Global Pet Cosmetics Market Size, Share, Growth Analysis By Product Type (Shampoo & Conditioner, Skin Powder Perfume, Eye Care Lotion, Moisturizing Balm, Others), By Pet Type (Dog, Cat, Others), By End Users (Individual Pet Owner, Professional Pet Groomers), By Distribution Channel (Pet Stores, Supermarket/Hypermarket, Online, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 156854

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

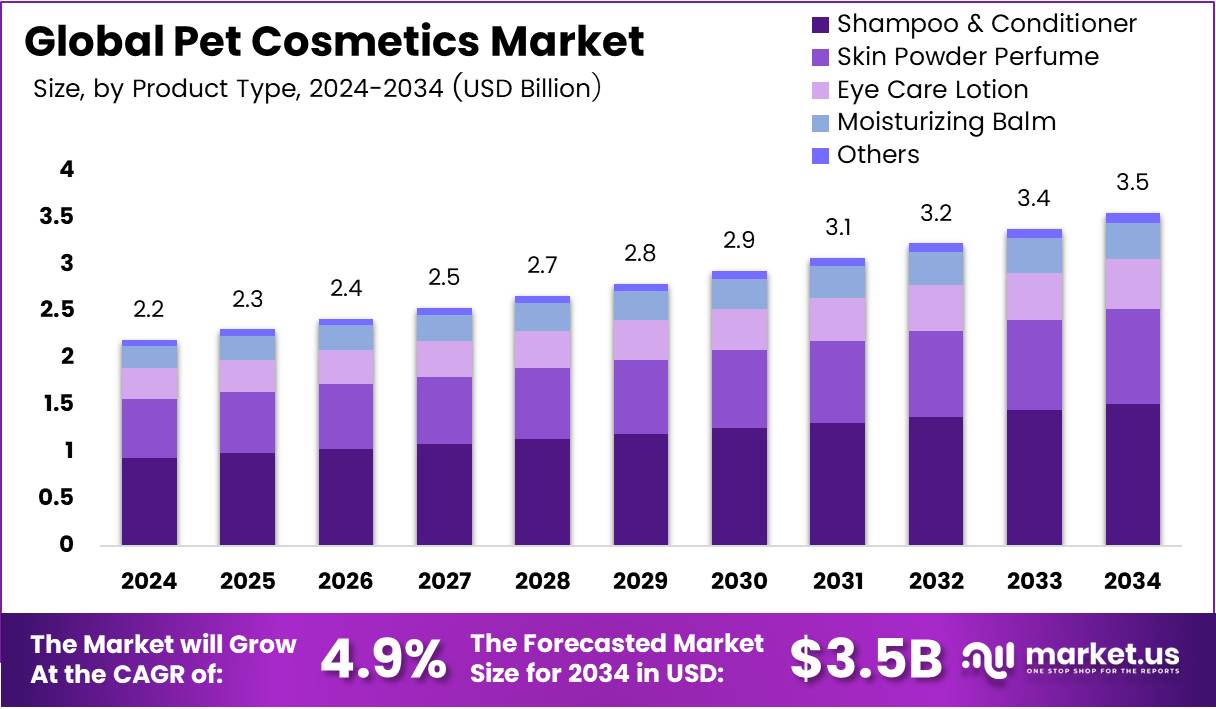

The Global Pet Cosmetics Market size is expected to be worth around USD 3.5 Billion by 2034, from USD 2.2 Billion in 2024, growing at a CAGR of 4.9% during the forecast period from 2025 to 2034.

The Pet Cosmetics Market is a fast-growing niche within the global pet care sector, focusing on grooming, hygiene, and beauty products for companion animals. These include shampoos, conditioners, lotions, and perfumes tailored to pets’ sensitive skin. With increasing pet humanization, owners prioritize grooming essentials, turning cosmetics into mainstream wellness-driven consumption.

Moreover, the market is gaining momentum due to rising pet ownership and evolving consumer preferences. The surge in pet adoption globally has expanded demand, while digital retail platforms enhance accessibility. E-commerce platforms now capture significant product sales, enabling rapid growth and exposure for niche brands catering to modern pet parents.

