Global Pharmaceutical Analytical Testing Outsourcing Market By Services (Bioanalytical Testing (Clinical, Non-Clinical), Method Development, Transfer, Validation, and Qualification (Extractable & Leachable, Impurity Method, Technical Consulting, etc.), Stability Testing (Long-Term/Accelerated, Photostability, Stress Testing, etc.), Microbiological Testing and Other Services), By Drug Development Stage (Preclinical, Clinical Phase (Phase I/II/III) and Commercial), By End-User (Large Pharmaceutical & Biopharma Companies, Small/Mid-Size Pharmaceutical & Biotech Companies and CROs, CDMOs, & CMOs), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 172774

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

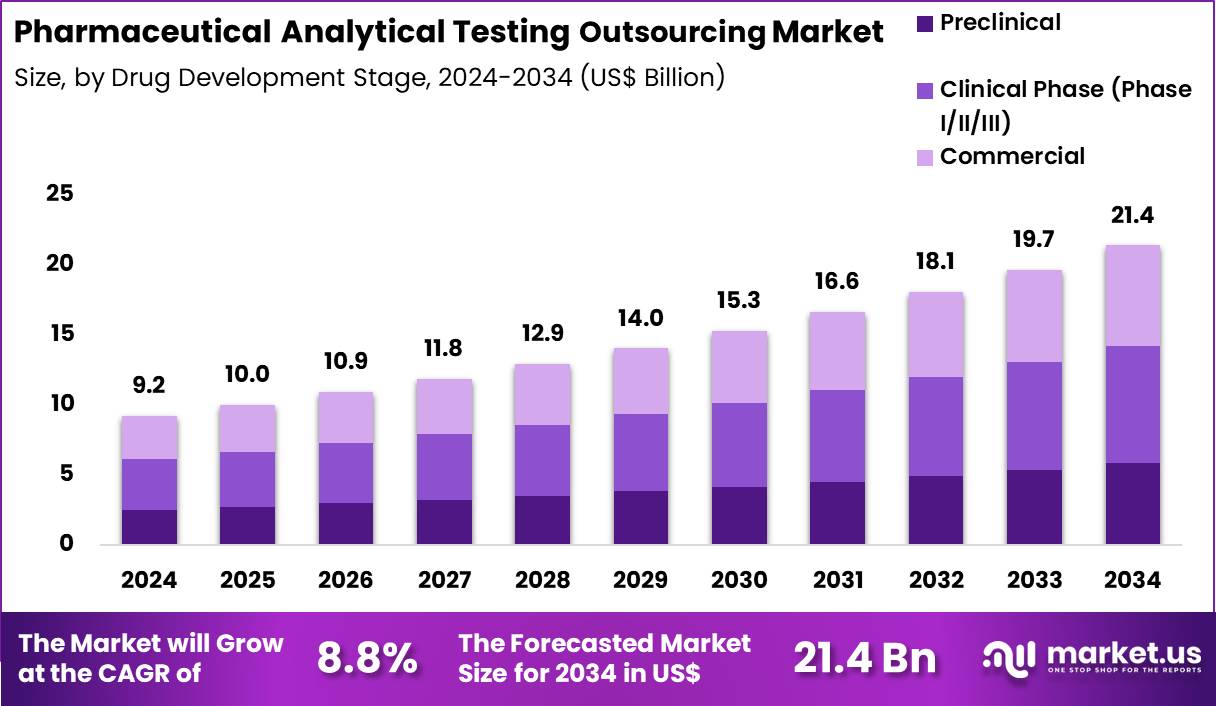

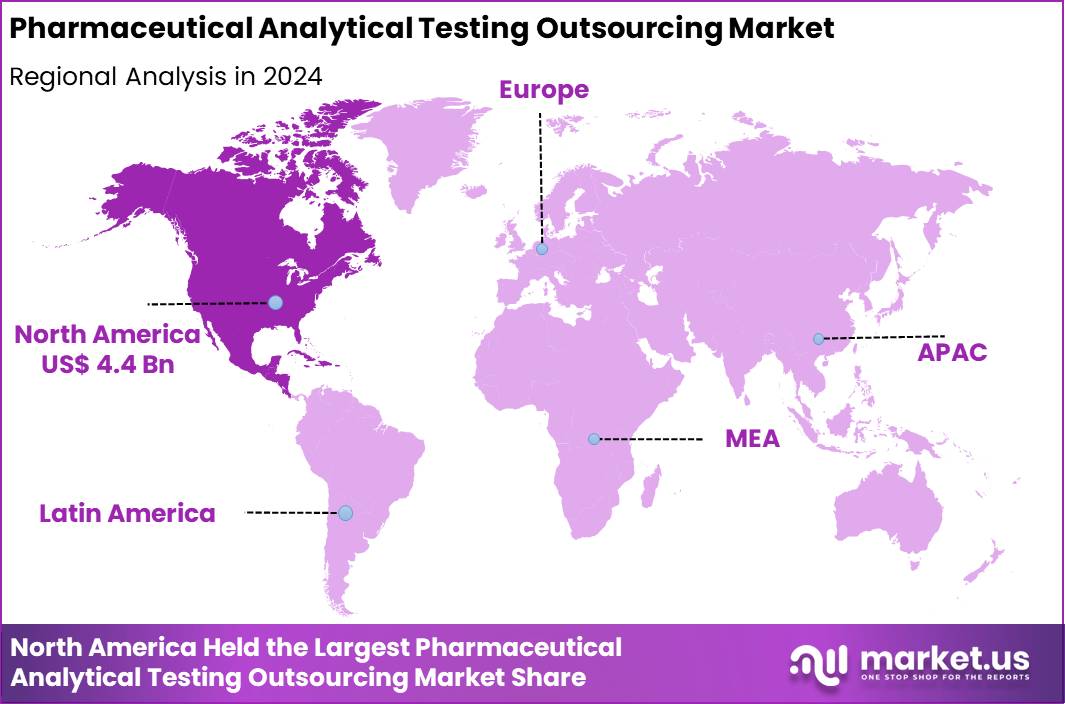

The Global Pharmaceutical Analytical Testing Outsourcing Market size is expected to be worth around US$ 21.4 Billion by 2034 from US$ 9.2 Billion in 2024, growing at a CAGR of 8.8% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 24.8% share with a revenue of US$ 4.4 Billion.

Growing complexity of pharmaceutical development pipelines compels companies to outsource analytical testing services that ensure compliance with stringent quality standards and accelerate time-to-market. Biopharmaceutical firms increasingly delegate method development and validation tasks to specialized providers, confirming assay robustness for monoclonal antibody characterization and potency assessments.

These services support stability studies by monitoring drug degradation profiles under various conditions, guiding formulation optimization in small molecule therapeutics. Outsourcing partners conduct impurity profiling to identify and quantify genotoxic contaminants, safeguarding patient safety in generic drug approvals. Providers perform extractables and leachables testing on container closure systems, mitigating risks in biologic delivery devices.

In August 2024, SGS launched expanded bioanalytical testing services at its laboratory in Hudson, New Hampshire. The site now supports studies from early discovery through Phase 3 clinical development, offering integrated testing solutions for biopharmaceutical programs through a combination of in-house expertise and strategic partnerships.

Pharmaceutical developers capitalize on opportunities to outsource dissolution testing for modified-release formulations, ensuring consistent bioavailability predictions in oral solid dosage forms. Service providers offer advanced spectroscopic techniques to verify polymorphism in active pharmaceutical ingredients, influencing solubility and therapeutic efficacy. These outsourced capabilities extend to bioequivalence studies, comparing test and reference products through pharmacokinetic endpoint evaluations.

