Global Personal Mobility Devices Market By Product (Wheelchairs, Mobility Scooters, Walking Aids, and Others), By End-user (Personal Users and Institutional Users), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142462

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

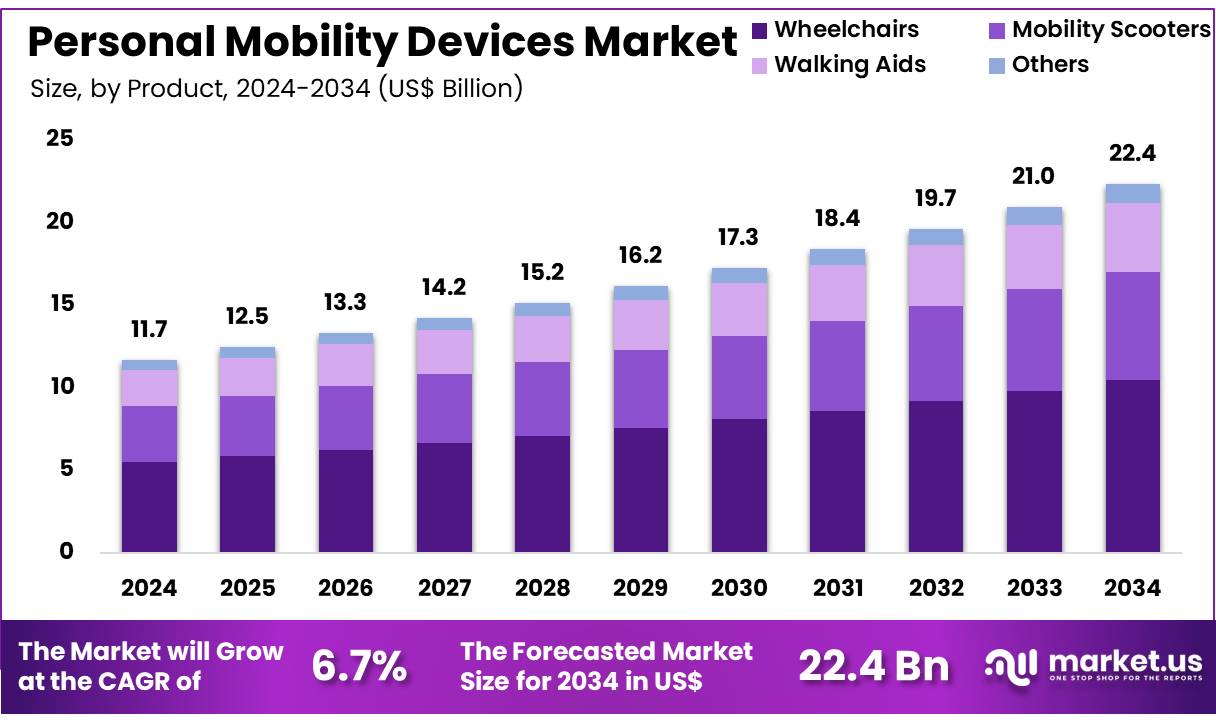

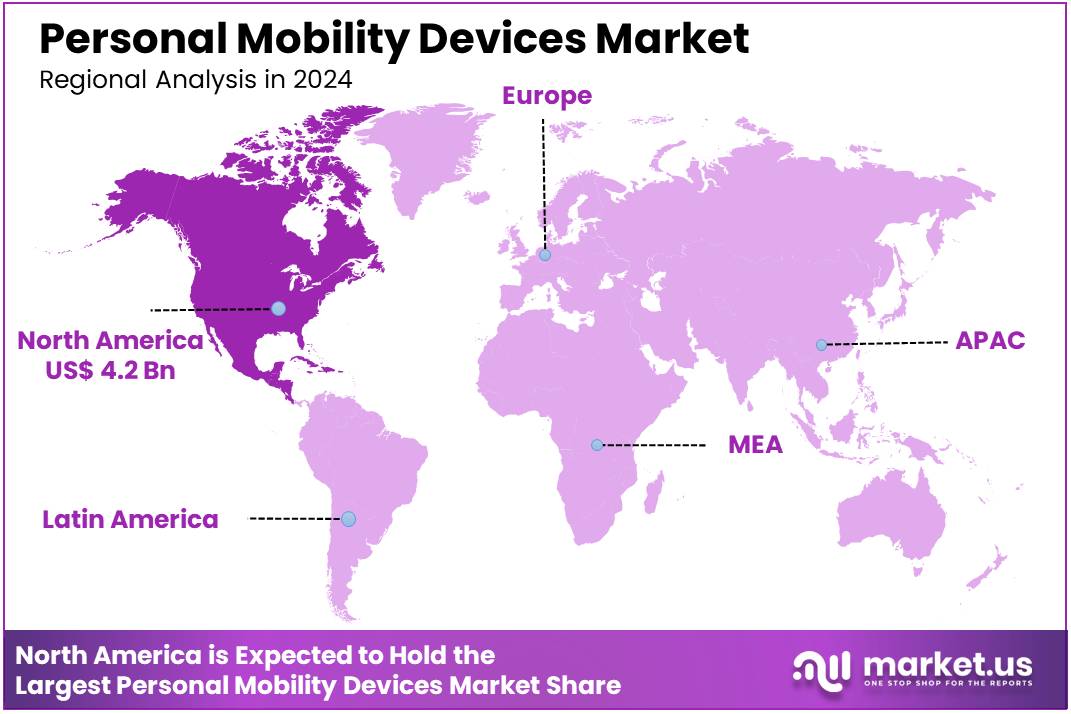

Global Personal Mobility Devices Market size is expected to be worth around US$ 22.4 billion by 2034 from US$ 11.7 billion in 2024, growing at a CAGR of 6.7% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 35.7% share with a revenue of US$ 1.6 Billion.

Increasing demand for personal mobility devices is driven by an aging global population and a rise in mobility-impairing disorders. These devices, including wheelchairs, scooters, and walking aids, enhance the independence and quality of life for individuals with mobility challenges. Technological advancements have led to the development of more sophisticated and user-friendly mobility aids, expanding their applications across various demographics. The growing awareness of mobility challenges and the importance of assistive devices has further fueled market growth.

Government initiatives and funding have improved access to these devices, particularly in low- and middle-income countries. The integration of smart technologies into mobility devices offers opportunities for innovation, providing features like real-time tracking and personalized settings. The increasing prevalence of chronic conditions and disabilities has heightened the need for effective mobility solutions.

The market is also benefiting from the expansion of home healthcare services, where mobility devices play a crucial role in patient care. According to the World Health Organization, over 2.5 billion people need one or more assistive products, such as wheelchairs, yet nearly one billion are denied access, highlighting a significant opportunity for market growth.

Key Takeaways

- In 2023, the market for personal mobility devices generated a revenue of US$ 11.7 billion, with a CAGR of 6.7%, and is expected to reach US$ 22.4 billion by the year 2033.

- The product segment is divided into wheelchairs, mobility scooters, walking aids, and others, with wheelchairs taking the lead in 2023 with a market share of 46.8%.

