Global Pesticide Spraying Drone Market Size, Share, Growth Analysis By Type (Fixed-Wing Drones, Multi-Rotor Drones), By Application (Crop Farming, Forestry, Pasture & Grassland, Others), By Farm Size (Small & Medium Farms, Large Farms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 164952

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

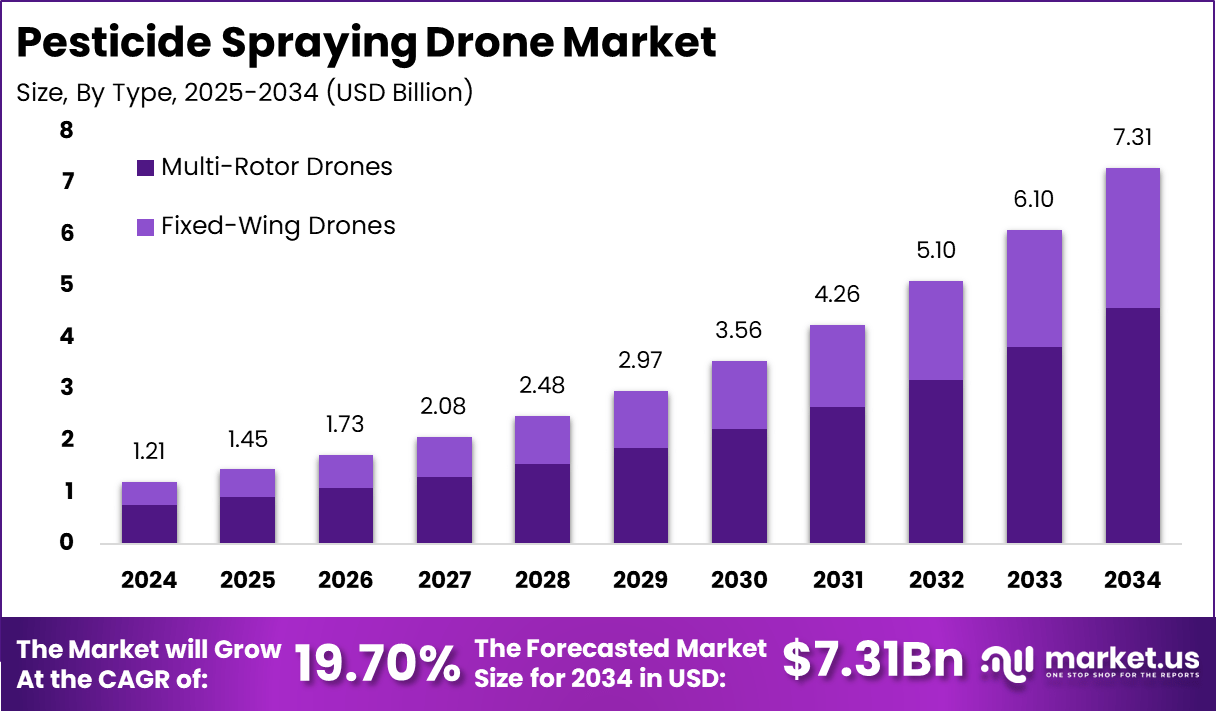

The global Pesticide Spraying Drone Market was valued at USD 1.21 billion in 2024 and is projected to reach USD 7.31 billion by 2034, expanding at a robust CAGR of 19.7% during the forecast period. The market growth is primarily driven by the increasing adoption of precision agriculture and the need for efficient pesticide application in large farmlands.

Pesticide-spraying drones are helping farmers reduce manual labor, minimize pesticide wastage, and achieve uniform crop coverage. Their ability to operate in difficult terrains and perform tasks with high precision is boosting their popularity, especially in regions with a limited agricultural workforce. Furthermore, growing environmental concerns and the demand for sustainable farming practices are encouraging the use of drones equipped with advanced sensors and AI-based spraying systems to ensure optimal chemical usage.