Opportunities expand in elemental impurity analysis using inductively coupled plasma mass spectrometry, aligning with regulatory guidelines for trace metal contaminants. Companies pursue microbiology testing outsourcing for sterility assurance, validating aseptic processes in injectable product manufacturing. Firms integrate particle size distribution assessments to optimize inhalation drug delivery systems for pulmonary therapies.

Industry specialists deploy high-resolution mass spectrometry platforms to elucidate complex conjugate structures in antibody-drug conjugates, enhancing outsourcing precision. Developers incorporate automation in chromatographic workflows, streamlining high-volume release testing for vaccine batches. Market participants refine ligand-binding assays with enhanced sensitivity, supporting immunogenicity evaluations in gene therapy products.

Innovators embed digital data management systems to facilitate real-time auditing and compliance tracking in outsourced raw material qualifications. Companies prioritize green analytical chemistry approaches that minimize solvent use in environmental impact assessments for sustainable drug production. Ongoing advancements emphasize multiplexed biomarker panels, delivering comprehensive pharmacodynamic insights in outsourced clinical trial support services.

Key Takeaways

- In 2024, the market generated a revenue of US$ 9.2 Billion, with a CAGR of 8.8%, and is expected to reach US$ 21.4 Billion by the year 2034.

- The services segment is divided into bioanalytical testing, method development, transfer, validation, and qualification, stability testing, microbiological testing and other services, with bioanalytical testing taking the lead in 2024 with a market share of 39.1%.

- Considering drug development stage, the market is divided into preclinical, clinical phase and commercial. Among these, clinical phase (phase i/ii/iii)held a significant share of 39.3%.