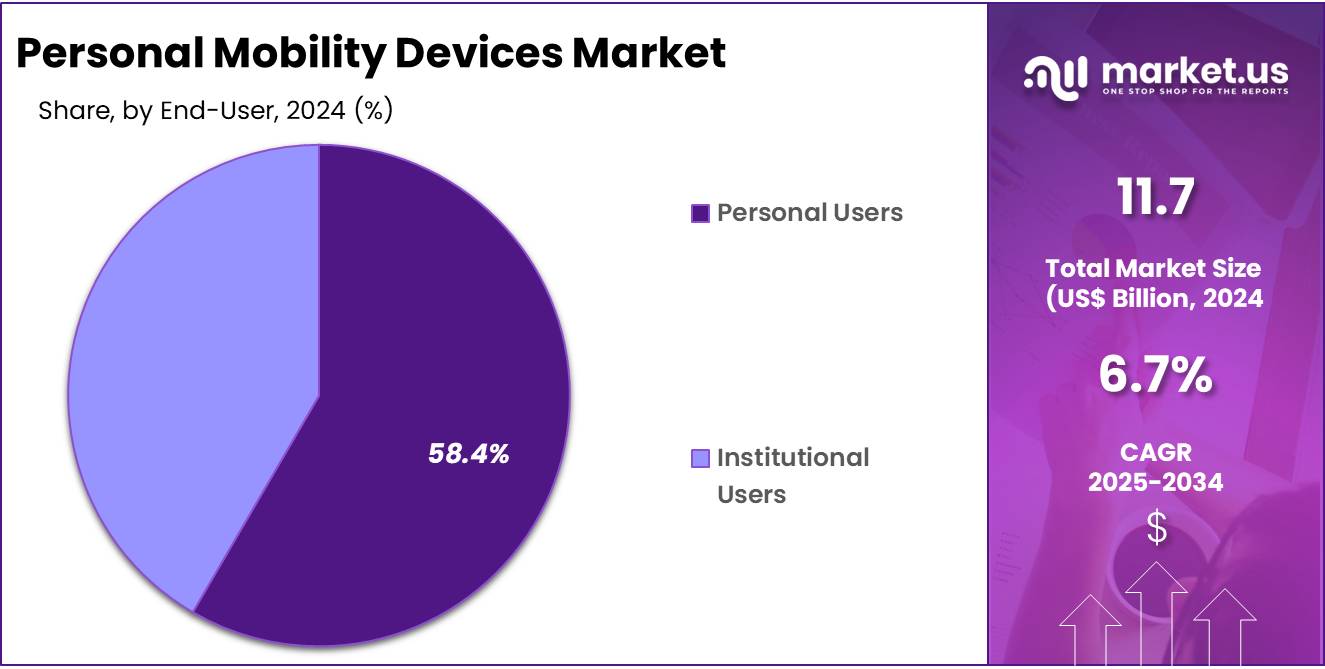

- Considering end-user, the market is divided into personal users and institutional users. Among these, personal users held a significant share of 58.4%.

- North America led the market by securing a market share of 35.7% in 2023.

Product Analysis

The wheelchairs segment led in 2023, claiming a market share of 46.8% as the demand for mobility aids continues to rise globally. This segment is anticipated to expand due to the aging population, with a growing number of elderly individuals requiring mobility assistance. Additionally, the increasing prevalence of disabilities, chronic diseases, and injuries is projected to drive the adoption of wheelchairs.

Technological advancements in wheelchair designs, such as lightweight materials, enhanced maneuverability, and improved comfort features, are likely to make them more appealing to users. The growing trend of home healthcare services and the increasing awareness of mobility solutions in various healthcare settings are expected to contribute further to the growth of the wheelchair segment. As patients and caregivers prioritize convenience and efficiency, the wheelchair market is projected to continue expanding.

End-User Analysis

The personal users held a significant share of 58.4% as more individuals seek independent mobility solutions. The increasing prevalence of mobility-related health issues, such as arthritis and neurological disorders, is likely to drive demand for personal mobility devices. As more people embrace the use of mobility aids for improved quality of life, the personal users segment is projected to expand, particularly in home care environments.

The growing trend of aging in place and the desire for enhanced independence among elderly individuals are anticipated to contribute to the adoption of personal mobility devices. Additionally, the rise in awareness and the availability of diverse, customizable mobility aids are expected to fuel the growth of this segment. As personal users continue to prioritize convenience, comfort, and mobility, the market for personal mobility devices is likely to grow in the coming years.

