Global Pesticides Market Size, Share, And Business Benefits By Target (Fungicides, Herbicides, Insecticides, Others), By Type (Chemical Pesticides, Bio-pesticides, Bio chemical Pesticide, Microbial Pesticides, Plant Incorporated Protectants, Others), By Formulation (Liquid, Dry), By Crop Type (Cereals and Grains, Vegetables and Fruits, Oilseeds and Pulses, Commercial Crops, Plantation Crops, Turfs and Ornamentals, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155155

- Number of Pages: 231

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

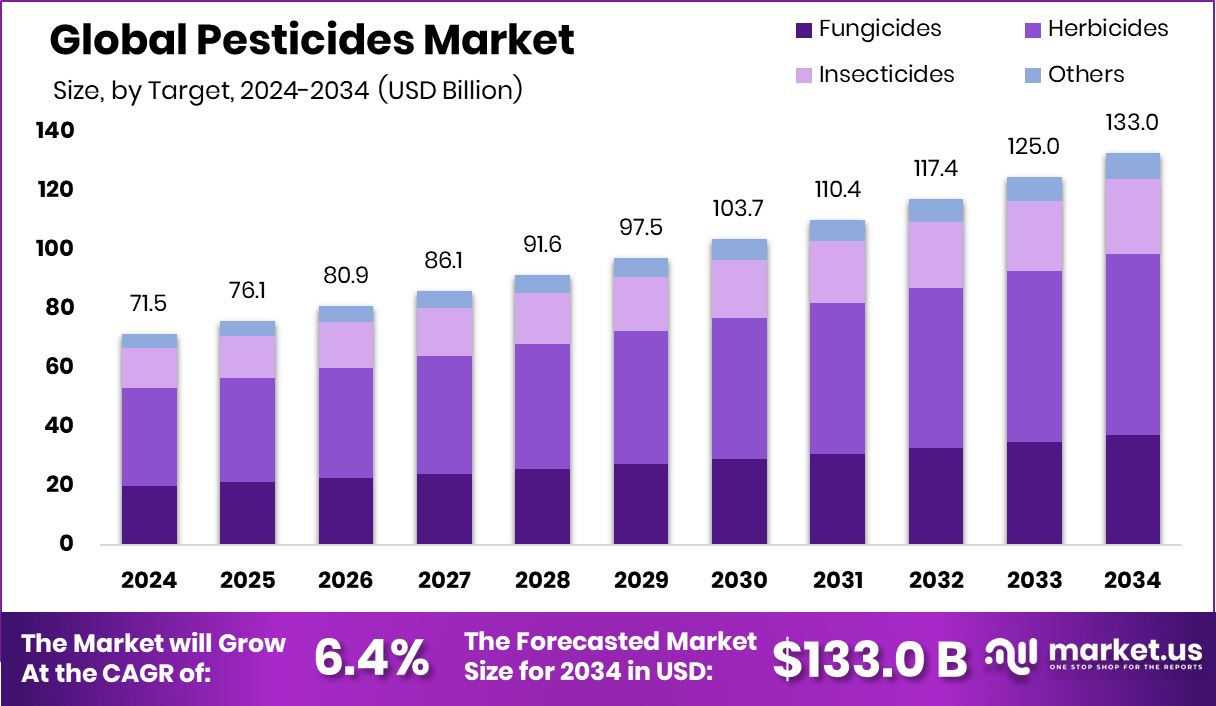

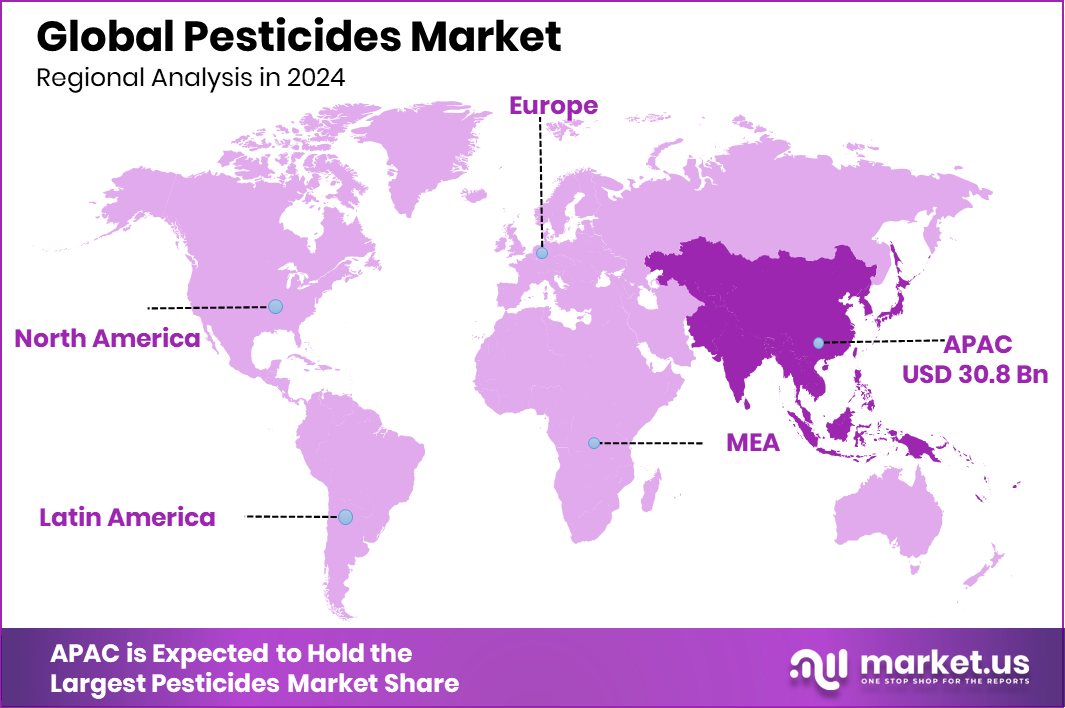

The Global Pesticides Market is expected to be worth around USD 133.0 billion by 2034, up from USD 71.5 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034. Favorable climate and large farming areas sustained Asia-Pacific’s 43.2% dominance in the pesticides market.

Pesticides are chemical or biological agents used to prevent, destroy, or control pests that can harm crops, livestock, or human health. They include insecticides, herbicides, fungicides, and rodenticides, each targeting specific pests. By protecting agricultural yields from insects, weeds, and diseases, pesticides play a vital role in ensuring food security, reducing crop losses, and improving the quality of agricultural produce. They are also used in public health programs to control disease-carrying organisms like mosquitoes. CABI is contributing US$37 million to the FARM programme, aimed at reducing pesticides and plastics in agriculture.

The pesticides market refers to the global industry involved in the production, distribution, and sale of these pest-control agents. It encompasses a wide range of products catering to agriculture, horticulture, forestry, and public health sectors. This market is shaped by factors such as technological advancements in formulations, environmental regulations, and changing agricultural practices.

BiocSol has secured €5.2 million in seed funding to advance microbial pesticide development. India’s Agrim has raised $17.3 million to improve farmers’ access to inputs like seeds and pesticides. BioPrime has obtained $6 million to create a new range of bio-fungicides and bio-insecticides.

Rising global population and the need for higher crop productivity drive pesticide demand. Farmers are adopting advanced crop protection solutions to maximize yields and minimize losses caused by pests and diseases. Growing food consumption, coupled with the expansion of commercial farming, has boosted the usage of pesticides, especially in developing regions with increasing agricultural output.

The University of Exeter has launched a global research network with £1.7 million in funding for antifungal resistance innovations. A Michigan State University-led research team has received a $500,000 grant to tackle herbicide-resistant weeds in soybeans. UK agritech firm RootWave has raised $15 million to develop herbicide alternatives. ADM has led a $10.5 million funding round for Harpe Bioherbicide Solutions.

