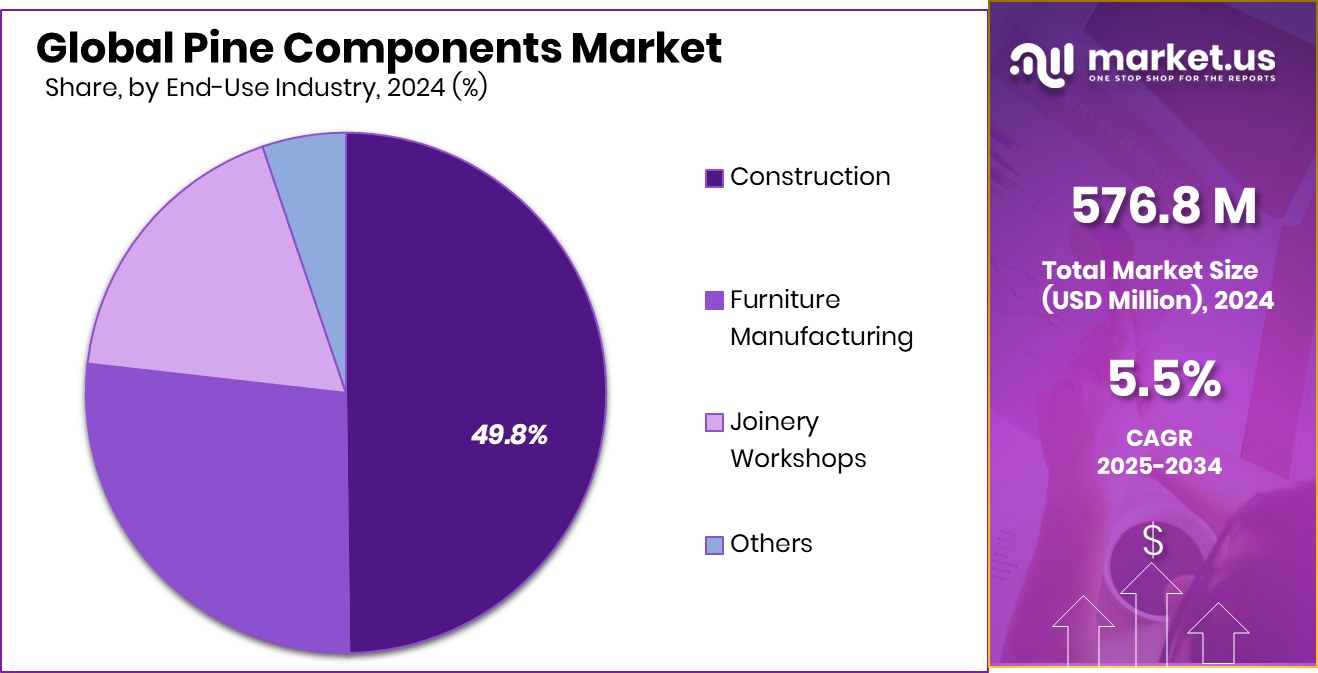

- Construction remains the leading end-use sector, contributing a significant 49.8% to market expansion.

- In North America, the market reached USD 185.1 Mn, securing 32.10% share.

By Treatment Analysis

The Pine Components Market sees strong demand as pressure treated products reach 38.4% share.

In 2024, the Pine Components Market saw strong demand for pressure-treated pine, holding a significant 38.4% share due to its durability and resistance to moisture, decay, and insects. Builders increasingly preferred this treatment type for structural and outdoor applications, especially in regions with high humidity. Growing awareness about long-lasting materials and shifting trends toward sustainable wood solutions supported this demand.

Pressure-treated pine also gained traction in DIY home improvement projects as consumers sought cost-effective and sturdy construction materials. The segment benefited from ongoing urban development and rising repair and renovation activities worldwide. Manufacturers continued improving treatment technologies to ensure better performance, enhanced safety standards, and compliance with global environmental regulations.

By Product Type Analysis

Finger-jointed pine leads the Pine Components Market with a dominant 59.1% portion.