In addition, strong opportunities exist as disposable incomes rise in developing regions. Luxury pet spas, premium grooming services, and specialty salons are creating higher demand for safe, innovative solutions. Brands focusing on cruelty-free, organic, and eco-friendly cosmetics align with human wellness trends, ensuring long-term loyalty among environmentally aware consumers.

Furthermore, government regulations and investments support market expansion. In the US and EU, non-toxic formulations and safety certifications are mandatory, boosting consumer trust. Public initiatives promoting animal health indirectly favor growth by ensuring product transparency. However, compliance costs and complex approval processes remain barriers for smaller cosmetic manufacturers entering competitive markets.

Key Takeaways

- The Global Pet Cosmetics Market is projected to reach USD 3.5 Billion by 2034, up from USD 2.2 Billion in 2024, at a CAGR of 4.9%.

- In 2024, Shampoo & Conditioner dominated the product type segment with a 42.7% share, reflecting its essential role in pet grooming routines.

- The Dog segment led the pet type category with a 63.8% share, driven by frequent grooming needs and coat maintenance requirements.

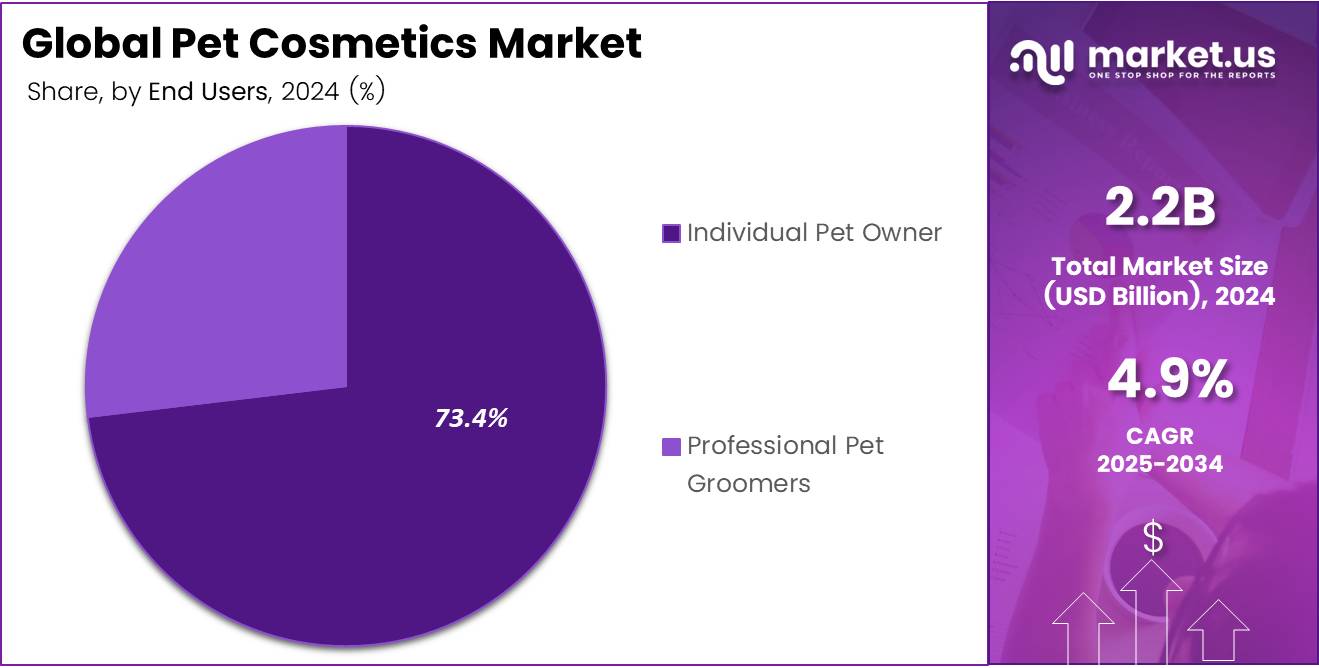

- Individual Pet Owners represented the largest end-user segment with a 73.6% share, highlighting strong consumer spending on premium grooming products.

- Pet Stores accounted for the leading distribution channel with a 39.1% share, supported by expert staff guidance and specialized product offerings.

