Global Pet Pheromones Market Size, Share, Growth Analysis By Product Type (Spray, Diffusers, Collars & Others), By Pet Type (Dog, Cat & Others), By Distribution Channel (Online Retail & Offline Retail), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 157692

- Number of Pages: 391

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Global Pet Pheromones Market, By Product Type, 2020-2024 (USD Mn)

- Pet Type Analysis

- Global Pet Pheromones Market, By Pet Type, 2020-2024 (USD Mn)

- Distribution Channel Analysis

- Global Pet Pheromones Market, By Distribution Channel, 2020-2024 (USD Mn)

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Geopolitical Impact Analysis

- Regional Analysis

- Global Pet Pheromones Market, By Region, 2020-2024 (USD Mn)

- Key Pet Pheromones Company Insights

- Recent Developments

- Report Scope

Report Overview

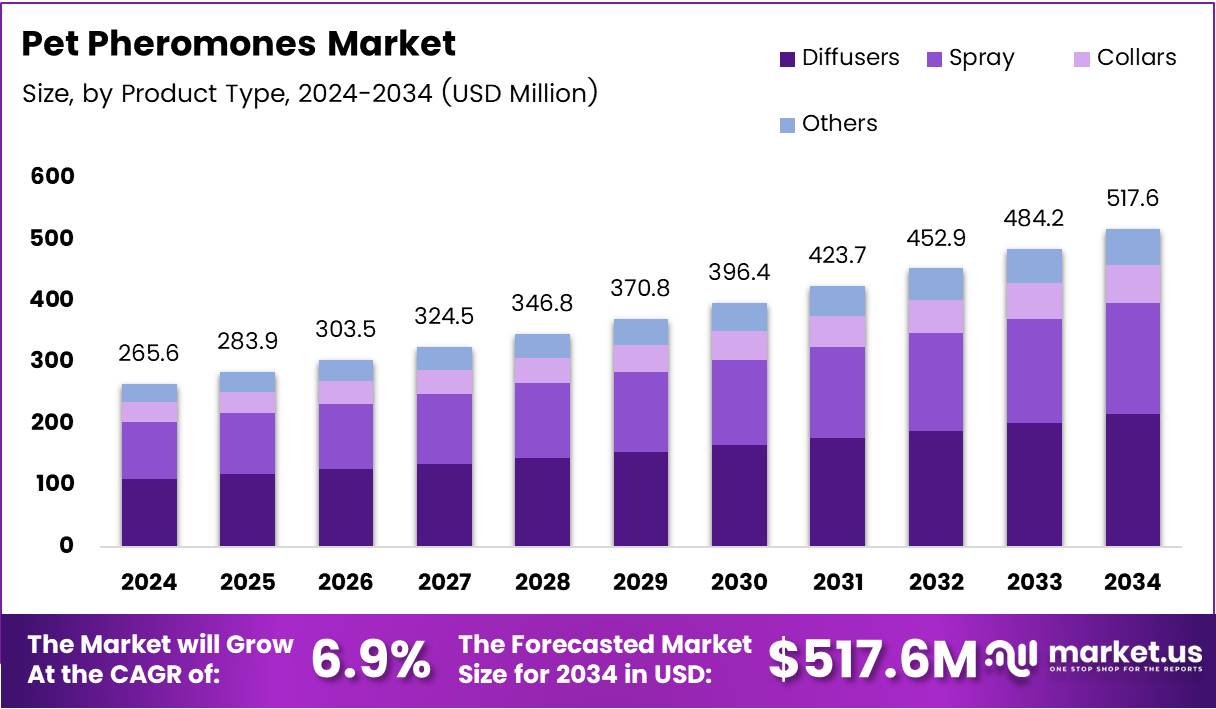

In 2024, the Global Pet Pheromones Market was valued at US$ 265.65 Million, and between 2025 and 2034, this market is estimated to register a CAGR of 6.9%. Pet pheromones are natural chemical substances secreted by animals such as cats and dogs to communicate with their own species, triggering instinctive behavioral or emotional responses.

Invisible and typically odorless to humans, pheromones are detected by specialized sensory organs in pets and can influence activities such as bonding, territory marking, calming, or stress management.

Based on this natural communication system, researchers and veterinary product manufacturers have developed synthetic pheromone analogues that replicate these signals, enabling owners and veterinarians to manage behavioral issues without resorting to pharmaceuticals.

