Global Pet Travel Services Market Size, Share, Growth Analysis By Travel Type (Domestic, International), By Pet Type (Dogs, Cats, Others), By Booking (Online & Phone Bookings, Offline Bookings), By Mode (Land, Air), By Application (Transportation, Relocation), By End Use (Pet Owners, Pet Nannies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157169

- Number of Pages: 247

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

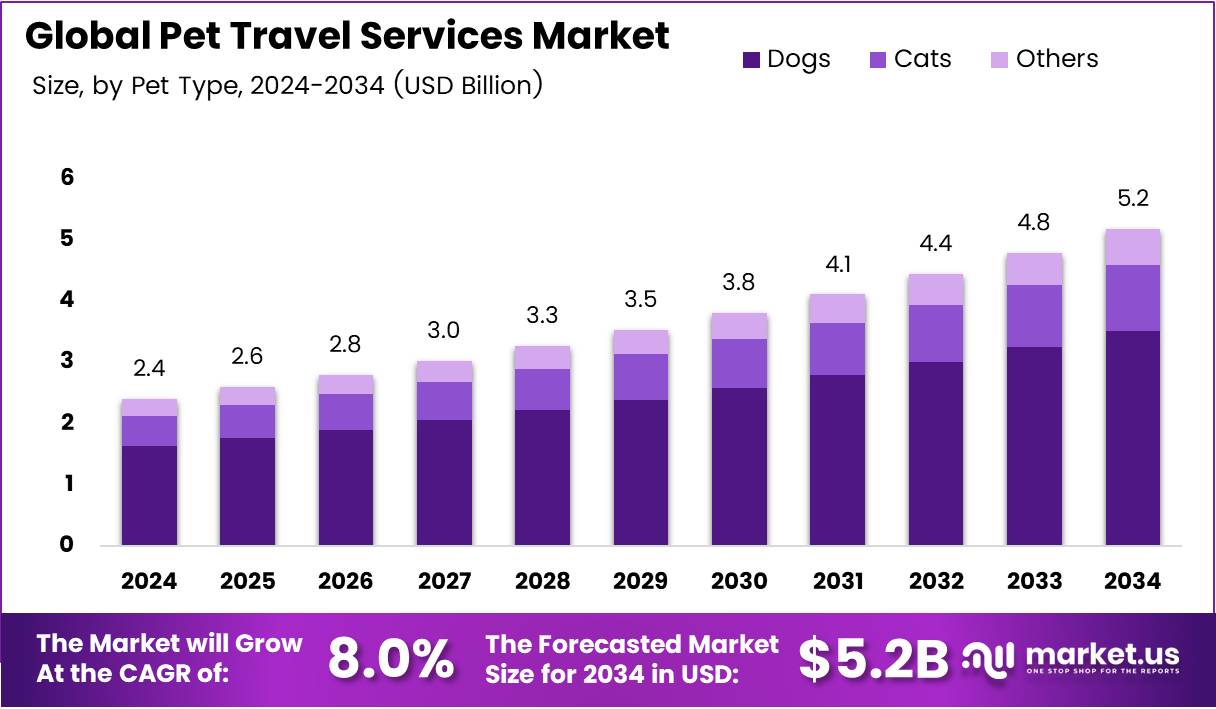

The Global Pet Travel Services Market size is expected to be worth around USD 5.2 Billion by 2034, from USD 2.4 Billion in 2024, growing at a CAGR of 8% during the forecast period from 2025 to 2034.

The Pet Travel Services Market is a rapidly growing sector catering to the increasing demand for pet-friendly travel options. As pet ownership continues to rise globally, more pet owners are seeking services that ensure their pets are well-cared for while traveling. This shift in consumer behavior is fueling market expansion, with various segments offering specialized services such as pet transportation, grooming, and accommodation.

The market is significantly influenced by changing travel patterns and an increasing awareness of pet care needs. Pet owners are becoming more focused on ensuring their pets’ safety, comfort, and well-being during trips. This trend is evident as more travel agencies, airlines, and hotels adapt to the growing demand for pet-inclusive experiences. Notably, 75% of American hotels from luxury to economy now allow pets, highlighting the widespread adaptation of pet-friendly policies in the hospitality industry.

As travel experiences continue to evolve, the market presents a considerable opportunity for businesses to tap into a loyal consumer base. The demand for specialized services, including pet transport and pet-friendly accommodations, is expected to grow, particularly in regions with high pet ownership rates. This opens up numerous opportunities for companies to develop and enhance their offerings, such as pet transport solutions, specialized pet amenities, and even insurance for pets during travel.