Key Market Segments

Product

- Wheelchairs

- Mobility Scooters

- Walking Aids

- Others

End-user

- Personal Users

- Institutional Users

Drivers

Aging Population is Driving the Market

The personal mobility devices market is experiencing significant growth, primarily driven by the increasing aging population. As individuals age, they often face mobility challenges due to conditions such as arthritis, osteoporosis, and general muscle weakness. This demographic shift has led to a heightened demand for mobility aids like wheelchairs, walkers, and scooters.

For instance, the US Census Bureau reported that in 2023, approximately 16.9% of the US population was aged 65 and older, a figure projected to reach 20% by 2030. This surge in the elderly population necessitates the adoption of personal mobility devices to maintain independence and quality of life.

Manufacturers are responding by developing innovative products tailored to the needs of older adults, further propelling market growth. As the global population continues to age, the demand for personal mobility devices is expected to rise correspondingly.

Restraints

High Costs of Advanced Mobility Devices are Restraining the Market

Despite the growing need, the high costs associated with advanced personal mobility devices pose a significant barrier to market expansion. Sophisticated devices, such as powered wheelchairs and mobility scooters, often come with substantial price tags, making them less accessible to individuals with limited financial resources.

The Centers for Medicare & Medicaid Services (CMS) in the United States have recognized this issue, noting that while Medicare Part B covers 80% of the approved amount for mobility devices, beneficiaries are still responsible for the remaining 20%, which can be a considerable expense. Additionally, not all devices qualify for coverage, and the approval process can be complex and time-consuming.

These financial and administrative hurdles deter many potential users from acquiring necessary mobility aids. To address this restraint, there is a pressing need for more affordable solutions and streamlined insurance processes to make personal mobility devices more accessible to those in need.

Opportunities

Technological Innovations are Creating Growth Opportunities

Technological advancements in personal mobility devices are opening new avenues for market growth. Innovations such as lightweight materials, improved battery life, and smart features like GPS tracking and health monitoring are enhancing the functionality and appeal of these devices. For example, companies like WHILL have introduced personal electric vehicles with advanced maneuverability and connectivity features, catering to tech-savvy users seeking both convenience and performance.

These developments not only improve user experience but also attract a broader customer base, including younger individuals with mobility impairments. Furthermore, the integration of artificial intelligence and machine learning is paving the way for personalized mobility solutions that adapt to individual user needs. As technology continues to evolve, the personal mobility devices market is poised to benefit from these innovations, offering more efficient and user-friendly products.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the personal mobility devices market. Economic downturns can lead to reduced consumer spending, limiting the ability of individuals to purchase advanced mobility aids. Inflation and currency fluctuations may increase production costs, resulting in higher prices for end-users.

Geopolitical tensions can disrupt global supply chains, causing delays in the manufacturing and distribution of mobility devices. For instance, trade disputes between major economies can lead to tariffs and import restrictions, affecting the availability of components necessary for device assembly. Conversely, government initiatives aimed at supporting the aging population and individuals with disabilities can positively impact the market.

Policies that provide subsidies or insurance coverage for mobility devices make them more accessible to a broader audience. International collaborations and agreements can also facilitate technological exchange and standardization, enhancing product quality and innovation. Overall, while challenges persist, proactive measures and supportive policies can foster a resilient and growing personal mobility devices market.

Latest Trends

Growing Popularity of Micromobility is a Recent Trend

A notable trend in the personal mobility devices market is the rising popularity of micromobility solutions, such as e-scooters and e-bikes. Urban areas are increasingly adopting these devices as alternative transportation modes to reduce traffic congestion and environmental impact. According to a report by the National Association of City Transportation Officials (NACTO), in 2022, riders took 112 million trips on shared micromobility vehicles in the United States, a significant increase from previous years.

This surge is attributed to the convenience, affordability, and eco-friendliness of micromobility options. Cities are responding by implementing infrastructure improvements, such as dedicated bike lanes and parking zones, to accommodate the growing number of users. This trend indicates a shift towards more sustainable and accessible personal transportation solutions, influencing the dynamics of the personal mobility devices market.