The global pet pheromones market has evolved into an important niche within the broader animal health and pet care industry, driven by the increasing emphasis on pet well-being, behavior management, and the humanization of companion animals.

Commercial products—sprays, plug-in diffusers, wipes, and wearable collars—are designed to reduce anxiety, aggression, destructive behavior, or inappropriate marking, particularly in stressful circumstances such as fireworks, travel, veterinary visits, house moves, or introduction of new pets. Market growth is supported by the rapid rise in global pet ownership and the cultural shift toward treating pets as family members.

Key Takeaways

- The global pet pheromones market was valued at US$ 265.6 million in 2024.

- The global pet pheromones market is projected to grow at a CAGR of 6.9% and is estimated to reach US$ 516.0 million by 2034.

- Between product types, diffusers accounted for the largest market share of 44.7%.

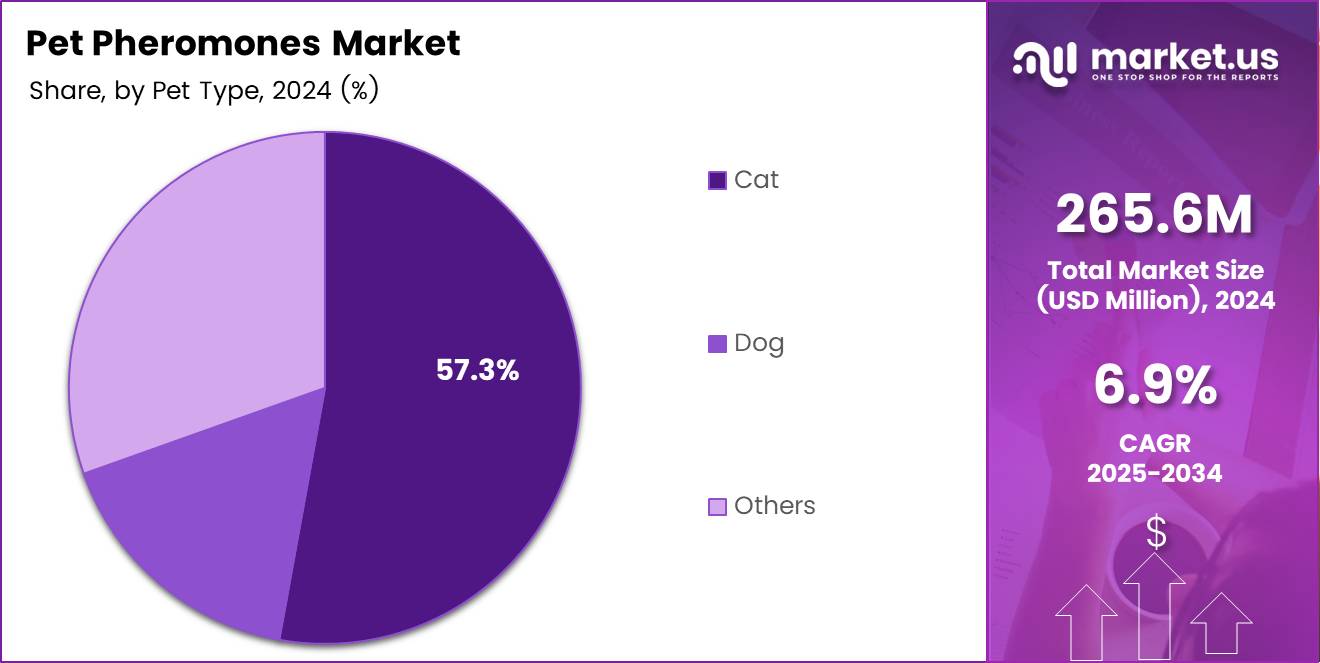

- Among pet types, cats accounted for the majority of the market share at 57.3%.

- Europe is estimated as the largest market for pet pheromones with a share of 41.1% of the market share.

- Asia-Pacific is anticipated to register the highest CAGR of 8.1%.

- North America, with a revenue share of 34.4% in 2024, and expected to register a CAGR of 7.2%.