Governments are also beginning to recognize the potential of the pet travel services market. Several initiatives, such as regulatory frameworks for the safe transportation of pets, are being implemented to ensure the welfare of animals during travel. For instance, airlines and transport providers are subject to increasing scrutiny regarding the safety and comfort of pets, prompting investments in infrastructure to meet these standards.

According to surveys, 94 million U.S. households owned a pet in 2024, a 12% increase from the previous year. This surge in pet ownership is closely linked to the rising demand for pet travel services. Additionally, 76% of dog owners base their travel plans around ensuring proper care for their pets, further highlighting the growing trend. 78% of Americans also travel with their pets annually, indicating the importance of offering pet-inclusive services. Notably, Alaska Airlines remains the most popular airline for pet transportation, having flown 107,042 pets in one year.

Key Takeaways

- The Global Pet Travel Services Market is expected to reach USD 5.2 Billion by 2034, growing at a CAGR of 8.0% from 2025 to 2034.

- Domestic travel dominates the market, with a 73.3% share in 2024, reflecting pet owners’ preference for local travel.

- Dogs lead the pet type segment with a 67.8% share in 2024, driven by the complexity and cost of transporting larger breeds.

- Online & Phone Bookings dominate the booking method with a 78.5% share in 2024, highlighting the shift to digital platforms.

- Land transportation holds a 64.9% share, reflecting preferences for ground travel due to cost and pet welfare considerations.

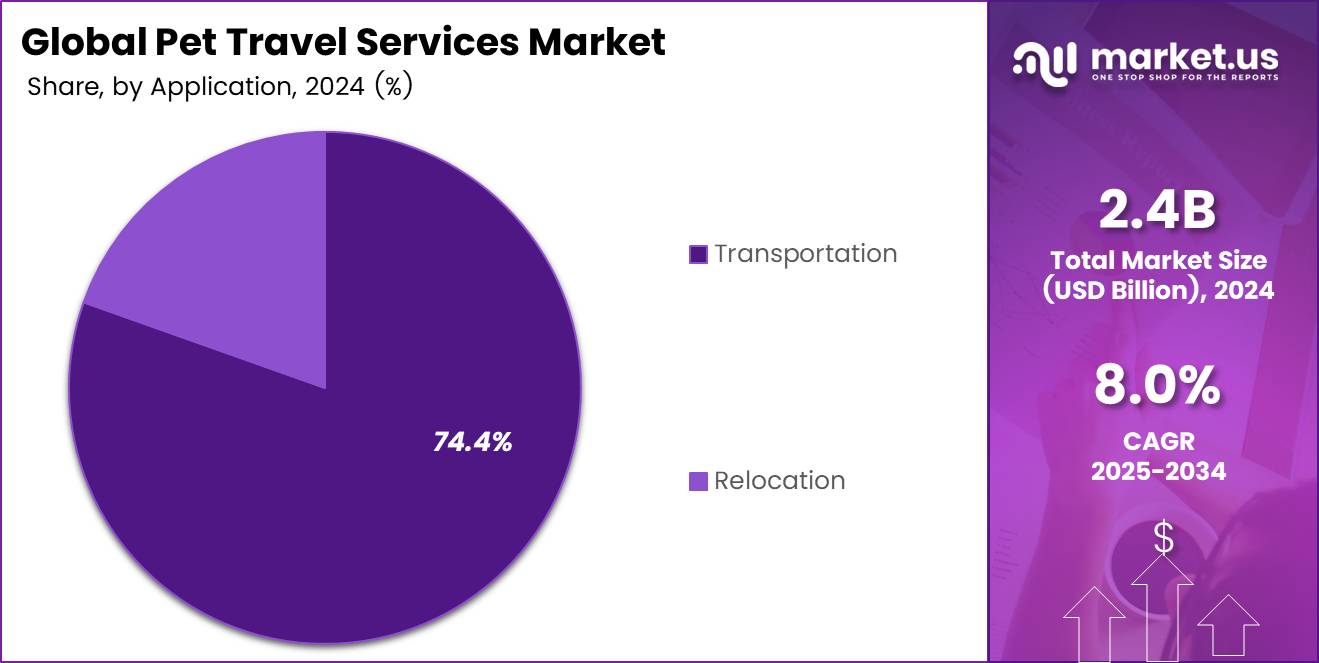

- Transportation is the dominant application with a 74.4% share in 2024, driven by the need for temporary travel arrangements.