Regional Analysis

North America Leads the Personal Mobility Devices Market with the Largest Market Share of 35.7%

North America is the dominant region in the personal mobility devices market, holding a substantial market share of 35.7% as of 2024. The market value in this region is estimated at USD 4.2 billion, driven by an aging population, high prevalence of chronic diseases, and well-established healthcare infrastructure that supports the adoption of advanced mobility aids. The increasing emphasis on enhancing the quality of life for the elderly and physically challenged individuals further contributes to the growth in this region.

Europe follows closely, characterized by increased government initiatives promoting disability aids, coupled with a significant elderly population that requires mobility assistance. European markets are also advancing in terms of product innovation and regulatory support, which are pivotal in driving the adoption of mobility devices.

Asia Pacific is projected to witness the fastest growth in the personal mobility devices market. This surge is attributed to the rapidly aging population in countries such as Japan and China, coupled with improving healthcare facilities and rising healthcare expenditure. The region’s large population base presents a vast market potential for mobility device manufacturers.

Middle East & Africa show gradual growth in the market, influenced by increasing healthcare investments and government policies aimed at improving the general healthcare infrastructure. The market in this region is expected to benefit from the rising awareness of mobility aids among the population.

Latin America is also seeing growth in the personal mobility devices market. Factors such as urbanization, increasing medical tourism, and policies supporting healthcare access are enhancing market growth. The region’s developing healthcare sector and growing middle-class population are pivotal in driving the demand for personal mobility devices.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the personal mobility devices market focus on developing lightweight, innovative solutions, such as electric wheelchairs, scooters, and walking aids, to improve mobility and independence for individuals with physical impairments. Companies invest in research and development to integrate advanced features, including ergonomic designs, longer battery life, and smart technologies for enhanced user experience.

Strategic partnerships with healthcare providers and insurers help expand product access and improve reimbursement models. Many players also emphasize expanding their distribution networks to reach underserved markets. Additionally, increasing focus on eco-friendly and energy-efficient products helps cater to growing environmental concerns.

Drive DeVilbiss Healthcare is a leading company in this market, offering a wide range of mobility aids, including power scooters and manual wheelchairs. The company focuses on continuous innovation, providing high-quality, user-friendly devices that support independent living. Drive DeVilbiss’s commitment to accessibility and global market reach positions it as a key player in the industry.

Top Key Players

- Rollz International

- Performance Health

- NOVA Medical Products

- Medline Industries, Inc

- Invacare Corporation

- Falcon Mobility

- Drive DeVilbiss Healthcare

- Briggs Healthcare

Recent Developments

- In August 2021, Falcon Mobility introduced the Ultra-Lite 2, an electric wheelchair engineered for enhanced portability and ease of use. This lightweight design aims to improve accessibility for elderly individuals and those with mobility challenges while simplifying transportation for caregivers.

- In June 2021, Rollz International unveiled the Rollz Flex 2, a redesigned rollator that offers improved comfort, stability, and aesthetics. The upgraded model reflects the company’s commitment to providing innovative mobility solutions for individuals requiring additional support.

Report Scope

Report Features Description Market Value (2024) US$ 11.7 billion Forecast Revenue (2034) US$ 22.4 billion CAGR (2025-2034) 6.7% Base Year for Estimation 2023 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Wheelchairs, Mobility Scooters, Walking Aids, and Others), By End-user (Personal Users and Institutional Users) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Rollz International, Performance Health, NOVA Medical Products, Medline Industries, Inc, Invacare Corporation, Falcon Mobility, Drive DeVilbiss Healthcare, and Briggs Healthcare. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Personal Mobility Devices MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Personal Mobility Devices MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Rollz International

- Performance Health

- NOVA Medical Products

- Medline Industries, Inc

- Invacare Corporation

- Falcon Mobility

- Drive DeVilbiss Healthcare

- Briggs Healthcare