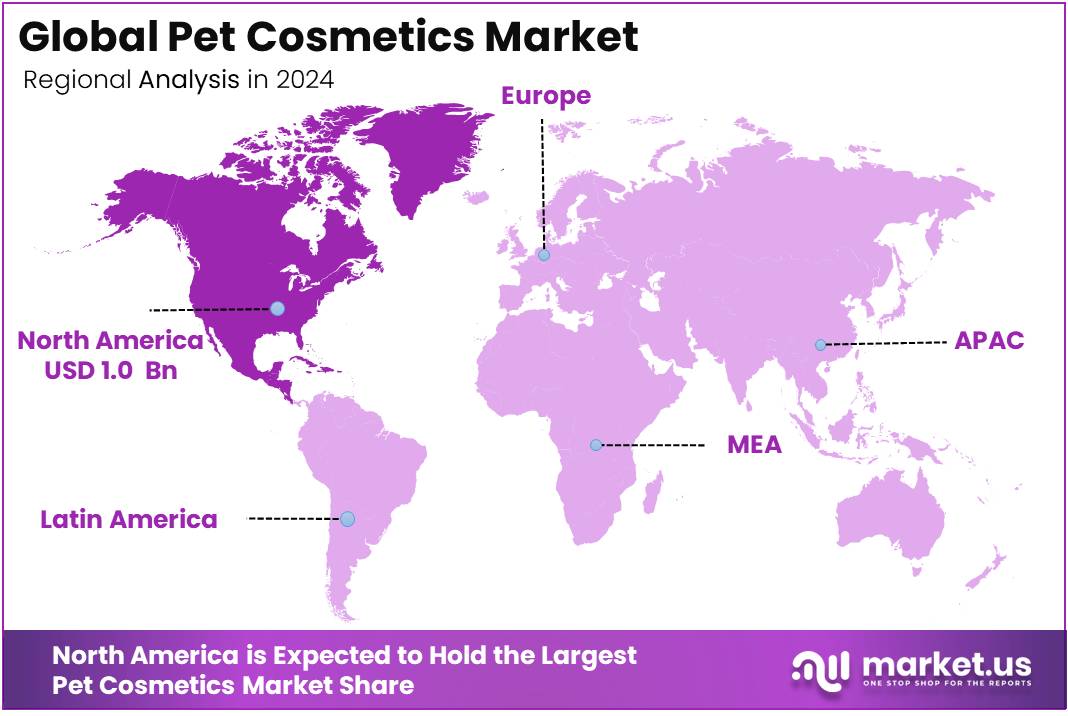

- North America held the dominant regional share of 47.8%, valued at USD 1.0 Billion, supported by pet humanization trends and demand for premium grooming solutions.

Product Type Analysis

Shampoo & Conditioner dominates with 42.7% due to its essential role in pet hygiene and grooming routines.

In 2024, Shampoo & Conditioner held a dominant market position in By Product Type Analysis segment of Pet Cosmetics Market, with a 42.7% share. This commanding market presence reflects the fundamental importance of basic cleansing products in pet care routines. Pet owners consistently prioritize maintaining their animals’ coat health and cleanliness, making shampoo and conditioner essential purchases rather than luxury items.

The secondary segments show more specialized applications. Skin Powder addresses specific dermatological needs, while Perfume caters to pet owners seeking to enhance their pets’ appeal. Eye Care products serve a niche but important health-focused market segment, addressing tear stains and eye hygiene concerns that are particularly relevant for certain breeds.

Lotion and Moisturizing Balm products target pets with specific skin conditions or those living in harsh climates where additional skin protection becomes necessary. The Others category encompasses emerging and specialized products that haven’t yet achieved significant market penetration but represent potential growth areas as pet care continues to evolve and become more sophisticated.

Pet Type Analysis

Dog dominates with 63.8% due to their widespread ownership and extensive grooming requirements.

In 2024, Dog held a dominant market position in By Pet Type Analysis segment of Pet Cosmetics Market, with a 63.8% share. This substantial market dominance reflects several key factors that make dogs the primary consumers of pet cosmetic products. Dogs require regular grooming maintenance, have diverse coat types that need specialized care, and benefit from frequent bathing routines that drive consistent product consumption.

The dog segment’s leadership position is further strengthened by the emotional bond between dog owners and their pets, leading to increased spending on premium grooming products. Many dog breeds have specific grooming needs that require specialized cosmetic solutions, from long-haired breeds needing intensive conditioning treatments to breeds with sensitive skin requiring gentle formulations.

