Phytosterols Market Analysis By Product (Beta-sitosterol, Campesterol, Stigmasterol, Others), By Application (Pharmaceutical, Cosmetics, Food Ingredients, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: April 2025

- Report ID: 18323

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

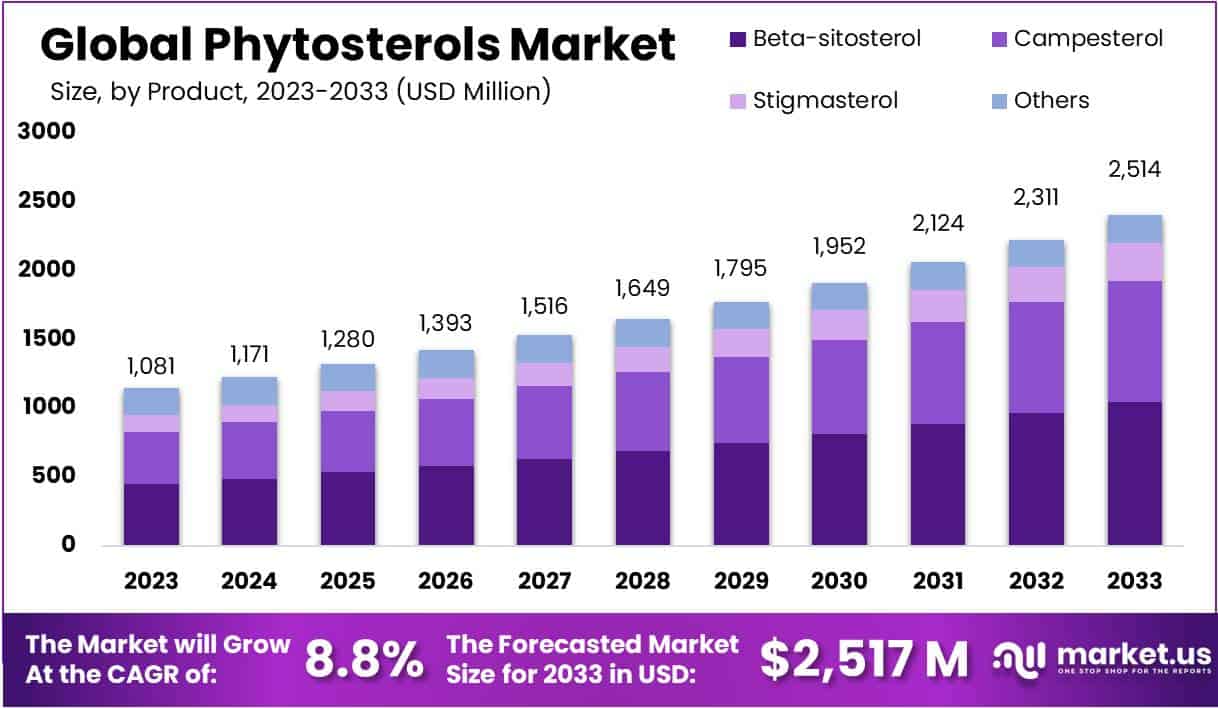

The Phytosterols Market Size is anticipated to reach a valuation of approximately USD 2,514 million by 2033, compared to its estimated worth of USD 1,081 million in 2023. This growth signifies a Compound Annual Growth Rate (CAGR) of 8.8% during the forecast period spanning from 2024 to 2033.

Phytosterols, also referred to as plant sterols or stanols, are naturally occurring compounds found in plants. They share a structural resemblance to cholesterol, a substance present in animal tissues. Common types include beta-sitosterol, campesterol, and stigmasterol, distributed in various plant-based foods like fruits, nuts, and vegetable oils. These compounds, integral to plant cell membranes, contribute to maintaining structural integrity.

The phytosterols market is witnessing substantial growth, propelled by the increasing awareness of their health benefits. Consumers are leaning towards functional foods and supplements enriched with phytosterols, especially those targeting heart health. Products like margarine, yogurt, and spreads are incorporating these compounds. The backdrop of this growth is a global concern about cardiovascular diseases, prompting a demand for products contributing to heart health. Regulatory support from entities like the U.S. FDA and the European EFSA, endorsing health claims related to phytosterols and coronary heart disease risk reduction, further solidifies the market’s upward trajectory.

Key Takeaways

- Market Growth: Anticipated market value of USD 2,514 million by 2033, showing a robust 8.8% Compound Annual Growth Rate (CAGR) from 2024 to 2033.

