Pharmaceutical Quality Management Software Market By Solution Type (Corrective Action Preventive Action (CAPA) Management, Training Management, Supplier Quality Management, Regulatory and Compliance Management, Non-Conformances Handling, Inspection Management, Document Management, Complaints Management, Change Management, and Others), By Deployment (On-Premise and On Cloud), By Enterprise Size (Large Enterprise and Small and Medium Enterprise (SME)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 149879

- Number of Pages: 388

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

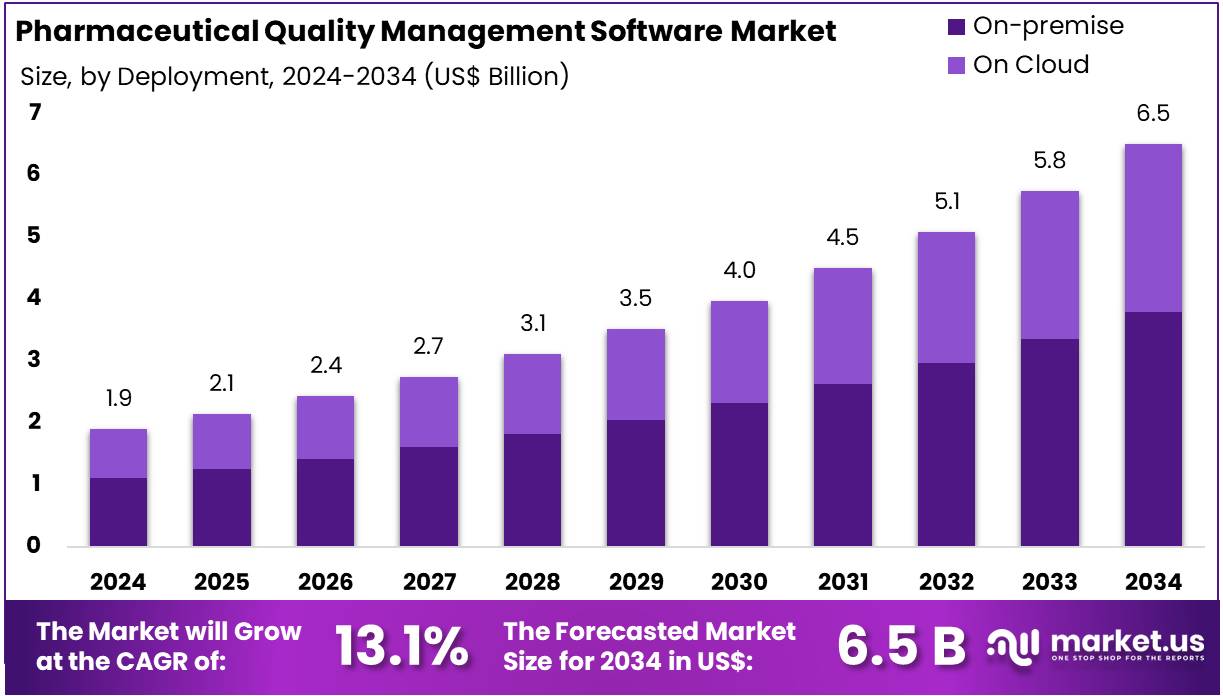

The Pharmaceutical Quality Management Software Market size is expected to be worth around US$ 6.5 billion by 2034 from US$ 1.9 billion in 2024, growing at a CAGR of 13.1% during the forecast period 2025 to 2034.

Increasing complexities in pharmaceutical manufacturing and stringent regulatory requirements drive the growing adoption of pharmaceutical quality management software (QMS). These software solutions streamline processes such as document control, audit management, change control, and corrective and preventive actions, ensuring consistent compliance with industry standards like FDA, EMA, and ICH guidelines. Pharmaceutical companies leverage QMS to enhance product quality, reduce risks, and accelerate time-to-market for new drugs.