Key Takeaways

- The Global Pesticides Market is expected to be worth around USD 133.0 billion by 2034, up from USD 71.5 billion in 2024, and is projected to grow at a CAGR of 6.4% from 2025 to 2034.

- Herbicides dominate the pesticides market with 46.3%, driven by rising weed control needs in modern farming.

- Chemical pesticides hold an 81.7% share, reflecting their wide application and effectiveness in large-scale agricultural production.

- Liquid formulations lead the market at 56.9%, offering ease of application and better crop coverage efficiency.

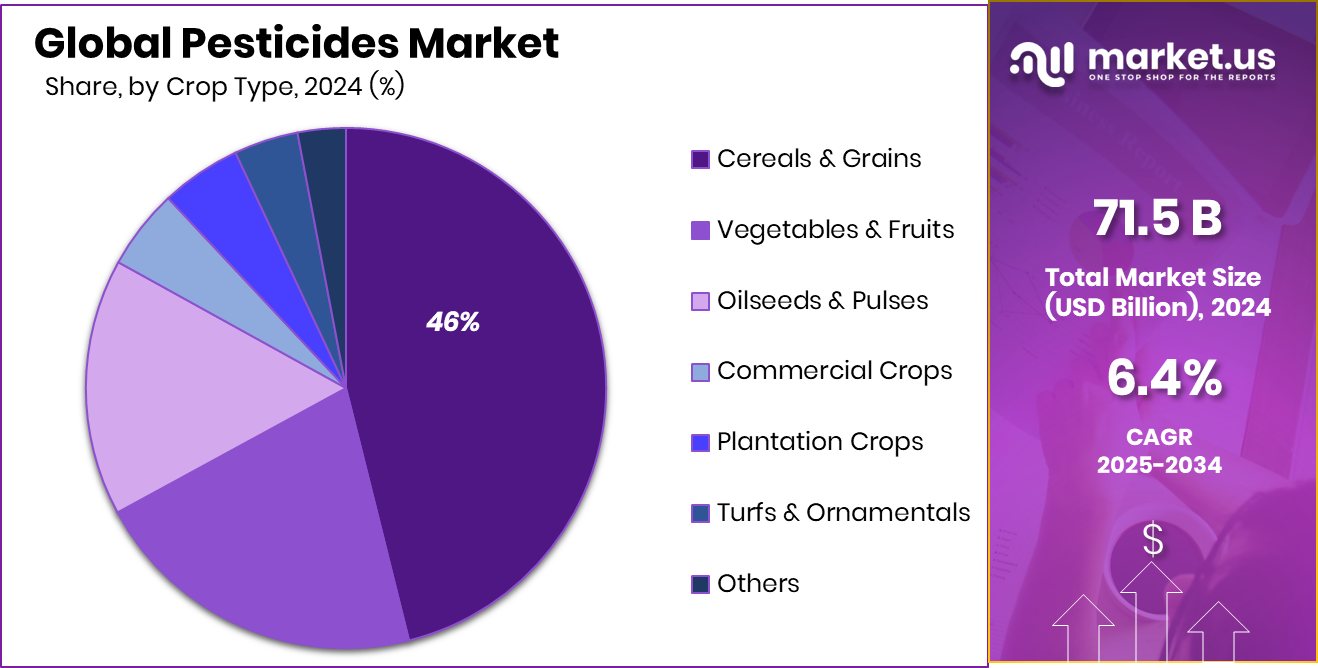

- Cereals and grains account for 46.2% usage, highlighting their priority in global food security and crop protection.

- Strong agricultural activities and rising food demand boosted the Asia-Pacific’s USD 30.8 Bn. pesticides market share and value.

By Target Analysis

Herbicides lead the pesticides market with a strong 46.3% share.