- Product Leadership: Beta-sitosterol dominates with over 32.7% market share, reflecting strong consumer preference for heart health-promoting products.

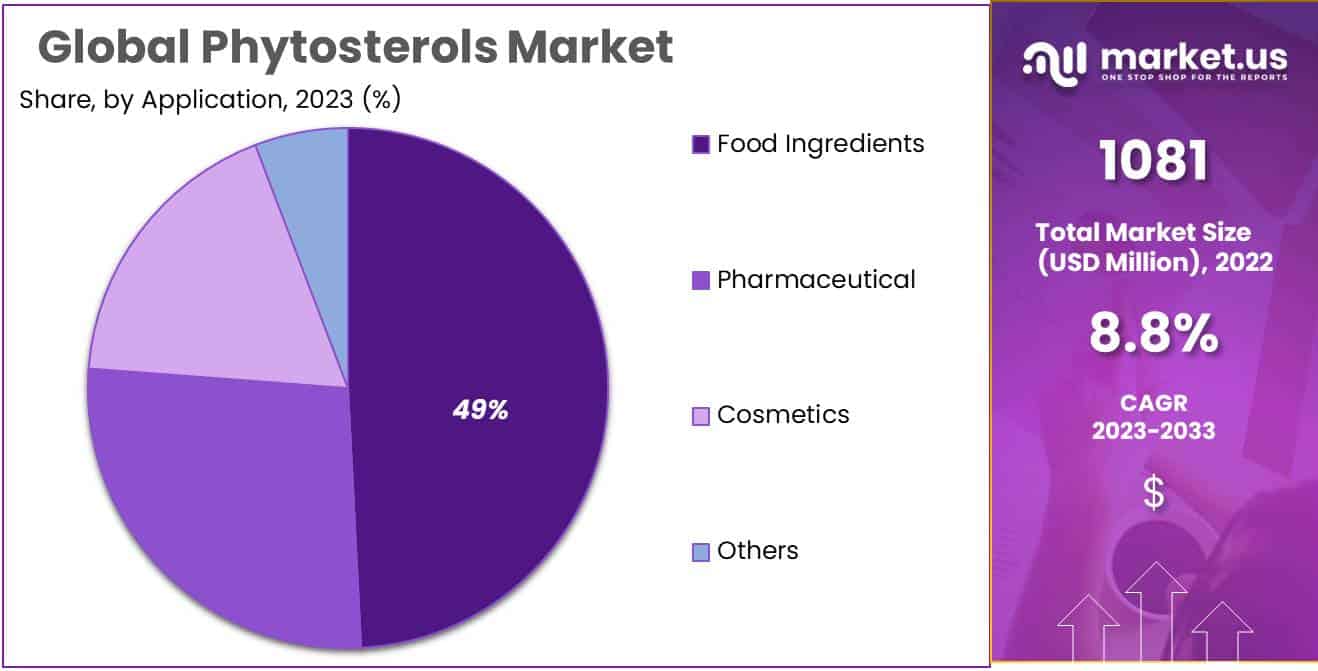

- Application Trends: Pharmaceutical Segment Secures A Large Market Share Of 49%.