In April 2022, Hexagon AB completed the acquisition of ETQ, a prominent provider of SaaS quality management systems, environmental health and safety, and compliance software, further strengthening its portfolio in governance and risk management solutions. This acquisition reflects the expanding market demand for integrated, cloud-based platforms that provide real-time visibility into quality processes across the pharmaceutical value chain. Recent trends emphasize automation, data analytics, and AI integration within QMS to improve decision-making and predictive quality control.

Opportunities abound as pharmaceutical firms focus on digital transformation initiatives to reduce manual errors, enhance traceability, and ensure product safety. Additionally, rising investments in biologics, personalized medicine, and vaccine production necessitate robust quality management frameworks adaptable to complex manufacturing environments.

Pharmaceutical QMS also supports compliance with Good Manufacturing Practices (GMP) and facilitates supplier quality management, ensuring raw material integrity. The software’s applications extend to risk management, deviation handling, and regulatory reporting, fostering a culture of continuous improvement. As the industry evolves, pharmaceutical quality management software emerges as a critical tool for operational excellence, regulatory adherence, and patient safety, positioning itself as a vital enabler in modern pharmaceutical manufacturing.

Key Takeaways

- In 2024, the market for pharmaceutical quality management software generated a revenue of US$ 1.9 billion, with a CAGR of 13.1%, and is expected to reach US$ 6.5 billion by the year 2034.

- The solution type segment is divided into corrective action preventive action (CAPA) management, training management, supplier quality management, regulatory and compliance management, non-conformances handling, inspection management, document management, complaints management, change management, and others, with corrective action preventive action (CAPA) management taking the lead in 2024 with a market share of 32.5%.

- Considering deployment, the market is divided into on-premise and on cloud. Among these, on-premise held a significant share of 58.4%.