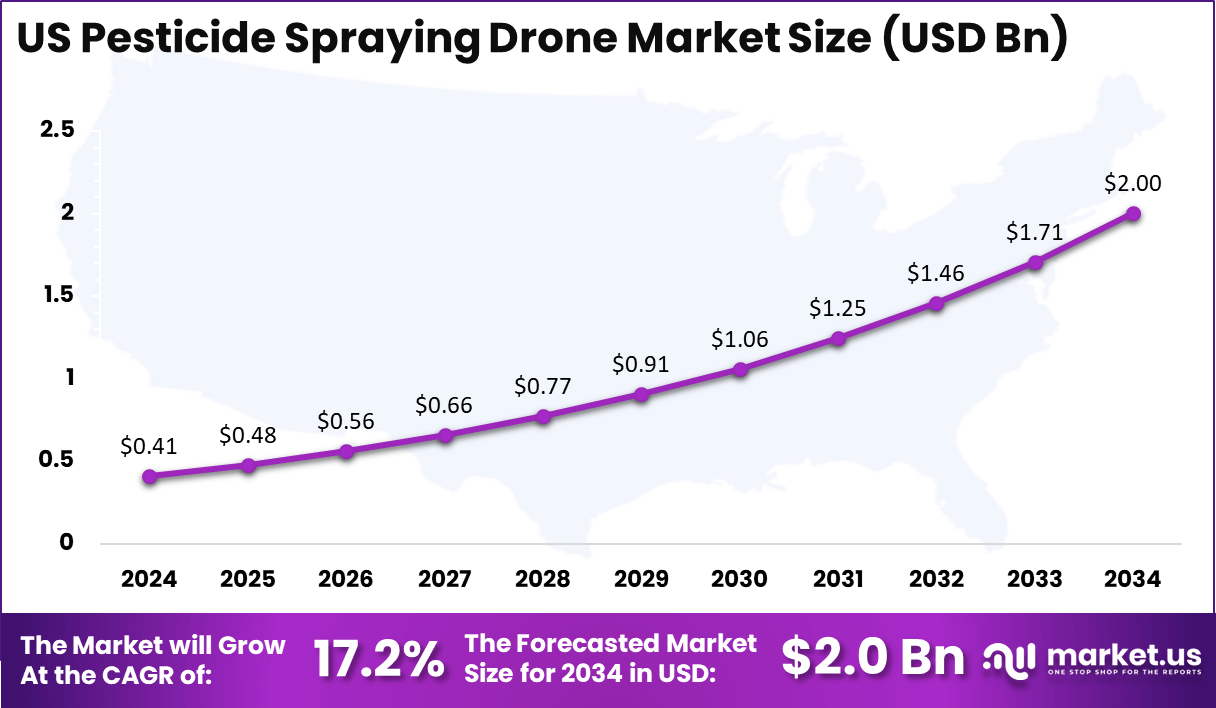

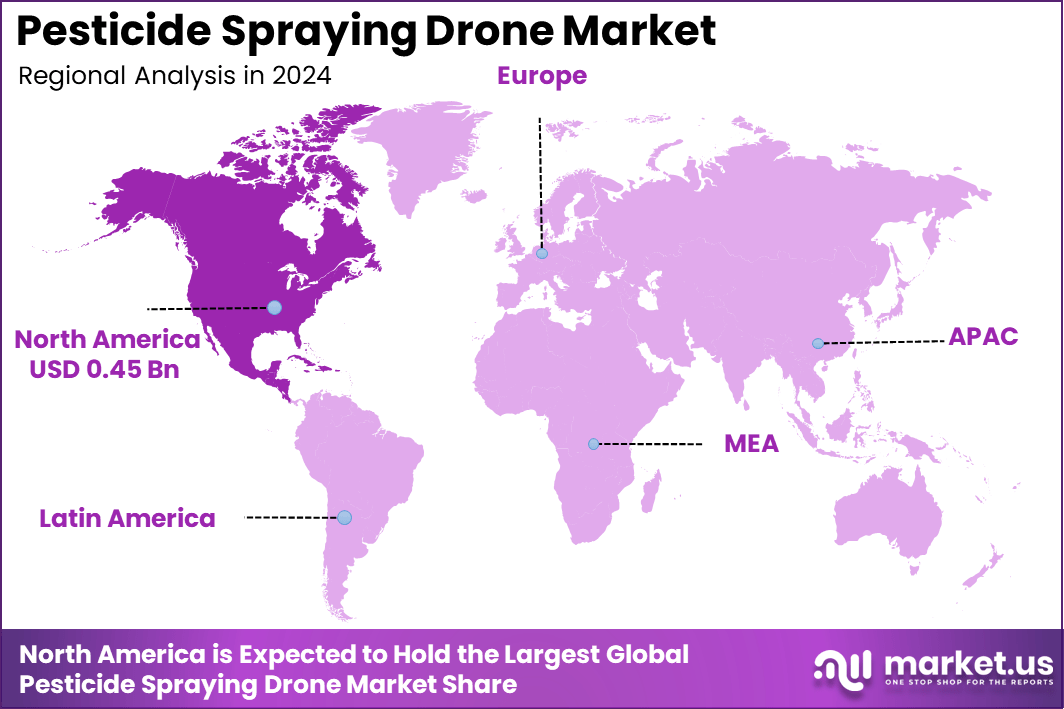

North America dominated the global market with a 38% share, accounting for USD 0.45 billion in 2024. The region’s growth is supported by rapid technological integration, favorable government initiatives, and the increasing trend of smart and digital farming. The US, valued at USD 0.41 billion in 2024, remains a key contributor, expected to grow at a CAGR of 17.2% through 2034, reflecting growth to USD 2.0 billion. The adoption of autonomous drones and AI-enabled crop monitoring solutions continues to drive market expansion across major agricultural states.