Product Type Analysis

Diffusers Pet Pheromones Dominated the Market, Owing to Their Convenience and Effectiveness

The pet pheromones market is segmented based on product type into spray, diffusers, collars & others. In 2024, the diffuser-type pet pheromones segment held a significant revenue share of 44.7%. This strong market position is largely attributed to the convenience and effectiveness of diffusers, which provide a continuous and consistent release of pheromones into the environment, making them especially suitable for addressing common behavioral issues such as anxiety, aggression, and stress in pets.

Unlike sprays or collars, diffusers require minimal effort from pet owners once installed and can cover larger living spaces, enhancing their appeal among households with multiple pets or those seeking low-maintenance solutions. Their reliability and growing consumer trust in their efficacy have positioned diffusers as the preferred choice within the pet pheromones market.

Global Pet Pheromones Market, By Product Type, 2020-2024 (USD Mn)

Product Type 2020 2021 2022 2023 2024 Spray 73.24 76.82 80.77 85.06 90.14 Diffusers 96.61 101.33 106.55 112.17 118.72 Collars 37.94 39.83 41.96 44.27 46.99 Others 8.19 8.59 8.98 9.34 9.79 Pet Type Analysis

The Pet Pheromones Market Was Dominated By the Cat Pet.

Based on pet type, the market is further divided into dog, cat & others. As of 2024, the cat segment dominated the pet pheromones market with a 57.3% share, largely due to cats’ high reliance on pheromonal communication.

Cats possess an exceptionally strong sense of smell and frequently use pheromones to mark territory, establish familiarity, and communicate stress or comfort. These pheromones are detected through the vomeronasal organ, located at the roof of the mouth, which triggers distinct behavioral or physiological responses.

As a result, pheromone-based products are particularly effective for managing common feline issues such as scratching, spraying, and anxiety, making them highly sought after by cat owners.

In comparison, dogs and other pets rely less heavily on pheromone signaling, which contributes to lower adoption rates of such products. The strong behavioral impact of pheromones on cats, combined with the increasing demand for stress-relief and behavioral solutions among cat-owning households, explains why this segment overwhelmingly led the market.

Global Pet Pheromones Market, By Pet Type, 2020-2024 (USD Mn)

Pet Type 2020 2021 2022 2023 2024 Dog 88.28 92.87 98.04 103.67 110.30 Large Breeds 39.03 40.81 42.85 45.07 47.69 Medium Breeds 25.78 27.23 28.82 30.56 32.61 Small Breeds 23.47 24.83 26.37 28.04 30.00 Cat 124.90 130.76 137.13 143.96 151.99 Others 2.81 2.95 3.08 3.21 3.36

Distribution Channel Analysis

The Pet Pheromones Market Was Dominated By the Personal Care & Cosmetics Industry.

Based on the distribution channel, the market is further divided into online retail & offline retail. The offline retail accounted for 63.1% of the market share in 2024. This predominance can be attributed to pet owners’ preference for purchasing such products directly from physical stores, including veterinary clinics, specialty pet shops, and supermarkets, where they can receive professional guidance and reassurance on product use.

Various consumers still value the trust and credibility associated with in-person recommendations, particularly when dealing with behavioral solutions for their pets. Additionally, immediate product availability and the ability to physically examine items like sprays, diffusers, or collars contribute to the continued strength of offline retail. These factors collectively reinforce the offline channel’s leadership, despite the rising convenience of online platforms.

Global Pet Pheromones Market, By Distribution Channel, 2020-2024 (USD Mn)

Distribution Channel 2020 2021 2022 2023 2024 Online Retail 77.58 81.85 86.67 91.91 98.07 E-commerce Platforms 55.00 57.94 61.25 64.85 69.09 Company-owned Websites 22.58 23.92 25.42 27.06 28.98 Offline Retail 138.41 144.72 151.59 158.93 167.58 Pet Specialty Stores 83.02 86.91 91.12 95.60 100.86 Supermarkets/Hypermarkets 39.39 41.16 43.12 45.24 47.77 Pharmacies 12.92 13.43 14.00 14.62 15.34 Others 3.08 3.22 3.34 3.46 3.61 Key Market Segments

By Product Type

- Spray

- Diffusers

- Collars

- Others

By Pet Type

- Dog

- Large Breeds

- Medium Breeds

- Small Breeds

- Cat

- Others

By Distribution Channel

- Online Retail

- E-commerce Platforms

- Company-owned Websites

- Offline Retail

- Pet Specialty Stores

- Supermarkets/Hypermarkets

- Pharmacies

- Others

Drivers

Rising Pet Ownership and Humanization of Pets Is Driving The Market Growth.