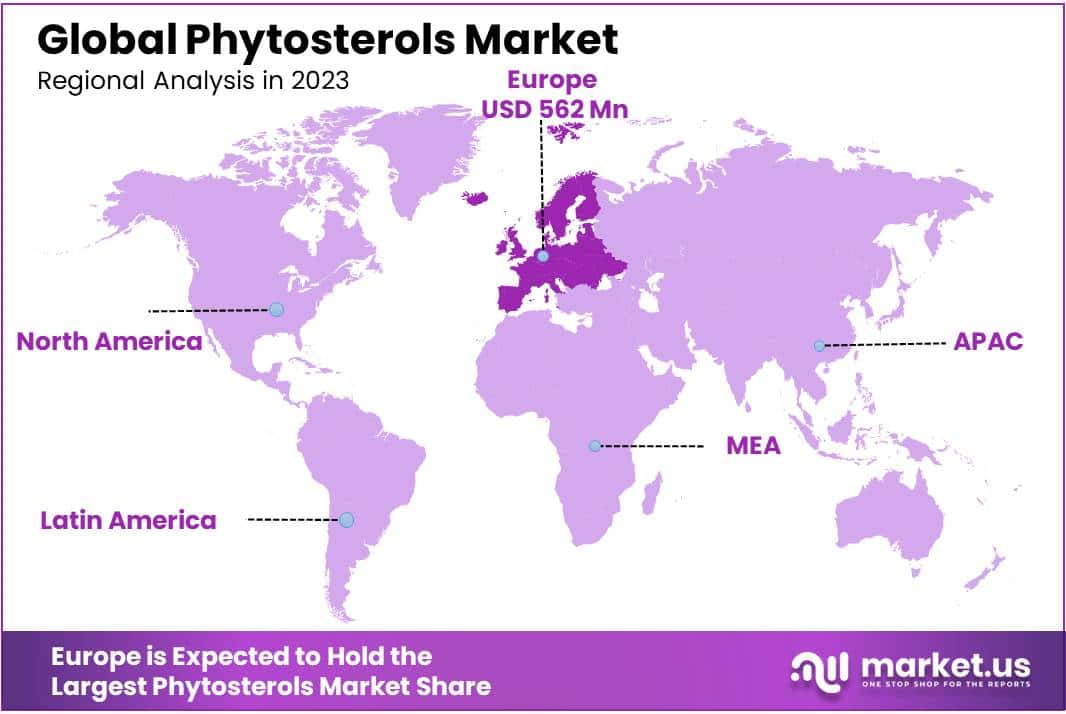

- Regional Dominance: Europe leads with a 52% market share, driven by strong regulatory support, key player presence, and proactive research and development efforts.

- Key Drivers: Increasing health awareness and rising cardiovascular health concerns drive an 8.8% CAGR, fostering demand for phytosterol-enriched products.

- Challenges: High production costs impact small-scale producers, limited consumer awareness hampers market penetration, and stringent regulatory approvals pose hurdles.

- Opportunities: Emerging markets present growth opportunities with a surge in health awareness, and innovations in product development offer avenues for expansion.

- Trends in Consumer Behavior: Clean label products gain popularity, with consumers seeking natural ingredients, and online retail channels become significant distribution platforms.

Product Analysis

In 2023, the Phytosterols market showcased a notable landscape, with distinct product segments contributing to its dynamic growth. Among these, the Beta-sitosterol segment emerged as a frontrunner, firmly securing a dominant market position by capturing more than a 32.7% share.

Beta-sitosterol, a plant-derived sterol, played a pivotal role in steering the market dynamics. Its widespread adoption can be attributed to its effectiveness in promoting heart health, thereby resonating well with health-conscious consumers. This segment’s commanding position signifies a robust consumer preference for products enriched with Beta-sitosterol, affirming its status as a key player in the Phytosterols market.

Following closely, the Campesterol segment demonstrated noteworthy growth, reflecting a heightened consumer interest in diverse phytosterol options. With its own set of health benefits and applications, Campesterol contributed to the overall market vitality, capturing attention across various consumer demographics.

Stigmasterol, another integral component of the Phytosterols market, maintained a solid presence, catering to consumers seeking a holistic approach to health and wellness. Its market share underscored its relevance and acceptance, indicating a steady demand for products featuring this specific phytosterol variant.

Beyond these primary segments, the market also witnessed the influence of other phytosterols, each carving its niche based on unique properties and applications. This diversified landscape suggests a consumer base that values options and is open to exploring varied phytosterol offerings.

Application Analysis

In 2023, Pharmaceutical held a dominant market position in the Application Segment of phytosterols market, and capturing more than a 49% share. This indicates a strong preference for Beta-sitosterol within the phytosterols landscape.

Within the pharmaceutical segment, phytosterols have gained traction as essential components in various medications. Their cholesterol-lowering properties and potential cardiovascular benefits have contributed to an increased demand. In 2023, pharmaceutical applications constituted a substantial market share, reflecting the growing recognition of phytosterols in the healthcare industry.

In the beauty and personal care scene, there’s been a remarkable rise in using phytosterols, especially in skincare products. People are increasingly drawn to natural and plant-based ingredients, and phytosterols are now highly coveted for their skin-nourishing benefits. This year, the cosmetics sector has prominently featured these plant-derived compounds, highlighting their incorporation into various beauty and personal care formulations.

Phytosterols found a prominent place in the food ingredients sector, driven by their cholesterol-lowering potential in functional foods. In 2023, the food ingredients application emerged as a key player in the market, signifying the increasing incorporation of phytosterols into various food products to promote heart health.

Beyond pharmaceuticals, cosmetics, and food ingredients, phytosterols found diverse applications in other sectors. These applications span industries where the unique properties of phytosterols can be harnessed. In 2023, the ‘others’ category showcased a notable presence, emphasizing the versatility of phytosterols in different applications.