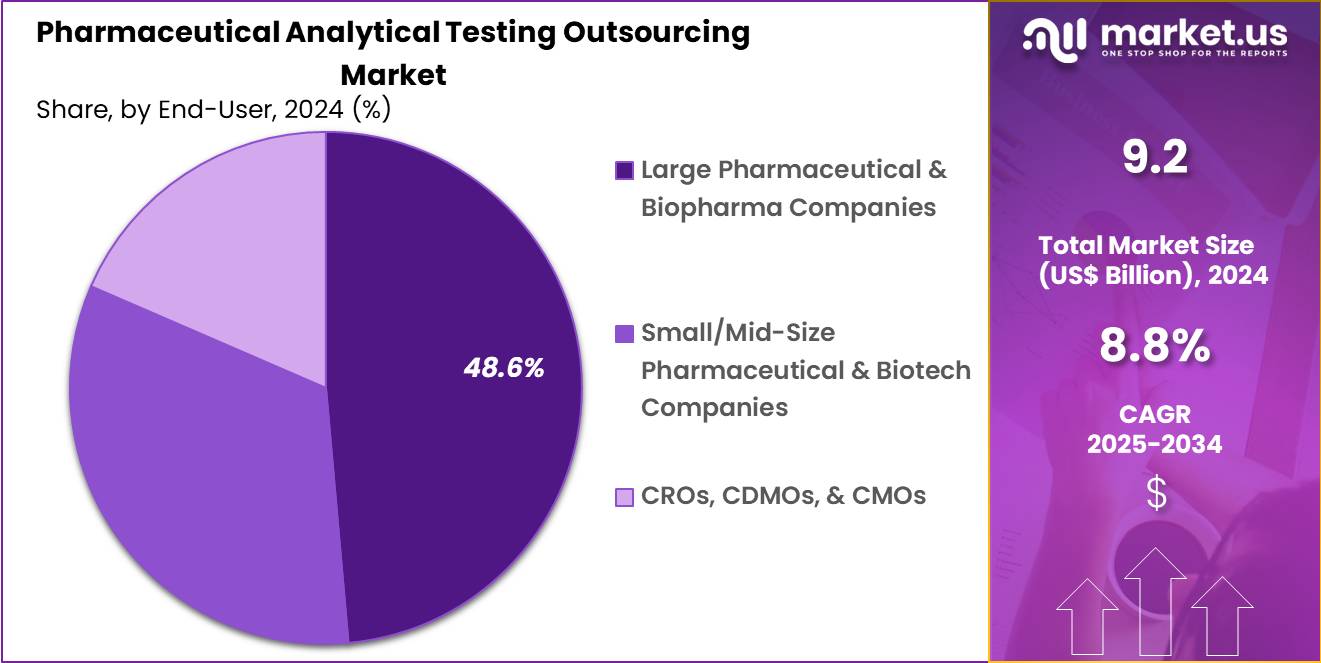

- Furthermore, concerning the end-user segment, the market is segregated into large pharmaceutical & biopharma companies, small/mid-size pharmaceutical & biotech companies and CROs, CDMOs, & CMOs. The large pharmaceutical & biopharma companies sector stands out as the dominant player, holding the largest revenue share of 48.6% in the market.

- North America led the market by securing a market share of 24.8% in 2024.

Services Analysis

Bioanalytical testing accounted for 39.1% of the pharmaceutical analytical testing outsourcing market, reflecting its critical role in quantifying drugs, metabolites, and biomarkers. Sponsors increasingly rely on outsourced bioanalysis to manage complex assays for biologics, biosimilars, and highly potent small molecules. Rising adoption of LC-MS and ligand binding assays increases demand for specialized expertise.

Drug developers prioritize accuracy and sensitivity to meet stringent regulatory expectations. Outsourcing partners invest heavily in advanced instrumentation and skilled analysts, which strengthens service quality. Growing complexity of pharmacokinetic and pharmacodynamic studies expands testing volumes. Sponsors prefer external providers to reduce internal capital expenditure and operational burden.

Accelerated drug pipelines further increase sample throughput requirements. Global regulatory harmonization supports standardized bioanalytical practices. This segment is projected to grow steadily due to technical intensity and sustained outsourcing preference.

Drug Development Stage Analysis

Clinical phase testing represented 39.3% of the pharmaceutical analytical testing outsourcing market, driven by expanding global clinical trial activity across phase I, II, and III studies. Sponsors generate large volumes of biological samples during dose escalation and efficacy evaluation stages. Analytical testing plays a central role in safety monitoring and exposure assessment.

Increasing trial complexity demands rapid turnaround and high data reliability. Outsourcing enables sponsors to scale analytical capacity across multiple geographies. Adaptive trial designs further increase testing frequency and data requirements. Regulatory authorities expect robust analytical support throughout clinical development.

Time sensitive milestones encourage reliance on experienced external laboratories. Growth in biologics and specialty drugs amplifies analytical complexity. As a result, the clinical phase segment is anticipated to remain a key growth contributor due to sustained trial intensity.

End-User Analysis

Large pharmaceutical and biopharma companies held a 48.6% share of the pharmaceutical analytical testing outsourcing market, reflecting their extensive and diversified development portfolios. These organizations manage multiple concurrent programs that require continuous analytical support. Strategic outsourcing helps optimize internal resource allocation and operational efficiency.

Large sponsors prioritize partners with global regulatory compliance and proven quality systems. High R and D spending supports long term outsourcing contracts. Portfolio diversification across modalities increases analytical workload. These companies increasingly adopt virtual or hybrid development models. Risk mitigation strategies favor experienced external testing providers.

Long standing vendor relationships improve workflow integration and consistency. Consequently, this end user segment is likely to maintain dominance due to scale driven demand and sustained innovation investment.

Key Market Segments

By Services

- Bioanalytical Testing (Clinical, Non-Clinical)

- Method Development, Transfer, Validation, and Qualification (Extractable & Leachable, Impurity Method, Technical Consulting, etc.)

- Stability Testing (Long-term/Accelerated, Photostability, Stress Testing, etc.)