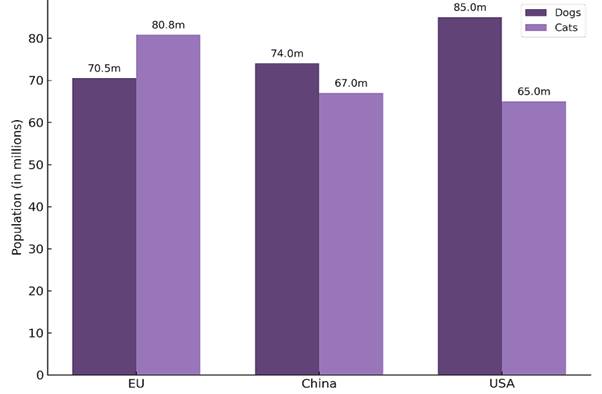

The growth of the global pet care industry is increasingly tied to two interconnected phenomena: rising rates of pet ownership worldwide and the cultural shift toward the humanization of pets. In many countries, pet ownership has reached historic levels.

In the United States, the American Pet Products Association (APPA) reports that nearly two-thirds of households own at least one pet, while in Europe, the European Pet Food Industry Federation (FEDIAF) states that 139 million households—or 49% of the population—share their homes with pets, totaling more than 299 million companion animals. This surge in pet ownership reflects broader demographic and lifestyle changes: more single-person households, delayed parenthood, urban living, and increased recognition of pets’ roles in providing companionship, mental health benefits, and emotional support.

Owners are purchasing premium food made with organic or natural ingredients, investing in advanced healthcare such as dental cleanings or rehabilitation therapies, and even exploring complementary treatments like acupuncture or pheromone-based calming aids. The emotional connection also drives spending on services that reflect human care.

The Population Of Pets In Major Markets

Source: HealthforAnimals global animal health association

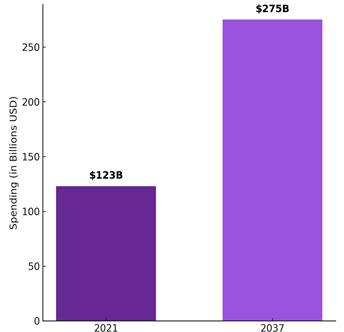

- The U.S. alone accounts for the largest share of global pet expenditures, with total spending on pets and pet-related products projected to reach $275 billion by 2037, up from $123 billion in 2021. This growth creates a favorable environment for pheromone-based products, which are widely used to address behavioral issues such as stress, separation anxiety, aggression, and marking in dogs and cats.

Estimated U.S. Consumer Spending on Pets and Pet-related Products

Source: HealthforAnimals global animal health association

Restraints

Competition from Substitutes is Attributed to Restraint on The Growth to a Certain Extent

A significant restraint on the growth of the global pet pheromones market is the competition from substitute products and behavioral solutions, which often offer pet owners more affordable, familiar, or versatile alternatives.

While pheromone-based products are scientifically designed to mimic natural animal signals and help alleviate stress or anxiety, several pet owners still turn to substitutes such as nutritional supplements, herbal remedies, calming treats, prescription medications, and behavioral training programs.

For instance, calming chews containing ingredients like chamomile, melatonin, or L-theanine are widely marketed as natural anti-anxiety aids and are often perceived as more convenient and cost-effective than pheromone sprays or diffusers that require regular replenishment.

Similarly, prescription pharmaceuticals, though associated with side effects, remain trusted by veterinarians for treating severe behavioral issues, further diverting demand away from pheromone products.

In addition, pet owners may rely on environmental modifications and behavioral interventions, such as crate training, pet toys, or white noise machines, to manage issues like separation anxiety, noise phobias, or destructive behaviors—approaches that do not involve recurring product costs.

The growing pet supplement market also intensifies competition, as many brands heavily promote holistic health and wellness products that double as calming aids, creating overlap with the functional role of pheromones.

Furthermore, the limited awareness and variable efficacy of pheromone products add to the challenge, as some owners may not see immediate results and therefore turn to alternatives that appear more reliable.

Growth Factors

Rising Demand for Non-Pharmaceutical Behavioral Solutions

One of the most powerful opportunities driving the global pet pheromones market is the growing demand for non-pharmaceutical, natural, and drug-free behavioral solutions for companion animals.