Cat ownership represents a smaller but significant market segment, as cats typically require less frequent bathing and grooming intervention due to their natural self-cleaning behaviors. However, certain cat breeds and specific circumstances still drive demand for feline-specific cosmetic products.

The Others category encompasses various pets including rabbits, guinea pigs, and exotic animals, representing emerging opportunities as pet diversity continues to expand in households worldwide.

End Users Analysis

Individual Pet Owner dominates with 73.6% due to the personal nature of pet care and growing premium product adoption.

In 2024, Individual Pet Owner held a dominant market position in By End Users Analysis segment of Pet Cosmetics Market, with a 73.6% share. This overwhelming market dominance demonstrates the deeply personal relationship between pet owners and their animals’ care routines. Individual pet owners are increasingly treating their pets as family members, leading to higher spending on premium cosmetic products that promise enhanced appearance and health benefits.

The individual consumer segment benefits from emotional purchasing decisions, where pet owners prioritize their animals’ comfort and appearance regardless of cost considerations. This demographic shows strong brand loyalty and willingness to experiment with new products, driving innovation and premium positioning within the market.

Professional Pet Groomers represent a smaller but highly influential market segment. While they account for lower overall volume, professional groomers often influence individual pet owners’ purchasing decisions through product recommendations and demonstrations of effectiveness. These professionals require bulk purchasing options and products that deliver consistent, professional-grade results.

The professional segment also drives demand for specialized products designed for high-volume use, concentrated formulations, and products that address specific breed requirements that individual owners might not encounter regularly in their personal grooming routines.

Distribution Channel Analysis

Pet Stores dominates with 39.1% due to specialized product knowledge and trusted pet care expertise.

In 2024, Pet Stores held a dominant market position in By Distribution Channel Analysis segment of Pet Cosmetics Market, with a 39.1% share. This market leadership position reflects the specialized nature of pet cosmetic products and consumers’ preference for expert guidance when selecting grooming solutions. Pet stores offer knowledgeable staff who can provide breed-specific recommendations and address specific pet care concerns that general retailers cannot match.

The pet store channel benefits from creating a trusted environment where pet owners feel confident making purchasing decisions. These specialized retailers often carry premium brands and niche products that aren’t available through broader distribution channels, making them essential destinations for discerning pet owners seeking high-quality cosmetic solutions.

Supermarket/Hypermarket channels serve the convenience-focused segment, offering basic pet cosmetic products alongside regular shopping trips. This channel appeals to price-conscious consumers and those seeking widely recognized mainstream brands.

Online distribution continues growing rapidly, offering convenience, competitive pricing, and access to specialized products that might not be available locally. The Others category includes veterinary clinics, mobile grooming services, and emerging direct-to-consumer channels that represent evolving market dynamics and changing consumer shopping preferences in the digital age.

Key Market Segments

By Product Type

- Shampoo & Conditioner

- Skin Powder Perfume

- Eye Care Lotion

- Moisturizing Balm

- Others

By Pet Type

- Dog

- Cat

- Others

By End Users

- Individual Pet Owner

- Professional Pet Groomers

By Distribution Channel

- Pet Stores

- Supermarket/Hypermarket

- Online

- Others

Drivers

Rising Humanization of Pets Driving Grooming Demand

Pet owners today are treating their pets as family members, leading to a strong push for premium grooming products. This emotional bond encourages spending on cosmetics such as shampoos, conditioners, and perfumes that not only clean but also enhance a pet’s appearance. Such behavior is a clear driver of demand in the market.

The rise of premium and organic pet care products further supports market growth. Owners are increasingly aware of the risks of chemicals and prefer natural, safe, and eco-friendly options for their pets. This shift toward organic ingredients highlights the changing mindset of consumers, making room for specialized brands to capture loyal buyers.

Urbanization also plays a major role as city households are witnessing higher pet adoption rates. With limited space and busier lifestyles, grooming products become essential to manage hygiene and comfort. This urban trend pushes retailers and manufacturers to expand their product range to suit modern pet owner needs.

E-commerce growth is another critical factor, enabling easy access to a wide range of grooming solutions. Online platforms not only improve convenience but also expose consumers to new brands, subscription models, and exclusive discounts. This digital channel is expected to create continuous growth opportunities for the pet cosmetics market.