The pesticide spraying drone market is witnessing rapid transformation as agriculture increasingly embraces automation and precision technologies. These drones are revolutionizing pest management by offering farmers efficient, accurate, and cost-effective solutions for crop protection. They enable uniform pesticide application across large and complex terrains, reducing human exposure to harmful chemicals while optimizing chemical use.

Their integration with GPS navigation, multispectral imaging, and AI-based control systems allows for targeted spraying and real-time crop health monitoring. Growing awareness about sustainable farming practices, coupled with the global push to enhance crop yield and minimize resource wastage, is accelerating the demand for pesticide-spraying drones across both developed and developing agricultural economies.

In recent years, technological advancements and government support for smart farming have further boosted market adoption. Farmers are increasingly shifting toward automated spraying systems to overcome labor shortages and meet the growing global food demand. Countries with strong agricultural infrastructure are investing in drone-based solutions for improved farm productivity and environmental safety.

Moreover, the trend of data-driven farming—where drones gather precise field analytics for decision-making—is shaping the next phase of agricultural innovation. As a result, pesticide-spraying drones are becoming an integral part of modern agriculture, promoting efficiency, safety, and sustainability in crop management.

Recent developments in the pesticide spraying drone market have included several impactful acquisitions, product launches, and technological advancements with clear numerical significance. In late 2024, a key player in AI drone solutions acquired a SaaS-based compliance company for $15 million, enabling smarter agricultural drone management.

By September 2025, innovative drones featuring multi-nozzle systems capable of spraying up to 20 liters per flight were introduced, improving spray precision and reducing chemical use by up to 40%. These drones can cover over 50 acres per day, a 25% efficiency gain over earlier models.

Regionally, a major agricultural drone company expanded into Southeast Asia through a $12 million acquisition of a drone spraying startup, augmenting local market presence. Demonstration projects in India indicated a potential 30% reduction in pesticide costs and 90% water savings per hectare thanks to drone spraying technology. The global drone spraying services market was valued at approximately $266.5 million in 2024, with forecasts projecting a compound annual growth rate (CAGR) of 24.7% through 2034, which suggests the market could exceed $2 billion by that year.

Key Takeaways

- The global market for pesticide spraying drones is growing rapidly, driven by the adoption of precision agriculture and automation technologies.

- The market was valued at USD 1.21 billion in 2024 and is projected to reach USD 7.31 billion by 2034, expanding at a CAGR of 19.7%.

- North America accounted for 38% of the global market in 2024, representing a regional size of USD 0.45 billion.

- The US held the dominant share within North America with USD 0.41 billion in 2024 and is projected to reach USD 2.0 billion by 2034, growing at a CAGR of 17.2%.

- Based on type, multi-rotor drones led the market with a 62.6% share in 2024, owing to their superior maneuverability and efficiency in uneven terrains.

- By application, crop farming emerged as the largest segment, contributing 49.8% share due to the high need for targeted pesticide spraying in large-scale agricultural fields.