As pets become more deeply integrated into family life, owners are increasingly concerned not only with their animals’ physical health but also with their emotional well-being and behavior.

Stress, anxiety, separation distress, noise phobias, destructive behaviors, and inter-pet aggression are common issues in both cats and dogs, yet several owners hesitate to rely on traditional pharmaceuticals due to concerns about side effects, sedation, or long-term dependency. This has opened the door to pheromone-based solutions, which are perceived as safe, species-specific, and non-invasive alternatives for managing stress-related behaviors.

Veterinary practitioners are reinforcing this trend by recommending pheromone products as first-line or complementary interventions in behavior management protocols. Unlike medications, pheromone products do not enter the bloodstream, carry minimal safety risks, and can be used preventively during stressful transitions—such as moving to a new home, introducing new pets, or exposure to thunderstorms and fireworks.

This positions them as particularly attractive for owners who are health-conscious or wary of pharmacological interventions, reflecting trends seen in human healthcare where natural and holistic remedies are gaining ground.

Emerging Trends

Premiumization and Lifestyle Alignment

Premiumization and lifestyle alignment are affecting the path of the global pet pheromones market as owners increasingly view pets as family members whose care should mirror human standards of wellness. This trend reflects a shift toward high-quality, scientifically validated, and branded behavioral solutions that align with modern lifestyles focused on convenience, sustainability, and holistic well-being.

Pet pheromone products—such as smart diffusers, long-lasting collars, and eco-friendly sprays—are marketed not merely as functional aids but as part of a premium pet wellness routine, comparable to human stress-relief or aromatherapy products.

Younger, urban consumers in particular are willing to invest in these premium solutions, especially when integrated with their values of natural, drug-free care and emotional well-being.

Moreover, marketing strategies emphasize lifestyle alignment by positioning pheromones as tools that enhance harmony in multi-pet households, reduce stress during travel, and support pets’ adaptation to modern living, thereby reinforcing their role in a premiumized, wellness-driven pet care ecosystem.

Geopolitical Impact Analysis

Impact of U.S. Tariffs On The Growth Of The Pet Pheromones Market.

The imposition of U.S. tariffs has created prominent disruptions in the pet pheromones market, primarily by raising the cost of imported raw materials, chemical compounds, packaging, and veterinary supplies essential to production. Because these products depend on specialized synthesis and packaging sourced internationally, tariffs on imports from regions such as China, the EU, and the U.K. have inflated input costs by 10–25%, with recent policy announcements adding further levies of up to 20%.

While some veterinary drugs remain exempt, ancillary supplies critical for pheromone sprays, diffusers, wipes, and collars face steep surcharges, forcing manufacturers to either absorb losses or pass on the burden through higher retail prices. This is especially damaging since pheromone solutions are positioned as premium, non-essential behavioral aids, making them vulnerable to consumer cutbacks.

Rising costs may drive pet owners—already managing higher food and vet bills—to seek cheaper substitutes or forgo solutions altogether, potentially tolerating stress-driven behaviors like scratching, marking, or separation anxiety.

In more severe cases, cumulative pet care expenses could push some households toward rehoming pets, indirectly contributing to shelter overpopulation. Ultimately, tariffs amplify costs across the supply chain, constrain manufacturer margins, inflate consumer prices, and reduce market accessibility, undermining the stability of the pet pheromones industry.

Regional Analysis

Europe Held the Largest Share of the Global Pet Pheromones Market

In 2024, Europe dominated the global pet pheromones market with 41.1% of the total share, largely due to its strong pet ownership culture, advanced veterinary infrastructure, and high consumer awareness of pet wellness solutions.

The region has one of the highest rates of pet ownership globally, particularly in countries like Germany, France, and the U.K., where companion animals are considered integral to households.

European consumers also show a strong willingness to invest in premium pet care products, including pheromone-based sprays, diffusers, and collars, which are often viewed as safer, non-pharmaceutical alternatives for managing stress-driven behaviors in pets.

Additionally, the presence of leading industry players headquartered in Europe, combined with supportive regulations promoting animal welfare and product innovation, has further strengthened market growth.

Distribution networks through veterinary clinics, retail chains, and e-commerce platforms are also well-developed, ensuring wide product accessibility. These factors, together with rising disposable incomes and a growing trend of pet humanization, positioned Europe as the largest market for pet pheromones.