Restraints

Limited Awareness About Specialized Pet Cosmetic Benefits

Despite growing interest, many pet owners are still unaware of the benefits of specialized pet cosmetics. Basic grooming practices often overshadow advanced products such as skin powders, moisturizing balms, or eye care solutions. This limited awareness restricts product adoption in several regions and slows down overall market penetration.

Another significant restraint is regulatory control over ingredients used for animal grooming. Authorities impose strict guidelines to ensure safety, which often delays product launches. Companies investing in research and approvals face extended timelines and additional costs, creating barriers for smaller players who struggle to comply with standards.

Distribution challenges in rural and semi-urban areas also hinder growth. Limited retail presence, lack of trained groomers, and weaker supply chains reduce availability of premium pet cosmetics in these regions. As a result, rural pet owners rely on general hygiene products, creating a clear gap in the adoption of specialized grooming solutions.

These restraints collectively underline the hurdles faced by the pet cosmetics market. Addressing awareness, easing regulatory pathways, and strengthening rural distribution channels will be necessary to expand the market reach and tap into untapped customer segments.

Growth Factors

Innovation in Hypoallergenic and Vegan Pet Cosmetic Formulations

The pet cosmetics market is set to grow as brands innovate with hypoallergenic and vegan formulations. Rising cases of skin sensitivities in pets are pushing owners toward safer, chemical-free options. Companies investing in cruelty-free and allergy-safe cosmetics gain a competitive edge and attract a broader customer base.

Subscription-based delivery services also represent a major growth opportunity. Busy pet owners value convenience, and monthly grooming kits delivered at their doorstep simplify purchases. This recurring model ensures brand loyalty while providing predictable revenue streams for manufacturers and retailers.

Region-specific solutions are gaining importance as climate and cultural differences impact pet care needs. For example, moisturizing balms may be popular in colder climates, while anti-flea shampoos see demand in warmer regions. Tailoring products to such requirements allows brands to differentiate themselves and capture niche audiences.

Collaborations between pet spas and cosmetic brands further enhance growth prospects. Grooming centers act as direct touchpoints where owners experience new products firsthand. Partnerships help brands build trust, encourage product trials, and strengthen visibility, making them a key growth lever in this expanding industry.

Emerging Trends

Rising Popularity of Pet-Friendly Spa and Salon Services

Pet-friendly spa and salon services are gaining popularity, creating new opportunities for cosmetics. Owners are investing in treatments such as massages, aromatherapy, and coat styling, which require specialized products. This trend enhances demand for premium cosmetics tailored to luxurious pet care experiences.

Social media has amplified grooming trends as pet owners showcase styled pets online. Platforms like Instagram and TikTok influence purchase decisions, creating viral demand for grooming products. This digital visibility pushes both established and emerging brands to introduce innovative cosmetics aligned with online trends.

Sustainability is also becoming central, with eco-friendly packaging gaining traction. Owners are now aware of the environmental impact of plastic waste and prefer recyclable or biodegradable packaging. Companies that invest in sustainable packaging solutions are better positioned to appeal to conscious consumers.

AI-driven personalization is another emerging factor, offering tailored grooming recommendations. Digital tools assess coat type, allergies, and lifestyle to suggest specific products. This advanced approach not only improves customer satisfaction but also positions brands as innovative leaders in the pet cosmetics industry.

Regional Analysis

North America Dominates the Pet Cosmetics Market with a Market Share of 47.8%, Valued at USD 1.0 Billion

North America held the largest share of the pet cosmetics market, accounting for 47.8% with a valuation of USD 1.0 billion. The strong demand is supported by the rising humanization of pets, high disposable incomes, and advanced retail distribution channels. Additionally, consumers in the US and Canada prioritize premium and organic grooming solutions, driving continued adoption.

Europe Pet Cosmetics Market Trends

Europe demonstrates steady market growth with increasing adoption of natural and eco-friendly pet cosmetics. The region’s consumers are highly conscious of pet welfare and prefer sustainable formulations. Countries such as Germany, France, and the UK have witnessed expanding online and offline distribution channels, reinforcing steady demand for premium pet care products.

Asia Pacific Pet Cosmetics Market Trends

Asia Pacific is emerging as one of the fastest-growing regions due to rising pet adoption rates in urban areas of China, Japan, and India. Changing consumer lifestyles and the growing middle-class population are influencing higher expenditure on grooming and cosmetic products for pets. E-commerce expansion further accelerates access to premium offerings.