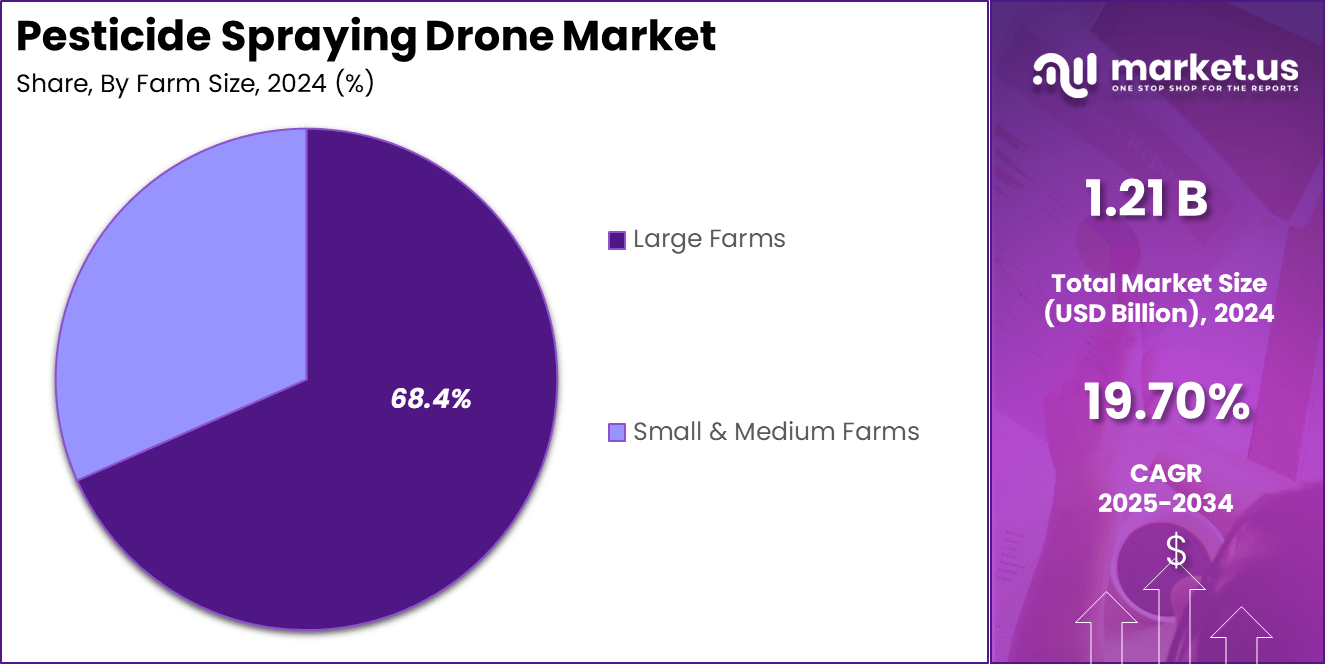

- By farm size, large farms dominated the market with a 68.4% share, reflecting the increasing use of drone-based automation in extensive agricultural operations.

- Technological advancements in AI, GPS, and sensor integration continue to enhance drone performance and fuel market expansion globally.

Role Of Agri-Tech

The role of agri-tech in advancing the pesticide-spraying drone segment is increasingly critical. Integration of unmanned aerial vehicles and related technologies into farming operations is enabling higher efficiency, targeted chemical application, and improved resource-use performance. Drones equipped with multispectral sensors and AI analytics are delivering real-time crop-health diagnostics, enabling, detection of nutrient deficiencies, pests, and disease early in the cycle.

With feeding a global population projected to reach nearly 9.7 billion by 2050, agriculture must increase output by approximately 70 % — agri-tech offers one of the pathways to reach that scale while lowering input waste. Specifically, agri-tech facilitates variable-rate pesticide application in drone systems, meaning chemicals are applied only where needed, reducing volume and cost.

Data platforms integrating IoT sensors, satellite imagery, and drone imagery are reducing farm-data engineering time by up to 80%, enabling faster decision-making by growers. In the context of pesticide-spraying drones, this means that large-scale farms can adopt those systems much more efficiently, improving coverage, lowering labour intensity, and enhancing environmental performance.

The role of agri-tech in the pesticide-spraying drone market is increasingly central and transformative. Drones equipped with multispectral sensors, GPS navigation, and AI-driven control systems enable precise mapping of crop health, target-specific pesticide application, and significantly reduce over-spraying and human exposure to chemicals.

These technologies are projected to contribute to the broader drone-enabled agriculture market, which is expected to grow at a compound annual growth rate of 18.5% from 2024 onwards, reaching USD 23.78 billion by 2032. Agri-tech adoption is still in early stages: one estimate indicates only about 15% of farmers have deployed precision-agriculture hardware such as drones, and some of the more advanced automation and robotics categories sit at around 5% adoption.

Government incentives are playing a key role in this push — in India, for instance, financial assistance of up to 40% (up to USD 4,800) is offered for purchasing drones through custom-hiring centres under farmer cooperatives. Overall, agri-tech in this context is projected to enhance operational efficiency, support sustainability, and respond to labour shortages and environmental pressures, thereby positioning spraying drones as a critical component of modern precision agriculture.