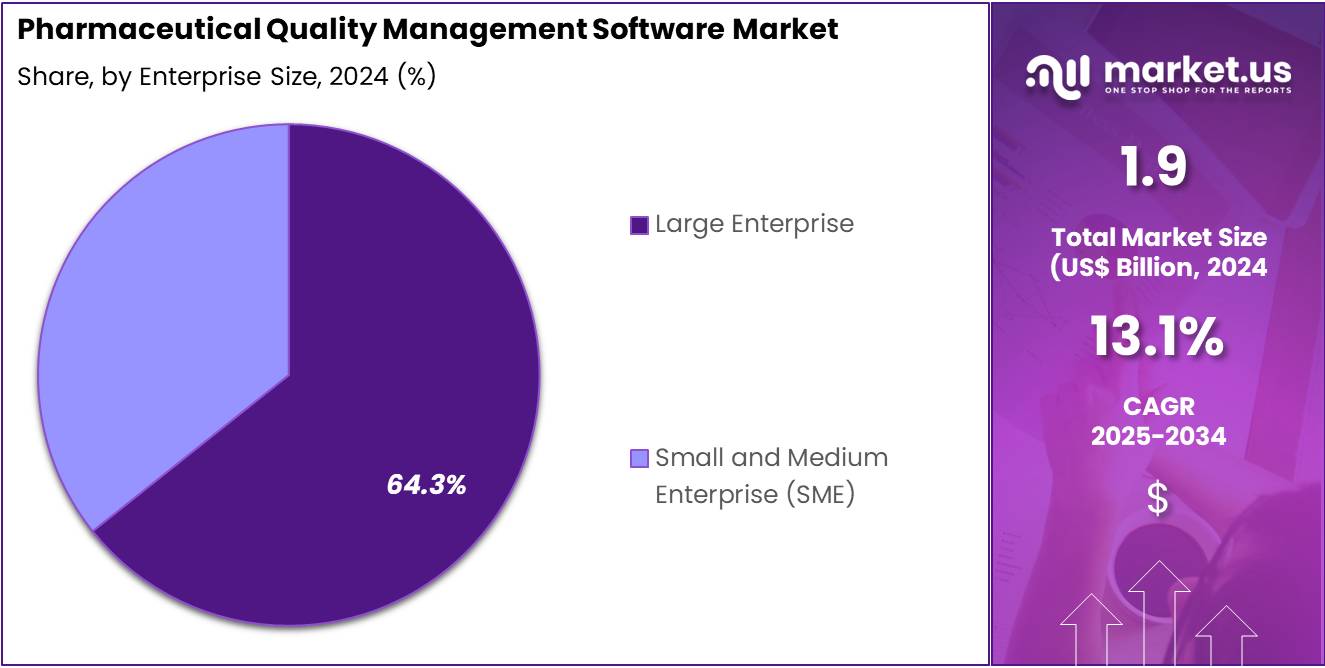

- Furthermore, concerning the enterprise size segment, the market is segregated into large enterprise and small and medium enterprise (SME). The large enterprise sector stands out as the dominant player, holding the largest revenue share of 64.3% in the pharmaceutical quality management software market.

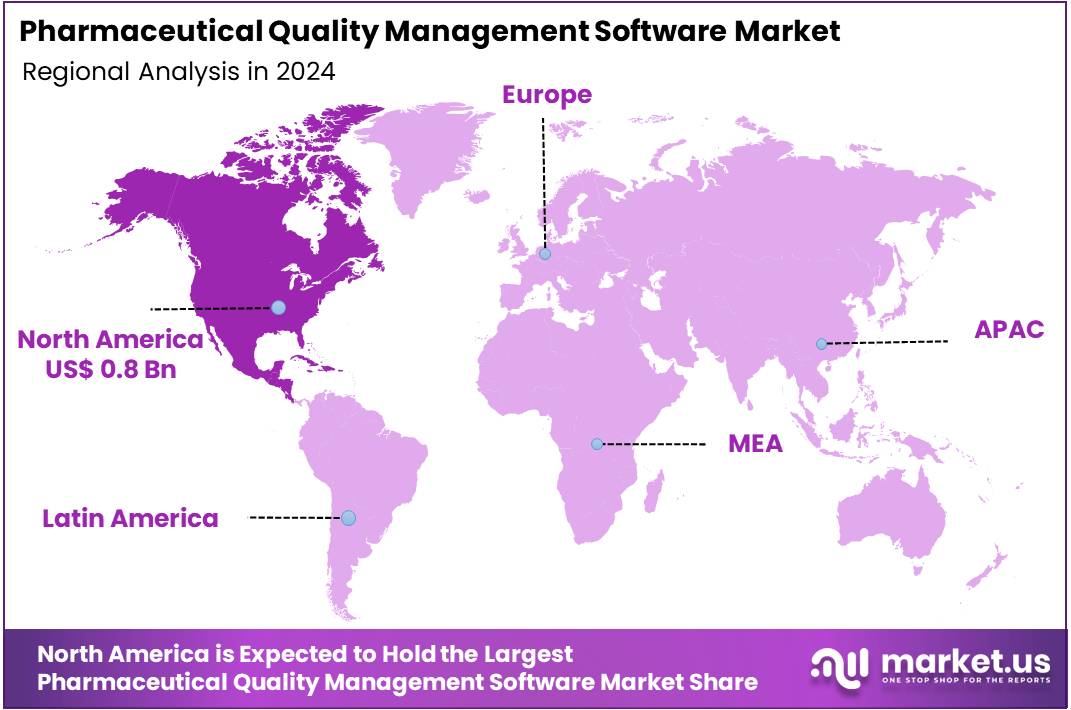

- North America led the market by securing a market share of 41.2% in 2024.

Solution Type Analysis

The corrective action preventive action (CAPA) management segment claimed a market share of 32.5%. Increasing regulatory scrutiny and the critical need to address quality issues promptly drive demand for CAPA solutions. Pharmaceutical companies focus on reducing product recalls and improving manufacturing processes, which positions CAPA management as a vital tool for maintaining compliance and enhancing overall quality.