Global Pet Pheromones Market, By Region, 2020-2024 (USD Mn)

Region 2020 2021 2022 2023 2024 North America 73.61 77.40 81.59 86.10 91.40 Europe 89.88 93.98 98.51 103.37 109.12 Asia Pacific 25.79 27.34 29.06 30.92 33.09 Middle East & Africa 7.34 7.66 8.01 8.39 8.84 Latin America 19.38 20.19 21.09 22.05 23.19 Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pet Pheromones Company Insights

To maintain a competitive edge in the pet pheromones market, major companies place strong emphasis on product innovation and research & development (R&D).

Continuous investment in R&D allows these companies to explore new formulations, delivery methods, and product designs that enhance effectiveness and convenience for pet owners.

Innovations such as multi-cat diffusers, longer-lasting collars, and eco-friendly packaging not only address evolving consumer needs but also help differentiate brands in an increasingly crowded market.

Additionally, R&D efforts focus on scientific validation of product claims, which strengthens credibility among veterinarians and pet owners, thereby driving trust and adoption.

By combining innovation with evidence-based research, leading players can expand their product portfolios, capture larger market shares, and sustain long-term growth while meeting the rising demand for effective, safe, and user-friendly pheromone solutions.

Top Key Players in the Market

- Central Garden & Pet Company

- Spectrum Brands Holdings, Inc

- Ceva Animal Health, LLC

- Virbac SA

- PetIQ, Inc

- UnRuffled Pets

- Beaphar B.V.

- Tevra Brands LLC

- Beloved Pets Brand

- AB7 Group

- Laboratorium DermaPharm Sp. z o.o.

- Genveticon (Nanjing) Animal Health Co., Ltd

- Oimmal Pet

- FurLife

- Other Key Players

Recent Developments

25 October 2024: PetIQ, Inc. completed its acquisition by Bansk Group in an all-cash transaction valued at $1.5 billion. Shareholders received $31.00 per share, and PetIQ’s Nasdaq listing ended upon deal closing. The company became privately held while its executive team continued independent operations. Cord Christensen, Founder, Chairman, and CEO, said the acquisition delivered significant value to shareholders and would help accelerate PetIQ’s mission of providing affordable pet healthcare. Bansk Group’s leaders, Chris Kelly and Bart Becht, said they planned to use their consumer brand expertise to strengthen PetIQ’s marketing, innovation, and growth through strategic investments and acquisitions.

23 January 2025: Virbac has recently launched ZENIFEL Pheromone Products, a breakthrough solution aimed at reducing stress-related behaviors in cats. Combining synthetic feline facial pheromones with Nepeta cataria (catnip) extract, ZENIFEL promotes calm and emotional well-being.

Available in two formats—a gel diffuser lasting up to two months and a portable spray with 400+ uses—these products offer long-lasting, flexible support for feline anxiety. Clinical studies show up to an 80% reduction in stress signs, outperforming leading competitors. Virbac will showcase ZENIFEL at major veterinary conferences in 2025, reinforcing its commitment to enhancing pet care and strengthening the bond between cats and their families.

Report Scope

Report Features Description Market Value (2024) USD 265.65 Million Forecast Revenue (2034) USD 516.0 million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Spray, Diffusers, Collars & Others), By Pet Type (Dog, Cat & Others), By Distribution Channel (Online Retail & Offline Retail) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Central Garden & Pet Company, Spectrum Brands Holdings, Inc, Ceva Animal Health, LLC, Virbac SA, PetIQ, Inc, UnRuffled Pets, Beaphar B.V., Tevra Brands LLC, Beloved Pets Brand, AB7 Group, Laboratorium DermaPharm Sp. z o.o., Genveticon (Nanjing) Animal Health Co., Ltd, Oimmal Pet, FurLife, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Central Garden & Pet Company

- Spectrum Brands Holdings, Inc

- Ceva Animal Health, LLC

- Virbac SA

- PetIQ, Inc

- UnRuffled Pets

- Beaphar B.V.

- Tevra Brands LLC

- Beloved Pets Brand

- AB7 Group

- Laboratorium DermaPharm Sp. z o.o.

- Genveticon (Nanjing) Animal Health Co., Ltd

- Oimmal Pet

- FurLife

- Other Key Players