Industry Adoption

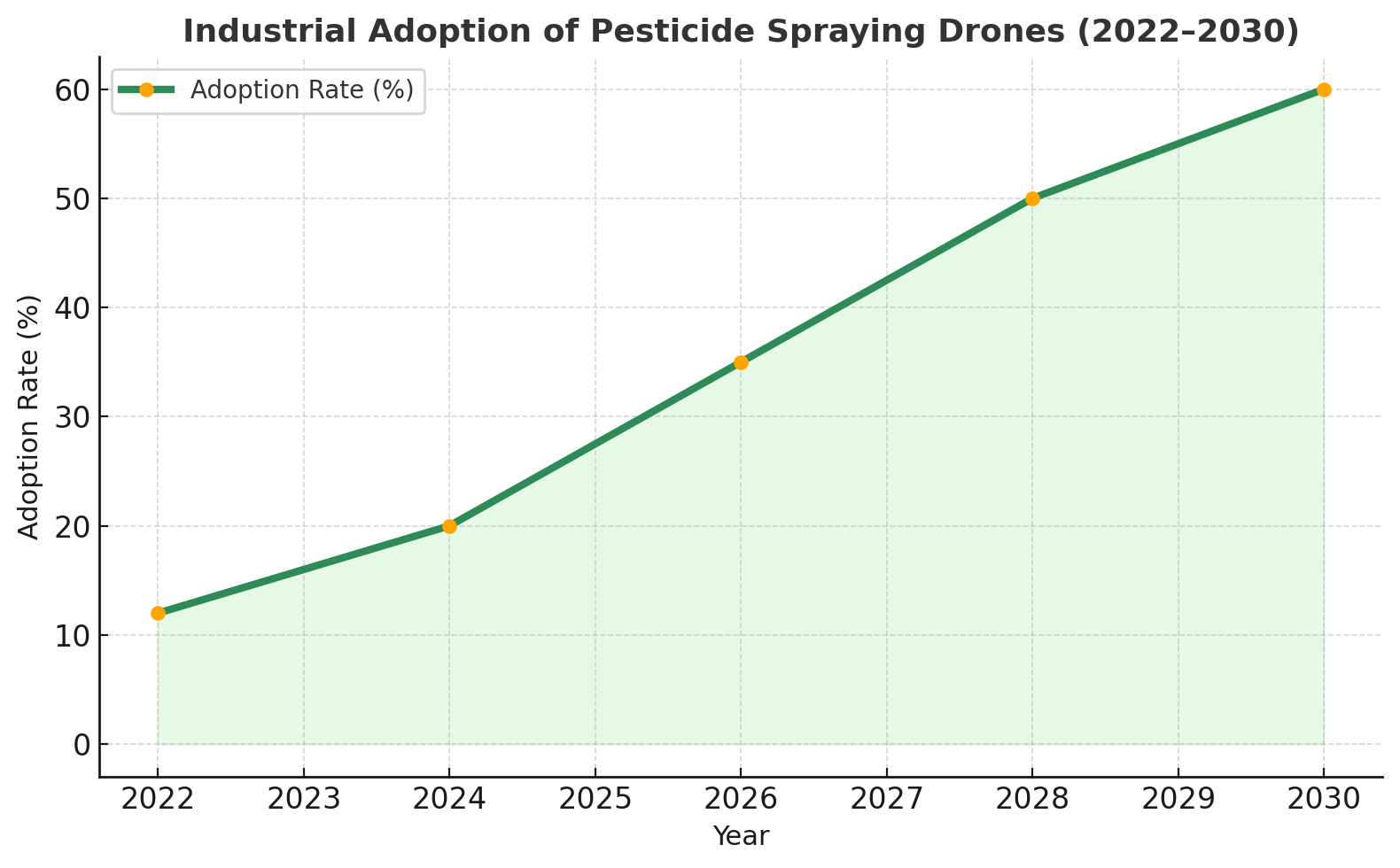

Industry adoption of pesticide-spraying drones has progressed significantly across global agriculture. According to data from DJI, approximately 400,000 agricultural drones were operational worldwide by the end of 2024, marking an increase of 33 % compared with 2023 and 90 % compared with 2020. These drones were used to treat over 500 million hectares of farmland across more than 100 countries.

In the US, survey data from the United States Department of Agriculture (USDA) indicate that only around 12 % of large-scale crop-producing family farms and 13 % of non-family farms report using drone technology for crop operations, highlighting the early stage of adoption in certain markets. Adoption has been more rapid in regions such as China, where, by 2021, over 120,000 crop-protection drones were in use, covering more than 175.5 million acres of agricultural land.

The economic rationale is becoming clearer for growers: implementing UAV-based crop management solutions is reported to deliver 15 % to 20 % returns within the first two years through savings on inputs and improved yield performance. These figures underscore how industry adoption is accelerating, though penetration remains uneven across geographies and farm sizes, with larger farms leading uptake.

Despite rapid progress, widespread adoption of pesticide-spraying drones still faces challenges related to regulatory frameworks, training, and upfront investment costs. However, with continuous improvements in battery capacity, payload efficiency, and AI-based automation, global adoption is expected to exceed 60% of commercial farms by 2030, marking a major leap toward data-driven precision agriculture.

Analysts’ Viewpoint

Industry analysts view the pesticide spraying drone market as poised for robust expansion, with many predicting double-digit growth driven by advances in automation and smart agriculture. One forecast indicates that the broader agricultural drone market, of which spraying is a major segment, is expected to grow at a CAGR of around 21.5% from 2024 to 2032.

Analysts highlight that the operational benefits of drone-enabled spraying—such as reduced labour, better coverage of large or difficult terrain, and more precise chemical dosing—are compelling value propositions for large farms. A study found that drone applications reduced pesticide operator exposure significantly compared with handheld methods.