Additionally, the integration of CAPA with other quality management functions, such as document control and supplier management, strengthens its appeal. Automation and data analytics further improve CAPA effectiveness, accelerating adoption. Companies seek solutions that proactively identify potential risks and enforce corrective measures, fueling this segment’s expansion.

Deployment Analysis

The on-premise held a significant share of 58.4% due to several reasons. Many pharmaceutical organizations prefer on-premise solutions due to stringent data security, regulatory compliance, and control requirements. These companies prioritize safeguarding sensitive patient and product data internally, making on-premise deployment attractive.

Furthermore, existing IT infrastructure investments encourage enterprises to maintain on-site software to integrate with legacy systems seamlessly. Customization capabilities and direct control over software updates appeal to larger organizations managing complex processes. Despite the rise of cloud-based solutions, on-premise deployment retains significant relevance, especially in highly regulated environments, supporting its sustained growth.

Enterprise Size Analysis

The large enterprise segment had a tremendous growth rate, with a revenue share of 64.3%. Large pharmaceutical firms face complex compliance landscapes and extensive quality assurance demands that necessitate robust, scalable software solutions. These enterprises invest heavily in comprehensive quality management systems to streamline operations across multiple sites globally.

Large organizations benefit from advanced features such as integration with manufacturing execution systems and real-time analytics, enhancing decision-making. Their substantial budgets enable early adoption of innovative technologies, driving market expansion. The need to mitigate risks and ensure product safety at scale positions large enterprises as key growth drivers within this software market.

Key Market Segments

By Solution Type

- Incorrective Action Preventive Action (CAPA) Management

- Training Management

- Supplier Quality Management

- Regulatory and Compliance Management

- Non-Conformances Handling

- Inspection Management

- Document Management

- Complaints Management

- Change Management

- Others

By Deployment

- On-Premise

- On Cloud

By Enterprise Size

- Large Enterprise

- Small and Medium Enterprise (SME)

Drivers

Stringent Regulatory Compliance is driving the market

The stringent and evolving regulatory landscape governing the pharmaceutical industry is a significant driver for the adoption of quality management software. Agencies like the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) enforce rigorous quality standards throughout the drug lifecycle. For instance, the FDA’s Current Good Manufacturing Practice (CGMP) regulations necessitate robust quality systems.

In January 2024, the FDA introduced the Quality Management System Regulation (QMSR) to align with international standards, updating CGMP requirements for medical devices, which indirectly emphasizes the need for comprehensive quality oversight that software solutions can provide across the pharmaceutical sector as well. This constant focus on compliance compels pharmaceutical companies to invest in software that can automate and manage quality processes effectively.

Restraints

High Implementation Costs can be restraining the market

The initial and ongoing costs associated with implementing and maintaining sophisticated pharmaceutical quality management software can act as a restraint, particularly for smaller pharmaceutical companies. These costs include the software licenses, customization, integration with existing systems, and training of personnel. While the long-term benefits of improved quality and compliance often outweigh these expenses, the significant upfront investment can be a barrier.

For example, the implementation of a comprehensive QMS can require substantial financial and time resources, potentially delaying adoption for organizations with tighter budgets. Overcoming this restraint often involves vendors offering more scalable and cost-effective solutions tailored to the needs of different-sized companies.

Opportunities

Increasing Focus on Data Integrity and Traceability creates growth opportunities

The growing emphasis on data integrity and the need for end-to-end traceability in pharmaceutical manufacturing creates significant growth opportunities for quality management software. Regulatory bodies worldwide are increasingly scrutinizing data management practices to ensure the reliability and accuracy of information. As per industry reports, nearly 74% of compliance failures are attributed to human errors, highlighting the need for automated systems.