- Pet Owners hold a dominant share of 76.2% in the end-use segment, indicating a strong connection between ownership and pet travel services.

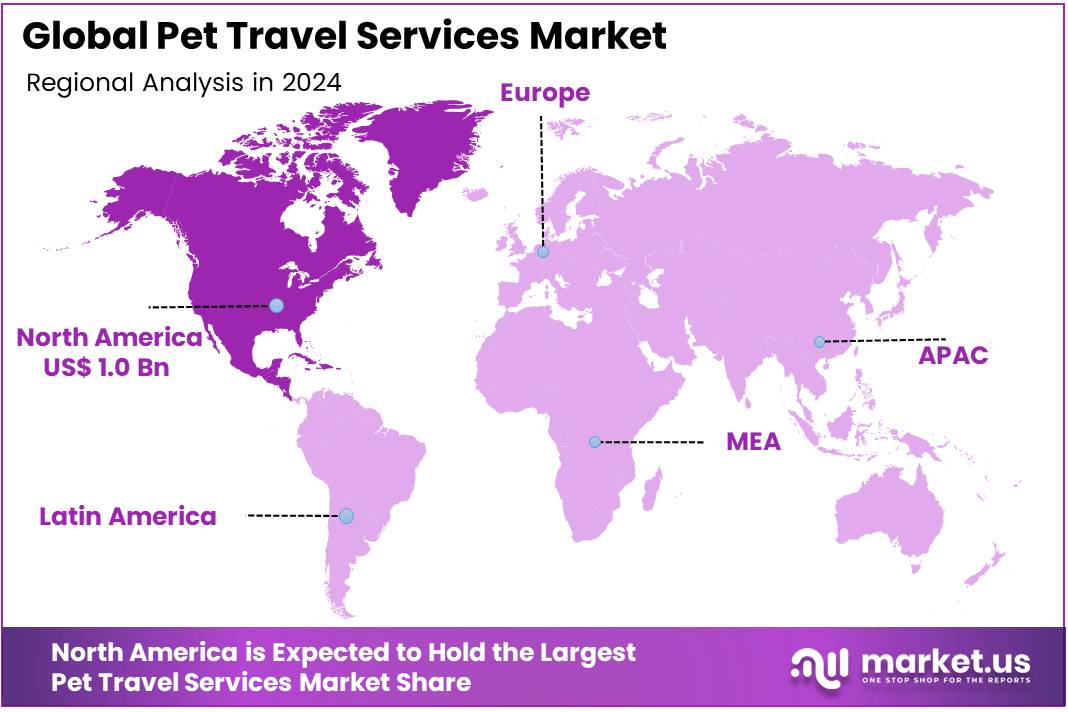

- North America accounts for 42.8% of the global market, valued at USD 1.0 Billion, fueled by high pet ownership and demand for pet-inclusive travel.

Travel Type Analysis

Domestic travel dominates with 73.3% due to its convenience and lower regulatory barriers.

In 2024, Domestic held a dominant market position in By Travel Type Analysis segment of Pet Travel Services Market, with a 73.3% share. This commanding position reflects pet owners’ preference for domestic travel arrangements, which offer significantly fewer regulatory hurdles and documentation requirements compared to international alternatives.

Domestic pet travel services benefit from streamlined processes, reduced costs, and shorter travel durations that minimize stress for both pets and owners. The segment’s growth is driven by increased pet ownership rates and the growing trend of treating pets as family members who accompany owners on vacations and relocations within national borders.

International travel, while representing the remaining market share, faces challenges including complex quarantine requirements, extensive health certifications, and higher costs. However, this segment shows potential growth opportunities as global mobility increases and pet owners become more willing to invest in comprehensive travel services for their companions.

The dominance of domestic travel services indicates a mature market segment with established service providers and standardized processes that cater to the majority of pet travel needs.

Pet Type Analysis

Dogs dominate with 67.8% due to their larger size requirements and higher travel frequency.

In 2024, Dogs held a dominant market position in By Pet Type Analysis segment of Pet Travel Services Market, with a 67.8% share. This substantial market leadership reflects the higher complexity and cost associated with transporting dogs, particularly larger breeds that require specialized handling and accommodation arrangements.

Dogs typically require more comprehensive travel services including larger carriers, specific airline accommodations, and often ground transportation vehicles designed for canine comfort and safety. The segment benefits from dogs being the most popular pet choice globally and their owners’ willingness to invest in professional travel services.