In 2024, herbicides held a dominant market position in the By Target segment of the pesticides market, with a 46.3% share. This strong presence reflects the increasing need to control unwanted weeds that compete with crops for nutrients, water, and sunlight, ultimately impacting yields. Herbicides are widely preferred due to their ability to provide efficient, targeted weed control with less manual labor compared to traditional methods. Their adoption has been further supported by the expansion of large-scale farming, where effective weed management is critical for maximizing productivity.

The demand for herbicides has grown in both developed and developing regions, driven by the rising cultivation of cereals, oilseeds, and commercial crops. In addition, advancements in selective herbicide formulations have made it possible to target specific weed species without harming the main crop, enhancing efficiency and reducing costs for farmers. Climate change and unpredictable weather patterns have also contributed to weed proliferation, further boosting the reliance on herbicide-based solutions.

Moreover, ongoing innovations in low-toxicity and environment-friendly herbicides align with stricter agricultural regulations, enabling broader market acceptance. With continuous research and development in application technologies, herbicides are expected to maintain their leading role in the pesticides market over the coming years.

By Type Analysis

Chemical pesticides dominate globally, capturing an impressive 81.7% market share.

In 2024, Chemical Pesticides held a dominant market position in the By Type segment of the Pesticides Market, with an 81.7% share. This dominance is attributed to their widespread use in modern agriculture for controlling a broad spectrum of pests, including insects, weeds, and fungi. Chemical pesticides are valued for their quick action, high efficiency, and ability to deliver consistent results across various crop types and climatic conditions. Their availability in diverse formulations—such as liquids, powders, and granules—has further supported their adoption in both large-scale commercial farming and smallholder agriculture.

The growth of chemical pesticides is also driven by rising global food demand and the need to increase crop productivity within limited arable land. These products help farmers reduce yield losses significantly, making them an essential part of integrated crop protection programs. Additionally, advancements in active ingredients and improved application technologies have enhanced their precision, reducing wastage and minimizing environmental impact compared to older formulations.

Despite increasing awareness about sustainable practices, chemical pesticides remain the preferred choice due to their proven track record and cost-effectiveness. With continuous innovations focusing on safety, efficiency, and regulatory compliance, their strong market presence is expected to persist in the foreseeable future.

By Formulation Analysis

Liquid formulations are most preferred, holding 56.9% of the total market.

In 2024, Liquid held a dominant market position in the By Formulation segment of the Pesticides Market, with a 56.9% share. This leadership is driven by the high efficiency, ease of application, and uniform coverage that liquid formulations provide compared to other forms. Liquid pesticides can be easily diluted, sprayed, and absorbed, ensuring better penetration and contact with target pests, which enhances their effectiveness. Their adaptability for use with modern spraying equipment also makes them a preferred choice for large-scale agricultural operations.

The popularity of liquid formulations is further supported by their suitability across a wide variety of crops, including cereals, fruits, vegetables, and commercial plantations. They offer flexibility in both pre-emergence and post-emergence applications, enabling precise pest control at different crop growth stages. Moreover, liquid formulations reduce dust-related handling issues, making them safer and more convenient for farmers.

Growing mechanization in agriculture, especially in emerging economies, has increased the adoption of liquid pesticides due to their compatibility with automated spraying systems. Additionally, ongoing advancements in suspension concentrates, emulsifiable concentrates, and microemulsions are enhancing product stability and performance. With their proven effectiveness, convenience, and adaptability, liquid pesticides are expected to maintain a leading share in the market in the years ahead.

By Crop Type Analysis

Cereals and grains account for 46.2% of pesticide usage.

In 2024, Cereals and Grains held a dominant market position in the By Crop Type segment of the Pesticides Market, with a 46.2% share. This dominance is largely due to the high global demand for staple crops such as wheat, rice, maize, and barley, which form the backbone of food security in many regions. Protecting these crops from pests, weeds, and diseases is critical, as even minor infestations can result in significant yield losses and threaten supply stability.