Quality management software offers functionalities like audit trails, electronic signatures, and secure document management, which are crucial for maintaining data integrity and facilitating traceability throughout the supply chain. This demand for robust data management capabilities to meet regulatory expectations and improve overall quality is a key driver for the increased adoption of these software solutions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions and geopolitical factors can exert influence over the pharmaceutical quality management software market. Economic downturns might lead pharmaceutical companies to optimize their spending, potentially affecting the pace of new software adoption unless a clear and rapid return on investment, such as through improved efficiency and reduced compliance risks, can be demonstrated. Conversely, government initiatives to bolster the pharmaceutical industry or to ensure drug safety and quality can drive increased investment in quality management systems.

Geopolitical tensions might impact global supply chains for IT infrastructure, although the direct effect on this software market is likely less pronounced than on sectors dealing with physical goods. However, the fundamental need for stringent quality control in pharmaceutical manufacturing, driven by regulatory requirements and patient safety concerns, tends to sustain the demand for effective quality management software, making it a relatively resilient market despite broader economic and political shifts.

Current US tariffs could have a limited but present impact on the pharmaceutical quality management software market. If tariffs increase the cost of imported hardware or IT infrastructure components used to run this software, it might slightly raise the overall operational expenses for pharmaceutical companies. However, as the solutions are primarily software-based, the direct impact of tariffs on physical goods is less significant compared to pharmaceuticals themselves or medical devices.

Increased costs for pharmaceutical manufacturers due to tariffs on raw materials or equipment, as noted in some analyses, might indirectly influence their budgets for software investments. Nevertheless, the critical need for robust quality management to meet FDA and other international regulations remains a primary driver for adopting these systems. While tariffs might create some marginal cost considerations, the essential value proposition of these software solutions in ensuring drug quality, compliance, and efficiency is expected to maintain market demand.

Latest Trends

Shift Towards Cloud-Based Solutions is a recent trend in the market

A key trend in the pharmaceutical quality management software (QMS) market is the growing shift toward cloud-based deployment. Cloud-based QMS offers advantages such as scalability, remote access, and reduced IT costs. These solutions allow companies to collaborate in real time, improving efficiency and compliance. The demand is growing across small, mid-sized, and large pharmaceutical firms. As regulatory requirements become more complex, companies prefer tools that can be accessed securely from multiple locations. This flexibility makes cloud deployment a practical and future-ready option for the industry.

In July 2024, Antares Vision Group launched DIAMIND Sentry, a cloud-based QMS tailored for pharmaceutical companies. The system helps manage compliance exceptions and regulatory updates seamlessly. Its release highlights the broader industry movement toward digital transformation. Cloud-based systems like DIAMIND Sentry support real-time data sharing and streamlined workflows. They also reduce dependence on local IT infrastructure. This trend reflects a strategic shift, where pharmaceutical companies are adopting agile tools that support global operations while maintaining regulatory alignment.

Regional Analysis

North America is leading the Pharmaceutical Quality Management Software Market

North America dominated the market with the highest revenue share of 41.2% owing to the highly regulated nature of the pharmaceutical industry and the critical emphasis on drug safety and efficacy. The FDA’s Current Good Manufacturing Practice (CGMP) regulations, as meticulously outlined in 21 CFR Parts 210 and 211, necessitate the implementation of comprehensive quality systems across all stages of pharmaceutical manufacturing, from raw material sourcing to final product release.

The FDA’s proactive stance on enforcing these regulations through rigorous inspections and the issuance of detailed guidance documents compels pharmaceutical companies to adopt sophisticated software solutions for managing quality processes, ensuring meticulous documentation, and maintaining unwavering regulatory compliance.