Key Market Segments

Product

- Beta-sitosterol

- Campesterol

- Stigmasterol

- Others

Application

- Pharmaceutical

- Cosmetics

- Food Ingredients

- Others

Drivers

Increasing Health Awareness

The surge in health consciousness has propelled a growing awareness of the numerous health benefits associated with phytosterols, particularly their role in reducing cholesterol and promoting heart health. This heightened awareness is significantly influencing consumer preferences, driving an increased demand for products enriched with phytosterols.

Rising Cardiovascular Health Concerns

An escalating concern regarding cardiovascular diseases has further intensified this demand. With cardiovascular issues on the rise, there is a notable shift towards functional foods and dietary supplements that incorporate phytosterols due to their recognized ability to manage cholesterol levels effectively.

Expanding Application in Food Industry

The food industry is experiencing a noteworthy expansion in the application of phytosterols. These functional ingredients are now being integrated into a diverse range of products, including spreads, dairy items, and bakery goods. The versatility of phytosterols is proving to be a key attraction for food manufacturers, fostering their incorporation into various offerings.

Government Initiatives and Regulations

Government initiatives and regulations have played a pivotal role in propelling the growth of the phytosterols market. Supportive regulatory frameworks and initiatives by governments advocating for the utilization of phytosterols in food products, coupled with increased investments in research and development, are contributing significantly to the overall expansion of the market.

Restraints

High Production Costs

The extraction and purification processes involved in obtaining phytosterols are known to be costly, thereby significantly impacting overall production expenses. This economic challenge is particularly pronounced for small-scale producers who may find it difficult to absorb such high operational costs.

Limited Consumer Awareness

Despite a growing awareness surrounding the health benefits of phytosterols, a notable segment of consumers remains insufficiently informed. This lack of awareness poses a hurdle in terms of market penetration and the widespread adoption of phytosterol-enriched products.

Stringent Regulatory Approvals

Obtaining regulatory approvals for products that contain phytosterols can be a demanding and lengthy process. This can result in delays in launching new products, which may slow down market growth. Successfully navigating through these strict regulations is essential for companies in this industry.

Availability of Substitutes

The market for phytosterols faces robust competition from alternative cholesterol-lowering ingredients and supplements that can act as substitutes. This competition introduces a dynamic where the market share of phytosterols is influenced by the availability and acceptance of these substitute products. Producers must navigate this landscape strategically to maintain and enhance their market position.

Opportunities

Expansion in Emerging Markets

The burgeoning potential for growth is evident in untapped markets, particularly within emerging economies. Here, a noticeable surge in awareness regarding health benefits and an evolving shift in dietary habits present a substantial opportunity for market penetration.

Innovations in Product Development

A continuous commitment to research and development is crucial for ushering in innovations within phytosterol-based products. This includes the exploration of novel formulations and the development of convenient delivery systems. Such advancements not only enhance product offerings but also open up new avenues for market players.

Collaborations and Partnerships

Strategic alliances between phytosterol manufacturers and key players in the food industry can prove instrumental in expanding market reach. By seamlessly incorporating phytosterols into a diverse range of food products, these collaborations create synergies that contribute to overall market growth.

Increased Demand for Plant-Based Products

The escalating popularity of plant-based diets and lifestyles is fostering a heightened demand for plant-derived ingredients, with phytosterols being a notable contender. This paradigm shift in consumer preferences not only aligns with health-conscious choices but also propels substantial growth prospects for the phytosterol market.

Trends

Clean Label Products

The market is witnessing a trend towards clean label products, with consumers seeking natural and minimally processed ingredients. Phytosterols, being plant-derived, align with this clean label trend.

Product Diversification

Manufacturers are diversifying their phytosterol product offerings, creating a range of fortified products beyond traditional supplements, including beverages, snacks, and functional foods.

Online Retailing and E-commerce

The increasing prevalence of online retail channels provides a platform for phytosterol-enriched products to reach a broader consumer base. E-commerce is becoming a significant distribution channel for these products.

Focus on Sustainable Sourcing

There is a growing emphasis on sustainability in the sourcing and production of phytosterols. Consumers are showing interest in products that not only promote personal health but also align with environmentally conscious practices.

Regional Analysis

In 2023, Europe held a dominant market position in the global Phytosterols market, capturing more than a 52% share and boasting a market value of USD 0.562 billion for the year. This stronghold can be attributed to several key factors that position the region as a frontrunner in the Phytosterols industry.