- Microbiological Testing

- Other Services

By Drug Development Stage

- Preclinical

- Clinical Phase (Phase I/II/III)

- Commercial

By End-User

- Large Pharmaceutical & Biopharma Companies

- Small/Mid-Size Pharmaceutical & Biotech Companies

- CROs, CDMOs, & CMOs

Drivers

Increasing FDA drug quality assurance inspections is driving the market

The pharmaceutical analytical testing outsourcing market is driven by the escalating number of FDA drug quality assurance inspections, which necessitate comprehensive analytical testing services often outsourced to specialized providers for efficiency. Regulatory demands for thorough quality checks on manufacturing sites amplify reliance on outsourced testing to ensure compliance with standards.

Pharmaceutical companies outsource analytical testing to manage the volume of inspections, focusing internal resources on core development activities. Outsourcing partners offer expertise in advanced analytical methods required for inspection readiness and data integrity. Government emphasis on supply chain security encourages outsourcing for robust testing capabilities across global sites.

Key players in outsourcing benefit from this trend by expanding capacities to handle inspection-related testing workloads. Clinical and non-clinical analytical testing requirements during inspections further stimulate market demand. Collaborative efforts between regulators and outsourcers enhance testing protocols for faster resolution of quality issues.

In FY2022, the FDA conducted 522 drug quality assurance inspections, increasing to 766 in FY2023 and 972 in FY2024. This progression reflects heightened oversight that sustains outsourcing needs for analytical support in pharmaceutical quality management.

Restraints

Rise in warning letters for drug quality issues is restraining the market

The pharmaceutical analytical testing outsourcing market is restrained by the rise in FDA warning letters issued for drug quality issues, which erodes confidence in outsourced testing services and prompts stricter internal controls. Companies may hesitate to outsource analytical testing amid fears of non-compliance findings linked to partner performance. Regulatory actions highlight deficiencies in testing processes, leading to additional scrutiny on outsourced vendors.

Manufacturers face potential delays in product approvals due to quality concerns flagged in warning letters, impacting outsourcing contracts. Outsourcing providers must invest heavily in corrective measures to maintain credibility, increasing operational costs. Pharmaceutical firms reevaluate outsourcing strategies to mitigate risks associated with quality lapses. Legal and financial repercussions from warning letters deter expansion of outsourcing arrangements.

Global harmonization challenges complicate outsourced testing compliance across regions. The FDA issued 105 warning letters to human drug manufacturing sites for quality reasons in FY2024, the highest in five years. These enforcement trends collectively limit market growth by fostering caution in outsourcing decisions.

Opportunities

Growth in biosimilar products is creating growth opportunities

The pharmaceutical analytical testing outsourcing market presents growth opportunities through the expansion of biosimilar products, which require extensive analytical testing for comparability and quality assurance often handled by specialized outsourcers. Developers outsource bioanalytical and stability testing to meet regulatory demands for biosimilar approvals. Outsourcing enables efficient handling of complex characterization studies essential for biosimilar market entry.

Providers offer scalable testing services to support the increasing pipeline of biosimilars in oncology and immunology. Regulatory pathways for biosimilars encourage outsourcing for cost-effective development support. Pharmaceutical companies leverage outsourced expertise to accelerate biosimilar launches amid patent expirations.

Collaborative testing frameworks enhance data quality for biosimilar submissions. Global adoption of biosimilars drives demand for outsourced analytical capabilities in emerging markets. The FDA report indicated a 47% increase in biosimilar products to 63 in FY2024. This expansion opens avenues for outsourcing firms to diversify services and capture new revenue streams.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic expansions bolster the pharmaceutical analytical testing outsourcing market as surging R&D budgets and biopharma growth encourage companies to outsource stability testing and bioequivalence studies to specialized CROs for cost efficiency. Industry executives strategically partner with offshore providers in India and China, tapping into talent pools to accelerate drug development timelines amid rising global demand.