The large cultivation area dedicated to cereals and grains globally amplifies the need for efficient pest control solutions. Farmers rely heavily on pesticides to protect against a range of threats, including insect infestations, fungal diseases, and aggressive weed growth, especially under changing climate conditions that favor pest proliferation. Modern pesticide formulations and precision application methods have further enhanced productivity while optimizing resource use.

Additionally, the growing commercialization of agriculture and rising exports of cereals have increased the focus on quality standards, further driving pesticide use in this segment. With their essential role in meeting food demand, cereals and grains are expected to continue leading pesticide consumption in the coming years.

Key Market Segments

By Target

- Fungicides

- Herbicides

- Insecticides

- Others

By Type

- Chemical Pesticides

- Bio-pesticides

- Bio chemical Pesticide

- Microbial Pesticides

- Plant Incorporated Protectants

- Others

By Formulation

- Liquid

- Dry

By Crop Type

- Cereals and Grains

- Vegetables and Fruits

- Oilseeds and Pulses

- Commercial Crops

- Plantation Crops

- Turfs and Ornamentals

- Others

Driving Factors

Rising Global Food Demand Boosting Pesticide Usage

One of the biggest driving factors for the pesticides market is the rising global demand for food. As the world population continues to grow, farmers are under increasing pressure to produce higher yields from limited farmland. Pesticides help protect crops from insects, weeds, and diseases, which can otherwise cause major losses.

By ensuring healthier and more abundant harvests, pesticides play a key role in meeting the food needs of millions of people. This is especially important in countries where agriculture is a main source of livelihood. With climate change making crops more vulnerable to pests, the use of effective pest control solutions has become even more essential, making this factor a strong force in market growth.

Restraining Factors

Environmental and Health Concerns Limiting Pesticide Adoption

A major restraining factor for the pesticides market is the growing concern about their impact on the environment and human health. Excessive or improper use of chemical pesticides can lead to soil degradation, water contamination, and harm to beneficial insects like bees. There are also rising worries about pesticide residues on food and their potential long-term health effects.

These concerns have led to stricter government regulations, limiting the availability and use of certain pesticides. Farmers are increasingly being encouraged to adopt safer, eco-friendly alternatives, which can sometimes be costlier or less effective. Public awareness about sustainable farming is also influencing buying decisions, reducing reliance on traditional chemical pesticides, and posing a challenge to market expansion.

Growth Opportunity

Rising Demand for Bio-Based and Eco-Friendly Pesticides

A key growth opportunity in the pesticides market lies in the rising demand for bio-based and eco-friendly products. With stricter environmental regulations and increasing awareness about sustainability, farmers and agricultural companies are looking for pest control solutions that are safe for the environment and human health. Bio-based pesticides, made from natural sources like plant extracts, beneficial microbes, and minerals, offer an effective alternative to synthetic chemicals.

These products not only reduce harmful residues but also support soil health and biodiversity. Growing consumer preference for organic food further fuels this shift. As research and innovation in bio-pesticide formulations advance, companies have significant opportunities to expand their product portfolios and meet the increasing global demand for safer crop protection solutions.

Latest Trends

Adoption of Precision Agriculture Enhancing Pesticide Efficiency

One of the latest trends in the pesticides market is the growing adoption of precision agriculture technologies. Farmers are increasingly using GPS-guided equipment, drones, and smart sensors to apply pesticides more accurately and efficiently. This approach ensures that pesticides are sprayed only where needed and in the right amounts, reducing waste and minimizing environmental impact. Precision agriculture not only lowers costs for farmers but also improves crop health by avoiding overuse or underuse of chemicals.

With rising concerns about sustainability and stricter regulations, this trend is gaining strong momentum worldwide. As technology becomes more affordable and accessible, precision pesticide application is expected to become a standard practice, driving efficiency and supporting long-term agricultural productivity.