Middle East and Africa Pet Cosmetics Market Trends

The Middle East and Africa are gradually expanding with rising awareness of pet wellness and increasing pet ownership in metropolitan areas. Premium grooming products are gaining attention among affluent households, particularly in the Gulf countries. However, overall market penetration remains at an early stage compared to other regions.

Latin America Pet Cosmetics Market Trends

Latin America shows growing potential with expanding pet ownership, particularly in Brazil and Mexico. Increasing consumer awareness of pet hygiene and the influence of western lifestyle trends are fueling demand. However, challenges in distribution and price sensitivity limit rapid growth, though urban markets display rising interest in specialized grooming solutions.

United States Pet Cosmetics Market Trends

The United States remains a key driver within North America, with strong consumer spending on premium pet grooming and cosmetic products. High emphasis on product innovation, coupled with the popularity of subscription-based e-commerce channels, is fueling market expansion. The preference for natural and organic formulations further strengthens growth in the country.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Pet Cosmetics Company Insights

In 2024, the global Pet Cosmetics Market was shaped by the strategies of several leading players, each carving a niche through innovation and tailored offerings. Barklogic maintained a strong foothold by focusing on eco-friendly, plant-based grooming solutions, catering to rising consumer demand for chemical-free pet care products. Its positioning in the premium organic category allowed it to appeal to health-conscious pet owners.

Biocrown Biotechnology capitalized on its expertise in biotechnology-driven formulations to expand into customized grooming and skincare lines for pets. By leveraging scientific innovation, the company strengthened its reputation in high-quality, dermatologically safe cosmetics, particularly in Asia-Pacific markets where pet care spending continues to rise.

Earthwhile Endeavours emphasized sustainable sourcing and ethical product development, aligning with the global trend toward eco-conscious consumerism. Its products, often marketed as cruelty-free and environmentally friendly, gained traction among millennial and Gen Z pet owners who prioritize sustainability when making purchasing decisions.

Floof differentiated itself by combining functionality with lifestyle branding, offering premium grooming products that blend performance with aesthetic appeal. Its modern marketing campaigns and influencer-driven strategies helped the brand attract a loyal base of urban pet owners seeking both quality and style in their cosmetic choices.

Together, these companies demonstrate how innovation, sustainability, biotechnology, and lifestyle positioning shaped competitive advantages in the global Pet Cosmetics Market in 2024, reflecting the industry’s shift toward premiumization and consumer-driven values.

Top Key Players in the Market

- Barklogic

- Biocrown Biotechnology

- Earthwhile Endeavours

- Floof

- General Nutrition Centers

- Himalaya Drug Company

- Innovacyn

- Natural Pet Innovations

- OM Botanical

- Pet ReLeaf

Recent Developments

- In June 2024, MyMicrobiome introduced the world’s first Microbiome-Friendly Certification Standard for pet cosmetics, setting a benchmark for safe formulations. This initiative is expected to strengthen transparency and consumer trust in microbiome-safe grooming products for pets.

- In August 2024, Dolce & Gabbana launched a premium $100 perfume for dogs, expanding luxury pet care into the fragrance category. This move highlights the growing demand for high-end pet cosmetics and the increasing humanization of pets as lifestyle companions.

Report Scope

Report Features Description Market Value (2024) USD 2.2 Billion Forecast Revenue (2034) USD 3.5 Billion CAGR (2025-2034) 4.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Shampoo & Conditioner, Skin Powder Perfume, Eye Care Lotion, Moisturizing Balm, Others), By Pet Type (Dog, Cat, Others), By End Users (Individual Pet Owner, Professional Pet Groomers), By Distribution Channel (Pet Stores, Supermarket/Hypermarket, Online, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Barklogic, Biocrown Biotechnology, Earthwhile Endeavours, Floof, General Nutrition Centers, Himalaya Drug Company, Innovacyn, Natural Pet Innovations, OM Botanical, Pet ReLeaf Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Barklogic

- Biocrown Biotechnology

- Earthwhile Endeavours

- Floof

- General Nutrition Centers

- Himalaya Drug Company

- Innovacyn

- Natural Pet Innovations

- OM Botanical

- Pet ReLeaf