Inflationary pressures, however, hike operational expenses for lab reagents and personnel, compelling firms to renegotiate contracts and slow expansions in weaker economies. Geopolitical conflicts, including U.S.-China trade tensions and European regulatory shifts, fragment supply chains for critical samples and equipment, delaying project deliveries and raising compliance risks for cross-border operations.

Current U.S. tariffs, featuring up to 25 percent duties on imported lab equipment and reagents under Section 301 as of December 2025, amplify procurement costs for American outsourcers and strain margins amid ongoing investigations. These tariffs also ignite retaliatory policies abroad, restricting U.S. firms’ access to affordable Asian testing services and complicating joint ventures. Nevertheless, the tariff environment spurs investments in domestic CRO facilities and nearshoring to Mexico, enhancing supply chain control and fostering innovative, resilient models for future prosperity.

Latest Trends

Shift toward foreign manufacturing site inspections is a recent trend

In 2024, the pharmaceutical analytical testing outsourcing market has observed a notable trend toward a greater focus on inspections of foreign manufacturing sites, prompting increased outsourcing of analytical testing to ensure global compliance. Regulators prioritize foreign sites for quality assurance, driving demand for outsourced testing partners with international expertise. Pharmaceutical firms outsource analytical services to prepare for and respond to foreign inspections efficiently.

Providers adapt testing protocols to address site-specific challenges in foreign locations. Collaborative international efforts enhance outsourced testing standards for cross-border operations. Manufacturers utilize outsourcing to mitigate risks identified during foreign site evaluations. Academic and industry partnerships refine analytical methods for global site applications.

Patient safety considerations underscore the need for robust outsourced testing in foreign supply chains. Ethical protocols guide outsourcing practices in diverse regulatory environments. The FDA conducted 62% of its drug quality assurance inspections at foreign sites in FY2024, marking an all-time high.

Regional Analysis

North America is leading the Pharmaceutical Analytical Testing Outsourcing Market

In 2024, North America captured a 48.2% share of the global pharmaceutical analytical testing outsourcing market, propelled by intensified drug development pipelines and stringent quality assurance requirements that prompted biopharmaceutical firms to delegate complex analyses to specialized providers. Companies outsourced bioanalytical services for pharmacokinetic evaluations and stability testing to accelerate timelines for novel therapeutics, leveraging external expertise amid talent shortages in internal labs.

Regulatory pressures from the Food and Drug Administration necessitated comprehensive impurity profiling and method validation, driving collaborations with contract labs equipped for advanced chromatography and mass spectrometry. Rising biosimilar approvals demanded rigorous comparability studies, encouraging firms to externalize extractables and leachables assessments to ensure compliance with international pharmacopeial standards. Venture-backed startups focused on cell and gene therapies outsourced genotoxicity testing to mitigate risks in early-phase trials, optimizing resource allocation.

Established manufacturers shifted elemental analysis for raw materials to third-party facilities, enhancing supply chain resilience post-disruptions. Academic-industry partnerships outsourced high-throughput screening validations, fostering innovation in personalized medicine formulations. The Food and Drug Administration approved 50 novel drugs in 2024, underscoring the heightened analytical demands fueling outsourcing trends.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Industry analysts forecast considerable momentum in pharmaceutical analytical testing outsourcing within Asia Pacific over the forecast period, as expanding biopharma sectors confront surging demands for sophisticated assays in emerging markets. Governments channel investments into contract research organizations, enabling local firms to handle dissolution testing and microbial limit evaluations for generic drug exports.

Biotech innovators contract out spectroscopic characterizations, tailoring protocols to regional active pharmaceutical ingredient variants amid intellectual property expansions. Regional health bodies enforce bioequivalence requirements, compelling manufacturers to delegate chromatographic separations to accredited labs for faster market entries. Pharmaceutical leaders streamline heavy metal quantifications through external partnerships, aligning with harmonized good manufacturing practices across diverse regulatory landscapes.