Cats represent a significant but smaller portion of the market, often requiring different handling approaches and typically generating lower service revenues per trip due to their smaller size and different transportation requirements.

The Others segment, encompassing exotic pets, birds, and small mammals, represents a niche but growing market. These pets often require highly specialized services and expert handling, commanding premium pricing but serving a limited customer base with specific regulatory and care requirements.

Booking Analysis

Online & Phone Bookings dominate with 78.5% due to convenience and 24/7 accessibility.

In 2024, Online & Phone Bookings held a dominant market position in By Booking Analysis segment of Pet Travel Services Market, with a 78.5% share. This overwhelming preference demonstrates the successful digital transformation of pet travel services and customers’ demand for convenient, accessible booking options.

Online platforms offer pet owners the ability to compare services, read reviews, upload pet documentation, and track their pets’ journey in real-time. Phone booking services complement digital platforms by providing personalized consultation for complex travel arrangements and addressing specific concerns about pet safety and comfort.

The dominance of digital booking channels reflects modern consumer behavior, where pet owners expect seamless, transparent booking experiences similar to human travel services. These platforms often integrate payment processing, document management, and communication tools that streamline the entire travel arrangement process.

Offline bookings, while representing a smaller market share, remain relevant for customers requiring in-person consultations, particularly for first-time users or complex international travel arrangements. However, the trend clearly favors digital-first approaches that offer greater convenience and operational efficiency.

Mode Analysis

Land transportation dominates with 64.9% due to cost-effectiveness and reduced pet stress.

In 2024, Land held a dominant market position in By Mode Analysis segment of Pet Travel Services Market, with a 64.9% share. This preference for ground transportation reflects both economic considerations and pet welfare priorities that drive customer decision-making in the travel services market.

Land transportation offers significant advantages including lower costs, reduced stress for pets who may be anxious about flying, and greater flexibility in scheduling and routing. Ground services can accommodate various pet sizes and temperaments more easily than air travel, which has strict regulations and size limitations.

The land segment benefits from specialized pet transport vehicles equipped with climate control, security features, and comfort amenities designed specifically for animal passengers. Professional drivers trained in pet handling ensure safe and comfortable journeys for various distances.

Air transportation, while representing the remaining market share, serves primarily long-distance and international travel needs where ground transportation is not feasible. Despite higher costs and more complex logistics, air travel remains essential for time-sensitive relocations and intercontinental pet movement, particularly for military families and corporate relocations.

Application Analysis

Transportation services dominate with 74.4% due to temporary travel needs and vacation demand.

In 2024, Transportation held a dominant market position in By Application Analysis segment of Pet Travel Services Market, with a 74.4% share. This significant market leadership reflects the predominant use of pet travel services for temporary transportation needs rather than permanent relocations.

Transportation services cater primarily to vacation travel, temporary relocations, veterinary visits to specialized facilities, and emergency situations requiring professional pet transport. This segment benefits from repeat customers who regularly travel with their pets and require reliable, professional services for various trip types.

The transportation application encompasses both short-term and medium-term travel needs, serving pet owners who want to ensure their animals receive proper care and handling during transit. Services often include pickup and delivery, travel monitoring, and basic care during the journey.

Relocation services, while representing a smaller market share, typically involve higher-value transactions and more comprehensive service packages. This segment serves customers making permanent moves, often requiring additional services such as quarantine coordination, extended care arrangements, and documentation management. Though less frequent, relocation services often generate higher per-customer revenue due to their complexity and comprehensive nature.

End Use Analysis

Pet Owners dominate with 76.2% due to direct responsibility and emotional investment.

In 2024, Pet Owners held a dominant market position in By End Use Analysis segment of Pet Travel Services Market, with a 76.2% share. This substantial market dominance reflects the direct relationship between pet ownership and the need for professional travel services, driven by emotional attachment and responsibility for pet welfare.

Pet owners represent the primary customer base, directly purchasing services for their animals’ transportation needs. This segment includes individual families, elderly pet owners who cannot handle travel logistics themselves, and busy professionals who prioritize convenience and professional handling for their pets’ travel requirements.

Pet owners are typically willing to invest in premium services that ensure their animals’ safety, comfort, and well-being during transport. Their decisions are often driven by emotional factors and the desire to minimize stress for both themselves and their pets.

Pet Nannies and Others segments represent professional and institutional customers including pet care businesses, veterinary clinics, and breeding facilities that require regular transport services for multiple animals. While smaller in market share, these segments often provide steady, recurring business and may require specialized services for handling multiple pets or specific breeds with unique transportation requirements.