In 2024, the Pine Components Market was strongly dominated by finger-jointed pine, capturing an impressive 59.1% share due to its superior stability and minimal defects. This product type remained highly preferred for interior applications because it offers smooth finishing, consistent quality, and reduced warping compared to solid pine boards. Demand was supported by rising production of mouldings, trims, and other engineered wood components widely used in residential and commercial construction.

Manufacturers expanded automated joining technologies to improve bonding strength and optimize resource utilization. As sustainability gained importance, finger-jointed pine became a favored solution because it efficiently uses small wood sections, reducing waste, improving structural performance, and meeting eco-friendly building requirements.

By Grade / Quality Analysis

Knotty grade materials capture 38.7% share within the Pine Components Market globally.

In 2024, knotty-grade pine held a notable 38.7% share in the Pine Components Market, driven by growing consumer preference for rustic and aesthetic wood designs. This grade appealed strongly to interior décor trends emphasizing natural textures and warm finishes. Knotty pine remained popular for wall paneling, cabinetry, and custom furniture, particularly in residential projects. Designers preferred this grade for its visual character and cost-effectiveness compared to higher-grade pine.

Manufacturers enhanced surface treatments to maintain durability while preserving its natural look. Rising interest in country-style and vintage-inspired interiors further supported segment growth. With increasing renovation activities worldwide, knotty-grade pine continued to attract both homeowners and commercial buyers seeking budget-friendly, stylish wood materials.

By Application Analysis

Window frames account for 27.2% application share in the Pine Components Market.

In 2024, the window frames segment accounted for 27.2% of the Pine Components Market, supported by the rising use of pine due to its lightweight structure, easy machinability, and good insulation properties. Builders favored pine window frames for their ability to provide strong thermal performance and aesthetic appeal, especially in residential construction.

Growing demand for energy-efficient homes encouraged the use of wooden frames as a sustainable alternative to PVC and aluminum. Manufacturers focused on improved surface coatings and lamination techniques to enhance durability against weather conditions. Renovation of older homes, particularly in Europe and North America, also contributed to steady demand for pine-based window components.

By End-Use Industry Analysis

Construction remains the top end-use, holding 49.8% of the Pine Components Market.

In 2024, the construction industry emerged as the leading end-use sector, holding 49.8% of the Pine Components Market. The material’s cost-effectiveness, workability, and compatibility with modern building systems made it widely used in framing, interior finishing, joinery, and paneling. Rapid urbanization, housing development, and infrastructure upgrades across emerging markets boosted consumption.

Additionally, sustainable construction practices encouraged builders to shift toward certified wood products, further supporting pine adoption. Government initiatives promoting green buildings and energy-efficient materials also played a vital role. With increasing demand for residential and commercial spaces, construction activities remained the primary driver of pine component usage globally.

Key Market Segments

By Treatment

- Untreated

- Pressure Treated

- Heat Treated

- Primed/Painted

By Product Type

- Finger-Jointed Pine

- Laminated Pine

By Grade / Quality

- Clear Grade

- Industrial Grade

- Knotty Grade

By Application

- Window Frames

- Door Frames

- Furniture Components

- Mouldings and Trims

- Structural Components

- Interior Paneling

By End-Use Industry

- Construction

- Furniture Manufacturing

- Joinery Workshops

- Others

Driving Factors

Strong Furniture Demand Boosts Pine Components Growth

The Pine Components Market is rising mainly because demand for furniture and home décor is growing fast. Pine is widely used for making frames, shelves, tables, and modular pieces, and this demand expands as the furniture rental and subscription sector grows. Recent investments highlight this momentum, such as Furlenco raising USD 15 million in funding and an additional ₹125 crore funding to scale its rental operations. These investments signal more movement of furniture across homes and cities, which increases the requirement for strong, lightweight, and affordable pine components. Pine fits this need well due to its versatility, making it a preferred material in growing urban and rental-driven furniture markets.