Analysts caution, however, that meaningful uptake depends on overcoming barriers including high upfront costs, limited training, and regulatory uncertainty. According to industry sources, these obstacles are especially pertinent for small- and medium-scale farms in developing regions.

According to these views, as drone hardware costs decline and service models (e.g., contract spraying) mature, market adoption is expected to accelerate. Analysts note that the current relatively low base penetration means there is a large incremental growth opportunity ahead.

Emerging Trends

Emerging trends in the pesticide-spraying drone market highlight how rapidly innovation is reshaping agricultural operations and offering new value to growers. Integration of AI and multispectral sensors is enabling drones to perform targeted spraying with up to 30% less chemical use compared with conventional methods. Drones are increasingly being used for more than simple coverage—features like real-time crop-health monitoring and autonomous flight path planning are enabling precision operations across both large and fragmented farms.

Another trend is the rise of service-based models: farmers are shifting to drone-as-a-service options rather than outright ownership, lowering entry barriers and enabling adoption on smaller farms. Regulatory evolution is also significant, with some regions approving drone spraying of low-risk pesticides and biocontrol agents, broadening operational contexts.

Battery and payload improvements are expanding operational scope—for example, newer drones now carry larger tanks and fly longer, enabling coverage of larger acreages in less time. Together, these trends are expected to reduce cost-per-acre and improve ROI for growers, thereby accelerating adoption and positioning drone spraying as a core component of modern precision agriculture.

US Market Size

The US pesticide spraying drone market is experiencing rapid growth, driven by increasing adoption of precision agriculture technologies and growing emphasis on sustainable crop management. Valued at USD 0.41 billion in 2024, the market is projected to reach USD 2.0 billion by 2034, expanding at a CAGR of 17.2% during the forecast period.

This expansion is supported by technological advancements in AI-driven navigation, GPS mapping, and sensor-based spraying systems that enable accurate and efficient pesticide application. The country’s well-established agricultural infrastructure, combined with a strong focus on automation and digitalization, is accelerating the use of drones across large commercial farms.

Government initiatives promoting smart farming and labor shortages in rural areas are further encouraging the integration of drones for pesticide application. The ability of these drones to reduce operational costs, minimize chemical wastage, and enhance safety for farm workers is fostering strong adoption among growers of crops such as corn, soybeans, and cotton.

Leading drone manufacturers and agri-tech startups in the US are investing in high-capacity drones and cloud-based farm management software to improve efficiency. As awareness about precision farming grows, the US market is expected to remain one of the most significant contributors to global pesticide spraying drone adoption.

By Type

In the “By Type” category, multi-rotor drones dominated the pesticide spraying drone market with a 62.6% share in 2024. These drones are widely preferred due to their superior maneuverability, vertical take-off and landing capabilities, and ability to hover steadily over crops for precise pesticide application. Their design allows them to navigate small or irregularly shaped fields, making them ideal for farms with varying terrain and dense vegetation.

Multi-rotor drones are equipped with GPS-guided flight control systems and AI-enabled sensors that ensure uniform spraying, minimize pesticide wastage, and reduce labor dependency. Their ease of operation, lower maintenance costs, and ability to perform targeted spraying make them the most practical choice for medium to large-scale farms.

Fixed-wing drones, on the other hand, are gaining attention for their ability to cover vast areas in a single flight and their extended flight endurance. However, they are more suited for mapping, surveillance, and large-scale monitoring rather than detailed spraying tasks.

Their requirement for a runway or open space for take-off and landing limits their flexibility in smaller fields. Despite these limitations, fixed-wing drones are expected to find niche use in large plantation settings, while multi-rotor drones will continue to dominate spraying operations due to their precision and operational versatility.

By Application

The application segment of the pesticide-spraying drone market is led by crop farming, accounting for 49.8% of total usage. Crop farming benefits from drone deployment through targeted pesticide delivery over row crops and large tracts of arable land, enabling optimized coverage and reduced chemical waste.

Drones equipped with variable-rate nozzles, GPS-assisted flight paths, and multispectral imagery support precise spraying, which addresses both productivity and sustainability requirements. The efficiency of drone-based spraying has been shown to decrease operator exposure and improve the timely treatment of pest infestations.

Beyond crop farming, emerging applications in forestry, pasture & grassland, and other niche segments are gaining traction. In forestry, drone spraying supports tree-crop protection, especially in remote or steep terrain where traditional methods are impractical. Drones are also applied in pasture & grassland management for selective spraying of invasive species, spot treatment in ecologically sensitive zones, and support of rangeland health monitoring.