Key Market Segments

By Travel Type

- Domestic

- International

By Pet Type

- Dogs

- Cats

- Others

By Booking

- Online & Phone Bookings

- Offline Bookings

By Mode

- Land

- Air

By Application

- Transportation

- Relocation

By End Use

- Pet Owners

- Pet Nannies

- Others

Drivers

Increasing Pet Ownership and Humanization of Pets Drives Market Growth

Pet ownership has reached record levels globally, with millions of households now considering pets as family members rather than just animals. This shift in mindset has created a strong demand for pet travel services as owners refuse to leave their beloved companions behind during vacations or business trips.

The growth in global tourism and international travel has opened new opportunities for pet travel service providers. As more people explore different countries and cultures, they want their pets to experience these adventures alongside them. This trend has pushed airlines, hotels, and travel agencies to develop pet-friendly policies and services.

Government regulations worldwide are becoming more accommodating toward pet travel. Many countries have simplified quarantine procedures and introduced standardized health certificates, making international pet travel easier and more accessible for pet owners.

The rising demand for specialized pet care services reflects the growing sophistication of pet owners. They now seek professional assistance for pet transportation, boarding, and travel planning, creating a lucrative market for specialized service providers who understand the unique needs of traveling pets.

Restraints

High Costs Associated with Pet Travel Services Limit Market Expansion

The significant expenses involved in pet travel services pose a major barrier for many pet owners. Costs include airline fees, health certificates, quarantine expenses, and professional transportation services, which can quickly add up to thousands of dollars for international travel.

Limited availability of pet-friendly travel infrastructure remains a persistent challenge. Many destinations still lack adequate facilities such as pet-friendly hotels, restaurants, and transportation options, forcing pet owners to limit their travel choices or seek expensive alternatives.

Concerns over pet health and safety during travel create hesitation among potential customers. Pet owners worry about stress, injury, or illness that might affect their pets during long journeys, particularly air travel. These concerns often lead to reluctance in using pet travel services, especially for older or health-compromised animals.

Growth Factors

Emergence of Sustainable and Eco-Friendly Pet Travel Options Creates New Market Potential

The emergence of sustainable and eco-friendly pet travel options represents a significant growth opportunity. Environmentally conscious pet owners increasingly seek services that minimize carbon footprints, such as electric vehicle transportation and eco-friendly accommodations, creating demand for green travel alternatives.

Pet travel concierge services are gaining popularity as busy pet owners seek comprehensive, hassle-free travel solutions. These premium services handle everything from documentation to transportation, appealing to affluent pet owners who value convenience and professional expertise.

Technology integration offers tremendous potential for streamlining pet travel management. Mobile apps, GPS tracking, and automated booking systems can simplify the travel process while providing real-time updates and peace of mind to pet owners throughout their journey.

Emerging markets present untapped opportunities for expansion. Countries with growing middle classes and increasing pet ownership rates, particularly in Asia and Latin America, offer substantial potential for pet travel service providers willing to invest in these developing markets.

Emerging Trends

Adoption of Real-Time Pet Tracking and Monitoring Solutions Shapes Industry Innovation

Real-time pet tracking and monitoring solutions have become essential features in modern pet travel services. GPS collars, temperature sensors, and health monitoring devices provide continuous updates to pet owners, reducing anxiety and ensuring pet safety throughout the travel experience.

The focus on luxury and premium pet travel experiences reflects the growing affluence of pet owners. High-end services now include private jets for pets, luxury pet hotels, and personalized travel itineraries, catering to owners who spare no expense for their pets’ comfort.

The rise in pet-friendly accommodations and transportation options has transformed the travel landscape. Hotels, airlines, and cruise lines are expanding their pet policies and facilities, making it easier for pet owners to find suitable travel arrangements without compromising on quality.

Growth of pet travel communities and social media influence has created powerful marketing channels. Pet owners share their travel experiences online, inspiring others to travel with their pets while providing valuable feedback and recommendations that drive industry improvements and innovation.

Regional Analysis

North America Dominates the Pet Travel Services Market with a Market Share of 42.8%, Valued at USD 1.0 Billion

North America holds a dominant share in the Pet Travel Services Market, accounting for 42.8% of the total market, valued at USD 1.0 Billion. This region’s growth is fueled by a high pet ownership rate and a growing demand for pet-inclusive travel services. Moreover, the pet-friendly culture in the region and increasing adoption of premium travel services for pets have further contributed to its strong market position.