Regional Analysis

In 2024, the Asia-Pacific led the pesticides market with 43.2%, reaching USD 30.8 Bn.

In 2024, Asia-Pacific emerged as the dominant region in the global pesticides market, capturing a significant 43.2% share valued at USD 30.8 billion. The region’s leadership is primarily driven by its vast agricultural base, favorable climatic conditions, and high dependency on crop protection chemicals to safeguard yields. Countries such as China, India, and Japan have been at the forefront of pesticide consumption, supported by expanding cultivation areas for cereals, grains, fruits, and vegetables.

Rapid population growth, coupled with rising food demand, has further fueled the adoption of pesticides to maximize productivity and meet quality standards for both domestic consumption and export markets. In contrast, North America and Europe have shown steady growth, driven by advanced farming practices and increasing adoption of eco-friendly formulations, while the Middle East & Africa and Latin America are witnessing gradual expansion due to agricultural modernization.

Additionally, the Asia-Pacific market benefits from continuous innovation in pesticide formulations and the integration of precision agriculture technologies, enabling more efficient pest control. With strong government support for agricultural productivity and growing awareness of pest management solutions, the Asia-Pacific is expected to maintain its leading position in the global pesticides market over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Dow Inc. continues to focus on advanced chemical formulations that deliver high efficacy against a wide range of pests while aligning with evolving environmental regulations. Their emphasis on innovation supports sustainable farming practices and enhances crop productivity.

Adama Agricultural Solutions Ltd. is recognized for its diverse portfolio and farmer-centric approach, offering tailored solutions for various crops and climatic conditions. The company’s adaptability and product accessibility have strengthened its presence in both developed and emerging markets.

Syngenta AG maintains a strong position through its integrated crop protection strategies, combining chemical and biological solutions. Its investments in research and development aim to deliver products that balance performance with environmental stewardship, meeting the growing demand for safe and efficient pesticides.

Corteva Agriscience leverages its extensive agricultural expertise and innovative pipeline to provide targeted pest management solutions. The company’s focus on advanced formulations and precision application methods enhances pest control efficiency while reducing environmental impact.

Top Key Players in the Market

- Dow Inc.

- Adama Agricultural Solutions Ltd.

- Syngenta AG

- Corteva Agriscience

- BASF SE

- bioworks inc.

- Bayer Cropscience

- Certis USA L.L.C.

- FMC Corporation

- Aegis Sciences Corporation

Recent Developments

- In May 2025, Dow sold its Telone™ soil fumigation business—used in agricultural pest control—to TriCal Soil Solutions. The sale was for US$121 million and aligns with Dow’s strategy to focus on core, higher-value markets.

- In June 2024, ADAMA marked progress in its Brazilian active ingredient facility at Taquari (RS). The new fungicides coming out of there now use more eco‑friendly production and formulation methods—biodegradable or renewable materials make up 30% to 80% of the products.

Report Scope

Report Features Description Market Value (2024) USD 71.5 Billion Forecast Revenue (2034) USD 133.0 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Target (Fungicides, Herbicides, Insecticides, Others), By Type (Chemical Pesticides, Bio-pesticides, Bio chemical Pesticide, Microbial Pesticides, Plant Incorporated Protectants, Others), By Formulation (Liquid, Dry), By Crop Type (Cereals and Grains, Vegetables and Fruits, Oilseeds and Pulses, Commercial Crops, Plantation Crops, Turfs and Ornamentals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Dow Inc., Adama Agricultural Solutions Ltd., Syngenta AG, Corteva Agriscience, BASF SE, bioworks inc., Bayer Cropscience, Certis USA L.L.C., FMC Corporation, Aegis Sciences Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dow Inc.

- Adama Agricultural Solutions Ltd.

- Syngenta AG

- Corteva Agriscience

- BASF SE

- bioworks inc.

- Bayer Cropscience

- Certis USA L.L.C.

- FMC Corporation

- Aegis Sciences Corporation