Community initiatives train analysts on advanced dissolution apparatuses, bridging expertise gaps in high-growth hubs. Trade alliances facilitate cross-border method transfers, empowering providers to support oncology formulation verifications. The World Health Organization indicates that the Western Pacific region registered 27,172 clinical trials in 2024, highlighting robust R&D activity that amplifies testing needs.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Pharmaceutical Analytical Testing Outsourcing market drive growth by expanding end-to-end capabilities across method development, validation, stability studies, and impurity profiling to shorten client timelines. Companies strengthen competitiveness by investing in advanced instrumentation, digital data integrity, and regulatory-aligned quality systems that meet global compliance demands.

Commercial strategies emphasize long-term partnerships with pharma and biotech sponsors, embedding analytical services early in development to secure recurring programs. Market leaders scale through geographic expansion near manufacturing hubs and by adding rapid-response capacity for late-stage and commercial needs.

Service differentiation also comes from flexible resourcing models and deep therapeutic expertise that reduce risk and cost for sponsors. Eurofins Scientific exemplifies leadership as a global testing specialist with extensive pharmaceutical analytics laboratories, broad regulatory experience, and integrated services that support molecules from discovery through commercialization.

Top Key Players

- Eurofins Scientific

- Charles River Laboratories

- WuXi AppTec

- Intertek

- Pace Analytical

- SGS SA

- Labcorp

- Thermo Fisher Scientific

- BA Sciences

- West Pharmaceutical Services

- ICON plc

- BioAgilytix

- Syngene International

- Immunologix Laboratories

- Indoco Analytical Solutions

- Alcami

- Toxikon

- LGM Pharma

Recent Developments

- In August 2025, Charles River Laboratories announced a capital investment of US$13 million to expand its facility in West Ashley, South Carolina. The upgrade adds cleanroom infrastructure and automated systems to increase capacity for microbial testing and product batch release, supporting higher throughput and improved quality control services.

- In March 2025, Eurofins Scientific finalized the purchase of SYNLAB’s clinical diagnostics business in Spain in a transaction valued at US$162.7 million. The acquisition strengthens Eurofins’ presence in the European diagnostics and bioanalytical testing landscape, expanding its regional service capabilities and customer reach.

Report Scope

Report Features Description Market Value (2024) US$ 9.2 Billion Forecast Revenue (2034) US$ 21.4 Billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Services (Bioanalytical Testing (Clinical, Non-Clinical), Method Development, Transfer, Validation, and Qualification (Extractable & Leachable, Impurity Method, Technical Consulting, etc.), Stability Testing (Long-Term/Accelerated, Photostability, Stress Testing, etc.), Microbiological Testing and Other Services), By Drug Development Stage (Preclinical, Clinical Phase (Phase I/II/III) and Commercial), By End-User (Large Pharmaceutical & Biopharma Companies, Small/Mid-Size Pharmaceutical & Biotech Companies and CROs, CDMOs, & CMOs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Eurofins Scientific, Charles River Laboratories, WuXi AppTec, Intertek, Pace Analytical, SGS SA, Labcorp, Thermo Fisher Scientific, BA Sciences, West Pharmaceutical Services, ICON plc, BioAgilytix, Syngene International, Immunologix Laboratories, Indoco Analytical Solutions, Alcami, Toxikon, LGM Pharma Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pharmaceutical Analytical Testing Outsourcing MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Pharmaceutical Analytical Testing Outsourcing MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Eurofins Scientific

- Charles River Laboratories

- WuXi AppTec

- Intertek

- Pace Analytical

- SGS SA

- Labcorp

- Thermo Fisher Scientific

- BA Sciences

- West Pharmaceutical Services

- ICON plc

- BioAgilytix

- Syngene International

- Immunologix Laboratories

- Indoco Analytical Solutions

- Alcami

- Toxikon

- LGM Pharma