These “other” applications broaden the addressable market and underscore the versatility of drone systems across diverse land-use types. As drone technology evolves—improving payloads, flight endurance, and sensing capability—application penetration in forestry, grassland, and other non-row-crop sectors is expected to advance, thereby increasing overall market share beyond the current dominance of crop farming.

By Farm Size

The large-farm segment commanded 68.4% of the market for pesticide spraying drones, reflecting its dominant role in uptake and investment. On large farms, the economy of scale permits the cost-intensive drone systems to be amortized over extensive acreage, making the return on investment more compelling.

Farmers managing large hectares are better positioned to deploy drones across multiple fields, achieve efficient coverage, and realise benefits such as reduced labour, lower pesticide usage, and faster turnaround times. Moreover, large-farm operations often have more capital and more technical staff, enabling smoother integration of drone-based spraying into existing agronomic workflows.

Conversely, small and medium farms continue to trail in adoption, largely due to higher per-hectare cost burdens, limited access to financing, and less flexibility to integrate novel technologies at scale. Data indicate that smaller farm operations face greater barriers, such as upfront cost, technical complexity, and uncertain ROI, which suppress their share of drone-based spraying usage.

As drone hardware and service models (for example, drone-as-a-service) mature and become more cost-effective, it is anticipated that small and medium farms will begin closing the adoption gap, thus gradually shifting the market balance over the forecast period.

Key Market Segments

By Type

- Fixed-Wing Drones

- Multi-Rotor Drones

By Application

- Crop Farming

- Forestry

- Pasture & Grassland

- Others

By Farm Size

- Small & Medium Farms

- Large Farms

Regional Analysis

The North America region accounted for 38% of the global pesticide spraying drone market in 2024, reflecting its status as a key growth market in precision-farming technologies. The regional market size stood at approximately USD 0.45 billion in 2024, underpinned by a combination of mature agricultural infrastructure, strong technology adoption, and favourable regulatory conditions.

Large commercial farms in the US and Canada have increasingly embraced drone-based spraying systems to address labour shortages, improve operational efficiency, and comply with tighter environmental standards. The market momentum is driven by continual improvements in drone hardware, payload capacity, sensor integration, and data analytics, which enhance the value proposition for growers in North America.

The combination of high-digital-fertility soils, wide expanses of row crops, and high input costs makes drone-enabled pesticide spraying particularly compelling. Contract-spraying services and drone-as-a-service models are expanding, enabling even large-acreage farms to outsource drone operations rather than invest heavily in in-house fleets.

While North America currently leads in share, the adoption trajectory suggests that further cost reductions, streamlined regulations, and wider field-level demonstrations will sustain growth. As drones become a standard tool in large-farm spraying operations, North America’s high-baseline share indicates it will remain a benchmark region, influencing equipment design, service models, and adoption strategies globally.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

The growth of the pesticide spraying drone market is primarily driven by the increasing need for precision agriculture and the demand for cost-efficient crop protection solutions. Drones enable farmers to achieve uniform pesticide application, minimize chemical wastage, and reduce human exposure to harmful substances.

Labor shortages in agricultural sectors across major economies are further accelerating the shift toward automation. Technological advancements such as AI-powered navigation, real-time imaging, and GPS-guided flight systems are improving accuracy and operational efficiency. Additionally, government initiatives supporting sustainable farming and subsidies for agri-tech adoption are promoting wider use of drones in pest management.

The integration of cloud-based data platforms and IoT sensors allows real-time crop monitoring and customized pesticide planning. As a result, farmers are increasingly adopting drone technology to enhance productivity, cut operational costs, and meet sustainability goals, making it one of the most transformative trends in modern agriculture.

Restraint Factors

Despite strong growth potential, several challenges restrain the adoption of pesticide-spraying drones. High initial investment costs for advanced drones equipped with sensors and AI capabilities limit accessibility for small and medium-scale farmers. In many regions, regulatory restrictions on drone operations, particularly for beyond-visual-line-of-sight flights, slow market expansion.

Weather conditions such as heavy wind and rainfall can also affect flight stability and spraying accuracy, limiting year-round operations. Furthermore, the shortage of trained personnel for drone operation, maintenance, and data analysis remains a significant bottleneck.

Concerns related to data privacy and integration complexity with existing farm management systems also hinder adoption. The lack of standardized certification and safety frameworks in certain regions further complicates commercialization. Until these regulatory and cost-related barriers are addressed, adoption is expected to remain concentrated among large farms and agribusinesses with higher technical capacity and financial resources.

Growth Opportunities

The pesticide spraying drone market presents significant growth opportunities driven by expanding technological capabilities and diversified applications. The increasing adoption of drone-as-a-service (DaaS) models allows small and medium farmers to access drone technology without heavy capital expenditure, accelerating penetration in developing markets.