Europe Pet Travel Services Market Trends

Europe follows closely behind in terms of market share, driven by the increasing trend of pet travel among pet owners. The growing demand for specialized services such as pet transportation and accommodation is anticipated to drive the market in this region. Additionally, a shift towards sustainability and eco-friendly travel options for pets is also gaining momentum.

Asia Pacific Pet Travel Services Market Growth

The Asia Pacific region is witnessing significant growth in the Pet Travel Services Market. This region benefits from a growing middle-class population and an increasing number of pet owners who seek to travel with their pets. Moreover, the rise in international tourism and the expanding pet services infrastructure are key drivers in this market’s growth.

Middle East and Africa Pet Travel Services Market Overview

In the Middle East and Africa, the pet travel services market is still in its nascent stage but is expected to grow steadily. Rising disposable income, increasing pet ownership, and a growing tourism industry are expected to boost the demand for pet travel services in this region. As pet owners seek more inclusive travel experiences, the market is anticipated to expand in the coming years.

Latin America Pet Travel Services Market Insights

The Latin American region is also seeing an upward trajectory in the Pet Travel Services Market. This growth can be attributed to the rising popularity of pet ownership and the increasing desire to travel with pets. While the market is still emerging, growing consumer interest and the development of specialized services will likely contribute to its expansion.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pet Travel Services Company Insights

The global pet travel services market is experiencing significant growth, driven by increasing pet humanization and a rising number of pet owners seeking to travel with their companions. Key players in this market are adapting to these trends by offering specialized services to ensure safe and comfortable travel for pets.

AirPets International offers comprehensive pet relocation services, including domestic and international shipping, pet taxi, and pet nanny services. Their focus on personalized care and attention to detail positions them as a reliable choice for pet owners seeking professional assistance in relocating their pets.

Air Animal, Inc. provides veterinarian-owned pet transport services, emphasizing the health and safety of pets during transit. Their expertise in handling various pet types and understanding of regulatory requirements make them a trusted partner for pet relocation needs.

Happy Tails Travel, Inc. specializes in both air and ground pet transportation, catering to a wide range of destinations. Their commitment to providing safe and compassionate travel options ensures that pets are well cared for throughout their journey.

Royal Paws focuses on private, door-to-door international pet transportation, particularly for dogs and puppies. Their USDA APHIS licensing and use of two-person teams for each trip highlight their dedication to maintaining high standards of care and comfort for traveling pets.

Top Key Players in the Market

- AirPets International

- Air Animal, Inc.

- Happy Tails Travel, Inc.

- Royal Paws

- Bluecollar Pet Transport

- CitizenShipper

- Starwood Pet Travel

- World Care Pet Transport, LLC

- PetRelocation, Inc.

- Worldwide Animal Travel Ltd.

Recent Developments

- In February 2024, Rover, a pet-sitting platform, was acquired by private equity funds affiliated with Blackstone in an all-cash transaction valued at approximately $2.3 billion. This strategic acquisition strengthens Blackstone’s position in the growing pet services market, expanding Rover’s capabilities across the pet care ecosystem.

- In August 2025, Tractive, a pet tracking company, acquired U.S.-based pet technology company Whistle to expand its presence in the U.S. market. This acquisition enhances Tractive’s product offerings, allowing the company to capture a larger share of the pet technology market and meet rising demand for pet tracking solutions.

- In October 2024, CapVest Partners acquired Butcher’s Pet Care, a UK-based producer of pet foods, for $56.8 million, complementing their existing portfolio. This acquisition bolsters CapVest’s footprint in the pet food sector, enhancing their product range with established pet food brands in the UK market.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Billion Forecast Revenue (2034) USD 5.2 Billion CAGR (2025-2034) 8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Travel Type (Domestic, International), By Pet Type (Dogs, Cats, Others), By Booking (Online & Phone Bookings, Offline Bookings), By Mode (Land, Air), By Application (Transportation, Relocation), By End Use (Pet Owners, Pet Nannies, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape AirPets International, Air Animal, Inc., Happy Tails Travel, Inc., Royal Paws, Bluecollar Pet Transport, CitizenShipper, Starwood Pet Travel, World Care Pet Transport, LLC, PetRelocation, Inc., Worldwide Animal Travel Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AirPets International

- Air Animal, Inc.

- Happy Tails Travel, Inc.

- Royal Paws

- Bluecollar Pet Transport

- CitizenShipper

- Starwood Pet Travel

- World Care Pet Transport, LLC

- PetRelocation, Inc.

- Worldwide Animal Travel Ltd.