Furthermore, the recent implementation of the Quality Management System Regulation (QMSR), which harmonizes GMP requirements for medical devices with ISO 13485:2016 and became effective in February 2024, also impacts pharmaceutical combination products, thereby further amplifying the demand for advanced quality management software capable of handling these evolving requirements. This stringent regulatory environment in North America serves as a significant catalyst for the growth of this software market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the burgeoning pharmaceutical manufacturing sector within the region, with countries like China and India increasingly establishing themselves as prominent global pharmaceutical manufacturing hubs, supplying both domestic and international markets. As these nations strive to meet stringent international quality standards, including those set by regulatory bodies like the FDA and EMA, the adoption of robust quality management systems becomes paramount.

Moreover, the escalating domestic demand for high-quality pharmaceutical products within Asia Pacific countries is further incentivizing manufacturers to invest in comprehensive quality management software to ensure product excellence and patient safety. The increasing embrace of advanced digital technologies, such as cloud computing and data analytics, within the Asia Pacific pharmaceutical sector is also expected to facilitate the seamless deployment and widespread adoption of sophisticated quality management software solutions, contributing significantly to the market’s expansion in this dynamic region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the pharmaceutical quality management software market are driving growth through the integration of advanced technologies. These include artificial intelligence (AI), machine learning, and cloud computing. By adopting these technologies, companies aim to improve operational efficiency and compliance. They also enhance interoperability, enabling seamless data exchange across different healthcare systems. Strategic initiatives such as partnerships and acquisitions help expand service portfolios. These efforts strengthen market reach and support competitive positioning in a fast-changing digital landscape.

Focus on user-friendly interfaces and mobile accessibility is growing. These features improve user engagement among patients and caregivers. Companies also prioritize intuitive design and system flexibility to meet regulatory and operational needs. As the demand for real-time data access rises, mobile platforms have become essential. This trend supports better decision-making and enhances workflow efficiency. Moreover, firms invest in research and development to remain innovative. This ensures their platforms stay updated with the latest industry standards and compliance requirements.

Veeva Systems Inc. is a leading company in this space. It offers cloud-based software tailored for the pharmaceutical and life sciences industries. Founded in 2007, the company is headquartered in Pleasanton, California. Veeva provides tools for customer relationship management (CRM), content management, and data analytics. The firm has expanded its presence in China. It formed partnerships with six of the top 20 biopharma companies to boost healthcare professional engagement. This growth is increasing demand for Veeva’s AI-powered services, supporting its long-term market potential.

Top Key Players in the Pharmaceutical Quality Management Software Market

- Yokogawa Electric Corporation

- Veeva Systems

- Sparta Systems

- Qualio

- QT9

- ETQ, LLC

- AssurX, Inc

- AmpleLogic

Recent Developments

- In February 2025: Yokogawa Electric Corporation introduced the OpreX Quality Management System, a cloud-based platform designed to accelerate digital transformation within quality assurance workflows, improving efficiency and oversight.

- In October 2022: Qualio launched its Modern Validation Pack tailored for the life sciences industry. This solution assists companies in adapting to the latest FDA guidelines on Good Automated Manufacturing Practice (GAMP) and Computerized System Assurance (CSA), streamlining validation processes while reducing resource demands.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 billion Forecast Revenue (2034) US$ 6.5 billion CAGR (2025-2034) 13.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Solution Type (Corrective Action Preventive Action (CAPA) Management, Training Management, Supplier Quality Management, Regulatory and Compliance Management, Non-Conformances Handling, Inspection Management, Document Management, Complaints Management, Change Management, and Others), By Deployment (On-Premise and On Cloud), By Enterprise Size (Large Enterprise and Small and Medium Enterprise (SME)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Yokogawa Electric Corporation, Veeva Systems, Sparta Systems, Qualio, QT9, ETQ, LLC, AssurX, Inc, and AmpleLogic. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pharmaceutical Quality Management Software MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Pharmaceutical Quality Management Software MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Yokogawa Electric Corporation

- Veeva Systems

- Sparta Systems

- Qualio

- QT9

- ETQ, LLC

- AssurX, Inc

- AmpleLogic