In Europe, they’ve made strong rules to encourage eating healthy stuff, especially things like phytosterols. The European Food Safety Authority (EFSA) is a big part of this – they’ve given the thumbs up to health claims about phytosterols. This makes people trust and know more about these things. So, now, more and more products in Europe have phytosterols in them. Older folks in Europe are more, and they worry more about heart problems. Phytosterols are known for making cholesterol go down, so everyone’s into them now. People want food and drinks with phytosterols because they’re good for your heart.

Europe boasts several key players in the phytosterols market, and these companies have been proactive in their research and development efforts. They have introduced innovative formulations and products centered around phytosterols, contributing significantly to market growth in the region. The presence of these industry leaders has further propelled the popularity and acceptance of phytosterol-fortified products among consumers.

The food and beverage industry in Europe has witnessed a growing trend of incorporating functional ingredients into various products. Phytosterols, being recognized for their health benefits, have found widespread application in the formulation of functional foods, spreads, and dairy products. This diversification of product offerings has contributed significantly to the market’s expansion.

Collaborations between phytosterol manufacturers, food processors, and retailers have played a pivotal role in expanding market reach. Partnerships across the supply chain have facilitated efficient distribution channels, ensuring a steady supply of phytosterol-enriched products to consumers across Europe.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

BASF SE emerges as a pivotal player in the Phytosterols Market, wielding significant influence. Renowned for its innovative approach, BASF SE contributes cutting-edge solutions to the market, fostering growth and shaping industry trends. With a robust portfolio and a commitment to sustainability, BASF SE stands out as a key driver in the dynamic landscape of phytosterols.

Arboris LLC plays a vital role in the Phytosterols Market, offering distinctive contributions. The company’s focus on quality and customer-centric solutions positions it as a preferred choice for stakeholders. Arboris LLC’s strategic initiatives and product offerings contribute to the overall competitiveness and evolution of the phytosterols sector.

The Archer-Daniels-Midland Company (ADM) holds a noteworthy position in the Phytosterols Market, marked by its extensive experience and global presence. ADM’s commitment to research and development, coupled with its emphasis on sustainable practices, underscores its significance. As a key player, ADM plays a pivotal role in shaping the market dynamics and driving advancements.

Other Key Players: Beyond the mentioned giants, other key players inject diversity and dynamism into the Phytosterols Market. These players, through niche expertise or regional prominence, bring unique perspectives and offerings. Their collective impact shapes the market landscape, fostering healthy competition and innovation.

Market Key Players

- BASF SE

- Arboris LLC

- Archer-Daniels-Midland Company

- Cargill Inc.

- The Lubrizol Corporation

- Advanced Organic Materials

- Ashland Global Holdings Inc.

- Gustav Parmentier GmbH

- Other Key Players

Recent Developments

- In September 2023, Archer Daniels Midland (ADM) made a significant stride in fortifying its position in the phytosterol market by acquiring Heartland Food Products, a prominent producer of phytosterol-enriched ingredients. This strategic move is anticipated to not only enhance ADM’s standing in the industry but also broaden its product portfolio to cater to the escalating demand for functional food ingredients.

- In August 2023, Cargill entered the European market with the launch of “Plant-Based Boost,” a novel phytosterol-enriched beverage. Crafted from soy protein, pea protein, and phytosterols, this beverage is expressly formulated to promote heart health, marking Cargill’s commitment to meeting evolving consumer preferences.

- In July 2023, witnessed Ingredion making waves in the industry as it unveiled its merger with DuPont’s nutrition business. This strategic alliance aims to establish a global powerhouse in plant-based ingredients, boasting an expanded product portfolio and a reinforced global presence in the competitive phytosterol market.

- In June 2023, Kemin Industries, disclosed its plans to amplify phytosterol production capacity at its Iowa-based facility in the United States. This expansion initiative is poised to double Kemin Industries’ phytosterol production, strategically positioning the company to fulfill the surging demand for this sought-after ingredient.

Report Scope

Report Features Description Market Value (2023) USD 1,081 Mn Forecast Revenue (2033) USD 2,514 Mn CAGR (2024-2033) 8.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Beta-sitosterol, Campesterol, Stigmasterol, Others), By Application (Pharmaceutical, Cosmetics, Food Ingredients, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, Arboris LLC, Archer-Daniels-Midland Company, Cargill Inc., The Lubrizol Corporation, Advanced Organic Materials, Ashland Global Holdings Inc., Gustav Parmentier GmbH, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BASF SE

- Arboris LLC

- Archer-Daniels-Midland Company

- Cargill Inc.

- The Lubrizol Corporation

- Advanced Organic Materials

- Ashland Global Holdings Inc.

- Gustav Parmentier GmbH

- Other Key Players