Continuous improvements in battery capacity, payload efficiency, and autonomous flight systems are expanding operational range and reducing downtime. Additionally, the integration of AI analytics and multispectral imaging provides farmers with valuable insights for precision spraying and pest identification. Emerging use cases in forestry, grassland management, and horticulture create new revenue streams beyond traditional crop farming.

Growing emphasis on sustainable farming and environmental safety supports the demand for drones capable of minimizing chemical use and improving soil health. As digital transformation advances across agriculture, collaborations between drone manufacturers, agri-tech startups, and government bodies are expected to unlock long-term opportunities and enhance market scalability.

Trending Factors

The pesticide spraying drone industry is witnessing rapid technological evolution with several key trends shaping its future. Integration of artificial intelligence, computer vision, and advanced sensor systems is enabling autonomous and adaptive spraying solutions. Multi-drone swarm operations are emerging, allowing simultaneous spraying across large farms and improving time efficiency.

The trend toward data-driven agriculture is growing, with drones collecting detailed crop-health and pest data for predictive analytics. Manufacturers are focusing on lightweight composite materials, improved propulsion systems, and extended battery life to enhance flight performance. The rise of subscription-based and contract spraying models is reducing entry barriers for smaller farms.

Additionally, the combination of drones with other agri-tech solutions, such as satellite mapping and IoT-based monitoring, is driving ecosystem integration. With sustainability goals gaining global momentum, drones are increasingly used to achieve optimized pesticide usage, reduced emissions, and eco-friendly agricultural practices, reinforcing their long-term market potential.

Competitive Analysis

Competitive analysis of the pesticide-spraying drone market reveals a concentration of key players, differentiated by technology, service models, and geographic reach. Leading manufacturer DJI boasts a global installed base of over 300,000 agricultural drones operating in more than 500 million hectares of farmland.

Its dominant position is underpinned by strong brand recognition, comprehensive service networks, and a broad product portfolio (for example, the DJI Agras T50). This scale provides DJI with both cost advantages and data insights that help refine its product offering. Emerging competitor XAG is notable for its focus on high-payload sprayers and autonomous flight systems, appealing to large-scale farms seeking efficiency gains.

Meanwhile, companies such as Guardian Agriculture from the US emphasize service-based models and high-quality materials, targeting contract-spray operators. These competitors challenge the market leader by offering niche differentiation—autonomy, regional compliance, or tailor-made service offerings. Barriers for new entrants remain significant: achieving scale in manufacturing, building global support networks, and securing regulatory approvals are substantial hurdles.

As cost per unit declines and service-based adoption grows, second-tier players may expand rapidly. Overall, the competitive landscape is moving from hardware sales toward integrated platform ecosystems combining drones, data analytics, and spraying services — companies that execute across all three are expected to command higher value capture.

Top Key Players in the Market

- XAG

- Yamaha Motor

- Parrot

- AeroVironment

- Honeycomb

- AgEagle

- TTA

- Kray

- Delair

- DJI Agriculture

- Hylio

- Ursula Agriculture

- ATI

- Israel Aerospace Industries

- Others

Recent Developments

- August 5, 2025: SORA Technology Co., Ltd. entered into a collaboration with EXEDY Corporation (Japan) to deploy drones and AI-based systems for pesticide spraying and mosquito control in African countries, extending drone use beyond traditional farming into public-health and large-scale ecological management.

- August 28, 2025: PT Yanmar Diesel Indonesia signed a sales-partnership agreement with Terra Drone Co., Ltd. to distribute Terra Drone’s in-house developed agricultural drones in Indonesia, leveraging Yanmar’s sales network and Terra Drone’s spraying expertise.

- October 16, 2025: Terra Drone Indonesia achieved TKDN certification for its agricultural drone model G20, with a local content ratio of 31.26 % (exceeding the required 30 %), enabling deeper access to government projects and faster maintenance operations.

Report Scope

Report Features Description Market Value (2024) USD 1.21 Billion Forecast Revenue (2034) USD 7.31 Billion CAGR(2025-2034) 19.70% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Type (Fixed-Wing Drones, Multi-Rotor Drones), By Application (Crop Farming, Forestry, Pasture & Grassland, Others), By Farm Size (Small & Medium Farms, Large Farms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape XAG, Yamaha Motor, Parrot, AeroVironment, Honeycomb, AgEagle, TTA, Kray, Delair, DJI Agriculture, Hylio, Ursula Agriculture, ATI, Israel Aerospace Industries, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Pesticide Spraying Drone MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Pesticide Spraying Drone MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- XAG

- Yamaha Motor

- Parrot

- AeroVironment

- Honeycomb

- AgEagle

- TTA

- Kray

- Delair

- DJI Agriculture

- Hylio

- Ursula Agriculture

- ATI

- Israel Aerospace Industries

- Others