Restraining Factors

High Capital Requirements Slow Pine Components Expansion

The major restraint for the Pine Components Market comes from rising capital requirements in the furniture and interiors sector. Manufacturers often need advanced machinery, new finishing technologies, and strong supply chains to meet quality expectations, which becomes difficult without financial support. This challenge is reflected in large funding activities happening around the industry, such as Spacewood’s talks for Rs 300 crore financing and Livspace investing $5.5 million in furniture hardware startup TplusA. These investments show how much capital product companies need to stay competitive. Smaller pine component producers may struggle to match this scale, slowing market expansion and making it harder to upgrade production or reach new customers.

Growth Opportunity

Expansion of Furniture Platforms Creates New Opportunities

The Pine Components Market is seeing strong opportunities as furniture rental, retail, and hybrid platforms rapidly expand. Pine is preferred for its affordability, smooth finish, and ease of customization, which makes it ideal for fast-turnover or modular furniture. Several companies are scaling quickly, creating more demand for pine-based structures. This is supported by developments such as Furlenco preparing for an IPO with a ₹100 crore fundraise, along with an Indian furniture rental startup securing $70 million in debt funding. These expansions increase production and inventory requirements across furniture platforms, opening new doors for pine component suppliers that can deliver consistent quality and large volumes at competitive pricing.

Latest Trends

Rise of Omni-Channel Platforms Shapes Pine Trends

A key trend shaping the Pine Components Market is the rapid shift toward omni-channel furniture models that combine online, offline, and rental ecosystems. This creates a steady flow of orders for pine-based parts used in modular and ready-to-assemble furniture. Recent funding activities reflect this shift, including Pepperfry raising Rs 43.3 crore to strengthen its marketplace and Furlenco attracting ₹125 crore funding to expand its footprint. As these platforms grow in reach, they require a wide variety of pine components for beds, storage units, shelves, and décor items. This trend promotes the use of pine because it is easy to process, cost-effective, and suitable for high-volume, fast-moving furniture lines.

Regional Analysis

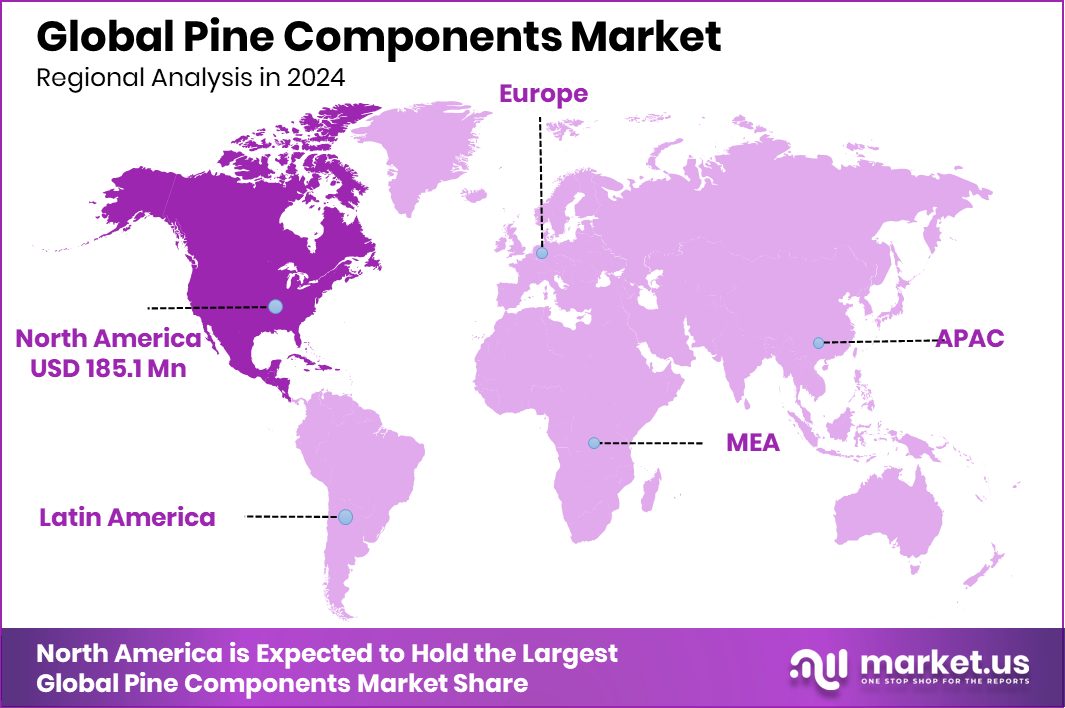

North America leads the Pine Components Market with 32.10%, valued at USD 185.1 Mn.

In the Pine Components Market, North America emerged as the leading region, holding a dominant 32.10% share valued at USD 185.1 Mn, supported by strong construction activity, widespread use of engineered pine products, and steady residential renovation trends across the U.S. and Canada.

Europe followed with stable demand driven by its preference for high-quality pine components used in windows, doors, furniture, and interior finishing applications. The Asia Pacific market continued gaining traction as manufacturing expansion and growing construction activity boosted the consumption of pine-based materials in both residential and commercial projects.

Meanwhile, the Middle East & Africa region showed gradual growth, supported by rising urban development and increasing use of wood components in interior applications. Latin America contributed moderately, with the market shaped by improving building activities and renewed interest in cost-efficient wood solutions.

Collectively, these regions demonstrated varied growth patterns, but North America maintained clear dominance because of its mature construction ecosystem and consistent adoption of pine components across multiple end-use industries.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Weyerhaeuser continued to strengthen its role through its extensive timberland operations and long-standing expertise in producing high-quality wood components. The company’s integrated approach, from forestry to finished pine products, enabled it to support consistent supply, maintain cost control, and align with the rising preference for durable and responsibly sourced materials across end-use industries.

Metsa Group remained influential due to its deep roots in sustainable Nordic forestry and advanced wood-processing capabilities. The company’s focus on optimizing pine resources and expanding engineered wood solutions supported its competitive positioning, especially as global buyers increasingly valued product reliability and environmentally conscious manufacturing. Its emphasis on circular practices further enhanced its relevance in markets prioritizing eco-friendly materials.

Stora Enso, known for its broad portfolio of wood-based innovations, continued leveraging pine components as part of its transition toward renewable material solutions. Its strong European manufacturing base, combined with ongoing advancements in wood engineering, helped reinforce its presence in construction, packaging, and interior applications. Collectively, these companies contributed to strengthening supply stability, product quality, and innovation momentum in the 2024 Pine Components Market.

Top Key Players in the Market

- Weyerhaeuser Company

- Metsa Group

- Stora Enso

- Mayr-Melnhof Holz Holding AG

- Pfeifer Group

- Setra Group

- Interfor Corporation

- UFP Industries

- Arauco

- Boise Cascade

Recent Developments

- In December 2025, Boise Cascade completed the acquisition of Humphrey Company, Inc. (doing business as Holden Humphrey), a building materials distributor based in Chicopee, Massachusetts. This acquisition expanded the company’s distribution reach and strengthened its presence in the Northeast U.S. market.

- In November 2024, Arauco introduced a Sustainable Financing Framework to guide how it funds projects related to sustainability and long-term investments. This framework supports financing that aligns with environmental and social goals, helping back forestry and wood products initiatives.

Report Scope

Report Features Description Market Value (2024) USD 576.8 Million Forecast Revenue (2034) USD 985.3 Million CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Treatment (Untreated, Pressure Treated, Heat Treated, Primed/Painted), By Product Type (Finger-Jointed Pine, Laminated Pine), By Grade / Quality (Clear Grade, Industrial Grade, Knotty Grade),By Application (Window Frames, Door Frames, Furniture Components, Mouldings and Trims, Structural Components, Interior Paneling), By End-Use Industry (Construction, Furniture Manufacturing, Joinery Workshops, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Weyerhaeuser Company, Metsa Group, Stora Enso, Mayr-Melnhof Holz Holding AG, Pfeifer Group, Setra Group, Interfor Corporation, UFP Industries, Arauco, Boise Cascade Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Weyerhaeuser Company

- Metsa Group

- Stora Enso

- Mayr-Melnhof Holz Holding AG

- Pfeifer Group

- Setra Group

- Interfor Corporation

- UFP Industries

- Arauco

- Boise Cascade